HI Market View Commentary 03-08-2021

What the heck is happening to our markets over the last week?!?!?!?!!!!

We’ve been told from talking heads that it is Interest Rates on the 10-Year

Stock markets always move on money flows = currency movement

David Tepper making comments on the inflows from Japan

When you start to put the dots together Japan 10yr pays 1.1% and the US 10 year 1.60%

IF you arbitrage Japan debt to US debt what’s happening ?= US is financing other countries debt

Stronger $ which means US companies Domestic have inflation/ US companies that sell overseas have more expensive products, COST of purchasing materials to create your product goes up

Tepper thinks in general the bond market will stabilize 1.3-1.7 could go to 2%

IF the bond market stabilizes the US stock market will skyrocket higher

Tepper “we should be good for several months”? “The fed will probably take a nap until September”

September 3rd worst month historically on the S&P 500, October the worst month, New fiscal budget and someone has to pay for all the stimulus so higher taxes are on the way

Kevin why is the Nasdaq getting killed ? Could it be that they investment heavy industry

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF MAR. 1 THROUGH MAR. 5, 2021 |

| The S&P 500 index rose 0.8% last week thanks to a Friday jump on better-than-expected February jobs data that helped the market reverse losses posted earlier in the week. The market benchmark ended the week at 3,841.94, up from last Friday’s closing level of 3,811.15. As of Thursday’s close, the index appeared headed for its third consecutive weekly decline amid worries about the potential impacts of rising bond yields. However, a 2% Friday increase in the S&P 500 lifted the index into the black for the week. The Februaryr jobs data released Friday by the Labor Department showed some 379,000 jobs were added last month, much better than the Econoday consensus estimate for just 175,000 additions. January’s job additions were boosted to 166,000 from a previously reported 49,000. Also, the unemployment rate edged down to 6.2% from 6.3% a month prior; the consensus estimate had been for the unemployment rate to stay at 6.3%. The week’s previous declines came as bond yields continued to climb and comments by Federal Reserve Chairman Jerome Powell failed to ease investors’ worries about the rising yields. In comments Thursday, Powell said the central bank’s policy stance is appropriate, disappointing investors who had been hoping he would hint toward efforts to contain yields. The rising bond yields are thought to be a reflection of an improved outlook as COVID-19 cases, hospitalizations and deaths have fallen since January and vaccinations have been increasing, but investors worry that higher yields would weigh on consumers’ and businesses’ ability to borrow. Still, amid the better-than-expected jobs data, all but three S&P 500 sectors ended the week in positive territory. The energy sector had the strongest increase of the week, up 10%, followed by a 4.3% rise in financials and a 3.1% increase in industrials. The three sectors in the red were consumer discretionary, down 2.8%, and real estate and technology, down 1.4% each. The energy sector’s climb came as crude oil futures rose on the week. Among the gainers, shares of ONEOK (OKE) jumped 12% as Credit Suisse boosted its price target on the stock to $49 per share from $44. The firm kept its investment rating on the stock at neutral. Weighing on the consumer discretionary sector, shares of Target (TGT) shed 5.9% this week despite the retailer’s report of year-over-year increases in fiscal Q4 adjusted earnings per share and revenue that topped analysts’ expectations, as investors questioned whether a plan to invest about $4 billion annually over the next few years to accelerate new store openings and remodels and further scale up its operations may be too aggressive. The decliners in consumer discretionary also included Ross Stores (ROST), whose shares fell 3% on the week as the off-price retailer reported fiscal Q4 earnings per share and revenue below year-earlier results and analysts’ mean estimates. The company also forecast EPS for the 13 weeks ending May 1 below the Street view. Next week, economic data will be light earlier in the week, with just wholesale inventories due Monday and the National Federation of Independent Business small-business index due Tuesday. The consumer price index and federal budget are due Wednesday, followed by weekly jobless claims Thursday and producer prices and consumer sentiment Friday. Provided by MT Newswires |

Where will our markets end this week?

Up

DJIA – Bearish (turning bullish)

SPX – Bearish

COMP – Bearish

Where Will the SPX end March 2021?

03-08-2021 0.0%

03-01-2021 0.0%

Earnings:

Mon:

Tues: DKS, HRB

Wed: CPB, ORCL, AMC

Thur: JD, DOCU, ULTA, MTN

Fri: BKE

Econ Reports:

Mon: Wholesale Inventories,

Tues:

Wed: MBA, CPI, Core CPI, Treasury Budget

Thur: Initial Claims, Continuing Claims,

Fri: PPI, Core PPI, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Some protection and even that’s is making some mistakes

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.washingtonpost.com/business/2021/03/06/biden-stimulus-poverty-checks/

Biden stimulus showers money on Americans, sharply cutting poverty and favoring individuals over businesses

The $1.9 trillion package enjoys wide support across the country, polls show, but it comes with political and economic risks.

President Biden spoke at the White House on March 6 after senators passed a $1.9 trillion relief plan. The House of Representatives will vote on the bill next. (The Washington Post)

By

Alyssa Fowers and

March 6, 2021 at 2:02 p.m. MST

President Biden’s stimulus package, which passed the Senate on Saturday, representsone of the most generous expansions of aid to the poor in recent history, while also showering thousands or, in some cases, tens of thousands of dollars on Americans families navigating the coronavirus pandemic.

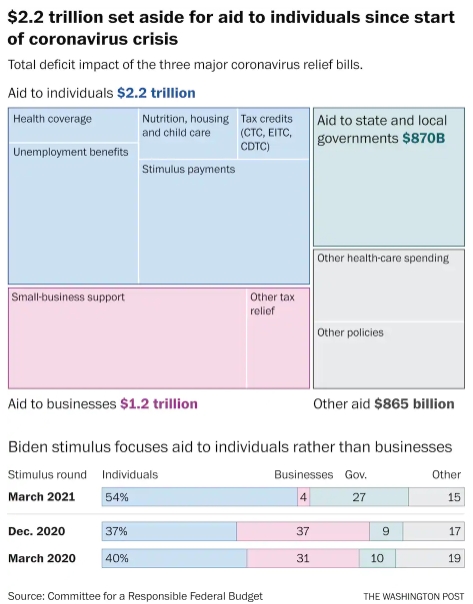

The roughly $1.9 trillion American Rescue Plan, which only Democrats supported, spends most of the money on low-income and middle-class Americans and state and local governments, with very little funding going toward companies. The plan is one of the largest federal responses to a downturn Congress has enacted and economists estimate it will boost growth this year to the highest level in decades and reduce the number of Americans living in poverty by a third.

This round of aid enjoys wide support across the country, polls show, and it is likely to be felt quickly by low- andmoderate-income Americans who stand to receive not just larger checks than before, but money from expanded tax credits, particularly geared toward parents;enhanced unemployment; rental assistance; food aid and health insurance subsidies.

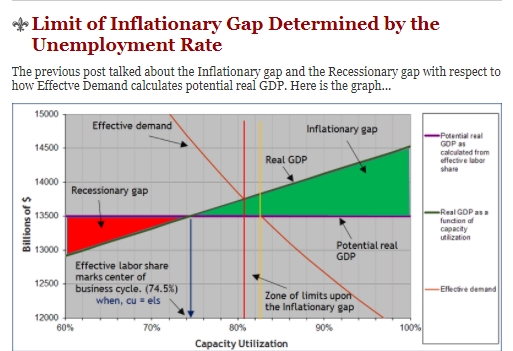

But the ambitious legislation entails risks — both economic and political. The bill, which the House is expected to pass and send to Biden within days, injects the economy with so much money that some economists from both parties are warning that growth could overheat, leading to a bout of hard-to-contain inflation.Meanwhile, some businesses are saying that government aid has been so generous that they’re already having trouble getting unemployed workers to return to work — a problem that could be exacerbated by the legislation.

Unlike many other significant anti-poverty measures passed by Congress in history, this one has a short time horizon, with almost all the relief for families going away over the coming year. That could be an abrupt awakening for Americans who have grown accustomed to financial support since Congress moved swiftly to create a stronger safety net at the start of the pandemic a year ago. It also lacks the bipartisan imprint of former President Trump’s bills, which directed money in larger measure to companies as well as individuals.

“This legislative package likely represents the most effective set of policies for reducing child poverty ever in one bill, especially among Black and Latinx children,” said Indivar Dutta-Gupta, co-executive director of the Georgetown Center on Poverty and Inequality. “The Biden administration is seeing this more like a wartime mobilization. They’ll deal with any downside risks later on.”

The total numbers are staggering. Cumulatively, the government will hand out $2.2 trillion to workers and families between the relief passed last year and this latest bill, according to the Committee for a Responsible Federal Budget, a nonpartisan group. That’s equivalent to what the government spends annually on Social Security, Medicare and Medicaid combined.

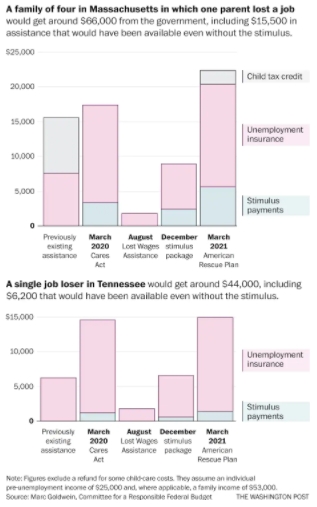

Exactly how much money Americans are set to receive depends on a number of factors including whether they are unemployed, their household income, whether they have children or other dependents, and the state they live in.

According to calculations by Marc Goldwein, senior policy director for the Committee for a Responsible Federal Budget, a Massachusetts family of four that had an income of about $53,000 before the pandemic and has one parent unemployed stands to receive more than $22,000 from this package. That’s in addition to the unemployment assistance and child tax credit the family would be eligible for without the pandemic.

In total, this family of four is set to have received more than $50,000 from the relief bills Congress has passed since the crisis began, a large amount that more than replaces the family’s lost income during the crisis.

The Democratic stimulus package also provides significant funding for vaccine distribution and state and local governments. Business and health leaders say getting most Americans vaccinated is key to the economic recovery. But most of the attention on the bill has focused on its overall price tag and the payments that are set to go to about 150 million American households.

The latest stimulus will reduce poverty by a third, lifting nearly 13 million Americans out of it, according to an analysis by Columbia University’s Center on Poverty and Social Policy. Black Americans, Hispanic Americans and poor families with children are set to benefit the most. Child poverty would be reduced by more than half, the researchers predict.

Who will get a third stimulus check and why?

The magnitude of aid, especially combined with last year’s relief, is much greater than the U.S. government has responded to other economic crises. The response to the Great Recession was about $1.8 trillion over several years and the most optimistic estimates are that about 6 million Americans were kept out of poverty in 2009 because of efforts by Congress at the time.

Biden and his top officials have repeatedly said they have learned lessons from the mistakes made during the Great Recession response. This time around they want to go big enough to ensure jobs return swiftly. They want a package that, in the words of White House press secretary Jen Psaki, will get families “talking about it at their dinner tables.”

Many economists say the package is far from perfect, but they broadly agree that this crisis has been an unprecedented hit on low-income workers and their children and the aid should be targeted most toward them.

Recent history has shown that giving money to poorer families delivers the greatest boost to the economy, because those Americans are the most likely to spend the money right away.

“History and a strong body of research would tell us the only way to avoid more lasting scars on households and the economy is by not doing too little,” said Ellen Zentner, chief economist at Morgan Stanley. She pointed out that giving money to low-income households “is much more stimulative than past policies in a downturn.”

Still, one of the biggest criticisms of the bill is that it is too large overall at a time when the Congressional Budget Office projects the economy is running roughly $700 billion below potential — a concept that tries to measure what a completely healthy economy would like.

“I don’t think there’s any justification from an economic standpoint or a bottom-up standpoint for $1.9 trillion in further covid relief,” Goldwein said. “A package half that size would still be a safe boost to the economy.”

Goldwein and others are especially critical of Democrats’ decision to allot $350 billion to state and local aid, even though many states are no longer running deficits and independent estimates suggest the need is far less than that amount. Many economists also question the need to send $1,400 to people who have not lost their jobs.

“To me the part that’s the hardest to justify is the $1,400 checks to everyone,” said Greg Mankiw, a Harvard University professor who served as President George W. Bush’s chief economist from 2003 to 2005. “They are making large payments to people who don’t need them.”

Mankiw points out that two of his adult children who have not lost jobs have been receiving the payments. And a family of four who didn’t lose any income in this crisis would still receive an additional $5,600. Some economists are also concerned that the money, along with enhanced unemployment benefits until early September, are discouraging some people from returning to work.

“Many small businesses complain they are not able to reconnect with employees because of these benefits,” said Lindsey Piegza, chief economist at the investment firm Stifel. “We want to be leery of getting a short-term boost that ends up creating longer-term roadblocks.”

But the mantra of the White House and the Federal Reserve has been that it’s better to err on the side of doing too much than too little. Treasury Secretary Janet Yellen has made the case that it’s not just the jobless who are struggling. Many people have taken a pay cut or are working fewer hours and many families have had to juggle jobs with child-care and elder-care responsibilities, which brings more costs.

“Any time you try to design a targeted system in the scale of the U.S. economy, you end up missing people,” Neel Kashkari, president and chief executive of the Federal Reserve Bank of Minneapolis, said in a Friday interview. This bill“really, in my mind, is not meant to be stimulus, it’s meant to be relief for those families who’ve lost jobs.”

Kashkari led the bank bailout, known as the Troubled Asset Relief Program (TARP), in the wake of the 2008-09 financial crisis. Back then, he said,the government was so concerned about targeting aid to deserving families that a lot of struggling homeowners didn’t get money fast enough and the nation ended up with a massive foreclosure problem. He doesn’t want to see that repeated.

Democrats say the American Rescue Plan corrects the flaws, not just of the Great Recession response but also the Cares Act and the covid relief bill from December. They argue that last year’s bills cut aid off too soon and did not give enough help to struggling families, which is how the nation ended up with millions of Americans facing eviction, relying on food banks and unable to afford diapers.

On Friday, the Labor Department reported that the official unemployment rate is 6.2 percent, but the White House said the true rate is 9.5 percent because so many Americans, especially mothers, have stopped working or even looking for a job while they care for children. People are not counted in the official unemployment statistics if they have not looked for a job in the past month.

To address the needs of low-income families, this bill does more than provide stimulus funds and extended unemployment aid. It also expands three key tax credits — the child tax credit, the earned income tax credit, and the child and dependent care tax credit — that advocates for the poor have long urged the government to do to help reduce poverty. These programs make up about $150 billion of the bill.

Under this more generous child tax credit plan, parents would receive $3,000 a year for every child ages 6 to 17 and $3,600 a year for every child under 6. The current credit is $2,000, and the poorest families can get a refund from the government for only $1,400. The stimulus bill also expands the child and dependent care tax credit so eligible families can deduct up to 50 percent of their costs, up from 20 to 35 percent before.

For people without children, the legislation expands the earned income tax credit, which helps supplement wages for the working poor.

These tax changes, along with another round of cash payments, will boost incomes of the bottom 20 percent of Americans by 33 percent, according to Steve Wamhoff, a tax expert at the liberal Institute on Taxation and Economic Policy. That’s more than double what the March 2020 Cares Act did for the poorest Americans.

Many liberals hope these policies can be made permanent so this income boost does not disappear in 2022. The bill also provides more generous subsidies to help people afford health insurance and another attempt to expand Medicaid in states that have not yet done so.

“Most of us believe these programs like the child allowance will be made permanent,” said Diane Whitmore Schanzenbach, director of Northwestern University’s Institute for Policy Research.

If these programs do stick around, it raises questions about whether Democrats should be paying for them and not treating them like they are emergency relief. But advocates on the left point out that if America’s safety net were better, not as many people would have fallen into such a difficult situation during the pandemic and the nation would not need as large of a response.

“We wouldn’t have had to take such big steps if our policies even before the crisis had been more supportive of low-income workers and low-income kids,” said Sharon Parrott, president of the left-leaning Center on Budget and Policy Priorities. “If all we do is recover back to 2019, then most low-paid workers still won’t have access to health insurance and benefits and millions of children will still be in poverty.”

Jeff Stein contributed to this report.

Consumers Saved $2.9 Trillion During the Pandemic. Their Money Will Drive the Global Recovery

March 2, 2021, 10:00 PM MST

Bloomberg estimates U.S. has $1.5 trillion in extra savings

Whether savings are run down will determine recovery speed

Consumers in the world’s largest economies amassed $2.9 trillion in extra savings during Covid-related lockdowns, a vast cash hoard that creates the potential for a powerful recovery from the pandemic recession.

Households in the U.S., China, U.K., Japan and the biggest euro-area nations socked money away when forced by the coronavirus to stay home and out of the shops, according to estimates by Bloomberg Economics. They are likely continuing to do so as restrictions remain and governments dole out stimulus.

Half that total — $1.5 trillion and growing — is in the U.S. alone, the data show. That’s at least double the average annual growth of gross domestic product witnessed in the last expansion and equivalent to the annual output of South Korea.

Such savings should provide fuel for economies to rebound once Covid-19 is finally wrestled under control and as vaccines roll out.

The optimists are betting on a shopping spree as people return to retailers, restaurants, entertainment venues, tourist hot spots and sports events as well as accelerate those big-ticket purchases they held back on. Those who are less confident wonder if the money will instead be used to cover debts or hoarded until the health crisis passes and labor markets look stronger.

In the U.S., a running down of all the money saved in the past year would propel economic growth to as much as 9% rather than the 4.6% currently projected for 2021 GDP, according to BE. By contrast, if the savings go unspent, the economy will likely grow just 2.2%.

“Summer 2020 turned out to be a false dawn, but it also showed how quickly economies can bounce back when Covid-19 controls are removed,” said Maeva Cousin, senior euro-area economist at Bloomberg Economics. “Could the same thing happen in 2021? Massive cash buffers from households’ lockdown savings are one reason we are confident demand should rebound sharply.”

The U.S. is not alone in enjoying a cushion. Chinese households poured 2.8 trillion yuan ($430 billion) more into their bank accounts than they might have done normally. Similar deposits rose 32.6 trillion yen ($300 billion) in Japan and 117 billion pounds ($160 billion) in the U.K. Those in the biggest euro-area economies climbed a combined 387 billion euros ($465 billion), led by Germany’s 142 billion euros.

One factor that might increase the urge to splurge: Low interest rates that reduce the appeal of keeping funds in the bank.

Pulling in the other direction is the risk is that people choose to use their savings to pay down debt or decide to preserve their household budgets because of ongoing health risks or concern that the jobs market will recover sluggishly.

Not everyone will be feeling flush. It’s those who earn the most who will likely have stockpiled, while lower-income households may have been forced to dip into their savings already and are the most likely to consume.

Some may be put off by the suspicion that at some point governments will jack up taxes to pay for their rescue programs.

“Short term, a lot depends on post-pandemic behavior — which may take time to revert to pre-pandemic norms,” said Yelena Shulyatyeva, senior U.S. economist for Bloomberg Economics. “Medium term, whether the extra funds go to consumption, paying down debt, or even stay in the bank as a rainy-day fund, that’s a positive for growth.”

The American Consumer Is Flush With Cash After Paying Down Debt

By American Online News November 16, 2020 38

(Bloomberg) — Eight months into the pandemic, Americans’ household finances are in the best shape in decades. It’s a seemingly incongruous thought, what with the widespread business lockdowns earlier in the year and coinciding surge in unemployment — and it certainly doesn’t apply to all families equally. But it points to just how strong the U.S. economy was going into the virus outbreak, and how powerful the combined monetary and fiscal response was from the Federal Reserve, Congress and the Trump…

SEC Will Evaluate Order Flow Payments If I’m Chair: Gary Gensler

By Peter RawlingsMarch 3, 2021

Gary Gensler said that if he is confirmed as the next chair of the Securities and Exchange Commission, the regulator will evaluate if retail investors are getting the best execution for their trades despite the practice of order flow payments.

Gensler made the remark in response to lawmakers’ questions about the order flow payments that brokers receive to route customer orders to certain traders and venues. Gensler appeared before the U.S. Senate Committee on Banking, Housing, and Urban Affairs yesterday for his confirmation hearing.

Order flow payments came under increasing scrutiny following the GameStop trading frenzy earlier this year when, at one point, Robinhood Financial, which makes most of its money from the practice, temporarily halted transactions in several securities.

Sen. Jack Reed, D-R.I., asked Gensler whether he thought order flow payments deserved “greater scrutiny and perhaps reform” by the SEC, given critics’ contention that the payments “warp the incentives of brokers and encourage them to maximize their revenue at the expense of retail investors by encouraging excessive trading.”

Gensler, the former chair of the Commodity Futures Trading Commission, committed to evaluate order flow payments if confirmed as SEC chair to determine the extent to which retail investors benefited.

“Technologies change and markets change, but we should always evaluate new approaches to markets, and payment for order flow is … it’s important to look at economically and look at whether retail investors are getting best execution,” said Gensler.

Sen. Sherrod Brown, D-Ohio, the chair of the Senate committee, similarly asked Gensler how he thought the SEC should respond to the recent GameStop-related volatility and other market turbulence.

The SEC needs to be asking questions about those recent events, Gensler said. The questions include “how to ensure that customers still get best execution in the face of payment for order flow [and] how to protect investors using trading applications with behavioral prompts designed to incentivize customers to trade more,” he said.

Sen. Mark Warner, D-Va., said during the hearing that he was concerned that Robinhood’s business model resembled that of Facebook.

“I’m not sure if you’re a customer of Robinhood whether you’re really a customer or a product,” Warner said, referring to the customers’ orders being a source of revenue for the robo-advisor.

Warner said nearly $6 billion in order flow payments have been made over the past year, which “dramatically disadvantages retail investors.”

Sen. Pat Toomey, R-Pa., the ranking Republican on the committee, also raised concerns about market structure.

Gensler said he would evaluate requests from Toomey to review issues such as a shortening of the settlement cycle and the role of transfer agents.

Do you have a news tip you’d like to share with FA-IQ? Email us at editorial@financialadvisoriq.com.

Tech ‘rollover’ is a major buying opportunity: Oppenheimer’s top strategist

PUBLISHED WED, MAR 3 20216:47 PM EST

Stephanie Landsman@STEPHLANDSMAN

One top strategist is calling the tech slump a major buying opportunity.

According to Oppenheimer Asset Management’s John Stoltzfus, the group will rebound because it plays a key role in the economy’s reopening. He cites the critical support tech companies provide to consumers and every sector of corporate America.

“We see the rollover in the Nasdaq to be actually an opportunity to add to positions that may have been a little more expensive just a few days ago,” the firm’s chief investment strategist told CNBC’s “Trading Nation” on Wednesday.

The tech-heavy Nasdaq dropped 2.7% to close at 12,997.75. The move came as the benchmark 10-year Treasury Note yield ticked up toward 1.5%. Rising yields have been putting pressure on the index because they place a ceiling on growth companies’ earnings multiples and signal inflation.

However, Stoltzfus isn’t worried.

“Without a doubt, we think some of the inflation that we’re seeing in the economic data really comes from the fact we’ve had disruptions in supply chains,” he said. “They tend to be related to the Covid pandemic.”

Stoltzfus, who has been on Wall Street since 1983, isn’t just bullish on tech. He also likes groups tied to the economic recovery such as financials, consumer discretionary and materials.

As for the broader S&P 500, Stoltzfus has a 4,300 year-end target, which implies a 13% gain from Wednesday’s close.

Investors haven’t fully grasped inflation is ‘dead ahead,’ economist Mark Zandi warns

PUBLISHED SUN, MAR 7 20215:00 PM EST

Stephanie Landsman@STEPHLANDSMAN

Investors may want to hold on even tighter.

Moody’s Analytics Mark Zandi believes Wall Street is significantly underestimating the seriousness of an inflation comeback, and he warns it will affect every corner of the market — from big tech to cyclical trades.

“Inflationary pressures will develop very quickly,” the firm’s chief economist told CNBC’s “Trading Nation” on Friday. “I don’t think there’s any shelter here.”

Yet, recent inflation jitters on the Street got a reprieve on Friday with the major indexes ending the week on a positive note. The bullish activity came as Treasury yields eased.

The S&P 500 is now just 3% from its record high while the tech-heavy Nasdaq gained 1.55% for its first positive day in four.

Zandi contends the market is too sanguine about rising interest rates. He sees inflation “dead ahead.”

So far this year, the benchmark 10-year Treasury Note yield has soared 72%. On Friday, it hit a 2021 high of 1.62%, and then receded due to some sluggishness in the February employment report.

But Zandi predicts the labor market will heat up this year and reflect a booming economy.

“We’ve got the pandemic winding down, a boatload of fiscal support coming and we’ve got a lot of folks who have pent up demand and a lot of savings that they’re going to unleash,” Zandi noted. “Growth is going to be very, very strong – lots of jobs, falling unemployment [and] wage growth.”

As a consequence, he warns investors will have to get accustomed to wild market swings that last longer than two weeks. According to Zandi, not even stocks tied to the economic recovery will offer investors a safe haven.

“These are broad, macroeconomic forces that are going to affect all parts of the market equally,” said Zandi.

His forecast calls for a sideways market for one to three years with bursts of volatility due to frothiness amid rising rates.

“Most importantly valuations are very, very high by any historical standards,” said Zandi.

The bottom line: A three year time horizon may not be a long enough for investors in this environment.

“You should be thinking out the next five or ten years,” Zandi said. “For investors who are more near-term focused, I think it’s just going to be a very difficult market to navigate in, and I don’t know that there’s one part of the market that is going to do meaningfully better than the other.”

I retired at 34 with $3 million—here are 5 downsides of early retirement that no one tells you

Sam Dogen, Contributor@FINANCIALSAMURA

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Many people have negative views on young retirees: They’re spoiled. They’re lazy. Their parents helped them. They won the lottery. But none of these things apply to me.

I grew up in a middle-income household. I worked hard to earn good grades and pay for college. I was the first one in the office and the last to leave. Sure, I got lucky by landing a high-paying investment banking job and in some of my investments, but I live a frugal life and have always been diligent about staying on top of my finances.

Don’t miss: The best cash-back credit cards with no annual fee

All of that played a huge role in my early retirement in 2012, at 34. By the time I *quit my job*, I had amassed a net worth of about $3 million that generated roughly $80,000 in investment income per year.

I don’t regret my decision

I won’t lie: Early retirement has been a dream come true. I gave up a healthy six-figure paycheck, but I gained something priceless in return: Freedom.

People told me I was crazy to leave a high-paying job at such a young age, but I was absolutely burned out and felt disillusioned by my industry of work. I never anticipated how miserable I’d be working in finance, especially after the financial crisis.

Early retirement isn’t for everyone. But from my experience, the pros outweigh the cons. I get to wake up whenever I want. I no longer have to endure unproductive meetings or put up with nefarious colleagues. I’ve traveled to more than 20 countries with my wife, wrote a book on how to negotiate a severance and get to coach high school tennis.

I also became a dad in 2017. Being a parent has been the toughest full-time job I’ve ever had; it makes working in investment banking for 13 years feel like a walk in the park.

The downsides of early retirement

I will admit that there are a few downsides. (I finally understand why researchers say that, no matter how much of a boost we get in freedom or money, we eventually revert back to our normal baseline of happiness.)

In a 2017 CompHealth survey, 68% of the 400 late-career physicians surveyed said they were not excited about retirement. Some of the top concerns included losing social interactions at work, a loss of purpose, boredom and depression.

That said, here are the biggest negatives of early retirement that no one likes to talk about:

1) You may suffer from an identity crisis.

One of the most common questions people ask when they first meet each other is: “What do you do for a living?”

When you’ve spent at least a decade working in any job, you may find it incredibly jolting to no longer be identified as the marketing expert, the investment professional or the management consultant.

It was only after I left my job that I realized how obsessed I was with my profession. I often wondered: How is the business doing without me? I was there for 11 years. Were they really able to survive without my expertise?

But after months of no emails or phone calls begging for me to come back, I finally accepted the fact that I was no longer needed.

2) You may second-guess yourself.

When you retire young, you may find yourself questioning whether you made the right choice and regret all the money and status you forewent.

I still had a mortgage to pay and was worried that I made a grave mistake. But after some time, my retirement plans grew clearer. I started writing more on Financial Samurai, the personal finance website I started in 2009. It was a cathartic way of dealing with any stress and uncertainty.

Fortunately, after writing three times a week for the past 10 years, Financial Samurai has grown tremendously. I reinvested 100% of the profits it made and generated a decent amount of passive income.

3) People may treat you like a misfit.

Maybe it’s because retiring early is unconventional. Or maybe they’re secretly jealous you’re not grinding away at a day job. Whatever the reason, people won’t always give you the same amount of respect as they would to a working-class citizen.

Eventually, I grew tired of explaining why I retired early or that I wasn’t a trust fund kid. To keep the discussion simple and regain a social identity, I’d simply say I was a writer and tennis coach.

4) You may be surprised that you aren’t that much happier.

Many people think that once they achieve financial freedom or leave a job they hate, they’ll be permanently happier. But, as I mentioned earlier, research has found that any significant amount of elevated happiness is only short-term.

On a scale of one to 10, my happiness level skyrocketed to a 10 after I was able to negotiate a pretty solid severance. It was enough to pay for five years worth of living expenses. But not too long after that check hit my bank account, I reverted back to my normal post-retirement baseline of happiness.

5) You may get really, really bored.

Retiring early is like finishing the season finale of your favorite TV show. You’re glad it got a nice ending, but you’re also sad it’s over and left wondering what’s next.

With an extra 10 to 14 hours of free time every day, my productivity suffered and I grew less motivated to achieve great wins. It didn’t help that none of my friends or former colleagues were able to hang out. There were no more company holiday parties or various client events. Believe it or not, I actually enjoyed those things!

Now, I try to attend various meet-up events in order to make new friends, but my social life mostly consists of the folks I meet through playing tennis and softball.

It wasn’t until three years later, when my wife joined me in early retirement, that my boredom began to dissipate. We did a lot of traveling, but more importantly, we became parents, which renewed my sense of purpose.

Early retirement won’t solve all your problems

Here’s the truth: If you’re unhappy before you retire early, it’s likely that you’ll still be unhappy after you retire. It’s better to figure out what’s at the very core of your issues and fix them first. Then, have a clear vision of what you actually plan to do when you retire. Otherwise, you’re just treating retirement as a crutch — and that rarely ever works out.

After seven years of retirement, I finally found my groove by regularly doing things that I enjoy:

- Writing on Financial Samurai

- Investing in real estate

- Coaching high school tennis

- Being a husband and stay-at-home parent

(I consider the first two to be more like hobbies, even though I make some money off of them.)

Early retirement isn’t the elixir to everlasting happiness, but it sure beats commuting to work and sitting in meetings all day long!

HI Financial Services Mid-Week 06-24-2014