HI Market View Commentary 03-07-2022

Keve Bybee – Keve@hurleyinvestments.com

The Big Picture

Last Updated: 04-Mar-22 14:42 ET

The economic boom in 2021 at risk of going bust in 2022

Close to 70% of GDP is driven by consumer spending. Said another way, the U.S. economy has a lot riding on the strength of the consumer.

That’s good when the consumer is strong. We saw that in 2021 as consumers, flush with stimulus cash, spent freely on goods, and eventually services, as their COVID fears lessened. Throw in the wealth effect from rising home and stock prices, and there was a lot of gun powder for a spending explosion.

Sure enough, things went boom! Real personal consumption expenditures increased 7.9% in 2021, driving a 5.7% increase in real GDP that was the strongest since 1984.

That strength won’t be repeated in 2022 and most likely won’t be seen again for a long time, if ever. In fact, the boom seen in 2021 risks going bust in 2022.

On Their Own

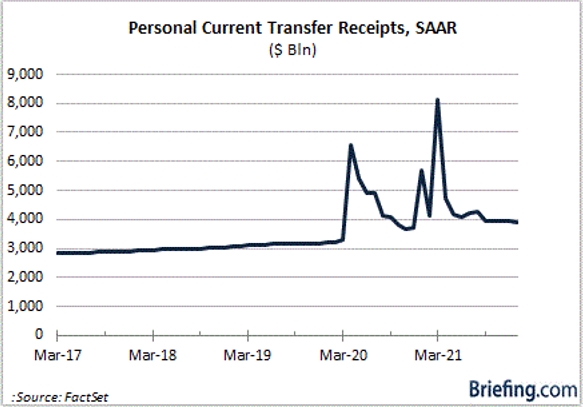

The stimulus spigot is being shut off. That’s one factor working against the consumer, comparatively speaking. There is just no way the spending activity seen in 2021 can be sustained.

Granted wages are up for most workers, yet personal current transfer receipts are way down.

Consumers for the most part are on their own again and that should change their spending behavior simply because they are not as flush with excess savings as they had been. In fact, the personal savings rate, as a percentage of disposable personal income, is lower today (6.4%) than it was in February 2020 (8.3%).

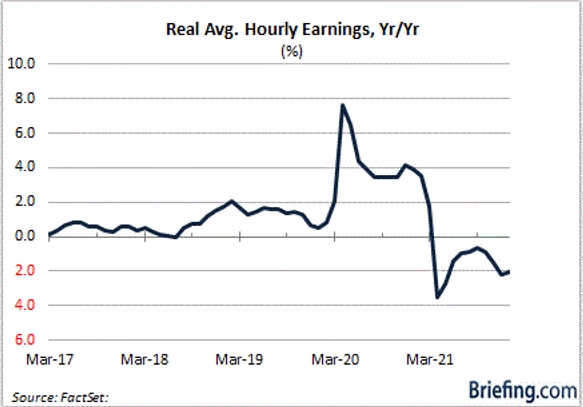

Presumably, the savings rate will continue to come down because the consumer, either because they are trying to keep up with the 2021 Joneses or because their wage gains aren’t enough to keep up with inflation, are spending out of their savings. They have to in many cases because their inflation-adjusted earnings are negative.

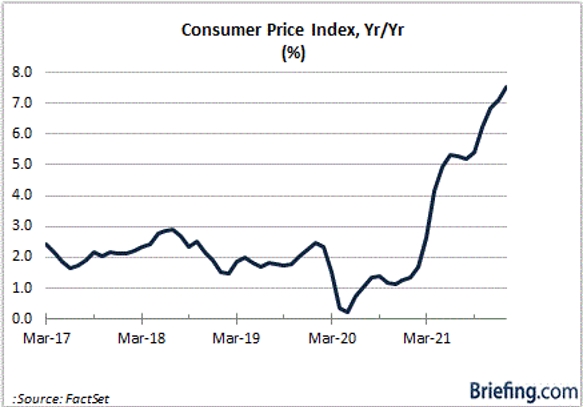

In fact, inflation-adjusted earnings have been negative since April 2021. That was the month following the peak in personal current transfer receipts, it was the month after the personal savings rate, as a percentage of disposable personal income, peaked at 26.6%, and it was the month that CPI went north of 4.0% without really looking back.

What It All Means

The Federal Reserve needs to get inflation under control. That task has been complicated by the Russia-Ukraine situation, which is driving up commodity prices, but particularly energy, metals, and agricultural futures. That is going to drive up costs for producers, which will be passed on to consumers. The pain will be (and already is for many) most acute at the gas pump and in the grocery aisles.

The wage growth we are seeing now is some of the best we have seen in a long time, but it’s being consumed by the high inflation rate.

Purchasing power would be more resilient if real earnings were positive, but that power is eroding along with the personal savings rate, stimulus payments, and stock prices.

Consumer spending is the engine that powers the U.S. economy, but that engine is going to be powering down without inflation relief because there won’t be enough real earnings to keep spending freely at a time when personal savings are becoming more dear.

That won’t be just a drag on GDP growth. Importantly, for the stock market, it will also turn into a drag on earnings growth.

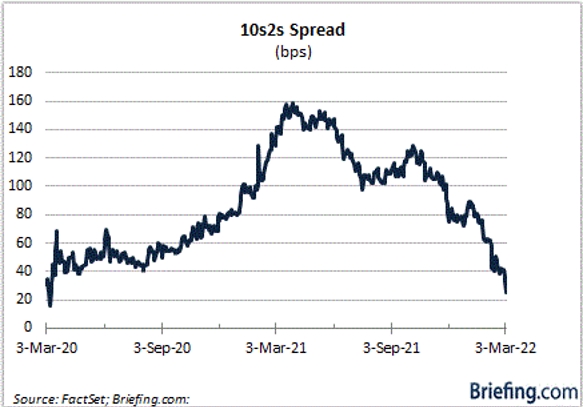

The flattening yield curve in the Treasury market and the multiple compression in the stock market are among the emerging signs that speak to these concerns.

—Patrick J. O’Hare, Briefing.com

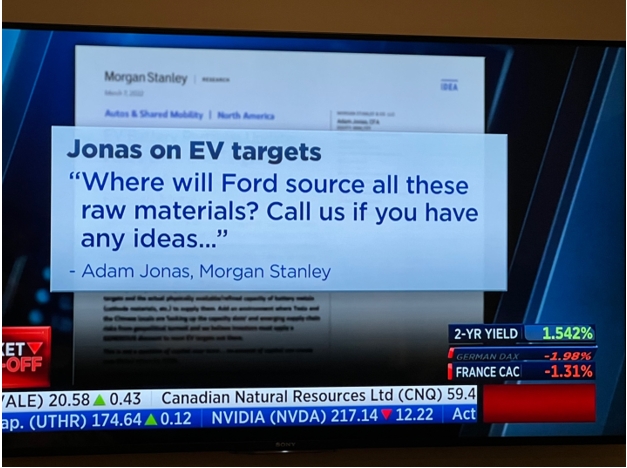

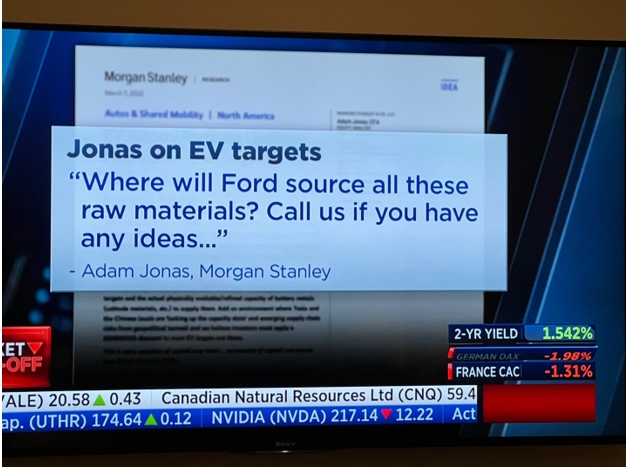

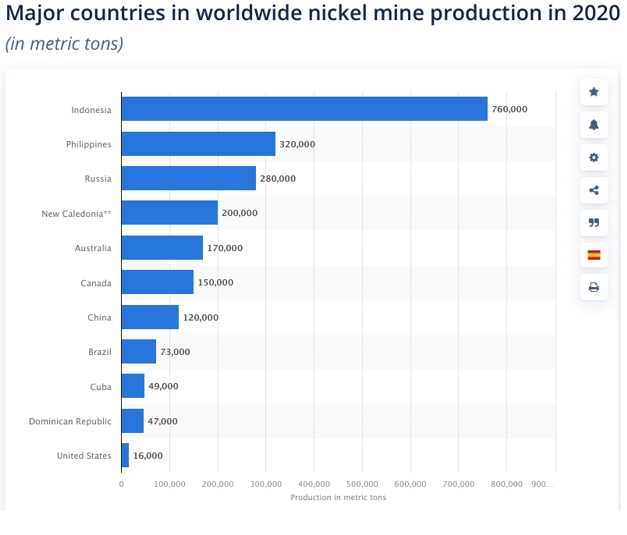

Ford – CNBC talked about how Ford and other EV manufacturers were in for a world of hurt not being able to source metals like nickel from Russia who has all the nickel.

3 problems with that:

- Not only does Russia not have the lions share of nickel, there are several other countries that produce plenty to fill demand. The price might go up, but they will still be able to find nickel

- When other countries black list Russia from selling resources to them, it doesn’t mean that they can’t sell those resources to other countries that aren’t black listed and then have Russian nickel find its way to the global market.

- Ford doesn’t deal directly with countries to source metals and commodities, they go to the futures exchanges and buy there (where there will be supply and the ability to buy nickel for a certain price and quantity far in advance).

https://www.statista.com/statistics/264642/nickel-mine-production-by-country/

I think Ford is going to be just fine, even if they have to pay a little more for these metals.

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end March 2022?

03-11-2022 -3%

Earnings:

Mon:

Tues: DKS, WOOF, WTI

Wed: UNFI

Thur: JD, UP, AOUT, DOCU, LZ, ORCL

Fri:

Econ Reports:

Mon: Consumer Credit

Tues: Trade Balance, Wholesale inventories

Wed: MBA Mortgage Apps., JOLTS, EIA Crude Oil Inv.

Thur: CPI, Initial Claims, Continuing Claims

Fri: Consumer Sentiment

How am I looking to trade?

Adding extra puts on stocks that break through support levels: BIDU, BA, DIS, FB, F, UAA

Covered calls for more protection.

Maybe something that could work for AAPL

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???