HI Market View Commentary 03-01-2021

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF FEB. 22 THROUGH FEB. 26, 2021 |

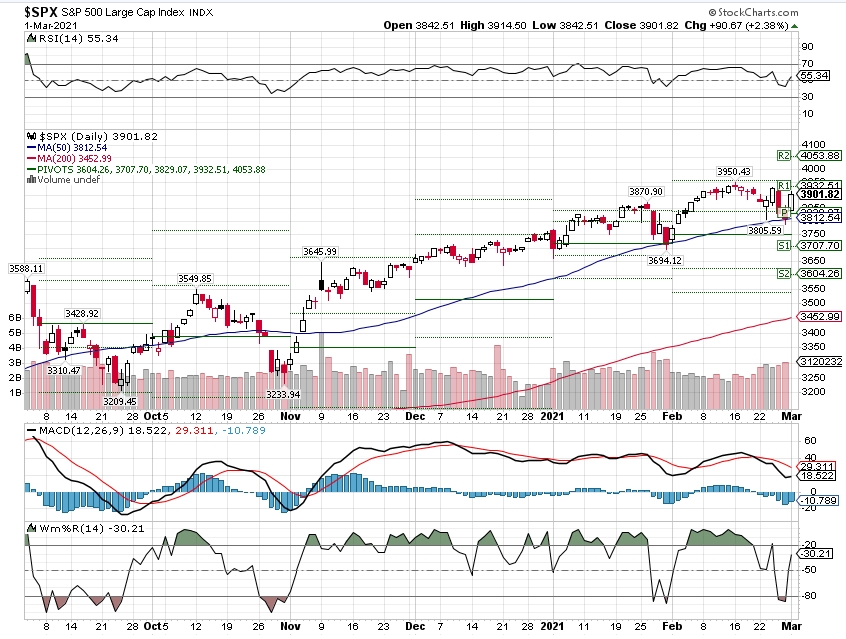

| The S&P 500 fell 2.45% last week, the market benchmark’s second weekly drop in a row, as every sector other than energy fell. However, the market benchmark ended the last trading day of February with a monthly gain of 2.6% as its declines in the second half of the month failed to erase its gains in the first half. The S&P 500 ended Friday’s session at 3,811.15, down from last week’s closing level of 3,906.71. It is now up 1.5% for the year to date. The weekly drop came as investors continued to closely watch the race between COVID-19 vaccinations and the spread of variants that may be more resistant to existing vaccines. Total US deaths from COVID-19 surpassed 500,000 earlier this week, a harrowing milestone in the pandemic. Also weighing on stocks, a jump in bond yields this week prompted investors to worry the Federal Reserve could boost rates sooner than expected. The utilities sector had the largest percentage drop of the week, down 5.1%, followed by a 4.9% slide in consumer discretionary and a 4% slip in technology. Energy was the lone sector that bucked the drop, rising 4.3%. CenterPoint Energy (CNP) was among the utilities sector’s decliners. The company reported Q4 adjusted earnings per share below the year-earlier period, although the adjusted EPS still beat analysts’ expectations and its revenue also topped the Street view. Shares fell 9.3%. Also in utilities, shares of American Water Works (AWK) shed 9.4% despite better-than-expected Q4 earnings as the company’s revenue for the quarter missed the Street view. The midpoint of its guidance range for 2021 EPS also was slightly below analysts’ mean estimate. The decliners in consumer discretionary included Best Buy (BBY) as the electronics retailer reported fiscal fourth-quarter sales below analysts’ expectations as same-store sales also missed the consensus estimate. While the company’s adjusted earnings per share for the quarter still beat the Street view, Chief Executive Corie Barry warned investors of “a high level of uncertainty related to the impacts of the COVID-19 pandemic.” Shares fell 15% on the week. Among the technology sector’s decliners, shares of Leidos Holdings (LDOS) shed 15% as the company announced an agreement to acquire Gibbs & Cox, an engineering and design firm specializing in naval architecture and marine engineering, for $380 million in cash. Leidos also reported Q4 adjusted earnings per share above analysts’ expectations, but its revenue missed the Street view and its guidance for the new fiscal year’s adjusted EPS also came in below expectations. On the upside, the energy sector’s advance came as crude oil futures also climbed. Among the gainers, shares of Marathon Oil (MRO) rose 17% on the week as the company reported a narrower-than-expected adjusted net loss for Q4 despite weaker-than-expected revenue. As the calendar turns to March next week, February manufacturing data are due Monday from Markit and the Institute for Supply Management in addition to construction spending for January. However, the biggest focus will be on the February employment figures due later in the week, with monthly private-sector jobs data from Automatic Data Processing (ADP) expected Wednesday while Thursday will bring weekly jobless claims and Friday will feature the Labor Department’s nonfarm payrolls and unemployment rate for February. |

Bond markets relax, stimulus bill heads to the Senate and Johnson & Johnson vaccine approved.

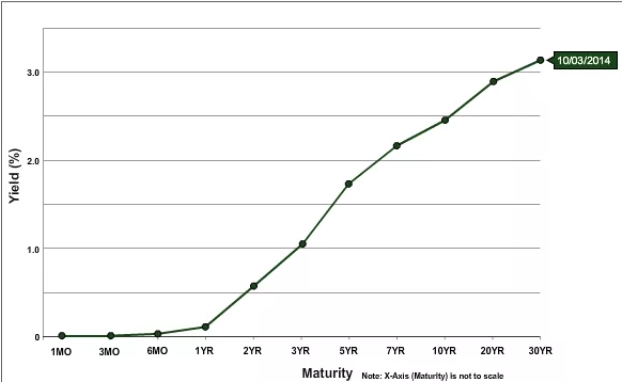

Yields down

Global bond markets are stabilizing after last week’s rout as central banks across the world reassure investors that they will continue their accommodative policy measures. While officials at the Federal Reserve and Bank of England have said they see little cause for concern in the rapid run up in yields last week, Australia’s monetary authority signaled it would stick with its yield target and the European Central Bank has said it will not tolerate higher yields that risk undermining the economy. Increasingly, investors are also reassessing the risk of a breakout in inflation, with some now thinking fears of a rapid increase in consumer prices are overblown.

Stimulus

President Joe Biden’s $1.9 trillion stimulus bill, which was passed by the House on Saturday with no Republican support, moves to the Senate. Plans to penalize companies that don’t raise the minimum wage have been shelved in order for the package to quickly progress, according to people familiar with the matter. With some unemployment support measures running out in two weeks, the focus for lawmakers is on getting the bill passed through the Senate and ready for Biden’s signature as quickly as possible.

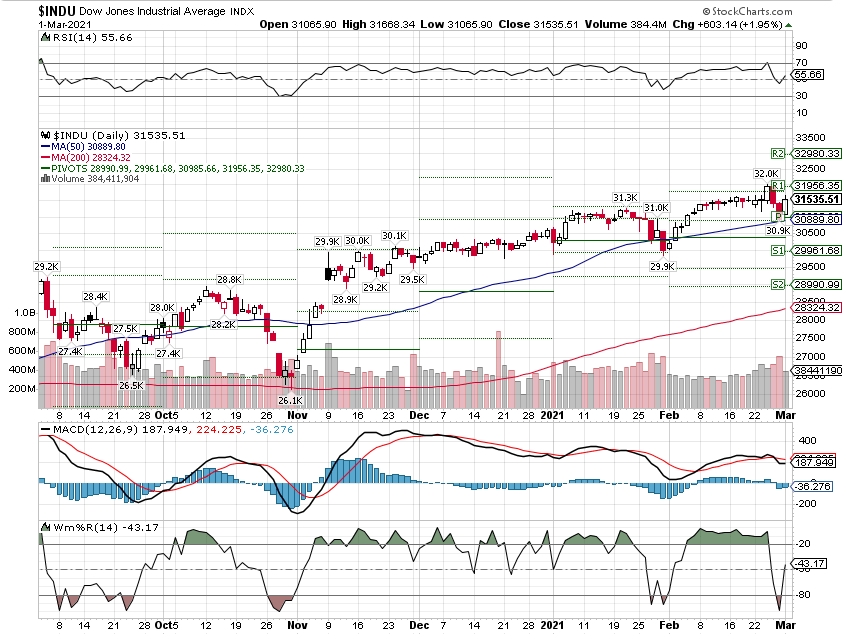

Where will our markets end this week?

Up

DJIA – Bullish

SPX – Bullish

COMP – Turning Bullish

Where Will the SPX end March 2021?

04301-2021 0.0%

Earnings:

Mon: DDD, ZM

Tues: ANF, AZO, CHS, KSS, HPE, JWN, ROST, URBAN, TGT, AMC

Wed: DLTR, WEN, MRVL, RRGB, TCOM

Thur: BJ, KR, ACGO, GPS, IMAX, SWBI, CCL, COST

Fri: BIG

Econ Reports:

Mon: ISM Manufacturing, Construction Spending

Tues:

Wed: MBA, ISM Services, Fed Beige Book, ADP Employment

Thur: Initial Claims, Continuing Claims, Productivity, Unit Labor Costs, Factory Orders

Fri: Average Workweek, Non- Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings, Trade Balance, Consumer Credit

Int’l:

Mon –

Tues –

Wed – CN: Ciaxin Services PMI

Thursday –

Friday-

Sunday –

How am I looking to trade?

EARNINGS

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

How JPMorgan Makes Money

JPMorgan generates most of its revenue from Consumer & Community Banking

Updated Feb 25, 2021

JPMorgan Chase & Co. (JPM) is a global financial services holding company and the largest U.S. bank by assets.1 The company provides services including consumer banking, investment banking, commercial banking, and asset management for individuals, corporations, institutions, and governments globally.2 New York City-based JPMorgan competes internationally with a broad range of banks, brokerage firms, investment banking companies, hedge funds, commodity trading companies, private equity firms, insurance companies and investment managers, including Bank of America Corp. (BAC), Citigroup Inc. (C), Morgan Stanley (MS), Wells Fargo & Co. (WFC), and Goldman Sachs Group Inc. (GS).

KEY TAKEAWAYS

- JPMorgan provides financial services to consumers, small businesses, large corporations, governments, and other clients.

- Its Consumer & Community Banking segment is the largest source of revenue.

- The Corporate & Investment Bank segment is the largest source of net income and is growing fast.

- JPMorgan is shutting down its private banking business in Mexico after a similar closure of its private banking business in Brazil last summer.

https://datawrapper.dwcdn.net/9LX4k/1/ JPMorgan’s Financials

JPMorgan posted net income of $29.1 billion on revenue of $119.5 billion in its 2020 fiscal year (FY), which ended December 31, 2020. Revenue rose 3.6% compared to the previous year.3 The rise in revenue was driven by an 11.7% increase in non-interest revenue, which was slightly offset by a 4.7% decrease in net interest income.

Net income fell 20.0% in FY 2020 compared to FY 2019. Despite rising revenue, JPMorgan’s net income was adversely impacted by a significant increase in provision for credit losses during the year. The bank set aside additional provisions amid the economic uncertainty triggered by the COVID-19 pandemic.3

JPMorgan’s Business Segments

JPMorgan breaks down its revenue and net income into the following business segments: Consumer & Community Banking; Corporate & Investment Bank; Commercial Banking; Asset & Wealth Management; and Corporate. Unlike JPMorgan’s companywide financial numbers, the segment breakdown is done on a non-GAAP basis. Total non-GAAP revenue in FY 2020 was $122.9 billion, approximately $3.4 billion more than GAAP revenue. Total non-GAAP net income for the year was $29.1 billion, the same as GAAP net income.4

Consumer & Community Banking

JPMorgan’s Consumer & Community Banking segment provides a variety of services to consumers and businesses including deposit and investment products, cash management, payment solutions, mortgage origination and servicing, credit-card issuance, and auto loans.5 The segment reported net income of $8.2 billion in FY 2020, down 50.3% from the previous year. Revenue for the segment was $51.3 billion, down 7.0% from FY 2019. The segment accounts for about 27% of total net income and about 41% of total non-GAAP revenue.4

Corporate & Investment Bank

JPMorgan’s Corporate & Investment Bank segment provides investment banking, market-making, prime brokerage, and treasury and securities products and services to corporations, investors, financial institutions, and governments.6 Net income for the segment grew 43.0% in FY 2020 compared to FY 2019. At $17.1 billion, the segment accounts for about 55% of JPMorgan’s total net income. Revenue for the segment grew 25.5% to $49.3 billion for the year, comprising about 40% of total non-GAAP revenue.4

Commercial Banking

JPMorgan’s Commercial Banking segment offers comprehensive financial solutions, including lending, wholesale payments, investment banking, and asset management products to clients including small businesses, midsized and large corporations, and local governments.7 The segment posted net income of $2.6 billion in FY 2020, down 34.9% from the previous year and comprising about 8% of the total. Revenue for the segment grew 0.5% to $9.3 billion, comprising nearly 8% of total non-GAAP revenue.4

Asset & Wealth Management

JPMorgan’s Asset & Wealth Management segment provides services across all asset classes, and has $2.7 trillion of assets under management (AUM).8 The segment also provides retirement products and services, as well as brokerage and banking.9 Net income rose 4.4% in FY 2020 to $3.0 billion, comprising nearly 10% of JPMorgan’s total net income. Revenue grew 4.8% compared to FY 2019. At $14.2 billion, revenue for the segment accounts for about 11% of total non-GAAP revenue.10

Corporate

JPMorgan’s Corporate segment measures, monitors, reports, and manages the bank’s liquidity, funding, capital, and foreign exchange risks, among other functions.11 The segment reported a net loss of $1.8 billion in FY 2020 compared to net income of $1.1 billion in the previous year. Revenue for the segment was also negative at -$1.2 billion compared to $1.2 million in FY 2019.4

(Note: segments with negative revenue and/or net income are excluded from the respective revenue and net income percentage share calculations and pie charts above.)

JPMorgan’s Recent Developments

JPMorgan is planning to close its private banking business in Mexico, people familiar with the matter told Bloomberg. The bank has signed an agreement to refer local business to BBVA Mexico, which is the local unit of Banco Bilbao Vizcaya Argentaria SA. However, JPMorgan will still continue to serve clients based in Mexico from outside of the country. The move follows a similar decision made by the bank last summer to shut down its local private-banking operations in Brazil and refer Brazilian clients to Banco Bradesco SA.12

How JPMorgan Reports Diversity & Inclusiveness

As part of our effort to improve the awareness of the importance of diversity in companies, we offer investors a glimpse into the transparency of JPMorgan and its commitment to diversity, inclusiveness, and social responsibility. We examined the data JPMorgan releases to show you how it reports the diversity of its board and workforce to help readers make educated purchasing and investing decisions.

Below is a table of potential diversity measurements. It shows whether JPMorgan discloses its data about the diversity of its board of directors, C-Suite, general management, and employees overall, as is marked with a

| JPMorgan Diversity & Inclusiveness Reporting | |||||

| Race | Gender | Ability | Veteran Status | Sexual Orientation | |

| Board of Directors |  (U.S. Only) (U.S. Only) |  | |||

| C-Suite |  (U.S. Only) (U.S. Only) |  | |||

| General Management |  (U.S. Only) (U.S. Only) |  |  (U.S. Only) (U.S. Only) |  (U.S. Only) (U.S. Only) |  (U.S. Only) (U.S. Only) |

| Employees |  (U.S. Only) (U.S. Only) |  |  (U.S. Only) (U.S. Only) |  (U.S. Only) (U.S. Only) |  (U.S. Only) (U.S. Only) |

https://www.investopedia.com/how-bank-of-america-makes-money-4798042

How Bank of America Makes Money

Bank of America gets most of its revenue from consumer banking

By NATHAN REIFF

Updated Feb 27, 2021

Bank of America Corp. (BAC), one of the world’s largest investment banks and financial institutions, serves a broad range of customers, including individual consumers, wealthy investors, large corporations, and governments. It operates primarily in the U.S., where it gets the vast majority of its revenue, as well as in dozens of countries around the globe. The company faces a broad array of competitors, including JPMorgan Chase & Co. (JPM), Citigroup Inc. (C), Goldman Sachs Group Inc. (GS), credit card issuers like Visa Inc. (V), hedge funds, and private equity firms.1 The Charlotte, North Carolina-headquartered company expanded from a regional player into a global giant through a series of major acquisitions in the past several decades.2

KEY TAKEAWAYS

- Bank of America provides financial services to customers including consumers, wealthy investors, institutional clients, and governments.

- The company’s Consumer Banking segment provided the largest share of total revenue in 2020, but Global Markets had the fastest revenue growth.

- Bank of America cut some of its staff in the global banking and markets division in January 2021.

https://datawrapper.dwcdn.net/gpKZX/1/ Bank of America’s Financials

Bank of America has staged an operational turnaround in the wake of the 2008 financial crisis, when many experts feared it might slip into bankruptcy.2 But the company is once again feeling the adverse effects of an economic crisis, this time one stemming not from within the financial sector but from the COVID-19 pandemic. Bank of America reported a fall in total revenue, net of interest expense, of 6.3% to $85.5 billion for its 2020 fiscal year (FY), which ended December 31, 2020. Net income declined 34.8% to $17.9 billion compared to the previous year. The bank’s net interest income, a key indicator, declined 11.3% to $43.4 billion in FY 2020.3

Bank of America’s Business Segments

Bank of America’s four business segments are categorized predominantly according to the types of customers utilizing each area. The Consumer Banking segment is focused on consumers and small businesses, while the Global Wealth & Investment Management segment addresses the needs of individual clients with over $250,000 of total investable assets. Global Banking provides investment banking services and related products, while Global Markets focuses on institutional clients.4 The data shown in the pie charts above excludes negative revenue in the company’s “All Other” segment, which is outlined in further detail below.

Consumer Banking

The Consumer Banking segment provides varied credit, banking, and investment products and services to small businesses and consumer clients. These range from traditional savings accounts, CDs, and IRAs, to credit and debit cards, residential mortgages, and loans.5 In FY 2020, Consumer Banking accounted for 37% of total revenue and about 36% of net income. The segment generated the most revenue across all segments, accounting for $33.3 billion in revenue. This is down about 13.8% from FY 2019. Consumer Banking net income fell 49.8% to $6.5 billion, but still comprised the largest share of the company’s total net income for the year.6

Global Wealth & Investment Management

The Global Wealth & Investment Management segment provides financial advisory, brokerage, banking, and retirement products to clients with large amounts of investable assets.5 In FY 2020, this segment generated $18.6 billion in revenue, down 4.9% from the previous year. This segment also accounted for $3.1 billion in net income, a decrease of 27.7%. Global Wealth & Investment Management represented about 21% of total revenue and 17% of net income for FY 2020.6

Global Banking

Bank of America’s Global Banking segment offers lending-related products and services, including underwriting and advisory services, as well as investment banking products. The customers in this segment are most commonly middle-market companies, commercial real estate firms, not-for-profit organizations, and corporations of various sizes.5 Global Banking generated $19.0 billion in revenue for the year. This was down 7.3% from FY 2019. Global Banking also generated $3.5 billion in net income, down 57.0%. The segment accounted for 21% of revenue and 19% of net income in FY 2020.6

Global Markets

The Global Markets segment provides sales and trading services as well as research services to institutional clients, including financing, securities clearing, settlement, custody, and market-making services.5 The segment generated $18.8 billion in revenue for FY 2020, up 20.2% from the previous year. It accounted for $5.2 billion in net income, up 50.0% from FY 2019. Global Markets made up about 21% of all revenue and 29% of net income for the year.6

‘All Other’ Segment

Bank of America’s “All Other” segment includes non-core mortgage loans, liquidating businesses, equity investments, and other activities which are not categorized in one of the four primary segments above.5 This segment posted a revenue loss of $3.6 billion and net loss of $407 million in FY 2020.6

Bank of America’s Recent Developments

Bank of America cut some of its staff in the global banking and markets division, Bloomberg reported at the end of January 2021. The layoffs affected employees in sales and trading, research, investment banking, and capital markets. It is typical for Wall Street banks to make staffing changes around this time of year. But the move comes months after Bank of America CEO Brian Moynihan pledged not to lay off any employees in 2020 amid the pandemic, signalling that the suspension of layoffs has not carried over into the new year.78

How Bank of America Reports Diversity & Inclusiveness

As part of our effort to improve the awareness of the importance of diversity in companies, we offer investors a glimpse into the transparency of Bank of America and its commitment to diversity, inclusiveness, and social responsibility. We examined the data Bank of America releases to show you how it reports the diversity of its board and workforce to help readers make educated purchasing and investing decisions.

Below is a table of potential diversity measurements. It shows whether Bank of America discloses its data about the diversity of its board of directors, C-Suite, general management, and employees overall, as is marked with a

| Bank of America Diversity & Inclusiveness Reporting | |||||

| Race | Gender | Ability | Veteran Status | Sexual Orientation | |

| Board of Directors |  |  | |||

| C-Suite | |||||

| General Management |  (U.S. Only) (U.S. Only) |  | |||

| Employees |  (U.S. Only) (U.S. Only) |  |

$15 minimum wage not allowed in Biden’s Covid relief bill, Senate official says

KEY POINTS

- Democrats cannot include a $15 per hour minimum wage in their $1.9 trillion coronavirus relief package.

- Senate parliamentarian Elizabeth MacDonough ruled the provision does not comply with the rules governing budget reconciliation, the process that enables Democrats to pass the rescue package without GOP votes.

- Democratic leaders consider raising the stagnant federal minimum wage a priority, but Republicans say a $15 pay floor could hamper small businesses in parts of the country.

Democrats cannot include a $15 per hour minimum wage in their $1.9 trillion coronavirus relief package, a Senate official ruled Thursday, derailing for now a party priority and a raise for millions of Americans.

Nonpartisan Senate parliamentarian Elizabeth MacDonough determined lawmakers could not include the policy under budget reconciliation, CNBC confirmed. She and her staff heard arguments from Democrats and Republicans about whether the proposal met strict standards for deficit effects needed to include it in the process.

Reconciliation allows the Senate to pass bills with a simple majority — in this case with no Republicans who are wary of another massive rescue package. However, Democrats faced challenges in passing the pay hike regardless of whether the chamber’s rules allowed it in the legislation.

House Democrats included the $15 per hour minimum wage in the rescue bill they plan to approve Friday. House Speaker Nancy Pelosi, D-Calif., said in a statement Thursday that the provision “will remain” in the relief bill as Democrats “are determined to pursue every possible path” to a federal pay hike.

The decision means the Senate will likely pass a different version of the bill than the House, and representatives will have to approve the plan a second time.

“We are deeply disappointed in this decision,” Senate Majority Leader Chuck Schumer, D-N.Y., said in a statement. “We are not going to give up the fight to raise the minimum wage to $15 to help millions of struggling American workers and their families. The American people deserve it, and we are committed to making it a reality.”

President Joe Biden is also “disappointed in this outcome,” White House press secretary Jen Psaki said in a statement.

Senate Budget Committee Chair Bernie Sanders, I-Vt., said Thursday that “I strongly disagree” with the parliamentarian’s decision. He added that he will work to include an amendment in the relief bill “to take tax deductions away from large, profitable corporations that don’t pay workers at least $15 an hour and to provide small businesses with the incentives they need to raise wages.”

The bill would raise the federal pay floor to the threshold by 2025, then index future hikes to inflation. It would lift 900,000 people out of poverty but cost 1.4 million jobs, the nonpartisan Congressional Budget Office estimated earlier this month.

The proposal would give up to 27 million people a raise, the CBO said.

Democrats consider raising the minimum wage — stuck at $7.25 an hour since 2009 — a priority while they control both chambers of Congress and the White House. But as Republicans question whether a $15 pay floor will hamper small businesses in parts of the country, the policy will not garner 60 votes in a Senate split 50-50 by party.

Senate Budget Committee ranking member Lindsey Graham, R-S.C., cheered MacDonough’s decision on Thursday.

“Very pleased the Senate Parliamentarian has ruled that a minimum wage increase is an inappropriate policy change in reconciliation. This decision reinforces reconciliation cannot be used as a vehicle to pass major legislative change – by either party – on a simple majority vote,” he said in a statement.

Republicans used reconciliation in 2017 to approve tax cuts for businesses and households and scrap the Affordable Care Act’s individual mandate.

Republican Sens. Mitt Romney and Tom Cotton offered a GOP answer to the minimum wage push, proposing a plan that would raise the pay floor to $10 an hour and put restrictions on hiring undocumented immigrants. Arkansas, the state Cotton represents, has an $11 minimum wage.

Democratic leaders will reject the framework proposed by Romney and Cotton.

Democratic Sens. Joe Manchin of West Virginia and Kyrsten Sinema of Arizona both opposed a $15 per hour minimum wage. Manchin said he backed $11 per hour instead.

The ruling removes the biggest remaining point of conflict among Senate Democrats as they try to pass the relief package before March 14, when unemployment aid programs expire.

— CNBC’s Ylan Mui contributed to this report

https://seekingalpha.com/article/4406698-deep-dive-in-boeing-earnings

A Deep Dive Into Boeing Earnings

Feb. 18, 2021 9:00 AM ETThe Boeing Company (BA)40 Comments10 Likes

Summary

- Boeing lost billions, but considering forward carrying de-risk I do see improvement.

- Investors should be aware of divergence between revenue, earnings and cash flow more than ever.

- Boeing is facing an improving but tough path ahead.

- I do much more than just articles at The Aerospace Forum: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Boeing’s (BA) Q4 2020 report contained some interesting elements and while Boeing has been getting a lot of attention since the MAX grounding it seems like the same is not happening now that the Boeing 737 MAX is cleared. However, especially now it’s important to keep an eye on the numbers to see where they show improved and to see where they remain depressed. While I have been laying low I have seen there has not been a lot of detailed coverage on the earnings report while there’s a lot that can be said about the earnings.

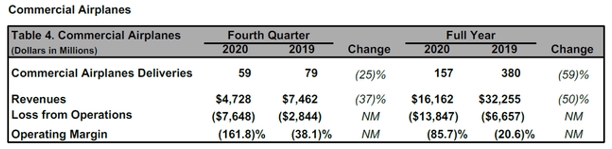

Boeing Commercial Airplanes: Signs of improvement

Source: Boeing

Obviously, for Boeing Commercial Airplanes (referred to as “BCA” after this) expectations have not been high, but currently I’m interested in seeing sequential improvement in results. Boeing delivered 59 aircraft, up 31 units compared to Q3, and we also observed that year-over-year cumulated deliveries declined 59% compared to 67% last quarter. So in terms of delivery volume the decline for the full year numbers was significant, less compared to the same quarter last year but a significant improvement sequentially. The sequential improvement in delivery volume was obviously driven by the Boeing 737 MAX returning in the delivery mix accounting for 27 Boeing 737 MAX aircraft.

Sequentially, revenues increased by almost $1.1B which is a major improvement though to the full year numbers it has very little impact as the revenue decline remained stable around 50%. The TAF Boeing Orders and Deliveries Monitor estimated the BCA revenues at $4.84B. Seemingly Boeing missed expectations by $112 million when looking at the delivery volumes for commercial aircraft. However, included in Boeing’s number was an increase of $128 million in liabilities related to the Boeing 737 MAX which affects Boeing’s topline. Taking that into consideration we can conclude that the revenues were $16 million higher than our Monitor shows. So you can say BCA revenues excluding the liabilities impact were in line with expectations.

For BCA earnings the same cannot be said; Losses increased from $1.37B in the previous quarter to $7.65B in Q4 2020 compared to $2.84B in Q4 2019 bringing the full year losses to $13.85B compared to $6.66B in 2019. Losses widened considerably by all reference points.

This was driven by a combination of several charges:

- Boeing Commercial Airplanes reported a $6.5B reach-forward loss on the Boeing 777X program. Boeing determined the accounting quantity for the program and on the back of reduced demand, cost growth, further delays and continued lower than anticipated production rates the company contracted the accounting quantity and recorded a reach forward loss meaning that for the 350 units in the accounting block Boeing expects that costs will exceed revenues by $6.5B. The Boeing 777X loss accounts for 85% of the Boeing Commercial Airplanes losses and while it is by no means a pretty sight it does serve as a significant de-risk for the Boeing 777X program.

- As Boeing continued production of the Boeing 737 MAX at an extremely low rate it recognized abnormal production costs of $468 million.

- Liabilities related to the Boeing 737 MAX grew by $128 million.

So, what would the BCA numbers have looked like without the charges? BCA stacked $7.1B in charges. Correcting for this, the loss would have narrowed to $559 million. However, I do believe that the abnormal production cost, which will continue in the quarters to come, should be added back. That would bring the Q4 2020 loss to $1B vs. $1.5B in the previous quarter. That means that if we remove the one-off items, most notably the Boeing 777X, which is a forward carrying de-risk, there has been a significant improvement in loss from operations. Conclusion remains that Boeing would remain loss-making when stripping off the charges.

The full-year results show a significant deterioration of $7.2B but $6.5B of that is driven by the forward carrying de-risk on the Boeing 777X program.

For Boeing Commercial Airplanes. On a revenue level, the segment performed as expected during the quarter. On earnings level, BCA lost billions of dollars, but put it in the crisis context and considering the de-risk on the Boeing 777X program I believe these numbers are quite positive developments with further room for recognized profits to run as the Boeing 737 MAX delivery stream recovers further.

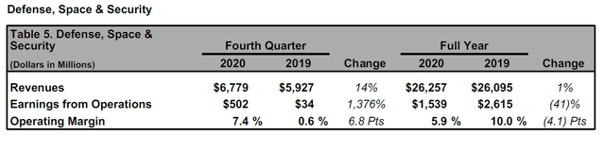

Boeing Defense, Space and Security earnings disappoint

Source: Boeing

Fourth quarter revenues for Boeing Defense, Space & Security (referred to as “BDS” after this) improved by 14% during the quarter. That was primarily driven by a $410 charge in the fourth quarter of 2019. Nevertheless, revenues improved by 7% if we correct for the Q4 2019 charge driven by higher volumes. Also the full year revenues do show the relative stability of the business being 1% higher in 2020 and 1% lower compared to 2019 when we add back the $410 million charge for the Commercial Crew program.

The same, however, does not hold for earnings. During the quarter, we saw a significant improvement in profitability but for BDS we are looking for a margin of 11%. That means Boeing underperformed by $243 million and that can be explained by $275 million in cost growth on the KC-46A program due to COVID-19 and other production efficiencies.

During the down turn in the BCA results I have tried to look at BDS results as a factor of stability. Reality, however, is that while revenues are stable the profits tumbled by 41% or $1.076B. So, we can’t really speak about stability here. The KC-46A program added $1.32B in costs of which $769 million was driven by COVID-19. This is likely related to the additional costs the KC-46A program carries as commercial wide body production has decreased. What remains is that even amid the COVID-19 driven cost growth, the full year results were not what we are looking for to call BDS a stable contributor to earnings. Also when looking at the sequential numbers we see that profits declined from $628 million to $502 million.

BDS results were disappointing and, if anything, it showed the continued weakness of the KC-46A program.

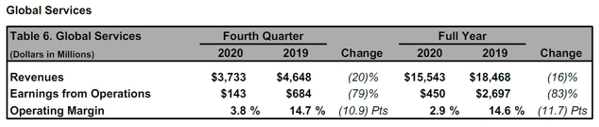

Boeing Global Services: Reset on earnings

Source: Boeing

In recent years, Boeing focused on increasing its sales in the spare parts, logistics and services segment. The acquisition of KLX Aerospace fits the long-term objective of growing into this services sphere. However, the pandemic has significantly eroded this business as contract values have fallen or even completely terminated as aircraft are being retired.

Revenues declined by 20% to $3.7B, which is a similar decline to the one we saw last quarter when the decline was 21%. Sequentially, revenues improved by 1% but earnings dropped by 48% driven by a $290 million charge. Excluding the charge earnings would be 60% higher sequentially.

So, impairment has significantly eroded earnings but I believe that at some point we will be able to see the operational strength again, though I do believe that revenues will remain depressed in the coming years as airlines right size their fleet and that means that services revenues might not fully recover.

What to say about earnings?

The tough part is to say something about earnings, because it’s loaded with charges. Some could really be seen as one-off items, others cannot. What stands is that earnings declined by $10.8B generating a $12.8B loss. What I consider to be one-off items are the $6.5B de-risk and the $744 million settlement between Boeing and the Department of Justice. Excluding these items there would be a $5.5B loss. This includes $2.6B in annual abnormal production costs for the Boeing 737 MAX which will continue throughout 2021 and $1.7B in severance costs and impairments, $500 million in liabilities increases, $336 million in costs related to the pickle fork issue on the Boeing 737 Next Generation, $702 million in costs related to the KC-46A COVID-19 impact and $551 million in costs for fixes for the Remote Visions System. Excluding one-off items with Boeing always is tricky, because business as usual numbers are mostly smooth, and when costs occur they are expensed via charges. The difficult part with Boeing’s earnings is that especially with the KC-46A every time you think that the program is de-risked, additional costs are absorbed, and with all earnings you can correct for one-off items until the earnings look somewhat acceptable, but that’s a practice that won’t necessarily provide an accurate image.

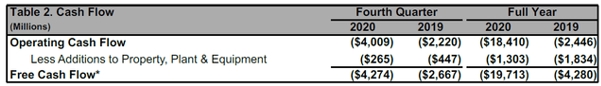

What I’m seeing, however, is a lot of reason to assume that the losses will significantly taper in 2021 despite a challenging path ahead. At the same time, I believe investors should be extremely aware that even if earnings will taper significantly we do have to look at the cash flow.

Cash flow, cash and debt

How bad of a year it was is clear from the free cash flow standing at negative $19.7B, and I think that is the nicer metric to look at this point. Not because the free cash flow picture is better… it is not, but in the end while you can strip off earnings in any way you want things boil down to cash flow. So the free cash flow will show that while revenues and profits will be recognized on the Boeing 737 MAX deliveries throughout the year not all of that will translate to cash, it also will show that while the Boeing 787 has low contributions to earnings the actual cash flow from delivery of the aircraft which should start picking up later in the ear will provide a tailwind to cash flow. Continued cash usage can be expected in 2021 but it should be significantly better than what we saw in 2020 and sequentially there also has been a lot of improved from $5.6B in Q2 2020 when the pandemic hit to $4.3B in Q4 2020 and we are expecting continued improvement that should drive the cash burn down to a lower but still challenging level that still is challenging given Boeing’s year-end cash position.

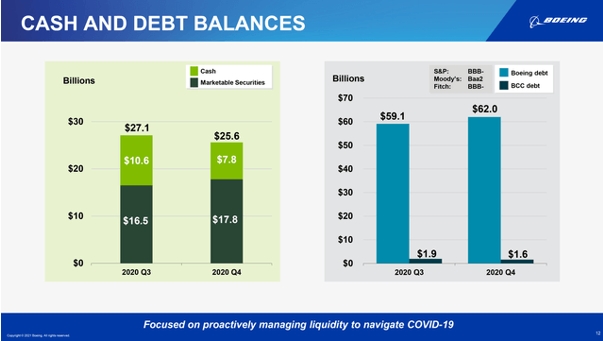

Source: Boeing

By year-end Boeing had $25.6B in cash and marketable securities including $7.8B in cash. With that cash on hand figure, I believe things will be challenging for Boeing but the company can still draw down its $9.5B credit facility and recently issued $9.8B in bonds. So, Boeing will be able to service its cash needs in 2021 I believe. Problematic, however, is that stacking debt is continuing and paying off debt from operational cash is still at least 1-2 years away. While rated close to junk status, Boeing has been able to fall back on the bond market but the debt they have now it will pressure them for years to come. So, Boeing can sit things through but it won’t be a comfortable sit and it will be a long sit.

Conclusion

Boeing’s 2020 earnings were not pretty but deserve a closer look. BCA is matching expectations in terms of revenues while BDS is even exceeding expectations and BGS is not performing as one would hope but totally fitting to the current market environment. What should be noted is that the Boeing 777X is a de-risk that puts an accounting charge in the current quarter de-risking future year losses on the Boeing 777X from earnings perspective. Accounting for this, sequentially there still is strong improvement. For BDS and BGS the earnings are not looking pretty. BDS provides stability on revenues but not on earnings levels due to ongoing challenges on the KC-46A program but also its link to the Everett factory that likely makes it carry a lot of overhead costs now while BGS has been facing impairments and we will likely see lower commercial services revenues and earnings going forward.

At this time there’s a divergence between revenue and cash, simply because the way the accounting works so keeping an eye on cash generation is going to be important. Sequentially those numbers are improving but still point at a multi-billion cash burn in 2021, while Boeing’s debt remains at extremely elevated levels and currently Boeing will likely meet its repayment obligations largely by tapping into its borrowing capacity and refinancing debt. So, this is going to be an extremely long road for Boeing and while I see huge improvements, there’s still cash burn and Boeing’s debt has not moved in the right direction and one can wonder when that debt balance will finally start moving in the right direction.

Are you an investor looking to benefit from the growth of the aerospace industry? The Aerospace Forum helps you do that. With a background in aerospace engineering, we have a unique approach to our investment theses and idea generation combining our engineering background and financial data analysis delivering deep-dive analysis and access to interactive monitors to inform your investment decisions.

Click here to join The Aerospace Forum today and start your flight to growth!

Disclosure: I am/we are long BA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

https://seekingalpha.com/article/4408768-apple-first-buying-opportunity-in-months

Apple: First Buying Opportunity In Months

Feb. 25, 2021 7:00 AM ETApple Inc. (AAPL)52 Comments35 Likes

Summary

- Apple has been firing on all cylinders lately as it benefits from the 5G super cycle, new Mac technology and growth in services.

- The problem is that, for the past few months, valuations have stretched a bit too thin. The recent 10%-plus correction may be an opportunity.

- I think that buying AAPL now is a chance to accumulate shares at a more attractive entry point and hold them for a multi-year period.

- Looking for a helping hand in the market? Members of Storm-Resistant Growth get exclusive ideas and guidance to navigate any climate. Get started today »

I have been favorable to an investment in Apple (AAPL) for as long as I have covered the name: Five years as an independent researcher and another two on Wall Street. The stock has rarely disappointed me.

But I must admit, it has been a few months since I felt comfortable being a pound-the-table Apple bull. Shares have been rushing ahead a bit too much, a bit too quickly. In my most recent article, I even urged readers to wait for a pullback before committing money to the stock again, despite outstanding fiscal first quarter results.

Now, I believe the risk-reward dynamic is finally favorable to an investment in Apple once again. Because this stock moves fast, it’s unclear how long the window of opportunity will remain open.

First, fundamentals

It must be hard for an Apple bear to build a strong case against the Cupertino, California,-based company based on business fundamentals. The tech giant has been firing on all cylinders lately.

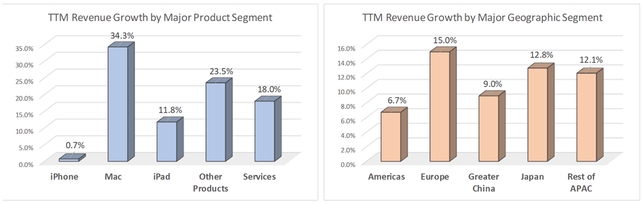

Driven by many factors that transcend the success of the most recently-launched smartphone, Apple managed to deliver (positive) revenue growth across every single segment and major geographic group in calendar 2020. Among them were the iPhone and Greater China, both of which had been under pressure until very recently. See graph below.

Source: DM Martins Research, data from multiple company reports

I remain slightly concerned about how well the stay-at-home beneficiaries, namely the Mac and iPad, will fare when the global economies fully reopen. Against tough comps of 34% and 12%, respectively, it will be hard for Apple to impress the more optimistic investor in 2021 – despite the opportunities provided by the new M1 chip and the tablet-as-a-PC trend.

Still, it’s hard to think of a better environment for Apple, at the very least since the launch of the highly successful iPhone 6:

- The 5G super cycle is still in its early innings.

- Apple has been gaining smartphone market share, at last.

- The Apple One bundle and new service offerings could lead service revenues to double again in five years.

- Green shoot opportunities in AR, VR and even autonomous vehicles have yet to be meaningfully explored.

Second, valuation

None of the above should be news to the more attentive Apple investor. What has changed in the past few weeks, however, are valuations.

Here, Apple bears can stitch together a plausible case against investing in the company’s stock. The graph below is straight-forward, and illustrates how much more expensive shares have become, especially since 2019, relative to the past decade.

But of course, 2021 is nothing like 2011. The market is now clearly more willing to pay up for shares of dominant players in the tech and consumer spaces, which is good news for Apple. Interest rates have fallen off a cliff, making stocks more desirable. Therefore, looking at more recent trends in valuation multiples makes more sense to me.

Data by YCharts

From this shorter-term perspective, Apple is finally looking affordable once again. A next-year P/E of 27x is far from being depressed, but the multiple has returned to August 2020 levels. Between then and now, business fundamentals have not deteriorated much and risks have not increased substantially to justify the valuation compression – quite the contrary, I would argue.

Here’s another way to think about this: Apple is a high-quality (think of brand identity, balance sheet solidity, etc.), top-performing player in its sector. It’s not a stretch to assume that, over time, the company will continue to deliver solid financial results, leading the stock price higher in the long run.

This being the case, logic suggests that buying the stock when it dips makes most sense, since shares will invariably recover. Today, Apple is down nearly 15% from the Jan. 25 intraday peak of about $145 apiece.

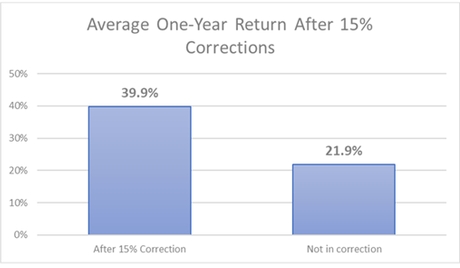

History supports the idea of buying Apple on weakness. As the chart below depicts, taking advantage of a 15% drawdown has paid off, going back all the way to 1980, relative to buying shares closer to all-time highs: 40% per year on average vs. 22%, respectively.

Source: DM Martins Research, data from Yahoo Finance

The key risk

Having said the above, there is one key risk of buying Apple today that still concerns me. At a broad market level, I continue to think that now is a better time to bet on smaller, cyclical and riskier stocks, rather than mega-cap growth ones. I have been repeatedly making this argument since around September 2020, and I have yet to change my mind on the strategy.

But as the old saying goes, Apple is a stock to own, not to trade. Buying it today may not pan out in the very near term, as the factor rotation towards small-cap, value and high beta continues to unfold. Rather, I see the proposed buy-on-weakness move as an opportunity to accumulate Apple shares at a more attractive entry point and hold them for a multi-year period.