HI Market View Commentary 02-28-2022

FOR RIGHT NOW

We need to get over the war, March 16th rate hike and April 15th Taxes due

| Here are some key takeaways from Jeffrey Schulze, Investment Strategist, ClearBridge Investments: Historically, Geopolitical Events Have Been Short-lived |

| Going back to World War II, the median market sell-off has been 5.7% after a geopolitical shock. |

| On average, it has taken three weeks for the market to reach a bottom and another three weeks for it to recover those losses. |

| Ultimately, the market isn’t driven by geopolitical events, but by the economic landscape. |

| Given the robust economic backdrop, the fallout specifically from this situation should be relatively short lived with the markets keying in on Fed policy and interest rates in order to dictate medium-term momentum. |

| U.S. Economy Remains Robust |

| The US economy is re-accelerating post-Omicron. While the invasion of Ukraine poses a minor headwind to growth, forward momentum is robust (GDP Now is 0.6% which is impressive considering January headwind – and should continue to strengthen as recent releases have been strong: IP, retail sales, and business inventories). |

| Importantly, the equity market’s YTD decline is explained by a contraction in P/E multiples as 2022 EPS estimates have risen by 2%. Earnings are well supported with nominal GDP likely approaching 10% this quarter. |

| Impact on Fed Policy Probably Negligible |

| The Fed has fulfilled its employment mandate (unemployment is 4%) and is focusing its entire attention on inflation. With inflation risks skewed to the upside, the Fed will likely not deviate materially from the market’s pricing of rate hikes from this situation. At present, the market is pricing in 5.9 hikes for 2022 (down from 6.4 hikes). While we’ve been more inclined to see a more dovish Fed than the market is pricing, we continue to believe that the Fed will slightly undershoot expectation. |

| Importantly, the Fed puts more weight into Core inflation rather than Headline because food and energy tend to mean revert and Fed policy acts with a lag. Put differently, higher materials/energy costs should not sway the Fed in a “material” way as the effects from tighter monetary policy generally kicks in when food/energy prices are deflating. |

| The Russian invasion of Ukraine may create a more dovish rate scenario, in particular with the ECB. We will get further clarity from Fed Chairman Powell when he speaks to Congress next week. |

| Core Inflation Not Likely to Rise Significantly Due to This Situation |

| Risk-off sentiment and uncertainty should put a bid under the dollar which historically has had a negative correlation with CPI. |

| Continued supply chain issues |

| ⚬ Goods and material flow out of Ukraine and Russia will be halted and could exacerbate the supply chain issues many companies are facing (example: steel for autos). |

| Natural gas and oil price spikes will have a material effect on US headline inflation and minor impact on core inflation. |

| Commodities/Materials |

| ⚬ Pricing pressures should remain sticky here due to potential supply disruptions, precautionary hoarding, and an embedded geopolitical premium. |

“Holy Hell hasn’t he looked at the price of gas, heating, food basics?!!!”

Gas will average over $4 per gallon Starting April before the May Summer rise

We should pull back to a 20% bear market level and then the later half of the year we get our rebound

Excluding banks, BIDU, AAPL

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 25-Feb-22 14:48 ET

The Federal Reserve is in a bad spot

Russia’s invasion of Ukraine this week made at least one thing clear: the Federal Reserve doesn’t have any live ammunition to fire at malevolent economic forces.

Specifically, the Fed doesn’t have any rate-cut bullets in the chamber. Nope. All the Fed can do is fire blanks in the event there is a big economic shock.

The market knows this, which is why it’s ironic that the market thinks the Fed could shoot itself in the foot, and kill the economy in the process, by raising rates too aggressively.

What Happens in Ukraine Stays in Ukraine

Fortunately for the Fed, the Russia-Ukraine situation hasn’t blown up into anything worse. It’s possible that it still could, but the way the stock market closed this week suggests it is comfortable with the idea that what happens in Ukraine stays in Ukraine.

To that end, the stock market staged a huge rally after President Biden announced a new round of harsher sanctions against Russia for its full-scale invasion of Ukraine. An initial round of sanctions was announced after President Putin recognized the separatist provinces of Donetsk and Luhansk in eastern Ukraine as independent and ordered Russian troops there to “keep the peace.”

The initial sanctions, obviously, did nothing to deter President Putin from carrying on with his “special military operation” to force the “demilitarization and denazification” of Ukraine.

There was some fear in the market that the full-scale invasion of Ukraine was going to become a really bad problem for the global economy.

Germany’s DAX Index fell more than 5.0% as news of the invasion broke, oil prices shot above $100/bbl, the 10-yr Treasury note yield slumped to 1.84%, wheat futures went limit up, the CBOE Volatility Index spiked 22% to 37.79, and the Nasdaq Composite declined 3.5%.

It was bad. Things were bad… and then they weren’t. The Fed rode to the rescue, only it did so like a headless horseman.

A Different Spin on the Fed Put

The Fed couldn’t cry out that it was cutting interest rates because it didn’t have an interest rate to cut. No, this time the market saddled the Fed’s horse for it and took some comfort in the idea that the Russia-Ukraine situation meant the Fed would likely only raise the target range for the fed funds rate by 25 basis points at the March meeting instead of 50 basis points.

It was a different spin on the so-called Fed put.

Suddenly, it became cause for a speculative trading celebration that the Fed wouldn’t raise rates as much as some had feared. That celebration got cranked up, though, when it became known that the U.S. and the EU weren’t going to impose any sanctions on Russia’s oil and gas exports nor cut off Russia’s access to the SWIFT financial transaction system.

That soft-handed approach made it clear that neither the EU nor the U.S. want their economies to get broadsided (further) by soaring energy prices. Sprinkle in some chatter that President Putin might now be open to discussing a diplomatic solution and you have the makings of quite a relief rally.

As of this writing, the Nasdaq Composite was up 8.5% from its February 24 low, the Russell 2000 was up 7.1%, the S&P 500 was up 6.4%, the Dow Jones Industrial Average was up 5.4%. In turn, oil prices were trading under $92.00/bbl, wheat futures were trading lower than they were before the news of the invasion hit, the 10-yr note yield was back to 2.00%, and the CBOE Volatility Index was down to 27.83.

Perhaps, though, no one was more relieved to think this Russia-Ukraine situation might not blow up after all than the Federal Reserve. That’s because it’s in a real bind if something economically wicked this way comes.

Cloudy Vision

First, the target range for the fed funds rate is already at the zero bound. The Fed cannot cut rates further. Technically, it could by taking the target range for the fed funds rate into negative territory, but that would be awful for the banks and a woeful economic signal that would hurt consumer confidence.

Secondly, the Fed could step up with increased purchases of Treasury securities and mortgage-backed securities in a bid to hold rates down, but that QE exercise has been exhausted. Moreover, given the inflation battle we are now fighting partly because of the QE bender, the market would unlikely see a renewed QE push at this juncture as a solution to a big economic problem.

Third, the Fed could communicate a commitment to keep rates lower at the zero bound for longer. The stock market might like that commitment, but that would just exacerbate economic imbalances, increase moral hazard, and perpetuate the inflation mess we are in today that creates bigger problems down the road.

Frankly, it’s hard to envision a monetary policy solution for a big economic problem at this time — and that’s a problem.

We have to rely on naturally favorable outcomes in a world that is naturally full of surprises that aren’t always favorable. And when your main policy rate is already at the zero bound, that’s called being in a compromised position if you are a central banker.

The ECB, arguably, is in an even more compromised state than the Fed. To that end, the Fed has at least conceded that inflation isn’t transitory and has signaled that rate hikes are coming soon.

What It All Means

The Fed needs to hope it isn’t faced with an exogenous shock that destabilizes the financial system and/or the U.S. economy just as it hoped inflation pressures would prove to be transitory (ooh, sorry, bad connection there).

It would certainly respond to such a shock. That’s a given. What isn’t a given is how the market will respond to the Fed’s response.

The Fed would have to be remarkably creative with its policy approach to restore confidence. It might have a better shot at doing that as it relates to building confidence in the functioning of the financial system, but it would be a long shot in restoring confidence in the economic outlook because it doesn’t have any rate-cut shots to fire.

The Fed is now taking aim at putting some of those rate-cut bullets back in the chamber. It will raise the target range for the fed funds rate at the March meeting by at least 25 basis points, but if the Russia-Ukraine situation settles down, as the stock market is hopeful it will, the Fed should take a bigger shot with a 50-basis points increase.

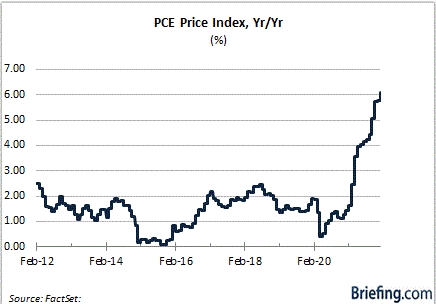

The January PCE Price Index made it clear that the Fed has an acute inflation situation on its hands with, or without, the Russia-Ukraine situation. The PCE Price Index is up 6.1% year-over-year, leaving it close to a 40-year high — and the Fed is still continuing with asset purchases!

That’s called being behind the inflation curve if you are a central banker. To be sure, the Fed has a lot of catching up to do.

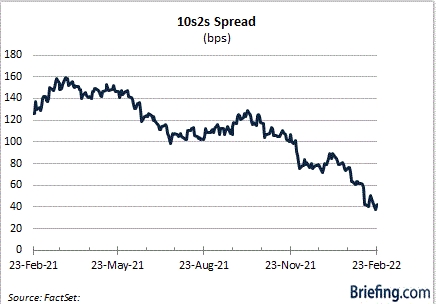

The stock market knows this, which is partly why the start of 2022 has been a period of upset. The Treasury market also knows it and seems to be increasingly uneasy about the Fed moving to rein things in. That uneasiness is showing up in a flattening yield curve.

The Fed has a big problem on its hands. It’s not just inflation. It’s not just the Russia-Ukraine situation. The problem is the Fed waited too long to raise its policy rate. Now, it doesn’t have any rate-cut bullets to fire, should it need them, and it just might need to do something explosive to get inflation under control.

That’s called being in a bad spot if you are a central banker, which is a spot no stock market should want its central bank to be.

—Patrick J. O’Hare, Briefing.com

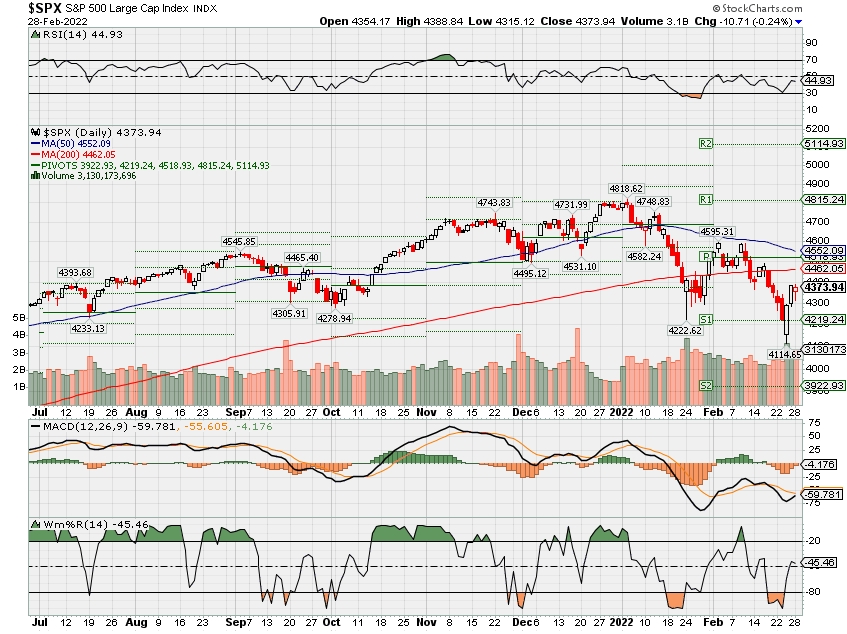

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end March 2022?

02-28-2022 -2.0%

Earnings:

Mon: DDD, HPQ, GRPN, ZM, WDAY

Tues: AZO, DPZ, KSS, WEN, AMC, FSLR, JWN, ROST, CRM, BIDU, TGT

Wed: DLTR, AEO, SNOW, ANF

Thur: BBY, BIG, BURL, KR, AVGO, GPS, MRVL, COST, SWBI

Fri:

Econ Reports:

Mon: Chicago PMI

Tues: Construction Spending, ISM Manufacturing Index

Wed: MBA, ADP Employment,

Thur: Initial Claims, Continuing Claims, ISM Services Index, Productivity, Factory Orders

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate

How am I looking to trade?

Long put protection EXCEPT for AAPL, UAA, and BAC

YES we are looking for short term 30 days or less covered calls for a little credit

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

China says Taiwan is ‘not Ukraine’ as island raises alert level

BEIJING/TAIPEI, Feb 23 (Reuters) – Taiwan is “not Ukraine” and has always been an inalienable part of China, China’s foreign ministry said on Wednesday, as Taiwan President Tsai Ing-wen called for the island to beef up vigilance on military activities in response to the crisis.

The comments come after British Prime Minister Boris Johnson flagged the risk for Taiwan in a warning last week about the damaging worldwide consequences if Western nations failed to fulfil their promises to support Ukraine’s independence. read more

China, which claims Taiwan as its own territory, has stepped up military activity near the self-governing island over the past two years, though Taiwan has reported no recent unusual manoeuvres by Chinese forces as tension over Ukraine has spiked.

Speaking in Beijing, Foreign Ministry spokesperson Hua Chunying dismissed any link between the issues of Ukraine and Taiwan.

“Taiwan is not Ukraine,” she said. “Taiwan has always been an inalienable part of China. This is an indisputable legal and historical fact.”

The issue of Taiwan is one left over from the civil war, but China’s integrity should never have been compromised and never has been compromised, Hua added.

The defeated Republic of China government fled to Taiwan in 1949 after losing the civil war to the Communists, who set up the People’s Republic of China.

Taiwan’s government strongly opposes China’s territorial claims. Tsai says Taiwan is an independent state called the Republic of China, which remains Taiwan’s official name.

All security and military units “must raise their surveillance and early warning of military developments around the Taiwan Strait,” Tsai told a meeting of the working group on the Ukraine crisis set up by her National Security Council.

Taiwan and Ukraine are fundamentally different in terms of geostrategy, geography and international supply chains, she added, in details of the meeting provided by her office. in the face of foreign forces intending to manipulate the situation in Ukraine and affect the morale of Taiwanese society, all government units must strengthen the prevention of cognitive warfare launched by foreign forces and local collaborators,” it cited Tsai as saying.

The statement did not mention China by name, but the country is the most significant military threat that Taiwan faces.

Tsai has expressed “empathy” for Ukraine’s situation because of the military threat the island faces from China. read more

Reporting by Yimou Lee, Ben Blanchard and Emily Chow; Editing by Gerry Doyle and Clarence Fernandez

Warren Buffett in annual letter calls Apple one of ‘Four Giants’ driving Berkshire Hathaway’s value

PUBLISHED SAT, FEB 26 20228:43 AM ESTUPDATED SAT, FEB 26 20227:37 PM EST

KEY POINTS

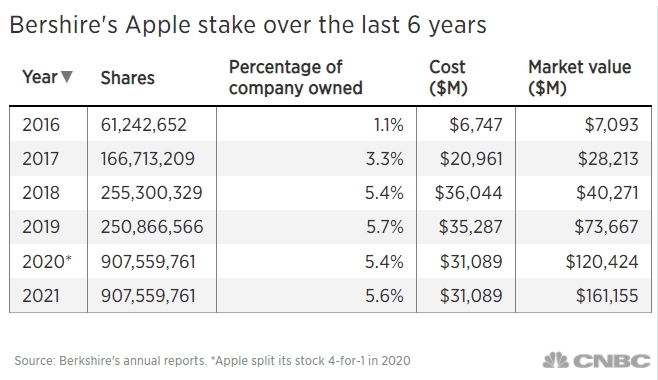

- Warren Buffett called Apple the second-most important business after Berkshire’s cluster of insurers.

- The “Oracle of Omaha” made clear he is a fan of CEO Tim Cook’s stock repurchase strategy.

- Berkshire’s Apple stake is now worth more than $160 billion, taking up 40% of its equity portfolio.

Warren Buffett said he now considers tech giant Apple as one of the four pillars driving Berkshire Hathaway, the conglomerate of mostly old-economy businesses he’s assembled over the last five decades.

In his annual letter to shareholders released on Saturday, the 91-year-old investing legend listed Apple under the heading “Our Four Giants” and even called the company the second-most important after Berkshire’s cluster of insurers, thanks to its chief executive.

“Tim Cook, Apple’s brilliant CEO, quite properly regards users of Apple products as his first love, but all of his other constituencies benefit from Tim’s managerial touch as well,” the letter stated.

The “Oracle of Omaha” made clear he is a fan of Cook’s stock repurchase strategy, and how it gives the conglomerate increased ownership of each dollar of the iPhone maker’s earnings without the investor having to lift a finger.

“Apple – our runner-up Giant as measured by its yearend market value – is a different sort of holding. Here, our ownership is a mere 5.55%, up from 5.39% a year earlier,” Buffett said in the letter. “That increase sounds like small potatoes. But consider that each 0.1% of Apple’s 2021 earnings amounted to $100 million. We spent no Berkshire funds to gain our accretion. Apple’s repurchases did the job.”

Berkshire began buying Apple stock in 2016 under the influence of Buffett’s investing deputies Todd Combs and Ted Weschler. By mid-2018, the conglomerate accumulated 5% ownership of the iPhone maker, a stake that cost $36 billion. Today, the Apple investment is now worth more than $160 billion, taking up 40% of Berkshire’s equity portfolio.

“It’s important to understand that only dividends from Apple are counted in the GAAP earnings Berkshire reports – and last year, Apple paid us $785 million of those. Yet our ‘share’ of Apple’s earnings amounted to a staggering $5.6 billion. Much of what the company retained was used to repurchase Apple shares, an act we applaud,” Buffett said.

Berkshire is Apple’s largest shareholder, outside of index and exchange-traded fund providers. The conglomerate has enjoyed regular dividends from the tech giant over the years, averaging about $775 million annually.

Railroad and energy

Buffett also credited his railroad business BNSF and energy segment BHE as two other giants of the conglomerate, which both registered record earnings in 2021.

“BNSF, our third Giant, continues to be the number one artery of American commerce, which makes it an indispensable asset for America as well as for Berkshire,” Buffett said. “BHE has become a utility powerhouse and a leading force in wind, solar and transmission throughout much of the United States.”

Berkshire’s operating earnings surged 45% in the fourth quarter, thanks to a continued rebound in its railroad, utilities and energy businesses from the pandemic hit.

Buffett bought back a record of $27 billion of Berkshire shares in 2021, as the investor continued to prefer internal opportunities in an increasingly expensive market. Berkshire’s cash pile stood at a near record $146.7 billion at the end of last year.

A psychotherapist shares the 3 exercises she uses every day ‘to stop overthinking’

Published Fri, Feb 25 20229:43 AM EST

Overthinking is an anxious tendency that I encounter often in my psychotherapy practice. There are many ways we tend to overthink, such as rehashing the past — replaying the same scenario over and over in our head. Worrying is another form, in which we obsess over what the future might bring.

I can empathize. When I was younger, overthinking decreased my quality of life. Research has shown that overthinking can decrease energy, limit creativity and cause sleeping problems.

Eventually, I knew I needed a healthy way to cope, and I created a career out of helping other people do the same. Here are three strategies I use every day to stop overthinking:

1. Positive reframing

This is often confused with “toxic positivity,” which asks people to think positively — no matter how difficult a situation is.

Positive reframing, on the other hand, allows you to acknowledge the negative aspects, then asks you to evaluate whether there’s another way to think about the situation. Perhaps there are benefits or things you can change about it.

Example:

You constantly find yourself complaining: “I hate being a boss. On top of all these deadlines and responsibilities, it’s hard to manage so many complex personalities. It’s emotionally and mentally exhausting. My job just sucks.”

Venting might feel good for a second, but it doesn’t solve anything. And you’ll likely continue to dwell on how much you hate your job or how bad you think you are at managing.

To practice positive reframing, replace the thought above with: “Things are challenging right now and I’m feeling disconnected from some things on my plate. I wonder if I can change anything about this situation or my expectations about it.”

This thought pattern gives you the power to change your situation. You could start small by examining what important tasks needs to get done first, then either delay or delegate the rest until you are feeling less anxious. The key is to take a step back and deal with things one at a time.

2. Write down your thoughts once, then distract yourself for 24 hours

When our brains think we are in conflict or danger, a built-in alarm system goes off internally to protect us.

One thing I have found success with is writing down my feelings and waiting at least 24 hours (or just a few hours if it’s an urgent matter) before replying or taking any sort of impulsive action.

Then, I put that draft away while I distract myself with another task.

Example:

You just received an email about something that went awry. You are upset, your heart starts to race, your breathing gets shallow, and you become hyper-focused on what’s going wrong and why it’s your fault.

If you respond to the email while your brain is in “alarm mode,” you might say things you’ll regret later on, which may then fuel the vicious cycle of overthinking.

Writing negative thoughts down takes the power out of them; I often don’t feel the need to take action based on my anxious thoughts once I’ve written them down.

3. Practice ‘specific gratitude’

In psychology, we know that expressing gratitude can increase our happiness. It can help us contextualize our frustrations against what we love and help us connect to something larger than ourselves — whether that’s other people, animals, nature or a higher power.

But I find that repeating the same gratitude practice over and over again can become rote and diminish the returns. For me, it can start to feel like a meaningless chore instead of a mindful practice. So, I like to practice something that I call “specific gratitude.”

Example:

Instead of writing in my journal every day that “I am grateful for my health,” I’ll write something like, “I am grateful that I woke up today without any back pain and have the ability to do today’s workout.”

This helps me stay focused on the here and now, rather than overthinking on general abstractions. Tomorrow, I might still be grateful for my health, but I might specifically be grateful that I have enough energy for a long run.

Jenny Maenpaa, LCSW, is a psychotherapist and founder of Forward in Heels, an intersectional feminist group therapy practice in New York City that empowers all women to stand tall and own their worth.

What Do They Know? High-End Investors Head for the Hills as Big Pharma Stocks Crater

| All indications from corporate media tell us Big Pharma is a safe investment as Pandemic Panic Theater continues to rage. But the biggest investors are pulling out now. Why? |

For the average investor, there seems to be a future in Big Pharma. The world is engulfed by Pandemic Panic Theater as new jabs, boosters, and pills continue to roll out to fight Covid. Mandates are still in place for millions of people and threats of more still loom. This week, a national vaccine passport quietly moved forward.

But the elite investors are inexplicably pulling out. Stock prices for the major vaccine manufacturers are plummeting as a result, leaving many smaller investors wondering if this is a long-term trend or a blip. According to The Deseret Review:

Wall Street investors are dumping their Moderna and Pfizer stock faster than the world can drop the mandates. Moderna is down 70 percent from its high, while Pfizer is off 19 percent. Former Blackrock Executive and investment adviser Edward Dowd calls for Moderna to go to zero and Pfizer to end under ten dollars per share.

How is this possible given that Pfizer now enjoys record earnings per share and a market capitalization of some $270 billion, making it the 29th largest corporation globally? With nothing but profits in sight for the Pharmaceutical giant, what could be the problem?

After all, in December, a Forbes‘ headline read, “The Vaccine Maker Can Dominate The Covid Market For Years to Come, Wells Fargo Predicts.” In addition to the enormously profitable mRNA vaccines, Pfizer is rolling out potent antivirals like Paxlovid, which could earn $22 billion in 2022.

Compared to the $81 billion in 2021 revenue, the earnings from the vaccines and the antivirals could top $102 billion for 2022, which is music to shareholders’ ears. However some are hearing shrieks, and these happen to be Wall Street’s finest, the smart money that beats the rest of the herd to the exits like clockwork.

These sophisticated investors make it their business to not go with the conventional wisdom but to do their own research, which often pays spectacular dividends.

The prevailing conspiracy theory explaining this swift change in money confidence claims the powers-that-be have initiated the next stage of their plan to bring forth The Great Reset. Russia in Ukraine, perhaps followed by China in Taiwan, and other conflicts across the globe could send America’s and the world’s economies into full-blown collapse.

Accounts are being frozen and money is losing stability, whether by Canada with their draconian reactions to the Freedom Convoy, sanctions currently being placed on powerful Russians, or the odd push for green energy. This all portends a near-future strong reaction from the people, a reaction that could usher in the “need” for a universal cashless society and government-controlled digital currency.

In other words, whatever the big investors know about Big Pharma stocks, it’s very likely that the agenda is not one the people of the world will enjoy. Machinations of globalist elites invariably harm the masses even as they’re promoted as beneficial to all. The precepts of The Great Reset demand an unwitting embrace of Neo-Marxism disguised with colorful terms like “stakeholder capitalism” and “the end of poverty.”

What they don’t tell you is that the “equity” they promote is designed to make us all equally destitute. They want the vast majority of people are beholden to the powers-that-be in order to survive.

We’ll be keeping a very close eye on how the big money is moving. Every action by the globalist elite going forward will be calculated and pre-planned. It’s time for the rest of us to prepare for what’s to come.