HI Market View Commentary 02-14-2022

Disney parks business roars back as company beats earnings expectations, stock soars

KEY POINTS

- Disney reported earnings for the fiscal first quarter that beat analyst estimates.

- Disney+ subscriptions beat estimates, adding nearly 12 million subscribers in the quarter.

- Disney’s parks, experiences and consumer products division saw revenues reach $7.2 billion during the quarter, double the $3.6 billion it generated in the prior-year quarter.

Disney reported earnings for its fiscal first quarter Wednesday that beat analyst estimates on earnings per share and revenue.

The stock popped about 8% in extended trading on the news.

Here are the results.

- Earnings per share: $1.06 adj. vs 63 cents expected, according to a Refinitiv survey of analysts

- Revenue: $21.82 billion vs $20.91 billion expected, according to Refinitiv

- Disney+ total subscriptions: 129.8 million vs 125.75 million expected, according to StreetAccount

Strong streaming numbers

Disney+ subscriptions beat estimates, even as executives previously said they expect subscriber growth for Disney+ to be stronger in the second half of the year compared to the first, with original content being released on the platform in Q4 2022.

The subscriber number includes nearly 12 million Disney+ subscriptions added in the first quarter. The service also saw average revenue per user (ARPU) in the U.S. and Canada grow to $6.68 per month from $5.80 a year ago.

CFO Christine McCarthy said on the company’s earnings call that Disney expects to spend significantly on streaming in the second quarter. She said the company expects programing and production expenses for the direct to consumer business to increase by about $800 million to $1 billion, including programing fees for Hulu live. They expect those expenses for linear to increase by about $500 million, in part due to pandemic-related timing shifts.

McCarthy said the company is not at a point of steady expenses for Disney+, but said they “expect to have made significant progress by fiscal 2023.”

In an interview with CNBC’s Julia Boorstin, CEO Bob Chapek said Disney is bidding for NFL Sunday Ticket, diving even deeper into streaming.

Though Netflix shares fell during its most recent report when it showed slowing subscriber growth, Chapek reiterated guidance of 230 million to 260 million Disney+ subscribers by 2024.

On the company’s call with analysts, Chapek indicated releases on Disney+ could continue to be an important distribution channel for its original content.

“We do not subscribe to the belief that theatrical distribution is the only way to build a Disney franchise,” he said, pointing to the success of its recent hit, “Encanto.”

Parks business roars back

Disney’s parks, experiences and consumer products division saw revenues reach $7.2 billion during the quarter, double the $3.6 billion it generated in the prior-year quarter. The segment saw operating results jump to $2.5 billion compared to a loss of $100 million in the same period last year.

Disney said the growth in revenue came as more guests attended its theme parks, stayed in its branded hotels and booked cruises.

McCarthy noted that Disney’s domestic parks, particularly its Florida-based locations, have yet to see a significant return in ticket sales from international travelers, which pre-pandemic accounted for 18% to 20% of guests.

The company’s consumer products business saw revenue fall 8.5% to $1.5 billion following the closure of a substantial portion of its Disney-branded retail stores during the second half of 2021.

During the most recent quarter, Disney’s domestic parks operated with fewer Covid-19 capacity restrictions. However, international locations continue to be impacted by mandatory capacity and travel restrictions, the company said.

Additionally, although Disney’s television and film productions have resumed, it is still experiencing disruptions in its pipeline. While the studio’s theatrical releases were among the top performing films of the year, the domestic box office still has not fully recovered from the pandemic. Income from Disney’s co-production of the Marvel Cinematic Universe film “Spider-Man: No Way Home” with Sony offset losses on other titles released during the quarter, which were unable to overcome significant marketing and production costs.

I’ve never viewed myself as particularly talented. Where I Excel is ridiculous, sickening, work ethic. You know, while the other guy’s sleeping (playing), I’m working” !!!!- Will Smith

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 11-Feb-22 14:59 ET

The interest rate push has come to shove for stock market

The bull market is okay until the interest rate push comes to shove. We said that last October. It is now February and there is a shoving match in the stock market because expectations about the Federal Reserve’s monetary policy have shifted rapidly.

When we penned that October piece, the Fed was still conveying a view that it didn’t expect to raise the target range for the fed funds rate anytime soon. It now expects to end its asset purchase program next month and at least one voting FOMC member — St. Louis Fed President Bullard — said this week that he thinks a 50 basis points hike at the March FOMC meeting would be a “sensible response” to the inflation shock that has hit the U.S.

When 2022 began, it was a close call in the fed funds futures market if there would be three rate hikes by the end of 2022. Today, the fed funds futures market is pricing in a heightened probability of seven rate hikes before the end of 2022, according to the CME’s FedWatch Tool.

Goldman Sachs for its part is calling for seven rate hikes, up from a forecasted five rate hikes just several weeks ago. BofA was the earliest with a call for seven quarter-percentage-point rate hikes this year and added at the same time that it thinks there will be four more rate hikes in 2023.

The times are changing, and they are changing quickly with respect to the interest rate outlook. That’s why the stock market is getting pushed around and it’s why adverse changes on the margin are apt to keep moving to the center, making it increasingly difficult for this bull market to party like it’s 1999 and 2021.

Eye on Inflation

The January Consumer Price Index was up 7.5% year-over-year. That was the largest increase since February 1982!

Naturally, that terrible report invited suggestions that it means we are at, or near, peak inflation, just like it did when CPI was up 5.3% year-over-year in August, up 5.4% year-over-year in September, up 6.2% year-over-year in October, up 6.8% year-over-year in November, and up 7.0% year-over-year in December.

We think you catch our drift, as it has been painfully clear that inflation has kept drifting higher. Cry wolf long enough, though, and eventually you will see a wolf, right?

It’s possible that we are close to peak inflation. What’s being taken for granted by some is a quick step down in the inflation rate from that peak to a more palatable 2.00-3.00% range.

The Fed’s median projection for the PCE inflation rate in 2022 is 2.6%. It currently sits at 5.8%.

We would be pleasantly surprised — as would a lot of people — if the inflation rate is in that 2.00-3.00% range by the end of the year. Base effects will provide some help as the rate of change slows. Also, there is a lot of pent-up hope that port issues will be cleared up, that supply chain challenges will be worked out, and that wage gains will moderate as more people come back to the workforce.

Our concern is that companies, which lacked pricing power for a long time, finally have it again and won’t be so quick to lower prices just because the port backlogs are cleared, and supply chains pressures are less pronounced. It’s likely going to take a consumer pullback of some scope before companies regularly cut prices in a bid to maintain and/or pickup market share.

Of course, the burgeoning concern in the market is that the Fed is going to be a catalyst for a consumer slowdown by raising its policy rate too aggressively and choking off growth, perhaps to the point of inviting a recession.

Eye on Spreads

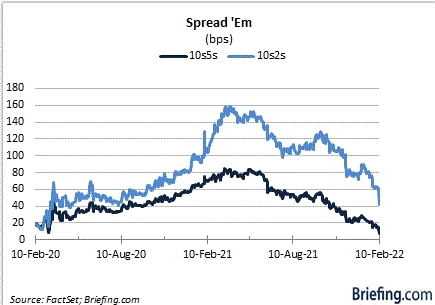

Market participants are keeping a close watch on credit spreads. There has been a discernible narrowing in the 10s5s and 10s2s spread in the Treasury market. They are pictures of a flattening yield curve, which is viewed by many as a harbinger of a slower period of economic growth.

An inverted curve will invite recession forecasts.

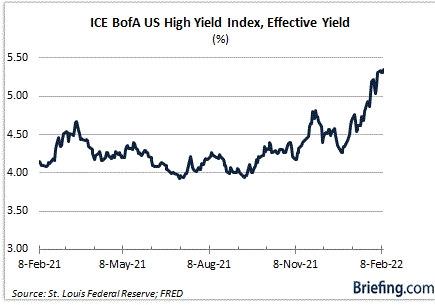

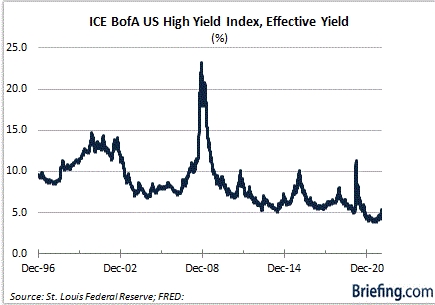

One of the better economic signals, however, is the high-yield spread. Junk bond issuers are perceived to be bigger credit risks, so if economic growth slows or contracts, there will be increased angst that these issuers won’t be able to make good on their interest payments.

Hence, a widening high-yield spread is regarded as a leading indicator of difficult economic times which, in turn, often invites a more challenging period for the stock market since difficult economic times translate into weaker earnings prospects.

What does that spread look like today? The effective yield for the ICE BofA High Yield Index sits at 5.35%, up 100 basis points since the start of the year. In other words, it is conveying some jitters in the high-yield universe, but to be fair, the effective yield at 5.35% is still a long way from sounding economic alarm.

That’s an important frame of reference as the short-term and long-term charts below make clear.

What It All Means

When it comes to paying a high premium for high-yield debt, attitudes are changing. Investors are becoming more discriminate. That should be the case, because the best case for high-yield debt is changing on the margin.

The Fed is going to be raising its policy rate and implementing quantitative tightening measures. Market rates are moving higher in anticipation of that move. Similar actions are being pursued by other central banks.

It’s no longer an all-in mentality. On the contrary, it’s now a pullback mentality with respect to the monetary and fiscal policy largesse.

That will inevitably fuel adverse changes on the margin. Economic growth can still be good for a while, but it will be sub-optimal. Earnings growth can still be good for a while, but it will be sub-optimal.

Some argue that these coming interest rate hikes from the Fed are already priced into the stock market. There is some truth to that, but from our vantage point, it’s only a half-truth because the rate hikes haven’t even happened yet, which is to say they haven’t even hit the economy and corporate earnings growth.

Inflation, though, has hit the economy and it is starting to have an adverse impact on corporate profit margins.

Higher interest rates will be used to help fight inflation. The Fed, though, is far behind the curve in fighting inflation. Consequently, it may take a pound of prevention to produce an ounce of cure.

That prevention effort is going to change things for the worse economically speaking, first on the margin and then in the center as the marginal weakness spreads.

Investors in general then — not just high-yield investors — need to be more discriminating about the companies in which they invest because the interest rate push is coming to shove. It has to because the Federal Reserve has been a pushover with its easy monetary policy far too long.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Lower

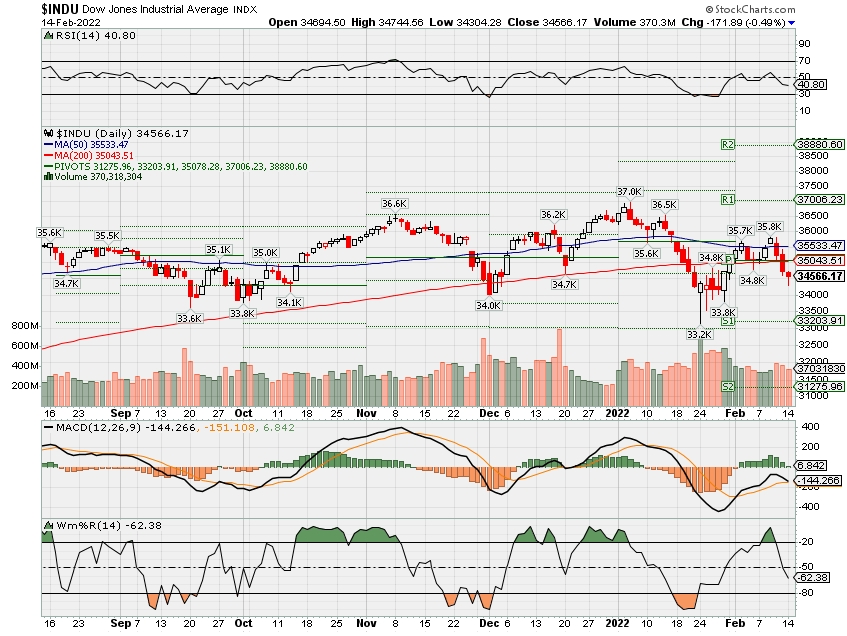

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end February 2022?

02-14-2022 -3.0%

02-07-2022 -3.0%

01-31-2022 -3.0%

Earnings:

Mon: AAP,

Tues: ARCH, MAR, ABND, AKAM, CF, DVN, WYNN

Wed: CROX, GRMN, HLT, KHC, NUS, OC, AMAT, SAM, CSCO, MRO, TRIP, VMI, NVDA

Thur: VG, CHUY, ROKU, AUY, BIDU

Fri: DE, PPL

Econ Reports:

Mon:

Tues: PPI, Core PPI, Empire Manufacturing

Wed: MBA, Retail Sales, Retail ex-auto, Capacity Utilization, Industrial Production, Business Inventories, NAHB Housing Market Index

Thur: Initial Claims, Continuing Claims, Building Permits, Housing Starts, Phil Fed

Fri: Existing Home Sales, MONTHLY OPTIONS EXPIRATION

How am I looking to trade?

Long put protection has been added to certain stocks

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

How is the transfers coming – Laggards 10% of my business that needs to come over 3.5 million

Will we be using SCHAW or the Street Smart Edge = YES as soon as my accounts come over

February 1, 2022 | Expert Perspective

Market perspectives: February 2022

Key highlights

- The surge in cases of the COVID-19 Omicron variant is likely to dent activity early in the first quarter in the United States, but we continue to see full-year 2022 growth around 4%.

- Vanguard believes that the Federal Reserve may need to raise its target for short-term interest rates to 3%. That would require steady rate hikes over the next few years.

- We expect the unemployment rate to fall below its pre-pandemic level toward the end of the 2022.

Asset-class return outlooks

The greatest change in our outlooks from the June 30 running of the Vanguard Capital Markets Model® (VCMM) was in emerging markets equities. Large price declines in the intervening months lowered valuations, which are reflected in a 10-year forecast range that is 60 basis points higher in the September 30 running. In fixed income, yields increased marginally in the third quarter, allowing for a marginal rise in forecasts for many fixed income sub-asset classes.

Our 10-year, annualized, nominal return projections, as of September 30, 2021, are shown below. Please note that the figures are based on a 1.0-point range around the rounded 50th percentile of the distribution of return outcomes for equities and a 0.5-point range around the rounded 50th percentile for fixed income.

| Equities | Return projection | Median volatility |

| U.S. equities | 2.3%–4.3% | 16.7% |

| U.S. value | 3.1%–5.1% | 19.2% |

| U.S. growth | –0.9%–1.1% | 17.5% |

| U.S. large-cap | 2.2%–4.2% | 16.3% |

| U.S. small-cap | 2.2%–4.2% | 22.5% |

| U.S. real estate investment trusts | 1.9%–3.9% | 19.1% |

| Global equities ex-U.S. (unhedged) | 5.2%–7.2% | 18.4% |

| Global ex-U.S. developed markets equities (unhedged) | 5.3%–7.3% | 16.4% |

| Emerging markets equities (unhedged) | 4.2%–6.2% | 26.8% |

| Fixed income | Return projection | Median volatility |

| U.S. aggregate bonds | 1.4%–2.4% | 4.6% |

| U.S. Treasury bonds | 1.2%–2.2% | 4.7% |

| U.S. credit bonds | 1.6%–2.6% | 4.7% |

| U.S. high-yield corporate bonds | 2.2%–3.2% | 10.4% |

| U.S. Treasury Inflation-Protected Securities | 1.0%–2.0% | 4.6% |

| U.S. cash | 1.2%–2.2% | 1.2% |

| Global bonds ex-U.S. (hedged) | 1.3%–2.3% | 3.8% |

| Emerging markets sovereign | 2.3%–3.3% | 10.1% |

| U.S. inflation | 1.5%–2.5% | 2.3% |

These probabilistic return assumptions depend on current market conditions and, as such, may change over time.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modeled asset class. Simulations are as of September 30, 2021. Results from the model may vary with each use and over time. For more information, see the Notes section.

Source: Vanguard Investment Strategy Group.

Omicron takes a toll on the economy

United States

The surge in cases of the COVID-19 Omicron variant is likely to dent activity early in the first quarter in the United States, quarantining in the workforce being more disruptive than any semblance of a “fear factor” to engage in activity.

- Although we expect the effects to be significant, we also expect them to be short-lived. As such, we continue to see full-year 2022 growth around 4%.

- Growth appears to have stabilized in the fourth quarter; we continue to see fourth-quarter growth around 5.5%.

Euro area

COVID-19-related restrictions on activity continue in many countries in the euro area, although the toughest of them, in the Netherlands, are being scaled back.

- The recent surge in daily virus cases to more than 2,000 per million is likely to continue to weigh on growth in the first quarter of 2022.

- This development is part of Vanguard’s base case and, as such, we maintain our full-year 2022 forecast for growth around 4%.

China

Gross Domestic Product (GDP) for all of 2021 increased by 8.1%, according to preliminary National Bureau of Statistics estimates. For all of 2022, we anticipate GDP growth around 5%, a level that would likely be below an official growth target that we expect will be set in a range of 5% to 6%.

- Headwinds include a “zero-COVID” policy that continues to result in broad lockdowns ahead of the forthcoming Lunar New Year and Beijing Winter Olympics.

- Given these headwinds, we expect below-consensus growth around 3.5% in the first quarter of 2022, followed by above-consensus growth around 5% in the second quarter on the strength of anticipated policy stimulus and tweaks to zero-COVID.

Emerging markets

COVID-19 and developed-market central banks may influence how economies in emerging markets perform in 2022.

- Countries with a combination of high vaccine-acquired and infection-acquired immunity to COVID-19, largely in Latin America but also in emerging Europe, will be supported simply by being able to keep their economies open.

- Countries primarily in emerging Asia with less immunity could be hampered by continued virus vulnerability.

- We foresee emerging-market growth around 5.5% in 2022, with diminished global liquidity a potential downside risk.

Inflation will remain elevated through the first half of 2022

The Consumer Price Index in the United States rose by 7% in December compared with December 2020, the largest 12-month increase since June 1982. The gauge rose by 0.5% on a seasonally adjusted basis in December compared with November, less than November’s 0.8% rise.

- Vanguard estimates that the effects from supply constraints will persist into 2022 before inflation normalizes gradually toward the pre-pandemic trend.

- We foresee inflation remaining elevated before slowing in the second half of 2022, bringing the core Personal Consumption Expenditures Price Index (PCE) for year-end 2022 in the range of 2.3%–2.6% year-over-year.

A revised outlook for when the FED will hike rates

Amid heightened inflation, falling unemployment, and increasing wage pressures, we believe the Fed will begin a rate-hike cycle in the first half of 2022, and perhaps as early as its March meeting depending on wage and inflation data in the interim.

- We anticipate at least two quarter-point hikes in 2022 to the Fed’s target range for its federal funds rate, with additional policy-tightening likely warranted, whether through balance sheet reduction or one or two additional policy rate hikes.

- Vanguard believes that the Federal Reserve may need to raise its target for short-term interest rates to 3% from its current range of 0%–0.25%. That would require steady rate hikes over the next few years, to a degree that markets haven’t priced in beyond 2022.

- The delicate position for the Fed is to tighten policy enough to moderate inflation pressures without doing so too aggressively and ending the business cycle prematurely, according to a new Q&A with Vanguard economists Josh Hirt, Asawari Sathe, and Adam Schickling.

- Bond investors should welcome the prospect of higher interest rates. Although rising rates may produce modest negative returns for a time, they’re a long-term positive.

- In a recent commentary, Vanguard Global Chief Economist Joe Davis noted that, “In my view, markets are underestimating the degree to which central banks will need to use their powerful tools to pull inflation back to acceptable levels.”

Labor demand begins to push wages up

A second straight below-consensus headline job-creation figure in the United States once again underestimated the labor market’s strength. The Bureau of Labor Statistics reported that 199,000 jobs were created in December and the unemployment rate fell to 3.9%.

- Vanguard anticipates further labor market tightening with continued upward wage pressure amid strong demand for workers.

- We expect the unemployment rate to fall below its pre-pandemic level toward the end of summer in 2022.

Inflation won’t come down magically

Our global chief economist explains why central banks will need to act decisively to rein in accelerating inflation.

Jefferies downgrades JPMorgan to hold as higher expenses could hold back stock

A person on a scooter rides past a JPMorgan Chase & Co. bank branch in New York, U.S., on Thursday, June 11, 2020.

Jeenah Moon | Bloomberg | Getty Images

The higher level of spending that caused JPMorgan’s stock to slide after earnings last month will keep shares in neutral this year, according to Barclays.

Analyst Ken Usdin downgraded JPMorgan Chase to hold from buy, saying in a note to clients Sunday that the bank’s internal investments and rising costs will hold back the stock this year.

“JPM’s initiatives to investment meaningfully in its future should pay off over a few years’ time, but will weigh on earnings growth and [return on tangible common equity] for ’22/’23,” Usdin wrote. “We expect JPM to provide more clarity on the potential ROI from these investments, which could alleviate some of the recent pressure on the shares, but we see upside as somewhat limited due to the deserved premium valuation that remains.”

The bank’s stock slipped 1.8% in premarket trading.

Rising interest rates are often seen as a positive sign for banks, as it is easier for businesses to grow their net interest income when rates are higher. However, an expected slowdown in other parts of JPMorgan’s business may offset that, according to Jefferies.

“JPM is well-positioned for higher rates, which will lead to improved net interest income growth, but tough comparisons in many fee businesses … will work against the grain, especially with the large increase in expenses planned in ’22 (to $77B) and potentially higher beyond,” the analyst said.

Jefferies slashed its price target to $155 per share from $180. The stock closed at $153.92 on Friday.

The JPMorgan downgrade was not the only bank rating change from Jefferies. The firm also downgraded U.S. Bancorp to down, and upgraded Zions Bancorp. and Comerica to buy.

-CNBC’s Michael Bloom contributed to this report.

China’s tech giants push toward an $8 trillion metaverse opportunity — one that will be highly regulated

KEY POINTS

- China’s technology giants from Tencent to Alibaba and ByteDance are investing in the metaverse, a market that could be worth $8 trillion in the future, according to Morgan Stanley.

- While U.S. firms like Facebook parent Meta and Microsoft are going all-in on the metaverse concept, Chinese companies are taking a more cautious approach amid tighter regulation.

- China’s metaverse could look very different to the rest of the world due to government censorship, strict rules on the technology sector and Beijing’s crackdown on cryptocurrencies.

Citizens try out a virtual reality experience at the opening of Cheonan Qianshu Shopping mall, Shanghai, China, On December 22, 2021. Virtual reality is a key part of the concept of the metaverse.

Xing Yun | Costfoto | Future Publishing | Getty Images

Imagine this: the metaverse with Chinese characteristics. That’s how the virtual world that everyone’s talking about will likely look in the world’s second-largest economy.

China’s technology giants are beginning to invest in the metaverse — the latest buzzword in internet technology. It’s a term with no concrete definition, but largely taken to mean virtual worlds that people will be playing and living in.

Censorship will likely be rife and regulation tight as Beijing continues to keep a close check on the practices of its domestic technology firms.

U.S. firms like Facebook parent Meta are going all-in on the metaverse concept, while Microsoft has positioned its proposed acquisition of gaming company Activision as a play on this theme.

Chinese firms are taking a more cautious approach. So what are they up to and how will regulation play out?

What are the apps?

In China, the total addressable market for the metaverse could be 52 trillion yuan, or around $8 trillion, Morgan Stanley said in a note published last month.

Companies like Tencent, NetEase, TikTok owner ByteDance and Alibaba could be the front-runners in this space among China’s internet companies.

Metaverse is the future of social network. All China’s tech giants have to embrace it to find new ways to engage the youngest generation of internet users…

Winston Ma

MANAGING PARTNER, CLOUDTREE VENTURES

That comes down to the type of applications that could be part of the metaverse. Analysts say that virtual reality, gaming and social media could be some of the early applications.

This may include things like buying virtual items in games or creating digital avatars of yourself to participate in meetings.

“Metaverse is the future of social network. All China’s tech giants have to embrace it to find new ways to engage the youngest generation of internet users, which is critical at the time when their business models on smartphones and mobile internet are matured,” Winston Ma, managing partner at CloudTree Ventures, told CNBC.

China’s tech giants in the metaverse

In an earnings call in November, Tencent CEO Pony Ma said the metaverse will be an opportunity to add growth to existing industries such as gaming. Tencent is the world’s largest gaming company with a strong portfolio of PC and mobile games.

Tencent also owns WeChat, a messaging service with over a billion users that has social media aspects.

Ma said the company has “a lot of the technology and know-how building blocks” to explore and develop the metaverse.

Meanwhile, ByteDance has made an aggressive expansion into gaming over the last year. In August, the company acquired virtual reality headset maker Pico. ByteDance also owns TikTok, the short-form video app, and its Chinese equivalent Douyin. The Beijing-headquartered firm has laid foundations in VR, social media and gaming.

Alibaba this year said it plans to launch augmented reality glasses for virtual meetings. Augmented reality refers to virtual images overlaid on the real world. Again, this could be a play on the metaverse. The e-commerce giant launched a “virtual influencer” named Dong Dong for the Winter Olympics in Beijing. The digital avatar can be found on Alibaba’s Taobao shopping app and provides facts about the Olympics and also promotes items related to the Games.

NetEase, another one of China’s gaming giants, has set up a base in the southern province of Hainan focused on the development of metaverse applications, local media reported last year.

Search giant Baidu launched a metaverse app last year called XiRang, a sort of virtual world that can hold up to 100,000 people at once. Baidu executives, however, downplayed expectations of the app at its launch and said many aspects were not yet up to par. Ma Jie, a vice president at Baidu, said it could be another six years until a full launch.

https://art19.com/shows/bcd08fc3-8958-4c47-bf8e-524432adcd77/episodes/2d72ab21-b016-4a1b-a5b8-e6e58406ac24/embed Still, there are signs that China’s biggest technology names are beginning to experiment and lay the groundwork for future applications.

“Similar to the pitch we’ve seen from Meta, the metaverse concept may at first involved VR/AR-supported games and social interactive environments,” Charles Mok, the founder of Tech For Good Asia, told CNBC.

“These will obviously be the areas that China big tech players will follow first, with features that are advanced in China — such as payment, and WeChat-like integrated online services — that can be extended and built into the metaverse.”

China’s regulated metaverse

The metaverse push by Chinese tech firms comes after an intense year of regulatory scrutiny on the country’s tech sector.

New anti-monopoly laws for internet platforms were proposed, while a landmark personal data protection law has been passed. Beijing has also cut the amount of time children under 18 years of age are allowed to play online games.

Analysts said these existing pieces of legislation will likely be used to regulate metaverse applications as well, even as new ones are developed.

“The sheer diversity of metaverse applications means developing a ‘one-fits-all’ set of policies will not be feasible for Beijing,” Hanyu Liu, China market analyst at Daxue Consulting, told CNBC.

“Each specific application would receive its own unique set of regulations that builds upon existing legislature.”

[China] knows just when and where it needs to stay its hand; close enough so that it can keep a careful watch, but not to the point where it would cause irreversible harm to the industry.

Hanyu Liu

CHINA MARKET ANALYST, DAXUE CONSULTING

China also continues to censor content on its tightly controlled internet.

“We should also expect to see strict censorship, meaning there will most likely be an isolated, Chinese metaverse that is separate from the international,” Liu said.

There are more specific pieces of regulation that analysts said could be used to manage the metaverse.

In January, authorities passed a set of regulations that governs how internet firms can use recommendation algorithms. That was followed by draft rules regarding so-called “deep synthesis” technology. This relates to software that could be used to generate or edit voices, video or images or virtual settings. The two rules overlap.

“This overlap with the recent algorithm rule as specifically required by the new rule would have important impact on Metaverse companies in China,” Ma said.

“China is extremely smart when it comes to this. It knows just when and where it needs to stay its hand; close enough so that it can keep a careful watch, but not to the point where it would cause irreversible harm to the industry,” Liu said.

What about crypto?

Some metaverse applications may rely on cryptocurrencies. For example, if you are buying some sort of virtual land or item, you could pay with a digital currency.

This is likely to be problematic in China, where the government has looked to wipe out trading and the so-called mining of cryptocurrencies.

https://art19.com/shows/beyond-the-valley/episodes/1c321bab-2c21-4b9d-b422-4f33478a1f31/embed?theme=dark-blue Meanwhile, the government has been promoting its own central bank-issued digital currency, known as the digital yuan or e-CNY.

“There’ll likely be very limited options for crypto,” Liu from Daxue Consulting said, adding that China’s digital currency might be used instead in metaverse payment applications.

These growth stocks are trading for really cheap, Barclays says

There may be a lot of uncertainty about what comes next for markets, but some stocks with strong growth prospects may be too cheap for investors to pass up, according to Barclays.

The investment firm put together a list of stocks it describes as “growth at a reasonable price.” The strategy, also known as GARP, is a common investing approach among professional fund managers. The strategy focuses on finding stocks that have solid revenue growth but not sky-high valuations for sales or earnings, like is often seen in newly public technology companies.

The list seeks to capture “companies that are trading at a reasonable valuation relative to the potential revenue growth that Barclays sees for the upcoming year,” Barclays said in the Feb. 6 note.

The parameters are for large-cap stocks with overweight ratings from Barclays analysts, at least 10% upside to price targets, and a price-to-estimated sales ratio that was below both the sector valuation and the stock’s 5-year average.

The list includes many stocks tied to the consumer economy, including Southwest Airlines and Tapestry. The 2022 economy could be particular beneficial for consumer service stocks, according to Barclays, which would include Southwest.

“Our outlook for the US economy in 2022-23 is based, in part, on the unwind of the shock to relative demand and relative prices as the effects of the pandemic on behavior diminish. Recent data suggest that consumer spending may be shifting back to services,” the note said.

There are two shipping companies on the list in FedEx and J.B. Hunt Transportation. FedEx has underperformed the broader market year to date, shedding more than 10%, but it does sport a dividend yield of roughly 1.3%.

One stock on the list that is significantly cheaper than it was just a few weeks ago is PayPal. The payments stock closed at $175.80 per share on Feb. 1, leading into its fourth-quarter earnings report.

Then, PayPal delivered weaker-than-expected guidance for earnings and sales, and the stock has tumbled more than 34% since.

For investors looking for a stock that has held up better than that during the turbulent start to 2022, real estate investment trust Ventas may fit the bill. The stock, which is focused on health care real estate, is down less than 1% since the end of December.

-CNBC’s Michael Bloom contributed to this report.

Buy these dividend expanders while the Fed is hiking, Trivariate Research says

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

In this article

With investors bracing for higher interest rates this year, Trivariate Research shared the best way to trade dividend stocks and which types of shares to buy.

“We decided to look in detail at dividend-related strategies given the massive shift in the perception about the path of interest rates,” Adam Parker, former Morgan Stanley chief U.S. equity strategist and founder of Trivariate Research, said in a note this past week.

Expectations are rising for the Federal Reserve’s rate hike plan this year. Some economists anticipate the Fed will hike interest rates by a half point in March. Others, like economists at Goldman Sachs, see as many as seven quarter-point hikes for this year.

A dividend is a regular payout of a portion of a company’s profits to its shareholders. In the past, during rapid moves in rates, dividend stocks have sometimes come under pressure as bonds are seen as competition to their payouts.

However, that conventional wisdom could be breaking down as the types of stocks that qualify as high yield has changed and the gap between yields of stocks and bonds has widened.

“The timing is particularly good to investigate dividend as a strategy today given the pending Fed lift-off, and importantly, with valuation dispersion very wide among the dividend yielding stocks (signaling potential opportunity),” Parker said.

Trivariate analysis found the market rewards companies initiating a dividend and those expanding their payouts. In fact, a basket of dividend-expanding stocks has outperformed the firm’s hyper-growth cohort since 2010.

“Investors may not realize the sustained excellence of this investment approach,” Parker said.

Trivariate found the names with a high yield and expanding dividends. Take a look at five of their picks.

TRIVARIATE: HIGH-YIELD, DIVIDEND EXPANDERS

| TICKER | COMPANY | INDUSTRY | MARKET CAP ($ US BIL) |

| AMGN | Amgen | Pharma Biotech | 134.48 |

| BX | Blackstone | Diversified Financials | 94.22 |

| ALLY | Ally Financial | Diversified Financials | 16.60 |

| WHR | Whirlpool Corporation | Consumer Durables & Apparel | 11.83 |

| AEO | American Eagle Outfitters | Retailing | 3.96 |

Ally Financial and Blackstone are among the stocks on Trivariate’s list. Financial stocks tend to outperform during times of rising rates because the cost of borrowing rises, which can boost firms’ profit.

Amgen is another high-yield dividend expander Trivariate highlighted. The stock is outperforming the market this year, up more than 1% in 2022 compared with the S&P 500′s 7% loss.

Also making the list are retail stock American Eagle Outfitters and home appliance maker Whirlpool.

—CNBC’s Michael Bloom contributed reporting.

This 35-year-old mom quit her job to work on her eBay side hustle full-time—and made $141 million in sales last year

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

In 2011, when I wasn’t working my $25,000-per-year insurance job or spending time with my family, you could find me shopping online.

I was 24 years old, and I loved browsing the internet for clothes that were both on-trend and affordable. Unfortunately, there weren’t too many options back then. That’s what gave me the idea to start a side hustle selling women’s clothing on eBay.

At first, it was just a fun hobby. Little did I know, 10 years later, my husband Chris and I would be running Pink Lily full-time. Last year, our online clothing business generated $141 million in gross sales. And today, our social media audience has grown to 3.6 million followers.

From an eBay side hustle to $141 million in sales

To start our eBay store, my husband Chris and I made an initial investment of about $300 to buy clothes and accessories from a wholesale website.

Since I wasn’t familiar with pricing strategies, I priced items at what I would pay as a customer. We worked out of our living room, so we didn’t have much overhead to worry about except for shipping costs.

Profits varied during the first few years, but we typically made anywhere from $300 to $1,000 per month. We used that money to pay off student loans and invest back into the business.

I’d fly to Los Angeles to meet with vendors and place product orders, and eventually started attending trade shows to expand our line of selections.

Two years later, in 2013, I started a personal Facebook group to market my clothes. We had loyal customers who showed an increasing demand for our products, especially in our local community in Bowling Green, Kentucky.

By the end of the year, we had saved around $20,000 from our profits, which we used to launch Pink Lily’s official website. That’s when business really began booming.

In May 2014, we surpassed $100,000 in monthly revenue. After three years of running Pink Lily as a side hustle, I quit my insurance job to work on the business full-time. Chris joined me a few months later to oversee the company’s finances and operations. We closed the year with more than $4 million in revenue.

In 2019, after achieving $70 million in total sales, we received a minority stake investment to support the business’ rapid growth. This helped us expand our product offerings and scale an amazing team.

Currently, we sell more than 11,000 products on our site every day, have a brick-and-mortar store and, with 250 full-time employees, are one of the biggest employers in Bowling Green.

While we still visit trade shows, we now have a core group of vendor partners who we work with to create custom designs.

Co-founding Pink Lily alongside my husband has been the journey of a lifetime. Here are my best tips for starting a successful business:

1. Find a gap in the market

You’ve probably heard some version of this before, but I can’t kick off entrepreneurial advice without hammering this point home: It’s so important to find a gap in the existing market.

When I started my side hustle, I saw an unmet need for fashion-inclined women who wanted to be able to find a dress for $50 or less. I knew I could help to fill that need in my own small way.

2. Reinvest your profits

If you want growth to happen quickly, you need to reinvest all or most of your early profits back into the business.

You may be very strapped for cash during the first few years. That was our experience, and it wasn’t easy. We worked up to 60 hours per week, lived frugally, and reinvested the money we made back into growing Pink Lilly.

3. Find fun, unique ways to engage your social media followers

Being active on social media has been a key part of our success. We regularly ask our 1.4 million Instagram followers what they’d like to see on our site and on our shelves.

For example, we’ll post photos of items we are considering purchasing or brands we could partner with for Pink Lily. Then we’ll use everyone’s responses and feedback to make any final decisions. This helps shoppers feel like insiders and part of the family.

We also ship products in custom bags printed with our company logo and the hashtag #pinklilystyle. Then we’ll feature customers who post a photo of themselves in their new outfit on Instagram, along with the hashtag, on our website.

4. Empower loyal customers to be brand ambassadors

I always encourage entrepreneurs to carefully consider how they can design a brand ambassador program that resonates with their customers.

At Pink Lily, our program offers paid positions — with a 10% commission offered on every sale — to an exclusive group of longtime customers who can authentically vouch for the products. This is an important, sustainable part of our marketing strategy, and generated about $7.5 million in sales last year.

5. Find something you can truly own

It’s essential to carve out a niche or a product line that you can exclusively own as a company. What will come to mind when consumers hear the name of your brand?

We’ll often buy out a vendor’s entire inventory when we find a special product, for example, so that no other retailer can access it. This way, we end up with curated collections that can only be found at Pink Lily.

Tori Gerbig co-founded Pink Lily, an online women’s fashion store, as an eBay shop in 2011. Today, it one of the fastest-growing online retailers in America. A graduate of Western Kentucky University, Tori resides in her hometown of Bowling Green, Kentucky with her husband and co-founder Chris, and their three children. Follow Pink Lily on Instagram and Facebook.

HI Financial Services Mid-Week 06-24-2014