HI Market View Commentary 01-27-2020

| Market Recap |

| WEEK OF JAN. 20 THROUGH JAN. 24, 2020 |

| The Standard & Poor’s 500 index fell 1.0% this week as fears of a spreading coronavirus and its potential impacts on travel and global economic growth weighed on a number of sectors, especially energy.

The market benchmark ended the week at 3,295.47, down from last week’s closing level of 3,329.62. The weekly slide came despite the index hitting a fresh record intraday high Wednesday at 3,337.77. Much of the week’s drop came in Friday’s session when the S&P 500 fell 0.9% as a second confirmed case of the new coronavirus was reported in the US while the number of deaths and infections in China ramped up. Adding to worries, officials at the Centers for Disease Control & Prevention said they expect the virus to spread to more people in the US and elsewhere. The energy sector had the largest percentage drop of the week, sliding 4.8%, as oil futures fell on fears of travel disruptions due to the coronavirus worries. China has banned transportation in and out of Wuhan, the epicenter of the outbreak. The materials and financial sectors followed with declines of 1.9% and 1.8%, respectively. Just three sectors ended the week in the black, led by a 3.1% rise in utilities, which is often treated as a safety sector. Real estate rose 1.1% while technology edged up 1.0%. The energy sector’s decliners included Cabot Oil & Gas (COG), whose shares fell 13% this week amid the lower oil futures and as analysts at UBS and Wells Fargo both reduced their price targets on the stock. In the materials sector, shares of CF Industries (CF) fell 11% as Stephens downgraded its investment rating on the stock to equal weight from overweight while reducing its price target on the shares to $50 each from $60. Among financial stocks, Zions Bancorp’s (ZION) shares fell 8.1% on the week as investors were disappointed to see the bank’s Q4 earnings per share come in below analysts’ mean estimate according to Capital IQ despite higher-than-expected revenue for the quarter. Analysts at Bank of America Securities and Janney responded to the Q4 EPS miss with downgrades of their investment ratings on the stock. On the upside, the utilities sector’s gainers included American Water Works (AWK) and Public Service Enterprise Group (PEG), whose shares rose 4.1% and 4.2%, respectively. Investors seeking safety are often attracted to utilities under the view that their services tend to be in demand regardless of economic growth. Provided by MT Newswires. |

What I want to talk about today?

Earnings, Protection, and a Virus

Protection using a leap short call

Original Risk = Debit of the long call Jun 21 $210= $27.80

Current Profit 106.37 – 27.80 = $78.57 Profit

For some or a little downside protection I can sell a Jun 21 $350 short call for a $24.10 credit

New risk in position = 27.80 – 24.10 = $3.70

I have about $20 of downside protection

Maximum Reward = 350-210 = $140 – Debit 3.70 = $133.30 or 3,600 % ROI

Our market has a Virus that can’t be cured with a lime !!!

We are Probably going to go lower

For how long? Who knows but in an earnings perspective this should be a buying opportunity

Where will our markets end this week?

Lower

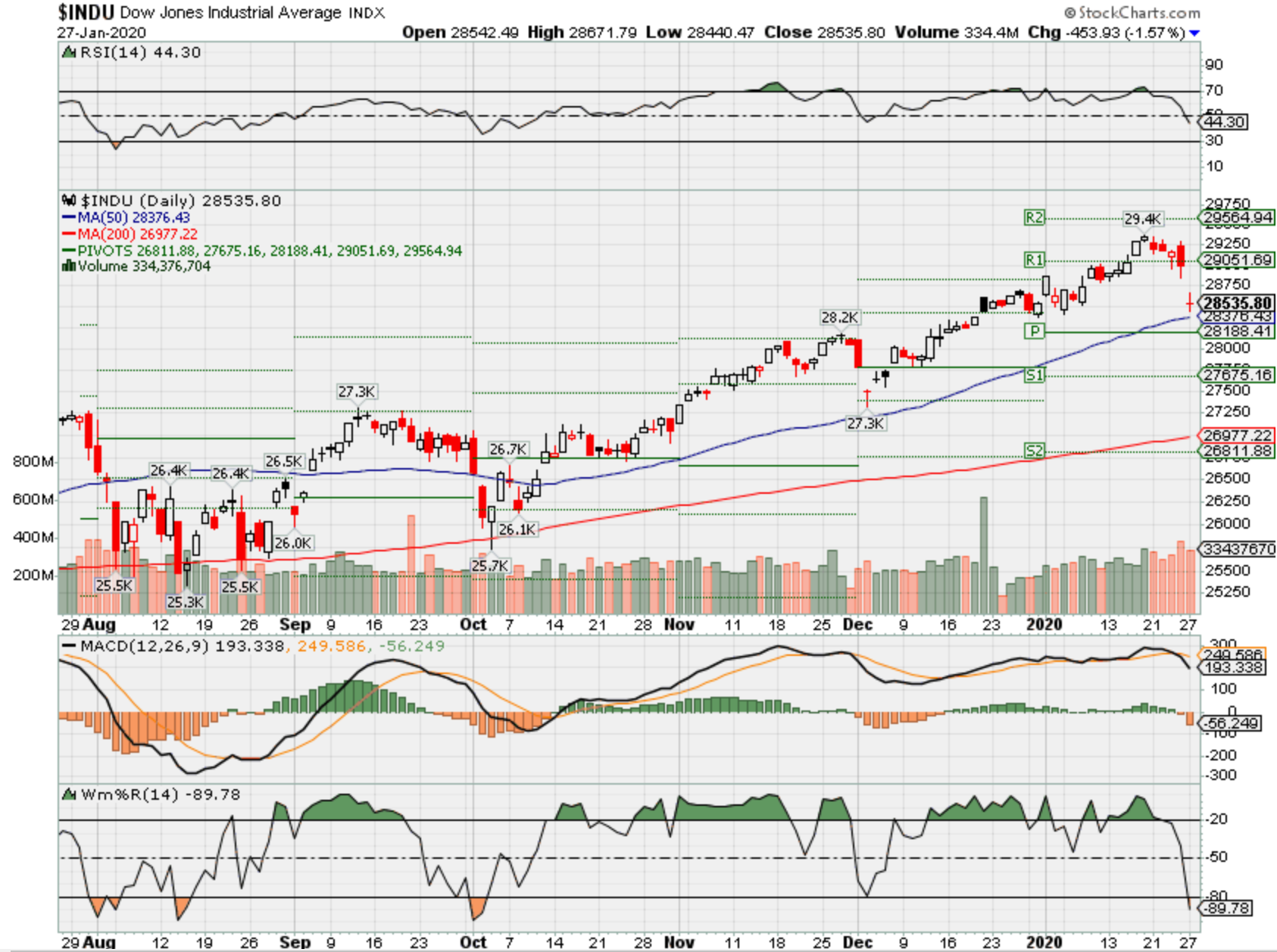

DJIA – Bearish

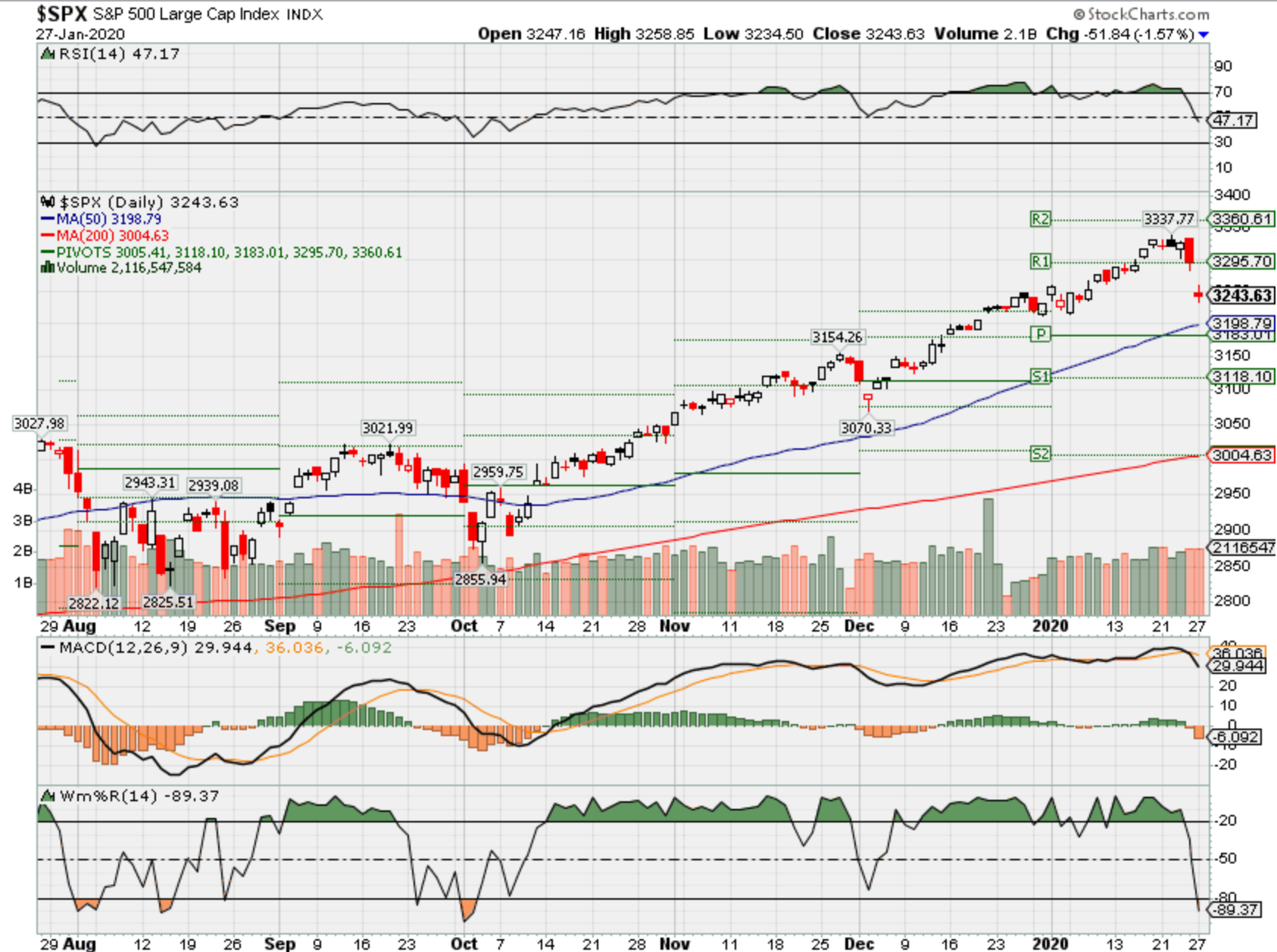

SPX – Bearish

COMP – Bullish

Where Will the SPX end January 2020?

01-27-2020 +2.0%

01-21-2020 +2.0%

01-13-2019 +2.0%

01-06-2018 +2.0%

Earnings:

Mon: DHI, S, FFIV, JNPR, RMBS

Tues: MMM, CIT, LMT, MKC, PFE, AMD, EBAY, AAPL, SBUX

Wed: T, GWW, GE, HES, MA, MCD, CREE, LVS, MSFT, TSLA, PYPL, BA, FB

Thur: MO, KO, GWW, HSY, RTN, MUR, UPS, VLO, AMZN, AMGN, BZH, WYNN, WDC, X, V, LLY

Fri: CAT, XOM, HON, JCI, SOHU, CVX

Econ Reports:

Mon: New Home Sales

Tues: Durable Goods, Durable ex-trans, Case-Shiller, Consumer Confidence

Wed: MBA, Pending Home Sales, FOMC Rate Decision,

Thur: Initial, Continuing, GDP, GDP Deflator,

Fri: Personal Income, Personal Spending, PCE Prices, Employment Cost Index, Chicago PMI, Mich

Int’l:

Mon:

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Earnings are coming up and protecting through earnings with protective puts and NO short Calls

AAPL – 1/28 AMC

AOBC – 3/05 est

BA – 1/29 BMO

BIDU – 2/20 est

CVS – 2/12 BMO

DIS – 2/04 AMC

F – 2/04 AMC

FB – 1/29 AMC

LLY 1/30 BMO

MRO – 2/12 AMC

MU – 3/19 est

NEM – 2/20 BMO

TGT – 3/03 est

UAA – 2/13 est

V – 1/30 est

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://seekingalpha.com/article/4318420-facebook-valuation-not-too-late

Facebook Valuation: It’s Not Too Late

Jan. 22, 2020 4:33 PM ET

Summary

Facebook stock has gained almost 50% in the past year, and it’s currently trading at historical highs.

However, price performance and valuation are very different things.

Facebook remains reasonably priced at current levels, even under conservative assumptions about future growth.

Regulatory uncertainty and the maturation in the core Facebook platforms are the main risk factors to watch.

This is not the right time to aggressively buy more Facebook, but valuation remains more than reasonable, and any pullback in the near term could present a buying opportunity.

I do much more than just articles at The Data Driven Investor: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Facebook (FB) stock has been on fire lately, shares of the social network have gained over 50% in the past year, and they are trading at historical highs as of the time of this writing. With this in mind, it makes sense for investors to wonder if it still makes sense to invest in Facebook right now or the stock is too expensive at current prices.

In this respect, it’s important to understand where the stock is coming from and what this means going forward. Facebook stock was considerably undervalued a year ago, and now valuation remains at reasonable levels, even under conservative assumptions.

The stock is not the bargain it used to be, and the market itself is overbought, so patience makes sense when building a position in Facebook. However, Facebook not overvalued at current prices, and the stock should be able to deliver solid returns in the years ahead. Even better, any pullback down the road could present a buying opportunity.

Keeping Things In Perspective

It is true that Facebook stock has significantly appreciated in the past year, but it is also true that the stock is not too far away from levels it first reached in July of 2018.

In fact, during 2018, Facebook had a massive drawdown of nearly 45% due to the data privacy scandals and all the negative press coverage surrounding the company. This clearly produced a big washout in investor sentiment around the stock.

Data by YCharts

It is all a matter of perspective, and the price chart above looks very different when we look at the modest gain of only 5% that Facebook has produced from its highs of July 2018.

Data by YCharts

Importantly, price momentum and valuation are two remarkably different things. Momentum is about measuring how the stock price is evolving over time, while valuation is about comparing the stock price versus fundamental metrics of value such as earnings and cash flows.

If we look at valuation ratios such as price to sales, price to operating cash flow, and enterprise value to EBITDA, those metrics are barely starting to move higher in 2020, and it’s easy to see how Facebook remains attractively priced by historical standards.

Data by YCharts

Forward-Looking Valuation

The difficult thing about valuation is that the true value of the business does not depend on past earnings, but rather on the earnings that the business is going to generate in the future. Unfortunately, the future can never be known with precision, it can only be estimated, and those estimates carry a considerable margin of error. Nevertheless, it can be an insightful exercise to asses forward-looking valuation ratios based on different ranges of earnings estimates.

The table below shows the forward price to earnings ratios for Facebook based on 3 levels of earnings expectations. The lowest estimate among Wall Street firms, the average estimate, and the highest earnings estimate among the analysts following the stock.

For a company that delivered a 28% increase in revenue last quarter, Facebook looks fairly attractively priced, especially if the company can meet or exceed the average earnings estimate. A price to earnings ratio below 25 is more than reasonable, and below 20, the stock looks clearly undervalued.

| PE Low E | PE Avg E | PE High E | |

| Dec 2020 | 29 | 24 | 20 |

| Dec 2021 | 24 | 20 | 17 |

| Dec 2022 | 18 | 16 | 14 |

| Dec 2023 | 15 | 14 | 13 |

Source: Seeking Alpha Essential

Speaking of which, Facebook has exceeded earnings expectations in each of the past 16 consecutive quarters, building quite an exceptional track-record of consistency in outperforming expectations.

Source: Seeking Alpha Essential

The fact that the company has outperformed expectations in the past does not guarantee that it will continue doing so in the future. However, it’s good to know that management tends to provide conservative guidance, usually underpromising and overdelivering.

If past history is any valid guide for the future, then Facebook could easily outperform the average Wall Street estimate in the coming quarters. In such a scenario, the stock would look conveniently valued if not downright undervalued.

Relative Valuation

In order to asses valuation ratios from a comparative perspective, we need to interpret these ratios in their due context and consider other metrics such as revenue growth and profit margins for different alternatives in the industry.

In that spirit, the table below shows revenue growth on a trailing twelve months basis, projected sales growth in the next five years, and operating margin for Facebook versus Alphabet (GOOG) (GOOGL), Snap (SNAP), Twitter (TWTR), Match Group (MTCH), and Baidu (BIDU).

Social media and online advertising are industries with plenty of potential for growth and profitability, among a group of relatively strong stocks, Facebook comes out as a top name in terms of financial quality.

The company has the second strongest growth rate in revenue behind Snap, and it leads the industry in terms of profitability, with an outstanding operating margin of 42% of revenue.

| FB | GOOGL | SNAP | TWTR | MTCH | BIDU | |

| Sales Growth TTM | 28.20% | 19.40% | 43.50% | 17.30% | 18.77% | 1.13% |

| Sales Growth Projected | 21.91% | 17.32% | 37.58% | 14.64% | 17.77% | 11.42% |

| Operating Margin | 42.01% | 22.84% | -67.76% | 12.41% | 31.58% | 2.61% |

Data from S&P Global via Portfolio123

This sky-high profitability is generated in spite of the fact that Facebook has significantly accelerated spending in recent quarters, with total cost and expenses growing 32% in the third quarter of 2019. It is reasonable to expect expenses to grow at a slower rate than revenue in the years ahead, so profitability could even increase from already high levels.

Back to the valuation ratios, the table below shows EV to EBITDA, forward PE, PE to long-term growth expectations (PEG) and EV to Sales. Facebook is the cheapest stock in the group in terms of EV to EBITDA and price to earnings growth ratios, and it doesn’t look too expensive at all when considering forward PE or EV to Sales.

| FB | GOOGL | SNAP | TWTR | MTCH | BIDU | |

| Enterprise Value to EBITDA | 17.67 | 19.76 | -26.75 | 26.54 | 41.06 | 37.09 |

| Forward PE | 25.9 | 30.5 | N/A | 14.3 | 45.8 | 24.8 |

| PEG | 1.35 | 1.95 | N/A | 1.46 | 2.7 | N/A |

| Enterprise Value to Sales | 8.88 | 5.91 | 16.58 | 6.92 | 13.68 | 2.76 |

Data from S&P Global via Portfolio123

Facebook is one of the best companies in social media and online advertising in terms of financial performance, and valuation ratios look rather attractive in comparison to peers.

Risk And Reward Going Forward

When considering the risks, regulatory pressure, public opinion backlash, and data-privacy concerns are the top factors to keep in mind. The company does not have any further room for error in these sensitive areas, and management needs to make sure that Facebook stays on the right track.

Ideally, Facebook should focus on promoting healthy interactions and connections among its users in order to reverse, at least to some degree, the damage that the company’s public image has suffered in recent years.

In addition to this, the main Facebook platform is maturing. The company is doing a great job at monetizing Instagram, and both WhatsApp and Facebook Messenger offer plenty of untapped potential going forward. Nevertheless, the transition to these platforms as main growth engines could make financial performance harder to predict in the middle term.

However, those uncertainty drivers are already accounted for in market expectations and in hence the stock price. In fact, the stock is still fairly attractively valued at current levels, even when incorporating those risk factors into the equation.

In May of 2019, I published an article entitled Facebook Is Undervalued. This article included a discounted cash flow valuation with an estimated value of $236 per share. The main thesis at the time was that the market was overreacting to the negative press coverage around Facebook.

From the article:

Facebook deserves a lot of the criticism that the company has received in recent months, and management needs to find the right ways to guarantee to users, regulators, and investors that will do the right thing to protect data privacy and guarantee a fair flow of information going forward.

However, the main point is that the uncertainty created by those struggles is already incorporated into current stock prices to a good degree. Facebook is still producing impressive financial performance and the stock is valued at attractively low levels.

Investors tend to miss the forest for the trees, often paying too much attention to the short-term news affecting the stock price and underlooking the long term fundamentals and valuation drivers. In this particular case, short-term uncertainty seems to be creating a buying opportunity for long term investors in Facebook stock.

Since then, the stock has appreciated by 23%, so the opportunity is not as large as it was at the time, and I wouldn’t rush into building a large position in Facebook now that the stock is more fairly valued. Besides the stock market, in general, is quite extended in the short term, so patience is a better idea than aggressively chasing Facebook at all-time highs.

But the main thesis remains in place, and the $236 fair value estimate is based on rather conservative cash flow assumptions. In fact, recent price targets from Wall Street firms are at $275 and $280. These price targets imply an upside potential of 25%-27% from current levels, and they are not unreasonable at all when looking at the cold-hard valuation metrics.

In other words, Facebook stock is rather moderately valued at current prices, even making conservative assumptions about earnings. The stock should be able to produce solid returns going forward, and any pullback down the road should be considered a buying opportunity as long as the fundamentals remain strong.

A subscription to The Data Driven Investor provides you with solid strategies to analyze the market environment, control portfolio risk, and select the best stocks and ETFs based on hard data. Our portfolios have outperformed the market by a considerable margin over time, and The Data Driven Investor has an average rating of 4.9 stars out of 5. Click here to get your free trial now, you have nothing to lose and a lot to win!

Performance as of December 31, 2019

Disclosure: I am/we are long FB, GOOG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

https://seekingalpha.com/news/3533612-films-parks-should-lift-disney-bofa

Films, parks should lift Disney – BofA

Jan. 22, 2020 2:31 PM ET|About: The Walt Disney Company (DIS)|By: Jason Aycock, SA News Editor

Disney (DIS +0.4%) is just inside two weeks from its first-quarter earnings report, and the company should benefit from recent strength at the film studio and its parks, BofA says.

The company wrapped an outstanding year at the box office with no letup, analyst Jessica Reif Ehrlich suggests: Frozen II quickly became the highest-grossing animated film ever, and Christmastime brought Star Wars: The Rise of Skywalker.

Frozen II has grossed $1.41B worldwide, with $938.7M of that coming from overseas markets. The Rise of Skywalker has his $1.03B worldwide, with $535.95M of that from international.

Star Wars is also a spur at the theme parks as attractions roll out, and business in that division should be “healthy,” Ehrlich says.

And shares face other tailwinds, including success at Disney Plus.

For Q1, consensus expectations are the Disney will log EPS of $1.48 on revenues of $20.9B. BofA expects $1.28 in EPS, raised from $1.22.

BofA has a Buy rating and a price target of $168, implying 17% upside.

White House has started work on second round of tax cuts to boost growth, Mnuchin says

PUBLISHED THU, JAN 23 20208:26 AM ESTUPDATED THU, JAN 23 202011:30 AM EST

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- The White House is putting together another tax cut, this time aimed at the middle class, Treasury Secretary Steven Mnuchin said Thursday.

- Those intentions come amid a trillion-dollar budget deficit and a national debt in excess of $23 trillion.

- Mnuchin acknowledged that government spending needs to slow, but stuck to the administration’s projections that the cuts will pay for themselves through economic growth.

The White House has started work on a second round of tax cuts even as the budget deficit continues to grow, Treasury Secretary Steven Mnuchin said Thursday.

“The president has asked us to start working on what we call ‘tax 2.0,’ and that will be additional tax cuts,” Mnuchin told CNBC during an interview at the World Economic Forum in Davos, Switzerland. “They’ll be tax cuts for the middle class, and we’ll also be looking at other incentives to stimulate economic growth.”

Talk of election year tax cuts comes amid a swelling budget deficit that eclipsed $1 trillion for the 2019 calendar year. In addition, total government debt recently passed $23 trillion, despite President Donald Trump’s promises that economic growth would wipe out the deficit and pull down the federal IOU.

Mnuchin maintained that the tax cuts would pay for themselves even as growth has fallen well short of the administration’s promises of 3%-4% annually. He did concede that the level of spending needs to be curtailed.

“There’s no question that we need to slow down the rate of growth of government spending, because we cannot sustain these deficits growing at these levels,” he said.

The White House pushed through a bill in late 2017 that pulled the business tax down sharply and also lightened the load for many individual taxpayers. However, economic growth has fallen below 3%, and the red ink has continued to grow.

Under the plan the administration will advance this time, the cuts will be more targeted to the middle class.

“The president feels that we need to continue to incentivize the middle class, that their taxes have been too high historically,” Mnuchin said. “We’ve had big tax cuts already, and that’s an area that we’ll continue to look at.”

The administration still expects the tax cuts to pay for themselves over a 10-year period, though Mnuchin acknowledged that the reductions were “front-loaded” and thus impacting the deficit more. He also said Trump chose to prioritize rebuilding the military, which also has added to the shortfall.

“The president’s economic program is clearly working,” Mnuchin said.

U.S. copper frenzy grows as Rio Tinto plans $1.5 bln Utah mine expansion

PUBLISHED TUE, DEC 3 201912:14 PM EST

Ernest Scheyder

Dec 3 (Reuters) – Rio Tinto Plc said on Tuesday it would spend $1.5 billion to expand its Kennecott copper mine in Utah, part of a growing trend by miners to invest in strategic mineral projects across the United States.

The move more than doubles the mining industry’s recent investment in U.S. copper projects, as Tesla Inc and other automakers demand more of the red metal for electric vehicle motors and other components.

“We like copper. We like the U.S.,” Rio Chief Executive Jean-Sebastien Jacques said in an interview. “If we had not taken this decision, our position in the U.S. market would be shrinking.”

Rio said the investment will extend the life of the more-than 100-year-old open-pit mine near Salt Lake City from 2026 through 2032, with the potential to keep it operational thereafter. The expansion project, which Rio said will generate “attractive returns” without elaborating, is set to get underway next year.

Once seen as a laggard in the global mining industry, U.S. copper deposits have drawn more than $1.1 billion in recent investments from small and large miners alike before Rio’s Tuesday announcement.

U.S. President Donald Trump has moved to cut mining regulations since taking office in a bid to encourage domestic mining and also offset China’s control of key parts of the military weapons supply chain, efforts that have dovetailed with those in the U.S. Congress.

The Kennecott mine on privately-owned land produces nearly 20% of the U.S. copper production, as well as gold and silver. Rio operates one of three U.S. copper smelters at the site.

The Anglo-Australian company had telegraphed last year https://www.reuters.com/article/us-rio-tinto-copper/rio-tinto-ready-to-splash-ou t – o n – c o p p e r – i d U S K B N 1 J P 0 L B that it was on the hunt for fresh copper, though analysts had assumed a large acquisition rather than expansion of an existing asset, was likely.

Rio has faced recent challenges in other parts of its copper portfolio. Its Mongolian copper mine project hit a major setback last month when lawmakers there approved plans to revise the terms of an agreement underpinning the multibillion-dollar development.

In Arizona, Rio’s Resolution underground copper project with BHP Group has spent years waiting for U.S. approval, though the permit logjam appears to be clearing.

Rio also said on Tuesday it was working with U.S. government scientists to extract rhenium and tellurium – used in jet engines and military explosives – from Kennecott’s refiners and smelters.

Rivals Glencore Plc and Freeport-McMoRan Inc also have U.S. mining projects under development. (Reporting by Ernest Scheyder Editing by Bill Berkrot)

Stocks Are ‘Ridiculously Cheap’? Why Warren Buffett Isn’t Buying

Jan. 23, 2020 4:18 AM ET

Summary

You can always count on a blowoff in the stock market to bring out the most creative and sincere of rationalizations.

Buffett certainly is not acting as if stocks are “ridiculously cheap” as so many would like to believe today in rationalizing a stock market trading at its highest valuation in history.

In light of his comments, I’m sure he wishes he had been able to buy precious metals over the past few years rather than allow that cash pile to grow to where it is today.

You can always count on a blowoff in the stock market to bring out the most creative and sincere of rationalizations. Most often we hear something along the lines of, “it’s a liquidity-driven rally,” suggesting that monetary policy is forcing stock prices higher. This is one we have heard not just for the past few months but for the entire duration of the bull market. And it’s popular because there is some semblance of truth to it even if it is not the whole truth.

Another rationalization that has been popular for quite a while but has made a comeback with the surge in equities is the idea that because interest rates are so low, much higher valuations are justified. These folks like to point to a comment Warren Buffett made last in a CNBC interview last May: “I think stocks are ridiculously cheap…” They fail, however, to remember how he qualified that statement: “…if you believe that 3% on the 30-year bonds makes sense.”

Here’s where the larger context can be very instructive. Buffett’s quip about stocks being cheap was in response to a question about broad stock market valuations but it followed on the heels of his business partner, Charlie Munger, answering the same question by discussing the valuations in the fixed income markets, if in a very roundabout way:

I am so afraid of a democracy getting the idea that you can just print money to solve all problems and eventually I know that will fail… All the politicians in Europe and America have learned to print money… Who knows when money printing runs out of control? At the end, if you print too much you end up with something like Venezuela.

Does this sound like someone who believes 3% on the 30-year bond makes sense? So Buffett’s quote was really more than an answer to a question about valuations; it was really an answer to the question, ‘Are both stock and bond valuations too high?’ Here’s how he answered:

I probably could not have conceived a world… where you would have full employment, 5% budget deficits with actually the probability of those rising from that level and at the same time have the long bond at 3%. I would have said that that couldn’t happen… The convergence of these factors would have seemed impossible to me and, generally, if I think something is impossible it’s going to change. Over time, I don’t know in what way but I don’t think we can continue to have these variables in this relationship. Now if we can, then stocks are ridiculously cheap… It looks like Nirvana; it looks like we’ve found the promised land where essentially money doesn’t cost anything and you can print lots of money and no inflation… I wouldn’t think you could have these things at these levels. Long-term rates, inflation rates, budget deficits and have that be a stable situation for a long time. And I still believe that.

To me, that sounds like someone who believes 3% on the 30-year bond should be impossible given where unemployment and the fiscal deficit currently sit. Should those latter two variables stay the same, then interest rates should be higher and thus equity valuations lower. To justify 3%, on the other hand, unemployment would have to be higher or the deficit much lower. Either way, you’re looking at recession and thus lower equity valuations.

Perhaps, this is why Warren currently holds his largest cash position in history. He certainly is not acting as if stocks are “ridiculously cheap” as so many would like to believe today in rationalizing a stock market trading at its highest valuation in history. And, in light of his comments, I’m sure he wishes he had been able to buy precious metals over the past few years rather than allow that cash pile to grow to where it is today.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Kobe Bryant turns 41 today—here’s the money advice he would give his 17-year-old self

Published Fri, Aug 23 20199:39 AM EDT

Former NBA star Kobe Bryant, who played his entire 20-year career with the Los Angeles Lakers, turns 41 today.

The basketball legend signed his first pro contract with the Lakers straight out of high school, at 17. It was worth $3.5 million and made him a millionaire virtually overnight.

“When your Laker dream comes true tomorrow, you need to figure out a way to invest in the future of your family and friends,” Bryant wrote in a letter to his younger self on The Players’ Tribune in 2016. “I said INVEST. I did not say GIVE.”

“Purely giving material things to your siblings and friends may appear to be the right decision,” continued Bryant, who would go on to earn a record $680 million over the course of his career. “But the day will come when you realize that as much as you believed you were doing the right thing, you were actually holding them back.”

Handing out money to your closest friends and family is not necessarily the best way to show your love, Bryant learned, since it can negatively affect their work ethic and may even suppress their ambition: “You will come to understand that you were taking care of them because it made YOU feel good; it made YOU happy to see them smiling and without a care in the world,” he wrote.

“While you were feeling satisfied with yourself, you were slowly eating away at their own dreams and ambitions. You were adding material things to their lives, but subtracting the most precious gifts of all: independence and growth.”

If you come into a windfall, Bryant recommends helping the people around you by investing in their future rather than giving them handouts.

“Put them through school. Set them up with job interviews and help them become leaders in their own right,” he wrote, adding: “You will see them grow independently and have their own ambitions and their own lives, and your relationship with all of them will be much better as a result.”

HI Financial Services Mid-Week 06-24-2014