HI Market View Commentary 01-24-2022

What a day !!! So what happened?

God placed the best things in life on the other side of fear and adversity

Hurley Investments Methodology

1st we protect stock ownership during the most volatile times when stock s can lose on average 15% of their value

Most if NOT all stock positions are protected

THE TRANSITION TO SCHWAB HAS BEEN HORRIFICALY LONGER than expected

Rich Mohrmann – Asked why haven’t you cashed in the protection to add more shares

2nd We dollar cost average without asking you for more money to make more as the market recovers

3rd We are always watching so you don’t have too

Why?= BECAUSE our money is in the exact same positions that we have your money in

Without commitment you will never start, without consistency you will never finish !!!!

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 21-Jan-22 15:05 ET

Potential for negative surprises is inflated – like wages

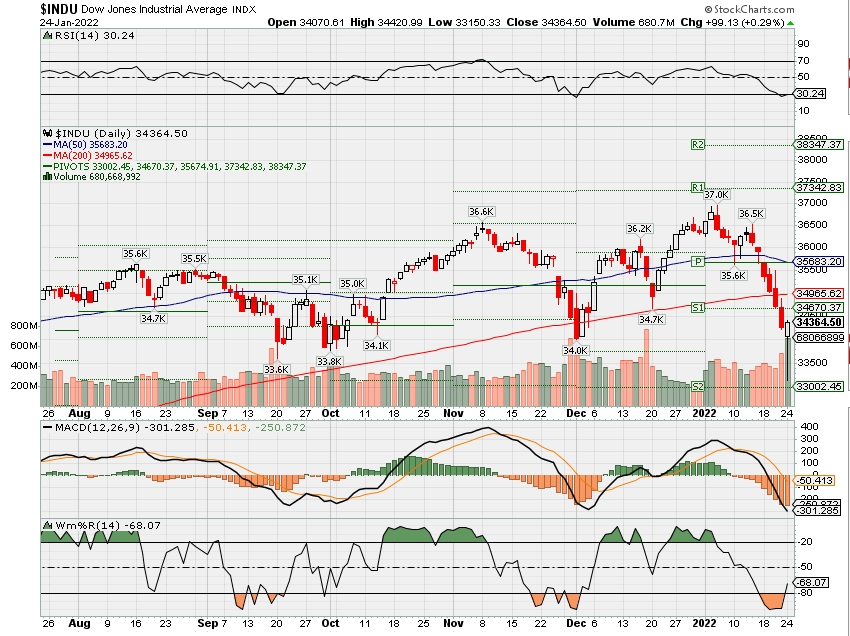

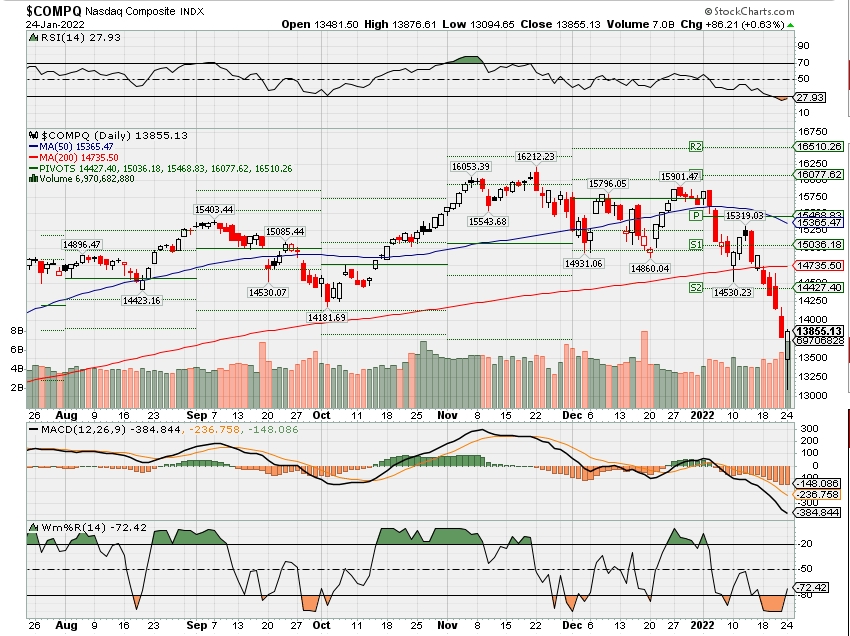

2022 has not gotten off to a good start. The Nasdaq has suffered a correction, which is loosely defined as a 10% pullback from a prior closing high. The Russell 2000 has flirted with a bear market, which is loosely defined as a 20% pullback from a prior closing high. The S&P 500 and Dow Jones Industrial Average both fell below their 200-day moving averages.

A rush to buy every dip in 2021 has been supplanted by an inclination to sell into strength in 2022.

The 10-yr note yield went from 1.51% to 1.90% in just 11 trading sessions. The fed funds futures market, which only a month ago thought three rate hikes in 2022 was a close call, is now projecting four rate hikes in 2022. Furthermore, there has even been some chatter that the Fed will raise the target range for the fed funds rate by 50 basis points at the March meeting to try to regain some inflation-fighting credibility.

As a reminder, the target range for the fed funds rate is at the zero bound while the consumer inflation rate of 7.0% sits at a 40-year high.

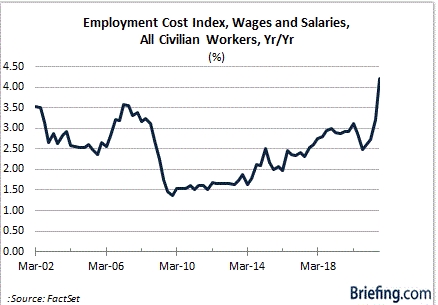

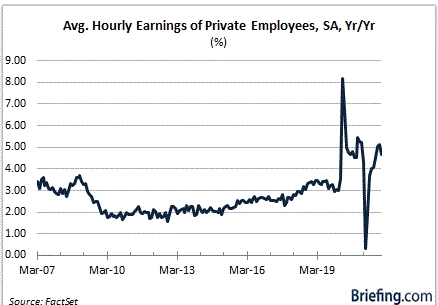

That inflation has been driven by higher prices for goods and services, which have been exacerbated by supply chain problems, transportation bottlenecks, and underinvestment. In due course, another inflation driver should avail itself as a problem: wage inflation.

On the Up and Up

Wages are going up. That is being heard anecdotally just as easily as it is being seen objectively.

Goldman Sachs CEO David Solomon captured the reality well on his company’s earnings conference call, saying “There is real wage inflation everywhere in the economy, everywhere.” He said this after the bank reported much higher than expected compensation expenses that led to an earnings miss and a year-over-year profit decline.

Shares of GS declined 7.0% the day of its report.

It is not a bad thing that wages are increasing. It can become a bad thing for the stock market, however, if that wage inflation cuts into profit margins and/or leads to higher prices (i.e., inflation) to protect profit margins.

We’ve Got Issues

Something a lot of new arrivals to the market might need to get acquainted with is the understanding that earnings ultimately drive the stock market. If profit margins are expanding, there will be an allowance to pay more for every dollar of earnings. If they are contracting, investors won’t pay as much for earnings growth that is either decelerating or declining because of the margin pressure.

That’s one issue.

Some — perhaps many — companies will be successful in passing along their higher labor costs in the form of higher prices for their goods and services. These companies would benefit from an expansion in profit margins, assuming customer demand holds steady or even increases.

This is the other issue.

If more and more companies are looking to offset higher compensation expenses with higher prices for their customers, there is going to be wage-based inflation pressures that are apt to prove stickier since employers aren’t going to start cutting wages when their competitors aren’t, lest they accept the risk losing a bunch of employees.

This stickier wage push inflation will be an added component that compels the Fed to keep aggregate inflation pressures in check with higher interest rates.

We are at this crossroads now, only there isn’t a good turn in any direction.

Individual companies reporting profit margin pressures during the Q4 reporting period are going to be penalized (and have been penalized), whereas the broader market is going to be penalized by a more aggressive Fed that sees a risk of wage-based inflation pressures leading to more persistent inflation.

It’s somewhat of a lose-lose position or at least a position that is going to make multiple expansion much harder to come by in 2022. Companies are literally going to have to earn their way this year, which is why many of the profitless story stocks of 2021 risk being left further behind in 2022.

What It All Means

The Q4 earnings reporting period is about to go throttle up. There have been some early warning signs that it could be a more challenging reporting period — certainly in relation to recent reporting periods.

That might sound ridiculous against a backdrop that includes an estimated blended earnings growth rate of 22.8%, according to FactSet. It resonates, though, in the understanding that it will be the slowest earnings growth rate since the fourth quarter of 2020 and precedes a quarter where earnings growth is projected to be just 6.2%.

It also resonates knowing the Fed is on the verge of increasing its policy rate at a time when labor supply remains tight, necessitating higher wages to attract and retain skilled workers, oil prices are at a 7-year high, and supply chain improvement has been impeded by the Omicron variant.

We should be hearing a lot about higher costs for corporate America, ranging from raw materials to transportation to packaging to labor. We don’t expect to hear a lot about anticipated cost relief in the first half of the year nor do we expect companies to project a lot of confidence in their forecasting ability for the full year.

The element of positive surprises this reporting period is unlikely to be what it used to be while the potential for negative surprises, not so much in the actuals reported for Q4 but the guidance for Q1, is inflated — like wages.

—Patrick J. O’Hare, Briefing.com

| Market Recap |

| WEEK OF JAN. 10 THROUGH JAN. 14, 2022 |

| The S&P 500 index slipped 0.3% last week, marking its second weekly drop in a row, as investors traded cautiously at the start of the Q4 earnings reporting season. The market benchmark ended the week at 4,662.85, down from last Friday’s closing level of 4,677.03. The index is now down 2.2% for the year to date following a 27% jump in 2021. The decline for 2022 thus far has come amid concerns about inflation and the COVID-19 pandemic. While the pandemic has been going on for two years, the US recently has been setting new record highs in daily case counts due to the spread of the highly contagious omicron variant. This has contributed to recent staffing and supply-chain issues. As the Q4 earnings season begins, investors are looking to see how US companies coped with the inflation, staffing and supply-chain issues last quarter. They also will be paying close attention to the companies’ outlooks. Some of the season’s early reports have added to investors’ concerns. Delta Air Lines (DAL) swung to a Q4 profit that topped analysts’ estimates, but the US airline expects to record a loss in the current three-month period with the omicron variant of COVID-19 impacting its short-term outlook. JPMorgan Chase’s (JPM) Q4 earnings per share surpassed analysts’ mean estimate but fell from the year-earlier period while its revenue not only declined year over year but also missed the Street consensus estimate. By sector, real estate had the largest percentage drop last week, down by 2%, followed by a 1.5% slip in consumer discretionary, a 1.4% fall in utilities and a 0.8% decline in financials. Still, two sectors managed to gain. Energy jumped 5.2% and communication services rose 0.5%. The real estate sector’s decliners included shares of Extra Space Storage (EXR), whose shares fell 2.3% on the week. A release earlier last week said the company sold 16 self-storage facilities across 12 US states to Rosewood Property for an undisclosed sum. The stock decline also came as the real estate investment trust’s shares were downgraded to hold from buy by Jefferies, which cut its price target on the shares to $223 from $229. In the consumer discretionary sector, shares of Domino’s Pizza (DPZ) shed 7% as Oppenheimer cut its price target on the pizza company’s stock to $550 per share from $565. The firm noted investors have been hoping for a same-store-sales boost if management raised price points on its national value platform. However, “this coveted tailwind now appears unlikely,” Oppenheimer analysts said in a note to clients following a presentation Domino’s management gave at a conference. The energy sector’s climb coincided with a continued advance in crude oil futures as investors have been betting demand will rise after new infections from the COVID-19 omicron variant peak. The US Energy Information Administration on Wednesday said US oil inventories fell for the seventh-straight week, dropping by 4.5 million barrels, which was greater than expected and added to the buoyant demand outlook. Among the energy sector’s gainers, shares of APA Corp. (APA) jumped 12% last week while Hess (HES) added 6%. Markets will be closed on Monday for the Martin Luther King Jr. Day holiday. When it reopens Tuesday, investors will see earnings reports from companies including Bank of America (BAC) and Goldman Sachs Group (GS). Wednesday’s reports are expected to include Procter & Gamble (PG), Alcoa (AA) and United Airlines Holdings (UAL). Thursday’s list features Union Pacific (UNP) and Netflix (NFLX) while Friday will bring reports from Schlumberger (SLB) and Huntington Bancshares (HBAN). Economic data being released next week will include some regional January data, including the Empire State Manufacturing Survey on Tuesday and the Philadelphia Fed manufacturing survey on Wednesday, as well as housing data including December building permits and housing starts on Wednesday and December existing home sales on Thursday. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end January 2022?

01-20-2022 -5.0%

01-20-2022 -3.0%

01-10-2022 -3.0%

Earnings:

Mon: HAL, IBM, ZION

Tues: MMM, AXP, GE, JNJ, RTX, COF, MSFT, TXN, LMT, VZ

Wed: ABT, T, FCX, GD, HES, KMB, INTC, LVS, TSLA, WHR, BA

Thur: ALK, MO, IP, MA, MCD, MUR, NUE, LUV, VLO, BZH, JNPR, WDC, AAPL, V,

Fri: ALV, CAT, CVX, CL, PSX, VFC

Econ Reports:

Mon:

Tues: FHFA Housing Price Index, S&P Case Shiller, Consumer Confidence,

Wed: MBA, New Home Sales, FOMC Rate Decision,

Thur: Initial Claims, Continuing Claims, GDP, GDP Deflator, Durable Goods, Durable ex-trans, Pending Home Sales,.

Fri: Employment Cost Index, PCE Index, PCE Core, Personal Income, Personal Spending, Michigan Sentiment

How am I looking to trade?

Long put protection has been added to certain stocks

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

How is the transfers coming – Laggards 15% of my business that needs to come over 5.6 million

Will we be using SCHAW or the Street Smart Edge = YES as soon as my accounts come over

‘Double down’ on defense because stocks will plunge another 10%, Morgan Stanley’s Mike Wilson warns

Investors may be playing with fire.

According to Morgan Stanley’s Mike Wilson, the S&P 500 is vulnerable to a 10% plunge despite Monday’s late buying binge. He warns investors are dangerously downplaying a collision between a tightening Federal Reserve and slowing growth.

“This type of action is just not comforting. I don’t think anybody is going home feeling like they’ve got this thing nailed even if they bought the lows,” the firm’s chief U.S. equity strategist and chief investment officer told CNBC’s “Fast Money.”

Wall Street hasn’t seen an intraday reversal this large since the 2008 financial crisis. During Monday’s session, the Nasdaq bounced back from a 4% drop while the Dow was off 3.25% at its low. At one point, the blue chip index was down 1,015 points. But by the close, the Nasdaq, Dow and S&P 500 were all in positive territory.

Wilson, the market’s biggest bear, expects the painful drop will happen within the next three to four weeks. He anticipates challenging earnings reports and guidance will give investors a wake-up call regarding slowing growth.

“I need something below 4,000 to get really constructive,” said Wilson. “I do think that’ll happen.”

His strategy: Double down on defensive trades ahead of the predicted setback. He warns virtually every S&P 500 group will see more trouble due to frothiness and is making decisions on a stock by stock basis.

“We’re not making a big bet on cyclicals here like we were a year ago because growth is decelerating. People got a little too excited on these cyclical parts of the market, and we think that’s wrong-footed,” he said. “There’s going to be a payback in demand this year. We do think margins are a potential issue.”

Wilson doubts the Federal Reserve’s two-day policy meeting which kicks of Tuesday will provide meaningful comfort to investors.

“They’re not going to back off because the market sold off a bit here,” Wilson said. “The data really hasn’t been soft enough for them to stop the tightening process.”

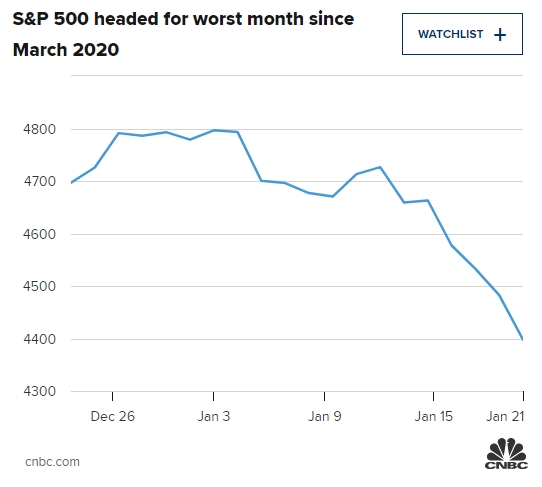

On Monday, the S&P 500 closed at 4410.13, 8.5% below the index’s all-time high hit on Jan. 4. Wilson’s year-end price-target is 4,400.

CNBC’s Robert Hum contributed to this report.

Here’s why stocks are on such shaky ground to start January

Maggie Fitzgerald@MKMFITZGERALD

It was a wild day for stocks on Monday, adding to the market’s shaky start to 2022.

The Dow Jones Industrial Average fell as much as 1,000 points, before coming back to close about 100 points higher. The S&P 500 was off by nearly 4% at its session low but managed to eke out a small gain. The Nasdaq Composite rose 0.6% after falling as much as 4.9%.

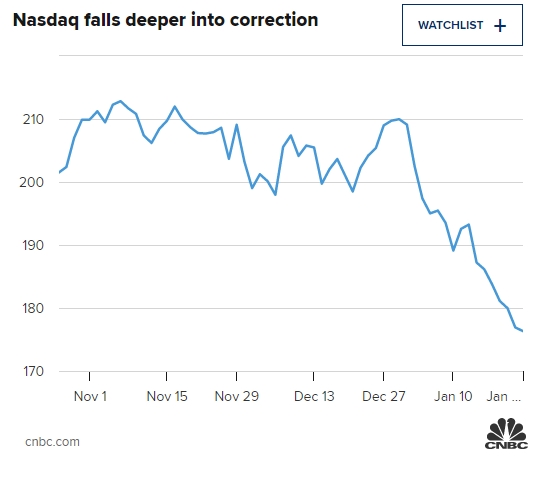

Despite the late-day jumps, both the Dow and S&P 500 are on pace for their worst month since March 2020, when the market fell into turmoil amid the pandemic. The Nasdaq, meanwhile, is still headed for its biggest one-month loss since October 2008.

What’s behind the market’s weak start to the year?

Though some areas of the market considered more expensive or speculative began to struggle in November, the broader market took a big step back during the first week of January following increasing hints from the Federal Reserve that the central bank will take aggressive action to slow down the jump in consumer prices.

“Over the past month, the Federal Reserve (Fed) has made it increasingly clear that it is serious about fighting that inflation,” the Wells Fargo Investment Institute said in a note to clients on Jan. 19.

The central bank has signaled that it plans to stop its asset purchases, hike rates and possibly reduce its balance sheet, starting in March. Government bond yields have surged in preparation for the rate increases, with the U.S. 10-year Treasury rising more than 40 basis points this year alone to nearly 1.9% at its high point after finishing last year just above 1.5%. (1 basis point equals 0.01%.)

Investors are now expecting four rate hikes this year, with some officials warning that more may be needed, after most Wall Street pros expected just one or two hikes a few months ago.

“The Dec. 15 minutes that came out on Jan. 5, they were a shock to investors,” Ed Yardeni, founder of Yardeni Research, said on CNBC’s “Halftime Report” on Monday.

The Fed will give its latest update on Wednesday. While it’s unlikely to raise rates at this meeting, market experts believe the central bank will stick with its plan tighten financial conditions despite the market decline given the high level of inflation.

Concerns about persistent inflation, supply chain disruptions from new Covid variants and the potential for conflict in Ukraine are other factors that have weighed on the risk appetites for investors.

Tech leads the way down

Technology stocks with high valuations got hit first and are continuing to get hit.

Last week, the technology-focused Nasdaq Composite fell into correction territory, marking a 10% drop from its November 2021 record close. At one point on Monday, the index was just a few percentage points away from reaching a bear market.

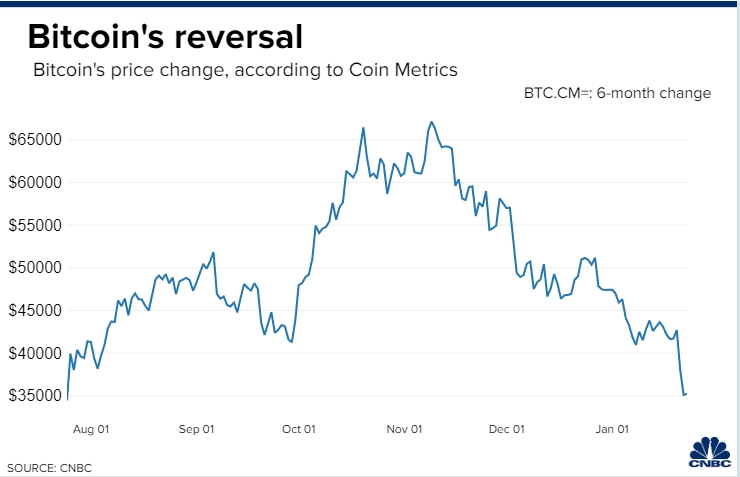

Nasdaq falls deeper into correction

Climbing bond rates typically disproportionally punish growth stocks as their future earnings growth become less attractive as rates rise. The growth expectations for tech stocks have also weakened as Wall Street analysts have gotten a better sense of what the post-pandemic economy may look like. “Since the end of 3Q21, 2022 earnings estimates for [the Nasdaq 100] fell 0.8%, while estimates for the S&P 500 rose 1.9%, indicating weaker fundamentals for Growth stocks relative to the overall market,” Bank of America equity and quant strategist Savita Subramanian said in a note on Monday. Many of the biggest stocks in the market are tech names, so their declines can have a major impact on market averages. Now, the selling pressure is feeding on itself as investors dump risk assets, dragging every stock sector but energy down in January. The cryptocurrency market has been hit hard as well. The price of bitcoin fell briefly below $34,000 on Monday morning, bringing its year-to-date losses to roughly 30%. Since its record high in November, the largest cryptocurrency has lost about 50%.

Bitcoin has lost roughly 50% since its all-time high in November.

CNBC

The price of ethereum has seen a similar decline over that time period.

Bright spots

To be sure, the health of the economy is looking good. The unemployment rate has fallen to 3.9% after a record year of nonfarm payrolls growth. Other metrics of economic growth are positive, even if they show a slower recovery than in 2021.

Earnings season is also turning out to be a strong one, despite some disappointing reports from high-profile firms. More than 74% of S&P 500 companies that have reported results have topped Wall Street’s earnings expectations, according to FactSet.

Covid-19 cases are also coming down. After exploding to staggering new highs amid the spread of the highly transmissible omicron variant, Covid-19 cases started to come down in New York State over the last two weeks, according to Gov. Kathy Hochul, leading to hope that other areas of the U.S. can see a similarly quick wave.

-CNBC’s Michael Bloom contributed to this report.

https://finance.yahoo.com/news/mercadolibre-doubles-down-crypto-two-222840930.html

MercadoLibre Doubles Down on Crypto With Two Purchases

Vinícius Andrade

Fri, January 21, 2022, 7:45 AM·1 min read

MercadoLibre Doubles Down on Crypto With Two Purchases

-3.55%

(Bloomberg) — Latin American e-commerce powerhouse MercadoLibre Inc. is deepening its presence in the crypto world.

The company acquired shares of 2TM Participacoes SA, the Softbank Group Corp.-backed owner of the biggest cryptocurrency brokerage based out of Brazil, MercadoBitcoin.com. MercadoLibre also said it made a strategic investment in New York-based Paxos, a blockchain company that it had worked with to offer crypto investments to some clients.

It’s the latest move by the e-commerce and fintech firm as it expands its crypto footprint. Starting last year, Brazilian customers of the Buenos Aires-based firm are allowed to buy, sell and hold cryptocurrencies using their digital wallets, with plans to replicate the product in other Latin American markets.

The company’s treasury has made purchases of Bitcoin, and Marcos Galperin, its co-founder and chief executive officer, is among those who have been vocal about the potential of opportunities around cryptocurrencies.

Bitcoin and other digital assets have been seen by some as potential hedges against swings in other areas of the financial market. The Bloomberg Galaxy Crypto Index is down 19% this year, after soaring to an all-time high last November.

MercadoLibre didn’t disclose the value for either of the transactions. The purchases reinforce the company’s “commitment to the development and use of crypto assets and blockchain technology in the region,” according to a statement. “With the investments, Mercado Libre also intends to stimulate the regional ecosystem, allowing it to offer increasingly relevant products and services.”

Shares in MercadoLibre swung between gains and losses early trading Friday.

Jeremy Grantham Doubles Down on Crash Call, Says Selloff Has Started

- GMO co-founder predicts drop of almost 50% in benchmark stocks

- Investor favors overseas value stocks, cash, commodities, gold

Jeremy GranthamPhotographer: Matthew Lloyd/Getty Images By

January 20, 2022, 9:00 AM MSTUpdated onJanuary 20, 2022, 11:14 AM MST

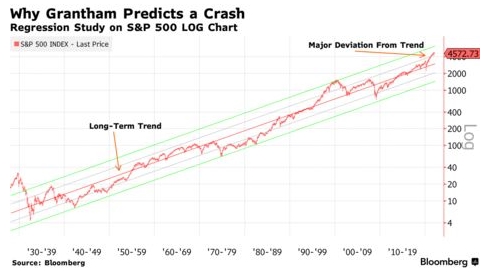

Jeremy Grantham, the famed investor who for decades has been calling market bubbles, said the historic collapse in stocks he predicted a year ago is underway and even intervention by the Federal Reserve can’t prevent an eventual plunge of almost 50%.

In a note posted Thursday, Grantham, the co-founder of Boston asset manager GMO, describes U.S. stocks as being in a “super bubble,” only the fourth of the past century. And just as they did in the crash of 1929, the dot-com bust of 2000 and the financial crisis of 2008, he’s certain this bubble will burst, sending indexes back to statistical norms and possibly further.

That, he said, involves the S&P 500 dropping some 45% from Wednesday’s close — and 48% from its Jan. 4 peak — to a level of 2500. The Nasdaq Composite, already down 8.3% this month, may sustain an even bigger correction.

HI Financial Services Mid-Week 06-24-2014