HI Market View Commentary 01-20-2022

Last Week I went over how to use valuations to determine a stock price !!!!

Stock Ticker Symbol Forward PE Range Next Yr EPS Expected Stock Price within 1 Yr

AAPL $172.17 32 – 34 $6.18 $197.76 – $210.12

BA $215.50 54 – 58 $4.87 $262.98 – $282.46 ALL $ 410

BAC $49.18 18 – 22 $3.18 $57.12 – $69.96

BIDU $153.33 8 – 12 $56.94 ($38) $304 – $456

COST $536.18 40 – 44 $13.97 $558.80 – $614.68

CVS $104.19 14 – 16 $8.26 $115.64 – $132.16

DG $238.27 22 – 23 $11.25 $247.50 – $253

DIS $157.83 34 – 36 – 44 $5.61 $190.74 – $213.18 – $246.84

F $24.44 13 – 14 – 15 $1.99 $25.87 – $27.86 – $29.85

JPM $167.16 16 – 18 $11.96 $191.36 – $215.28

SQ $141.54 125 – 135 $1.83 $228.75 – $247.05

UAA $19.85 28 – 32 $0.79 $22.12 – $25.28 – 27.50=34.4PE

V $216.96 32 – 36 $8.41 $269.12 – $302.76

FB $331.79 25 – 28 – 32 $14.23 $355.75 – $398.44 – $455.36

WHAT ARE THE FOUR NEW OPPORTUNITIES FOR 2022

BBY $100.30 14 – 16 $9.25 $129.50 – $148.00

RCL $83.97 and the PE ratios are not making sense

I am looking at a short float 5.88% and a previous high of 133.99

CCL $21.84 and again the PE’s don’t matter

A short float rate of 8.43% and a previous high of $51.34

GM

F looks to be a quicker and better return than GM

IN GENERAL we have a new market risk – Russia and Putin invading Ukraine

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 07-Jan-22 14:26 ET

2022 starts with an overdue thud after 2021 ended with a bang

It has been a tough start to 2022 for the stock market and particularly the growth stocks and mega-cap stocks. At the same time, it has been a tough start for the Treasury market, particularly longer-dated securities, yet nothing has been spared along the curve.

Market participants, however, shouldn’t be scratching their heads so much about the start to 2022 as they should have been shaking their heads about the end to 2021.

Then again, maybe enough did shake their heads while they were on holiday, which is why the stock and bond markets are off to such a shaky start in 2022.

Overdue Notice

From its low on December 20 to its high on December 30, the S&P 500 gained 6.1% in a span of just seven trading sessions. Not bad, eh? Well, it wasn’t as good as the Nasdaq Composite, which gained 6.8%. Even better was the Russell 2000, which surged 7.8%.

In that same span, Tesla (TSLA) soared 22.6%, NVIDIA (NVDA) rallied 12.2%, Microsoft (MSFT) jumped 8.1%, Apple (AAPL) increased 7.8%, and Alphabet (GOOG) gained, ho-hum, a mere 4.9%.

Let’s just keep this in mind before everyone pulls their hair out at the thought of the Nasdaq losing close to 5.0% this week and the Vanguard Mega-Cap Growth ETF (MGK) shedding close to 5%.

For a little more context bear in mind that, entering this week, the S&P 500 and Nasdaq Composite were up 113% and 128%, respectively, from their lows on March 23, 2020 (the day the Fed effectively went all-in with its policy accommodation).

Now, as for the 10-yr note yield, it went from 1.41% on December 20 to 1.51% on December 30. Seems like a decent-sized move, but then again, with a consumer inflation rate at 6.8%, a near $3.0 trillion budget deficit, and the Fed having signaled that it is going to pivot away from its uber-accommodative policy, it defied textbook reason that the 10-yr yield would only be 1.51%.

Well, it isn’t any longer. The 10-yr yield raced as high as 1.80% in this first week of 2022. That was an overdue move in our estimation just as much as the selling in the crowded mega-cap stocks was.

High Points

No one rings a bell at the top, but one must at least think things could be getting a little toppy for the near term.

At its high on Monday, Apple sported a $3 trillion market capitalization. If equated to nominal GDP, that would make Apple the fifth largest economy in the world. That same day we heard CNBC discuss how insider sales hit a record in 2021 (not at Apple, but in the overall stock market).

Also on Monday, Tesla saw its market capitalization increase as much as $150 billion (in less than a day!) on the news that it delivered 308,600 EVs in the fourth quarter — or 41,600 more cars than analysts expected, according to FactSet. Relative to the market cap increase, that equates to an allowance of roughly $3.6 million of added value per extra vehicle.

When the liquidity is flowing, it sure is flowing alright.

Monday was not only the high point of trading this week for Tesla, but it was also the high point for the market this week. The S&P 500 finished the session at a record closing high of 4796.56.

Since then, things have come off the boil so to speak. There has been a cooling down of the mega-cap stocks and the growth stocks, many of which were already entering the year on frigid terms with investors, trading 20%, 30%, 40% or even more off their 52-week highs.

That’s what happens when the excitement of a profitless story stock runs out of marginal buyers and also has to contend with a changing interest rate environment that forces the market to take a more sober view of valuations.

What It All Means

We had cautioned about these realities in recent columns published here:

- October 22, 2021: Bull market okay until interest rate push comes to shove

- November 12, 2021: An absurd monetary policy position is a risk we should all see coming

- November 19, 2021: A sign of old times for this dotcom Boomer

- December 10, 2021: 2022 stock market return expectations should get dialed down

- December 16, 2021: Fed Chair Powell delivers understatement of the year

Alas, Briefing.com subscribers might not be as surprised by the way 2022 has started as some others might be. The writing has been on the wall (and in this column) that this year promises to be more challenging on the return front than recent years.

That’s why we suggested in our 2022 market outlook that price returns at the index level should moderate, the speculative energy should lose some spark, volatility should be higher, and the back-and-forth rotation between growth and value should persist.

At the moment, the Russell 3000 Value Index is up 0.9% to start the year and the Russell 3000 Growth Index is down 4.6%.

It was quite a party in 2021 and it ended with a bang. Now, the market is confronted with the hangover and some of that pain was felt this week with heads pounding on the understanding that the Fed seems eager now to get out of its all-in position.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: The next installment of The Big Picture will be posted the week of January 17)

| Market Recap |

| WEEK OF JAN. 10 THROUGH JAN. 14, 2022 |

| The S&P 500 index slipped 0.3% last week, marking its second weekly drop in a row, as investors traded cautiously at the start of the Q4 earnings reporting season. The market benchmark ended the week at 4,662.85, down from last Friday’s closing level of 4,677.03. The index is now down 2.2% for the year to date following a 27% jump in 2021. The decline for 2022 thus far has come amid concerns about inflation and the COVID-19 pandemic. While the pandemic has been going on for two years, the US recently has been setting new record highs in daily case counts due to the spread of the highly contagious omicron variant. This has contributed to recent staffing and supply-chain issues. As the Q4 earnings season begins, investors are looking to see how US companies coped with the inflation, staffing and supply-chain issues last quarter. They also will be paying close attention to the companies’ outlooks. Some of the season’s early reports have added to investors’ concerns. Delta Air Lines (DAL) swung to a Q4 profit that topped analysts’ estimates, but the US airline expects to record a loss in the current three-month period with the omicron variant of COVID-19 impacting its short-term outlook. JPMorgan Chase’s (JPM) Q4 earnings per share surpassed analysts’ mean estimate but fell from the year-earlier period while its revenue not only declined year over year but also missed the Street consensus estimate. By sector, real estate had the largest percentage drop last week, down by 2%, followed by a 1.5% slip in consumer discretionary, a 1.4% fall in utilities and a 0.8% decline in financials. Still, two sectors managed to gain. Energy jumped 5.2% and communication services rose 0.5%. The real estate sector’s decliners included shares of Extra Space Storage (EXR), whose shares fell 2.3% on the week. A release earlier last week said the company sold 16 self-storage facilities across 12 US states to Rosewood Property for an undisclosed sum. The stock decline also came as the real estate investment trust’s shares were downgraded to hold from buy by Jefferies, which cut its price target on the shares to $223 from $229. In the consumer discretionary sector, shares of Domino’s Pizza (DPZ) shed 7% as Oppenheimer cut its price target on the pizza company’s stock to $550 per share from $565. The firm noted investors have been hoping for a same-store-sales boost if management raised price points on its national value platform. However, “this coveted tailwind now appears unlikely,” Oppenheimer analysts said in a note to clients following a presentation Domino’s management gave at a conference. The energy sector’s climb coincided with a continued advance in crude oil futures as investors have been betting demand will rise after new infections from the COVID-19 omicron variant peak. The US Energy Information Administration on Wednesday said US oil inventories fell for the seventh-straight week, dropping by 4.5 million barrels, which was greater than expected and added to the buoyant demand outlook. Among the energy sector’s gainers, shares of APA Corp. (APA) jumped 12% last week while Hess (HES) added 6%. Markets will be closed on Monday for the Martin Luther King Jr. Day holiday. When it reopens Tuesday, investors will see earnings reports from companies including Bank of America (BAC) and Goldman Sachs Group (GS). Wednesday’s reports are expected to include Procter & Gamble (PG), Alcoa (AA) and United Airlines Holdings (UAL). Thursday’s list features Union Pacific (UNP) and Netflix (NFLX) while Friday will bring reports from Schlumberger (SLB) and Huntington Bancshares (HBAN). Economic data being released next week will include some regional January data, including the Empire State Manufacturing Survey on Tuesday and the Philadelphia Fed manufacturing survey on Wednesday, as well as housing data including December building permits and housing starts on Wednesday and December existing home sales on Thursday. Provided by MT Newswires |

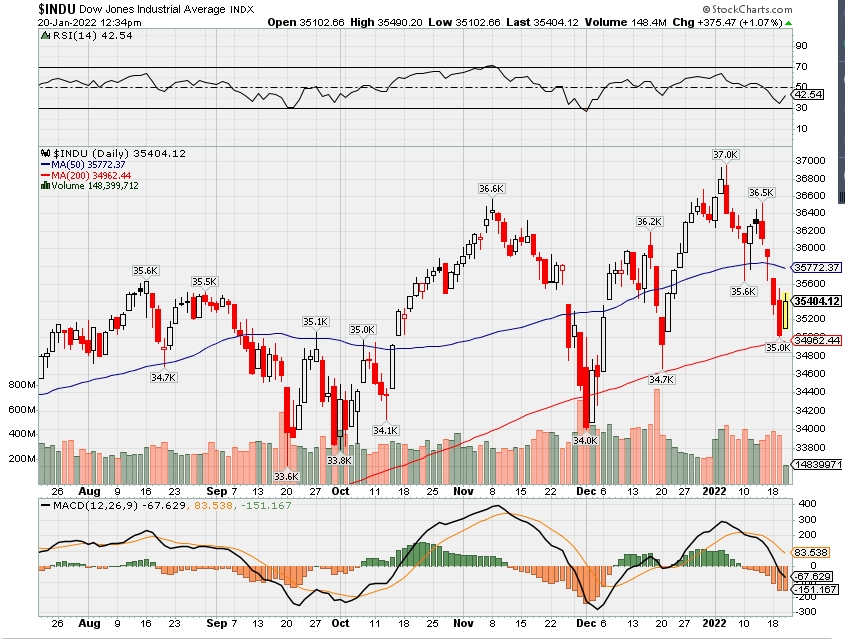

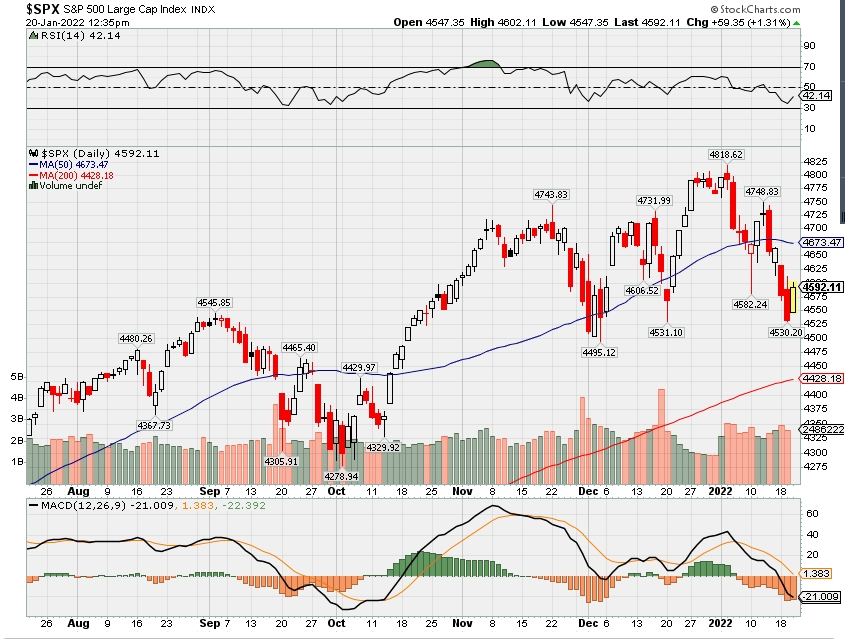

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end January 2022?

01-20-2022 -3.0%

01-10-2022 -3.0%

Earnings:

Mon:

Tues: SCHW, GS, PNC,

Wed: FAST, MS, USB, UNH, AA, DFS, FUL, KMI, UAL, BAC

Thur: AAL, FNH, KEY, UNP, NFLX

Fri: SLB

Econ Reports:

Mon:

Tues: Empire Manufacturing, NAHB Housing Market Index

Wed: MBA, Building Permits, Housing Starts

Thur: Initial Claims, Continuing Claims, Phil Fed, Existing Home Sales,

Fri: Leading Indicators

How am I looking to trade?

Long put protection has been added to certain stocks

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

How is the transfers coming – Laggards 15% of my business that needs to come over 5.6 million

Will we be using SCHAW or the Street Smart Edge = YES as soon as my accounts come over

https://www.fool.com/investing/2022/01/19/why-ford-stock-is-down-today/

Why Ford Stock Is Down Today

It’s about Rivian and accounting, it’s a little complicated, and it’s kind of silly.

Jan 19, 2022 at 1:35PM

What happened

Shares of Ford Motor Company (NYSE:F) were trading down on Wednesday, after the company previewed a series of one-time items it expects to report with its fourth-quarter earnings.

As of 1 p.m. ET, Ford’s shares were down about 7.2% from Tuesday’s closing price.

So what

At first glance, Ford’s preview, released after the U.S. markets closed on Tuesday, was good news. The company said it will report a fourth-quarter gain of $8.2 billion on its stake in Rivian Automotive (NASDAQ:RIVN), which went public late last year. Ford said it will also realize a $3.5 billion accounting gain from its annual pension-fund remeasurement, and a $3.6 billion tax benefit related to its global restructuring.

That all sounds good, right? So why is the stock down?

This will take a little bit of explaining. Back in the first quarter of 2021, Ford reported a roughly $900 million gain on its Rivian investment, based on the valuation used in the then-private start-up’s most recent funding round. At the time, Ford recognized that gain as income, not as a one-time item.

Then, during Ford’s third-quarter earnings call in October, Ford CFO John Lawler said that once Rivian went public, Ford would retroactively recategorize that $900 million gain as a one-time item, not as income.

In yesterday’s press release, Ford reminded investors of that recategorization plan — and noted that it will affect the guidance Ford gave during that same third-quarter call, when it said its full-year adjusted earnings before interest and tax would come in between $10.5 billion and $11.5 billion, because that range assumed that the $900 million would still count as income at year-end.

But because Rivian went public before year-end, it won’t be counted as part of Ford’s 2021 income. Put simply, Ford has essentially revised its full-year earnings guidance lower because of an accounting change related to the timing of Rivian’s initial public offering.

The change doesn’t affect the long-term investment case for Ford in any meaningful way. But because the traders and algorithms are seeing yesterday’s news as a “guidance cut,” Ford’s stock is getting clobbered today.

Now what

Auto investors can look ahead to Ford’s fourth-quarter and full-year earnings report on Feb. 3 after the U.S. markets close, during which — we hope — Ford will make clear to Wall Street that this accounting change had no material effect on its finances.

https://www.cnbc.com/2022/01/17/hedge-fund-manager-says-ark-etf-stocks-are-a-potential-time-bomb.html?__source=iosappshare%7Ccom.apple.UIKit.activity.Mail

Hedge fund manager says Ark ETF stocks are a potential ‘time bomb’

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- David Neuhauser’s hedge fund Livermore Partners was short Cathie Wood’s Ark Innovation ETF in 2021.

- He now says ARKK will become a “poster boy for all the things in the current cycle that you should not have been investing in.”

- ARKK is down 11% year-to-date, according to Refintiv data.

Hedge fund manager David Neuhauser, who shorted Cathie Wood’s flagship fund last year, says Ark Innovation will become a “poster boy for all the things in the current cycle that you should not have been investing in.”

Neuhauser, founder and CIO of Chicago-based Livermore Partners, said during CNBC’s latest Pro Talks that the “valuations assigned to many of her companies are still extremely frothy and potentially could be a time bomb when those sectors see some level of a downturn.”

The comments come after a difficult end to 2021 for ARKK following a stellar performance sparked by the coronavirus pandemic. The fund is down over 12% year-to-date in 2022, and off around 45% from its Feb. 2021 all-time high.

Streaming device company Roku, along with telemedicine and virtual health care company Teladoc Health and Zoom Video are among the companies held in ARKK, all of which have fallen year-to-date.

Neuhauser said he had covered, or closed, Livermore Partners’ short position in ARKK after it fell 20% to “lock in gains,” but doesn’t rule out shorting the ETF again in the future.

On Jan. 7, Wood said that the market looks “irrational” as technology companies sold off, but added that it will stabilize soon amid the new earnings season.

“As we see these earnings reports coming in, and the guidance for the first quarter and this ’fessing up out there into what’s really going on with inventories, that we’re going to see the turn sooner rather than later,” Wood said in the video posted on Ark Invest’s website.

Neuhauser, however, is not convinced and said Wood had it wrong when she called stock markets irrational.

‘Perfect storm’

The Covid pandemic had been a “perfect storm” for Wood’s style of investing, Neuhauser said, alluding to how central banks have supported economies with loose monetary policy. This has buoyed so-called “growth stocks” in particular, because looser policy has made it cheaper for these companies to hold and service debt.

Now, the U.S. Federal Reserve has said tighter monetary policy will be needed to control inflation. In his confirmation hearing before the U.S. Senate on Tuesday, Fed Chairman Jerome Powell said he expected interest rate hikes this year.

In contrast to most on Wall Street, however, Woods expects deflation to be an issue this year, after a fall in commodity prices.

“And I think completely the opposite to her, as far as where inflation is,” Neuhauser stated.

The U.S. consumer price index, one gauge of inflation, rose 7% in December from a year earlier, according to the data released by the Labor Department on Wednesday. This represented the fastest increase in consumer prices over a 12-month period since 1982.

“Some [of ARKK’s holdings] are very strong companies, things like Paypal, Square and Tesla, things that, you know, have grown tremendously,” Neuhauser said. “But the sustainability path and valuations have always been a concern because its been fed on this low rate environment.”

He added: “I think now we’re going to see sort of 180 [degree turn] over the next few years, and I think her shares are going to suffer.”

Woods, however, insists the “disruptive innovation” stocks in her fund will outperform, urging investors to stick with her. “Just keep your eye on the prize. Truth will win out,” she said in December.

CNBC contacted Ark Invest for comment but had not received a response at the time of publishing.

Bill Ford is doubling down on Ford shares, and quietly amassing more control of his great-grandfather’s company in the process

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- Ford Motor Chair Bill Ford has been slowly amassing more control of the automaker his great-grandfather founded in 1903.

- He is the company’s biggest individual shareholder with 2.3 million shares of the Ford’s common stock.

- More importantly, he directly owns 16.1 million, or 23%, of the Class B shares. That’s quadruple the roughly 4 million, or 5.7%, he owned in 2012, according to FactSet.

DETROIT – Ford Motor Chair Bill Ford has been slowly amassing more shares, and control, of the automaker his great-grandfather founded in 1903.

Unlike Elon Musk and other CEOs who’ve recently cashed out some of their company stock as prices soared, Ford has been doubling down on his namesake company over the last decade.

The 64-year-old is the company’s biggest individual shareholder with 2.3 million shares of Ford’s common stock. More importantly, he’s also the biggest holder of the automaker’s Class B shares that carry super-voting powers that have allowed the Ford family to retain control of the company. While the Class B shares account for 2% of Ford’s outstanding stock, they control 40% of the voting power.

Bill Ford directly owns 16.1 million, or 23%, of the Class B shares, which are only available to family members. That’s quadruple the roughly 4 million, or 5.7%, he owned in 2012, according to FactSet.

“I think it’s really important that the family legacy continue. It gives us a face and maybe a humanity that a lot of other companies don’t have.”

Bill Ford Jr.

CHAIR

From Satya Nadella at Microsoft to Jeff Bezos and Musk, CEOs, founders and other company insiders have been cashing in their stock at the highest pace on record with $69 billion in stock in 2021, as looming tax hikes and lofty share prices encouraged many to take profits.

Ford, whose stake has grown through his work as chair of the board, said he’s holding on to his shares because of his “tremendous confidence” in the company’s management team, led by CEO Jim Farley, to deliver on Farley’s Ford+ turnaround plan focusing on electric and connected vehicles. Bill Ford received $16 million in total compensation from Ford in 2020, which came in a mix of benefits, cash and equity awards.

Ford acquired 412,500 additional Class B shares last month that are being held in a family trust. The move came roughly a week after he acquired almost 2 million common shares of the company by exercising stock options, some of which were set to expire.

Instead of cashing in on the $18 million in proceeds he would have gotten from exercising the options like most executives do, Ford paid $20.5 million in cash as well as taxes on the gains to hold on to the shares.

“I just feel like we are very well positioned to deliver superior shareholder returns and I for one wanted to be a big part of that,” Ford told CNBC. “I think in many ways we have an opportunity to create the most value for shareholders since the scaling of the Model T.”

EVs

Unlike his predecessor, Farley has won investor confidence since taking over the helm in October 2020. Shares of the automaker have surged by about 270% since then, sending its market value above $100 billion on Thursday for the first time ever. 2020 marked the first year since 2001 that Ford’s stock has topped $20 a share.

The stock closed Thursday at $25.02 a share, with the company’s market value at $99.99 billion. Ford’s now worth more than crosstown rival General Motors, which is valued at about $90 billion.

Under Farley’s Ford+ plan, the company is pivoting hard to EVs, including the Mustang Mach E and all-electric Ford F-150, as well as connected services to generate recurring revenue. The company expects an 8% adjusted profit margin before interest and taxes in 2023 — earlier than many analysts expected.

“The Mach-E and the Lightning, both their order banks just overwhelmed us,” Ford said. “We’re on this electrification journey, but it’s more than that. It’s connecting to the customer, it’s all the services that will be developed around electrification.”

Family shares

Ford directly owns about 20.3 million shares, including restricted, common and Class B stock. The holdings, which may exclude some trusts, were worth more than $500 million as of Thursday’s closing price.

There are 71 million Class B shares worth about $1.8 billion held by descendants of company founder Henry Ford. The Ford family’s voting power diminishes once their Class B shares fall below about 60.8 million.

Some have criticized the dual-share system for unfairly allowing the family to retain control of the automaker. Ford has repeatedly defended the dual-share structure as allowing the automaker to concentrate more on the long term and not be another “nameless, faceless corporation.”

“I think it’s really important that the family legacy continue,” he said. “It gives us a face and maybe a humanity that a lot of other companies don’t have.”

The dual-class stock structure, which has been in place since the company went public in 1956, has faced numerous shareholder challenges. At last year’s shareholders meeting, 36.3% of voters supported a system that gave every share an equal vote, slightly higher than the 35.3% average since 2013.

Ford believes his stock ownership supports his defense of the family’s shares and voting power. Ford said he can’t remember, if ever, selling Ford shares in the open market. That doesn’t include exercising options, transferring shares to trusts or converting common shares to Class B stock.

“I’m in this for the long haul. This is my life and I love the company,” he said. “I really believe that we are headed for an incredible future.”

– CNBC’s Robert Frank contributed to this report.

Correction: Henry Ford was Bill Ford’s great-grandfather. The headline on an earlier version misstated the relationship. Ford’s stock closed Thursday at $25.02. An earlier version misstated the day.

28-year-old millionaire: Here’s how to earn seven figures

Self-made millionaire Tanner Chidester has figured out how to earn a lot of money: He built two, seven-figure businesses, Fit Warrior and Elite CEOs, from scratch. And he did it by age 27.

“The slow way to wealth is to save,” the now 28-year-old tells CNBC Make It. “At the end of the day, it’s a lot easier to make more money than to save more.”

Making more starts with a specific net worth or earnings goal, he says: “Make non-negotiable goals, then reverse engineer it.” If your goal is to become a millionaire in ten years, figure out exactly how much money you have to make in a year, month or week to achieve it.

“When you break it down that simple, it’s not as scary anymore,” he says. “But a lot of people just set a huge goal and they never break it down and know the numbers and the statistics that they have to hit, so it just becomes unfathomable and overwhelming.”

Once you’ve set your financial goal, you have to actually get to work and start earning. The best way to make big money is to start with a skill you already have that you can monetize, Chidester says. “Maybe you’re really good at getting someone in shape, or you’re really good at running ads for companies. Maybe you do the best backflip in the world, or you’re really good at selling books. Find one skill you’re really good at, package that together into a service and sell it to people.”

That’s how he started. Chidester played Division 1 college football and had been a fitness buff since he was a kid, so he decided to create personalized fitness and eating plans for clients. At the time, he was 22 and had just dropped out of college before finishing his senior year.

He didn’t make money off of his programs right away. In his first two years, he made just $2,000 and worked at Olive Garden to pay the bills.

It wasn’t until he took a course about how to build an online training business that he started to see results. “That’s when I learned that people will pay high ticket prices — high ticket meaning $1,500 plus — for a service,” says Chidester, who was 25 at the time. “I was selling my fitness programs for like 40 bucks. That’s when I learned, Oh, people will pay me $1,500 for my service.”

Chidester homed in on one-on-one coaching, which people will shell out four figures for, he realized. As soon as he increased his prices, he started seeing big money: He made $10,000 in one week. Eventually, he worked his way up to making between $30,000 and $50,000 a month. By 27, his net worth hit $1 million.

He then used a new skill he’d developed — how to scale a business online — to start teaching other business owners and fitness trainers how to grow their ventures. That evolved into his second company, Elite CEOs, which he runs in addition to Fit Warrior.

“What most people struggle with is, they don’t sell stuff high enough to ever get out of their financial situation,” he says. If your product or service is priced at $100, you have to sell a ton of units to get by. But, “If you sell one high priced service for $1,500, you only have to sell four or five a month and you’re already almost at six figures a year.

“That’s how I really got out of my situation.”

Editor’s note: This story has been updated to reflect that Tanner Chidester recently turned 28.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.

Wage inflation has arrived in a big way and Jamie Dimon says CEOs ‘shouldn’t be crybabies about it’

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- Megabanks including JPMorgan Chase and Citigroup are disclosing that hot inflation in one area — employee wages — is casting a shadow over the next few years.

- JPMorgan’s professional class in particular — trading personnel, investment bankers and asset management employees — have seen pay swell during two straight years of strong performance.

- “Please don’t say I’m complaining about wages; I think wages going up is a good thing for the people who have the wages going up,” Jamie Dimon, the bank’s chairman, said. “CEOs shouldn’t be crybabies about it. They should just deal with it.”

Banks have been one of the main beneficiaries of high inflation recently because their profit margins tend to expand when higher prices force central banks to raise interest rates.

At least, that was the thinking as investors bid up bank shares while rates climbed and inflation reached multi-decade highs. Now, megabanks including JPMorgan Chase and Citigroup are disclosing that hot inflation in one area — employee wages — is casting a shadow over the next few years.

Shares of JPMorgan fell more than 6% on Friday after the bank said that expenses will climb 8% to roughly $77 billion this year, driven by wage inflation and technology investments. Higher expenses will likely push the bank’s returns in 2022 and 2023 below recent results and the lender’s 17% return-on-capital target, according to CFO Jeremy Barnum.

“We’ve seen a somewhat elevated attrition and a very dynamic labor market, as the rest of the economy is seeing,” Barnum said. “It is true that labor markets are tight, that there’s a little bit of labor inflation, and it’s important for us to attract and retain the best talent and pay competitively.”

The development adds nuance to the bull case for owning banks, which typically outperform other sectors in rising-rate environments. While economists expect the Federal Reserve to raise rates three or four times this year, boosting the finance industry, there is the risk that runaway inflation could actually wipe out those gains, according to Barnum.

“On balance, a modest inflation that leads to higher rates is good for us,” the CFO told analysts in a conference call. “But under some scenarios, elevated inflationary pressures on expenses could more than offset the rates benefit.”

Citigroup CFO Mark Mason said Friday that there was a “lot of competitive pressure on wages” as banks jostle for talent amid the boom in deals and trading activity.

“We have seen some pressure in what one has to pay to attract talent,” Mason said. “You’ve even seen it at some of the lower levels, I should say entry levels in the organization.”

At JPMorgan, the biggest U.S. bank by assets, it is the bank’s professional class in particular — trading personnel, investment bankers and asset management employees — who have seen pay swell after two straight years of strong performance. The company also raised wages at branches last year.

“There’s a lot more compensation for top bankers and traders and managers who I should say did an extraordinary job in the last couple years,” chairman and CEO Jamie Dimon told analysts during a conference call. “We will be competitive in pay. If that squeezes margins a little bit for shareholders, so be it.”

Dimon said that while overall inflation would “hopefully” start to recede this year as the Fed gets to work, increases in “wages, and housing and oil are not transitory, they’ll stay elevated for a while.”

In fact, Dimon told analysts that wage inflation would be a recurring theme among corporations this year. Some companies will navigate the change better than others, he said.

“Please don’t say I’m complaining about wages; I think wages going up is a good thing for the people who have the wages going up,” Dimon said. “CEOs shouldn’t be crybabies about it. They should just deal with it. The job is to serve your client as best you can with all the factors out there.”

Professor who predicted ‘The Great Resignation’ shares the 3 trends that will dominate work in 2022

In 2021, three words shaped the world of work: “The Great Resignation.”

Anthony Klotz, an organizational psychologist and professor at Texas A&M University, coined the phrase during an interview with Bloomberg last May to describe the wave of people quitting their jobs due to the ongoing coronavirus pandemic, which led many to re-think where, how and why we work.

But he never predicted what would happen next: The Great Resignation has continued to dominate headlines and stun business leaders as turnover reaches new highs. In November, a record 4.5 million workers left their jobs, according to the Labor Department’s latest Job Openings and Labor Turnover report.

The Great Resignation has inspired other terms to describe the work revolution we’re witnessing, including “The Great Reimagination,” “The Great Reset” and “The Great Realization.” These narratives explain how we’re re-examining the role of work in our lives, but miss the broader consequences of this quitting wave, and what it means for the individual worker, Klotz argues.

“It’s not just about getting another job, or leaving the workforce, it’s about taking control of your work and personal life, and making a big decision – resigning – to accomplish that,” he tells CNBC Make It. “This is a moment of empowerment for workers, one that will continue well into the new year.”

Below, Klotz shares his three predictions for what work will look like in 2022:

The Great Resignation will slow down

Quitting will continue in 2022 — but Klotz doesn’t expect turnover to spike as high as it did last year.

Americans quit jobs at a record pace during the second half of 2021, and more plan to resign in the new year. About 23% of employees will seek new jobs in 2022, while 9% have already secured a new position, according to a December ResumeBuilder.com poll of 1,250 American workers.

Although Klotz predicts that quitting will continue steadily at similar, elevated rates we’ve seen over the past year, he’s not confident that “we’ll see another big quitting wave in 2022,” he says.

That’s because the tight labor market has pushed companies to offer better benefits and higher salaries, which Klotz says will keep employee turnover from being “completely rampant” in the months ahead.

Flexible work arrangements will be the norm, not the exception

The freedom to work from anywhere has become the most sought-after benefit during the pandemic – so much so that people value flexibility as much as a 10% pay raise, according to new research from the WFH Research Project.

More companies will embrace this change to attract and retain talent, Klotz argues. “Leaders are starting to ask, ‘How can we give people more power over their schedules? How can we be more flexible?’” he says.

Managers that blame external factors for turnover – whether it be government leadership, the pandemic, unemployment benefits or other reasons – and refuse to offer flexible work arrangements will be the “losers who struggle in the wake of the Great Resignation,” Klotz adds.

Klotz expects that a flexible working culture will lead to better work-life balance and improved mental health for employees. “A silver lining of this horrible pandemic is that the world of work will take a huge positive step forward for workers,” he says. “Work will fit around our personal lives rather than our personal lives fitting around work.”

Remote jobs will become more competitive

As companies struggle to hire in the United States, a growing number of managers could turn to automation and international candidates to fill open roles.

The pandemic accelerated the trend toward automation as companies embraced digital waiters, concierges and other technologies amid social distancing rules and virus fears. In 2020, the World Economic Forum surveyed about 300 global companies and found that 43% of businesses expect to reduce their workforces with new technology.

Klotz predicts that companies will make larger investments in robots and artificial intelligence to reduce hiring times and costs even after the pandemic subsides.

Those same benefits could push companies to hire more international candidates for remote roles and create even more competition for remote jobs, he adds. “In the United States, employees tend to be paid higher wages than people in many other countries,” Klotz says. “If you’re a remote organization, you can recruit workers from all over the world who can do the same job for a cheaper rate.”

A parenting expert shares the 5 toxic mistakes that can make kids more ‘selfish and entitled’

When it comes to raising successful, caring and well-rounded kids, everything starts with the family. The best homes are compassionate homes, where children’s voices and feelings are prioritized.

Studies show that by age three, children begin to show genuine compassion and empathy, and are able to understand that their feelings and experiences can be different from those of others.

As a parenting coach, here are some of the toxic parenting mistakes I’ve noticed that can kids more selfish and entitled in adulthood:

1. Saying yes to almost everything

Studies show that children who grow up with a sense of entitlement — which comes from over-parenting and overindulging your children — are more concerned about themselves, show less empathy for others, lack a strong work ethic, and may behave as if rules don’t apply to them.

Teaching compassion to your children requires you to start saying no sometimes. No, you’re not going to clean up after them. No, you’re not going to buy them that thing they want. No, you’re not going to be spoken to in that way.

Giving consequences to their unhealthy actions will support their ability to see situations from various viewpoints.

If your child calls his sibling a name, for example, don’t let it slide. Instead, say: “I feel [insert your feelings] when you talk to your brother that way. Being kind to your brother is a rule in our house. Calling him [insert name] is unacceptable, and there are consequences for that behavior.”

2. Failing to create teaching opportunities

You may think they’re not paying attention, but kids watch very closely to see how you respond to situations. You want them to witness the way you see the good in everyone, no matter how small the issue or who the person is.

Even the youngest children can get used to the idea of putting themselves in someone else’s shoes. For example, I want my sons to want to help and think of each other more often:

- Me: “I’m fixing sandwiches. What kind do you want?”

- Son: “Turkey, please!”

- Me: “What should I make for your brother?”

- Son: “Turkey!”

- Me: “Hmm. That’s definitely the sandwich you want because it’s your favorite. But let’s think about your brother. How do you think he’d feel if he came home and saw your favorite sandwich made for him? What do you think he’d say about the sandwich that he wanted?”

- Son: “He’d have wanted peanut butter and jelly?”

- Me: “Yes, I love how you thought about your brother’s feelings and what would make him feel happy.”

3. Not addressing what’s happening in the world

By the time children are eight years old, they’re able to understand that a person’s feelings may not be based on what’s going on with them at the moment, but instead may be a byproduct of their general life circumstances.

During this developmental period, children also grow a more concrete understanding and empathy for a group of oppressed people. This is why it’s so important to talk to them about what they might be seeing in the news, hearing outside of home, or reading on social media.

Use these moments to model how to show genuine care, support or speak up for others. The more seeds of compassion you sow, the more your children will harvest a life of service for others.

4. Giving them everything without enforcing gratitude

Working for their allowance or because they are part of the family teaches children to support others, which helps them understand the importance of community and teamwork.

Children learn to be grateful when they don’t get everything that they ask for. Allow them to want those extra things. Teach them to say “thank you” (even when it’s for Aunt Ethel’s bland fruitcake). Have them keep a “grateful journal.”

In our house, we have a whiteboard on the front door and the kids have to write an answer to a daily question before they leave each day. That question is often centered around gratitude and giving thanks.

5. Not introducing them to volunteer work

We can’t always experience what someone else has gone through, but we can connect on a human level through volunteering.

Compassion in a community means coming together around this common idea of seeing others and trying to understand their lived experiences — in ways that open your heart to showing up for them.

I urge parents to work untiringly to alleviate the suffering of our neighbors, to wrangle our egos, and to honor the sacredness of every human being. This is how I choose to live my life and how I want to raise my children to live theirs.

Dr. Traci Baxley is a professor, parenting coach and author of “Social Justice Parenting: How to Raise Compassionate Anti-Racist Justice Minded Kids in an Unjust World.” An educator for over 30 years with degrees in child development, elementary education and curriculum, she specializes in diversity and inclusion, anti-bias curriculum, and social justice education. Follow her on Instagram.