HI Market View Commentary 01-19-2021

| WEEK OF JAN. 11 THROUGH JAN. 15, 2021 |

| The S&P 500 index fell 1.5% last week as declines in a number of sectors led by communication services and technology outweighed energy-led gains. The market benchmark ended Friday’s session at 3,768.25, down from last Friday’s record-high closing level of 3,824.68. Still, the S&P 500 remains up for the year and month to date with a gain of 0.3% since Dec. 31 as this week’s decline only erased part of last week’s advance. Communication services had the largest percentage drop of the week, down 3.3%, followed by technology, down 2.6%. Other sectors down by more than 1% included consumer staples, consumer discretionary and materials. However, the overall market drop this week was reduced by a 3.2% jump in the energy sector, a 1.9% rise in real estate and a 1.1% increase in utilities. Financials eked out an increase of 0.06%. The activity came as investors reflected on the turmoil of last week’s riot at the US Capitol and traded cautiously while assessing the fallout, which included an impeachment of US President Donald Trump for inciting the riot. Shares of social media companies were among the week’s hardest-hit stocks after the companies banned Trump from making posts on their platforms. Market participants were also keeping an eye on the rollout of COVID-19 vaccines, which have been moving at a slower pace than expected, at a time when case and hospital counts are still climbing. Economic data continue to show the continued impact of the pandemic, with the latest weekly jobless claims rising by more than economists expected to their highest level in more than four months. The cautious trading this week also came as investors are watching for the pandemic’s impacts on corporate earnings as US companies begin releasing their fourth-quarter results. Friday, big banks JPMorgan Chase (JPM), Citigroup (C) and Wells Fargo (WFC) all reported year-over-year declines in Q4 revenue at their consumer banks, yet their earnings for the quarter came in above expectations. The decliners in communication services included shares of Twitter (TWTR) and Facebook (FB) after the social media companies suspended Trump’s accounts on their platforms. Shares of Twitter fell 12.2% on the week while Facebook shares dropped 6.1%. In the technology sector, shares of Automatic Data Processing (ADP) fell 5.8% as Evercore ISI downgraded its investment rating on the stock to underperform from outperform while cutting its price target on the shares to $143 from $197. The company provides payroll and other human resource services and thus drops in employment levels tend to weigh on its results. On the upside, the energy sector jumped amid a climb in crude oil futures as the Organization of the Petroleum Exporting Countries left its 2021 demand forecast unchanged. Among the gainers, shares of Occidental Petroleum (OXY) added 11.5% as Barclays raised its price target on the stock to $23 from $18 while keeping its investment rating at equal weight. Next week, the earnings calendar will feature more financial companies including Bank of America (BAC) and Goldman Sachs (GS) Tuesday while other heavyweights reporting will include Alcoa (AA) and Procter & Gamble (PG) Wednesday, and Intel (INTC) and Union Pacific (UNP) Thursday. On the economic calendar, data will be light earlier in the week amid the Martin Luther King Jr. holiday Monday and leading up to the Wednesday inauguration of Joe Biden as the new US president. Weekly jobless claims, housing starts and building permits will be among Thursday’s data, followed by December existing home sales and Markit’s January readings on the manufacturing and services sectors due Friday. Provided by MT Newswires. |

New equity positions for 2021 that I am looking at – WMT, ALK, PYPL, SQ, CCL, RCL, MGM, SBUX

I still like my favorites – AAPL, BIDU, BAC, BA, DIS, F, V, & UAA is “still” my wildcard

For smaller accounts following the SPY, QQQ, DIA, F, UAA, Leaps

Earnings Watch List

AAPL 1/27 AMC

BA 1/27 BMO

BAC 1/19 BMO

BIDU 2/25

CVS 2/16 BMO

DIS 2/11 AMC

F 2/04 AMC

FB 1/27 AMC

FCX 1/26 BMO

JPM 1/15 BMO

KEY 1/21 BMO

KO 2/10 BMO

LMT 1/26 BMO

MU 3/24

NEM 2/18 BMO

SBUX 1/26 AMC

TGT 3/03

UAA 2/09

UBS 1/26 BMO

V 1/27 AMC

VZ 1/26 BMO

WMT 2/18 BMO

ALK 1/26 BMO

PYPL 1/28 AMC

SQ 2/23 AMC

CCL 1/11 BMO

RCL 2/02

MGM 2/11

Where will our markets end this week?

DOWN

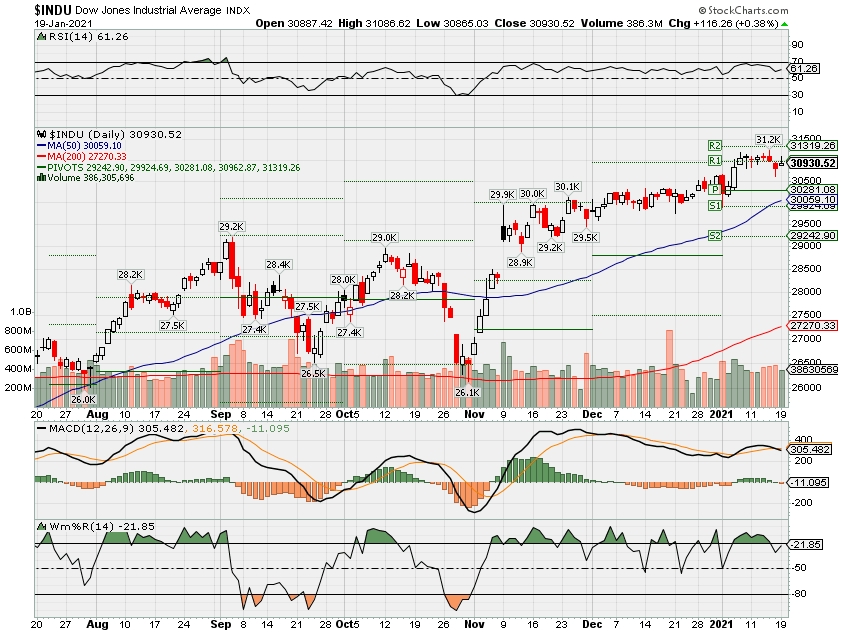

DJIA – Bullish

SPX – Bullish

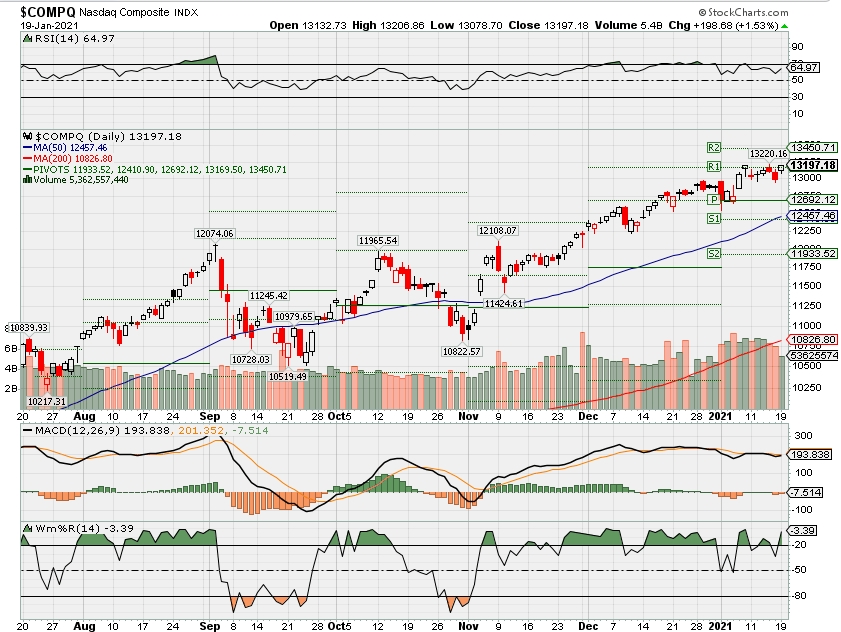

COMP – Bullish

Where Will the SPX end January 2021?

01-19-2021 +0.0%

01-11-2021 +0.0%

01-04-2021 +0.0%

Earnings:

Mon:

Tues: BAC, SCHW, GS, HAL, NFLX, ZION

Wed: FAST, MS, PG, AA, KMI, UAL, USB

Thur: UNP, CSX, IBM, INTC, ISRG, CCL, KEY

Fri: BLMN, FHN, SLB

Econ Reports:

Mon:

Tues: Net Long Term TIC Flows

Wed: MBA, NAHB Housing Market Index

Thur: Initial Claims, Continuing Claims, Housing Starts, Building Permits, Phil Fed

Fri: Existing Home Sales,

Int’l:

Mon –

Tues –

Wed – CN: Interest rate meeting

Thursday – ECB Interest Rate Decision

Friday-

Sunday –

How am I looking to trade?

Waiting for earnings and will protective put into this earnings season and add short calls after the announcement and after I listen to the guidance

EARNINGS

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

More Advisors Are Charging Separate Financial Planning Fees. Here’s Why

By Peter RawlingsJanuary 14, 2021

Advisors are increasingly charging separate fees for their financial planning work, driven by a range of factors from improved payment processing to a desire for more stable revenue streams.

“We’ve certainly seen more advisors over the last three, four years introduce discrete planning fees,” says Greg Gohr, managing principal at Commonwealth Financial Network.

“The idea is that [the financial planning fee] ensures they’re getting paid for the work they do, and it describes the scope of the planning engagement in a much clearer way as far as what services are going to be provided,” he adds.

By separating fees for planning, advisors can be more transparent with clients about the charges they are paying, according to Gohr. “It attaches a very tangible value to the services the advisors are providing,” he says.

A survey of more than 1,600 advisors by Envestnet MoneyGuide found that the percentage of advisors who charge a flat fee, commission or asset-based fee for financial planning has shot up from 8% in 2017 to 72% in September last year.

Around 38% of the respondents charge a separate fee for financial planning. Of those, 65% charge a flat planning fee, while 18% bill by the hour, and 8% charge by subscription, according to the survey.

There has been, in particular, a recent move towards subscription-based fees as a means of charging separately for financial planning work, says Dennis Moore, financial advisor and chief operating officer at Quest Capital Management, which offers securities through Raymond James Financial Services.

“Over the last one, two, three years it seems like the subscription model is really gaining traction, Planning is a value-add, and people are starting to charge for that specifically instead of wrapping it in with an AUM fee.”

Dennis Moore

Quest Capital Management

“Over the last one, two, three years it seems like the subscription model is really gaining traction,” he says. “Planning is a value-add, and people are starting to charge for that specifically instead of wrapping it in with an AUM fee.”

At Quest, there are annual planning fees that are broken up into quarterly charges to clients, Moore says.

The recent trend towards separate charges is likely to continue in the years ahead, says Robert Russo, CEO of Independent Advisor Alliance, an office of supervisory jurisdiction on LPL Financial’s platform.

“In the future we will likely see advisors’ practices have more of a flat dollar fee than a basis point, or percentage of assets, fee because assets don’t always dictate the amount of time it takes to manage that client relationship,” he says.

The role of tech, new regulations and the pandemic in accelerating the trend

In part, technological developments have made it easier to facilitate and coordinate different types of payments, including separate financial planning fees, says Russo. In the recent past, it was more difficult to collect and process multiple or separate checks and, thus, it was easier to simply embed planning costs into an overall fee, he says.

The ongoing Covid-19 pandemic has also been a driving force in the change in planning charges, says IAA chief innovation officer Steve Gensler.

Related Content

- December 7, 2020Many More FAs Charging for Financial Planning; Fees Sharply Higher

- August 20, 2020LPL Execs: FAs Should Explicitly Charge for Advice, Not Just on Assets

- February 24, 2020How — and What — Top Advisors Charge Their Clients

“You’ve had a lot of clients who have been working from home and may have spent several hours trying to do their own planning and come to realize that even with unlimited time, working from home, they still need help from a professional,” he says.

Regulatory changes, in particular the SEC’s Regulation Best Interest, are also cited as an underlying factor propelling the shift.

The new standards of conduct established by Reg BI and the earlier Department of Labor fiduciary rule “brought light on the need for [having] a focus on the client’s needs at inception. Planning provides it all,” says Tony Frigoletto, managing partner at LPL-affiliated River’s Edge Wealth Partners in New Jersey.

Benefits to advisors

There are also longer-term benefits for advisors who charge planning fees, says Commonwealth’s Gohr. An example is that by splitting the charges, advisors may be able to lower asset-based fees, which “positions them as a bit more competitive on the asset management side,” he says.

The shift also helps provide advisors with a more stable income by detaching a portion of their revenue from the performance of the market, according to Gohr.

“It’s a little bit like an asset allocation decision in a client’s portfolio in that charging discrete planning fees creates a predictable income stream for the advisors.”

Obstacles

“The roadblock, in my experience at WFA [Wells Fargo Advisors], is the client’s perceived value in paying a fee where some do it for free,” he says.

Tony Frigoletto

River’s Edge Wealth Partners

Still, there can be obstacles to restructuring fee arrangements in the form of questions from clients about paying separate charges, says River’s Edge Wealth Partners’ Frigoletto, who broke away from Wells Fargo Advisors last year.

“The roadblock, in my experience at WFA, is the client’s perceived value in paying a fee where some do it for free,” he says.

And while there is a noticeable trend toward advisors charging flat fees or separate planning fees, not everybody is hopping on board.

Kevin Smith, vice president at RIA Wealthspire Advisors in Florida,saysthatat his firm, for the most part, the decision has been made to keep a single comprehensive fee that includes planning, which makes it easier to “get buy-in” from clients and foster participation in the planning process.

Do you have a news tip you’d like to share with FA-IQ? Email us at editorial@financialadvisoriq.com.

JPMorgan Asset and Wealth Mgmt Assets Up 17% YoY But Net Income Down

By Alex PadalkaJanuary 15, 2021

JPMorgan Chase’s asset and wealth management business saw healthy growth in client assets but its advisor ranks shrank during the fourth quarter of 2020, and net income was down year-over-year.

The unit’s client assets stood at $2.72 trillion at the end of December, up from $2.56 trillion the firm had at the end of the prior quarter and up 17% from the end of 2019, when the company had $2.33 trillion, JPMorgan says in its fourth-quarter earnings release.

The growth was due to appreciating markets — but also to “net inflows of over $190 billion into long-term and liquidity products over the last twelve months,” JPMorgan CEO Jamie Dimon says in a statement.

Client assets rose from $3.37 trillion in the third quarter of 2020 to $3.65 trillion by the end of the year, which was also up from the $3.09 trillion the firm had at the end of 2019, JPMorgan says.

Average loans in the fourth quarter, meanwhile, were $177 billion at the end of December 2020, which was 15% higher year-over-year, and average deposits were $180 billion, a 31% increase over the prior year, the company says.

But JPMorgan shed a few wealth management client advisors during the last three months of the year, ending December with 2,462, down from the 2,520 it had at the end of the third quarter of 2020, the company says. However, that was still a 2% increase year-over-year, JPMorgan reports.

Net revenue in the asset and wealth management business was $3.87 billion in the last quarter of 2020, a 9% increase from the third quarter and a 10% increase year-over-year, the company says, attributing it primarily to higher performance and management fees and higher deposit and loan balances. Noninterest expense, however, reached $2.76 billion in the fourth quarter of 2020, which was 13% higher than in the previous quarter as well as in the fourth quarter of 2019, JPMorgan says. The increase was due to higher legal expenses as well as “cumulative net inflows into liquidity and long-term products,” the company says.

As a result, the unit’s net income slid from $876 million in the third quarter of 2020 to $786 million — which was also a 2% lower year-over-year, JPMorgan says.

Do you have a news tip you’d like to share with FA-IQ? Email us at editorial@financialadvisoriq.com.

Biden Poised to Pick Wall Street Critic Gary Gensler to Lead SEC

(Bloomberg) — Gary Gensler is President-elect Joe Biden’s likely pick to lead the Securities and Exchange Commission, according to two people familiar with the matter, a move that would put a former regulator who is known for sparring with financial executives atop Wall Street’s main overseer.

Gensler, 63, ran the Commodity Futures Trading Commission during the Obama administration, a post where he was the driving force behind the government’s new oversight regime of the massive over-the-counter swaps market. The role put him in frequent combat with banks, which resisted his push to bring transparency and guardrails to a corner of finance that helped ignite the 2008 credit crunch.

https://products.gobankingrates.com/r/d9360ea31bf06ea8b9d0ef49288e28fb If nominated by Biden to be SEC chairman and confirmed by the Senate, Gensler would likely find himself in familiar territory battling lobbyists over contentious policy decisions. The SEC is the front-line regulator of the securities industry and arbiter of what public companies must disclose to their shareholders.

Democratic lawmakers would expect Gensler to undo actions put in place during the Trump administration, including reversing rollbacks of post-crisis rules and toughening a recently approved standard for stock-broker conduct that progressives blasted as too weak. The SEC under Biden will also face intense pressure to make corporations boost disclosures of political contributions and how climate change affects their bottom lines.

Leading Candidate

While Gensler is seen as the leading SEC candidate, a final decision hasn’t been made, said one person, who asked not to be named before a public announcement. A spokesperson for Biden’s transition declined to comment on Gensler’s potential selection, which was reported earlier by Reuters. Gensler also declined to comment.

Gensler runs the team that is reviewing the SEC, Federal Reserve and other financial regulators for Biden’s transition. After stepping down as CFTC chairman six years ago, he worked as the chief financial officer for Hillary Clinton’s 2016 presidential campaign. Gensler is currently a professor at MIT’s Sloan School of Management where he teaches classes on financial technology and cryptocurrencies.

At the CFTC, Gensler helped author the 2010 Dodd-Frank Act and pushed through many of the law’s new rules. His aggressive agenda made him the financial industry’s No. 1 adversary in Washington — a label he relished. It was an extraordinary turn for the former Goldman Sachs Group Inc. partner, who many Democrats feared would be too deferential to Wall Street when President Barack Obama selected him for the CFTC in 2008.

Gensler’s ability to twist arms and pierce through the bureaucracy to get things done also arguably had a downside. His relations with other Obama regulators were at times rocky, and his tough negotiating tactics on policy bruised egos and wore down his colleagues. The CFTC staff felt so taxed by the long hours and heavy workload Gensler demanded that they began an ultimately successful effort to unionize.

Goldman Millions

Earlier in his career, Gensler earned millions of dollars at Goldman. He left the firm in 1997 to join the Clinton administration, where he worked at the Treasury Department under Secretary Lawrence Summers. While that resume once made liberal Democrats nervous, his time at the CFTC largely won them over. Progressives support his SEC candidacy, as do consumer groups and investor advocates.

Gensler’s prospects of winning confirmation were helped significantly by Democrats winning two Senate run-off elections in Georgia this month, resulting in a 50-50 split. The incoming vice president, Kamala Harris, holds the tie-breaking vote should all Republicans oppose him. That could nullify any efforts by the powerful banking lobby to block Gensler, whose nomination would go before the Senate Banking Committee.

For more articles like this, please visit us at bloomberg.com

Companies Are Preparing to Cut Jobs and Automate if Biden Gets $15 Minimum Wage Hike, Reporting Shows

Let’s hope that Joe Biden’s minimum wage fantasies never become law—or workers will pay the price for his economic naiveté.

Sunday, November 15, 2020

Brad Polumbo

Nobel laureate Milton Friedman once said that “One of the great mistakes is to judge policies and programs by their intentions rather than their results.” When it comes to the $15 minimum wage hike supported by Joe Biden and many of his fellow Democrats, it’s becoming increasingly clear that the results will be ugly.

New reporting reveals that Chief Financial Officers at top American companies are “considering raising prices, cutting workers’ hours and investing in automation to offset a potential rise in labor costs.”

https://platform.twitter.com/embed/index.html?creatorScreenName=feeonline&dnt=false&embedId=twitter-widget-0&frame=false&hideCard=false&hideThread=false&id=1326887249028505605&lang=en&origin=https%3A%2F%2Ffee.org%2Farticles%2Fcompanies-preparing-to-cut-jobs-and-invest-in-automation-if-biden-gets-15-minimum-wage-hike%2F&siteScreenName=feeonline&theme=light&widgetsVersion=ed20a2b%3A1601588405575&width=550px CFOs are gearing up to raise prices, reduce workers’ hours and ramp up technology investments as they face the possibility of higher labor costs under a Biden administration, @markgmaurer reports for @CFOJournal @WSJ. https://t.co/t6Kscf5lu6

— CFO Journal (@CFOJournal) November 12, 2020

“Companies including Chipotle Mexican Grill Inc., Potbelly Corp. and Texas Roadhouse Inc. are already doing the math to assess what a higher federal minimum wage could mean for their operations and cost base,” the Wall Street Journal reports.

“Some executives fear that increases to the federal pay floor would drive up wages across income classes, hurting profits and forcing businesses to find savings to offset higher spending on labor,” the paper continues.

First and foremost, we can expect businesses to respond to artificially-high wage mandates by cutting jobs and reducing employee hours.

Why?

Well, labor is a product like any other. If the cost of soda was artificially mandated at $10 per can by the government, the simple fact is that consumers would buy less of it. When employers are legally forced to pay more for labor than it is worth in the market, they naturally and inevitably do the same.

“By the simplest and most basic economics, a price artificially raised tends to cause more to be supplied and less to be demanded than when prices are left to be determined by supply and demand in a free market,” famed economist Thomas Sowell wrote in Basic Economics. “The result is a surplus, whether the price that is set artificially high is that of farm produce or labor.”

“Unfortunately, the real minimum wage is always zero,” Sowell concluded. “And that is the wage that many workers receive in the wake of the creation or escalation of a government-mandated minimum wage.”

https://platform.twitter.com/embed/index.html?creatorScreenName=feeonline&dnt=false&embedId=twitter-widget-1&frame=false&hideCard=false&hideThread=false&id=1149505606954303490&lang=en&origin=https%3A%2F%2Ffee.org%2Farticles%2Fcompanies-preparing-to-cut-jobs-and-invest-in-automation-if-biden-gets-15-minimum-wage-hike%2F&siteScreenName=feeonline&theme=light&widgetsVersion=ed20a2b%3A1601588405575&width=550px The government may determine and decree a “living wage” under a minimum wage law, but unless the worker actually finds an employer willing to pay him that much, he will remain unemployed with a hypothetical right.

— Thomas Sowell (@ThomasSowell) July 12, 2019

Ample evidence confirms these theoretical predictions.

For example, the nonpartisan Congressional Budget Office projects that enacting a $15 minimum wage nationwide would destroy from 1.3 to 3.7 million jobs. Similarly, analysis from the Employment Policies Institute concludes that a federal $15 minimum wage would kill 2 million jobs.

These studies aren’t outliers. A research review by the Cato Institute concluded, “The main finding of economic theory and empirical research over the past 70 years is that minimum wage increases tend to reduce employment.”

So, it’s fair to assume that the warnings CFOs are offering about potential slashes in employment can be extrapolated beyond their specific companies. Proponents of a $15 minimum wage might intend to help workers, but they will inevitably and invariably put millions of them out of work altogether if their efforts are successful.

Meanwhile, other companies told the Journal they would pass the costs onto consumers by hiking prices. (Is that a win for the working class?)

And in an another twist, some companies said they would seek additional opportunities to invest in automation and eliminate their demand for labor altogether in lieu of paying mandated wages that far exceed a worker’s value.

“Pool Corp., a distributor of swimming pool supplies, plans to ramp up investments in technology to offset the potential rise in labor costs,” the Journal reports. “The company would look to reduce manual processes such as product orders and certain warehouse operations.”

“[Automation is] the most significant investment that we can make…when it comes to lowering the impact of potentially higher labor costs down the road,” Pool Corp CFO Mark Joslin said.

All of this is bad, bad news for workers. You know, the group that a $15 minimum wage is supposed to help.

So, let’s hope that Joe Biden’s minimum wage fantasies never become law—or workers will pay the price for his naiveté.

Jamie Dimon says JPMorgan Chase should absolutely be ‘scared s—less’ about fintech threat

KEY POINTS

- Jamie Dimon’s message to the management team of $3.4 trillion banking goliath JPMorgan Chase: Be frightened of fintech rivals.

- “Absolutely we should be scared s—less about that,” Dimon told analysts.

- Dimon said he sent his deputies a list of global competitors, and that PayPal, Square, Stripe, Ant Financial as well as Amazon, Apple and Google were names the bank needs to keep an eye on.

JPMorgan Chase CEO Jamie Dimon has watched while a new breed of fintech players, led by PayPal, Square and tech giants around the world have exponentially grown users and market value.

His message to the management team of his $3.4 trillion banking goliath: Be frightened.

“Absolutely, we should be scared s—less about that,” Dimon said Friday in a conference call with analysts. “We have plenty of resources, a lot of very smart people. We’ve just got to get quicker, better, faster. … As you look at what we’ve done, you’d say we’ve done a good job, but the other people have done a good job, too.”

Dimon’s blunt assessment was in response to questions from analysts including Mike Mayo of Wells Fargo who pointed out that with rich, tech-like valuations, fintech players have “trounced” the traditional banks in recent years.

Dimon said he sent his deputies a list of global competitors, and that PayPal, Square, Stripe, Ant Financial as well as U.S. tech giants including Amazon, Apple and Google were names the bank needs to keep an eye on. The rivals are also clients of JPMorgan’s commercial and investment banking in many cases, he added.

Competition will be particularly tight in the world of payments, he said: “I expect to see very, very tough, brutal competition in the next 10 years,” Dimon said. “I expect to win, so help me God.”

Dimon added that in some cases, the new players were “examples of unfair competition” that the bank would do something about eventually. He included players that take advantage of richer debit-card revenue for small banks and firms Dimon accused of not taking precautions against money laundering.

He specifically called out Plaid, the payments start-up whose acquisition by Visa recently collapsed, saying “people who improperly use data that’s been given to them, like Plaid.”

Plaid CEO Zach Perret declined to directly respond to the accusation during an interview with CNBC’s David Faber, adding that Plaid is spending time with the bank on a partnership.

When contacted for further comment, a Plaid spokeswoman said the company is “focused on ensuring people have access to their own financial information so they can securely share it with permission in order to use the fintech apps they choose.”

She added that “data privacy and security are core to everything we do, including the data exchange agreements we have with JPMorgan Chase among many other banks.”

— CNBC’s Dawn Giel contributed to the report.

Goldman Sachs says the S&P 500 will rise 14% in 2021. Here’s the road map

Published: Jan. 14, 2021 at 3:15 p.m. ET

By

Jack Denton

Critical information for the U.S. trading day

Goldman Sachs projects the S&P 500 index will hit 4,300 at the end of 2021, and rise to 4,600 by the end of 2022.

With global markets rallying on the hopes that massive economic stimulus will accompany President-elect Joe Biden’s new administration, Goldman Sachs’ projection that the S&P 500 will end 2021 at 4,300 points seems even more realistic.

In our call of the day, the investment bank’s chief U.S. equity strategist David J. Kostin has mapped out the road to 4,300.

Goldman sees the S&P 500 SPX, +0.81% rising 14% through the year, after one of the world’s most closely watched indexes closed at 3,756 to finish 2020. A further 7% growth in the index is projected for 2022 — reaching 4,600.

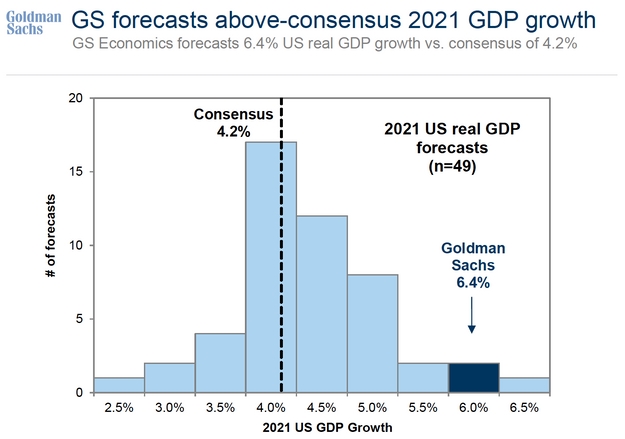

Underlying a double-digit forecast for returns in 2021 is the investment bank’s bullish projection on the U.S. economy — 6.4% real gross domestic product growth compared with the consensus of 4.2%.

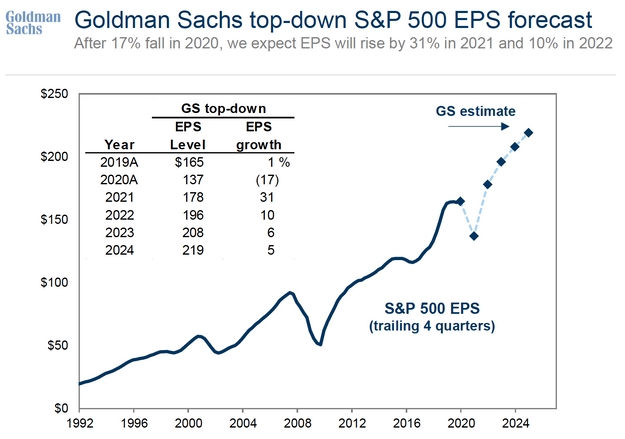

Adding to the economic boost for equities is a massive increase in earnings per share (EPS), a rebound from the dire impact the COVID-19 pandemic has had on corporate bottom lines. Goldman expects EPS to shoot up 31% in 2021 after falling 17% in 2020.

In tandem with EPS are projections of a strong rebound in margins, which Goldman expects to be higher than the bottom-up consensus forecast. An increase in margins is largely driven by operating leverage, as well as moderating costs like labor.

High-operating leverage stocks outperformed in 2020, and Goldman expects that trend to continue through this year on the back of strong economic growth.

In many ways, the 18% rally on the S&P 500 in 2020 was helped by its five largest stocks: the technology giants Facebook FB, +3.87%, Amazon AMZN, +0.53%, Apple AAPL, +0.54%, Microsoft MSFT, +1.78%, and Alphabet GOOGL, +3.29%. These stocks returned 56% compared with 11% growth from the remaining 495 companies.

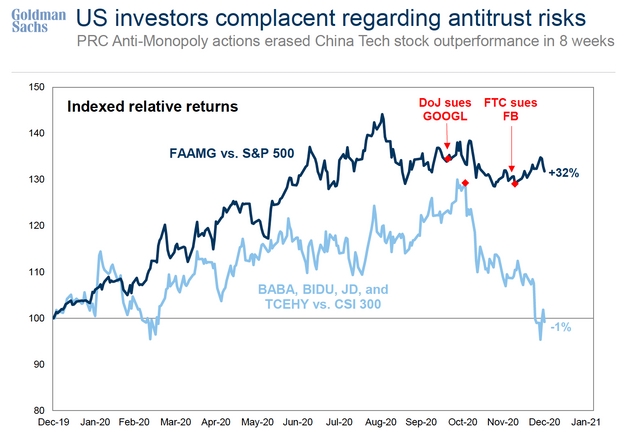

However, Goldman warns that investors are complacent about antitrust risks.

Whereas China’s antimonopoly actions wiped out the performance of Chinese tech stocks in just eight weeks, the market largely hasn’t reacted to the Justice Department’s lawsuit against Google and the Federal Trade Commission’s suit against Facebook.

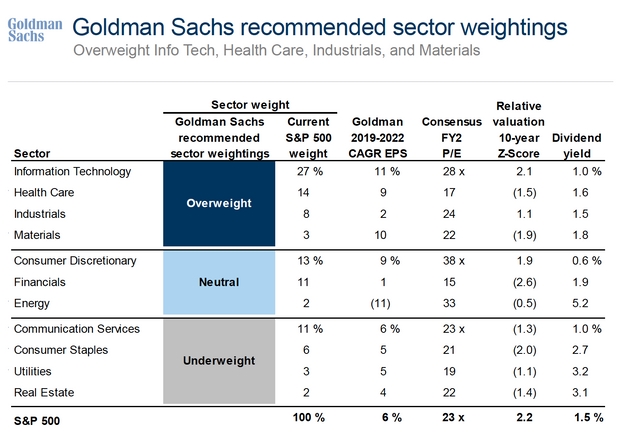

Closing out the road map to 4,300 is Goldman Sachs’ recommended sector weightings. The investment bank has information technology, health care, industrials, and materials classified as overweight, while communication services, consumer staples, utilities, and real estate are underweight.

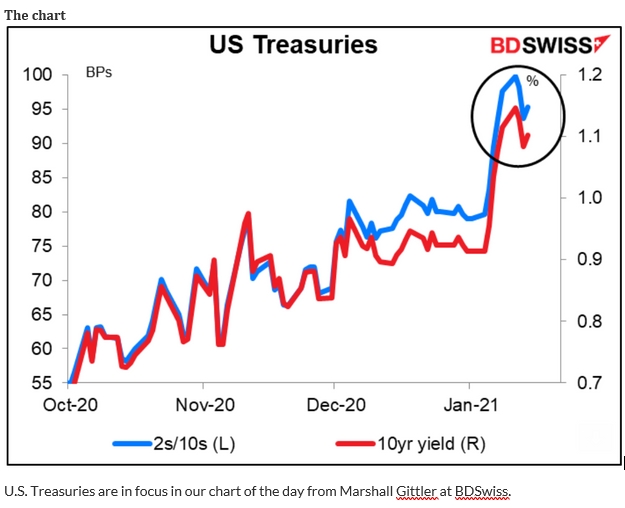

The chart

U.S. Treasuries are in focus in our chart of the day from Marshall Gittler at BDSwiss.

Yields on the 10-year Treasury note TMUBMUSD10Y, 1.094% initially moved lower on Wednesday, pushed down by strong demand for 30-year bonds in a $24 billion auction. But the fall was reversed late in the day after the report on Biden’s stimulus plans.

HI Financial Services Mid-Week 06-24-2014