HI Market View Commentary 01-11-2021

| Market Recap |

| WEEK OF JAN. 4 THROUGH JAN. 8, 2021 |

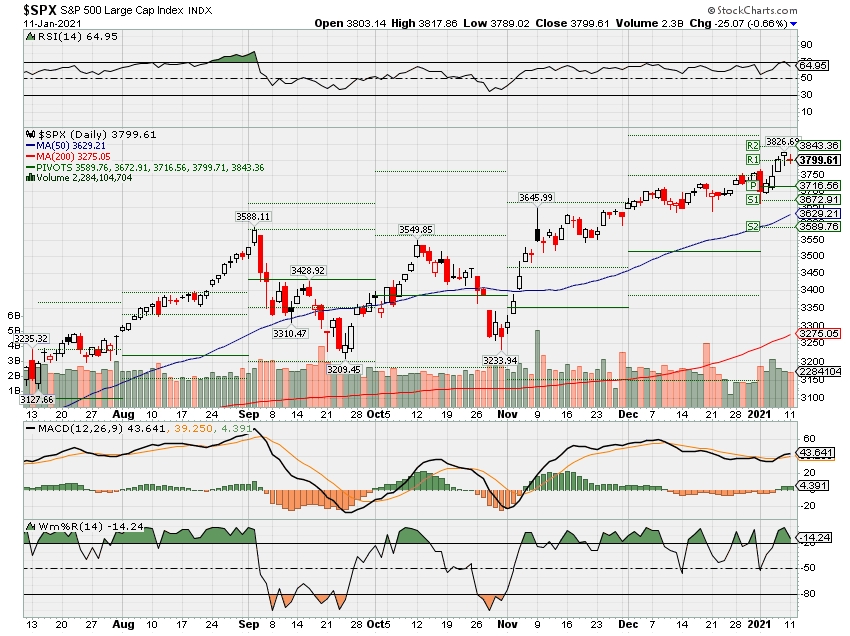

| The S&P 500 kicked off the first week of the new year with a 1.8% increase and fresh record highs as investors looked past turmoil at the US Capitol building and made optimistic bets on the outcomes of COVID-19 vaccine distributions and Democrats gaining control of both the Senate and the House. The market benchmark ended the first business week of 2021 at 3,824.68, up from last week’s closing level of 3,756.07 and marking a new closing high. The index also reached a new intraday high Friday at 3,826.69. The gains came despite the US Capitol being stormed Wednesday by pro-Trump rioters who were attempting to block the certification by Congress of Joe Biden as the nation’s president-elect. In the aftermath of the riot, Congress still certified Biden and Democratic congressional leaders called for President Donald Trump to be removed from office while a number of Trump administration officials resigned. Friday’s record highs also came despite weaker-than-expected monthly jobs data. US December non-farm payrolls fell by 140,000 last month when the consensus on Econoday had been for a gain of 50,000. December’s fall was the first since April. Still, the unemployment rate remained unchanged at 6.7%, better than the Street’s view for 6.8%. Investors instead placed the focus of their trades on the outcome of two runoff races in Georgia that gave Democrats control of the Senate. Democrats have retained control of the House, and market participants are hopeful that having Democratic control of the presidency, House and Senate will make for a smoother path for legislation including stimulus plans that could boost the economy. Market participants are also optimistic about the distribution of COVID-19 vaccines. The US reported new highs in COVID-19 deaths and hospitalizations this week while a new variant of the virus continues to be identified in more parts of the country, so investors are eager for vaccines to slow down the spread of the virus, although the distribution of the vaccines has been moving more slowly than anticipated. This week’s advance was led by the energy sector, up 9.3%, followed by the materials sector, up 5.7%, and financials, up 4.9%. On the downside, three sectors fell, led by real estate, which shed 2.5%, followed by a 0.8% decline in consumer staples, and a 0.6% drop in utilities. The energy sector’s jump came as crude oil futures also rose on the week. The gainers included Apache (APA), whose shares jumped 16.8% this week as the oil and gas explorer and producer said its board authorized the company to create a holding company structure. The new structure offers advantages in risk management and provides financial and administrative flexibility, Apache’s CEO said. In the materials sector, shares of Mosaic (MOS) climbed 16.5% as JPMorgan upgraded its investment rating on the fertilizer company’s stock to overweight from neutral. UBS also raised its price target on the stock this week to $28 from $27 while reiterating a buy investment rating. In financials, Huntington Bancshares (HBAN) shares rose 14.3% on the week as the stock was added to the “Best Ideas List” at Wedbush, whose analysts said they see the lender delivering strong increases in net interest income through loan growth. The stock also received positive analyst actions this week from Piper Sandler, which upgraded its investment rating on the stock to overweight from neutral, as well as from Barclays and Jefferies, which raised their price targets on the shares. On the downside, the real estate sector’s decliners included Alexandria Real Estate Equities (ARE), which priced a public offering of 6 million shares at $164 per share, a 3.9% discount from the stock’s previous close. The shares posted a weekly drop of 6.9%. Next week’s calendar appears light early in the week but will get busier as the days go by. On the economic front, the December consumer price index is due Wednesday, followed by import prices and weekly jobless claims Thursday while Friday’s economic schedule includes December producer prices, retail sales, industrial production and capacity utilization, among other readings. Fourth-quarter earnings reports from big banks including JPMorgan Chase (JPM), Citigroup (C) and Wells Fargo (WFC) are also expected Friday. |

Stock Watch

The stock market has rocketed this year, mostly since hitting 52-week bottoms in March. The recovery of the markets overall has set new highs, so it might not be surprising that many of the publicly held companies behind streaming video services have logged some impressive numbers. Here’s the rundown since March lows:

- NFLX – up slightly over 80%

- AMZN – higher by nearly 93%

- DIS – adding close to 111% in value

- AAPL – jumping nearly 137%

- CMCSA – advancing by nearly 62%

- T – edging up 7%

- DISCA – tacking on nearly 63%

Source: TD Ameritrade, as of December 31, 2020.

New equity positions for 2021 that I am looking at – WMT, ALK, PYPL, SQ, CCL, RCL, MGM, SBUX

I still like my favorites – AAPL, BIDU, BAC, BA, DIS, F, V, & UAA is “still” my wildcard

For smaller accounts following the SPY, QQQ, DIA, F, UAA, Leaps

Earnings Watch List

AAPL 1/27 AMC

BA 2/25

BAC 1/19 BMO

BIDU 2/25

CVS 2/10

DIS 2/11 AMC

F 2/02

FB 1/27 AMC

FCX 1/26 BMO

JPM 1/15 BMO

KEY 1/21 BMO

KO 1/21

LMT 1/26 BMO

MU 3/24

NEM 2/18 BMO

SBUX 1/26

TGT 3/03

UAA 2/09

UBS 1/26 BMO

V 1/27

VZ 1/26 BMO

WMT 2/18 BMO

ALK 1/26 BMO

PYPL 1/27

SQ 2/23 AMC

CCL 1/11 BMO

RCL 2/02

MGM 2/11Z

Where will our markets end this week?

DOWN

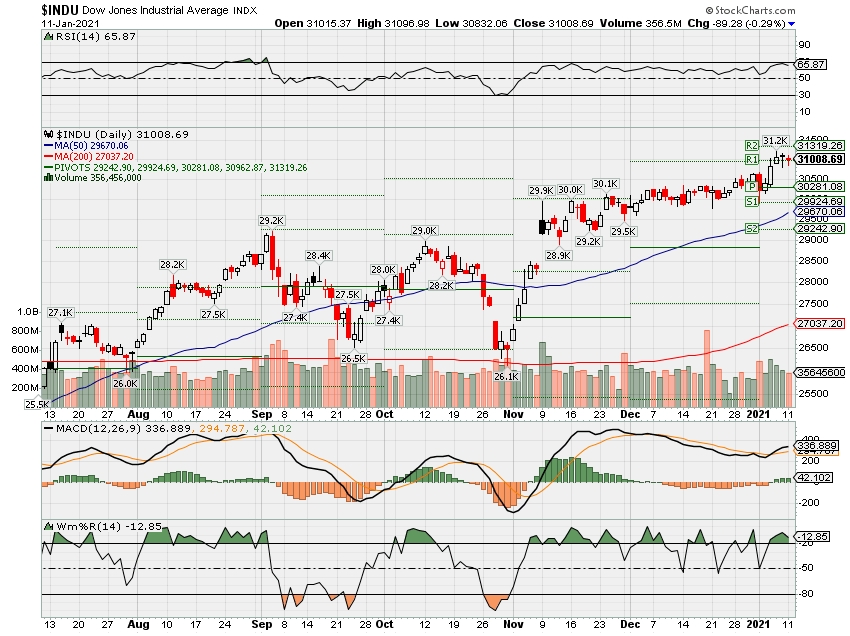

DJIA – Bullish

SPX – Bullish

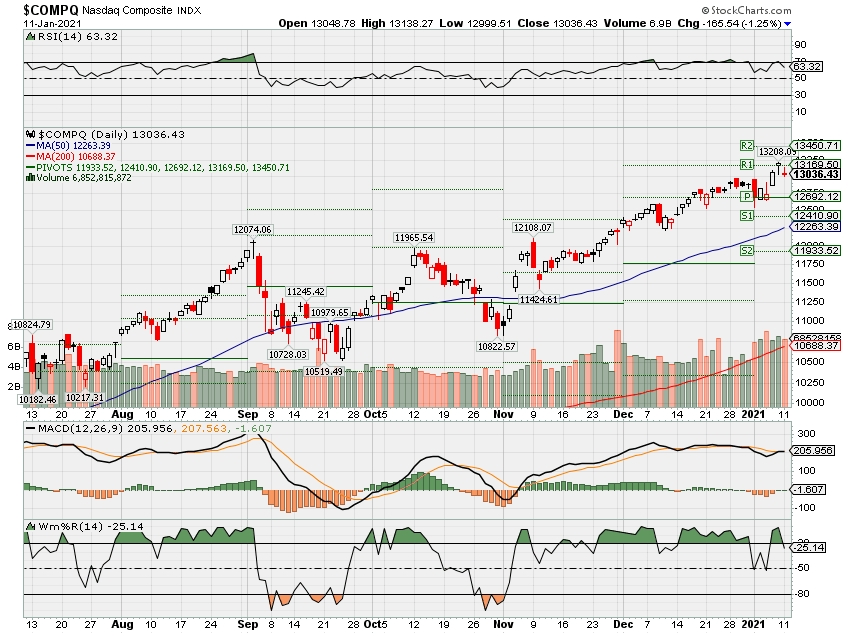

COMP – Bullish

Where Will the SPX end January 2021?

01-0402021 +0.0%

01-04-2021 +0.0%

Earnings:

Mon:

Tues: KBH

Wed:

Thur: BLK, DAL, SINA

Fri: C, WFC, JPM OPTIONS EXPIRE

Econ Reports:

Mon:

Tues: JOLTS, NFIB Small Business Optimism

Wed: MBA, CPI, CPI Core, Treasury Budget

Thur: Initial Claims, Continuing Claims, Import, Export

Fri: PPI, Core PPI, Business Inventory, Empire, Retail Sales, Retail ex-auto, Capacity Utilization, Industrial Production, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Waiting for earnings and will protective put into this earnings season and add short calls after the announcement and after I listen to the guidance

EARNINGS

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

You need to look at the link per their disclosure that doesn’t let us reproduce the article in any form called “2021 Market Predictions are Trash”

Not sure how valid this is. From Investopedia.

The IPO Market Is Getting Weird, and We’ve Been Here Before

The market apparently misses the 1990s

By James Chen

Updated Jan 6, 2021

A technology stock completes its initial public offering (IPO), and the founders are stunned watching the shares shoot up in value in trading far beyond the initial offering price. What year does the event described belong to? A year ago, many of us would have placed it somewhere in the late 1990s. However, it seems like the ’90s are here again with a frothy IPO market, an updated version of the blank check company, and some seemingly insane tech valuations.

Key Takeaways

- 2020 IPOs have seen massive pops on their first day of trading, with the effect on tech stocks being particularly powerful.

- Special purpose acquisition company (SPAC) IPOs have also increased and will result in these capital-flush companies reaching further into the private market for more pre-IPO companies at earlier and earlier stages.

- The market enthusiasm for tech IPOs is uncomfortably familiar for investors who were around for the dotcom bubble.

Fine Line Between Hot and Burning

The market for tech stocks is hot. Tesla, Inc. (TSLA) can attest to that as it continues to defy logic when it comes to the connection between fundamentals and market performance. But this heat is even more intense when it comes to new tech stocks hitting the market. Citing Dealogic data, The Wall Street Journal indicates that the percentage gain in terms of an IPO pop being enjoyed by stocks on their first day of trading is at its highest in the past 10 years.1

This type of market froth actually makes carrying out an IPO more difficult for investment bankers. In order to have a happy client following the offering, the syndicate wants to see the shares trading within a range of the offering price. When this happens, it suggests that they got the pricing just right. When a stock doubles on its first day of trading, as happened with Airbnb, Inc. (ABNB) and Snowflake Inc. (SNOW), it means that the company has left money on the table in a sense even though the shareholders within the company are still happy. The appetite for IPOs and tech stocks in particular has companies like Roblox delaying their offering to better understand where they should be pricing to bring in the most capital.

The Role of SPACs

Special purpose acquisition companies (SPACs) have played a large role in the IPO froth in 2020 and now 2021. According to PricewaterhouseCoopers, we haven’t seen an IPO year like this since – you guessed it – the 1990s. 2020 saw 183 traditional IPOs and 242 SPAC deals worth $180 billion.2 These types of blank check companies used to be firmly in the realm of speculation, but they are gaining in popularity as returns elsewhere are depressed due to a flood of stimulus and a pandemic dampening activity. SPACs are still speculative as they are mostly launching to buy into private companies, but more investment capital is flowing into them than ever before.

The number of quality private companies just waiting to go public through a reverse merger is an open question, but the odds are looking good that some SPACs will have to reach deeper into the barrel than their investors may want. There are other pros and cons around the growth in SPACs, including how the companies using them can market themselves prior to “going public,” but that is a topic for another day. The important thing to realize for investors looking at the IPO market with confusion is that SPACs will be eating away at the IPO pipeline in their own way due to the capital they have to put to work.

Remembering What Happened to 1990s Surge

In the 1990s, of course, the craze was for companies who took a “www.something.com” approach to their business plans. There are many examples of how frothy the market was for internet stocks. Pets.com made an accelerated journey from IPO to insolvency within a year owing to the timing of the IPO at the busting of the dotcom bubble and a number of unresolved issues in the basic business model.

While we can tell ourselves that the market understands tech better now, there is no denying that the valuations on tech firms old and new are now extremely dependent on growth to catch up. The price-to-earnings (P/E) ratios on tech stocks are breaking barriers that were last pierced in the internet bubble, and even ones that were trending toward traditional value, like Microsoft Corporation (MSFT) and Alphabet Inc. (GOOGL), are climbing up in the 30s again. Although there is a first time for everything, we have historically seen markets ultimately face correction when a sector becomes unmoored from fundamental valuations.

The Bottom Line

The dotcom bubble and bust of the ’90s and early 2000s burned a lot of investors and reduced the capital available for the tech companies developing in the following decade. Apparently those burns have largely healed in the 20 years since, as we are once again seeing incredible valuations on minimal revenue and a frenzy for IPO stocks and pre-IPO companies. Maybe this is that magical time when there are no consequences for valuations outrunning fundamentals, but there are concerning signs for investors who remember what it was like in the ’90s.

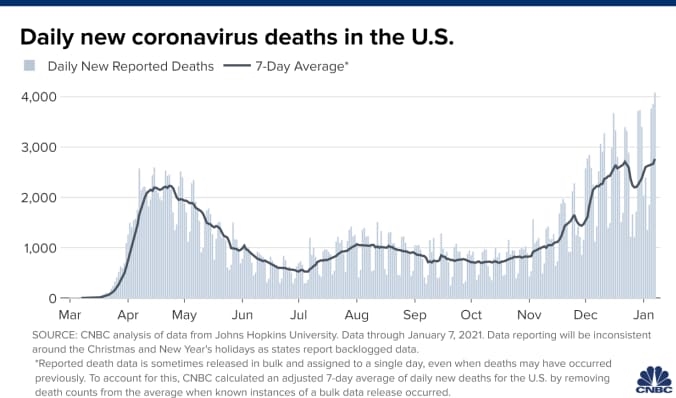

U.S. reports more than 4,000 Covid deaths for first time as outbreak grows worse than ever

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- The U.S. has reported a record-high daily death toll on five of the past 10 days, according to data compiled by Johns Hopkins University.

- “We believe things will get worse as we get into January,” Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, said Thursday.

- With the outbreak growing more severe, many Americans across the country are waiting to receive one of the authorized vaccines now being rolled out.

More than 4,000 people died of Covid-19 in the United States in one day for the first time on Thursday as the country reports record-high numbers and the outbreak grows more severe by the day.

The U.S. has reported a record-high daily death toll on five of the past 10 days, according to data compiled by Johns Hopkins University. Over the past week, the U.S. has reported an average of more than 2,700 deaths per day, up 16% compared with a week ago, according to a CNBC analysis of Johns Hopkins data.

Nearly 20,000 people in the country have died of Covid in January alone, setting the pace for a month that will likely rival December for the deadliest month yet of the pandemic.

Top health officials, including Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, are warning that the outbreak is likely to get worse before it gets better.

“We believe things will get worse as we get into January,” Fauci said Thursday in an interview with NPR. He said Americans can still “blunt that acceleration” if they strictly adhere to public health measures like mask wearing and social distancing.

As of Thursday, cases were still rising quickly, a sign that more deaths will follow as people get diagnosed, become sick and enter hospitals, many of which are overwhelmed by the surge of Covid patients. The U.S. reported more than 274,700 new cases on Thursday, bringing the seven-day average up to a new all-time high of 228,400, according to Johns Hopkins data.

Daily new cases are increasing nearly everywhere. The average number of daily new cases is rising by at least 5% in 44 states and the District of Columbia. New deaths are increasing especially rapidly in Southern California, where health-care workers are rationing supplemental oxygen and asking ambulances to wait hours before dropping off patients.

Cases and hospitalizations are rising rapidly in Arizona, as well, according to Johns Hopkins data, a sign that daily new deaths could soon catch up. The Department of Health and Human Services announced Thursday that it was setting up an infusion center to help administer Covid antibody treatments, which have shown promise in preventing hospitalization if used early on in infection.

With the outbreak growing more severe, many Americans across the country are waiting to receive one of the authorized vaccines now being distributed. The initial rollout has been slow, with the U.S. failing to hit the goal of vaccinating 20 million Americans in December, as federal officials had aimed for.

However, federal officials, including Fauci and Dr. Nancy Messonnier, director of the Centers for Disease Control and Prevention’s National Center for Immunization and Respiratory Diseases, have said the pace will likely pick up this month. The rollout has already shown some signs of slowly gaining speed.

The U.S. administered more than 600,000 shots in 24 hours, the CDC reported Thursday. That’s the most in a one-day period so far, according to the agency’s data. More than 21.4 million doses have been distributed, according to the data, but just 5.9 million have been administered.

Amid criticism of a slow initial rollout, HHS officials are now urging states to move beyond the first tier of prioritization. Health-care workers and residents of long-term care facilities are supposed to receive the vaccine first, according to guidance from the CDC. But HHS Secretary Alex Azar said earlier this week that states should open up to more old and vulnerable Americans if it will hasten the pace of the rollout.

Also adding to the pressure to quickly vaccinate is the arrival of a new strain of the virus. The new variant, known as B.1.1.7, which was first discovered in the United Kingdom, has now been found in at least seven states. While it does not appear to cause people to become more severely sick, CDC officials say they believe it spreads more easily. That could make the outbreak even worse and quickly overwhelm hospitals, CDC officials said last week.

Pickup trucks dominate America’s 10 best-selling vehicles of 2020

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- Led by the Detroit automakers, pickup trucks accounted for five of the industry’s 10 best-selling vehicles in 2020.

- Ford’s F-Series pickup remained America’s best-selling vehicle for the 39th straight year. It’s also the industry’s top-selling truck for 44-consecutive years.

- The three top-selling pickups accounted for about 13% of the 14.5 million vehicles estimated to have been sold last year in the U.S.

2021 Ford F-150 Limited

Ford

Look no further than the automotive industry’s best-selling vehicles of last year as proof of America’s love for pickup trucks.

Led by trucks from the Detroit automakers, pickups accounted for five of the industry’s 10 best-selling vehicles in 2020 despite their increasingly higher prices and the coronavirus pandemic.

Ford Motor’s F-Series truck retained its decades-long sales dominance, followed by pickups from General Motors and Fiat Chrysler. The three top-selling pickups accounted for about 13% of the 14.5 million vehicles estimated to have been sold last year in the U.S.

“Pickup trucks have been very successful. They have marched through this pandemic so well,” Jessica Caldwell, executive director of insights for auto research firm Edmunds, told CNBC. “They have boosted up all of their respective companies. Particularly the Detroit companies, they have kept business afloat fairly well.”

As sales to commercial and other fleet customers came to a grinding halt during the coronavirus pandemic, automakers touted retail consumers purchasing pickups as quickly as they could produce them in 2020. The companies are still attempting to resupply inventories following a roughly two-month shutdown of their North American plants last spring due to the coronavirus pandemic.

“It was astonishing. It was like pulling a rabbit out of a hat. I think the automakers were magicians basically in selling trucks this year,” said Jeff Schuster, LMC Automotive president of the Americas. “It was a remarkable year for trucks.”

Ford’s F-Series, which includes the F-150 and its larger siblings, remained America’s best-selling vehicle for the 39thstraight year and the industry’s top-selling truck for the 44th consecutive year. GM’s Chevrolet Silverado regained its silver medal position after dropping to third in 2019 behind Fiat Chrysler’s Ram pickup.

Newcomers to the 10 best-selling vehicles last year included GM’s GMC Sierra as well as the Toyota Tacoma, which outsold the Toyota Corolla compact car. Falling off the sales leaderboard compared to 2019 were the Corolla and Nissan Rogue, which ranked sixth in 2019.

Here’s the full list of America’s 10 best-selling vehicles in 2020:

1. Ford F-Series (Sales of 787,422 units, down 12.2% compared to 2019)

Ford CEO Jim Farley takes off his mask at the Ford Built for America event at Fords Dearborn Truck Plant on September 17, 2020 in Dearborn, Michigan.

Nic Antaya | Getty Images

2. Chevrolet Silverado (594,094, up 3.2%)

2019 Chevrolet Silverado LT Trail Boss

Source: General Motors

3. Ram pickup (563,676, down 11%)

2019 Ram 1500

Mack Hogan/CNBC

4. Toyota RAV4 (430,387, down 3.9%)

2018 Toyota Rav 4 on display at the 2018 New York International Auto Show on March 29th, 2018.

Adam Jeffery | CNBC

5. Honda CR-V (333,502, down 13.2%)

2020 Honda CR-V

Honda

6. Toyota Camry (294,348, down 12.7%)

Toyota Camry TRD

Source: Toyota

7. Chevrolet Equinox (270,994, down 21.7%)

A Chevrolet Equinox SUV is seen on the production line at SAIC-GM Wuhan Manufacturing Plant on April 7, 2017 in Wuhan, China.

VCG | Getty Images

8. Honda Civic (261,225, down 19.8%)

2021 Honda Civic sedan

Honda

9. GMC Sierra (253,016, up 8.9%)

2021 GMC Sierra HD pickup

GM

10. Toyota Tacoma (238,806, down 4%)

2020 Toyota Tacoma TRD Off-Road

Source: Toyota

From tech to bitcoin, long-time bull Ed Yardeni worries a meltdown will strike the market

Stephanie Landsman@STEPHLANDSMAN

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Edward Yardeni is concerned the market will get smoked.

The long-time bull, who spent decades running investment strategy for firms including Prudential and Deutsche Bank, is comparing Wall Street euphoria to the height of the dot-com bubble in 1999.

“The Nasdaq from late 1998 to early 2000 went up over 200%. Now, we’re up almost 100%, and we may very well be on that same track,” the Yardeni Research president told CNBC’s “Trading Nation” on Friday. “Everything I’m looking at points to a melt-up.”

The tech-heavy Nasdaq closed the week at a record high of 13,201.97. Yardeni is also highlighting bitcoin’s meteoric rise as an example of extreme frothiness. It was up 36% in the first five trading days of the year and is above 300% over the past six months.

“It’s just part of the bull market in everything,” he said. “It’s very important whether you’re in or not in bitcoin to just stare at the chart, and realize when it’s going straight up — it’s certainly a sign of exuberance, of speculative excess.”

Despite his warning, Yardeni isn’t sounding the alarm yet. He’s optimistic on the economic recovery due to coronavirus vaccines and the fiscal and monetary landscape.

“The first half of this year, the blue wave will probably continue to be bullish,” he noted. “We’re going to get more government spending. We’re going to have the Federal Reserve front a lot of that government spending through quantitative easing. I think interest rates will remain pretty low.”

Plus, Yardeni believes widespread distribution of the coronavirus vaccine later this year will help normalize the economy in the final six months of 2021.

But that’s where his forecast gets cautious. A booming economy, according to Yardeni, will lead to inflation risks due to the massive amounts of stimulus and demand increases.

“In the second half of the year, we may be on the lookout for some consumer price inflation which would not be good for overvalued assets,” he said.

According to Yardeni, the Fed may also be challenged to keep the benchmark 10-year Treasury Note yield around 1%.

“We do see upward pressure on the bond yield. I think at some point the Fed says ‘Maybe bond yields should be higher since the economy is doing well,’” said Yardeni.

For now, Yardeni is closely watching fundamentals and market indicators. He hopes they disprove his market melt-up thesis because they typically end in meltdowns.

“This market keeps stampeding ahead of my forecasts,” Yardeni said. “I hope we get to 4,300, my S&P 500 [year-end] target, in a leisurely fashion.”

On Friday, the S&P 500 index closed at an all-time highs of 3,824.68.

200 billion wiped off cryptocurrency market in 24 hours as bitcoin pulls back

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- Bitcoin and other digital coins tanked on Monday, wiping off some $200 billion from the entire cryptocurrency market.

- Bitcoin, the largest cryptocurrency, fell around 12% from a day earlier to $32,576.

- The sell-off in cryptocurrencies comes after a huge rally and perhaps signals some profit-taking from investors.

GUANGZHOU, China — Bitcoin and other digital coins tanked on Monday, wiping some $200 billion off the cryptocurrency market.

The market capitalization or value of the cryptocurrency market was $880 billion at 9:20 a.m. ET, down from $1.08 trillion a day earlier, according to Coinmarketcap.

Bitcoin, the largest cryptocurrency, fell over 12% from a day earlier to $32,576, according to Coin Metrics data. It earlier sank to an intraday low of $30,863. Ether, the second-largest cryptocurrency, was down 23% to $1,005. It briefly tumbled below $1,000, hitting an intraday low of $945.

The sell-off in cryptocurrencies comes after a huge rally and perhaps signals some profit-taking from investors. Bitcoin is still up over 300% in the last 12 months and last week hit an all-time high just below $42,000.

“The correction we saw was expected as we believe the BTC price surge recently from under $20,000 to $40,000 in the past four weeks will induce sell pressure,” said Simons Chen, executive director of investment and trading at cryptocurrency financial services firm Babel Finance.

The $40,000 mark could have been a trigger for profit-taking, Chen said.

Bitcoin’s resurgence has been attributed to a number of factors including more buying from large institutional investors.

And it has also been likened to “digital gold,” a potential safe-haven asset and a hedge against inflation. In a recent research note, JPMorgan said bitcoin could hit $146,000 in the long term as it competes with gold as an “alternative” currency. The investment bank’s strategists noted, however, that bitcoin would have to become substantially less volatile to reach this price. Bitcoin is known for wild price swings.

https://art19.com/shows/bcd08fc3-8958-4c47-bf8e-524432adcd77/episodes/a8f71e65-4c2f-41b1-9136-22d3b8c6ba29/embed But some bitcoin critics — such as David Rosenberg, economist and strategist at Rosenberg Research — have called bitcoin a bubble.

Long-term bullishness around bitcoin remains however.

Jehan Chu, founder of cryptocurrency-focused venture capital and trading firm Kenetic Capital, said the pullback in bitcoin could be a buying opportunity for new investors.

“This short term correction is both natural and needed, and is a great entry point for long-term investors as we quickly reach $50k this quarter and $100k by year’s end,” Chu told CNBC.

Last week, Social Capital’s Chamath Palihapitiya said bitcoin could go above six digits.

“It’s probably going to $100,000, then $150,000, then $200,000,” Palihapitiya told CNBC’s “Halftime Report.” “In what period? I don’t know. [Maybe] five or 10 years, but it’s going there.”

Biden’s administration could bring stability to Utah’s business sector, but potential tax hikes might hurt economy

By Lauren Bennett, KSL.com | Posted – Jan. 8, 2021 at 3:31 p.m.

Editor’s note: This is the third installment in a series looking at what a change in the presidency might mean for an array of topics that affects Utah.

SALT LAKE CITY — Ahead of the inauguration of President-elect Joe Biden, the business sector has mixed feelings about the potential policies his administration could bring as he enters the White House. His promise to raise corporate taxes has been criticized, but his commitment to sustainable infrastructure could greatly stimulate the economy.

To Derek Miller, president and CEO of the Salt Lake Chamber and Downtown Alliance, the most important thing Biden can do for the economy is simple: fight the novel coronavirus.

“Really, as it relates to how the Biden administration will have an impact on both the national economy as well as Utah’s economy has everything to do, in the short term, with how they do it at combating the virus and getting through this pandemic,” he said.

As the new administration prepares to take office in a few short weeks, here’s a look into a few potential policies that could bring a significant impact to Utah’s economy and business community.

COVID-19 response

Utah’s economy was booming before COVID-19 — the state had the fastest job growth in the nation, the most diverse and strongest economy, and was ranked as one of the best places to do business, according to Miller.

The pandemic has taken its toll on the nation’s economy and brought a devastating impact to small businesses, which make up more than 90% of Utah’s businesses, Miller said.

The Beehive State, however, has been outperforming the nation when it comes to economic recovery, according to Natalie Gochnour, an economist and director of the University of Utah’s Kem C. Gardner Institute.

“Right now our unemployment rate is at 4.3%, compared to a national unemployment rate of 6.7%,” she explained. “We’re getting through this better than most states; still contracting, still very difficult, very uneven hurting some people more than others, but on the whole, the Utah economy has been relatively strong.”

While the state has already begun to recover, business won’t return to normal as long as the pandemic continues to surge. Even with vaccine distribution rolling out, COVID-19 cases continue to rise across the United States. So, how will Biden handle the inherited pandemic?

On the campaign trail, President Donald Trump told his supporters a Biden administration would bring widespread shutdowns as part of the federal COVID-19 response, but Biden pushed back against the rhetoric and said he will not “shut down the economy, period.”

“I’m going to shut down the virus. That’s what I’m going to shut down,” Biden said at a November press conference. “There is no circumstance which I can see that would require a total national shutdown. I think that would be counterproductive.”

Biden acknowledged each area of the country is different and appropriate measures need to be taken depending on how widespread the virus is in the various states. He noted, as an example, that it’s important to have constraints on how much businesses can be open, including capacity requirements. In addition to supporting the economy in his response, Biden has said he will put an emphasis on mask-wearing and increased testing.

“There is no question that COVID-19 and this ongoing pandemic is the greatest risk to the economy,” Gochnour added.

Raising corporate taxes

There is one thing that experts say could potentially hurt the economy: Biden’s promise to reverse Trump’s corporate tax cuts and raise taxes from 21% to 28%. He also plans to impose a 15% minimum tax, “so that no corporation gets away with paying no taxes,” his campaign website reads. He also plans to increase taxes for anyone making more than $400,000 per year, while promising tax cuts for the middle class.

“I think there’s a lot of things that the president should be focused on to help the economy, and I do not think a corporate tax increase at this point in time would be warranted,” Gochnour said.

Those working in the business sector find the potential tax increase unhelpful as well.

“That, of course, would be not just unwelcome from the business community, but it would actually hurt a burgeoning economic revival,” Miller said.

Instead of raising corporate taxes, Gochnour thinks Biden should focus on his responsibility to restore confidence in Washington — something she said is greatly needed at this time.

“(Restoring confidence in D.C.) would require that there be a lot of common ground and predictability shared with the American public and with people who view the economy differently than he does,” she explained. “I think the tangible ways to restore confidence will be to have a broad base governance model that involves many people from different points of view and to see compromise with his partners on Capitol Hill.”

While detractors say Biden’s tax plan won’t help the economy, especially during a pandemic, Biden claims his administration is committed to helping struggling small businesses recover from the pandemic. In addition to tax hikes, Biden’s “Build Back Better” plan includes $400 billion to “tackle inequities in the federal contracting system.”

“It would be good for the Biden administration, when they talk about focusing on small businesses, to make sure that it’s focused on those businesses that were hit first. They were hit the hardest and their recovery is going to be the longest,” Miller said.

In addition to potential tax increases, Biden said he will combat corporate power by enforcing laws and regulations in place to keep them in check.

“Regulation is obviously important to business, like most things in life, and always requires a balance,” Miller said. “Businesses, in general, are supportive of regulation in so far that it provides a level playing field. That’s important to weed out the bad actors and to support and reward the good actors, whatever the industry is. But we always have to be careful that it doesn’t become overburdened by some regulation.”

Regardless of the other aspects to the plan, Miller said it will hurt the economy if Biden ends up increasing corporate taxes.

“Raising taxes on businesses just means that consumers are paying more and it gives the business less opportunity to create more jobs, and so that’s a misplaced campaign promise,” he said. “I hope that he’ll understand that would really be a detriment to the economic revival that we’re just beginning to experience and we certainly need to encourage.”

Investing in infrastructure

Instead of raising taxes, Miller said Biden should support investing in the country’s infrastructure, a bipartisan action the business community would support.

“It’s one of those rare items that both Democrats and Republicans agree on,” Miller said. “(There’s) a … recognition that if you put the right infrastructure into place, that it accelerates economic growth.”

According to his campaign website, Biden is committed to building a “more resilient, sustainable economy – one that will put the United States on an irreversible path to achieve net-zero emissions, economywide, by no later than 2050.”

Utah provides the perfect example of large economic growth after infrastructure was put into place, Miller said, referencing the historic driving of the Golden Spike and the transcontinental railroad.

“Time is of the essence to get our roads and our bridges back up to where they need to be, and I would say there’s an opportunity for additional infrastructure,” Miller said. “It would be a great boon to this country to see more electric vehicle infrastructure put into place across the country to put in clean energy infrastructure. And it’d be good all the way around — good for the environment and good for the economy.”

While infrastructure investment would help the economy and create jobs, Gochnour said it comes with a challenge: the huge national deficit.

“I think it would be, on whole, a positive for the economy to invest in infrastructure, but it’s got to be done in a way that also keeps government spending in check,” she said.

In addition to infrastructure, Miller said there is another thing the Biden administration could bring that would be welcome: stability.

“The first thing that he should do would be to bring more predictability and stability to international trade; that’s been an area that has suffered under the Trump administration,” Miller said.

Mainstream economists widely agree that open markets are good for the nation’s economy in the long run, Gochnour added.

“Trade wars and barriers to trade are not helpful,” she added. “I would expect this to be one of the policies of the administration that will be helpful for the economy — to re-engage with global markets in a way that has less friction.”

In November, Biden said the U.S. and its allies need to establish global trading perimeters to address China’s growing influence, Reuters reported. He also plans to discuss a detailed trade plan on his second day in office.

Miller felt Trump had the right idea when he asserted trade deals should be fair but said the so-called trade wars caused a lot of uncertainty in the market.

“One thing that all businesses of any size really crave is predictability and certainty. And it took the Trump administration too long to put new trade deals into place. That hurt Utah businesses because Utah is one of the nation’s largest exporting states,” he said. “I would hope that, for the sake of Utah small businesses the Biden administration would emphasize the fact that they want to have these free and fair trade deals,” he added.

National debt

Once the country comes out of the pandemic, Miller said the Biden administration needs to address the growing national debt “and the impact that it will have on the future of our country.” While the national debt needs to be addressed eventually, doing so in the middle of a widespread health and economic crisis is not the time, Gochnour added.

“The Biden administration needs to stay focused on getting this economy back on track and protecting public health,” she said, while noting that plans can be put into place to address deficit reduction once the ongoing pandemic is under control.

“You can’t do it right now. We’ve got to spend right now,” she said. “But, you can have a plan in place that you can address the debt once we’re on the other side of this crisis.

Biden’s economic plan does not directly address the national deficit, but an increase in government spending in programs he says will help the economy long-term.

Once the economy stabilizes, drastic measures need to be taken to address the growing national debt, Miller emphasized.

“I think, as a country and the Biden administration and Congress, (we) really need to start paying more attention to the level of our of our debt and how to get that under control, because that’s probably going to become the greatest long-term risk we have to our continued economic prosperity.”

https://www.foxbusiness.com/markets/bitcoin-is-a-fools-gold-peter-schiff

Bitcoin is ‘fool’s gold and anybody buying it is ultimately a fool’: Peter Schiff

Bitcoin is ‘never going to be money,’ Schiff tells FBN

By Angelica StabileFOXBusiness

https://static.foxnews.com/static/orion/html/video/iframe/vod.html?v=20210111194256#uid=fnc-embed-1 Will bitcoin surpass gold’s market cap?

Euro Pacific Capital chief economist and strategist Peter Schiff argues there’s a lack of value in cryptocurrency compared to gold.

Euro Pacific Capital chief economist and strategist Peter Schiff suggested cryptocurrency investors are “fools” Monday after bitcoin took a major dip in the market after reaching record-breaking highs against the dollar.

“All bitcoin is is the latest iteration of fool’s gold and anybody buying it is ultimately a fool,” Schiff told FOX Business’ “Making Money with Charles Payne.”

Schiff explained that bitcoin investors who were able to sell after the stock’s recent joyride are merely selling to other buyers who don’t recognize it’s all a “scheme.” However, he added, most people who don’t sell are “under the delusion” that bitcoin will someday turn to cash.

“It’s never going to be money,” he said. “It doesn’t fit the very definition of money. Money needs to be a commodity. It needs to have actual value unto itself, not just the uses and means of exchange.”

The economist likened bitcoin to fiat digital currency that’s “backed by nothing” and, moreover, is not legally recognized.

“People who are buying it are going to wake up one day and they’re just going to be a bagholder,” he concluded.

The cryptocurrency reached a record value of $40,797 per coin on Thursday, helping fuel the market capitalization for all digital coins to above $1 trillion for the first time. Bitcoin was trading down 5.14% at $33,519 per coin on Monday afternoon after reaching a session low of $30,568.

FOX Business’ Jonathan Garber contributed to this report.

HI Financial Services Mid-Week 06-24-2014