HI Financial Services Mid-Week Commentary 10-20-2015

I LOVE IT When a plan come together – “the A-Team”

With the little bump up by collar trading ALL the stock my puts bought will now go up – George Curtis !!!

What’s happening this week and why?

NAHB Housing Market Index – 64 vs est 62

Building Permits – 1103 vs est 1170

Housing Starts – 1206 vs est 1150

Right now our stock market is melting up, slow and easy, due to earnings even though big names aren’t knocking it out of the park ie….IBM

Where will our market end this week?

With better earnings we will see a higher market into the end of the week

DJIA – Technically bullish with a slow growth pattern in front of us

SPX – Technically bullish with a slow growth pattern in front of us

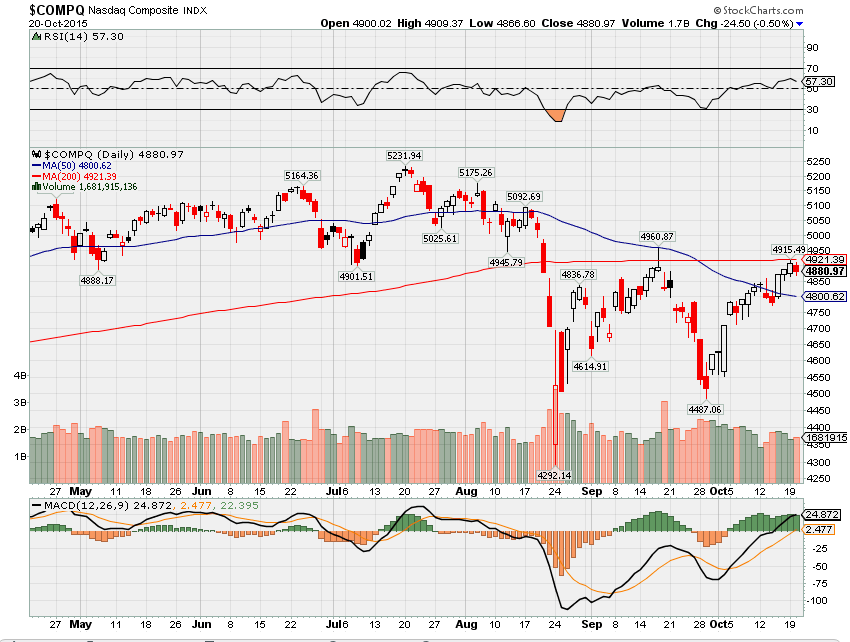

COMP – Technically bullish with a slow growth pattern in front of us

Where Will the SPX end October 2015?

10-20-2015 I think the market will give us a 3% increase as the market bottoms, earnings take the stage and we have a Christmas Rally

10-13-2015 I think the market will give us a 2% increase as the market bottoms, earnings take the stage and we have a Christmas Rally

10-06-2015 I think the market will give us a 2% increase as the market bottoms, earnings take the stage and we have a Christmas Rally

What is on tap for the rest of the week?=

Earnings:

Tues: CREE, HOG, CB, ISRG, LMT, VZ, VMW, YHOO

Wed: ABT, AXP, BA, KO, EBAY, EMC, GM, LVS, OC, SNDK, TXN, VMI

Thur: ALK, GOOGL, ALTR, AMZN, APOL, T, CAB, CAT, DOW, DPS, DNKN, LLY, FCX, JNS, MCD, MSFT, P, UNP, UA

Fri: PG, WHR

Econ Reports:

Tues: Building Permits, Housing Starts

Wed: MBA,

Thur: Initial Claims, Continuing Claims, FHFA Housing Price Index, Existing Home Sales, Leading Indicators

Fri:

Int’l:

Tues – JP: Merchandise Trade

Wed –

Thursday – EMU: EC Consumer Confidence Flash, JP:PMI Manufacturing Index Flash

Friday – FR:DE:EMU: PMI Composite

Sunday –

How I am looking to trade?

Currently in Protective puts or collars for everything !!! When earnings come around AA October 8th, I will cash in profits on Long puts and place my puts ATM for the opportunity to catch a Christmas bounce higher

Adbe

AAPL – 10/27 AMC

ADBE – 12/10 estimated

BABA – 11/04 BMO

BIDU – 10/29 AMC

CLDX – 11/04 estimated

D – 11/02 BMO

DIS – 11/05 AMC

F – 10/27 BMO

FB – 11/04 AMC

NVDA – 11/05 AMC

SNDK – 10/21 AMC

V – 11/04 estimated

VZ – 10/20 BMO

WBA – 10/28 BMO

ZION – 10/19 AMC

SBUX – 10/29 AMC

MS – 10/19 BMO

NKE 12/17 estimated

RHT 12/17 estimated

If you can’t do it I can for you !!!

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

http://www.trulia.com/blog/hidden-costs-refinancing/?ecampaign=cnews&eurl=www.trulia.com%2Fblog%2Fhidden-costs-refinancing%2F

Black swan risk rises to highest level ever

http://www.cnbc.com/id/103073883