“…..I opened a magazine and saw an advertisement for a fund that I own. The bold print bragged that the fund had averaged 5% over the past 3 years. I went home and looked at my statements to confirm what I had suspected. I HAD LOST MONEY!!! How could this be? – Potential Client Call

Investing in a Rising Rate Environment

How Rising Interest Rates Affect Bond Portfolios

By Baird’s Private Wealth Management Research

Summary With historically low interest rates and the unprecedented monetary and fiscal stimulus measures taken to combat the market downturn of 2008–2009, many believe that the Fed has no choice but to begin raising interest rates in the near future. That is a normal course of action and signals that the Fed believes the economy is on sounder footing. Yet, the prospect of rising interest rates provides much consternation for bond investors, who may be disserved by such action. In this paper, we seek to analyze recent periods of rising interest rates, evaluate how bonds performed and dispel myths that bonds make for a poor investment in these periods.

Ford Motor Company – Hasn’t grown in years !!!! A stuck in the mud, value trap

Short interest at the end of the settlement date of September 15, 2015 totals 101,654,457 that shows a 0.1% month over month increase. This short interest is 2.6% of the total number of shares available for trading. At the average daily volume of 33,392,210 it would take “roughly” 3 days to cover those share

What do we call it when we see a covering of those shares – short covering which means a huge spike in the price of F

What’s happening this week and why?

Personal Income .5 vs est .4

Personal Spending .2 vs est .3

PCE Prices .1 vs est .1

Pending Home sales -1.4 vs est .5

Case Shiller .5 vs est .5

Consumer Confidence 103.0 vs est 96.0

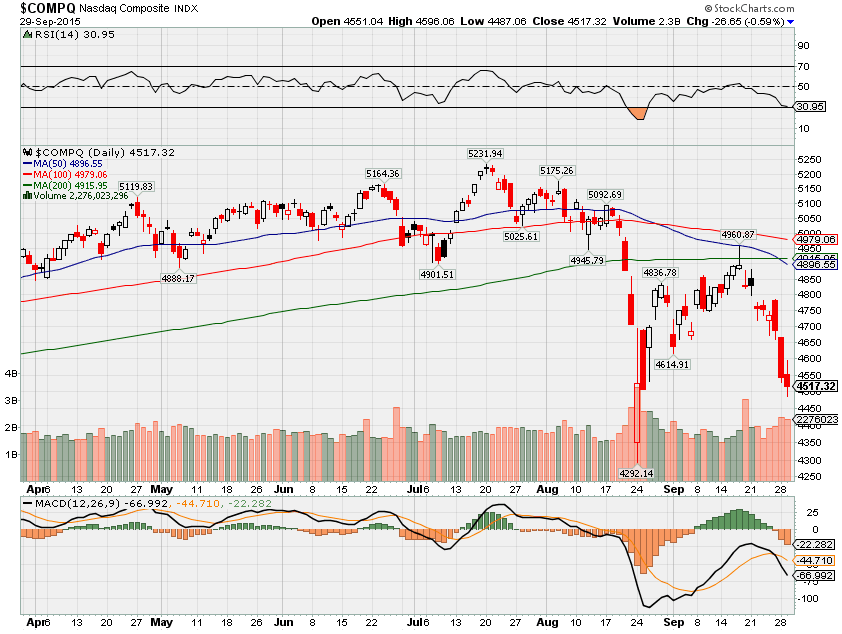

The Dow is down 16% from the highs and 10% year to date

S&P down 13% from the highs and down 8.6% year to date

Comp down 17.9% from the highs and 4%

Where will our market end this week?

Down again because the month of September is the end of a quarter and looking for a selloff on Wednesday

DJIA – Testing lows for a third time and looks to be building a base for a possible Christmas Rally – is totally dependent on the FOMC Rate hike this year or next

SPX – second time testing the August lows of 1867

COMP – At the lower RSI oversold line, bearish

Where Will the SPX end October 2015?

10-06-2015 I think the market will give us a 2% increase as the market bottoms, earnings take the stage and we have a Christmas Rally

What is on tap for the rest of the week?=

Earnings:

Tues: COST, DMND

Wed:

Thur: MU

Fri:

Econ Reports:

Tues: Consumer Confidence

Wed: MBA, ADP Employment, Chicago PMI

Thur: Initial Claims, Continuing Claims, Challenger Job Cuts, ISM Index, Construction Spending, Auto, Truck

Fri: Ave workweek, Non-Farm Payroll, Private, Unemployment Rate, Hourly Earnings, Factory

Int’l:

Tues – JP: Retail Sales, Industrial Production,

Wed – CN: PMI Manufacturing

Thursday – JP: Household, Unemployment Rate, FR:DE:EMU: PMI Manu

Friday – EMU: PPI

Sunday – JP: PMI Composite

How I am looking to trade?

Currently in Protective puts or collars except for a couple of stocks. When earnings come around AA October 8th, I will cash in profits on Long puts and place my puts ATM for the opportunity to catch a Christmas bounce higher

If you can’t do it I can for you !!!

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 06-24-2014