HI Financial Services Mid-Week Commentary 09-22-2015

Trading is a process that most people don’t have the stomach or patience to master – khurley@hurleyinvestments.com

Market Crashes and The Recovery:

Market Crashes occur every 4.5 years on average – 20% correction

Markets fall down faster than they rise

What is the advantage of a market crash on your portfolio?

With protection you get to lower your cost basis/add more shares of stock

Dollar cost average WITHOUT having to find more capital

Usually, you are not making money and/or the account is down slightly during this period

Recovery – Who makes money in a bullish market?Everyone

What if you have protection on in a bullish market?Still make money but not a much as other

Trading as a process = That you don’t win Every Day!

BUT I’ve learned as you win on the down days overall you will make more money than winning with risk on the up days!!!

Companies like F and NVDA that are were and are technically bullish goes thru a down day like today? YES

Let’s talk about why I am down 0.5% today and what the cause is?

Options expired last Friday which means I had to roll my long puts out in time and I chose to not add short calls.

I am choosing to take more risk because of the huge upside from the lows at where stocks are currently trading.

What’s happening this week and why?

Existing Homes sales 5.31 M vs est 5.50M

FHFA Housing Price Index .6 vs est .2

Fed disappointment

Is anyone surprised that we are in a slow growth recovery?

We are biggest and best (at times) economy in the world yet be are being led around by China, Europe, Japan,….?????

Why are we no longer able to stand alone as an Island to the world?=Because we are more globally driven economy, how about the dollar strength was built on a house of stimulus vs real growth, huge debt to repay, no 3% GDP which is the optional number, less jobs, Obamacare, weak useless debt driven, out for themselves candidates for public service

Where will our market end this week?

Down lower than today and it is a historical fact the worst week on a historical average in the stock market is this WEEK!!!

DJIA – Mixed signals with bearish price movement, break out to the downside today for our flag patter. More importantly the Median line on the RSI acted as resistance

SPX – Mixed signals with bearish price movement, break out to the downside today for our flag patter. More importantly the Median line on the RSI acted as resistance

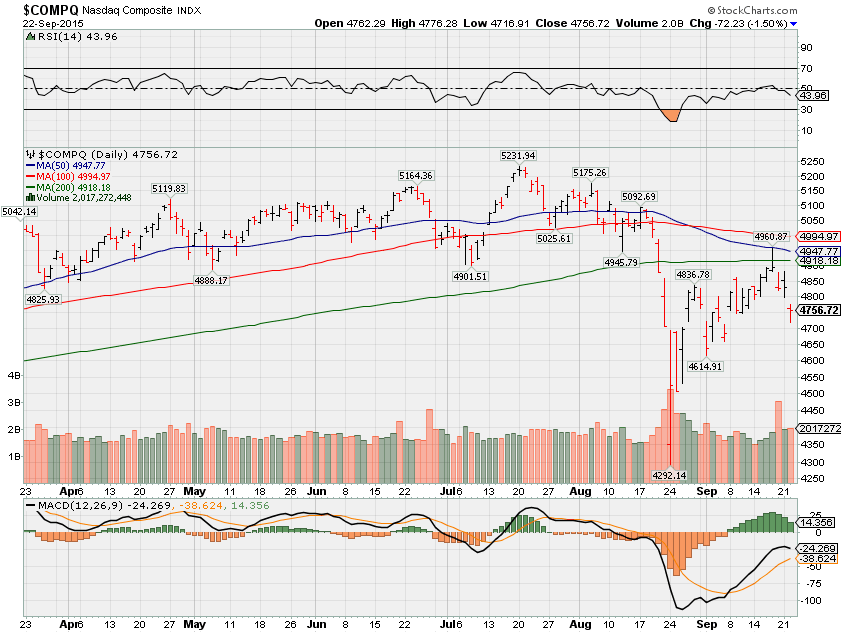

COMP – Mixed signals BUT the RSI median line was broken to the upside for a couple of days !!!

Where Will the SPX end September 2015?

09-15-2015 I think the market will give us a 2% decline as the market bottoms in September for an end of the year rally

09-15-2015 I think the market will give us a 2% decline as the market bottoms in September for an end of the year rally

09-08-2015 I think the market will give us a 2% decline as the market bottoms in September for an end of the year rally

09-01-2015 I think the market will give us a 2% decline as the market bottoms in September for an end of the year rally

08-25-2015 I think the market will give us a 2% decline as the market bottoms in September for an end of the year rally

What is on tap for the rest of the week?=

Earnings:

Tues: DRI, GIS

Wed: FUL

Thur: KBH, JBL, NKE, PIR

Fri:

Econ Reports:

Tues: FHFA Housing Price Index

Wed: MBA,

Thur: Initial Claims, Continuing Claims, Durable Goods, Durable ex-trans, New Home Sales

Fri: GDP, GDP Deflator, Michigan Sentiment

Int’l:

Tues – CN: PMI Flash

Wed – FR:DE:EMU: PMI Composite, JP: PMI Manufacturing

Thursday – JP: CPI, Janet Yellen Speaks 5 pm ET

Friday –

Sunday –

How I am looking to trade?

Currently in Protective puts or collars except for a couple of stocks. I Feel I want to be protected thru the Fed meeting

If you can’t do it I can for you !!!

Questions???

Inflation, Deflation or stagflation? I think we are in a deflation period in our economy based on commodity pricing

Bruce – good for consumer but no money to purchase and create future demand

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 06-24-2014