HI Financial Services Mid-Week Commentary 06-23-2015

You don’t know there is a market problem until there is a problem – CNBC Commentary

What are we waiting for forever 4.5 year’s?

Higher interest rates

The dreaded correction (-10 + drop)

PIGS drama to end/kicked out of the Euro

You don’t have to catch the initial drop in the correction to be profitable for the year

Look at trading like a process not a one-time event

Someone asked if I would roll a spread trade out in time “hoping” for the strategy to become profitable

NO WAY JOSE !!!

In Spread trading you are playing a shorter term trend so I want to follow the current trend.

Now investing is different because you want to buy and hold (while collar trading) to book profits as long term capital gains.

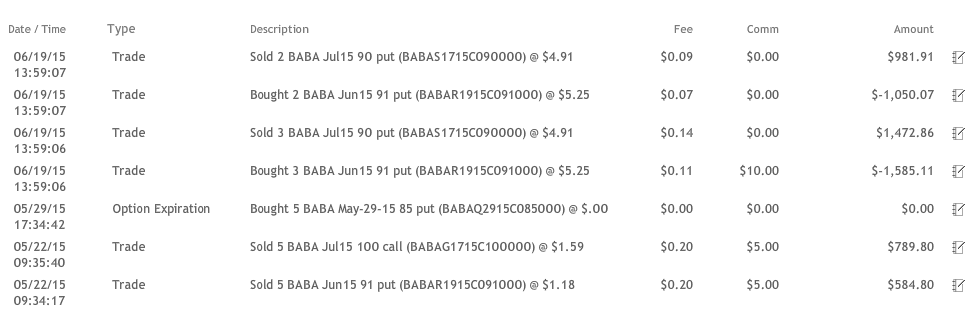

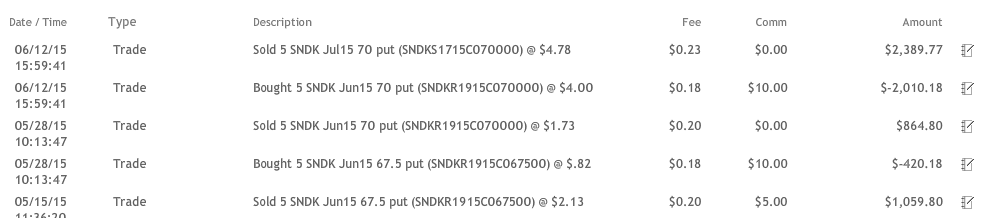

I have short puts on fundamentally sound stocks that are right now trading lower than they should. I am rolling the short put a week before options expiration to make sure I do not get the stock assigned. Not that it matters because any time I place naked short puts I have the capital to cover the purchase of the stock. As you work thru the totals I will have a net credit if assigned and it would lower my cost basis on the stock.

What’s happening this week and why?

Monday Greece blinked and is willing to negotiate terms

Existing home sales 5.35 M vs est 5.26 M

New Home Sales 546 vs est 525

Durable Goods -2.0 vs est -0.5

Durable ex-trans -0.3 vs est -0.3

Where will our market end this week?

Higher still because we have a Greek resolution next Monday and next week is also a holiday shortened week with Friday having the markets closed – 4th of July

DJIA – Bullish with all three crossovers

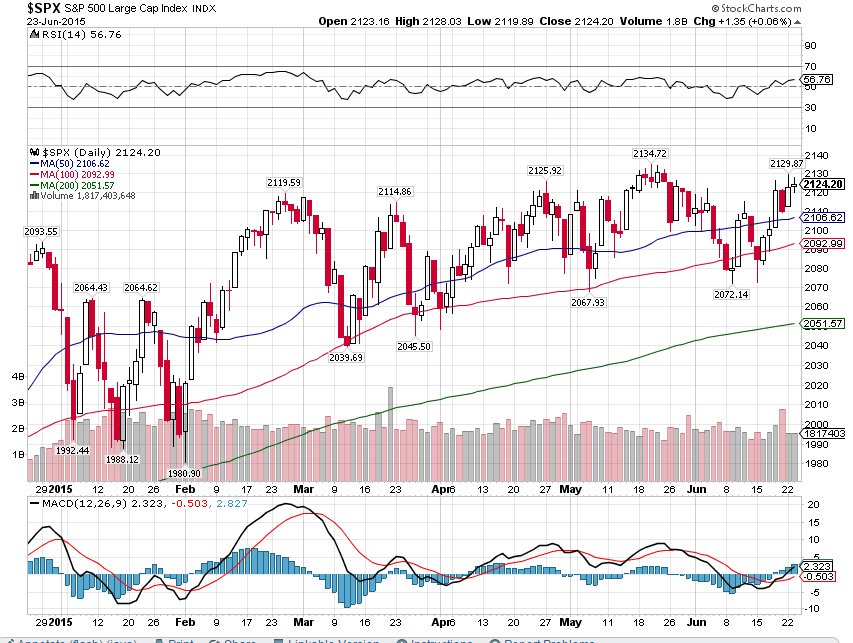

SPX – Bullish

COMP – Bullish

Where Will the SPX end June 2015?

06-23-2015 UP 2% for the month

06-09-2015 UP 2% for the month

06-02-2015 UP 2% for the month

What is on tap for the rest of the week?=

Earnings:

Tues: CCL, DRI

Wed: BBBY, FUL, LEN, MON

Thur: BKS, NKE, WGO

Fri:

Econ Reports:

Tues: Durable Goods, Durable ex-trans, FHFA Housing Price Index, New Home Sales

Wed: MBA, GDP. GDP Deflator

Thur: Initial Claims, Continuing Claims, Personal Income, Personal Spending, PCE PRices

Fri: Michigan Sentiment

Int’l:

Tues – FR:DE:EMU: PMI Composite Flash, JP: BOJ Minutes

Wed –

Thursday – JP: CPI, Unemployment

Friday – EMU: Money Supply

Sunday – JP: Industrial Production

How I am looking to trade?

Let’s go over unique trades at the end of the options expiration month last Friday

I have stocks sitting alone expecting a buying opportunity because of Greece

F, NVDA, DIS, V, FB, WBA,

BIDU, AAPL ½ , Collared thru August

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 06-24-2014