HI Financial Services Mid-Week 07-29-2014

Why are you putting in all this hard work to trade for a living?

For me because I want to be the best father I can be in spending time with my children

I want to do the things I want to do in life because life is too short. That means driving 50 miles into the Idaho Mountains to fish at Iron Lake

I like seeing other people happy. It’s those type of people I want to spend my time with. Even if it is my wife catching a fish !!!!

What has been happening so far this week?

I believe this week has been a “tough” week !!! No real bounce back from the Friday 166 point sell off. I also think this is a wait and see type of week. No bounce back on Monday and pending home sales were down for the first month after three consecutive up months in the housing market. Why is the housing market so important to the recovery? BECAUSE it does involve almost all growth aspects of the economy – paint, lumber, service, financials, glass, & unfortunately over 90% + of peoples retirement are built into the profit of their homes. Case Shiller report shows and increase in the value of the homes and consumer confidence was at a a high of 90.9 vs est 85.6. ALSO, sanctions against Russia have occurred from both EMU and USA. Gaza strip fighting and Ukraine are still in the headlines = headline risk.

Where will our market end this week?

I would expect to recover the 166 points lost or to be back above 17,000 on the DJIA by the end of the week because we have FOMC rate decision which should remain status quo – No rise in interest rates until mid 2015, GDP which has to be better than the -2.9, I would also expect non-farm payroll to be at the highest it’s been this year. ALSO, huge earnings especially in the energy sector

DJIA– This is a very typical testing of a round number. 50 day SMA as support but we also have technical crossovers ont eh DJIA

SPX – Building a base at 1950 for another leg up which would be the 2000 level.

COMP – Building a base at 4350 and cant breach 4500 yet.

Where Will the SPX end July 2014?

Today MTD DJIA – +0.36%, SPX +0.46%, COMP+1.02%

07-22-2014

I am standing by my monthly prediction of up 1% for the month.

07-15-2014

We are still testing 17,000 so I am standing by my expectation on July 1st.

07-08-2014

I think we are going to test the 2000 on the SPX and test 17,000 on the DJIA. We might be slightly higher but I would say a 1% up month.

07-01-2014

My guess is 2000 on SPX, 17,100 on the DJIA and 4500 on the COMP

What is on tap for the rest of the week?=

Earnings:

Tues: AET, AFL, AMGN, ACI, BGFV, BWLD, CHRW, GLW, FISV, GNC, IP, MAR, MRK, NEM, NTRI, PNRA, PFE, UPS, X, WM, WYNN, YNDX, TWTR,

Wed: ADT, ALL, AMC, ABX, SAM, CTRP, GRMN, HIG, HES, HUM, KRFT, LOCK, MET, MUR, PSX, PDM, SFLY, S, TSO, VLO, WDC, YELP, WFM

Thur: DDD, APA, BLL, BZH, CL, CME, COP, FLR, KBR, K, LLL, LNKD, MA, MCK, MOS, PPPL, SWC, TMUS, TSLA, TWC,

Fri: CBOE, BKW, CLX, CVX, HLT, PG

Econ Reports

Tues: Case-Shiller, Consumer Confidence,

Wed: MBA, ADP Employment, FOMC Rate, GDP, GDP Deflator,

Thur: Initial Claims, Continuing Claims, Challenger Job Cuts, Employment Cost Index, Chicago PMI

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, PCI Prices, Personal Income, Personal Spending, Michigan Sentiment, ISM Index, Auto, truck

Int’l:

Tues – JP: Industrial Production, GB: M$ Money Supply,

Wed – EMU: ECB Lending Survey, EC Economic Sentiment

Thurs – DE: Retail Sales, Unemployemnt Rate, EMU: HICP Flash, JP: PMI Manufacturing, CN: PMI Manufacturing, CFLP Manufacturing PMI

Friday – DE:FR:GB:EMU: PMI Manufacturing Index

Sunday –

How I am looking to trade?

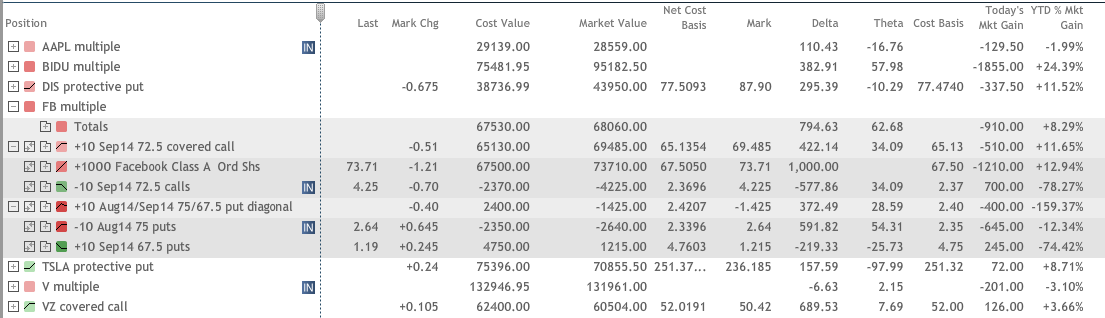

I am in Collar Trades and/or Protective Puts for earnings.

That means you need to build you earnings list

AAPL 7/22 AMC

BIDU 7/24 AMC

BBY 8/26 BMO

CLDX 8/6 AMC

D 7/30 BMO

DIS 8/5 AMC

F 7/24 BMO

FB 7/23 AMC

LNCO 8/7 BMO

MEI 8/28 est

MS 7/17 BMO

MU 10/09

NVDA 8/7 est

SBUX 7/24 AMC

SNDK 7/16 AMC

SLB 7/17 AMC

TSLA 7/31 AMC

V 7/24 AMC

VZ 7/22 BMO

ZION 7/21 AMC

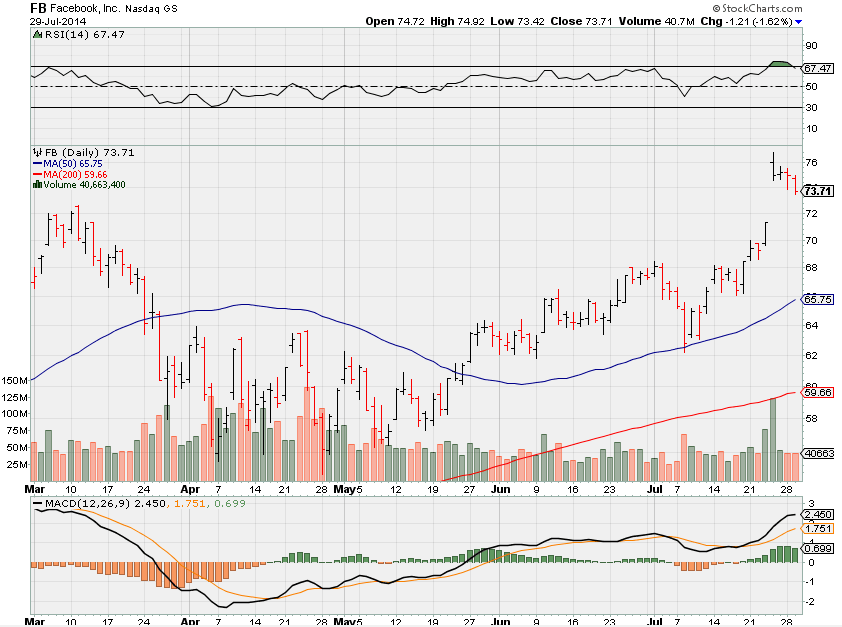

FB new trade Aug 92.50/95 Bull put for $1.04 credit Risk=$1.46 period !!!

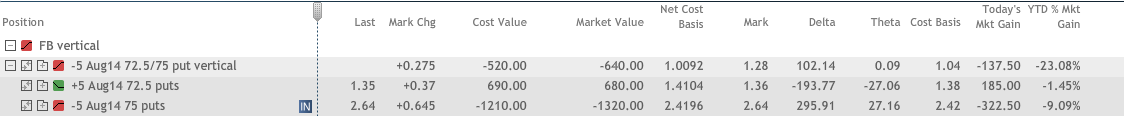

FB Collar Adjustment

Questions???

Blogsite down until Thursday. GoDaddy stopped using blogspot so I am transferring everything to word press

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a twitter follower

US oil’s new ‘Big Three’ form million barrel club

http://www.cnbc.com/id/101865224

Summer’s busiest week for markets is here

http://www.cnbc.com/id/101868173

Tech hardly a bubble like in 1999, pros say

http://www.cnbc.com/id/101876501

As S&P nears 2,000, traders say keep an eye on this

http://www.cnbc.com/id/101857900