HI Financial Services Mid-Week 03-17-2015

We had a booming stock market in 1929 and then went into the world’s greatest depression. We have a booming stock market in 1999. Will the bubble somehow burst, and then we enter depression? Well, some things are not different. – Jeffrey Sachs

What have we done to ward off a “great depression” – Made a lot (Printed) of money at low interest to be made available?

Dropped interest rates

Printed more money than ever – 4.1 T in the Fed balance sheet right now

Congress or Government is in debt 19T with a deficit this year again !!!!!

What’s happening this week and why?

Poor Economic data:

Empire 6.9 vs est 8.8

Industrial Production .1 vs est .3

Cap Utilization 78.9 vs est 79.5

NAHB housing Index 53 vs est 56

Housing Starts 897 vs est 1040

Good news Building permits 1092 vs est 1070

Is it the weather? YES

It has been unusually warm in the west !!!

Coldest Feb on record and most snow fall for the east

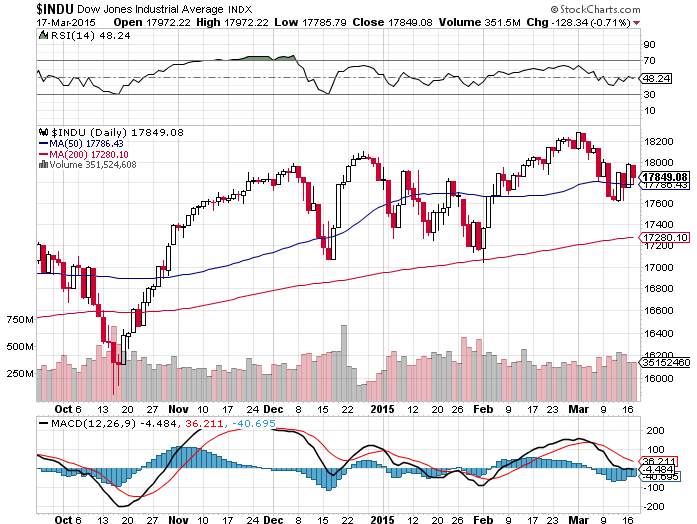

Volatility 9 days in March out of 12 that had 100 point closing movements or more 4 Bullish 5 bearish

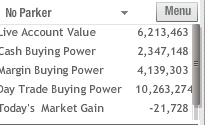

on a triple digit down day I was off – 0.003%

Where will our market end this week?

????? 100% dependent on Yellen’s Statement / Q&A

DJIA – Bearish but look to be making a turn

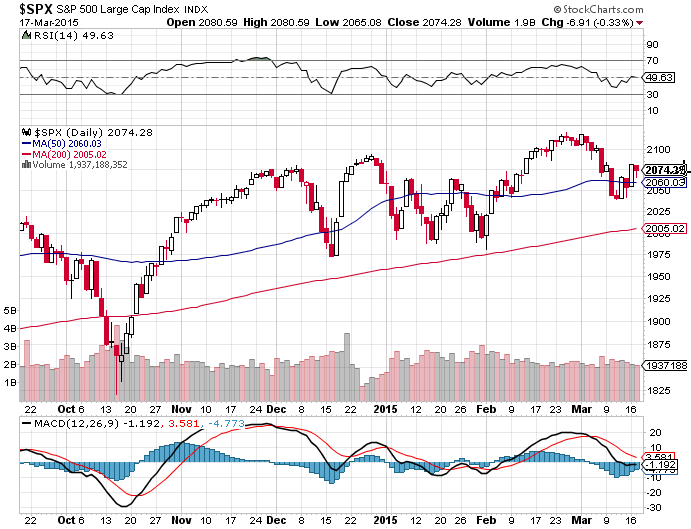

SPX – Bearish

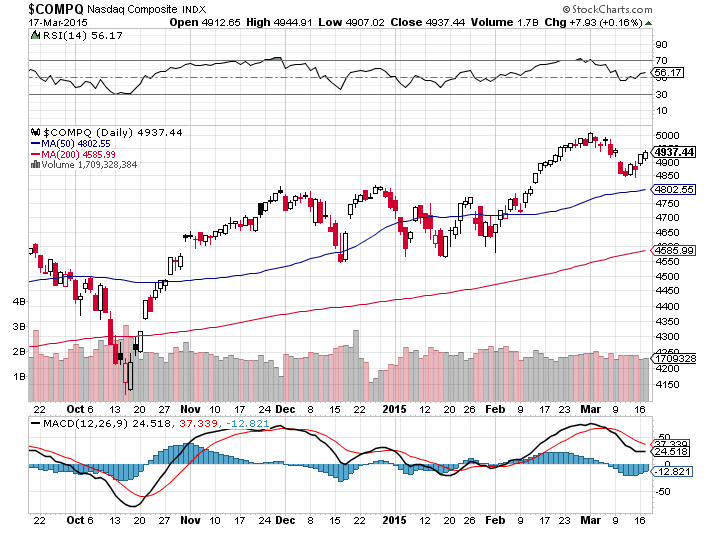

COMP – Looking to turn bullish with two bullish indicators

Where Will the SPX end March 2015?

03-10-2015 March will finish flat with a 3.5% move down and back up

03-10-2015 March will finish flat with a 3.5% move down and back up

03-03-2015 March will finish flat with a 3.5% move down and back up

02-25-2015 March will finish flat with a 3.5% move down and back up

What is on tap for the rest of the week?=

Earnings:

Tues: ADBE, BURL, CTRP, DRCL, SKYS, ORCL

Wed: CTAS, FDX, GIS, RENN

Thur: NKE, LEN

Fri: DRI, KBH, TIF

Econ Reports:

Tues: Housing Starts, Building Permits

Wed: MBA, Crude, FOMC Rate Decision

Thur: Initial Claims, Continuing Claims, Current Account Balance, Phil Fed, Leading Indicators

Fri: Options Expiration – Will people need to cover short positions

Int’l:

Tues – JP: Merchandise Trade

Wed – JP: All Industry Index, GB: BOE Minutes, Labour MKT Report

Thurs – JP: BOJ Minutes

Friday –

Sunday –

How I am looking to trade? Let me Show you what I changed and why?

Most of my stocks are thru earnings:

I have some stock only positions – DIS, NVDA, F, SBUX, D,

I have Protective puts on LNCO, ZION, AAPL

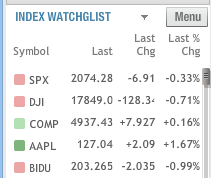

Still IN collars for – BIDU, FB,

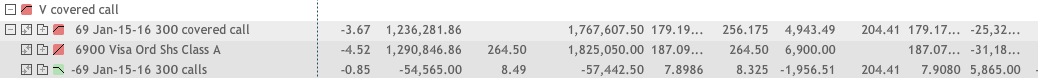

Covered Calls on – VZ, WBA, SNDK, P

Bull Puts – DIS, NVDA

Bear Puts – LNCO

Naked Puts –V ( 8 naked at 272.50 Mar 15)

BABA I have 80 % of the share covered (400) with long puts and all shares covered with a bear put spread 80/70

AAPL Bear put calendar with long puts

1st I am creating my earnings list so I don’t miss an earnings for a company I trade

WBA – 03/24

PCLN – 02/19

NKE – 3/19

RHT – 3/26

MU- 4/2

Questions???

Collar trade BUT I use earnings as the catalyst – Being in cash is probably a good thing right now !!

Buying opportunity knowing past performance NEVER guarantees future performance

Jan 2014 6.5%, April 4%, July/Aug 4%, October 7%, Dec 5%

ANYTHING you make on the way down is a profit in collar trading as the stocks come back

What is Protection and what is NOT protection

My stock lost $2.03

My covered call only lost $0.625 and covered calls are NOT PROTECTION

Why? Stock trading at $203 with a credit left of $8.29 = $195 ish at RISK

My long puts made up another $0.925

Net loss today because I was collared = 2.03 – 0.925 – .0625 = $0.48

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley