HI Financial Services Mid-Week 02-10-2015

“Listen, Kevin. Every day, poo poo’s gonna hit the fan. Stuff is gonna happen, and it’s gonna be bad. You just don’t know when or how bad it is going to be. But you have to put shutters on, set a goal, don’t listen to the noise, and just go forward. All of that noise is a distraction, and if you let it distract you, you’ll fail.” – Kevin O’Leary

But what if it wasn’t that scary because it was only

Klarman: What I learned from Warren Buffett

Seth A Klarman

Wednesday, 4 Feb 2015 | 7:18 PM ETFinancial Times

As Warren Buffett was a student of Benjamin Graham, today we are all students of Warren Buffett.

He has become wealthy and famous from his investing. He is of great interest, however, not because of these things but in spite of them. He is, first and foremost, a teacher, a deep thinker who shares in his writings and speeches the depth, breadth, clarity, and evolution of his ideas.

He has provided generations of investors with a great gift. Many, including me, have had our horizons expanded, our assumptions challenged, and our decision-making improved through an understanding of the lessons of Warren Buffett.

More from the Financial Times:

Warren Buffett: Know when to hold ’em

Murdoch loses Saudi ally at News Corp

ECB raises heat on Athens with curb on cash for banks

- Value investing works. Buy bargains.

- Quality matters, in businesses and in people. Better quality businesses are more likely to grow and compound cash flow; low quality businesses often erode and even superior managers, who are difficult to identify, attract, and retain, may not be enough to save them. Always partner with highly capable managers whose interests are aligned with yours.

- There is no need to overly diversify. Invest like you have a single, lifetime “punch card” with only 20 punches, so make each one count. Look broadly for opportunity, which can be found globally and in unexpected industries and structures.

- Consistency and patience are crucial. Most investors are their own worst enemies. Endurance enables compounding.

- Risk is not the same as volatility; risk results from overpaying or overestimating a company’s prospects. Prices fluctuate more than value; price volatility can drive opportunity. Sacrifice some upside as necessary to protect on the downside.

- Unprecedented events occur with some regularity, so be prepared.

- You can make some investment mistakes and still thrive.

- Holding cash in the absence of opportunity makes sense.

- Favor substance over form. It doesn’t matter if an investment is public or private, fractional or full ownership, or in debt, preferred shares, or common equity

- Candour is essential. It’s important to acknowledge mistakes, act decisively, and learn from them. Good writing clarifies your own thinking and that of your fellow shareholders.

- To the extent possible, find and retain like-minded shareholders (and for investment managers, investors) to liberate yourself from short-term performance pressures.

- Do what you love, and you’ll never work a day in your life.

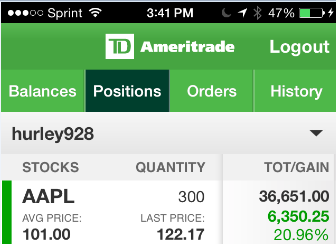

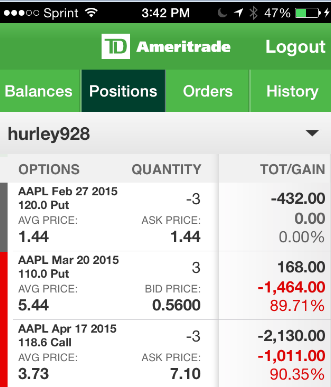

I had an interesting conversation about AAPL today:

I want to go over knowing your position !!!!!!!!!!!!!!!!!!!!!!!!!

AAPL BTO @ $101 and currently trading at $122.17

AAPL BTO $110 Long Put $5.44

AAPL Closed $2.79 Short Put @115

AAPL STO Short Put @ 120 for $1.44

AAPL STO 118.60 April Short call for $3.73

Stock is up $21.17 but they have to sell at $118.60 Plus a $3.73 = HAVE TO SELL AT NET $122.33

They were willing to pay $5.44 for the long put protection that we have shorted against for a booked credit of $2.79 and have an addition credit of $1.44 by Feb 27th and still have time to continue to short (2.79 + 1.44=$4.23)

I was waiting for a close above $120 before I make any bullish adjustments to the trade

What bullish adjustments can I make?

I can roll the covered call out an up for a net credit or break even to increase stocks profit.

I could continue to roll the short puts up and chase the stock higher

BTO new Leap 121.43 Jan 16 long calls 5 contracts to spend $12.85 per contract or $6425

What’s happening this week and why?

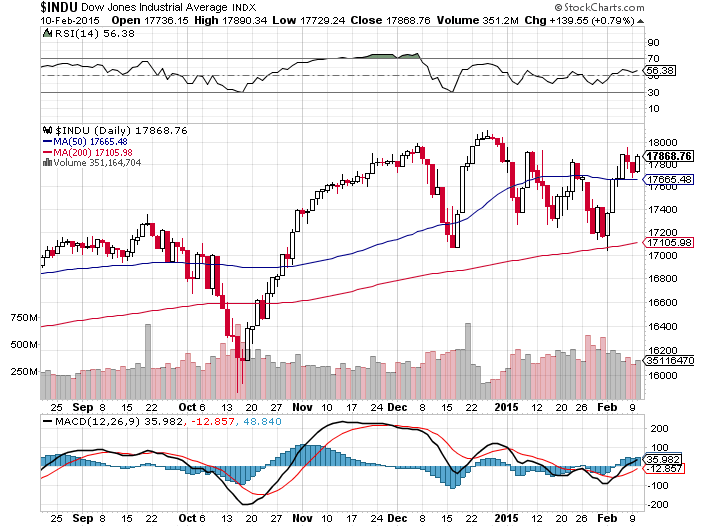

Oil, Greece, and Earnings are ruling the trends

First up day today in after 3 down days

Where will our market end this week?

All depends on DGP Frinday for DE:FR:EMU

DJIA – Technically Bullish holding the 50 SMA as support

SPX – Technically Bullish holding the 50 SMA

COMP – Technically Bullish holding the 50 SMA

Where Will the SPX end January 2015?

02-10-2015 Feb will finish at new market highs

02-03-2015 Feb will finish at new market highs

01-27-2015 Feb my guestimate is 2050 or slightly positive

What is on tap for the rest of the week?=

Earnings:

Tues: CVS, DF, GNW, KO, USNA, Z

Wed: BIDU, NVDA, AOL, AMAT, CTL, CSCO, FEYE, MOS, NTAP, OC, PNRA, PCP, TSLA, WFM, TRIP, TWX,

Thur: AAP, AIG, APA, CAB, CBS, DBD, GNC, K, KRFT, VG, ZNGA

Fri: VFC, TRW, SJM

Econ Reports:

Tues: Wholesale Inventories, Jolts Job Openings

Wed: MBA, Crude, Treasury Budget

Thur: Initial Claims, Continuing Claims, Retail Sales, Retail Ex-Auto, Business Inventories

Fri: Export, Import, Michigan Sentiment

Int’l:

Tues – FR: Industrial Production

Wed – JP: PPI, Machine Orders,

Thurs – EMU: Industrial Production

Friday – FR:DE:EMU: GDP Flash, EMU: Merchandise Trade

Sunday – JP: GDP

How I am looking to trade?

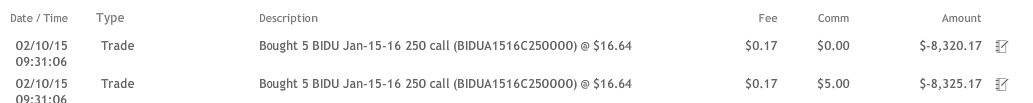

Still Have BIDU, NVDA, with Wednesday earnings. Most of my stocks are thru earnings:

I have some stock only positions – DIS, AAPL, F, MS, SBUX, D,

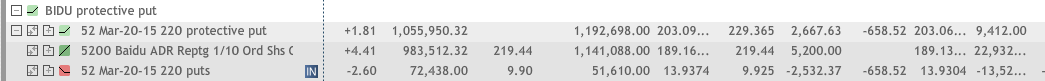

I have Protective puts on AAPL, LNCO, ZION,

Still IN collars for – BABA, BIDU, NVDA, FB, SNDK, MU

Covered Calls on – VZ, WBA, BAC, C,

Extra set of Puts with a 2 to 1 ratio of puts to stock ownership on – BABA

1st I am creating my earnings list so I don’t miss an earnings for a company I trade

BIDU – 02/11 AMC

CLDX – 03/02 BMO

LNCO – 02/26

NVDA – 02/11 AMC

WBA – 03/24

PCLN – 02/19

NKE – 3/19

RHT – 3/26

MU- 4/2

Questions???

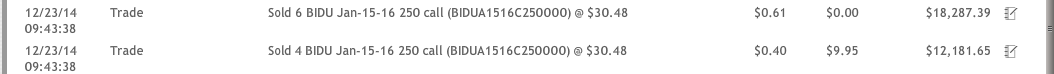

30.48 – 16.64 = $13.84 of profit that paid for

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

U.S. consumer spending falls 0.3%, biggest drop since 2009

European stocks complete their best month since 2011

Fed expresses monetary-policy ‘patience’ and shows no sign of rate-hike wavering