HI Financial Services Commentary 11-04-2018

You Tube Link: https://youtu.be/Wt5VJRc29os

What I want to talk about today?

Elections – Will the Democrats win the House

Nothing on the horizon to do but wait for the after election market movements

The Market LOVES CERTAINTY

I ALSO, have a new way I am currently working my technical analysis – Pivot points (resistance and support levels) and Williams %R

What happening this week and why?

Elections and will look at our markets Wednesday pending the markets reaction

Home builders reporting – BZH, DHI, with Home Depot

One of the stocks I trade is DIS – looking for a $122 to $125 pop in the stock on again movie revenues

Where will our markets end this week?

???? 100% dependent on election reactions BUT people, investors, fund managers seems to be getting out of the way from the moving train

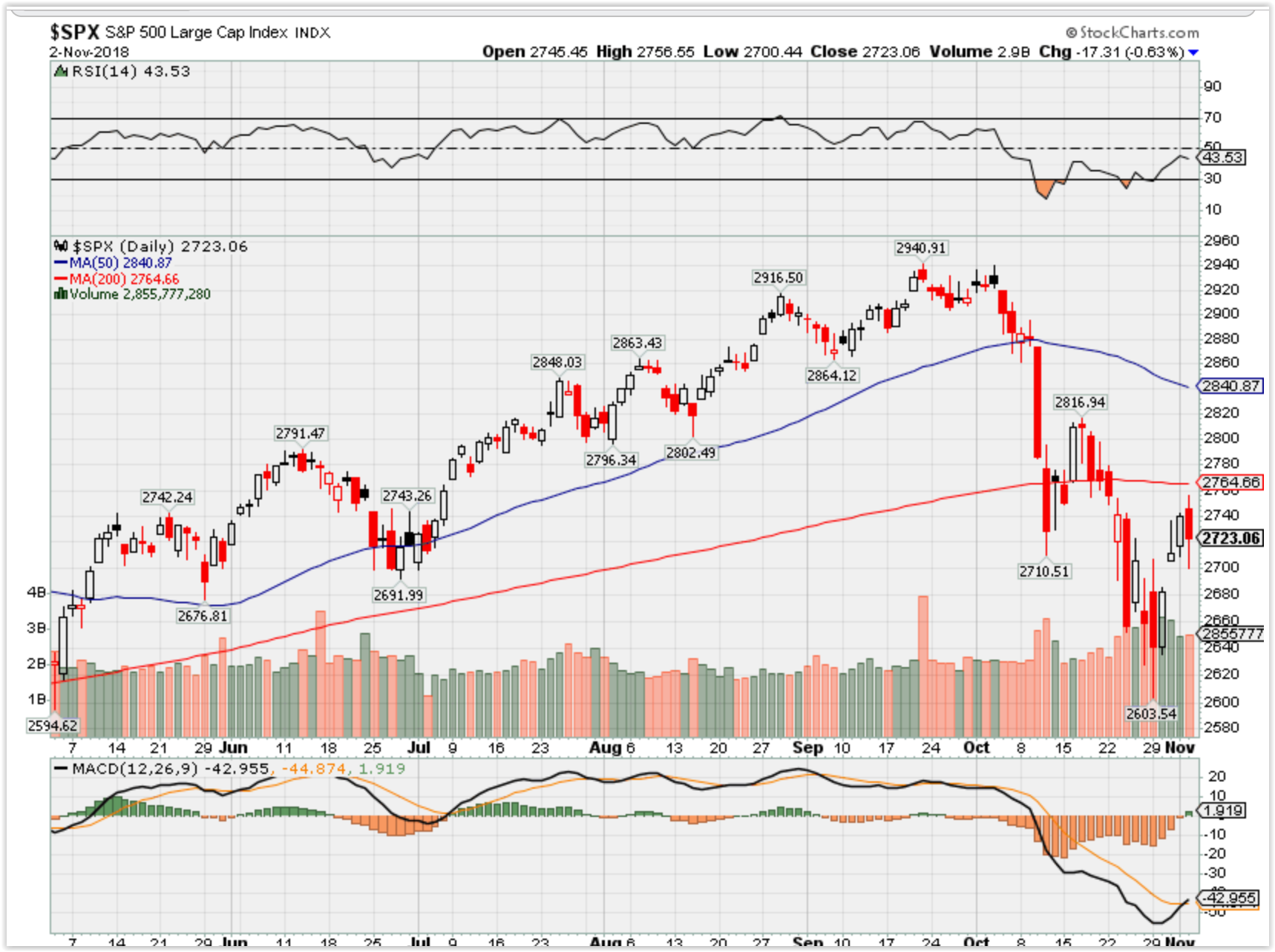

DJIA – BEARISH

SPX – Bearish

COMP – Bearish

Where Will the SPX end November 2018?

11-04-2018 +2.5%

Earnings:

Mon: L, SOHU, MOS, P

Tues: AAP, BZH, HD, JD,

Wed: HUM, KORS, ODP, CTRP, MRO, MUR, NUS, QCOM, SQ, WYNN

Thur: CAH, CROX, DHI, JCI, ATVI, CTL, YELP, DIS

Fri:

Econ Reports:

Tues: Jolts

Wed: MBA, Consume Credit

Thur: Initial, Continuing, FOMC Rate Decision Statement

Fri: PPI, Core PPI, Michigan Sentiment

Int’l:

Tues – EUR: Services PMI

Wed – JP: Leading Indicators, EUR: Retail Sales,

Thursday – CN: Trade Balance, Trade Balance with the US

Friday- CN: PPI, CPI

Sunday –

How am I looking to trade?

Protect the Stock Positions for earnings

AAPL 11/01 AMC

AOBC 12/06

BABA 11/02 BMO

DIS 11/08 AMC

MRVL 11/29

RHT 12/19

If possible I will be rolling protection up to ATM prices for most if not all of my equity positions

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Michael Virden’s Blogspot OCT Recap – http://mvirden.blogspot.com/

If possible I will be rolling protection up to ATM prices for most if not all of my equity positions

https://www.cnbc.com/2018/10/26/theres-a-major-reason-for-this-stock-sell-off-the-dollar.html

There’s a major reason for this stock sell-off that people are missing, and it’s only getting worse

- Executives are talking about challengesto their business they didn’t face just a few months ago. One of the biggest, they said, is the rising U.S. dollar.

- A widening gulf between the U.S. dollar and several foreign currencies is weighing on sentiment for U.S. companies trying to sell their goods overseas.

- Anheuser-Busch, 3M, Illinois Tool Works, UPS and PPG Industries have specifically cited currency as negatively impacting results and their outlook.

Published 6:51 AM ET Fri, 26 Oct 2018 Updated 6:33 PM ET Fri, 26 Oct 2018CNBC.com

The October stock market sell-off has been puzzling to many investors because most companies are riding high on business confidence and a tax-cut windfall.

Plus, profit growth has been solid, and many companies have been beating expectations on strong sales numbers and a positive outlook.

But one real worry cited on post-earnings conference calls is the rising U.S. dollar, which makes business overseas more expensive for U.S. companies. The strong dollar was cited by companies as varied as Anheuser-Busch and PPG Industries.

And it’s a problem that is only getting worse. The gains in the U.S. Dollar Index, a measure of the greenback against a basket of major currencies, are accelerating, up another 2 percent in the last one month. By no coincidence, the S&P 500 has headed lower at the same time.

3M revised its earnings per share estimate to include a 5 cent per share hit from currency translation. It previously had factored in a gain of 10 cents a share. And United Parcel Service said currency fluctuations could be a drag of $35 million to $45 million in the fourth quarter.

Add that to rising interest rates, rising fuel costs and the early effects of tariffs on imports of steel, aluminum and other manufacturing materials, and executives have struck a more cautious tone for the near term, though the overall message is still positive.

The dollar was higher versus most currencies again on Friday morning as stock futures pointed to another big drop.

“The market doesn’t believe 2019 growth is going to be anywhere near what it is expected to be,” said Nick Raich, CEO of research firm Earnings Scout.

Raich adds that there’s no evidence any of these fears will come true. Estimates for 2019 first- and second-quarter earnings have actually inched up, he said. And revenue growth of 8 percent for the S&P 500 companies that have reported so far is outpacing expense growth.

‘Unfavorable impact’

Anheuser-Busch on Thursday slashed its dividend in half and said beer sales fell during the third quarter. Currency volatility is a challenge for the brewing giant, which bought U.K.-based SABMiller in 2016. “In the last six months, we’ve seen a lot of [currency] volatility,” Chief Financial Officer Felipe Dutra told reporters on a conference call Thursday, as reported by Reuters. “This scenario triggers some sort of uncertainty and at a certain point … we thought it was the right time to adjust the dividend.”

PPG, an industrial bellwether, said currency turned into a headwind the third quarter as the dollar strengthened. Currency translation lowered sales $80 million and pretax income took a hit of $15 million. It also said sales could be cut $50 million to $60 million in the fourth quarter because of the “unfavorable impact” of currency translation.

Illinois Took Works said year-over-year earnings growth of 11 percent, to $1.90 per share, was on the high end of its range but included 3 cents a share of “unfavorable currency translation impact.”

Companies have had to adjust to account for the stronger dollar. “We’ve taken some other actions around the emerging markets and initiatives to ensure that we can overcome that,” UPS CFO Richard Peretz said on a call with analysts. “That’s one of the reasons we’ve called out the guidance for the total company to remain where we expect it to be even given this new headwind.”

Currency isn’t the only extra cost companies are facing. On Thursday, Southwest Airlines reported record third-quarter profit that beat expectations, then burst the bubble by saying its costs were going up more than expected, largely because of fuel. American Airlines said a 42 percent increase in fuel costs ate into its third-quarter profit despite record revenue.

More than one-third of companies reporting earnings so far have mentioned the Trump administration’s tariffs. Harley Davidson said it will pay at least $40 million more this year to cover such costs.

Estimates for next year reflect optimistic company guidance on sales and their ability to pass some of the higher costs on to customers, Morgan Stanley analysts said in a note last week. But tech is more vulnerable to profit-margin pressure, they said, as are consumer discretionary and transportation stocks.

Texas Instruments, like other semiconductor companies, is also seeing weakness ahead. While it beat profit expectations, it issued a weaker fourth-quarter outlook blaming slower demand. “We are heading into a softer market,” CFO Rafael Lizardi said on a conference call this week. “We believe this is mostly driven by a slowdown in semiconductors.” That slowdown, executives said, comes after several years of strong growth.

Ford CEO Jim Hackett says fixing carmaker’s problems starts with identifying them

- Following the May 2017 ouster of Mark Fields, Ford’s new CEO Jim Hackett launched what was billed as an intense, 100-day deep-dive aimed at addressing Ford’s problems.

- Yet, as 2018 rapidly comes to a close, Hackett has offered relatively few, and often inscrutable, indications of what he has in mind.

- Investors and Ford’s own executives are trying to understand precisely what directions he wants them to move in.

Paul A. Eisenstein | @DetroitBureau

Published 11:01 AM ET Sun, 28 Oct 2018 Updated 10:05 AM ET Mon, 29 Oct 2018CNBC.com

When Tesla delivered a rare and unexpected profit on Wednesday, investors went wild. Even some of CEO Elon Musk’s harshest critics sounded surprisingly bullish.

The California carmaker’s stock surged by 9.1 percent the next day and another 5 percent Friday.

Ford also reported better-than expected earnings for the third quarter, sending the shares up 9.9 percent the next day. But the celebration was short lived. The shares fell slightly on Friday as the Detroit automaker’s stock continues to languish below $10 a share, in territory it hasn’t seen in years.

At $991 million, Ford’s profit was more than three times that of Tesla’s. The electric carmaker’s earnings, however, told a very different story than Ford.

CEO Elon Musk finally appears to be delivering on expectations that Tesla can revolutionize the auto industry, or at least reliably turn a profit. With Ford, analysts and investors are yet to be sold on the $11 billion grand turnaround plan first promised by Jim Hackett when he was named Ford CEO in a broad management shake-up nearly 18 months ago. Its $991 million in profit fell 37 percent from the prior year.

Following the May 2017 ouster of Mark Fields, Hackett launched what was billed as an intense, 100-day deep-dive aimed at addressing Ford’s problems. Yet, as 2018 rapidly comes to a close, the former CEO of furniture-maker Steelcase has offered relatively few, and often inscrutable, indications of what he has in mind, leaving not only outsiders, but insiders at all levels, trying to understand precisely what directions he wants them to move in.

“A lot of us are asking the same question,” a senior Ford executive, who asked not to be identified, told CNBC. “I just have to work on rallying my troops and hope we’re all moving in the same direction

Critical moves

Hackett himself left plenty of folks scratching their heads during an earnings conference call with analysts and reporters Wednesday. Asked about his strategy, the former University of Michigan football player said “it’s not a restructuring plan it’s a redesign plan. First we have to identify the areas that need to be fixed, then we have figure out how to fix them and then execute.”

Under his guidance, Ford has made several critical moves. Hackett announced a shake-up of its struggling Chinese operations last week, appointing Anning Chen, an experienced auto executive, as the unit’s new president and CEO. And Hackett’s also formed several potentially far-reaching alliances. One with Mahindra Group, could help it crack into the promising Indian market. Another, with Volkswagen AG, ostensibly will focus on the lucrative commercial vehicle market.

The latter alliance has peaked interest across the auto industry, the always-active rumor mill questioning whether it could lead to a broader tie-up. Just don’t expect a latter-day equivalent of the ill-fated Daimler Chrysler “merger of equals,” or even something on the order of the Renault-Nissan-Mitsubishi Alliance, Ford chief spokesman Mark Truby told CNBC. “We are not considering any equity swap or cross-ownership.”

For those truly familiar with the history of Ford, that should come as no surprise. There are few who truly believe the controlling Ford family, heirs of founder Henry, would willingly relinquish control. Indeed, insiders say that was a key reason the second-largest domestic automaker chose not to follow cross-town rivals General Motors and Chrysler into bankruptcy at the beginning of the decade, despite the potential of wiping out billions of dollars in debt.

Ford family

Ultimately, all things Ford Motor Co. must win the approval of the Ford family and, for the moment, CEO Hackett appears to retain their confidence. But for how long is the question if he cannot deliver on expectations of a turnaround.

To pull it off, the 63 year-old executive has a handful of key issues he will need to address but, to a large degree, one-time Ford President Lee Iacocca might have summed it up best when he long ago explained that, “There are just three things that matter in the auto industry: product, product and product.”

That’s never been more obvious than in North America. Ford largely has it right on the truck side of its line-up. For more than three decades, the big F-Series pickup has been the best-selling product line in North America, and the automaker is a force to be reckoned with in the utility vehicle market, as well. But even here, there are unwelcome holes in the mix.

Ford was one of the many manufacturers who abandoned the midsize pickup segment after shutting down the Twin Cities plant in Minnesota that built its dated Ranger model in 2012. While General Motors and Honda rushed back into what turned out to be a resurgent market, Ford planners dithered like Hamlet and the company will only launch a new generation Ranger in January.

“We can’t go back and change the past,” Ford President of the Americas Joe Hinrichs said at an event last week marking the relaunch of Ranger production in the U.S. “But we think the market is big enough that there will be room for everybody.”

Trucks over sedans

The reborn Ranger will be joined in 2020 by the return of the Bronco, a once-popular Ford SUV that was discontinued in the late ’90s. Both models will be assembled at the Wayne plant which was, until recently, producing both the compact Focus sedan and C-Max people-mover. With the exception of the classic Ford Mustang “pony car,” those and the rest of the automaker’s passenger car line-up are in the process of being phased out, perhaps the single boldest – and controversial – move authorized by Hackett.

There’s no question that sedan sales have tumbled as millions of American buyers have shifted to sport-utility vehicles and crossovers. But key competitors, including GM, as well as import powerhouses Toyota, Nissan, Honda and Hyundai, are, if anything, redoubling their focus. And Stephanie Brinley, a principal analyst with IHS Markit, is skeptical of Ford’s decision. “The sedan market isn’t great, but it’s still large and Ford simply didn’t do what’s necessary to compete” by letting once-strong models like the Focus and bigger Fusion go years without necessary updates, she said.

Even as Ford let its sedans grow old, Joe Phillippi, head of AutoTrends Consulting, contends the carmaker waited far too long to rebuild its once-powerful Lincoln brand. The luxury division will be tested over the next 12 months with the launch of two critical SUVs which will, notably, abandon the unloved and confusing alpha-based naming strategy adopted a decade ago. The new version of the MKT, for one, will now be called the Aviator.

China

Product problems also catch the blame for Ford’s struggle in China, though it didn’t help that the automaker waited for a number of years after key competitors GM and Volkswagen entered what has become the world’s largest car market. When you’re playing a game of catch-up, said Brinley, you better have the products that can make a difference.

Chinese new vehicle sales dipped 11.6 percent in September, the third consecutive monthly decline in a market used to strong, double-digit growth. Ford, however saw a 43 percent drop last month and was off 6 percent for all of last year.

Earlier this month, Ford announced plans to launch what it is billing as a new core model for China, the Territory SUV, with a total of 50 all-new or updated products in the works.

“We’re in really good shape for the launch of these new products,” Jim Farley, president of Ford’s Global Markets said during the earnings call Wednesday. “We have tremendous opportunity to drive better margins in China. “Our turnaround in China is really up to us. It’s about our new products and our costs. The opportunity is in our control,” said Farley.

Whether his optimism proves valid is far from certain, especially in light of Ford’s ongoing promises to fix its China problem.

Confusion

And it has plenty of issues in other key markets, including Latin America and Europe. The Dearborn-based maker insists it won’t walk away from its endlessly troubled European operations, unlike GM which last year completed the sale of its Opel subsidiary to France’s PSA Group. Some observers question whether Ford may try to partner with VW in both Latin America and Europe in hopes of stemming its losses.

Following Hackett’s appointment last year, many observers questioned whether he would remain as committed to Ford’s so-called “new mobility” program as his predecessor Fields. Considering Hackett was a key strategist behind the company’s autonomous driving efforts, it should be no surprise that he has, if anything, redoubled that commitment.

Over the summer, Ford announced plans to build a massive complex for its electrified, connected and self-driving vehicle efforts in Detroit’s Corktown neighborhood, with its headquarters in the long-abandoned Michigan Central train station.

The question is when those efforts will actually pay off, many investors complain. Unlike GM, which has a clear path to revenue through its Maven ride-sharing service, Hackett and his team have yet to lay out a clear strategy for going beyond the R&D stage with its autonomous driving investment.

Brinley said that speaks to Ford’s most basic problem. The company simply hasn’t offered a clear and coherent sense of its strategy is and “because of that, it’s only causing confusion,” both inside and outside the company.

China’s Baidu posts 27 pct revenue growth, beats estimates

Published 4:45 PM ET Tue, 30 Oct 2018Reuters

Oct 30 (Reuters) – China’s biggest search engine operator Baidu Inc reported 27 percent growth in third-quarter revenue on Tuesday, beating analyst expectations, helped by gains in its core advertising business.

July-September revenue reached 28.2 billion yuan ($4.11 billion) from 23.49 billion yuan in the same period a year prior. The result compared with the 27.53 billion yuan average of estimates from 18 analysts polled by Refinitiv.

Net income rose 56 percent from a year earlier to 12.4 billion yuan, the company said.

(Reporting by Cate Cadell in Beijing and Jane Lanhee Lee, San Francisco)

The market is showing a similar pattern to peaks in 2000 and 2007: BofAML’s Stephen Suttmeier

Published 7:55 AM ET Wed, 31 Oct 2018 Updated 8:10 AM ET Wed, 31 Oct 2018CNBC.com

A technical signal bubbling underneath the roiled market’s surface could portend more pain for stocks, BofAML’s Stephen Suttmeier says.

Contracting margin debt coinciding with a market peak suggests rising risk-off sentiment, says Stephen Suttmeier, chief equity technical strategist at BofA Merrill Lynch Global Research. A similar setup was seen before the most significant market crashes of this century.

“In 2000 margin debt topped out. Basically oxygen coming out of the market, people less willing to take risk and that had an impact. You had a higher high in the S&P and then it was lights out until about 2002. The same thing happened in 2007,” Suttmeier said on CNBC’s “Futures Now” on Tuesday.

Margin debt measures how much a trader borrows from a broker to finance a trade. Margin debt petering out as stocks hit new highs suggest a flimsier rally and fewer investors willing to take on more risk, says Suttmeier.

“The risk is if margin debt continues to fall here we could be in a sell-strength market,” he added.

On top of that, the wave of punishing sell-offs this month has dragged the S&P 500 down from its record high set just over a month ago. The benchmark index is down 8 percent this month, its worst performance since May 2010.

“An important level has been broken: the 40-week moving average and the uptrend that goes all the way back to early 2016,” Suttmeier said. “This is not a good sign. … You can get rallies here and there but when you think about what has happened here, investors are pretty darn bearish.”

The S&P 500 had broken firmly below its 40-week moving average into the Brexit vote and the 2016 presidential election, two major risk-off events. It also bumped below during the sell-offs this past February and March but quickly recovered.

Suttmeier marks key support level for the S&P 500 at 2,600, a level it touched during Monday’s sell-off. If it breaks that, Suttmeier sees the next level of support coming in at the 2018 lows at 2,532, still a 6 percent decline from Tuesday’s close.

David Stockman: Epic downturn is here, brace for 40% market plunge

Stephanie Landsman | @stephlandsman

Published 3 Hours AgoCNBC.com

David Stockman warns a 40 percent stock market plunge is closing in on Wall Street.

Stockman, who served as President Reagan’s Office of Management and Budget director, has long warned of a deep downturn that would shake Wall Street’s most bullish investors. He believes the early rumblings of that epic downturn is finally here.

It comes as the S&P 500 Index tries to rebound from its worst month since 2011.

“No one has outlawed recessions. We’re within a year or two of one,” he said Thursday on CNBC’s “Futures Now.” He added that: “fair value of the S&P going into the next recession is well below 2000, 1500 — way below where we are today.”

This is far from the first time he’s issued a dire warning. But this time, he suggests the latest leg down is an early tremor of the pain that lies ahead.

“If you’re a rational investor, you need only two words in your vocabulary: Trump and sell,” said Stockman, in a reference to President Donald Trump. “He’s playing with fire at the very top of an aging expansion.”

According to Stockman, Trump’s efforts to get the Federal Reserve to put the brakes on hiking interest rates from historical lows is misdirected.

“He’s attacking the Fed for going too quick when it’s been dithering for eight years. The funds rate at 2.13 percent is still below inflation,” he said.

Stockman cited the trade war as another major reason why investors should brace for a prolonged sell-off.

“The trade war is not remotely rational,” he said. If the dispute worsens, it “is going to hit the whole goods economy with inflation like you’ve never seen before because China supplies about 30 percent of the goods in the categories we import.”

His latest thoughts came as stocks will try to build on last week’s rebound. The S&P 500 gained 2.4 percent the week ending Nov. 2. However, the index is still down 6.9 percent over the past month.

“We’re going to be in a recession, and we’re going to have another market correction which will be pretty brutal,” Stockman said.

The White House didn’t respond to CNBC for a comment on Stockman’s remarks.

HI Financial Services Mid-Week 06-24-2014