HI Financial Services Commentary 05-09-2017

YouTube Link https://youtu.be/RN0T_d5mLMg

What’s happening this week and why?

Earnings, Fed speakers, Comey getting fired

French Elections ended with communist party winning and didn’t matter

VIX 24 year low !!!!

What is it that causes a 24 yr low?

IS it complacency?=no fear, overly bullish expectations, total passiveness, lack concern for risk

I believe the Fed is now purchasing securities in an index form like they do over in Europe, Market Friendly reforms

Are all central banks backstopping the reserve currency = US Dollar

DIS Down $3 after hours and let’s look at my position to measure the “hurt”

I could expect an 8500 to 10K drop in accounts

Technically speaking it can go down to the 104 horizontal level of support or the $102.50 200 SMA

I’m Excited because I still have the right to sell at 115 and 600 shares at 113

Let’s do the math

On 1000 shares I can sell at $115 for $115,000 and now buy back in at $103

115000/103 = 1, 116.5 shares or in other terms I just picked up 100 shares without having to call and ask for more money to be put into the account so I can dollar cost average.

Where will our market end this week?

Higher

DJIA – Bullish but range bound

SPX – Bullish but sideways range bound

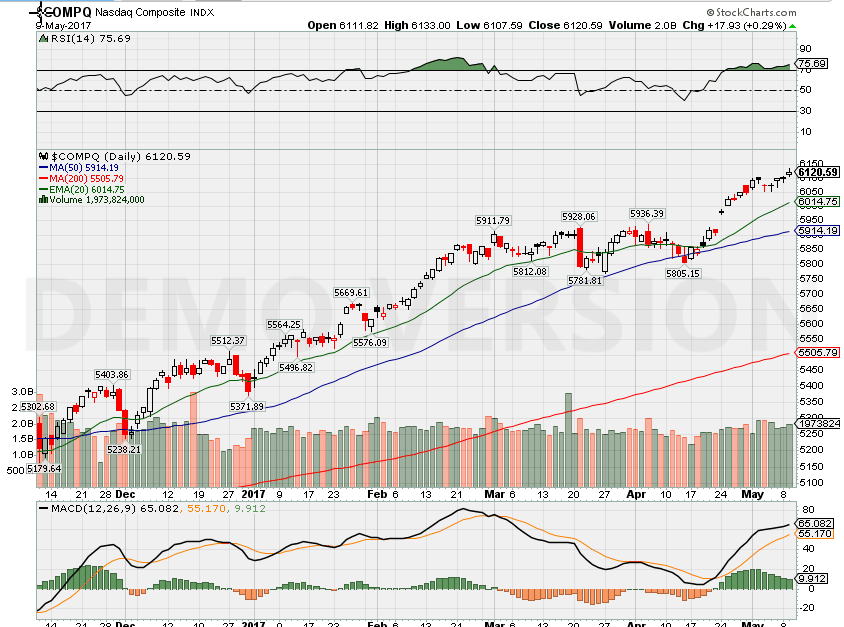

COMP – Overbought bullish

Where Will the SPX end May 2017?

05-09-2017 +2.0%

05-02-2017 +2.0%

What is on tap for the rest of the week?=

Earnings:

Tues: AGN, DF, MDC, ODP, US, FOSL, DUK, NVDA, DIS

Wed: CROX, SODA, TM, WEN, NTES, WFM

Thur: DDS, KSS, MCFT, JWN

Fri: JCP

Econ Reports:

Tues: Jolts, Wholesale Inventories

Wed: MBA, Crude, Import, Export, Treasury Budget

Thur: Initial, Continuing Claims, PPI, Core PPI

Fri: CPI, Core CPI, Retail Sales, Retail ex-auto, Business Inventories, Michigan Sentiment

Int’l:

Tues – CN: CPI, PPI

Wed –

Thursday – GB: BOE Announcement

Friday –

Sunday – CN: Industrial Production, Retail Sales

How I am looking to trade?

Finishing up earnings with Protective puts or collars. Bull Putting the protection when possible

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email