RECORDING Market Commentary 05-04-2016

HI Financial Services Commentary 05-04-2016

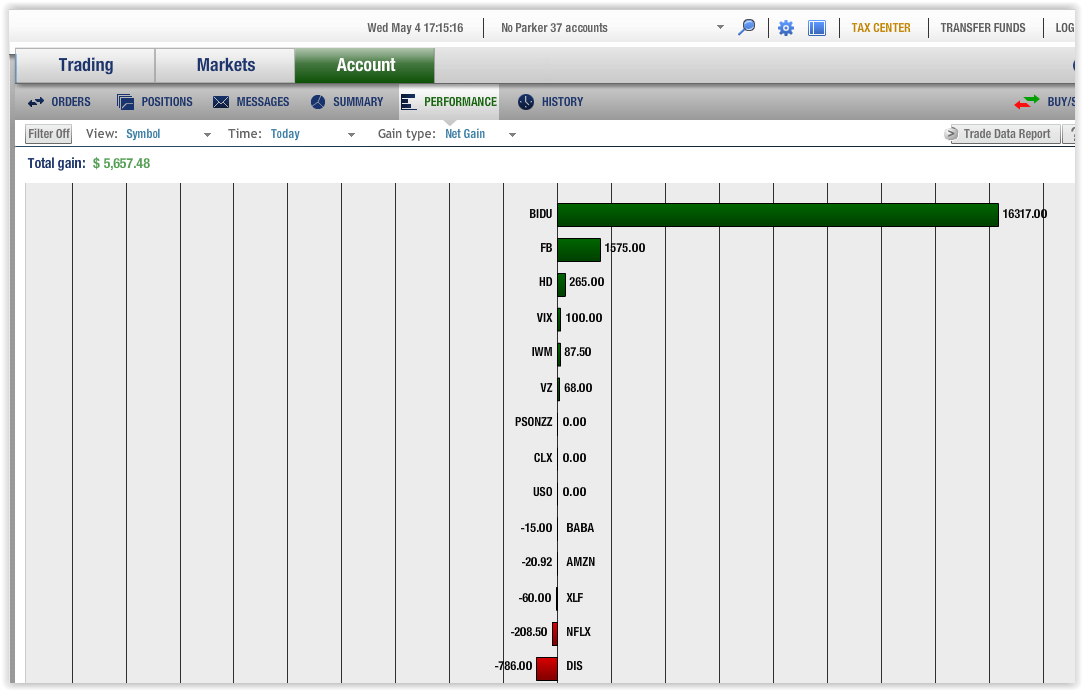

I think that is good. ANYTIME you are beating the market to the downside you are significantly further ahead

6,800,000 and multiply it by the loss today (S&P 500) 0.0059 (half of a percent ish)=$40,120

Plus I’m UP 5,867 for a difference of 46K more money to make more money another day

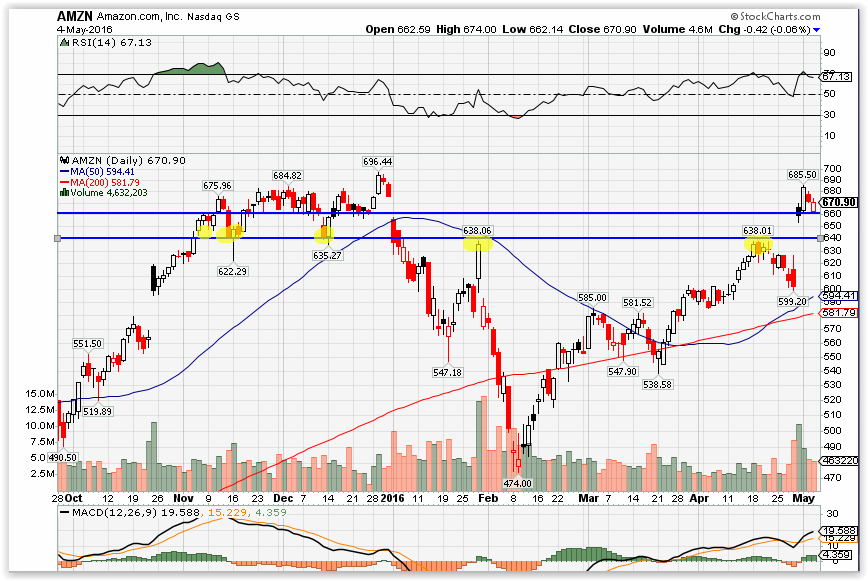

The AMZN 635/640 May 16 Bull put has 16 days left in the trade or 12 trading days with AMZN closing at $670.90

How much is the buffer on this ITM Bull put spread = $30

Today you can $0.77 per contract which is better than Jeffry’s $0.40 to $0.45

I like the Chart

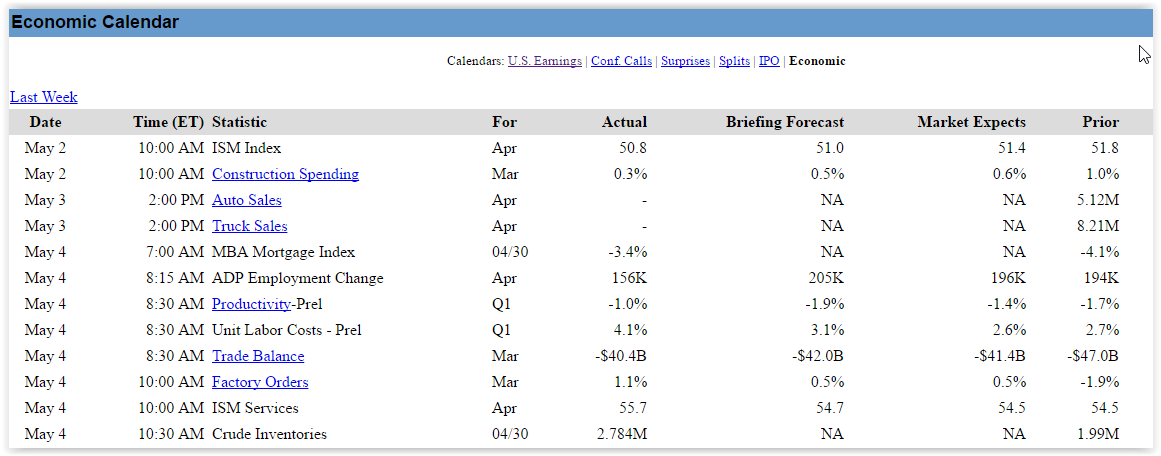

What’s happening this week and why?

China worse than expected growth, PMI, Manufacturing numbers, carryover from last week

ALL Global Manufacturing numbers / cuts on Monday for a weaker global growth outlook

Less than expected revenues, top/bottom line and guidance for earnings

ADP employment number missed big so ……………………

Bad news is BAD news right now

Trump is the GOP candidate with a clear path to the nomination

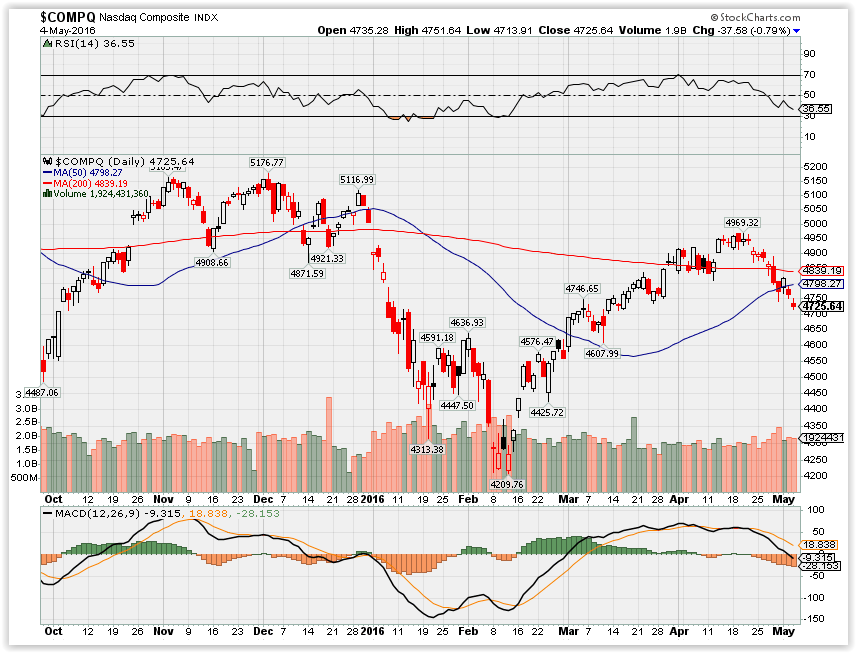

Where will our market end this week?

Down 1% from here

DJIA – Technically bearish indicators but today we bounced off of the 50 SMA

SPX – Technically bearish indicators but today we bounced off of the 50 SMA

COMP – Technically bearish indicators and approaching a 10% correction status

Where Will the SPX end May 2016?

05-04-2016 -2.5%

What is on tap for the rest of the week?=

Earnings:

Tues: CBS, CLX, CMI, CVS, DVN, DUK, EL, GRUB, TAP, MYGN, PFE, S, VLO, ZG

Wed: D, FIT, GDDY, HUM, MRO, MET, MOS, MUR, NBL, TSO, TWX, RIG, ZNGA

Thur: DDD, ATVI, CHK, DWA, LOCO, FEYE, FISV, FLR, GPRO, HLF, JMBA, K, KHC, MRK, MWW, REGN, YELP

Fri:

Econ Reports:

Tues: Auto, truck

Wed: MBA, Crude, ADP Employment, Productivity, Unit Labor Costs, Trade Balance, Factory Orders, ISM Services

Thur: Initial, Continuing Claims, Challenger Job Cuts,

Fri: Average Workweek, Private Payrolls, Non-Farm Payrolls, Unemployment Rate, Hourly Earnings, Consumer Confidence

Int’l:

Tues – ALL: Global Manufacturing

Wed – FR:DE:EMU: PMI Composite, CN: General Services PMI

Thursday – JP: PMI Manufacturing

Friday –

Sunday – CN: Merchandise Trade, JP:BOJ Minutes

How I am looking to trade?

Went through earnings and I’ve KEPT Long Puts to protect in the sell in May go Away mentality

Rolled Protection on DIS to 105 June Strike from 97.50 June Strike cost $2.85 ish

Rolled F from 12.75 to 13.50 and 13.75

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email