RECORDING HI Financial Services Commentary 04/13/2016

HI Financial Services Commentary 04-13-2016

I love it when a plan comes together. – Hannibal Smith – A-Team

Dinner with the Sitze Family over the weekend.

What do “professional” money managers use for a trading instrument?

Guessing, Crystal ball, back testing, ASSET Allocation model based on historical averages

Their portfolio management ended when they put you into the fund.

Don’t worry! You’re in for the long haul.

The PROBLEM: What’s wrong with a historical average?

It’s Just an Average

A $1 stock goes up 50% and down %50 = 0% historical Average

How much is the dollar worth? $1 up 50% = $1.50 then down 50% = $0.75

What’s a 25% historical average return on $1

Well, $1 goes up 75% = $.175 and then loses 50% for a 25% historical average GAIN = 1.75*0.50 = $0.875

What if it lost 50% first= $1 = $0.50 * 1.75 = $0.875

Morgan Stanley on a well-diversified blue chip stock fund made Down 14.9%

If you back out a 3% bond fund loss, and 2% currency loss, and 0.5% S&P 500 loss how much are fees?

3+2+.5= 5.5 then 14.9 – 5.5= 9.4%

BUT why not get something while you wait or as stocks fall down instead of worry with a little heart ache?

Why not pick up shares or lower cost basis or be able to sleep at night

When AA reported you built an earnings list on companies you trade

AAPL 4/25 AMC

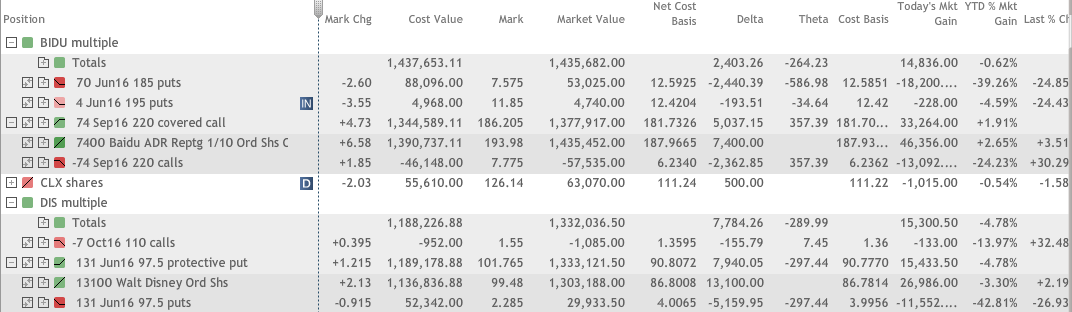

BIDU 4/28 est

BABA 5/5 est

DIS 5/10 est

F 4/28 BMO

FB 4/27 AMC

NFLX 4/18 AMC

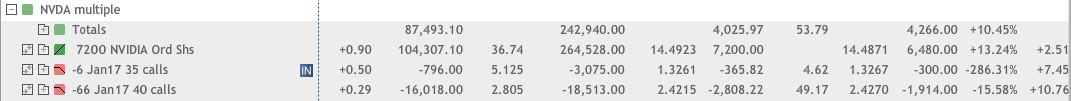

NVDA 5/5 est

SNDK 4/27 AMC

V 4/21 AMC

VZ 4/21 BMO

HD 5/17 BMO

ZION 4/25 AMC

What’s happening this week and why?

Treasury Budget -108.0B vs est -52.9B

Export .3/ vs est -.4

Imports -.1 vs est -.1

MBA 10.0%

Core PPI -.1 vs est .2

PPI -.1 vs est .3

Retail Sales -.3 vs est .2

Retail ex-trans .2 vs est .4

Business inv -.1 vs est -.1

Where will our market end this week?

Lower – 2 Reasons

Options expiration, The Middle East OPEC meeting

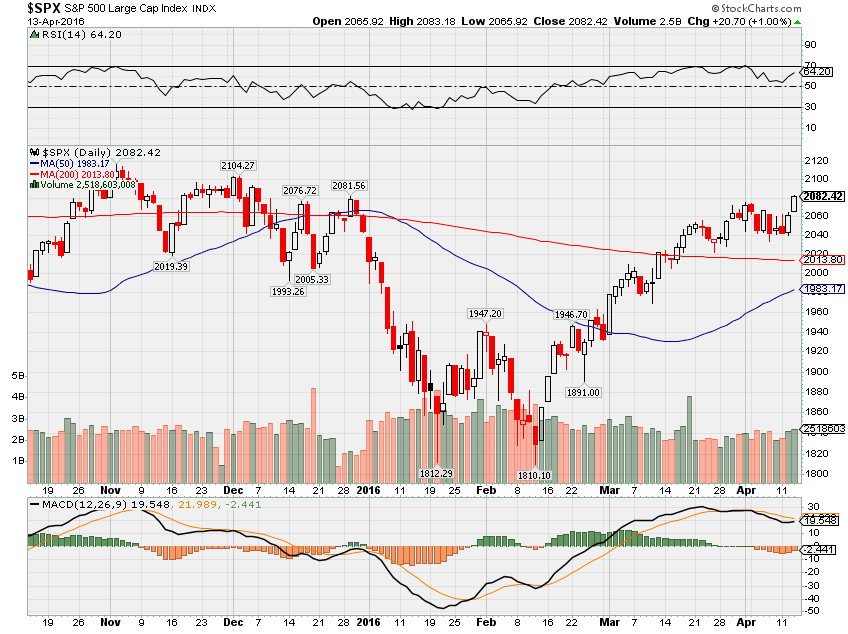

DJIA – We have mixed signals, uncertainty, and close to an overbought indicator on the RSI

SPX – We have mixed signals, uncertainty, and close to an overbought indicator on the RSI

COMP – Mixed signals here

Where Will the SPX end April 2016?

04-13-2016 +2.5%

04-06-2016 +2.5%

What is on tap for the rest of the week?=

Earnings:

Tues: CSX, FAST

Wed: JPM, PIR

Thur: BLK, DAL, PNC, WFC

Fri: SCHW, C, FHN, STX,

Econ Reports:

Tues: Treasury Budget, Import, Export

Wed: MBA, Crude, Fed Beige Book, Core PPI, PPI, Retail Sales, Retail ex-auto, Business Inventories

Thur: Initial, Continuing Claims, Core CPI, CPI

Fri: Empire Manufacturing, Capacity Utilization, Industrial Production, Michigan Sentiment, Baker-Hughes Rig Count

OPTIONS EXPIRATION

Int’l:

Tues – CN: Merchandise Trade

Wed – EMU: Industrial Production

Thursday – CN: GDP, Industrial Production, Retail Sales, GB: BOE Announcement and Minutes, EMU:HICP

Friday –

Sunday –

How I am looking to trade?

I’m set for earning sand my big question is do I roll protection to a higher price (strike price)

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Facebook: 2 Reasons For Caution $FB

http://www.seekingalpha.com/article/3965245

Disney Is In Good Hands

Ford takes market share in Europe

Disney Park Activist Play With 200% Return Potential

Dreamy talk from Motor Trend on the Apple Car

Facebook: user growth is massive, but messenger monetization is still early days – Deutsche Bank

Ignore The Noise, Facebook Delivers

http://seekingalpha.com/article/3964985-facebook-ignore-noise#alt1

10 Reasons You Can’t Short Facebook – Hold Rating Now But Looking To Go To Buy Rating

HI Financial Services Mid-Week 06-24-2014