HI Financial Services Commentary 02-27-2018

You Tube Link: https://youtu.be/JjbYbBxsxJA

What I want to talk about today?

Volatility – Movement of the S&P (VIX) over the next 30 days, movement of stock prices up and down in a quicker than expected manner – Flash crash, program trading, stop loss drops, news,

What do you do?

Because if you sell without a doubt you know it will most likely ( probability) that the stock will close higher than the price you sold it for that day

Stop Losses – are a market order when a stock drops below a certain price and in NO WAY guarantees the sale at the price you indicated in your order.

TOO pricey to BUY protection when it is happening you NEED to SELL PREMIUM

118

Blog/Training Tools

Posted Feb 19, 2018 by Martin Armstrong

QUESTION: Dear Martin,

In the private blog you mentioned a few times that the volatility will rise again in the week of the 12th. When you mention volatility, do you mean volatility as measured by the VIX index?

So far the VIX has lost around 1/3 this week so I suppose you mean something else?

Thanks!

JWD

ANSWER: The VIX is not a true indicator of volatility. We have three main volatility measurements and each is different.

(1) you have the traditional measurement of close to close. That is interesting, but it does not truly capture the concept of volatility.

(2) Then there is intraday volatility which we measure and simply the percentage movement between the high and low of that session. You can have a 1,000 point swing in the Dow intraday yet close nearly unchanged. The first volatility measurement would never even show a blip.

(3) The third measurement is overnight volatility. This is measured from the previous close to the open of the current day session. For example, Monday, February 5th the Dow opened at 25337.87 compared to Friday’s closing of 25520.96 gapping down.

Our indicators are intended for trading, unlike the VIX. In our Arrays, you will see Overnight Volatility, Intraday Volatility, and Panic Cycles, which are extreme moves in one direction or an outside reversal which exceeds the previous session high and penetrates the previous secession low.

The VIX is a convoluted formula that does not reflect trading but more of a trend lending itself to manipulations. Hence, the VIX is not very reliable. The VIX is a measure of expected volatility calculated as 100 times the square root of the expected 30-day variance (var) of the S&P 500 rate of return. The variance is annualized and VIX expresses volatility in percentage points.

where var = (365/30) x Expected 30-day variance.

The 30-day variance is the sum of squared standard deviations st (“volatilities”) of the S&P 500 rate of return at every point in time t during the 30 days:

What happening this week and why?

Where will our markets end this week?

Higher

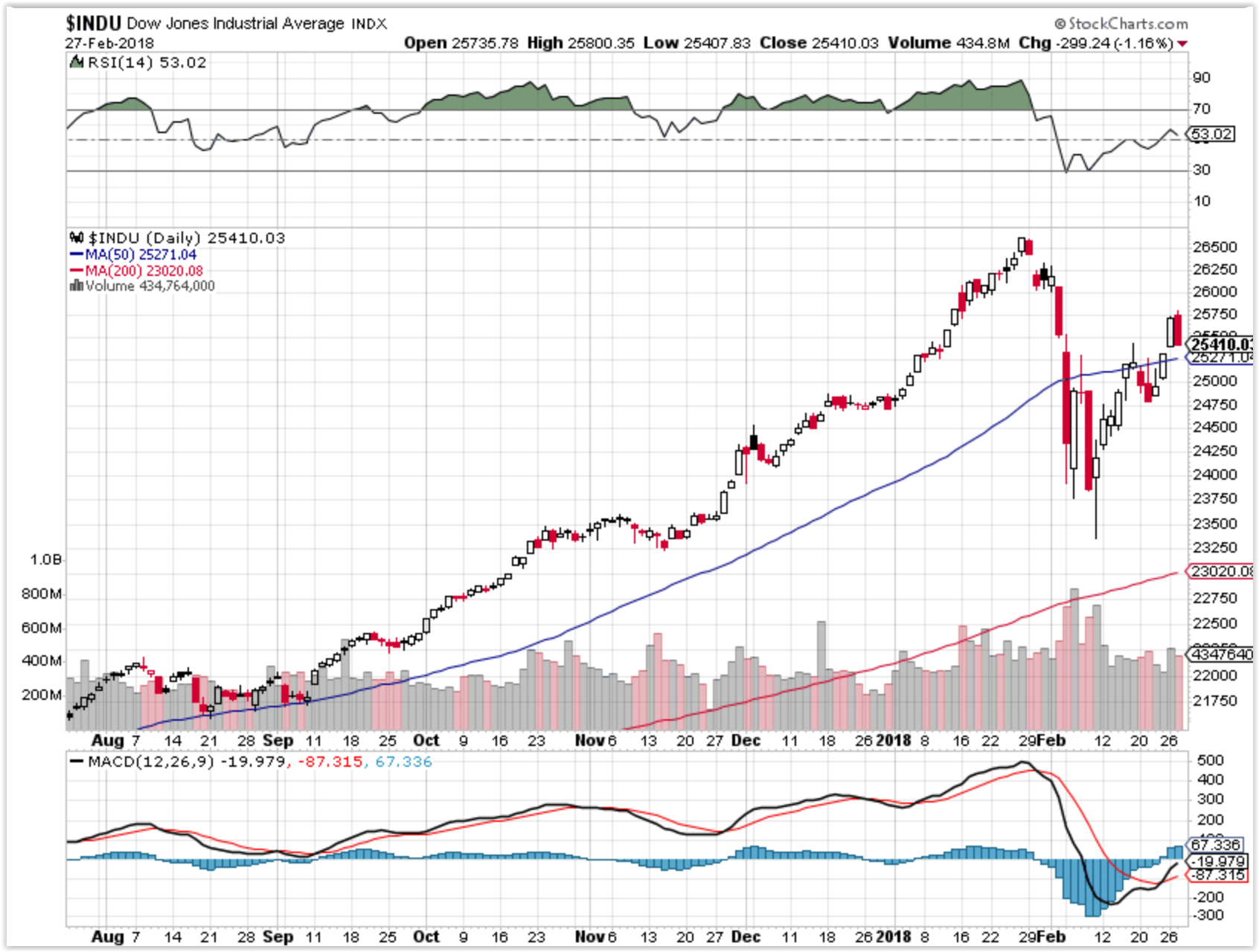

DJIA – Still Bullish, 50 SMA held and we only gave up yesterday’s gains

1 month return for -4.53%

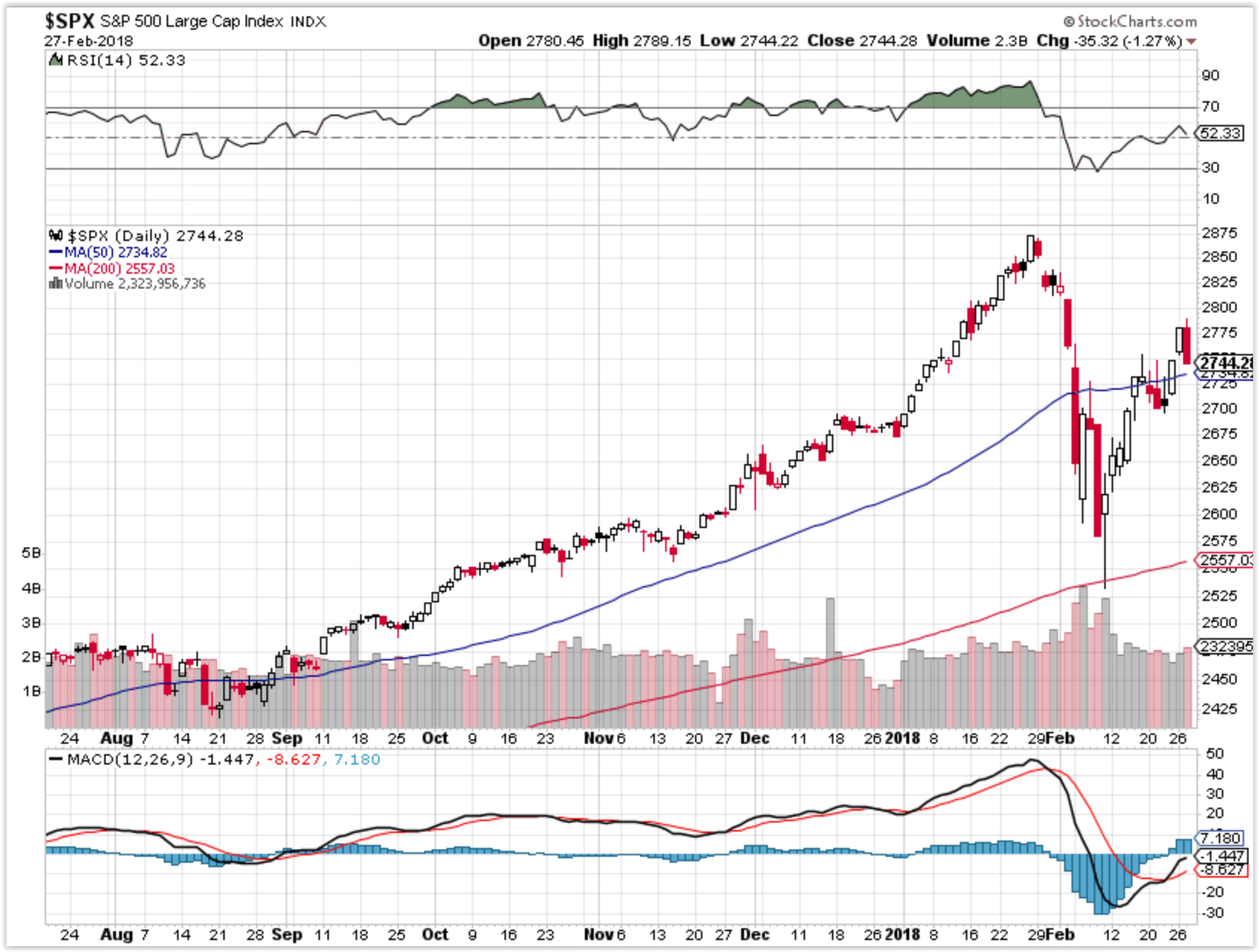

SPX – Still Bullish, 50 SMA held and we only gave up yesterday’s gains

1 month return for -4.48%

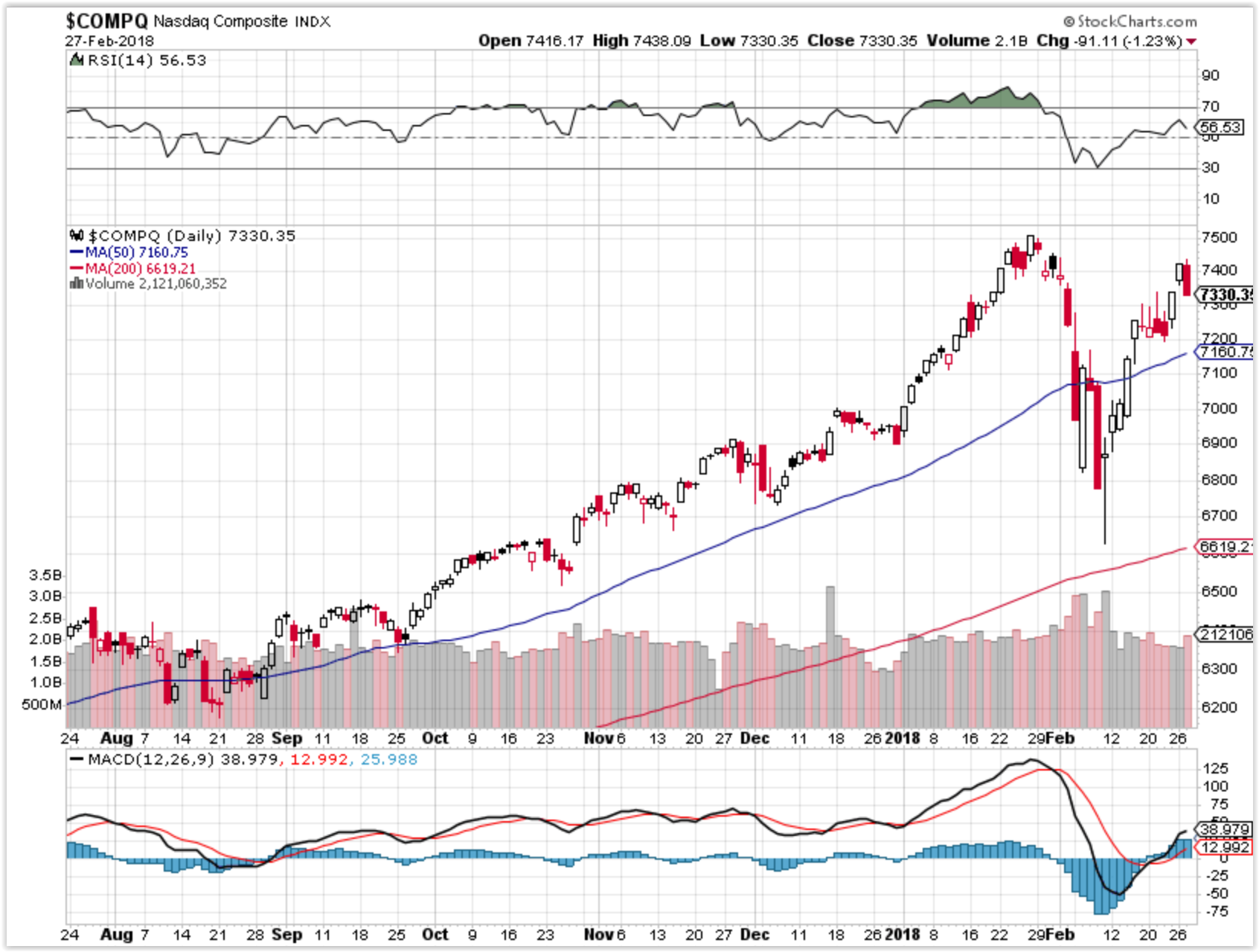

COMP – Still Bullish, 50 SMA held and we only gave up yesterday’s gains

1 month return for -2.34%

Where Will the SPX end March 2018?

02-27-2018 -3.0%

What is on tap for the rest of the week?=

Earnings:

Tues: AZO, M, TOL, HTZ, PZZA,TIVO

Wed: CHS, CROX, LOW, ODP, TJX, LB, MNST, CRM

Thur: AMC, BUD, BBY, BURL, KSS, DDS, GPS, JWN, VMW

Fri: BIG, FL, JCP, JD

Econ Reports:

Tues: Durable Goods, Durable ex-trans, FHFA Housing Price Index, Consumer Confidence

Wed: MBA, GDP, GDP Deflator, Chicago PMI, Pending Home Sales,

Thur: Initial, Continuing Claims, Personal Income, Personal Spending, PCE Prices, PCE Core, ISM Index, Construction Spending, Auto, truck

Fri: Michigan Sentiment

Int’l:

Tues – CN: CFPL Manufacturing PMI

Wed –

Thursday –

Friday-

Sunday –

Questions???

Yes owning AAPL is a valuje investments with more potential upside

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

How am I looking to trade?

Last week with Options expiration cashed in long puts, added shares, added shrot calls and have YET to add long put protection

AOBC – 03/01

KMX – 04/04 BMO

SODA 02/14

Bonds are entering a rising rates cycle for the first time since the 1940s, which could be ‘worrisome’

Published 5:01 PM ET Sun, 18 Feb 2018 Updated 6:46 PM ET Mon, 19 Feb 2018CNBC.com

Bid farewell to the bond market bull run, because the markets are entering a phase not seen in 72 years: A rising rates cycle.

“The 36-year falling rates cycle, in our opinion, is over,” Louise Yamada, managing director of Louise Yamada Technical Research Advisors, told CNBC’s “Futures Now” on Thursday.

Since hitting an all-time of 15.84 percent in September 1981, the yield on the U.S. 10-year has been steadily declining. Yields hit lows of 1.36 percent in July 2016. Since then, however, it appears the downtrend has broken, says Yamada.

The next test for yields will be the 3 percent level. At that point, it will have been confirmed technically that the yields have hit a floor, and that a new rising rate cycle is in place, says Yamada.

“We’re looking for 3 percent to be crossed and that will, from a long-term perspective, define the initiation of a new rising rate cycle which we haven’t seen since 1946,” said Yamada.

‘A bit more worrisome’

Interest rate cycles are long, typically stretching 22 to 37 years. This new rate cycle could last at least two decades, introducing a whole new class of investors to rising rates.

A move up to 3 percent looks likely as soon as this quarter, says Yamada, especially as expectations rise that the Federal Reserve will be aggressive about containing inflation.

At least three increases to the federal funds rate are expected in 2018, the first of which could come as soon as the Fed’s next meeting in March. The chances of a 25-basis-point rate hike in March sit at around 83 percent, according to CME Group fed funds futures.

The likelihood of higher interest rates this year has grown as rising prices return to the economy, and the benefits of tax cuts feed into the system. Consumer and producer prices both jumped in January.

For investors worried that a rising rate cycle will put a snag in the equity bull run, Yamada has good news: Markets can still rise along with an uptrend in interest rates… up to a point.

“You can see rates go up to a certain extent along with a growing economy. They can go in tandem for a while,” she said. “It’s really not until rates get somewhere over 5 percent that things become a little bit more worrisome.”

Lst week, the yield on the 10-year Treasury note hit a four-year high of 2.944 percent. Yields retreated below 2.9 percent again on Friday. The 10-year last traded above 3 percent on Jan. 9 2014.

Goldman Sachs sees red ink everywhere, warns US spending could push up rates and debt levels

- The U.S. economy won’t be able to count on the pump-priming from tax cuts for very long, Goldman Sachs said on Sunday.

- Federal spending, rising yields and surging debt needs are a growing worry, the firm said.

- Deficit spending is approaching ‘uncharted territory’, Goldman said.

Published 2:27 AM ET Mon, 19 Feb 2018 Updated 12 Hours AgoCNBC.com

Goldman Sachs sees a tidal wave of red ink — and it may drag the U.S. economy into its undertow.

Federal deficit spending is headed toward “uncharted territory,” the firm said on Sunday, suggesting that the Trump administration and Congressional Republicans may not be able to count on the economic boost of tax reform for very longer.

In the wake of an ambitious infrastructure plan and a budget that drew fire from virtually all sides, Goldman Sachs said in a note to clients that the federal deficit would reach 5.2 percent of U.S. growth by 2019, and would “continue climbing gradually from there.”

The GOP is counting heavily on the fiscal stimulus provided by tax reform—many companies have announced investment plans and doled out bonuses, even as the majority of taxpayers enjoy lower rates—to insulate them from a restive public in November. Polls suggest that Republicans may lose control of Congress, and President Donald Trump’s own poll numbers hover below 50 percent in most polls.

Yet Goldman Sachs warned that the economic impetus from tax reform may have diminishing returns after this year. “The fiscal expansion should boost growth by around 0.7pp in 2018 and 0.6pp in 2019, but will likely come to an end after that”—listing a litany of reasons why spending and debt would conspire to undermine the world’s largest economy.

While tax cuts are partly responsible, Goldman stated that “projected increases in mandatory spending—this includes Social Security, Medicare, Medicaid, and income support programs—are primarily responsible” for an unsustainable surge in spending.

The dire fiscal backdrop comes against Trump’s spending plans, which have created plenty of critics on the right and left. In a weekly podcast, Caleb Brown, a scholar at the libertarian Cato Institute, branded the Trump administration spending and infrastructure spending “budget buster[s]” saying that overall spending was “very likely” to rise in the coming years despite isolated cuts.

The Congressional Budget Office estimates the level of U.S. debt to gross domestic product (GDP) is currently around 77 percent. If current imbalances hold, Goldman Sachs expects the ratio to hit 85 percent of GDP by 2021. Last year, the CBO issued a dire forecast that the U.S. debt/GDP could skyrocket to 150 percent by 2047, if the trend was left unchecked.

Goldman’s analysts wrote that the “growth effect comes from the change in the deficit, not the level, and further expansion would put the U.S. onto an even less sustainable long-term trend. Second, some of the recent deficit expansion relates to changes unlikely to be repeated, such as the temporarily large effect of certain tax provisions.”

Lastly, “there is a good chance that control of Congress will change after this year’s midterm election, likely making it more difficult to further expand the deficit,” Goldman added.

Recently, the Treasury projected a virtual sea of red government ink, saying it would have to borrow close to $1 trillion this year, and above that level in the years to come. Goldman underscored that fact by saying the Treasury is borrowing at record low rates, but couldn’t expect to do so indefinitely.

The Treasury’s need for more debt is inauspicious, given the recent surge in U.S. yields and a Federal Reserve that’s expected to begin a campaign to hike borrowing costs and withdraw liquidity.

“We expect rising interest rates and a rising debt level to lead to a meaningful increase in interest expense,” Goldman said. “On our current projections, federal interest expense will rise to 2.3 percent of GDP by 2021,” and could hit 3.5 percent by 2027.

https://www.cnbc.com/2018/02/18/facebook-still-testing-users-patience-while-rewarding-investors.html

Facebook still testing users’ patience, while rewarding patient investors

- Facebook this week was still spamming users and forging ahead with an app for children after paying experts who blessed it.

- A new securities filing also shows that CEO Mark Zuckerberg still has iron-clad control over the company.

- So any reform to the company will remain voluntary — and a work in progress.

Published 5:25 PM ET Sun, 18 Feb 2018

Facebook is still requiring a lot of patience from some users, even after Mark Zuckerberg has pledged to make product changes amid the company’s struggle to combat fake news, hate speech and Russian misinformation.

Within the last week, it was still flooding users’ phones with annoying texts, in some cases in reply to a request related to an important security feature known as two-factor authentication.

Facebook also defended its decision to roll out Messenger Kids using testimonials from child experts that it had funded. The pharmaceutical industry has been doing the same thing for decades, of course, by paying researchers who tout its medical devices and drugs.

But many Facebook users-turned-critics — including early investors like Roger McNamee, former employees like Chamath Palihapitiya and even celebrities like comedian Jim Carrey — are demanding more accountability from Zuckerberg.

And perhaps they should, given that Zuckerberg said last summer that the company’s mission is no longer to merely connect the world but to help build stronger communities.

He’s also said Facebook has the potential to bind communities together as religion and Little League once did.

Those are grand ambitions from a powerful billionaire that could have big consequences for society, which helps explain the glaring attention, criticism and expectations directed at Zuckerberg.

Zuck holds all the cards

But other news this week reveals that Zuckerberg’s pledge to reform Facebook is more than a work in progress. It’s also a voluntary effort.

His latest securities filing shows that even after selling $942 million worth of stock last year, Zuckerberg still controlled 87.5 percent of the company’s Class B shares as of Dec. 31. Those are shares with 10 times the voting power of Class A shares.

Jim Carrey recently called for activist shareholders to pressure the company, but even the company’s largest institutional investors — financial behemoths Black Rock, Fidelity and Vanguard — couldn’t do so even if they wanted to.

(And given that Facebook’s stock surged 52 percent last year, why would they?)

While those three held an aggregate of 18.36 percent of the company’s Class A shares as of Dec. 31, based on annual filings all three have made during the past seven days, their voting stake is a small fraction of that, since they own no Class B shares.

So, if Zuckerberg makes major changes at Facebook to improve users’ well-being it won’t be because shareholders are forcing him to change. The only external pressure that could matter will have to come from government regulators stepping in, or disaffected users leaving.

For now, there’s no sign of the former in the U.S. — Europe is a different story — and no significant sign of the latter anywhere. (While Facebook’s user numbers dropped slightly in North America, its overall growth was still healthy.)

Any ship’s captain will tell you that it takes a long time to change the direction of a massive moving vessel. It’s more about coaxing than turning.

For 14 years Facebook’s business model has been increasing users and usage, so it could sell more ads and keep growing revenue.

Asking its employees to make their priority something as vague as boosting the emotional health of users will take time.

At least we know the company is starting to listen to users more, because it’s now asking how they feel about the service.

And it’s willing to apologize and reverse course, as when it reversed a block on Wednesday it had put on an Ethiopian activist’s account, after his supporters spammed Zuckerberg’s Valentine’s Day post.

But as this past week shows, it’s not clear how far Zuckerberg will take his newly stated mission to reform Facebook.

https://www.cnbc.com/2018/02/16/mark-cuban-follow-your-passion-is-bad-advice.html

Billionaire Mark Cuban: ‘One of the great lies of life is follow your passions’

10:30 AM ET Mon, 19 Feb 2018

Mark Cuban grew up working class in Pittsburgh. His father installed upholstery in cars and his mom worked a myriad of odd jobs. Today, Cuban is worth more than $3 billion, owns the Dallas Mavericks and is a star on ABC’s hit reality television show, “Shark Tank.”

He chased any number of random side-hustles on his way to the top, including selling baseball cards, stamps and coins. One thing Cuban did not do? Follow his passion.

“One of the great lies of life is ‘follow your passions,'” says Cuban as part of the Amazon Insights for Entrepreneurs series. “Everybody tells you, ‘Follow your passion, follow your passion.'”

Cuban says that’s bad advice because you may not excel at what you are passionate about.

“I used to be passionate to be a baseball player. Then I realized I had a 70-mile-per-hour fastball,” says Cuban. Competitive major league pitchers throw fastballs in the range of 90-plus miles per hour.

“I used to be passionate about being a professional basketball player. Then I realized I had a 7-inch vertical,” says Cuban. Top contenders for the NBA draft in 2017 each had a max vertical leap over 40 inches.

“There are a lot of things I am passionate about. A lot,” says Cuban.

Instead, pay attention to those things that you devote time to, says Cuban. Double down your investment there.

“The things I ended up being really good at were the things I found myself putting effort into. A lot of people talk about passion, but that’s really not what you need to focus on. You really need to evaluate and say, ‘Okay, where am I putting in my time?'” says Cuban.

“Because when you look at where you put in your time, where you put in your effort, that tends to be the things that you are good at. And if you put in enough time, you tend to get really good at it,” explains Cuban.

When you are good at something, you enjoy it, says Cuban. The effort and skill snowball.

“If you put in enough time, and you get really good, I will give you a little secret: Nobody quits anything they are good at because it is fun to be good. It is fun to be one of the best,” says Cuban.

“But in order to be one of the best, you have to put in effort. So don’t follow your passions, follow your effort,” says Cuban.

“I am going to give you one other secret: The one thing in life that you can control is your effort,” says Cuban.

The billionaire is not alone in his advice.

Jeff Chapin, co-founder of direct-to-consumer mattress company Casper calls passion “whimsical.”

“There are so many things that can captivate you that don’t have to do with your passions,” he tells CNBC Make It.

And often, hearing the advice “follow your passion” translates into following your hobby. “I love kitesurfing, so I’m going to go start a kitesurfing business,” Chapin says as an example. “The reality is you probably ruined your hobby because now you turned your passion into your job.”

Instead, Chapin recommends identifying a simple problem you have a personal advantage at solving. Start small, solve that problem. Repeat.

“Find things where you can get successes quickly,” says Chapin. “Don’t tackle world peace. Figure out how to get food to the homeless person on the street down the corner. Start local and very small.”

Like this story? Like CNBC Make It on Facebook.

Disclosure: CNBC owns the exclusive off-network cable rights to “Shark Tank.”

https://www.cnbc.com/2018/02/24/highlights-from-warren-buffetts-annual-letter.html

Here are the highlights from Warren Buffett’s annual letter to Berkshire Hathaway shareholders

Published 12:16 PM ET Sat, 24 Feb 2018

Updated 7:44 AM ET Mon, 26 Feb 2018

Warren Buffett’s highly anticipated annual letter to Berkshire Hathaway shareholders released on Saturday did not disappoint this year with a little something for all fans of the Oracle of Omaha, from professional value investors to the casual admirers of his wit and wisdom.

Most newsworthy in this year’s edition, the 87-year old billionaire pointed out that Berkshire Hathaway now has a $116 billion war chestto spend on a deal, but that prices were too high for him to spend any of it in a big way last year.

Buffett went on to give a valuable investing lesson that involved quoting a Rudyard Kipling poem from the 1800s. There are plenty of quips in the letter, including a joke likening a CEO’s penchant for dealmaking to the sex drive of teenagers.

Here are the highlights below:

The tax cut:

“Berkshire’s gain in net worth during 2017 was $65.3 billion, which increased the per-share book value of both our Class A and Class B stock by 23%…A large portion of our gain did not come from anything we accomplished at Berkshire. The $65 billion gain is nonetheless real – rest assured of that. But only $36 billion came from Berkshire’s operations. The remaining $29 billion was delivered to us in December when Congress rewrote the U.S. Tax Code.”

Why he didn’t make a big deal in 2017:

“In our search for new stand-alone businesses, the key qualities we seek are durable competitive strengths; able and high-grade management; good returns on the net tangible assets required to operate the business; opportunities for internal growth at attractive returns; and, finally, a sensible purchase price. That last requirement proved a barrier to virtually all deals we reviewed in 2017, as prices for decent, but far from spectacular, businesses hit an all-time high.”

‘Telling your ripening teenager…’

“Indeed, price seemed almost irrelevant to an army of optimistic purchasers. Why the purchasing frenzy? In part, it’s because the CEO job self-selects for ‘can-do’ types. If Wall Street analysts or board members urge that brand of CEO to consider possible acquisitions, it’s a bit like telling your ripening teenager to be sure to have a normal sex life. Once a CEO hungers for a deal, he or she will never lack for forecasts that justify the purchase. Subordinates will be cheering, envisioning enlarged domains and the compensation levels that typically increase with corporate size. Investment bankers, smelling huge fees, will be applauding as well. (Don’t ask the barber whether you need a haircut.) If the historical performance of the target falls short of validating its acquisition, large ‘synergies’ will be forecast. Spreadsheets never disappoint.”

‘Insane to risk what you have….to obtain what you don’t need.’

“Our aversion to leverage has dampened our returns over the years. But Charlie and I sleep well. Both of us believe it is insane to risk what you have and need in order to obtain what you don’t need. We held this view 50 years ago when we each ran an investment partnership, funded by a few friends and relatives who trusted us. We also hold it today after a million or so ‘partners’ have joined us at Berkshire.”

Berkshire lost an estimated $3 billion from the hurricanes

“We currently estimate Berkshire’s losses from the three hurricanes to be $3 billion (or about $2 billion after tax). If both that estimate and my industry estimate of $100 billion are close to accurate, our share of the industry loss was about 3%. I believe that percentage is also what we may reasonably expect to be our share of losses in future American mega-cats.”

Need to make one or more ‘huge acquisitions’

“Berkshire’s goal is to substantially increase the earnings of its non-insurance group. For that to happen, we will need to make one or more huge acquisitions. We certainly have the resources to do so. At yearend Berkshire held$116.0 billion in cash and U.S. Treasury Bills (whose average maturity was 88 days), up from $86.4 billion at yearend 2016. This extraordinary liquidity earns only a pittance and is far beyond the level Charlie and I wish Berkshire to have. Our smiles will broaden when we have redeployed Berkshire’s excess funds into more productive assets.”

Stock investments are not just ‘ticker symbols’

“Charlie and I view the marketable common stocks that Berkshire owns as interests in businesses, not as ticker symbols to be bought or sold based on their ‘chart’ patterns, the ‘target’ prices of analysts or the opinions of media pundits. Instead, we simply believe that if the businesses of the investees are successful (as we believe most will be) our investments will be successful as well. Sometimes the payoffs to us will be modest; occasionally the cash register will ring loudly. And sometimes I will make expensive mistakes. Overall – and over time – we should get decent results. In America, equity investors have the wind at their back.”

Why investors shouldn’t use borrowed money to buy stocks

“There is simply no telling how far stocks can fall in a short period. Even if your borrowings are small and your positions aren’t immediately threatened by the plunging market, your mind may well become rattled by scary headlines and breathless commentary. And an unsettled mind will not make good decisions.”

Rudyard Kipling poem

“When major declines occur, however, they offer extraordinary opportunities to those who are not handicapped by debt. That’s the time to heed these lines from Kipling’s If:

‘If you can keep your head when all about you are losing theirs …

If you can wait and not be tired by waiting…

If you can think – and not make thoughts your aim…

If you can trust yourself when all men doubt you…

Yours is the Earth and everything that’s in it.'”

On winning his 10-year bet against hedge funds:

“Let me emphasize that there was nothing aberrational about stock-market behavior over the ten-year stretch. If a poll of investment ‘experts’ had been asked late in 2007 for a forecast of long-term common-stock returns, their guesses would have likely averaged close to the 8.5% actually delivered by the S&P 500. Making money in that environment should have been easy. Indeed, Wall Street ‘helpers’ earned staggering sums. While this group prospered, however, many of their investors experienced a lost decade. Performance comes, performance goes. Fees never falter.

The bet illuminated another important investment lesson: Though markets are generally rational, they occasionally do crazy things. Seizing the opportunities then offered does not require great intelligence, a degree in economics or a familiarity with Wall Street jargon such as alpha and beta. What investors then need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals. A willingness to look unimaginative for a sustained period – or even to look foolish – is also essential.”

Bonds can be risky too

“It is a terrible mistake for investors with long-term horizons – among them, pension funds, college endowments and savings-minded individuals – to measure their investment ‘risk’ by their portfolio’s ratio of bonds to stocks. Often, high-grade bonds in an investment portfolio increase its risk.”

On his succession plan:

“I’ve saved the best for last. Early in 2018, Berkshire’s board elected Ajit Jain and Greg Abel as directors of Berkshire and also designated each as Vice Chairman. Ajit is now responsible for insurance operations, and Greg oversees the rest of our businesses. Charlie and I will focus on investments and capital allocation. You and I are lucky to have Ajit and Greg working for us. Each has been with Berkshire for decades, and Berkshire’s blood flows through their veins. The character of each man matches his talents. And that says it all.”