HI Financial Services Commentary 02-21-2017

What’s happening this year and why?

Fed raising rates – 3 times when they said 4 times last year

The markets are running on HOPEium

Supposedly a better tax rate for corporations

Border tax is a consumption/Home grown tax

Regulation rollback if new regulation comes out

Deregulation on ObamaCare

February being a typical down month looks like it will end positive

I’ve talked with people over the last 2 months that missed all the upside from 2008 and actually just now are coming back and going all in!!!

A couple of people have asked me why I trade china = BIDU, BABA

Where will our market end this week?

Higher than where we are today

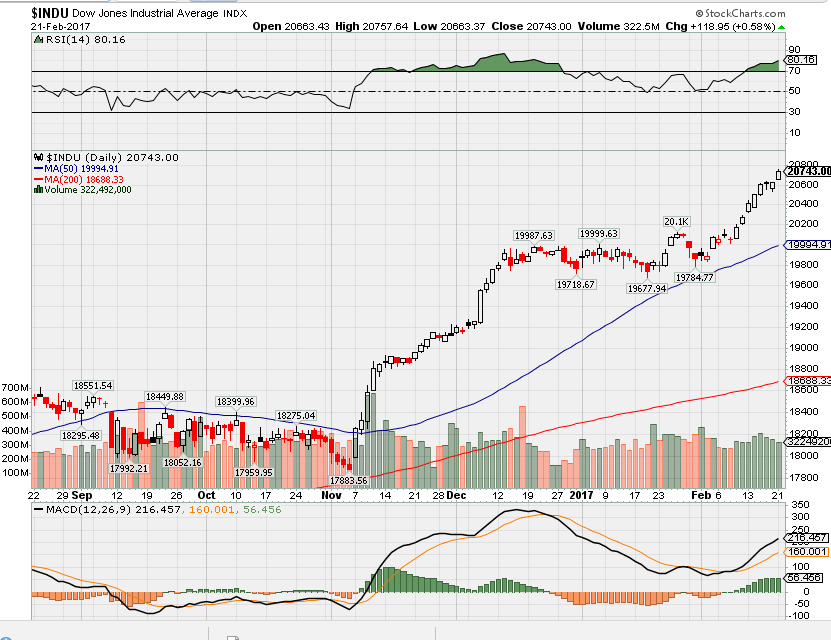

DJIA – technically overbought bullish

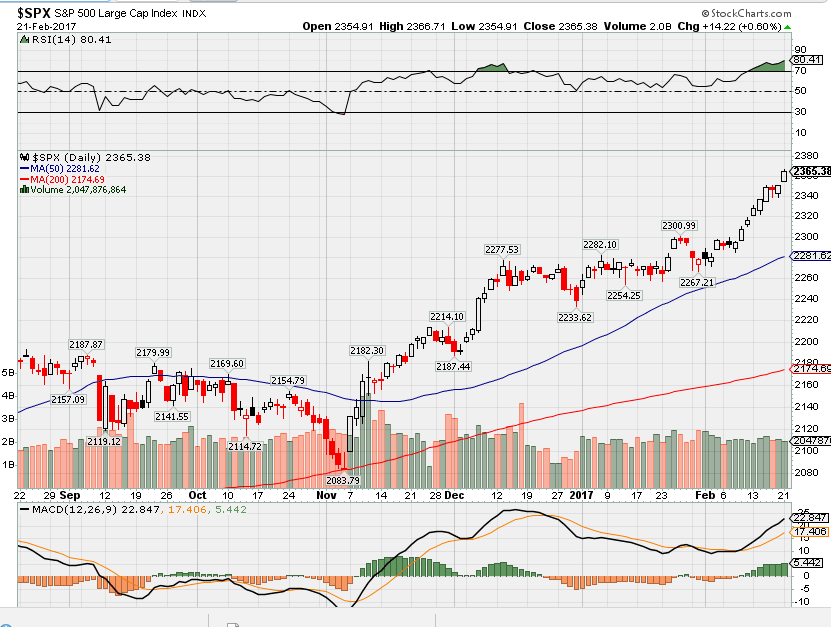

SPX – technically over-bought bullish

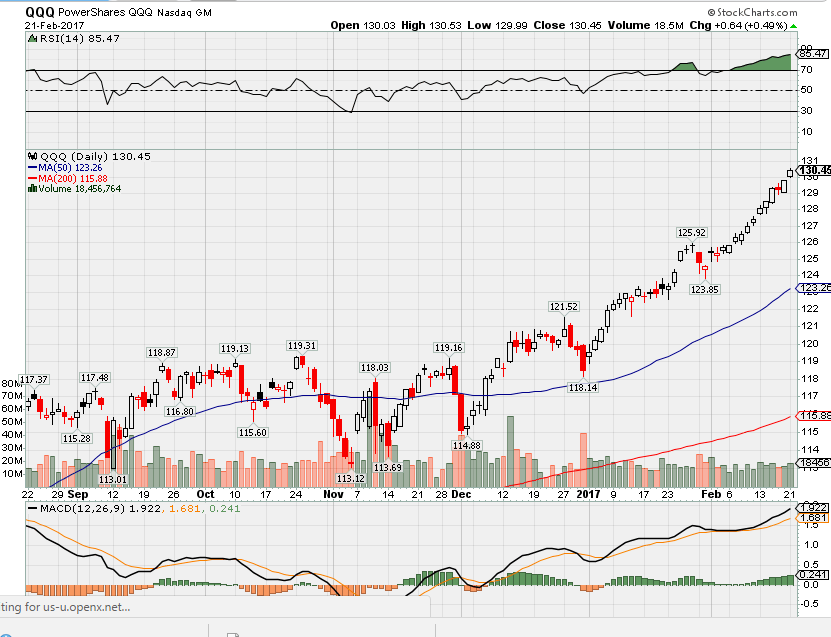

COMP – technically over-bought bullish

Where Will the SPX end Feb 2017?

02-21-2017 +2.0%

02-14-2017 -2.5%

02-07-2017 -2.5%

01-31-2017 -2.5%

What is on tap for the rest of the week?=

Earnings:

Tues: DDS, AAR, CBRL, FSLR, HD, M NEM, PZZA, SOHU, VMI, WMT

Wed: SAM, CHS, DISH, FIT, GRMN, HPQ, JACK, LB, PSA, SIX, SQ, TSLA, TOL, RIG,

Thur: AAWW, CHK, GPS, KSS, TREE, RMAX, SHLD, BIDU

Fri: FL, JCP, KBR

Econ Reports:

Tues:

Wed: MBA, Crude, Existing Home Sales, FOMC Minutes

Thur: Initial, Continuing Claims, FHFA Housing Price Index

Fri: Michigan Sentiment, New Home Sales

Int’l:

Tues –

Wed – GB: GDP

Thursday – DE:GDP, FR: Business Climate Indicator

Friday –

Sunday –

How I am looking to trade?

I’m basically staying long and it is very tough to do.

It is NOT SMART to be capped to the upside at this time with the possible tax reform on the horizon

Calendar Bull puts for long puts that were not needed

Earnings Chart

BIDU 02/23 est

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Will Apple Pay Be A Growth Engine?

Feb.13.17 | About: Apple Inc. (AAPL)

Summary

Can Apple double the size of its Services business to generate, by 2020, the equivalent of Facebook’s, Netflix’s and Twitter’s revenues combined?

Today, I look at how Apple Pay may help the company on this quest.

Apple Pay has potential to be one of the driving forces of growth for Apple’s Services. But the opportunities do not come without challenges.

Late last week, sell-side analyst Toni Sacconaghi questioned whether Apple (NASDAQ:AAPL) could indeed double its Services business over the next four years, as CEO Tim Cook has promised. In his view, such an aggressive growth target would likely “require the introduction of new services,” possibly through acquisitions.

Credit: Forbes

The graph below illustrates what the doubling of Apple’s Services business might look like, if executed as planned. The blue line indicates the quarterly YOY growth through F4Q20 and assumes a constant growth rate of 18.9%, for simplicity. For comparison, the Services segment has grown at an average pace of 21.6% per quarter over the past five quarters.

As the blue bar on the right suggests, if Apple is in fact able to double the size of Services by the end of fiscal 2020, the segment alone would generate about as much revenues in a quarter as Facebook (NASDAQ:FB), Netflix (NASDAQ:NFLX) and Twitter (NYSE:TWTR) did in 4Q16 combined. It looks indeed like a very tall order.

Source: DM Martins Research, using data from company reports and Seeking Alpha

Can Apple pull it off? And what might be the key drivers that would allow this aggressive growth in Services to take place?

To help answer these questions, let’s look at one business within Apple’s Services segment that I believe does not get enough attention from investors and analysts: Apple Pay.

The future of payment?

Apple Pay is the company’s secure payment system launched in 2014 that allowed Apple to keep a hefty 0.15% cut of every transaction generated through the platform in the United States. Tim Cook seemed very excited about the service when he said, just over a year ago, that “money will be forgotten by history, thanks to Apple Pay.”

I have been anxiously awaiting the day when bills and coins will become obsolete, freeing up my pockets from unnecessary weight and volume. I don’t think that Tim’s prediction is far-fetched, especially in the longer term, as the popularity of non-cash payments has increased fast. According to the UK Cards Association, contactless transactions had increased in the country by 155% YOY in November 2016 – to be fair, off a small base of 127.5 million transactions in November 2015.

Deloitte had already identified a turning point in usage of mobile payments back in 2015 (at which point Apple Pay was supported only in the U.S., U.K., Canada and Australia) as “the multiple pre-requisites for mainstream adoption – satisfying financial institutions, merchants, consumers, technology vendors and carriers – (had been) sufficiently addressed.” The consulting firm seemed to believe that contactless payments had yet to see a significant ramp up in usage, provided that a few challenges like security could be better addressed.

Echoing Deloitte’s findings, Business Insider estimated that mobile in-store payment volume in the U.S. would reach $500 billion by 2020 – suggesting an eye-popping 80% CAGR from 2015 levels.

Source: Business Insider

Apple is likely to bite off a chunk of this expanding market as more retail vendors globally adopt its payment platform. Last year marked the introduction of Apple Pay in China and at major retailers like KFC and Starbucks. And playing in Apple’s favor, growth in Apple Pay revenues should be largely independent of future device unit sales as I believe penetration (i.e. increased service adoption per active user) will be the key factor behind the eventual success of Apple’s payment service.

These are the good news – a fast increase in usage of contactless payment methods and a meaningful adoption ramp up that has yet to happen, even in developed markets.

But here is the bad news: Apple is not the only kid on the block. Tech powerhouses like Google (NASDAQ:GOOG)(NASDAQ:GOOGL), Samsung (OTC:SSNLF) and PayPal (NASDAQ:PYPL) are heavily vested in making their own solutions thrive. It is worth noting that many competing payment solutions can still be used on an Apple device, usually through downloadable apps. And from a broader perspective, payment processing giants like Visa (NYSE:V) and MasterCard (NYSE:MA), while partners in enabling the Apple Pay service, also can be thought of as large competitors – why learn how to use a new payment processing tool when I can swipe my plastic card or punch in my credit card number online as I have always done?

The impact of the challenging competitive landscape seems to be reflected in consumers’ usage of Apple Pay in lieu of other payment options. As the graph below indicates, fewer potential Apple Pay users seem to use Apple’s payment platform whenever they have a chance to do so: 22% in October 2016 vs. 48% a year earlier. Conversely, more than 35% have either stopped trying to use or rarely consider using Apple Pay (myself included), up from 18% in the prior year.

Source: pymnts.com

While the addressable market is likely to increase substantially, the same cannot necessarily be said about the usage of a specific payment platform.

Conclusion

Apple Pay has the potential to be one of the driving forces of growth for Apple’s Services segment. But the opportunities do not come without challenges and risks. While the market is likely to expand fast over the next few years, competition also is likely to become tighter, driving pricing pressures and fierce battles for market share.

I would not be surprised, however, to see Apple Pay become a key contributor in the doubling of Apple’s Services segment by 2020. The business is still small today, but has significant room to become a much more meaningful revenue generator in the future.

http://www.cnbc.com/2017/02/19/is-the-dollars-run-done-why-some-traders-say-yes.html

Is the dollar’s run done? Why some traders say yes

Sunday, 19 Feb 2017 | 11:19 AM ETCNBC.com

The U.S. dollar finished the week just barely positive, and some strategists see the greenback heading lower as political uncertainty mounts.

Federal Reserve Chair Janet Yellen’s fairly hawkish remarks in a press conference Wednesday failed to boost the dollar, which the next day saw its largest one-day drop in over two weeks.

In her two-daysemi-annual testimony on monetary policy before the House Financial Services Committee, Yellen reiterated that the Federal Reserve still expects to raise its federal funds rate target three times this year. Rate hikes tend to boost the value of the dollar, as higher short-term rates mean that those who hold greenbacks are paid more to do so.

As the dollar shows modest near-term weakness even in the face of this Fed hawkishness, foreign exchange strategist Boris Schlossberg said he sees further downside ahead.

“The market is not buying what Janet Yellen is saying. And that is actually a very, very telling sign,” Schlossberg of BK Asset Management told CNBC’s “Trading Nation” last week.

“When the Fed chief says, pretty much unabashedly, that she’s going to go to three rate hikes, and she sort of talks up the economy, and yet the market remains skeptical, that’s telling me something,” he added.

Major political uncertainty surrounding the new Trump administration is weighing on the dollar, Schlossberg said. He noted that such uncertainty regarding policy is also weighing on the fixed income market.

“That tells me that both markets remain skeptical about the continuity of this potential growth as we go forward,” he said, adding that these issues are lending themselves to being long the dollar right now would be “very, very dangerous” due to such uncertainty.

He would mark the dollar a sell so long as the yen fails to reach the 115 mark against the greenback. He points to the dollar-yen relationship as an important gauge of dollar strength, as weaker equity markets and yields are said to be associated with a stronger Japanese yen.

“We expect the [dollar] to move sideways until we get the details of the Trump fiscal plans, but we remain bullish,” Bank of America Merrill Lynch foreign exchange research strategists wrote in a note published Friday entitled, “Waiting for the great fiscal plan.”

The team of strategists led by Claudio Piron and Athanasios Vamvakidis wrote that pessimism surrounding the Trump administration has been feeding “stagflation,” or an economic dilemma that comes with high inflation, unemployment and slow growth.

The dollar rose nearly 4 percent in the month following the U.S. election in November. The longer-term trend certainly appears bullish, said Gina Sanchez, CEO of Chantico Global.

“I think the trend is still going to be for dollar strength, but I think that this dollar weakness is interesting and telling, because Yellen was really out talking the dollar up. I mean, she was making fairly hawkish comments, and that should lead to a stronger dollar,” Sanchez said Thursday on CNBC’s “Trading Nation.”

Some of the shorter-term weakness appears to be the result of political uncertainty.

“And I think that is probably what’s to blame for this. I don’t think that it’s going to last for very long,” and the general trend is still up, she forecasted.

A bearish technical trend is afoot in the dollar index, wrote Miller Tabak managing director and equity strategist last week. The Dollar Index measures the U.S. dollar’s strength against a basket of foreign currencies.

A so-called “head and shoulders” technical pattern—a trend that typically points to a bullish-to-bearish reversal in a security—appears to be forming in charts of the index, Maley wrote. As such, a break below the 99 mark could prove quite negative for the dollar.

This, in turn, could have important implications for other assets.

“We cannot get ahead of ourselves…but a lot of investment assumptions for 2017 have been based on the assumption that we’d see continued strength in the dollar. Therefore, if this ‘tradable’ pull-back becomes a more lengthy one, it could/should put a wrench in the works of many of those assumptions,” Maley wrote.