HI Financial Services Commentary 01-23-2018

You Tube Link: https://youtu.be/Hdop_WEuRj8

What I want to talk about today?

How are you doing in the market so far this year? +3.35% but very few of my companies have reported

I usually have yearly goals written out, posted and concentrate on them daily

What is the best way to protect bearish just in case? Collar trade

Kevin, I feel like I have to make sure I’m fully invested to not miss the run up? I AGREE

Trump and the Fed want ?= Weak Dollar$$$$

Goal = Make money or add shares thru protect while investing other peoples money

This year I will most likely move to more Long Call as profits are taken to be used for a stock substitute

Reasons Hurley Investments would do this:

Pay lower taxes tan last year and pay them before they go up again

Limitless upside and limited downside / Because I’m taking some huge profits and I am at the point I want some cash available for any potential correction – 20%. Better returns especially if less capital is being used/at risk

Dividends yields are so low that stock ownership isn’t as interesting and more efficient use of money though requires more tight management

What happening this week and why?

Earnings news drives the market for the time being

Tarrifs in place by executive order – Washing machines , solar panels

Where will our markets end this week?

Higher

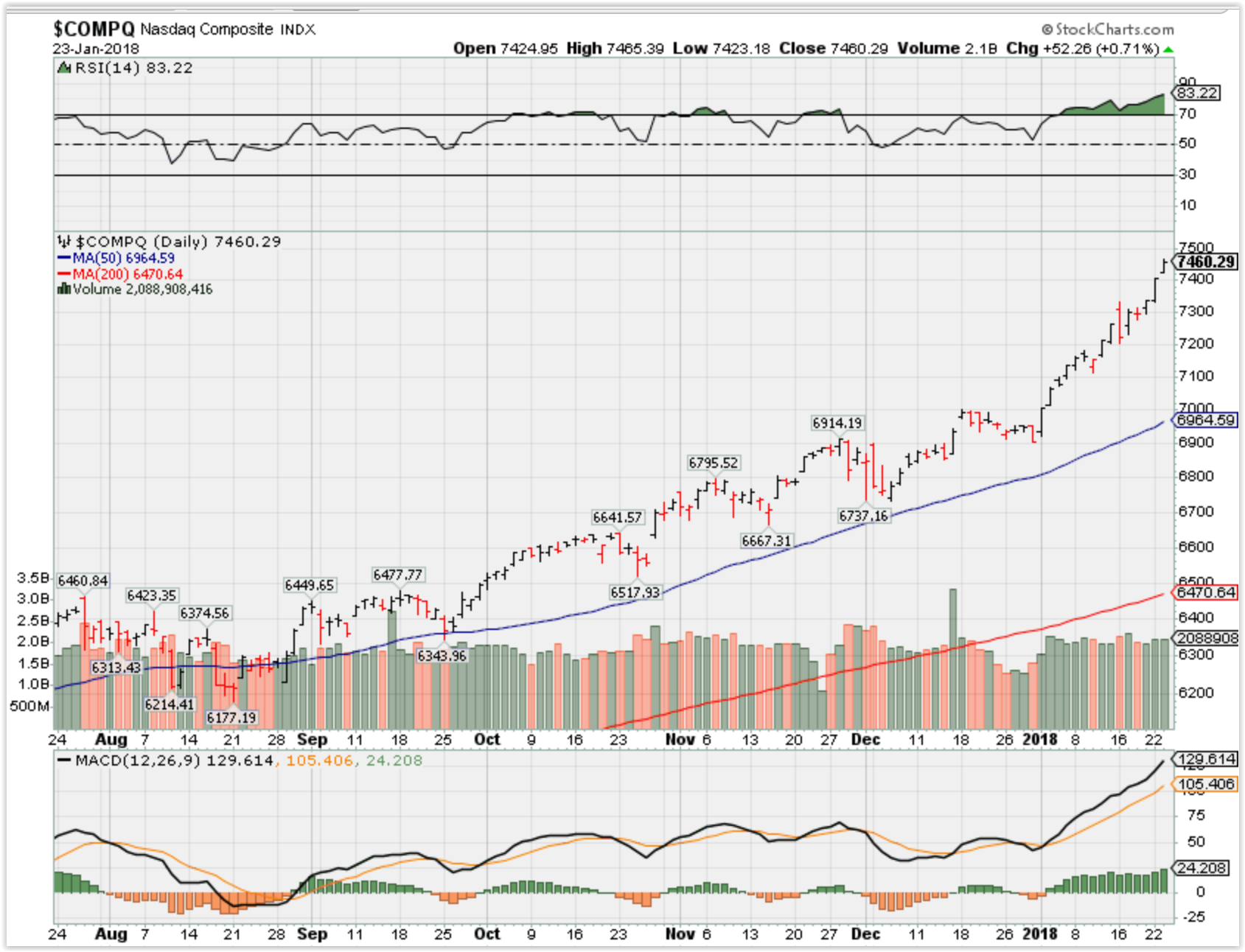

DJIA – Bullish we entered the over bought mark RSI

SPX – Bullish overbought on the RSI

COMP – Bullish and overbought on the RSI

Where Will the SPX end January 2018?

01-23-2018 +4.0%

01-16-2018 +2.0%

01-09-2018 +1.5%

01-02-2018 +1.5%

What is on tap for the rest of the week?=

Earnings:

Tues: KMB, JNJ, PG, VZ, COF, UAL

Wed: ABT, BHGE, CMCSA, GD, GE, GWW, RCL, SWK, FFIV, DFS, LVS, RMAX, WHR

Thur: MMM, ALK, AAL, CELG, JBLU, NOC, RTN, LUV, UNP, INTC, ISRG, WDC, SBUX

Fri: HON, LEA

Econ Reports:

Tues:

Wed: MBA, FHFA Housing Price, Existing Home Sales,

Thur: Initial, Continuing Claims, New Home Sales, Leading Indicators,

Fri: GDP, GDP Deflator, Durable Goods, Durable ex-trans, Michigan Sentiment

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday –

Questions???

KMX, GS, ULTA, TPR, MO, FCX, S, WEN

V, BAC, ZION, C, MS,

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

How am I looking to trade?

I now have long calls on BAC, V and I want more stock ownership in AAPL!

AAPL has the opportunity for a “one time” dividend could be $30 a share

AAPL – 02/01 AMC

AOBC – 03/01

BAC – 01/17 BMO

BIDU – 2/22

C – 01/16 BMO

DHI – 01/31 BMO

DIS – 02/06 AMC

F – 01/24 AMC

FB – 01/31 AMC

FCX – 01/25 BMO

MO – 02/01 BMO

KMX – 04/04 BMO

SODA 02/14

V – 02/01 AMC

ZION – 1/22 AMC

Investor ‘fear of missing out’ runs wild as record amount of money flows into stocks the last four weeks

- Stock-based mutual funds and ETFs pulled in $58 billion in the past four weeks, the fastest surge ever.

- The rush of cash is inspired by a “fear of missing out,” says BAML’s Michael Hartnett.

- The market has been on a tear during the period, with the S&P 500 up 4 percent over the span and off to one of its fastest-ever starts to a calendar year.

Published 10:00 AM ET Fri, 19 Jan 2018

Updated 11:25 AM ET Mon, 22 Jan 2018

Investors looking to get a piece of the latest market surge poured cash into stock funds at the highest pace ever during the past four weeks.

Mutual funds and ETFs that focus on stocks garnered $58 billion in fresh money during the period that ended Wednesday, according to Bank of America Merrill Lynch. The rush comes during a period when the S&P 500 rose about 4 percent and was off to one of its fastest-ever starts for a calendar year.

The rush of cash is inspired by a “fear of missing out,” Michael Hartnett, BofAML’s chief investment strategist, said in a report on weekly fund flows. He added that the “frothy price action likely continues in the short term,” though the firm’s indicator of market sentiment is getting closer to a sell level.

New money didn’t just go into exchange-traded funds that passively track market indexes like the S&P 500 and Dow industrials. Active funds, which have seen massive outflows in the past several years, also have reached a four-year peak inflows during the past four weeks.

All told, equity ETFs have pulled in $38.2 billion in 2018 while their mutual fund counterparts have gathered a net $5.6 billion, according to BofAML. Most mutual funds are run by managers who actively pick stocks and carry considerably higher fees than ETFs.

The one-week total inflow of $23.9 billion was the seventh-best on record.

U.S. funds showed the strongest money gains with $6.4 billion for the week, while Japan attracted $3.6 billion, emerging markets saw $3.5 billion and Europe pulled in $2.2 billion in creations. U.S. large-cap funds were the biggest beneficiary by style, with $6.5 billion of inflows, BofAML reported.

By sector, financials took in $1.6 billion while technology and energy saw $700 million apiece.

The surge comes as sentiment surveys show both professional and mom-and-pop investors getting much more optimistic.

The latest Investors Intelligence poll of professional newsletter editors saw bulls outnumber bears by 66.7 percent to 12.7 percent, the biggest spread since April 1986. The American Association of Independent Investors retail survey reported the difference at 54.1 percent to 21.4 percent.

https://www.cnbc.com/2018/01/16/cramers-5-cardinal-rules-of-engagement-with-the-bull-market.html

Cramer’s 5 cardinal rules of engagement with the bull market

- “Mad Money” host Jim Cramer gave investors several key guidelines for maneuvering the bull market in beast mode.

- Cramer recast some of his classic aphorisms, like “no one ever got hurt taking a profit,” to fit a market that just drove the Dow Jones industrial average past 26,000 for the first time.

Elizabeth Gurdus | @lizzygurdus

Published 6:10 PM ET Tue, 16 Jan 2018

Updated 7:35 PM ET Tue, 16 Jan 2018CNBC.com

Even after Tuesday’s massive stock market reversal — the biggest in roughly 10 months — CNBC’s Jim Cramer maintained that he liked the market.

But the “Mad Money” host acknowledged that there are “rules of engagement for dealing with a bull market that’s in beast mode,” so he wanted to highlight those for investors.

1. Take a profit

Cramer’s No. 1 rule is one of his most common sayings: no one ever got hurt taking a profit.

In a rallying market like this one, investors tend to forget that their gains aren’t really winnings until they ring the register. That can burn them when the market takes a hit.

“In this red-hot bull market, there are hundreds of stocks that you own with outsized gains where you’d be foolish not to do some profit-taking. I’m not saying you should sell the whole position — I like this market too much,” Cramer said. “I just want you to understand that profits on paper don’t count; it’s not a real gain until you’ve taken something off the table.”

2. Keep an eye out

Rule No. 2? You never know when an unexpected geopolitical or market-moving event might happen, so be prepared.

For example, Cramer has been guiding that Commerce Secretary Wilbur Ross might recommend that President Donald Trump use Article 232 of the Trade Expansion Act to prevent Chinese steel dumping.

The article reserves the right to protect key domestic industries, in this case steel, for national security purposes. By invoking it, the United States would effectively push back against China’s practice of artificially suppressing steel prices.

The move would “be a huge positive for the domestic steelmakers, but there’s so much collateral damage. It will hurt the stocks of our international companies that do a lot of business in the People’s Republic as investors start worrying about Chinese retaliation,” Cramer said. “Something you need to keep in mind is this retaliation.”

3. Don’t be greedy

Cue one of Cramer’s best-known aphorisms: “Bulls make money, bears make money, and pigs get slaughtered.”

While this rule applies more loosely for those saving for retirement, investors using their mad money should have some cash on the sidelines to be able to buy in at lower stock prices, Cramer said.

“These days, the conventional wisdom is that the only real money that ever goes into the stock market is retirement money. That’s supposed to go into index funds and it’s never supposed to be touched, no matter what,” he said. “I’m not telling you to mess with your 401(k), but if you do own individual stocks in your discretionary portfolio … I’m saying take something off the table!”

4. Don’t fall in love

Cramer has tried to explain Rule No. 4 — don’t fall in love with your investments — to cryptocurrency buyers time and time again.

“I fear for my life whenever I use the words ‘bitcoin‘ and ‘sell’ in the same sentence,” the “Mad Money” host said. “Still, the darned thing is in free-fall and the cryptomaniacs aren’t doing themselves any favors by getting so attached emotionally to it.”

Instead, Cramer recommended investors stay humble, stay on top of their investments and, most of all, stay detached.

5. Stay diversified

Finally, different areas of the market may have their heydays at different times, which is why investors must stay diversified, Cramer said.

For example, after the market reversed on Tuesday, the drug and health insurance stocks were still able to log strong gains. But the industrial stocks, red-hot just last week, were taken down along with last week’s other winners, the oil and retail names.

Final thoughts

“Here’s the bottom line: do not be greedy, take some profits [and] stay diversified, since you never know what’s going to come from left field and send us lower,” the “Mad Money” host concluded. “Simple rules to live by. Don’t screw it up.”

https://www.cnbc.com/2016/02/12/jamie-dimon-isnt-the-only-bank-executive-buying-back-stock.html

Jamie Dimon isn’t the only bank executive buying back stock

Published 10:39 AM ET Fri, 12 Feb 2016 Updated 12:02 PM ET Fri, 12 Feb 2016

Jamie Dimon’s announcement last night that he was purchasing 500,000 shares (roughly $25 million) of JPMorgan is another sign that some executives see their shares as undervalued, and who could blame them? JPMorgan’s stock is down 20 percent for the year.

Dimon already owns 6.2 million shares, but he has not been a big purchaser of stock, buying only twice in the last 12 years, once in January 2009 when he bought 500,000 shares, and again in July 2012 when he also bought 500,000 shares.

He’s not the only one. Several bank insiders have bought stock in the past couple weeks.

Banks: Recent insider buying (source: InsiderScore)

- Citigroup: CEO and chairman

- Zions: CEO and CFO

- Huntington Banc: CEO, CFO, and two others

- KeyCorp: CEO and eight directors

- Radian Group: CEO, CFO, and five others

These purchases have been significant. In the case of Citigroup, the CEO and Chairman bought $1 million each. Four insiders at Huntington Bancshares recently bought $1.3 million. Radian’s CEO not only bought shares, but the bank initiated the first company buyback plan.

Not only are bank stock prices down 20 percent on average, but most of the big banks are trading at a substantial discount to tangible book value.

Banks: Tangible book value

- Fifth Third: 0.92

- SunTrust: 0.99

- Goldman Sachs: 0.87

- Regions Financial: 0.84

- Comerica: 0.79

- Morgan Stanley: 0.72

- Bank of America: 0.72

- Zions: 0.72

- Citigroup: 0.58

JPMorgan is one of the few that trades above book value, at 1.1. Wells Fargo is another, at 1.62. But they are the exceptions.

With bank stocks down this much this year and most of the major banks trading at big discounts to book, look for more announcements of insider buying and buybacks.

https://www.cnbc.com/2018/01/18/cramer-ive-never-seen-market-fomo-like-this-in-my-life.html

Cramer: I’ve never seen market FOMO like this in my life

- “Mad Money” host Jim Cramer said an overload of buyers in the stock market is resulting in dramatically rising stock prices.

- For example, the broader market decline didn’t stop voracious buyers of UnitedHealth from pushing its shares higher, Cramer said.

- But this action, caused by investors’ FOMO, or ‘fear of missing out’ on the gains, isn’t happening in a vacuum, Cramer argued.

Elizabeth Gurdus | @lizzygurdus

Published 6:12 PM ET Thu, 18 Jan 2018 Updated 5:23 AM ET Fri, 19 Jan 2018

Thursday’s broad declines in the major averages didn’t stop CNBC’s Jim Cramer from noticing the positive action in individual stocks like UnitedHealth.

“I’m talking about these multi-day-up extravaganzas, where investors can’t buy enough shares in one session after a positive event so they keep coming back, day after day after day, to get their full positions on, no matter how much the stock runs in the interim,” the “Mad Money” host said. “Honestly, I have never seen anything like it, so I’ve got to point this out and explain it to you.”

Take UnitedHealth. Shares of the largest U.S. health insurer have been surging every day since the company delivered a strong earnings report on Tuesday, beating Wall Street estimates and issuing positive guidance for 2018.

Cramer was surprised that buyers kept reacting to the same news day after day, pushing the stock higher. But he soon realized that there was another side to the story.

After all, individual investors aren’t the only ones buying the stock. When he worked as a professional block trader, Cramer used to buy huge amounts of stock in bulk.

“I can tell you that we’re seeing something truly amazing happening here,” he said. “UNH, a $235 billion company with nearly a billion shares outstanding, doesn’t have enough liquidity to sate all the buyers out there at lower levels. It’s kind of like a bunch of Godzillas, unleashed all at once, trying to beat each other over the head to get some stock in, as much as possible.”

For example, if a block trader gets an order from a client for 100,000 shares of a company, he usually buys 50,000 shares, then “works the order” to get a lower price for the remaining 50,000 by the end of the day, Cramer said.

“The broker’s so confident there are sellers all over the place … that he’ll short you the stock as a favor to get the rest of the order in and keep you happy,” the “Mad Money” host explained.

But in this market, there aren’t enough sellers for block traders to be able to short the stocks. Stock prices keep climbing, so hedge fund buyers are racing to complete their orders, which must be big enough to “move the needle,” Cramer said.

“What’s so remarkable about this? None of the buyers seems to give up and walk away no matter what the price … and very few sellers appear,” he said. “It’s as if the owners don’t want to miss out on what’s to come and the buyers are desperate to have these shares because they expect them to fly much higher.”

“It’s a crazy case of FOMO — fear of missing out — on the next big move, even as these buyers are creating that move with their own massive footprint,” Cramer continued.

The “Mad Money” host has watched this trend reverberate through the market in semiconductor stocks, devicemakers’ stocks, industrial stocks and others.

Still, Cramer was loath to write this off as irrational exuberance, or the idea that the market is approaching a top.

“It’s really indicative of a shortage of stock. So many shares of so many companies have been retired, bought back and crunched. So many existing shareholders are owning, no longer renting, their stocks, that portfolio managers have no choice but to drive up prices dramatically with their own buying,” the “Mad Money” host said.

“The bottom line? The most amazing thing is that this gang-tackle buying that I’m talking about isn’t happening in a vacuum,” Cramer concluded. “Today the averages got slammed and it didn’t even matter. Now that’s FOMO with a hashtag, and I think it’s only going to get more heated as earnings season goes on.”