(888) 287-1030 FAX (801) 820-3180

A Registered Investment Adviser

Trade Findings and Adjustments 02-18-2021

So let’s go over part three in exponential growth

It involves booking a profit on stock ownership and converting the profits into a stock replacement strategy that leverages the returns

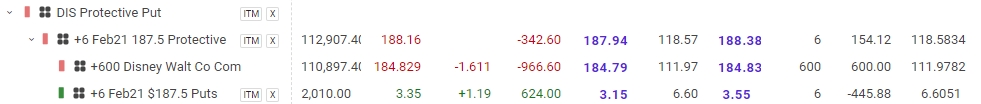

The net gain in selling DIS = 187.50 – 111.97 – 6.60 +3.35 = 72.28 Profit on DIS

Overall Profit = 72.28 * 600 Shares = $43,368

That stock replacement is the Long Call = Right the buy a stock at a certain price for a certain period of time

Why do we use the leap long call? Leverage profits and mitigate risk

BTO the Jan 23 $200 Leap long call for $30.60 per share

I’m going to buy 5 contracts =500*30.60 = $15,300

IF DIS tanks due to economy, taxes, COVID-19 outbreak, rules and regulations

IF you ar planning on dollar cost averaging you will spend more money

5 more contracts @ 15.90 * 500= $7,950

10 contracts dollar cost averaged = 15,300+7950= 23250/10 contracts =NEW average cost basis of $23.25 per contract

IF DIS get to $300 or $324.22 what do we get

10 contract w/ Right to buy @ 200

324.22 – 200 = $124.22 *10 = $124,220

124,220 – 23250 = NET Profit of $100,970 or 434% ROI