HI Market View Commentary 09-08-2025

So, what do you think is going to happen in September?= Very Volatile= FOMC is NOT supposed to be political BUT they cut rates the November before the election 0f surprise 0.50% when the expectation was a 0.25% or wait until after the election

Pullback from middle of September thru October 5-10%, 7% pullback

Depends Fed decision = 0.25% Possible 0.50%

With Powell kicked out or with him starting a dot plot rate cutting cycle the markets could post another 20% +

Does the President have the right per the constitution, etc… to make tariffs= NO Congress

The first “modern” president was a Republican Nixon who imposed a temporary tariff under the 1971 Trading with the Enemy Act

AI Overview

The U.S. Constitution grants Congress the power to regulate commerce through the Commerce Clause (Article I, Section 8, Clause 3), not the President. However, Congress often delegates some of its tariff and trade authority to the President, allowing the executive branch to implement trade policies and impose tariffs, though this power is subject to legal challenges and interpretation of the non-delegation doctrine.

President’s Role in Commerce

While the Constitution grants the power to regulate commerce to Congress, statutes have given the President and the executive branch expanded authority to enact tariff policies and enforce trade laws.

The President’s actions regarding tariffs and trade can be challenged in federal courts if they are seen as exceeding the scope of statutory authority.

President’s Powers vs. Congressional Powers

Congress has the power to levy taxes, duties, imposts, and excises, and to regulate commerce with foreign nations, among the several states, and with Indian tribes.

The President acts as the head of the executive branch, implementing and enforcing the laws passed by Congress. In the area of trade, this often involves the President enacting tariffs and trade agreements under authority granted by Congress.

The Commerce Clause

- Constitutional Basis:

The Commerce Clause is the part of the Constitution that gives Congress the power to regulate commerce.

- Historical Interpretation:

The Supreme Court has historically interpreted the Commerce Clause broadly, expanding Congress’s regulatory power over economic and commercial activities, though this authority has been re-examined in more recent decades.

- Purpose:

A primary reason for the Constitution’s adoption was to remove state trade barriers and foster free trade among the states, which the Commerce Clause was designed to achieve.

BAC $50 put 10 OCt

GOOGL 210/220 Bull Puts 10 OCT

MSTR Leap Short calls 18Jan26 $430 we took a $175 credit in

NVDA $175 Puts

PLTR $180 Short calls or we are trying to get $180 short calls in play

We are attempting to be nimble in our protection, using short calls

Why short calls because the bigger credit with the volatility can be erased quickly with Fed Rate cuts

Earnings

MU 09/24 est

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 05-Sep-25 14:27 ET | Archive

Labor market cracks point to slower growth… and rate cuts

Briefing.com Summary:

*Payroll growth is limping along, flashing warning lights the Fed can’t ignore much longer.

*The Treasury market is pricing in a weaker growth outlook.

*The labor market isn’t broken, but there are cracks.

The Employment Situation Report is aptly named because the Federal Reserve, the Trump administration, and the U.S. economy have an employment situation on their hands. That situation hit home with the release of the July employment report, and, unfortunately, it didn’t get better with an August employment report that also carried another downward revision to June nonfarm payrolls.

The funny thing is, the stock market greeted the August report with open arms initially, only it wasn’t angling to hug the report itself so much as it was angling to hug the rate cuts it sees coming.

It was a patented “bad news is good news” reaction. And you knew it was bad news based on the Treasury market’s reaction. Yields shot lower across the curve, with participants pricing in rate cuts at the front of the curve and—this may just be the kicker—weaker growth at the back of the curve.

Objectively Speaking

We can be concise with our supposition that this employment report provided another clear picture that the labor market is weakening. The following details make our objective case:

- Nonfarm payrolls were up just 22,000 in August (Briefing.com consensus: 78,000). Nonfarm private payrolls were up only 38,000 (Briefing.com consensus: 90,000).

- The 3-month average for nonfarm payrolls, after accounting for another downward revision to June nonfarm payrolls that showed a loss of 13,000 positions, was a scant 29,000 (versus 82,000 in the same period a year ago).

- Manufacturing payrolls declined by 12,000.

- Professional and business services payrolls declined by 17,000, including a 9,800 decline in temporary help services.

- Persons unemployed for 27 weeks or more accounted for 25.7% of the unemployed versus 24.9% in July. Excluding the COVID crisis, that is the highest since June 2016 and reflects the heightened challenge in finding a new job.

- The U-6 unemployment rate, which accounts for unemployed and underemployed workers, increased to 8.1% from 7.9% in July. Excluding the COVID crisis, that is the highest since October 2017.

- Average hourly earnings growth is decelerating.

- There was no increase in average weekly hours, which held steady at 34.2 for the third straight month.

Briefing.com Analyst Insight

To be fair, the labor market is not weak per se. The objective data also suggest as much, particularly an unemployment rate that sits at 4.3%. Nevertheless, there is a weakening trend that isn’t conducive to an acceleration in discretionary spending.

That is most likely why the market is guiding the Federal Reserve to a rate cut. Following the August employment report, the fed funds futures market was quick to price in at least 75 basis points worth of cuts before year-end, whereas before the report the prevailing expectation was for 50 basis points worth of cuts.

The stock market’s initial reaction to the report, then, was rooted in the notion that the Fed will be more aggressive in altering its restrictive monetary policy, but at the same time its enthusiasm was tempered by the consideration that the Fed is late to this game and that economic and earnings data will suggest as much in the coming months.

That outcome doesn’t match at all with the Trump administration’s outlook, and frankly, it hasn’t been the stock market’s default view either. Both the administration and the stock market could be right, but a sense of urgency is building with respect to the all-important labor market.

Hiring activity has weakened noticeably; average hourly earnings growth on a year-over-year basis is decelerating; and the ranks of the underemployed are rising. It is an employment situation that isn’t broken entirely but still needs fixing.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Lower

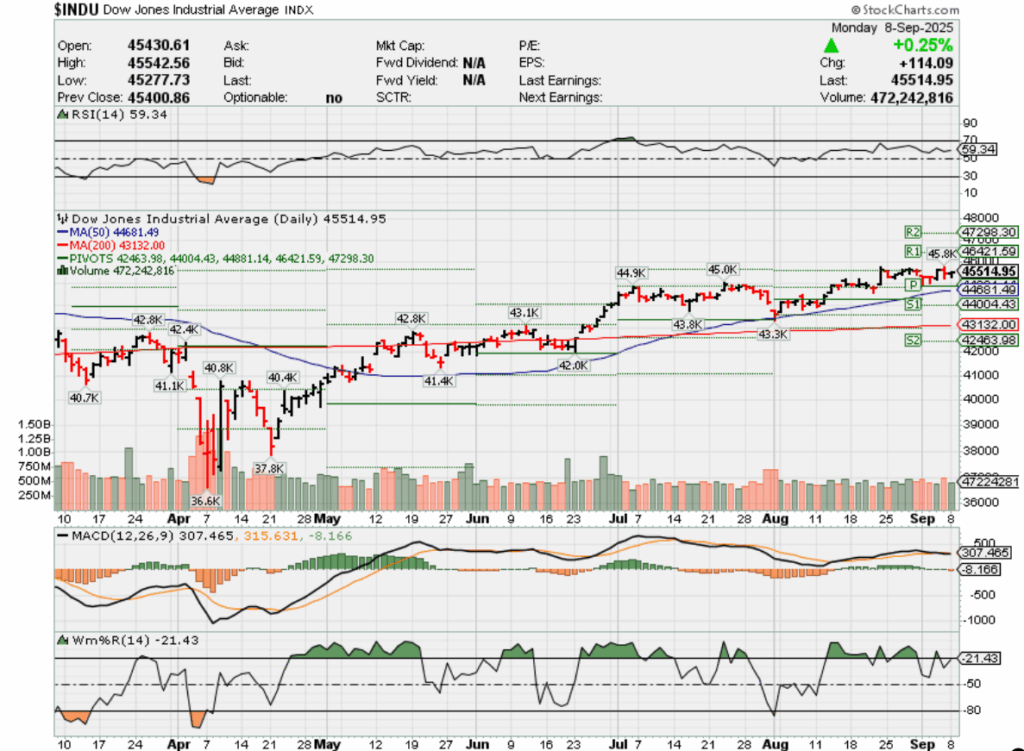

DJIA – Bullish

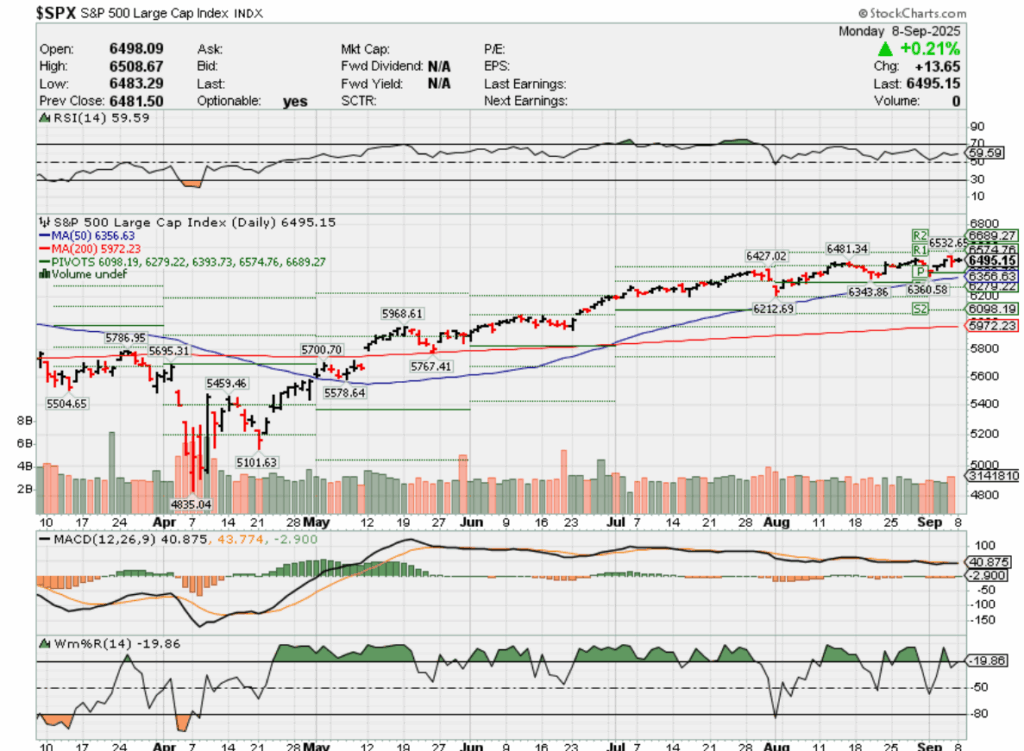

SPX – Bullish

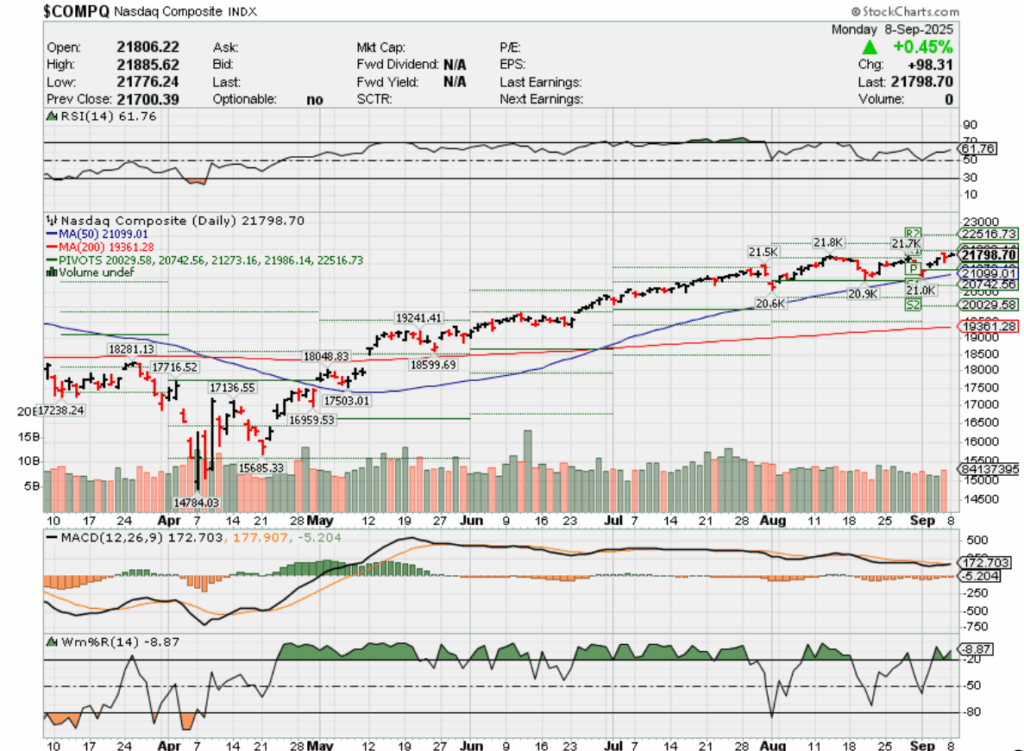

COMP – Bullish

Where Will the SPX end September 2025?

09-08-2025 -2.0%

09-02-2025 -2.0%

08-25-2025 -2.0%

Earnings:

Mon:

Tues:

Wed: CHWY, ADBE

Thur: KR,

Fri:

Econ Reports:

Mon:

Tue ISM Manufacturing, Construction Spending,

Wed: MBA, PPI, Core PPI, Wholesale Inventories

Thur: Initial Claims, Continuing Claims, CPI, Core CPI, Treasury Budget

Fri: Michigan Sentiment,

How am I looking to trade?

Time to start protecting after a rate cut / 2% jump in the market for historical downturn,

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

AI is not just ending entry-level jobs. It’s the end of the career ladder as we know it

Published Sun, Sep 7 202510:26 AM EDT

Key Points

- Postings for entry-level jobs in the U.S. overall have declined about 35% since January 2023, according to labor research firm Revelio Labs, with AI playing a big role.

- Job losses among 16-24 year-olds are rising as the U.S. labor market hits its roughest patch since the pandemic.

- But forecasts that AI will wipe out many entry-level roles pose a much bigger question than current job market woes: What happens to the traditional career ladder that allowed young workers to start at a firm, stay at a firm, and rise all the way to CEO?

Current CEO of Hewlett Packard Enterprise Antonio Neri rose from call center agent at the company to chief executive officer. Doug McMillon, Walmart CEO, started off with a summer gig helping to unload trucks. It’s a similar story for GM CEO Mary Barra, who began on the assembly line at the automaker as an 18-year old. Those are the kinds of career ladder success arcs that have inspired workers, and Hollywood, but as AI is set to replace many entry-level jobs, it may also write that corporate character out of the plot.

The rise of AI has coincided with considerable organizational flattening, especially among middle management ranks. At the same time, Anthropic CEO Dario Amodei is among those who forecast 50% of entry-level jobs may be wiped out by AI as the technology improves, including being able to work eight-hour shifts without a break.

All the uncertainty in the corporate org chart introduced by AI — occurring at a time when college graduates are struggling to find roles — raises the question of whether the career ladder is about to be broken, and the current generation of corporate leaders’ tales of ascent that have always made up an important part of the corporate American ethos set to become a thing of the past. If the notion of going from the bottom to the top has always been more the exception than the rule, it has helped pump the heart of America’s corporations. In the least, removing the first rung on the ladder raises important questions about the transfer of institutional knowledge and upward advancement in organizations.

Looking at data between 2019 and 2024 for the biggest public tech firms and maturing venture-capital funded startups, venture capital firm SignalFire found in a study there was a 50% decline in new role starts by people with less than one year of post-graduate work experience: “Hiring is intrinsically volatile year on year, but 50% is an accurate representation of the hiring delta for this experience category over the considered timespan,” said Asher Bantock, head of research at SignalFire. The data ranged across core business functions — sales, marketing, engineering, recruiting/HR, operations, design, finance and legal — with the 50% decline consistent across the board.

But Heather Doshay, partner at SignalFire, says the data should not lead job seekers to lose hope. “The loss of clear entry points doesn’t just shrink opportunities for new grads — it reshapes how organizations grow talent from within,” she said.

If, as Amodei told CNBC earlier this year, “At some point, we are going to get to AI systems that are better than almost all humans at almost all tasks,” the critical question for workers is how the idea of an entry-level job can evolve as AI continues to.

Flatter organizations seem certain. “The ladder isn’t broken — it’s just being replaced with something that looks a lot flatter,” Doshay said. In her view, the classic notion of a CEO rising from the mailroom is a perfect example since at many company’s it’s been a long time since anyone worked in an actual mailroom. “The bottom rung is disappearing,” she said, “but that has the potential to uplevel everyone.”

The new “entry level” might be a more advanced or skilled role, but with the upskilling of the bottom rung, pressure is being created for new grads to acquire these job skills on their own, rather than being able to learn them while already on a job they can’t land today. That should not be a career killer, though, according to Doshay.

“When the internet and email came on the scene as common corporate required skills, new grads were well-positioned to become experts by using them in school, and the same absolutely applies here with how accessible AI is,” she said. “The key will be in how new grads harness their capabilities to become experts so they are seen as desirable tech-savvy workers who are at the forefront of AI’s advances,” she said.

But she concedes that may not offer much comfort to the current crop of recent grads looking for jobs right now. “My heart goes out to the new grads of 2024, 2025, and 2026, as they are entering during a time of uncertainty,” Doshay said, describing it is a much more vulnerable group entering the workforce than ones further into the future.

Universities are turning their schools into AI training grounds, with several institutions striking major deals with companies like Anthropic and OpenAI.

“Historically, technological advancements have not harmed employment rates in the long run, but there are short-term impacts along the way,” Doshay said. “The entry-level careers of recent graduates are most affected, which could have lasting effects as they continue to grow their careers with less experience while finding fewer job opportunities,” she added.

Anders Humlum, assistant professor of economics at the University of Chicago, says predictions about AI’s long-term labor market impact remain highly speculative, and firms are only just beginning to adjust to the new generative AI landscape. “We now have two and a half years of experience with generative AI chatbots diffusing widely throughout the economy,” Humlum said, adding “these tools have really not made a significant difference for employment or earnings in any occupation thus far.”

Looking at the history of labor and technology, he says even the most transformative technologies, such as steam power, electricity, and computers took decades to generate large-scale economic effects. As a result, any reshaping of the corporate structure and culture will take time to become clear.

“Even if Amodei is correct that AI tools will eventually match the technical capabilities of many entry-level white-collar workers, I believe his forecast underestimates both the time required for workflow adjustments and the human ability to adapt to the new opportunities these tools create,” Humlum said.

But a key challenge for businesses is ensuring that the benefits of these tools are broadly shared across the workforce. In particular, Humlum said, his research shows a substantial gender gap in the use of generative AI. “Employers can significantly reduce this gap by actively encouraging adoption and offering training programs to support effective use,” he said.

Other AI researchers worry that the biggest issue won’t be the career ladder at the lowest rung, but ultimately, the stability of any rung at all, all the way to the top.

If predictions about AI advancements ultimately leading to superintelligence are proven correct, Max Tegmark, president of the Future of Life Institute, says the issue isn’t going to be about whether the 50% entry-level jobs being wiped out is accurate, but that percentage growing to 100% for all careers, “since superintelligence can by definition do all jobs better than us,” he said.

In that world, even if you were the last call center, distribution center or assembly line worker to make it to the CEO desk, your days of success might be numbered. “If we continue racing ahead with totally unregulated AI, we’ll first see a massive wealth and power concentration from workers to those who control the AI, and then to the machines themselves as their owners lose control over them,” Tegmark said.

Warren Buffett’s likely exit from Kraft Heinz creates a big overhang for the underperforming mac-and-cheese stock

Published Sun, Sep 7 20257:49 AM EDT

Warren Buffett has set the record straight that he was frustrated about the undoing of the Kraft Heinz merger, which he meticulously orchestrated a decade ago. That’s led many on Wall Street to conclude the only thing left to do for the Oracle of Omaha is to dump the stock.

“It certainly didn’t turn out to be a brilliant idea to put them together, but I don’t think taking them apart will fix it,” Buffett told CNBC Tuesday.

The 95-year-old investment legend took issue with the $300 million of additional costs from the split, the lengthy time the deal will take and the fact that shareholders didn’t get to vote on the transaction. His conglomerate Berkshire Hathaway is Kraft Heinz’s biggest shareholder by far, holding a 27.5% stake.

Kraft Heinz marks a rare blemish in Buffett’s decades-long track record, with the mac-and-cheese and Oscar Meyer hot dog purveyor having plunged nearly 70% since its merger in 2015. The losses were mitigated, somewhat, by the billions of dollars in dividends Berkshire collected over the years. Berkshire wrote down the value of its Kraft Heinz stake by $3.8 billion in its second-quarter earnings report.

An overhang on the stock

Buffett, who’s typically a passive investor, let it be known that his successor Greg Abel had expressed concerns about the breakup deal to Kraft Heinz a week ago, which didn’t make a difference even coming from its largest shareholder.

Buffett said he will do whatever is in the best interest of Berkshire. If Berkshire is approached to sell its shares, Buffett said he will not accept a block bid unless other shareholders receive the same offer.

“We expect Berkshire’s tenuous ownership position to continue to pressure the shares,” TD Cowen said in a note to clients. “These comments reinforce our view that Berkshire’s position represents an overhang to the stock due to the likelihood they will exit their position.”

It’s unclear how Berkshire might get rid of the underwater position. As an owner of more than 10%, if Berkshire decides to sell shares on the open market, it is subject to regulatory reporting of any sales within two business days.

“Beyond any worries that investors might have with the plan itself, they must also grapple with the possibility that Buffett will now dump his stock,” said Don Bilson, head of event-driven research at Gordon Haskett. “Working through that sizable overhang will create another obstacle for the stock.”

Shares of Kraft Heinz fell 7% Tuesday when the deal was formally announced and when Buffett voiced his disappointment. The Pittsburgh-based ketchup maker is now down 12% year to date after sliding 17% in 2024.

The split will once again separate Kraft Heinz into two companies: one focused on sauces, spreads and shelf-stable meals and a second that includes North American staples like Oscar Mayer meats, Kraft cheese singles and Lunchables.

In 2015, Berkshire teamed up with Brazilian private equity firm 3G Capital to merge Kraft Foods with H.J. Heinz. 3G Capital quietly exited its Kraft Heinz investment in 2023, after years of periodically trimming its stake as the company struggled.

“We think perceived shareholder overhang is coming to the forefront,” JPMorgan said in a note this week.

— CNBC’s Michael Bloom contributed reporting.

https://www.cnbc.com/2025/08/15/unitedhealth-why-buffett-is-buying.html

Why Warren Buffett and other top investors may find troubled UnitedHealth appealing right now

Published Fri, Aug 15 20259:21 AM EDT

UnitedHealth shares are getting a much needed boost after high-profile investors including Warren Buffett and David Tepper unveiled new stakes in the scandal-plagued insurer.

The health care stock popped 10% on Friday, on track for its best day in five years. The advance came after Buffett’s conglomerate Berkshire Hathaway revealed a stake of five million shares, worth about $1.6 billion. The “Big Short” investor Michael Burry and Appaloosa Management’s Tepper also disclosed sizable stakes in the company.

It may come as a surprising move as UnitedHealthcare has become the poster child for problems with the nation’s sprawling health-care system. The company recently suffered a string of setbacks, including a suspension of 2025 guidance, the abrupt departure of former CEO Andrew Witty and a Justice Department investigation into its Medicare billing practices.

So, why are these top investors buying now?

50% off

One unquestionable factor is just how cheap the stock has become. At its peak just nine months ago, shares closed at $615, topping a market capitalization of $500 billion. The stock has now been cut more than half, a rare occurrence for a blue-chip, household name that has been a member of the coveted Dow Jones industrial Average since 2012.

“It is available now at a 50% discount. It will probably pay major fines and some executives may be forced to leave the company. But the company will survive and likely regain its prominence in the industry,” said David Kass, a finance professor at the University of Maryland who has studied Buffett’s methods for a long time. “Its finances are solid. It has above average profitability and a below average price to earnings ratio.”

UnitedHealth in the past 1-year period

Shares of the insurer traded at a price-earnings ratio of just under 12 Thursday, near its lowest in more than a decade. That compared to a 10-year average multiple of 23, according to FactSet data. The healthcare sector is the worst performer among the 11 S&P 500 groupings this year, down nearly 3% as of Thursday’s close.

“The sector has been under-loved and undervalued for a while,” Robert Teeter, chief investment strategist at Silvercrest Asset Management, said on CNBC’s “Worldwide Exchange” Friday. “You get some investors that are willing to step in and that creates a sense of momentum. It’s an area that has a lot of potential for margin recovery.”

‘Surmountable’ woes?

Buffett has a history and reputation of avoiding conflict and controversy when it comes to investing. The last and perhaps the only time Berkshire had an investment embroiled in controversies was Wells Fargo, which conducted fraudulent practices that came to light in 2016. Buffett exited the position 2022.

Berkshire’s UnitedHealth bet is also an unlikely one given Buffett’s longtime distain towards the industry. He previously called the healthcare industry a “tapeworm” on the economy due to its high costs. In 2018, he, along with Jeff Bezos and Jamie Dimon, launched a joint venture to improve health care for their employees and potentially for all Americans, but it was eventually shut down.

Still, Buffett’s primary focus is always on understanding the business itself, the cost and its long-term potential. Berkshire, with a gigantic footprint in the broader insurance industry, may have special insight into the health insurer.

“UNH sports an undeniably cheap valuation but it comes under the cloud of a government investigation and questions about reimbursement levels,” said Bill Stone, Glenview Trust Company CIO and a longtime Berkshire shareholder. “Buffett is always interested in strong franchises that he thinks are dealing with surmountable short-term woes and that could be his view here.”

Long time horizon

The size of Berkshire’s stake — $1.5 billion — indicated to some that Buffett’s two investing lieutenants, Todd Combs and Ted Weschler, were more responsible for this purchase rather than the “Oracle of Omaha” himself. Though, it’s probable that Buffett and incoming CEO Greg Abel blessed this move.

What sets Berkshire apart from others is its buy-and-hold long-term approach, which could work to its advantage as UnitedHealth seeks to avert its crisis and regain public trust, according to George Hill, a healthcare analyst at Deutsche Bank.

“Berkshire clearly has the one attribute many investors do not have, which is duration,” Hill said in a note to clients. “While we believe that UNH shares appear attractively valued on a three-plus year time horizon, UNH’s next two years could be very choppy from a membership, reimbursement and profitability perspective.”

UnitedHealth owns the nation’s largest and most powerful insurer, UnitedHealthcare, and is often viewed as the industry’s bellwether.

Wall Street analysts have welcomed with the return of Stephen Hemsley to lead the company again. Hemsley is widely credited as the CEO who transformed the company into the conglomerate it is today.

UnitedHealth’s 2024 was a particularly tough one. It grappled with the murder of the UnitedHealthcare unit’s CEO, Brian Thompson, the torrent of public blowback that followed and a historic cyberattack that affected millions of Americans.

Why TJ Maxx is a winner as tariff-induced higher prices drive consumers to hunt for value

Published Sun, Sep 7 20257:51 AM EDT

As consumer sentiment fades, tariffs push prices higher and shoppers hunt for more value, Wall Street believes that TJX Companies is a clear winner.

Consumers have grown increasingly more anxious about the state of the U.S. economy over the last few months. The University of Michigan’s consumer sentiment index came in at 58.2 in August, down from July’s reading of 61.7 and year-over-year decline of 14.2%.

Businesses brought back recession specials earlier this summer, hoping to offset fear of a slowing economy. But the latest nod to bearishness may be signs of consumers flocking to more off-price retailers such as TJ Maxx, Burlington Stores and Ross Stores in an effort to stretch their dollars. TJX, which also owns the Marshalls and HomeGoods chains, is the corporate parent of TJ Maxx.

Mid-tier and more upscale merchants from Target to Best Buy to Macy’s have been left behind, seeing declines in weekly foot traffic, according to a report from Piper Sandler using data from Placer.ai.

Why off-price retailers are gaining ground

While lower-income consumers have felt the most impact on their wallets from higher tariffs and a slowing economy, higher-income consumers too have grown pickier, despite having the means to continue to spend, according to Nancy Lazar, chief global economist at Piper Sandler.

“The low-end consumer is getting squeezed, particularly by the tariffs … That said, the high-end consumer is worried. They’re worried about losing their jobs, and consumer confidence is a declining trend,” Lazar told CNBC in an interview. “As a result, they are looking for value, and that’s creating a bifurcation within the retail community where companies that appear to have some value or relatively lower price points are taking business away from companies that are perceived not to have lower price points.”

Consumer expert Stacy Widlitz, president of SW Retail Advisors, also thinks that higher income consumers have traded some semblance of luxury status for value.

“Shopping at Walmart is no longer something to hide, even for the higher income consumer,” she told CNBC. “People have changed the way they shop. Again, the tariffs and the level of inflation has really made every consumer, in every income bracket, consider how they’re spending their money.”

Justin Brown, portfolio manager for American Century Investments, pointed to recent quarterly earnings and revenue beats from all TJX, Burlington and Ross Stores as proof of their appeal in a more challenging retail climate.

“When the going gets tough, these guys tend to pick up [market] share,” Brown, who co-manages the $16-billion American Century Growth fund, told CNBC. “When we look back at prior recessions in 2001 and the Great Financial Crisis, in those periods of time [TJX] tended to accelerate share gains.”

Treasure hunt

Because these stores offer consumers a unique “treasure hunt” experience, they are more aligned with modern day shopping habits, which have tended to shift away from more traditional retail or department store experiences found at Target, Macy’s or Kohl’s, Widlitz said. Consumer enthusiasm for “treasure hunting” at stores like TJ Maxx is rampant on platforms such as TikTok, with creators raking up millions of views for such videos.

“I think consumers love the treasure hunt. But also it has to be a good treasure hunt,” Widlitz added, pointing out that Big Lots, which offers a similar experience, hasn’t done well in recent years. “It’s just like Disneyland for decor and home. And it’s fun; you never know what you’re going to find. It’s unexpected. It’s all the things that the department stores have lost.”

Adding to the shopping experience is off-price retailers’ “top-notch” execution, Widlitz said. Stores are clean, have ample inventory and are well laid out, making them easier and more pleasant to navigate. Notably, the stores are working despite having no online presence and little grocery selection.

TJX is the clear winner in the subcategory of off-price retailers, both Brown and Widlitz said. Brown, the money manager at American Century, recently increased his fund’s position in TJX and sold out of his holding in Ross Stores.

TJX strengths

This year’s heightened global trade war has created a “very unique” macroeconomic environment that TJX is well-suited to navigate, Brown said. TJX boasts strong senior management and targets higher income shoppers than its rivals.

“We’re not talking about luxury, but we’re talking about sort of like middle-income demographics,” he said. “They tend to play at a little bit higher income demographic, which has tended to be a better place to be in this cycle.”

The “secret sauce” for these types of stores lies in their product offerings, an area where TJ Maxx excels, Brown added. The company’s buying process is flexible, allowing it to offer in-season items at a discount to department store prices even in times of supply chain disruptions. TJX has thrived even during periods of dislocation, whether due to sharply higher tariffs or the Covid pandemic, the portfolio manager said.

TJ Maxx’s ability to reevaluate its needs and pounce on inventory when it spies value has made the stock attractive to investor Nancy Tengler, chief investment officer at Laffer Tengler Investments. She noted the company’s success at steadily acquiring a younger customer base, and skirting tariffs, at least in part.

TJX is “buying inventory that other retailers have already purchased and have been unable to unload. So they have flexibility in their purchasing, and they’re purchasing things that have already been tariffed,” she told CNBC.

The chain also has a certain cachet as a destination for consumers unable to find a specific product online, Tengler added. In these cases, TJ Maxx becomes the final destination for shoppers to “fill in the gaps.”

TJX’s expanding global footprint as another catalyst behind the company’s growth. Brown said that between 20% and 25% of TJX’s stores are outside of the United States, with presences in Europe, Canada and Australia.

“TJX does the best job out there. Whether it’s Home Goods or TJ, they absolutely do the best job,” Widlitz added. “TJ is a little more nimble in what they can do, and don’t forget, TJX is replicating what they’re doing here, in Europe … the customer universally has the same desires, and they’re able to translate that into the UK, and they’ve done a great job.”

There’s a ‘golden opportunity’ to pay 0% capital gains under Trump’s ‘big beautiful bill,’ experts say

Published Tue, Sep 2 20258:36 AM EDTUpdated Tue, Sep 2 20251:17 PM EDT

Kate Dore, CFP®, EA@in/katedore/

Key Points

- For 2025, you’re eligible for the 0% long-term capital gains rate with taxable income of $48,350 or less for single filers, or $96,700 or less for married couples filing jointly.

- President Donald Trump’s “big beautiful bill” added tax breaks that could expand eligibility for the 0% capital gains bracket.

- That 0% bracket could offer unique financial planning opportunities, experts say.

Many investors don’t know about the 0% capital gains bracket, which allows you to “harvest gains,” or sell profitable assets, without triggering taxes.

With new deductions added for 2025, more investors could qualify for the 0% bracket under President Donald Trump’s “big beautiful bill.″

That could offer a “golden opportunity” to sell investments at 0% capital gains, along with other tax strategies, said Tommy Lucas, a certified financial planner at Moisand Fitzgerald Tamayo in Orlando, Florida.

Here are some key things investors need to know, according to financial experts.

How the 0% capital gains bracket works

Assets owned for more than one year qualify for long-term capital gains, levied at 0%, 15% or 20%, based on taxable income. There’s also a 3.8% surcharge for higher earners, which brings the total to 23.8% for some investors.

For 2025, you qualify for the 0% long-term capital gains rate if your taxable income is $48,350 or less for single filers, or $96,700 or less for married couples filing jointly.

You calculate taxable income by subtracting the greater of the standard or itemized deductions from your adjusted gross income. However, if you sell investments, those gains count toward taxable income for the bracket.

Still, with a higher standard deduction, a temporary $6,000 deduction for older Americans, and other tax breaks added via Trump’s legislation, more investors could fall into the 0% bracket for 2025, experts say.

Use the 0% bracket for ‘tax-gain harvesting’

One benefit of the 0% long-term capital gains bracket is a strategy known as “tax-gain harvesting,” or strategically selling profitable brokerage account assets during lower-income years.

It’s the “perfect window to trim concentrated positions or rebalance portfolios tax-free,” said Jared Gagne, a CFP and private wealth manager at Claro Advisors in Boston.

Get this delivered to your inbox, and more info about about our products and services.

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy.

Others use the 0% capital gains bracket to sell investments and quickly rebuy to “reset their cost basis,” or the asset’s original purchase price, according to CFP Andrew Herzog, associate wealth manager at The Watchman Group in Plano, Texas.

Increasing your cost basis decreases your profit, which could lead to future tax savings, he said.

Of course, you need to consider how these strategies fit into your broader financial plan, including legacy goals, experts say.

For example, if you’re planning for adult children to inherit profitable assets from your brokerage account, they would already receive a “stepped-up basis,” based on the market value on your date of death.

https://www.cms.gov/newsroom/fact-sheets/2025-medicare-parts-b-premiums-and-deductibles

2025 Medicare Parts A & B Premiums and Deductibles

Share

opens in new windowopens in new windowopens in new window

On November 8, 2024, the Centers for Medicare & Medicaid Services (CMS) released the 2025 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2025 Medicare Part D income-related monthly adjustment amounts.

Medicare Part B Premium and Deductible

Medicare Part B covers physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Each year, the Medicare Part B premium, deductible, and coinsurance rates are determined according to provisions of the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $185.00 for 2025, an increase of $10.30 from $174.70 in 2024. The annual deductible for all Medicare Part B beneficiaries will be $257 in 2025, an increase of $17 from the annual deductible of $240 in 2024.

The increase in the 2025 Part B standard premium and deductible is mainly due to projected price changes and assumed utilization increases that are consistent with historical experience.

Beginning in 2023, individuals whose full Medicare coverage ended 36 months after a kidney transplant, and who do not have certain other types of insurance coverage, can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. For 2025, the standard immunosuppressive drug premium is $110.40.

Medicare Part B Income-Related Monthly Adjustment Amounts

Since 2007, a beneficiary’s Part B monthly premium has been based on his or her income. These income-related monthly adjustment amounts affect roughly 8% of people with Medicare Part B. The 2025 Part B total premiums for high-income beneficiaries with full Part B coverage are shown in the following table:

| Full Part B Coverage | |||

| Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-Related Monthly Adjustment Amount | Total Monthly Premium Amount |

| Less than or equal to $106,000 | Less than or equal to $212,000 | $0.00 | $185.00 |

| Greater than $106,000 and less than or equal to $133,000 | Greater than $212,000 and less than or equal to $266,000 | 74.00 | 259.00 |

| Greater than $133,000 and less than or equal to $167,000 | Greater than $266,000 and less than or equal to $334,000 | 185.00 | 370.00 |

| Greater than $167,000 and less than or equal to $200,000 | Greater than $334,000 and less than or equal to $400,000 | 295.90 | 480.90 |

| Greater than $200,000 and less than $500,000 | Greater than $400,000 and less than $750,000 | 406.90 | 591.90 |

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | 443.90 | 628.90 |

The 2025 Part B total premiums for high-income beneficiaries who only have immunosuppressive drug coverage are shown in the following table:

| Part B Immunosuppressive Drug Coverage Only | |||

| Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-Related Monthly Adjustment Amount | Total Monthly Premium Amount |

| Less than or equal to $106,000 | Less than or equal to $212,000 | $0.00 | $110.40 |

| Greater than $106,000 and less than or equal to $133,000 | Greater than $212,000 and less than or equal to $266,000 | 73.60 | 184.00 |

| Greater than $133,000 and less than or equal to $167,000 | Greater than $266,000 and less than or equal to $334,000 | 184.10 | 294.50 |

| Greater than $167,000 and less than or equal to $200,000 | Greater than $334,000 and less than or equal to $400,000 | 294.50 | 404.90 |

| Greater than $200,000 and less than $500,000 | Greater than $400,000 and less than $750,000 | 404.90 | 515.30 |

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | 441.70 | 552.10 |

Premiums for high-income beneficiaries with full Part B coverage who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

| Full Part B Coverage | ||

| Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses with modified adjusted gross income: | Income-Related Monthly Adjustment Amount | Total Monthly Premium Amount |

| Less than or equal to $106,000 | $0.00 | $185.00 |

| Greater than $106,000 and less than $394,000 | 406.90 | 591.90 |

| Greater than or equal to $394,000 | 443.90 | 628.90 |

Premiums for high-income beneficiaries with immunosuppressive drug only Part B coverage who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

| Part B Immunosuppressive Drug Coverage Only | ||

| Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses with modified adjusted gross income: | Income-Related Monthly Adjustment Amount | Total Monthly Premium Amount |

| Less than or equal to $106,000 | $0.00 | $110.40 |

| Greater than $106,000 and less than $394,000 | 404.90 | 515.30 |

| Greater than or equal to $394,000 | 441.70 | 552.10 |

Medicare Part A Premium and Deductible

Medicare Part A covers inpatient hospitals, skilled nursing facilities, hospice, inpatient rehabilitation, and some home health care services. About 99% of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment, as determined by the Social Security Administration.

The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,676 in 2025, an increase of $44 from $1,632 in 2024. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. In 2025, beneficiaries must pay a coinsurance amount of $419 per day for the 61st through 90th day of a hospitalization ($408 in 2024) in a benefit period and $838 per day for lifetime reserve days ($816 in 2024). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $209.50 in 2025 ($204.00 in 2024).

| Part A Deductible and Coinsurance Amounts for Calendar Years 2024 and 2025 by Type of Cost Sharing | ||

| 2024 | 2025 | |

| Inpatient hospital deductible | $1,632 | $1,676 |

| Daily hospital coinsurance for 61st-90th day | $408 | $419 |

| Daily hospital coinsurance for lifetime reserve days | $816 | $838 |

| Skilled nursing facility daily coinsurance (days 21-100) | $204.00 | $209.50 |

Enrollees age 65 and older who have fewer than 40 quarters of coverage, and certain persons with disabilities, pay a monthly premium in order to voluntarily enroll in Medicare Part A. Individuals who had at least 30 quarters of coverage, or were married to someone with at least 30 quarters of coverage, may buy into Part A at a reduced monthly premium rate, which will be $285 in 2025, a $7 increase from 2024. Certain uninsured aged individuals who have fewer than 30 quarters of coverage, and certain individuals with disabilities who have exhausted other entitlements, will pay the full premium, which will be $518 a month in 2025, a $13 increase from 2024.

For more information on the 2025 Medicare Parts A and B premiums and deductibles (CMS-8086-N, CMS-8087-N, CMS-8088-N), please visit https://www.federalregister.gov/public-inspection.

Medicare Part D Income-Related Monthly Adjustment Amounts

Since 2011, a beneficiary’s Part D monthly premium has been based on his or her income. Approximately 8% of people with Medicare Part D pay these income-related monthly adjustment amounts. These individuals will pay the income-related monthly adjustment amount in addition to their Part D premium. Part D premiums vary by plan and, regardless of how a beneficiary pays their Part D premium, the Part D income-related monthly adjustment amounts are deducted from Social Security benefit checks or paid directly to Medicare. Roughly two-thirds of beneficiaries pay premiums directly to the plan while the remainder have their premiums deducted from their Social Security benefit checks. The 2025 Part D income-related monthly adjustment amounts for high-income beneficiaries are shown in the following table:

| Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-related monthly adjustment amount |

| Less than or equal to $106,000 | Less than or equal to $212,000 | $0.00 |

| Greater than $106,000 and less than or equal to $133,000 | Greater than $212,000 and less than or equal to $266,000 | 13.70 |

| Greater than $133,000 and less than or equal to $167,000 | Greater than $266,000 and less than or equal to $334,000 | 35.30 |

| Greater than $167,000 and less than or equal to $200,000 | Greater than $334,000 and less than or equal to $400,000 | 57.00 |

| Greater than $200,000 and less than $500,000 | Greater than $400,000 and less than $750,000 | 78.60 |

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | 85.80 |

Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

| Beneficiaries who are married and lived with their spouses at any time during the year, but file separate tax returns from their spouses with modified adjusted gross income: | Income-related monthly adjustment amount |

| Less than or equal to $106,000 | $0.00 |

| Greater than $106,000 and less than $394,000 | 78.60 |

| Greater than or equal to $394,000 | 85.80 |