HI Market View Commentary 10-15-2025

Bryan is running the staddle / strangle AS A PROCESS

Investing is a process we have the opportunity to adjust

Investing a singular event 1 out of 3 chance of being right or 33.3% success and 66.6% of being wrong

What’s next = ???? Earnings

Probably because we going early

We run OTM options for this earnings cycle

We are seeing the rebalancing for a Christmas Rally

Earnings

AAPL 10/30 AMC

BA 10/29 BMO

BAC 10/15 BMO

BIDU 11/20 est

CB 10/21 AMC

DIS 11/13 BMO

F 10/23 AMC

GE 10/21 BMO

GOOGL 10/28 est

JPM 10/14 BMO

KEY 10/16 BMO

LMT 10/21 BMO

MA 10/30 est

META 10/20 AMC

MSTR 10/30 est

MU 12/17 est

NVDA 11/29 AMC

O 11/03 AMC

PLTR 11/03 est

TGT 11/19 BMO

TXN 10/21 AMC

UAA 11/06 est

V 10/28 est

VZ 10/21 BMO

WMT 11/20 BMO

Why might the new standard for S&P 500 Valuations??= The gov’t put trillions of dollars into companies pockets, we have a handful of trillion dollar companies that are changing the valuation/Price to Earnings index metric, We’ve had stretched valuations for decades

https://www.briefing.com/the-big-picture

The Big Picture

The Big Picture

Last Updated: 03-Oct-25 15:27 ET | Archive

A hot stock market could be running headlong into Warren Buffett’s cold patience

Briefing.com Summary:

*The Buffett Indicator suggests investors may be “playing with fire” at current valuations.

*Berkshire Hathaway’s cash position is at a record high alongside the S&P 500.

*Warren Buffett values patience over fear-driven investing in overheated markets.

Coming out of the COVID nightmare, people were spending like crazy, motivated by stimulus checks, cabin fever, and an unprecedented joie de vivre. There was at least one person, however, who did not join the spending party. In fact, this person saved even more, so much so that he became the largest private holder of U.S. Treasury bills.

To be fair, this person did not become the largest holder of Treasury bills, but the company he oversees did. That person, Warren Buffett, oversees Berkshire Hathaway (BRK.B).

We have touched on this point before, but we are revisting it again today because Berkshire Hathaway’s cash and short-term investment position has risen to record highs alongside the S&P 500. What this means only Warren Buffett and Berkshire Hathaway truly know, yet that won’t stop us from surmising that the greatest value investor of all time is struggling to find value in this market.

Comfortable, yet Agitated

Warren Buffett doesn’t buy stocks; he buys businesses. If there was a business he liked and aimed to acquire at a fair value, he would put that cash to work.

Berkshire Hathaway took a baby step in that direction recently, with its $9.7 billion cash acquisition of Occidental Petroleum’s chemical business, OxyChem. Based on the company’s second quarter 10-Q filing, that is slightly less than 10% of Berkshire Hathaway’s cash-only position. The cash used to buy OxyChem, though, will be recovered in short order when a sliver of Berkshire’s $243.6 billion in T-bills matures.

To say the least, Berkshire Hathaway sits in a comfortable, albeit agitated, cash equivalent position. We say comfortable because that is a ton of liquidity at the ready; we say agitated because the company would presumably prefer to earn a higher return on that capital.

The amazing quality Warren Buffett has is that he does not let that agitation translate into malinvestment. In other words, he doesn’t chase performance. He is patient and disciplined and would prefer to sit on a mountain of cash, like he is currently doing, than put it to work simply because he doesn’t know what else to do with it. A boring T-bill is just fine, particularly in markets trading with rich valuations.

Don’t Forget the Sunscreen

We observed last week that the S&P 500 is trading at 23x forward 12-month earnings. That is a 24% premium to the 10-year average of 18.6x and a 36% premium to the 25-year average of 16.9x, according to FactSet.

That is, historically, a very high valuation. History, though, isn’t the market’s guide at this time. The future is, and there is an enduring belief in that premium valuation that the future is bright. The price action leaves no doubt that things are burning bright in the market’s mind.

Every dip gets bought; every piece of bad economic news gets spun as good news for rate cuts; the AI trade is indefatigable; highly shorted stocks are crowd favorites; the IPO market is revving up; and there is a lot of speculative energy in profitless corners of the market like quantum computing.

There are UV rays galore shining down on equity portfolios and 401(k) accounts, so much so that investors should apply sunscreen before looking at their statements. But is it a warm glow or the heat being thrown off by a fire? It feels like a warm glow in the moment, yet the future just might reveal that it is the heat of a fire.

The ratio of the Wilshire 5000 market capitalization to nominal GDP—a valuation measure popularized by Warren Buffett—is at a record high of 219%. He said in 2001 that “if the ratio approaches 200%—as it did in 1999 and a part of 2000–you are playing with fire.”

Briefing.com Analyst Insight

If you are not invested in this stock market or you are sitting on a fair amount of cash, it can be mentally painful watching stock prices appreciate nearly every session, and even when they don’t, not pulling back much before the dip is bought.

There is an understandable tendency to want to put that cash to work in the stocks and sectors that keep running for fear of missing out on further gains. Buying at a record-high level in a richly valued market requires conviction that your reward will be greater than the risk.

That could end up being the case, but the bar for that tradeoff is so much higher when the market’s valuation is so much higher from which to begin. Fear can be a motivating factor, but it is not a virtue. Patience is a virtue, and Warren Buffett is perhaps the most virtuous of them all.

He knows value when he sees it, and he is okay sitting on a lot of cash, ready to strike when the iron is hot, as he did so adeptly during the financial crisis. From our vantage point, he and Berkshire Hathaway look to be in a strike position, ready to deploy cash opportunistically to extinguish fires in the stock market that lower asset values.

His approach may just be one worth copying for holders of cash feeling the heat of a stock market that seems to think nothing will go wrong.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Higher

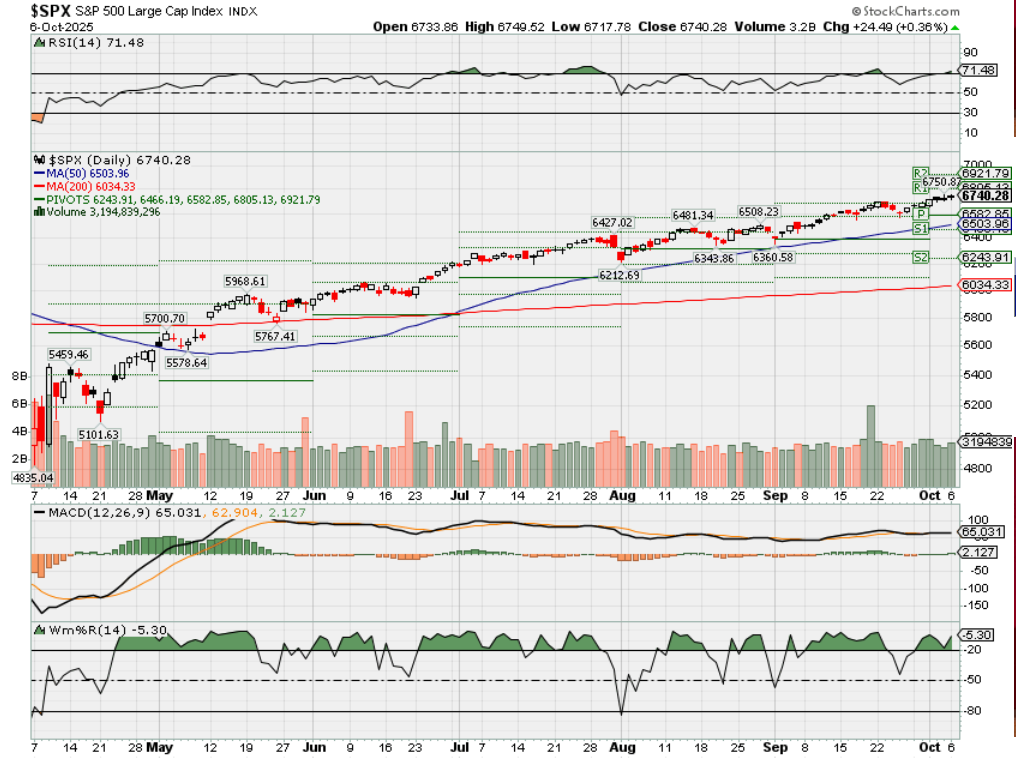

DJIA – Bullish

SPX – Bullish overbought right now

COMP – Bullish but overbought right now

Where Will the SPX end October 2025?

10-06-2025 +2.0%

09-29-2025 -2.0%

Earnings:

Mon:

Tues: MCK

Wed: DAL, PEP, LEVI

Thur:

Fri:

Econ Reports:

Mon:

Tue Trade Balance, Consumer Credit

Wed: MBA, FOMC Minutes

Thur: Initial Claims, Continuing Claims, Wholesale Inventories,

Fri: Michigan Sentiment, Treasury Budget

How am I looking to trade?

Time to start protecting for earnings

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

AI expectations are that those stocks will continue to move the markets = Growth

Europe’s work-life balance a key talent draw as Trump revamps H-1B visa

Published Tue, Sep 23 20258:27 AM EDTUpdated 20 Min Ago

Sam Meredith@in/samuelmeredith@smeredith19

Key Points

- The Trump administration’s revamp of the H-1B visa program is seen as a unique opportunity for global talent hubs to lure highly skilled foreign workers.

- Europe’s work-life balance is a “very important competitive factor” to attract top talent, according to Paul Achleitner, former chair of Deutsche Bank’s supervisory board.

- Research suggests work-life balance has soared in importance for employees across the globe.

U.S. President Donald Trump’s revamp of the H-1B visa program has rekindled the scramble to hire top global talent, with some touting Europe’s work-life balance as a key competitive advantage.

The Trump administration recently raised the H-1B visa application fee to $100,000, seeking to protect American jobs and prevent “abuse” of the program that it says has undermined economic and national security.

The surprise move jolted Big Tech and financial firms which have long counted on the visa program to recruit highly skilled foreign workers, particularly from India and China.

Talent hubs in the U.K., Europe, Middle East and Asia are widely expected to be among those that stand to benefit.

Paul Achleitner, former chair of Deutsche Bank’s supervisory board, described quality of life in Europe as a “very important competitive factor” when it comes to attracting skilled foreign workers.

“If there’s one thing we have in Europe, it’s quality of life. And you know, I don’t have to elaborate on that, from social systems to healthcare systems to educational systems,” Achleitner told CNBC’s Annette Weisbach on Monday.

“Increasingly, we may actually also be the beneficiaries of a potential rigorous brain drain, because in the past, we have had all the very talented individuals wanting to go to the U.S. And, given the fact that that is not quite as easy as it used to be, maybe some of that talent actually find their way to us,” he added.

Recent research suggests work-life balance has soared in importance for workers across the globe.

In fact, work-life balance has surpassed pay as the most important priority for thousands of employees in Europe, Asia-Pacific and the Americas, according to an annual review of the world of work by recruitment company Randstad. Published in January, it was the first time in the report’s 22-year history that work-life balance ranked higher than pay.

‘A unique opportunity’

Peter Specht, general partner at European venture capital firm Creandum, told CNBC that the prospect of attracting even more top global talent to the European ecosystem was “a unique opportunity” and “one that we shouldn’t let slip.”

In the short term, Sprecht said that increasing the talent density in the U.K. and Europe would be “an immediate win,” adding that improvements to the region’s research and development capabilities could be one of the longer-term benefits.

“It’s also a reminder that policy matters, and that we should be doing everything we can to establish Europe as a highly attractive place for founders and startups,” Sprecht said.

Some of measures he cited included an affordable visa system for top talent, standardized EU-wide stock options for founders, pan-EU mobility for employees and incentives to deepen expertise in forward-looking research fields, such as artificial intelligence.

CNBC has contacted the European Commission, the European Union’s executive arm, for comment on how the 27-nation bloc could respond to the H-1B visa shake-up.

In stark contrast to the U.S., the U.K. is reportedly looking at abolishing some visa fees for top global talent.

One option under the consideration of British Prime Minister Keir Starmer is a proposal to drop visa charges for top-level professionals, the Financial Times reported on Monday, citing people familiar with the matter.

CNBC has asked Downing Street to comment. A Home Office spokesperson told the Financial Times that the country’s global talent routes “attract and retain high-skilled talent, particularly in science, research and technology.”

Louise Haycock, partner at Fragomen, a global immigration services firm, said that the U.K. was an interesting case study in its pursuit of top talent, noting that the government recently raised both the salary and skills thresholds for “Skilled Worker” visas.

“One thing I would say about the U.K. immigration system, which puts it apart from many other systems, is that it is transparent and it is very, very quick,” Haycock told CNBC’s “Squawk Box Europe” on Tuesday.

“And that is really liked by employers, because it does give them the certainty that they need to be able to plan that talent pipeline,” she added.

‘A global war for talent’

Not everyone is convinced that European countries, particularly the U.K., will be able to capitalize on the Trump administration’s H-1B visa fee hike.

“We are in a global war for talent,” Harry Stebbings, founder of VC fund and podcast 20VC, told CNBC on Tuesday.

“We are fighting Dubai. Dubai is an incredible place to build a business. They are doing everything they can to get great talent. We are fighting against Milan; there’s a lot of tax incentives there. This is not us against the U.S.,” Stebbings said.

The 20VC founder said that more than 30 U.S.-based entrepreneurs have been in contact with him since the H-1B visa fee hike to say that London could be their next home.

Yet, when asked whether he expected this to provide a boost to the UK’s startup scene, Stebbings said: “No, because we’ve hung a sign up that says ‘closed for business.’”

He added: “Why would you come and build here, when Dubai hangs up an ‘open for business’ [sign], with zero percent capital gains and everything you could ever dream of? They sell a dream.”

— CNBC’s Michael Considine & Sawdah Bhaimiya contributed to this report.

Paul Tudor Jones says ingredients are in place for massive rally before a ‘blow off’ top to bull market

Published Mon, Oct 6 20258:40 AM EDTUpdated 43 Min Ago

Key Points

- Paul Tudor Jones said today’s market is reminiscent of the setup leading up to the burst of the dotcom bubble in late 1999.

- The difference between now and 1999 is the U.S. fiscal and monetary policy, Jones noted.

- He believes the bull market still has room to run before it reaches its final phase.

Paul Tudor Jones: Ingredients are in place for massive rally before a ‘blow off’ top to bull market

Billionaire hedge fund manager Paul Tudor Jones believes the conditions are set for a powerful surge in stock prices before the bull market tops out.

“My guess is that I think all the ingredients are in place for some kind of a blow off,” Jones said on CNBC’s “Squawk Box” Monday. “History rhymes a lot, so I would think some version of it is going to happen again. If anything, now is so much more potentially explosive than 1999.”

The founder and chief investment officer of Tudor Investment said today’s market is reminiscent of the setup leading up to the burst of the dotcom bubble in late 1999, with dramatic rallies in technology shares and heightened speculative behavior. Jones said the circular deals or vendor financing happening in the artificial intelligence space today also made him “nervous.”

The tech-heavy Nasdaq Composite has bounced 55% from its April bottom to consecutive record highs. The rally has been driven by mega-cap tech giants, which have invested billions in AI and are being valued richly on the potential of this emerging era.

The difference between now and 1999 is the U.S. fiscal and monetary policy, Jones noted. The Federal Reserve had just begun a new easing cycle, whereas rate hikes were on the way before the market top in 2000. The U.S. is now running a 6% budget deficit, while in 1999, there was a budget surplus in $99,000, Jones said.

“That fiscal monetary combination is a brew that we haven’t seen since, I guess, the postwar period, early 50s,” he said.

The longtime investor highlighted the tension at the heart of every late-stage bull market — the eager to capture outsized gains and the inevitability of a painful correction.

“You have to get on and off the train pretty quick. If you just think about bull markets, the greatest price appreciations always [occurs] the 12 months preceding the top,” Jones said. “It kind of doubles whatever the annual averages, and before then, if you don’t play it, you’re missing out on the juice; if you do play it, you have to have really happy feet, because there will be a really, really bad end to it.”

To be sure, Jones isn’t predicting an immediate downturn. He believes the bull market still has room to run before it reaches its final phase.

“It will take a speculative frenzy for us to elevate those prices. It will take more retail buying. It’ll take more recruitment from a variety of others from long short hedge funds, from real money, etc.,” he said.

He said he would own a combination of gold, cryptocurrencies and Nasdaq tech stocks between now and the end of the year to take advantage of the rally fueled by the fear of missing out.

Jones shot to fame after he predicted and profited from the 1987 stock market crash. He is also the co-founder of nonprofit Just Capital, which ranks public U.S. companies based on social and environmental metrics.

Correction: The tech-heavy Nasdaq Composite has bounced 55% from its April bottom to consecutive record highs. A previous version misstated the percentage.

Goldman Sachs CEO: Overextended AI Craze Puts Stock Market on “Risk Curve”

(US Dollar Defense)—Goldman Sachs CEO David Solomon has issued a stark caution about the stock market’s trajectory, predicting a pullback as the artificial intelligence craze shows signs of overextension. Speaking at Italian Tech Week in Turin on October 3, Solomon drew direct comparisons to historical tech surges that ended in painful adjustments for investors.

He described the inevitable ups and downs of market behavior this way: “Markets run in cycles, and whenever we’ve historically had a significant acceleration in a new technology that creates a lot of capital formation, and therefore lots of interesting new companies around it, you generally see the market run ahead of the potential … there are going to be winners and losers.”

This observation points to the dotcom boom of the late 1990s, when the internet sparked massive innovation and company creation, but also triggered widespread financial losses as overhyped ventures collapsed. Many investors poured money into unproven ideas, only to watch valuations evaporate when reality set in. Solomon sees echoes of that era in today’s AI landscape, where rapid advancements have lured capital but may not sustain the current enthusiasm.

Applying this lesson to the present, Solomon added, “You’re going to see a similar phenomenon here.” He went further, forecasting specific timing and consequences: “I wouldn’t be surprised if in the next 12 to 24 months, we see a drawdown with respect to equity markets … I think that there will be a lot of capital that’s deployed that will turn out to not deliver returns, and when that happens, people won’t feel good.”

Such a drawdown could ripple through portfolios heavily weighted in tech stocks, forcing reallocations and potentially curbing speculative bets. The S&P 500 and other major indices have climbed to repeated records on the back of AI investments in companies like Nvidia, Microsoft, Alphabet, and Palantir, even as earlier trade policy shifts under President Trump temporarily pressured values. Yet Solomon’s view suggests this momentum could reverse if promised AI breakthroughs fail to materialize at scale, leaving behind a trail of underperforming assets.

Solomon avoided labeling the situation outright but acknowledged the psychological drivers at play. “I’m not going to use the word bubble, because I don’t know, I don’t know what the path will be, but I do know people are out on the risk curve because they’re excited,” he said. He continued, “And when [investors are] excited, they tend to think about the good things that can go right, and they diminish the things you should be skeptical about.”

This mindset often leads to overlooked red flags, such as high energy demands for AI data centers, regulatory hurdles, or competition that erodes early advantages. Investors chasing quick gains might ignore these factors, amplifying vulnerability when sentiment shifts.

These concerns align with broader unease in the investment community. Amazon founder Jeff Bezos recently described AI as entering an “industrial bubble,” though he expects long-term societal gains despite short-term excesses. Similarly, a prominent UK tech investor has flagged “disconcerting” signals in skyrocketing AI valuations, warning of potential corrections ahead.

Not all assessments agree on the severity—some metrics show AI stock price-to-earnings ratios remain below dotcom peaks, and the Federal Reserve’s rate cuts could provide a cushion unlike the hikes that exacerbated the 2000 bust. Still, hedge funds are positioning for fallout, and industries tied to AI infrastructure face elevated crash risks over the next two years.

Despite the market jitters, Solomon has maintained a measured outlook on the economy at large. In a separate comment earlier this year, he assessed the odds of a U.S. recession as “very small,” even with ongoing global trade tensions. This suggests any stock drawdown might stem more from sector-specific hype than widespread downturns, allowing for recovery through diversified strategies and prudent capital allocation. Investors would do well to heed such warnings, balancing innovation’s promise with the discipline of risk

When you look at the headlines today, you’ll see experts in the retirement industry warning about big threats to your financial security:

- De-dollarization and the rise of BRICS

- Soaring national debt

- Unstable interest rates

- Weakened U.S. dollar

All of these are real concerns.

Investors should steer clear of these stocks likely to be targeted by tax-loss harvesters, Wolfe Research says

Published Wed, Sep 24 20252:07 PM EDT

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

With tax-loss harvesting season heating up in the fourth quarter, Wolfe Research found several stocks that could face selling pressure as investors look to lower their tax bills for 2025.

“Historically, avoiding the biggest year-to-date losers has been a positive alpha generating strategy heading into the last several months of the year,” Wolfe Research said in a note to clients last week. “The market’s biggest laggards can be subject to selling pressures by investors looking to harvest capital losses and/or provide ‘window dressing’ for their annual reports.”

Tax-loss harvesting refers to the practice of selling assets at a loss, to help offset capital gains from investments sold at a profit. Tax-loss selling typically peaks between September and December, adding more selling pressure to stocks that have already underperformed.

Investors probably want to steer clear of, or approach with caution stocks susceptible to being targeted by tax-loss harvesters. To help find such candidates, Wolfe Research screened for stocks with the following characteristics:

- Market capitalization above $5 billion

- Share price down 20% or more over the past 12 months or year-to-date

- Excluded stocks with a two-year gain

Here are some of the companies that appeared on the Wolfe Research screen:

Tax-loss selling candidates

| Ticker | Company | YTD % change | 1-year % change |

| LULU | Lululemon athletica | -53 | -31 |

| FRPT | Freshpet | -67 | -65 |

| CZR | Caesars Entertainment | -21 | -36 |

| TGT | Target Corp. | -35 | -44 |

| GIS | General Mills | -20 | -31 |

| KHC | Kraft Heinz Co. | -13 | -23 |

| MTN | Vail Resorts | -21 | -21 |

| CROX | Crocs | -28 | -45 |

| COTY | Coty Inc. Class A | -42.5 | -56.9 |

| STZ | Constellation Brands, Inc. Class A | -39.5 | -47.6 |

Source: Wolfe Research

Lululemon Athletica

Lululemon had plummeted 53% year to date and 31%, the biggest loser Wolfe found at the time of its report among consumer discretionary stocks.

The Canadian athletic wear maker is down 10% or more in five different months this year after management gave disappointing forward guidance citing mounting macroeconomic uncertainties, including the U.S.-China trade war. Earlier this month, Lululemon forecast full fiscal-year earnings of $12.77 to $12.97 per share, far below Wall Street analyst estimates of $14.40 per share, saying it may be forced to absorb higher production and shipping costs due to higher tariffs.

Freshpet

Freshpet shares have lost two thirds of their value this year, plunging 67%.

The Bedminster, New Jersey-based company twice cut its 2025 sales and profit outlook this year, citing economic concerns that have led consumers to tighten their belts. Fresh Pet also faces mounting competition from General Mills, which plans to deepen its foray into the pet food market.

Caesars Entertainment

Caesars’ shares are trading 21% lower since the beginning of this year and have tumbled 36% over the past 12 months.

The casino operator posted a worse-than-expected loss of 39 cents per share in the second quarter, citing softer leisure demand in the Las Vegas market. Caesars also said it has more than $12 billion in aggregate principal debt outstanding, little changed from the end of 2024.

Other potential tax-loss selling candidates investors might be wary of

https://www.cnbc.com/2025/10/06/government-shutdown-trump-hassett-vought.html

Trump could ‘start taking sharp measures’ if next government funding bills fail: Hassett

Published Mon, Oct 6 20259:20 AM EDTUpdated 2 Hours Ago

Kevin Breuninger@KevinWilliamB

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Key Points

- President Donald Trump could “start taking sharp measures” if the Senate’s next votes do not end the government shutdown, National Economic Council Director Kevin Hassett said.

- Hassett on CNBC’s “Squawk Box” said Democrats will be to blame for “any government worker that loses their job” due to reduction-in-force orders issued in response to the shutdown.

- The Senate is set to vote again on dueling stopgap funding measures after 5:30 p.m. ET.

President Donald Trump could “start taking sharp measures” on Monday if the government shutdown continues after the Senate’s next votes on stopgap funding bills, National Economic Council Director Kevin Hassett said.

Hassett’s warning on CNBC’s “Squawk Box” came after he said Democrats will be to blame for “any government worker that loses their job” due to reduction-in-force orders issued in response to the shutdown.

The Trump administration has repeatedly asserted that the shutdown will result in thousands of federal employees being laid off, rather than merely furloughed, as has been the case in past funding lapses.

Hassett said Monday morning that he expects Trump and other officials will be in the Oval Office watching the Senate’s upcoming vote on a Republican funding proposal that, if passed, would end the shutdown.

View More

Dueling Republican and Democratic bills have already failed to pass numerous times since the shutdown began six days earlier, after party leaders could not negotiate a compromise to keep the government open.

Both Republicans’ “clean” resolution, which would resume funding at current levels through late November, and Democrats’ version, which includes additional health-care funding and other measures, are set to come to a vote again after 5:30 p.m. ET.

Trump will be “hoping that we’re going to get the government to stop being shut down” during those votes, Hassett told CNBC.

“But if not, then I would guess that team in the Oval is going to start taking sharp measures,” he said.