HI Market View Commentary 09-22-2025

Bryan Strain – Newest HI RIA!!!

So, I get an advisor magazine every month and sometimes I just giggle at the stuff I am reading about.

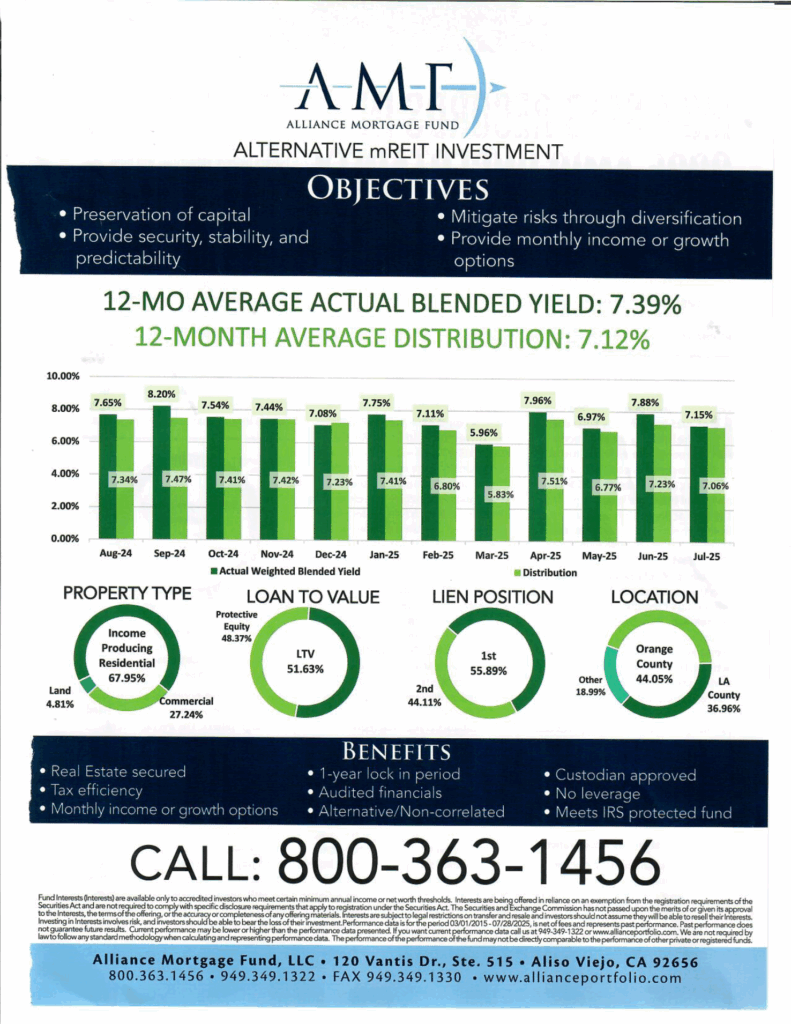

Here’s a page

Then you have the REIT push but make sure you READ THE SMALL PRINT !!!

And then again for those of you who approach me about becoming registered. Here is an interesting article and my suggestion is stop asking how to be come registered and just go get registered!!!

Earnings

MU 09/23

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 12-Sep-25 14:54 ET | Archive

A record $7 trillion+ in money market funds is facing pay cuts

Briefing.com Summary:

*Real returns for money market funds are eroding with inflation near 3% and rate cuts on the way.

*Liquidity and safety keep money market funds attractive, but yield compression will drive partial outflows.

*Cash migration depends on confidence that rate cuts sustain growth without reigniting inflation.

Can you hear it with the major indices rallying to new record highs? That is the sound of rate cuts coming. But even if you can’t hear it, you can see it in the fed funds futures market.

There is a 100% probability of at least a 25-basis-point cut to 4.00-4.25% at the September FOMC meeting, an 86.3% probability of at least a 25-basis-point cut to 3.75-4.00% at the October meeting, and an 80.9% probability of at least a 25-basis-point rate cut at the December meeting, according to the CME FedWatch Tool.

That is rather remarkable with inflation hovering closer to 3.0% than 2.0%, and the Atlanta Fed GDPNow model estimating real GDP growth of 3.1% on an annualized basis for the third quarter. That hasn’t typically been a combination screaming for rate cuts, but with nonfarm payroll growth slowing to stall speed in recent months, Fed officials are sounding more motivated by the employment side of their mandate to justify a rate cut, at least at the September FOMC meeting.

The stock market is loving the idea, partly because the Treasury market has been pricing in the idea, too, leading to lower market rates that have provided stocks with some extra valuation allowance on the premise that the lower rates will facilitate ongoing economic and earnings growth.

The stock market, though, may also just be loving the idea that there are gobs of cash on the sidelines that may soon be looking for a higher-yielding home.

Seven Trillion and Counting

Currently, there is over $7 trillion sitting in money market mutual funds. That is an all-time high, and it is roughly 13% of the S&P 500’s market capitalization.

Assets in money market funds surged during the COVID crisis and subsequently accelerated with the normalization of interest rates that followed the Fed’s rate-hike campaign in 2022 and 2023. In turn, they have surged with the stock market and home price appreciation that have been huge wealth-generating engines.

Separately, assets in money market funds have surged as part of a safe-haven trade tied to concerns about geopolitics, tariffs, and valuations. Money market funds offer a place to park cash and still generate income in a nearly risk-free way with higher yields than one would get in a normal savings account. Generally speaking, prime money market funds yield something on the order of 3.8% to 4.4% these days.

Money market funds typically invest in high-quality instruments with a shorter duration, like T-bills, certificates of deposit, commercial paper, and repurchase agreements, all of which can be easily exchanged for cash.

Briefing.com Analyst Insight

Where the Federal Reserve’s policy rate goes, rates on shorter-duration instruments typically follow. One can infer, then, with the fed funds futures market pricing in three rate cuts before the end of the year, that the yields on money market funds are apt to be coming down in the months ahead, assuming the market has things right.

The far right side of the chart above shows a trendline break between the 3-month T-bill yield and the effective fed funds rate. The chart below captures that break in closer detail, and what it reveals is a market frontrunning the rate cut(s).

It is notable that the inflation rate is closer to 3.0%, so returns on money market funds are coming down on an inflation-adjusted basis, diminishing some of their appeal when real rates were higher. It is an inflection point that will send some (not all) money market fund investors looking elsewhere for higher real rates of return.

The ongoing appeal of money market funds is that they are highly liquid, nearly risk-free, and still offer a better return than anything one can get in a basic savings account, which is why “all” investors won’t be fleeing money market funds simply because the Fed is cutting rates. Also, they are good parking spots for investors with more immediate cash needs.

We would expect some migration to other parts of the market, however, that have higher-yielding appeal. That would include Treasuries with longer duration, corporate bonds, and, yes, the stock market, which holds much more risk but appealing return potential on a nominal and real basis.

To be sure, no one is scurrying out of their money market fund to capture a 1.49% dividend yield for the S&P 500. The rotation out of money market funds to the stock market would be about total return and an expectation that the stock market will retain its bullish bias.

With $7 trillion-plus facing pay cuts, so to speak, higher returns will be sought elsewhere. That may just work in the stock market’s favor if confidence in the rate cut approach is corroborated by the future data.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: The next installment of The Big Picture will be published the week of September 22)

Where will our markets end this week?

Higher

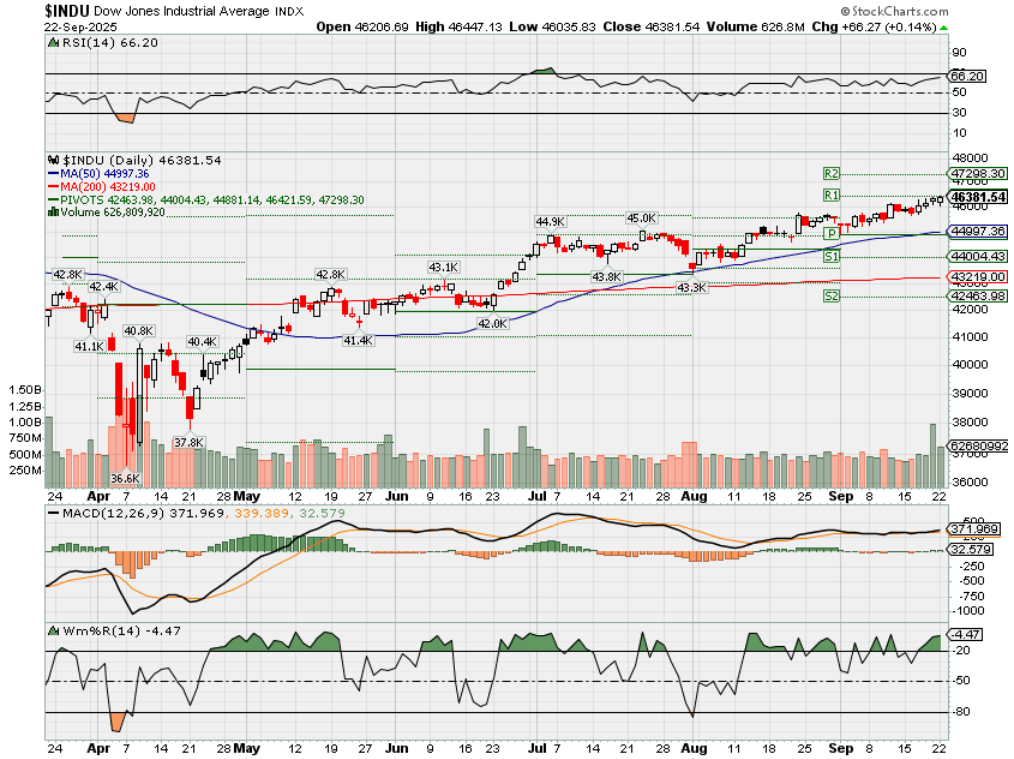

DJIA – Bullish

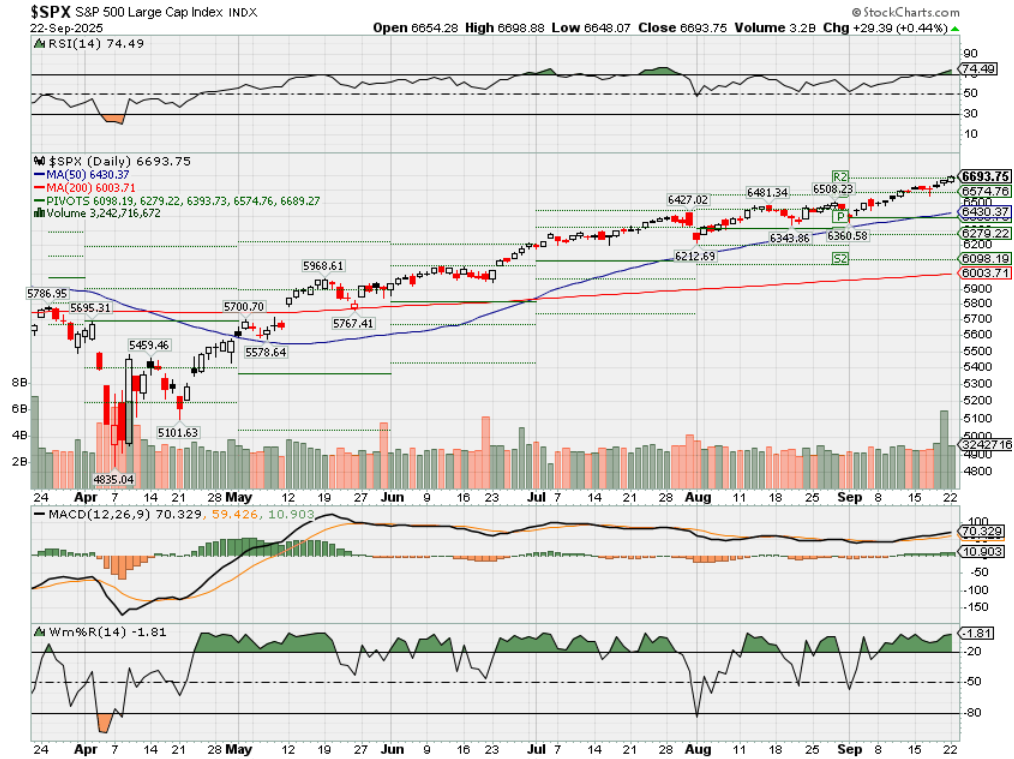

SPX – Bullish overbought right now

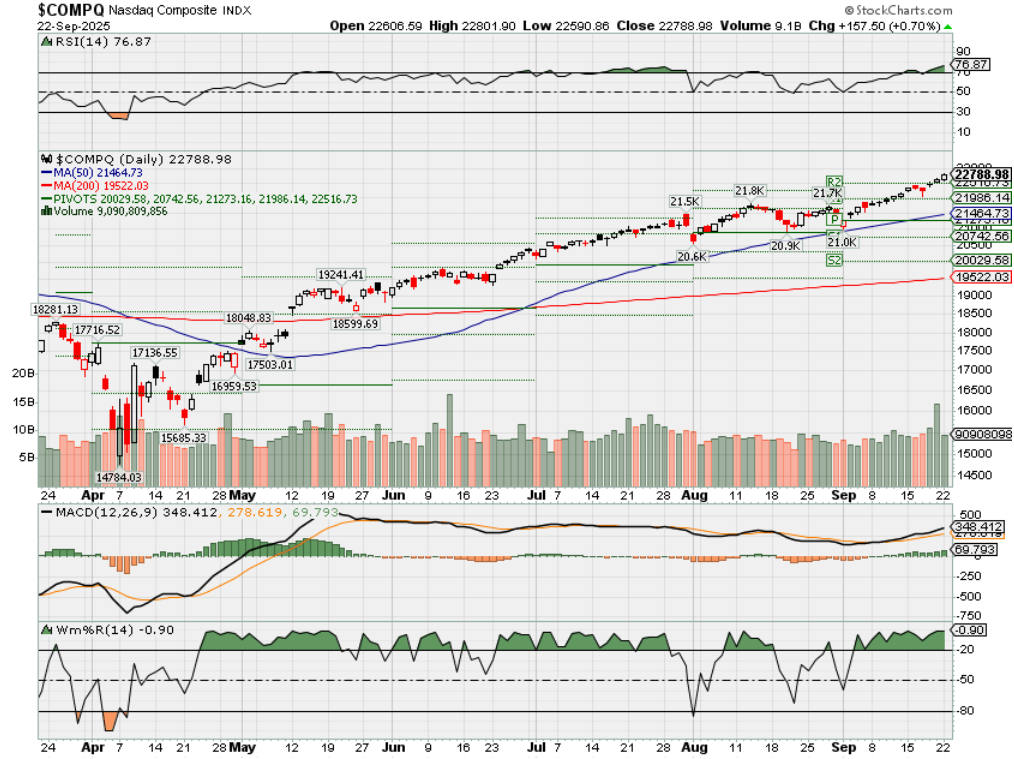

COMP – Bullish but overbought right now

Where Will the SPX end September 2025?

09-22-2025 +2.0%

09-15-2025 0.0%

09-08-2025 -2.0%

09-02-2025 -2.0%

08-25-2025 -2.0%

Earnings:

Mon:

Tues: AZO, MU

Wed: CTAS, FUL, KBH,

Thur: KMX, JBL, BB, COST

Fri:

Econ Reports:

Mon:

Tue Current Account Balances

Wed: MBA, New Home Sales

Thur: Initial Claims, Continuing Claims, GDP, GDP Deflator, Durable Goods, Durable ex-trans, Existing Home Sales,

Fri: Personal Income, Personal Spending, PCE Prices, Core PCE

How am I looking to trade?

Time to start protecting after a rate cut / 2% jump in the market for historical downturn,

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Fund manager reveals the rule that made him a 2,000% return on one stock

Published Wed, Sep 17 20253:10 AM EDT

Updated Wed, Sep 17 20255:21 AM EDT

Europe’s defense stocks have boomed this year, with some major players tripling in value — but one fund manager spotted the potential in sector darling Rheinmetall early, and won big as a result.

Christopher Hart manages Boston Partners’ $5.8 billion Global Premium Equities fund, which, net of fees, gained 22% from the beginning of this year to the end of July.

His team’s value investing strategy means ignoring market noise and focusing on the so-called “three circle rule” of only picking stocks that have an attractive valuation, strong business fundamentals, and positive business momentum.

If at any point a stock held in the fund no longer meets all three criteria — for example, because a company’s valuation appreciates too much or its fundamentals weaken — Hart said his team will sell.

“We’ve had tremendous asset growth over the last 20-odd years, really by sticking to our value style,” Hart told CNBC.

The fund’s performance in the first seven months of the year — the most recent Boston Partners has made available on its performance — has comfortably outperformed that of the MSCI World Index, which its management team uses as a comparative benchmark index. The MSCI World has returned 15.2%% so far in 2025.

However, Hart said the performance of the MSCI index has no influence on his strategy, which often means taking a somewhat “contrarian” position.

“There’s a reason why these businesses are mispriced. We look at it as the glass is half-full versus the glass is half-empty,” he said. “It’s just a disciplined approach, day in, day out, every stock that we that we pick and put in the portfolio exhibits those three characteristics.”

Rheinmetall bet

One example of that approach translating to a win for the fund is its return on Rheinmetall stock. Earlier this year, the Boston Partners Global Premium Equities Fund cashed out of its stake in the German arms manufacturer, even as investor demand for the company remains on an upward trajectory.

Since the beginning of 2025, Rheinmetall shares have surged 209% amid a broad European push to hike defense spending.

Boston Partners fund managers snapped up shares of Rheinmetall back in 2019, however, as they felt it met their three-circle criteria.

During the six-year holding period, Rheinmetall became one of the fund’s top 10 stocks, accounting for more than 2% of the portfolio. The fund managers trimmed their stake multiple times before fully cashing out this year as Rheinmetall’s valuation rose.

By the time they completely sold out of their position in Rheinmetall, the stock had risen by 2,056%, Boston Partners told CNBC.

Hart said that, prior to the war in Ukraine, many of Europe’s defense stocks did not meet the “three-circle criteria,” with Rheinmetall being the exception.

“Rheinmetall was the largest holding in the fund, it’s the best contributing stock to the fund I think in the history of the fund itself,” he told CNBC. “When we bought it, at the time it was two businesses, an autos components business and the defense business, and we thought it offered great value. We liked their fundamentals. And then along comes Ukraine and off to the races.”

Sticking to his strategy meant Hart’s team “kept selling into strength,” and winding down their stake even as the share price continued to rise.

“We have sell discipline, so that when a company or stock gets to a valuation level that we think is above its intrinsic value, we will sell it. We will move on, because then that stock is no longer a value stock,” he said. “When I look at Rheinmetall’s 27/28 earnings, [the forecast is] probably fair, it’s probably the number they’re going to hit, but the multiple that you’re paying for that is outside the realm of being a value stock, so we had to sell.”

″[When] it becomes a growth stock — not my style,” Hart added.

Value investing

Value investing — searching for intrinsically undervalued stocks — is not for everyone. Although credited as being the driving force behind billionaire investor Warren Buffett’s success, some investors believe it puts a portfolio at risk of missing out on the huge returns offered by growth stocks.

Boston Partners’ Global Premium Equities fund drastically underperformed the S&P 500 last year. While it returned 10.7% before fees, the S&P 500 surged 23.3% over the same stretch. So far this year, the S&P 500 is up by over 12%.

“Value investing as an industry is dead,” Greenlight Capital founder David Einhorn told CNBC in 2023. “The money has moved from value investors to index funds and it’s not coming back.”

Boston Partners’ Hart rebuffed such claims during his interview with CNBC.

“There have been multiple periods where [it appears that] value’s dead — and it turns out, value is not dead,” he said.

— CNBC’s Bob Pisani contributed to this article.

https://www.cnbc.com/2025/02/11/what-is-value-investing-how-warren-buffett-made-his-money.html

A complete guide to value investing — how Warren Buffett made his money

Published Mon, Feb 10 20256:08 PM EST

Lucy Handley@in/lucy-handley-b2b0a61a/@lucyhandley

Warren Buffett has long been a proponent of value investing — and those principles have helped him amass a personal fortune of around $150 billion.

It’s an investing approach that means taking the long view, holding your nerve and avoiding risky behavior — philosophies Buffett learned from economist Benjamin Graham’s 1949 book, “The Intelligent Investor.”

So what exactly is value investing, and how does it work?

What is value investing?

The short answer is that value investing refers to buying a stock that is trading below its intrinsic value, according to investor Guy Spier, a self-proclaimed “disciple” of Buffett’s.

“What many people would call a value stock is something that is cheap by some objective measure, like price-to-book ratio or price-to-earnings ratio,” Spier told CNBC via a video message.

A price-to-book (P/B) ratio below 1 can mean a stock is undervalued as it indicates that if a company’s assets were sold, they would be worth more than the value of its shares. A low price-to-earnings (P/E) ratio, meanwhile — which measures share price relative to earnings per share — suggests a stock’s price is low compared to a company’s earnings.

Like many investment approaches, value investing is all about figuring out how much a stock might be worth in the future. But value investors also often take a contrarian approach, targeting stocks they think the market is missing out on.

This is why value investors have to be “highly rational,” according to Spier.

You have to be able to “get control of your own behavior” when the rest of the market appears to be moved by emotion or driven by short-term aims, he said.

Buffett has warned against risky behavior or being “jealous” when another investor does well, and also said he looks to companies that are “operated by honest and competent people.”

Holding stocks for a ‘long, long, long time’

Value investors aim to hold stocks until they reach what they calculate to be a price that reflects their intrinsic value — which can take years.

“What counts is buying a good business at a decent price, and then forgetting about it for a long, long, long time,” Spier said. Buffett has said his ideal holding period is “forever,” although value investors usually sell stocks when they’ve reached the price they think they are worth.

This long-term holding strategy means value investors are less concerned about factors that affect the market in the shorter term, such as conflicts or political events. Bill Nygren, a value investor who manages the $23 billion Oakmark Fund, said U.S. President Donald Trump’s election victory is unlikely to impact what Oakmark will buy this quarter, for example.

Nygren looks at factors such as how much an industry is going to grow, the cashflow a company has, and how it will deploy it over a seven-year period.

“That affects the estimate of business value much more than trying to tweak the next couple years of earnings based on whether tariffs are higher or lower, or tax rates are a little bit higher or lower,” Nygren told CNBC in a video call.

Examples of value stocks — and how they’ve performed

The MSCI World Value Index is made up of large and mid-cap companies from 23 countries. Its largest constituents are in sectors including financials — like JPMorgan and Bank of America — and healthcare, such as Johnson & Johnson and pharmaceutical company AbbVie. The index’s second-biggest constituent is Berkshire Hathaway — Warren Buffett’s holding company.

But the MSCI World Value Index has underperformed the market as a whole over the past decade. In the 10 years to Jan. 31, 2025, the MSCI World Value Index logged annualized returns of 8.26%, while the tech-heavy MSCI World Growth Index returned 13.56% over the same period.

Sam Ziff, chief investment officer at value investment firm Oldfield Partners, pointed to two stocks that have exemplified the value investment strategy for him over the past 20 years.

The first is insurance company Chubb. Ziff said the company has generated an “unmatched” average combined ratio, which measures an insurer’s premiums collected versus the amount paid out in claims. In the third quarter, the insurer reported a combined ratio of 87.7%. A figure below 100% is a sign of profitability.

Some insurers “chase the cash they get paid by premiums and worry about the consequences later,” but Chubb has a longer-term focus, Ziff said in an email to CNBC.

The second example Ziff gave is Swedish bank Handelsbanken, which he said has been “conservatively managed,” and has a long-term approach. It has an “attractive” valuation, Ziff said, trading at a lower P/E ratio than banks such as Wells Fargo and Bank of America, while its dividend yield is more than 10%.

Value investing in the U.S. and beyond

If you’re interested in value investing, you might want to look beyond the U.S. which looks “expensive” as 2025 gets underway, according to Morningstar.

Philip Straehl, Morningstar’s head of capital markets and asset allocation for North America, highlighted opportunities in U.K. homebuilder stocks — which he said could rise by 50% — and European autos, where he said there are “huge discounts” to be found.

Most of Buffett’s investments via Berkshire Hathaway are in U.S. companies, with Apple, American Express and Bank of America its top constituents.

But Berkshire also owns significant stakes in companies outside the U.S., such as in Japanese trading houses Itochu, Mitsubishi, Mitsui and Sumitomo and Marubeni, collectively worth over $20 billion. In his 2023 letter to shareholders, Buffett said he likes these companies for retaining cash to “build their many businesses” and because their management is “far less aggressive about their own compensation than is typical in the United States.”

Meanwhile, about 56% of the $337 million Aquamarine Fund, which Spier runs, is invested in U.S. stocks, including Mastercard, American Express and — of course — Berkshire Hathaway. But it also owns global shares, including Indian Energy Exchange and Chinese automaker BYD.

Value versus growth

Growth stocks are typically those that investors think will grow faster than the rest of the market in the short term.

Big Tech firms are among the most well-known growth stocks, with Apple, Nvidia and Microsoft making up the top three constituents of the MSCI World Growth Index. The index’s annualized returns of 13.56% in the 10 years to Jan. 31, 2025 means it has outperformed the MSCI World Value Index by more than 5 percentage points.

Over 50 years, however, value stocks have slightly outperformed, with the MSCI World Value Index beating the MSCI World Growth Index by around 1 percentage point.

Yet the distinction between value and growth isn’t always clear-cut.

Nygren said there’s a “general impression that value investing is the opposite of growth,” but the idea that growth investors buy “really good” companies and “value managers kind of buy the leftovers” is a myth.

“The biggest distinction is that value managers are willing to buy almost anything if the price is right,” Nygren added. “That includes companies that you’d be stretching to say are average businesses … We own General Motors at five times earnings. We own Citigroup at six times what we expect them to earn in another year,” he said.

The market is valuing these companies at a much larger discount than his firm thinks is warranted, Nygren added.

On the other hand, Oakmark owns shares in Alphabet and Salesforce, which are often considered growth stocks. These are “well above average companies, but we think they’re being priced like average businesses,” Nygren said.

Risks and downsides of value investing

Value investing isn’t for everyone, according to Nygren.

You need to have a personality that aligns with its principles, he said, “because it’s so hard to maintain your conviction in something where the market is taking a longer time to come around to your point of view.”

His advice is to consider your buying habits in general. “If your personality is you’re happy paying retail price for Chanel, maybe value investing isn’t consistent with your personality,” he said.

Spier’s advice is to beware of the “value trap.” There are many stocks that look cheap, he said, but there might be a hidden reason why.

The Aquamarine Fund owns shares in Seritage, a real estate investment trust (REIT) which was spun out of retailer Sears in 2015. Spier said he bought the stock because he thought the properties were worth “a lot,” but rising interest rates and the popularity of online shopping mean his investment has been “hollowed out.”

“So there’s a stock that looked cheap for me, and it’s gotten a lot cheaper,” Spier said.

There are also now “a lot” of people investing in this way, he added, which creates more competition in the market.

Value opportunities

Looking ahead, Spier likes Indian credit ratings firm Care Ratings for its potential to compete with U.S. companies like Moody’s in five to 20 years.

“I find it interesting to look at ways in which the financial system and the global economy will be reset and rebalanced when, for example, the largest English-speaking economy is not the United States, but actually India,” he said.

For Nygren, the “best opportunities are always those that are being ignored by the rest of the market,” with “good opportunities” in traditional oil and gas and automotive companies.

It’s “wrong” that the world is going to stop relying on fossil fuels any time soon, Nygren said. “The companies are priced cheaply enough that if that takes a couple of decades to happen, the stocks could still be good investments,” he said.

Similarly, he sees the market’s excitement about electric vehicles as overblown. EVs are “just not practical” for driving long distances in the U.S., Nygren said, naming General Motors as a “very attractive” alternative.

Financial firms make up around 38% of Nygren’s Oakmark Fund, including Wells Fargo, payments company Fiserv and investment firm Charles Schwab.

The sector is now managed much better than it was during the 2008-2009 financial crisis, he said, which investors are “still scarred by.”

Banks “look at growth on a per-share basis, so when they’re generating a lot of capital, instead of trying to get bigger, they’re returning it to shareholders,” he said.

Ziff, meanwhile, said that Oldfield Partners is mostly focused on value investing opportunities outside the U.S. He named drinks firm Heineken as a “best-in-class” beer brand, and European steel company Arcelor Mittal as “trading at an extraordinary discount.”

– CNBC’s Yun Li contributed to this report.

Bessent sees trade deal likely with China before November deadline on reciprocal tariffs

Published Tue, Sep 16 20258:19 AM EDTUpdated Tue, Sep 16 202510:54 AM EDT

Jeff Cox@jeff.cox.7528@JeffCoxCNBCcom

Key Points

- With so-called reciprocal tariffs set to take effect in November, Treasury Secretary Scott Bessent said during a CNBC interview that he expects further talks to happen before then.

- The statement comes with talks taking a series of twists and turns since Trump announced his initial “liberation day” duties on U.S. global trading partners April 2.

Treasury Secretary Scott Bessent expressed confidence Tuesday that a trade deal with China is near.

With so-called reciprocal tariffs set to take effect in November, Bessent said during a CNBC interview that he expects further talks to happen before then.

“We’ll be seeing each other again,” he said during a wide-ranging exchange on “Squawk Box. “Each one of those talks has become more and more productive. I think the Chinese now sense that a trade deal is possible.”

The statement comes with talks taking a series of twists and turns since Trump announced his initial “liberation day” duties on U.S. global trading partners April 2.

Under the initial move, China would have faced tariffs up to 145%, but those were suspended as talks continued. An initial pause on reciprocal tariffs was to expire on Aug. 12, but Trump extended the suspension to Nov. 10.

Bessent said he has been told by U.S. trading partners that “Chinese goods are flooding their markets, and they don’t know what to do about it. They’re slightly apoplectic that these goods are coming in.”

The U.S. had a nearly $300 billion trade deficit with China in 2024. That’s on pace to decline significantly in 2025 and was at $128 billion through July.

Bessent noted that U.S. Trade Representative Jamieson Greer expects the deficit “will narrow by at least 30% this year and probably more in 2026.”

“So the idea here is to come into balance, to have fair trade,” he said.

Market track record is flawless when the Fed cuts rates with S&P 500 near record high

Published Tue, Sep 16 20259:25 AM EDTUpdated Tue, Sep 16 20251:35 PM EDT

A Federal Reserve rate cut on Wednesday could supercharge an already-strong stock market.

JPMorgan’s trading desk says that, when the Fed lowers its benchmark lending rate while the S&P 500 is within 1% of its all-time high, the index soars on average by nearly 15% over the next year. The traders also noted that this trend is apparent in the year since the Fed began cutting rates a year ago.

“Since then, the S&P 500 is up around 17%. … These types of returns are consistent with the ‘Fed cuts in a non-recessionary environment’ backdrop that we are expecting in the months ahead,” the JPMorgan traders said.

The S&P 500 closed above 6,600 for the first time on Monday and ended the day just 0.1% below its intraday record of 6,619.62 reached the same day.

A rate cut from the Fed is all but certain. The question heading into Wednesday’s announcement is how big the reduction will be.

The CME Group’s FedWatch Tool shows investors are pricing a 96% chance of a quarter percentage-point rate cut. They see only 4% odds of a bigger half-point cut.

But while the long-term market reaction to lower rates is always favorable, near-term moves could be choppier.

As Adam Crisafulli of Vital Knowledge notes: “Sentiment right now is mostly bullish, but people are nervous about the Fed decision triggering a quick ‘sell the news’ response (this is our concern too, although the most ‘painful’ outcome will be a dovish surprise that catalyzes an aggressive pro-value/cyclical, anti-tech/momentum rotation).”

JPMorgan’s trading desk also noted on Monday that stocks could be volatile depending on the Fed’s tone.

What does the Fed’s decision to cut interest rates mean for mortgages?

By Lisa Riley Roche, Deseret News | Posted – Sept. 17, 2025 at 10:20 p.m.

Mortgage rates just hit a three-year low, but rose slightly after the Federal Reserve’s benchmark interest rate was cut on Wednesday. Now, it remains unclear whether the decline in mortgage rates will continue. (Scott G Winterton, Deseret News)

KEY TAKEAWAYS

- Mortgage rates hit a three-year low on Wednesday prior to the Federal Reserve’s rate cut.

- Despite the anticipated rate cut, Zions Bank mortgage manager Jeremy Holmgren said mortgage rates won’t change much.

- Fed Chair Jerome Powell noted housing is sensitive to rate changes, and future cuts may also lower mortgage rates.

SALT LAKE CITY — Mortgage rates just hit a three-year low, but it’s not yet clear whether that decline will continue now that the Federal Reserve’s benchmark interest rate has been cut by a quarter percentage point, as expected.

Before Wednesday’s midday announcement by the Fed, Mortgage News Daily posted a 6.13% rate for a 30-year fixed-rate mortgage, falling 0.12 percentage points from the previous daily index to the lowest rate since late 2022.

That number crept up to 6.22% later Wednesday, a 0.09 percentage point increase.

The weekly average for a 30-year fixed-rate mortgage was down to 6.35% as of Sept. 11, the biggest weekly drop in the past year, according to the Federal Home Loan Mortgage Corporation, better known as Freddie Mac.

The recent reduction in mortgage rates, which had risen to more than 7% at the start of the year, has been widely seen as already reflecting the cut signaled in late August by the embattled Fed chairman Jerome Powell.

Zions Bank mortgage manager Jeremy Holmgren said rates aren’t going to move much because of Wednesday’s cut.

“The reason is simple: The market already anticipated this cut, and lenders priced it into mortgage rates over the past couple of weeks. That’s why we saw improvements before today, not after,” Holmgren said.

But that doesn’t mean mortgage rates couldn’t go lower.

“If the Fed follows through with two more rate cuts this year, there’s room for mortgage rates to improve further — though, again, the biggest moves may happen before each announcement as markets build in expectations,” he said.

Holmgren said he expects mortgage rates to continue to fall “slowly but surely.”

Still, he advised homebuyers not to hold out for lower rates.

“If they wait to buy when everyone else wants to buy, there will be more competition and they might not get the house they want,” said Holmgren, who also has warned that increased competition could drive “home prices higher. In the end, waiting could actually cost you more.”

The Fed’s action in lowering the interest rate that banks charge one another for short-term loans does not directly impact mortgage rates that track the yields on 10-year Treasury bonds, influenced by inflation, job growth and other economic factors.

Powell told reporters Wednesday that housing is sensitive to interest rate changes.

“When the (COVID-19) pandemic hit and we cut rates to zero, housing companies were incredibly grateful, and they said that was the only thing that kept them going was that we cut so aggressively,” he said.

“The other side of that is when inflation gets high and we raise rates … it does burden the housing industry,” Powell said, adding that “we don’t set mortgage rates, but our policy rate changes do tend to affect mortgage rates, and that has been happening.”

Rate cuts will help raise demand and reduce borrowing costs for builders, he said, although “most analysts think there would have to be pretty big changes in rates to matter a lot to the housing sector.”

Mortgage News Daily’s Matthew Graham had pointed out earlier this week that “rates were doing the same thing for the same reasons” ahead of the September 2024 Fed meeting, where an interest rate cut was also expected.

“Back then, mortgage rates moved paradoxically higher after the Fed rate cut,” Graham was quoted as saying by CNBC. “The same thing could happen this time, but it’s by no means guaranteed.”

Contributing: Art Raymond

The Key Takeaways for this article were generated with the assistance of large language models and reviewed by our editorial team. The article, itself, is solely human-written.

Belgian man sentenced to 5 years in federal prison for $5M Ponzi scheme

By Cassidy Wixom, KSL.com | Posted – Sept. 20, 2025 at 10:49 a.m.

A Belgian man was sentenced to five years in prison for conducting a $5 million Ponzi scheme in Utah. (Barbra Ford, Shutterstock)

KEY TAKEAWAYS

- A Belgian man was sentenced to five years in prison for a $5-million Ponzi scheme.

- Kenny Dirk Van Der Spek defrauded 75 investors in Utah from 2017-2023, federal prosecutors say.

- He must pay $4.1million in restitution, forfeit property and serve three years probation.

SALT LAKE CITY — A Belgian man was sentenced Thursday to five years in prison for conducting a $5-million Ponzi scheme in Utah.

Kenny Dirk Van Der Spek, 36, was living in South Jordan when he defrauded 75 investors over five years and used $3 million of the profits on personal purchases. In May, he pleaded guilty to securities fraud, wire fraud and money laundering.

In addition to his imprisonment, Van Der Spek was ordered to pay $4,107,282.97 in restitution to the victims; forfeit real estate in Martinsville, Virginia, and Spanish Fork; and serve three years on probation.

From 2017 to 2023, Van Der Spek operated K & K Strategies LLC, which he marketed as a “mom and pop hedge fund.” The company’s “purported business purpose was to help people who were not wealthy invest and to teach about stock trading,” charges state. Federal prosecutors stated that he specifically targeted “smaller investors” who had little to no safety nets.

Van Der Spek was not licensed to sell securities and made false promises about returns on investments to his investors. He fabricated financial records to prove to investors they were making money, including displaying a “live stream” of trades on his website so investors could “watch (their) money grow,” according to court documents.

“To convince investors and potential investors … Van Der Spek used investment money from one investor to pay the promised returns to a different investor. In this way, defendant Van Der Spek created the false impression that the investment was profitable, that the investment was safe and secure, and that the promised returns were being generated,” court documents state.

In reality, the investors were not making any profits, and Van Der Spek was using the investment proceeds to pay for his own real estate, a personal chef, a new 2022 Chevrolet Corvette, online gambling and more.

“It was the object of the scheme … to fraudulently obtain money from investors through false statements, misrepresentations, deception, fraudulent conduct and omissions of material facts, and thereafter cause the money to be diverted for defendant Van Der Spek’s personal benefit,” the charges state.

The Utah Division of Securities received complaints about Van Der Spek, which led to an investigation into his fraudulent activities and ultimately resulted in his arrest and conviction, a statement from the U.S. Attorney’s Office for Utah said.

“This was not a crime of opportunity. Van Der Spek specifically planned and targeted vulnerable investors and caused substantial financial hardships for victims in Utah and other states,” said Acting U.S. Attorney Felice John Viti of the District of Utah. “Stealing hard-earned money from our citizens is a serious offense.”

The Key Takeaways for this article were generated with the assistance of large language models and reviewed by our editorial team. The article, itself, is solely human-written.

Stocks are at a risk of a correction if the Fed makes the right call on the economy, says Morgan Stanley

Provided by Dow Jones Sep 22, 2025, 7:30:00 AM

By Jamie Chisholm

Equities are vulnerable to a spike in liquidity stress, says Mike Wilson

The sun may set on the bull run if the Fed is too slow cutting rates

The big three – the S&P 500, Dow, and Nasdaq – all finished last week at yet more record highs.

Indeed, the S&P 500 is now up 33.75% from the April low, registering a 13.3% gain for the year to date as the market has become inured to White House policy uncertainty, and optimism over the AI boom continues.

And of course there’s a more-supportive monetary policy regime, with another round of easing launched last week by the Federal Reserve.

However, a team of strategists at Morgan Stanley led by Mike Wilson sound a note of caution about the potential for market ructions should the Fed not match up to investors’ hopes.

At the moment, traders are pricing in a very high likelihood of another 50 basis points of Fed rate cuts this year from the current range of 4.00% to 4.25%. In fact, by this time next year the fed funds futures market sees the official rate around 3%.

But Wilson paints the picture of an economy that may not be in need of such aggressive rate cuts.

“Our view remains consistent that the rolling recession ended with Liberation Day and we are now transitioning to an early cycle/rolling recovery when earnings growth is likely to be stronger than expected,” he says.

This transition is being confirmed by an acceleration in earnings revisions breadth by analysts, which will dovetail with an improvement in gauges such as the ISM purchasing managers index, Wilson reckons.

“Pent-up demand is increasingly evident in areas of the economy/market that have experienced lackluster growth for the last 3-4 years. These include housing, shorter cycle industrials, consumer goods, transports, commodities, among others,” he adds.

This set up means the Fed is not as loose as it typically is at this stage of the economic cycle, Wilson feels, mainly because one part of its mandate, the labor market, hasn’t been bad enough, and the other part, inflation, is still stubbornly above the central bank’s 2% target.

“[T]his tension between the Fed’s reaction function and the markets’ ‘need for speed’ in terms of rate cuts is the near-term risk for equities and is something we’re respectful of in a weak seasonal window for performance,” says Wilson.

Evidence that the equity market wants to see lower interest rates can be seen by the rolling correlation between equity returns and real yields, which is now deeply negative. In other words, bad economic data is deemed good for stocks.

Source: Morgan Stanley

The danger for markets is if the Fed recognizes the ‘rolling recession / recovery dynamic’ and decides they don’t need to ease that much. “Indeed, this may be the right decision economically, but the markets have already priced more cuts to come and so this would be disappointing from that standpoint and would likely prevent a full, early-cycle rotation which would lead to relative outperformance of lower quality stocks and small caps,” says Wilson.

And this may be aggravated by an environment in which liquidity is drying up as the Fed continues with its quantitative tightening – the selling of assets on its balance sheet – amid large-scale bond issuance by the Treasury and high levels of corporate debt sales.

Evidence of liquidity stress are likely to show up first in the spread between the Secured Overnight Financing Rate and Fed Funds, says Wilson. Traders should also keep an eye on the BofA Merrill Lynch MOVE index, a measure of expected Treasury volatility. A meaningful rise in the MOVE, which is currently at 72.5 and near a four-year low, may signal building Treasury market tension.

Source: Morgan Stanley

“While seemingly not a concern yet, we think liquidity stress would show up here first, and if the Fed doesn’t address this potential risk, it could lead to a sharp and meaningful equity correction,” says Wilson.

The markets

U.S. stock-indices SPX DJIA COMP are lower at the opening bell as benchmark Treasury yields BX:TMUBMUSD10Y are little changed. Silver futures (SI00) trading on Nymex hit $44 an ounce for the first time in 14 years as the precious metal rallied in the wake of gold (GC00), which flirted with record highs near $3,757 an ounce.

Key asset performance Last 5d 1m YTD 1y

S&P 500 6664.36 1.22% 3.05% 13.31% 16.87%

Nasdaq Composite 22,631.48 2.21% 5.28% 17.20% 26.09%

10-year Treasury 4.132 8.80 -14.40 -44.40 38.10

Gold 3757.4 1.02% 10.17% 42.36% 41.61%

Oil 62.29 -1.56% -3.78% -13.33% -11.93%

Data: MarketWatch. Treasury yields change expressed in basis points

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

The buzz

A bunch of Federal Reserve officials are due to speak on Monday, including John Williams at 9:45 a.m. Eastern; Alberto Musalem at 10:00 a.m.; and Stephen Miran, Beth Hammock, and Tom Barkin, all at 12:00 p.m.

The Trump administration has imposed a $100,000 application fee on H-1B foreign worker visas, which may particularly impact technology companies.

President Trump said prominent billionaires – including media mogul Rupert Murdoch and tech founder Michael Dell – could be part of a deal in which the U.S. will take control of the social-video platform TikTok. Murdoch is the controlling shareholder of News Corp, which publishes this report.

Metsera stock (MTSR) jumped after a report in the Financial Times that Pfizer (PFE) was nearing a deal to buy the weight-loss drugmaker for $7.3 billion.

Kenvue shares (KVUE) are lower amid reports the Trump administration of will announce a link between its use and autism, and warn pregnant women to avoid the painkiller.

Volkswagen shares (XE:VOW3) are falling sharply after the carmaker warned late Friday of a EUR5.1 billion hit to its operating profits this year because its sports-car division Porsche said it would delay the rollout of its electric vehicles. Porsche’s stock (XE:P911) is down sharply too.

Best of the web

The new American hustle: dividends over day jobs.

How top hedge funds can pay traders $100 million.

The Waldorf’s makeover went a billion over budget – and China is footing the bill.

The chart

Macro trader and Substack writer Subu Trade notes that the S&P 500’s relative strength index, a momentum gauge, by late last week had stayed above 45 for 102 days straight, one of the longest streaks in history. “In the past 60 years, the S&P was lower EVERY time 2 weeks later,” Subu says.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

Ticker Security name

TSLA Tesla

NVDA Nvidia

GME GameStop

NIO NIO

AAPL Apple

PLTR Palantir Technologies

OPEN Opendoor Technologies

AMD Advanced Micro Devices

TSM Taiwan Semiconductor Manufacturing

INTC Intel

Random reads

Fat Bear Week is back….

…But they’re not all cuddly.

What’s this giant blob found floating in U.S. waters?

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

-Jamie Chisholm

This content was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is published independently from Dow Jones Newswires and The Wall Street Journal.

(END) Dow Jones Newswires

09-22-25 0930ET