HI Market View Commentary 02-10-2025

OK Let’s talk about the worst thoughts/comments when investing:

I could have…….made more in META $520 Today it is $717.40

On 500 shares of META x $520 =$260,000 = Every Freaking Penny

ROI = 100%+

You don’t necessarily lose or gain ANYTHING until you close the trade

You should preparing an exit strategy = There are plenty of other opportunities IF you will do the work to find them

My job is to make as much money as possible taking as little risk as possible!!

We prefer to be hedged in the times when big drops can occur

We Aren’t always hedged because that doesn’t make sense

Black Swan Percentage = 3 tenths of one percent = 6 standard deviations from Investopedia

So you would protecting 99.7% of the time that you Don’t need protection

WE ALSO create an stock replacement strategy = Much better ROI and much less risk

Longer term thinking/Investing = Process

One single day should NEVER make or break your portfolio

Last Tuesday were a little ticked off that we capped AAPL at $245

Work your numbers before you start to cry!!!

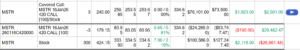

WE BTO MSTR $424.15 per share

Risk on trade per share is EVERY freaking penny of the stock

We also STO 16Jan26 $420 short call for a credit of $179.15

Net Debit = 424.15-179.15 = $245 = Maximum risk in the trade 245/424.15 = we reduced the risk in the trade by 43%

Maximum Return = 420 – 245 = $175 or 71.4% ROI

BE = $245

Earnings dates:

BABA 02/06 BMO

BIDU 02/26 est BMO

DG 03/13 est BMO

KO 02/11 est BMO

MU 03/19 est AMC

NVDA 02/26 AMC

O 02/20 est AMC

SQ 02/20 AMC

TGT 03/12 est BMO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 07-Feb-25 15:37 ET | Archive

Coloring stagflation with markers

We are going through the “Big T,” and we don’t mean Tucson. We mean tariffs.

Forrest Gump’s good friend, Bubba, might say “talk of tariffs, the threat of tariffs, actual tariffs… the easing of tariffs, the removal of tariffs, the reciprocity of tariffs… the cost of tariffs, the benefits of tariffs, the collection of tariffs… tariffs as a driver of inflation, tariffs as a killer of growth.”

Prepare yourself for all permutations of tariffs.

Why? Because the other “Big T” — President Trump — sees tariffs as an instrument for narrowing the U.S. trade deficit, increasing revenue, and raising the competitive stature of U.S. companies versus global counterparts. And he’s just getting started (again) in the Oval Office.

Thus far, there have been calls for tariffs on Colombia, Canada, Mexico, and China. The tariff call for Colombia was rescinded after Colombia said it would accept flights with deported immigrants; the 25% tariffs for Canada and Mexico have been “paused” for 30 days; and the 10% tariff on imported goods from China, which was met by some token retaliatory tariffs for select U.S. imports, is in effect.

The president said, vaguely, that he will be making an announcement in the coming week on reciprocal tariffs.

Yes, we will be talking tariffs a lot the next four years. The question is, will we also be talking about stagflation?

The Three Amigos

Depending on whom you listen to, tariffs are going to result in higher inflation. That’s not what Trump administration insiders are saying, but it is what many academics and private economists are saying.

At the same time, there is the thought running on a parallel track that suggests the ultimate penalty for tariffs will be lower growth in the United States as the higher costs induced by tariff actions will weaken end demand or hurt the profitability of companies that choose not to pass along the tariff costs to their customers — or both.

Low growth and high inflation is not a friendly economic mix. Some would be quick to label that dynamic as being in an environment of “stagflation.” That is only two-thirds right. When it comes to stagflation, there is a third parameter that comes into play: high unemployment.

One would be hard pressed to say any of those conditions are currently being met, which is why they will be tracked along with the tariff actions. In a nutshell:

- The Advance Q4 GDP report showed growth increased at an annual rate of 2.3%. However, real final sales of domestic product, which exclude the change in private inventories, were up 3.2%. Over the last eight quarters, real GDP growth has averaged 2.9% and the Atlanta Fed GDPNow model estimate for real GDP growth in the first quarter stands at 2.9%.

- Inflation is higher than the Fed would like to see. The latest PCE Price Index — the Fed’s preferred inflation gauge — showed PCE inflation up 2.6% year-over-year and core-PCE inflation, which excludes food and energy, up 2.8%. The Fed’s inflation target is 2.0%. We would label inflation as being “elevated” but not high relative to the inflation seen in 2021, 2022, and the first half of 2023 — or in the 1970s when we were dealing with stagflation.

- The unemployment rate, at 4.0%, is close to a 50-year low.

Let’s Not Go Down that Road

We have our stagflation markers, and they are all in a relatively good position. Hopefully, they stay that way because stagflation creates a real policy pickle for the Federal Reserve, which can’t lower rates in a stagflation environment to jumpstart growth because that could worsen inflation. In turn, the Federal Reserve can’t raise rates in a stagflation environment to tame inflation because that would worsen growth.

Saying the Federal Reserve can’t do something to tackle stagflation is a generalization. We learned during the Great Financial Crisis how creative the Federal Reserve can be when it puts its mind to it. The point is that a typical policy approach when inflation is high, or growth is low, won’t work as effectively when there is both high inflation and low growth that has triggered high unemployment.

So, it’s best for everyone if we just don’t go down the stagflation road, but with tariffs that get imposed liberally and are then met with retaliatory tariffs, it is an economic risk on the table.

Cutting regulations, then, and extending the 2017 tax cuts are potential tariff shock absorbers. The trick for the administration will be pulling off its tax plan without increasing the deficit and upsetting bond vigilantes. A deficit tantrum in the Treasury market would drive up long-term rates, which in turn would hurt growth at a time when tariff actions could invite high inflation.

What It All Means

There are scenarios with positive and negative economic outcomes. A stagflation scenario falls to the negative side of things. Right now, there is just talk of stagflation (including this piece), but it is not in the data.

There were some murmurings of it in the Treasury market on February 3, however, when the 25% tariffs for Canada and Mexico, and the 10% tariff for China, were announced. It wasn’t dramatic; it was just something subtle.

Yields at the front of the curve went higher that day while yields at the back of the curve came down. The front end was digesting the thought that tariffs could push up inflation and forestall a Fed rate cut while the back end was digesting the idea that tit-for-tat tariff actions, which drive up inflation, could squash growth.

It was a curve flattening trade that matched a high inflation-low growth scenario, but we don’t want to make too much out of that single session, except to say that it is this trading dynamic that would avail itself in a more discernible fashion if the market was truly fearing the arrival and/or the existence of stagflation. That said, the curve has been flattening to start the year, making it one more marker to keep an eye on, along with our economic indicators of GDP growth, inflation, and unemployment, to get a bead on stagflation.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Lower

DJIA – Bullish

SPX – Bullish

COMP – Bearish

Where Will the SPX end February 2025?

02-10-2025 -1.0%

02-03-2025 -1.0%

Earnings:

Mon: MCD

Tues: BP, HUM, MAR, SHOP, DASH, ZG, KO, ET,

Wed: GOLD, CME, DENN, CVS, MGM, HOOD, HUBS,

Thur: CROX, DE, DUK, GEHC, HTZ, TAP, WEN, ABNB, NUS, ROKU, TWLO, WYNN

Fri:

Econ Reports:

Mon:

Tue NFIB Small Business Optimism

Wed: MBA, CPI, Core CPI, Treasury Budget

Thur: Initial Claims, Continuing Claims, PPI, Core PPI

Fri: Retail Sales, Retail ex-auto, Import, Export, Industrial Production, Capacity Utilization, Business Inventories

How am I looking to trade?

Now we are protecting for Q4 earnings in 2025

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

DeepSeek’s AI claims have shaken the world — but not everyone’s convinced

Published Thu, Jan 30 20256:15 AM EST

Updated Fri, Jan 31 202512:12 AM EST

Dylan Butts@in/dylan-b-7a451a107

Key Points

- DeepSeek claims its R1 outperforms OpenAI’s latest o1 model despite costing a fraction of the price the U.S. AI lab charges for its large language models.

- The assertions have sparked concerns over the eyewatering sums tech giants are spending on AI — but many experts are urging skepticism.

- However the scrutiny surrounding DeepSeek shakes out, AI scientists broadly agree it marks a positive step for the industry.

Chinese artificial intelligence firm DeepSeek rocked markets this week with claims its new AI model outperforms OpenAI’s and cost a fraction of the price to build.

The assertions — specifically that DeepSeek’s large language model cost just $5.6 million to train — have sparked concerns over the eyewatering sums that tech giants are currently spending on computing infrastructure required to train and run advanced AI workloads.

Investor fears over DeepSeek’s disruptive impact erased close to $600 billion from Nvidia’s market capitalization Monday — the biggest single-day drop for any company in U.S. history.

But not everyone is convinced by DeepSeek’s claims.

CNBC asked industry experts for their views on DeepSeek, and how it actually compares to OpenAI, creator of viral chatbot ChatGPT which sparked the AI revolution.

What is DeepSeek?

Last week, DeepSeek released R1, its new reasoning model that rivals OpenAI’s o1. A reasoning model is a large language model that breaks prompts down into smaller pieces and considers multiple approaches before generating a response. It is designed to process complex problems in a similar way to humans.

DeepSeek was founded in 2023 by Liang Wenfeng, co-founder of AI-focused quantitative hedge fund High-Flyer, to focus on large language models and reaching artificial general intelligence, or AGI.

AGI as a concept loosely refers to the idea of an AI that equals or surpasses human intellect on a wide range of tasks.

Much of the technology behind R1 isn’t new. What is notable, however, is that DeepSeek is the first to deploy it in a high-performing AI model with — according to the company — considerable reductions in power requirements.

“The takeaway is that there are many possibilities to develop this industry. The high-end chip/capital intensive way is one technological approach,” said Xiaomeng Lu, director of Eurasia Group’s geo-technology practice.

“But DeepSeek proves we are still in the nascent stage of AI development and the path established by OpenAI may not be the only route to highly capable AI.”

How is it different from OpenAI?

DeepSeek has two main systems that have garnered buzz from the AI community: V3, the large language model that unpins its products, and R1, its reasoning model.

Both models are open-source, meaning their underlying code is free and publicly available for other developers to customize and redistribute.

DeepSeek’s models are much smaller than many other large language models. V3 has a total of 671 billion parameters, or variables that the model learns during training. And while OpenAI doesn’t disclose parameters, experts estimate its latest model to have at least a trillion.

In terms of performance, DeepSeek says its R1 model achieves performance comparable to OpenAI’s o1 on reasoning tasks, citing benchmarks including AIME 2024, Codeforces, GPQA Diamond, MATH-500, MMLU and SWE-bench Verified.

Private markets see more hype than substance around DeepSeek, says Gene Munster

In a technical report, the company said its V3 model had a training cost of only $5.6 million — a fraction of the billions of dollars that notable Western AI labs such as OpenAI and Anthropic have spent to train and run their foundational AI models. It isn’t yet clear how much DeepSeek costs to run, however.

If the training costs are accurate, though, it means the model was developed at a fraction of the cost of rival models by OpenAI, Anthropic, Google and others.

Daniel Newman, CEO of tech insight firm The Futurum Group, said these developments suggest “a massive breakthrough,” although he shed some doubt on the exact figures.

“I believe the breakthroughs of DeepSeek indicate a meaningful inflection for scaling laws and are a real necessity,” he said. “Having said that, there are still a lot of questions and uncertainties around the full picture of costs as it pertains to the development of DeepSeek.”

Meanwhile, Paul Triolio, senior VP for China and technology policy lead at advisory firm DGA Group, noted it was difficult to draw a direct comparison between DeepSeek’s model cost and that of major U.S. developers.

“The 5.6 million figure for DeepSeek V3 was just for one training run, and the company stressed that this did not represent the overall cost of R&D to develop the model,” he said. “The overall cost then was likely significantly higher, but still lower than the amount spent by major US AI companies.”

DeepSeek wasn’t immediately available for comment when contacted by CNBC.

Comparing DeepSeek, OpenAI on price

DeepSeek and OpenAI both disclose pricing for their models’ computations on their websites.

DeepSeek says R1 costs 55 cents per 1 million tokens of inputs — “tokens” referring to each individual unit of text processed by the model — and $2.19 per 1 million tokens of output.

In comparison, OpenAI’s pricing page for o1 shows the firm charges $15 per 1 million input tokens and $60 per 1 million output tokens. For GPT-4o mini, OpenAI’s smaller, low-cost language model, the firm charges 15 cents per 1 million input tokens.

Skepticism over chips

DeepSeek’s reveal of R1 has already led to heated public debate over the veracity of its claim — not least because its models were built despite export controls from the U.S. restricting the use of advanced AI chips to China.

DeepSeek claims it had its breakthrough using mature Nvidia clips, including H800 and A100 chips, which are less advanced than the chipmaker’s cutting-edge H100s, which can’t be exported to China.

However, in comments to CNBC last week, Scale AI CEO Alexandr Wang, said he believed DeepSeek used the banned chips — a claim that DeepSeek denies.

Nvidia has since come out and said that the GPUs that DeepSeek used were fully export-compliant.

The real deal or not?

Industry experts seem to broadly agree that what DeepSeek has achieved is impressive, although some have urged skepticism over some of the Chinese company’s claims.

“DeepSeek is legitimately impressive, but the level of hysteria is an indictment of so many,” U.S. entrepreneur Palmer Luckey, who founded Oculus and Anduril wrote on X.

“The $5M number is bogus. It is pushed by a Chinese hedge fund to slow investment in American AI startups, service their own shorts against American titans like Nvidia, and hide sanction evasion.”

Seena Rejal, chief commercial officer of NetMind, a London-headquartered startup that offers access to DeepSeek’s AI models via a distributed GPU network, said he saw no reason not to believe DeepSeek.

“Even if it’s off by a certain factor, it still is coming in as greatly efficient,” Rejal told CNBC in a phone interview earlier this week. “The logic of what they’ve explained is very sensible.”

However, some have claimed DeepSeek’s technology might not have been built from scratch.

“DeepSeek makes the same mistakes O1 makes, a strong indication the technology was ripped off,” billionaire investor Vinod Khosla said on X, without giving more details.

It’s a claim that OpenAI itself has alluded to, telling CNBC in a statement Wednesday that it is reviewing reports DeepSeek may have “inappropriately” used output data from its models to develop their AI model, a method referred to as “distillation.”

“We take aggressive, proactive countermeasures to protect our technology and will continue working closely with the U.S. government to protect the most capable models being built here,” an OpenAI spokesperson told CNBC.

Commoditization of AI

However the scrutiny surrounding DeepSeek shakes out, AI scientists broadly agree it marks a positive step for the industry.

Yann LeCun, chief AI scientist at Meta, said that DeepSeek’s success represented a victory for open-source AI models, not necessarily a win for China over the U.S. Meta is behind a popular open-source AI model called Llama.

“To people who see the performance of DeepSeek and think: ‘China is surpassing the US in AI.’ You are reading this wrong. The correct reading is: ‘Open source models are surpassing proprietary ones’,” he said in a post on LinkedIn.

“DeepSeek has profited from open research and open source (e.g. PyTorch and Llama from Meta). They came up with new ideas and built them on top of other people’s work. Because their work is published and open source, everyone can profit from it. That is the power of open research and open source.”

– CNBC’s Katrina Bishop and Hayden Field contributed to this report

DeepSeek hit with large-scale cyberattack, says it’s limiting registrations

Published Mon, Jan 27 202511:26 AM ESTUpdated Mon, Jan 27 202512:45 PM EST

Key Points

- DeepSeek on Monday said it would temporarily limit user registrations “due to large-scale malicious attacks” on its services.

- The Chinese AI startup recently toppled OpenAI’s ChatGPT from its title of most-downloaded free app in Apple’s App Store.

DeepSeek on Monday said it would temporarily limit user registrations “due to large-scale malicious attacks” on its services, though existing users will be able to log in as usual.

The Chinese artificial intelligence startup has generated a lot of buzz in recent weeks as a fast-growing rival to OpenAI’s ChatGPT, Google’s Gemini and other leading AI tools.

Earlier on Monday, DeepSeek took over rival OpenAI’s coveted spot as the most-downloaded free app in the U.S. on Apple’s App Store, dethroning ChatGPT for DeepSeek’s own AI Assistant. It helped inspire a significant sell-off in global tech stocks.

Buzz about the company, which was founded in 2023 and released its R1 model last week, has spread to tech analysts, investors and developers, who say that the hype — and ensuing fear of falling behind in the ever-changing AI hype cycle — may be warranted. Especially in the era of the generative AI arms race, where tech giants and startups alike are racing to ensure they don’t fall behind in a market predicted to top $1 trillion in revenue within a decade.

DeepSeek reportedly grew out of a Chinese hedge fund’s AI research unit in April 2023 to focus on large language models and reaching artificial general intelligence, or AGI — a branch of AI that equals or surpasses human intellect on a wide range of tasks, which OpenAI and its rivals say they’re fast pursuing.

The buzz around DeepSeek especially began to spread last week, when the startup released R1, its reasoning model that rivals OpenAI’s o1. It’s open-source, meaning that any AI developer can use it, and has rocketed to the top of app stores and industry leaderboards, with users praising its performance and reasoning capabilities.

The startup’s models were notably built despite the U.S. curbing chip exports to China three times in three years. Estimates differ on exactly how much DeepSeek’s R1 costs, or how many graphics processing units went into it. Jefferies analysts estimated that a recent version had a “training cost of only US$5.6m (assuming US$2/H800 hour rental cost). That is less than 10% of the cost of Meta’s Llama.”

But regardless of the specific numbers, reports agree that the model was developed at a fraction of the cost of rival models by OpenAI, Anthropic, Google and others.

As a result, the AI sector is awash with questions, including whether the industry’s increasing number of astronomical funding rounds and billion-dollar valuations is necessary — and whether a bubble is about to burst.

Ford beats earnings expectations but forecasts tougher year ahead

Published Wed, Feb 5 202512:00 PM ESTUpdated Wed, Feb 5 20255:32 PM EST

Key Points

- Ford Motor beat Wall Street’s top- and bottom-line expectations for the fourth quarter.

- But the automaker said its 2025 guidance, which is in line with or lower than many analysts’ expectations, “presumes headwinds related to market factors.

- Ford executives will host an earnings conference call at 5 p.m. ET.

In this article

DETROIT — Ford Motor beat Wall Street’s top- and bottom-line expectations for the fourth quarter but forecast a tougher year ahead for the company, as CEO Jim Farley promises improvements in vehicle quality and costs.

Shares of Ford fell 5% in after-hours trading.

Ford’s forecast this year calls for adjusted earnings before interest and taxes, or EBIT, of $7 billion to $8.5 billion; adjusted free cash flow of $3.5 billion to $4.5 billion; and capital expenditures between $8 billion and $9 billion.

For 2024, Ford reported adjusted EBIT of $10.2 billion, or $1.84 in adjusted earnings per share, and net income of $5.9 billion, or $1.46 in earnings per share. The automaker reported total revenue, including its financial arm, was a company record of $185 billion, and adjusted free cash flow was $6.7 billion.

“We think it’s prudent. There’s a lot of external factors … but our future is really in our hands,” Farley said Wednesday during CNBC’s “Closing Bell” on the cautionary guidance.

Here’s how the company performed in the fourth quarter compared with average estimates compiled by LSEG:

- Earnings per share: 39 cents adjusted vs. 33 cents expected

- Automotive revenue: $44.9 billion vs. $43.02 billion expected

The company said its 2025 guidance, which is in line with or lower than many analysts’ expectations, “presumes headwinds related to market factors.” They include 2% industry lower pricing and slightly lower wholesales for Ford but not additional tariffs by the Trump administration.

“Given the pause in the current tariff situation, specifically in Mexico and Canada, we are not choosing to take any actions at this time,” Ford Chief Financial Officer Sherry House told media on Wednesday during a call. “We’re going to let this run itself out so we can better understand the potential impacts on our business.”

Ford, GM, Stellantis and Tesla stocks

House said this year’s forecast also takes into account expectations of a $1 billion reduction in material and warranty costs compared with last year. This follows $1.4 billion in cost reductions in 2024, which were largely offset by unexpected quality and warranty costs.

The first half of 2025 is expected to be weaker than the backend. That includes first-quarter adjusted EBIT that is projected to be roughly breakeven due to lower wholesales and less profitable vehicles being produced, including launch activity at major U.S. assembly plants in Kentucky and Michigan.

For the fourth quarter of 2024, Ford reported net income of $1.8 billion, or 45 cents per share, compared with a net loss of $526 million, or a loss of 13 cents per share, a year earlier. Adjusting for one-time items, the company reported earnings per share of 39 cents.

Ford’s traditional “Blue” operations and “Pro” fleet businesses carried the automaker to profitability, as its “Model e” electric vehicle business lost $5.08 billion in 2024, including $1.39 billion during the fourth quarter.

Its Blue business, which includes internal combustion engine vehicles, earned $5.28 billion in 2024, a nearly $2.2 billion decrease from the year before. Pro earned more than $9 billion last year, including $1.63 billion in the fourth quarter.

For 2025, Ford is forecasting EBIT of $7.5 billion to $8 billion from Ford Pro; $3.5 billion to $4 billion for Ford Blue; and a loss of $5 billion to $5.5 billion for Ford Model e. Its Ford Credit arm is expected to post earnings of $2 billion.

Ford was under pressure to perform after crosstown rival General Motors easily topped Wall Street’s fourth-quarter expectations and said its 2025 guidance is in line with or above analysts’ expectations.

Ford underperformed expectations last year largely due to unexpected warranty and recall problems plaguing the company’s earnings. Shares of the automaker declined nearly 20% in 2024 amid the problems, which Farley has promised to rectify.

Tom Lee says buy this tariff dip in stocks, but bitcoin is headed for much more short-term pain

Published Mon, Feb 3 20257:17 AM ESTUpdated Mon, Feb 3 20259:02 AM EST

Tom Lee, widely followed stock market strategist and head of research at Fundstrat Global Advisors, said Monday’s sell-off on President Donald Trump’s tariffs was a buying opportunity for stocks, but not so much for cryptocurrencies yet.

“I think for the full year, S&P is going to be higher, even by midyear, much, much higher,” said Lee on CNBC’s “Squawk Box” Monday morning. “January already proved to be a positive month for the market when it faced all these headwinds so I think this one is another headwind, but another reason to be looking to buy the dip.”

Stock futures were indicating about a 600-point drop in the Dow Jones Industrial Average on Monday and the S&P 500 was set to shed about 1.5%.

But Lee was encouraged that the reaction wasn’t more severe after Trump issued a 25% tariff on Mexico and Canada and a 10% duty on China over the weekend.

That equity futures markets were only down about 1.5% “on pretty major universal tariffs is actually a sign of resilience,” said Lee.

As for the fundamental reason why it would be a good time to buy the market, Lee reasoned the U.S. was using tariffs for a negotiating tool to strengthen America’s competitive position and that the targeted countries would come to the bargaining table.

“There’s decent odds that let’s say we go three months out that the tariffs will be rolled back because concessions were received,” said the strategist.

Near-term bitcoin pain

Bitcoin tumbled to around the $95,000 level Monday from above $102,000 before the weekend as investors sold cryptocurrencies to raise cash amid the global equity rout.

“Bitcoin I think still is going to be one of the best-performing asset classes this year,” said Lee. “But I think that there is still an argument that in the short term bitcoin is a risk-on asset so as the market liquidates, which happened over the weekend, bitcoin takes a hit so I’d say February is not looking great for bitcoin in the near term ”

Bitcoin, 3 months

When asked if the levels here around $95,000 were the low, Lee said the cryptocurrency could ultimately trade down to $70,000 before rebounding.

Current levels are “probably not the floor for this month so it could visit much lower levels, even 70, but of course that’ll end up being a buying opportunity,” said Lee.

Google scraps diversity ‘aspirations,’ citing role as federal contractor

Published Wed, Feb 5 20256:52 PM ESTUpdated Thu, Feb 6 20256:39 AM EST

Key Points

- Google is scrapping its diversity targets, citing “recent court decisions and U.S. Executive Orders.”

- The company’s chief people officer said in an internal memo that “in the future, we will no longer have aspirational goals,” when it comes to diversity, equity and inclusion.

- Google is the latest big company to scrap its diversity goals, following similar announcements at Target, Meta, Walmart and McDonald’s.

Google is scrapping its diversity goals, becoming the latest tech giant to alter its approach to hiring and promotions following the election of President Donald Trump.

In its annual report published on Wednesday, Alphabet excluded language from prior years stating that, “we are committed to making diversity, equity, and inclusion part of everything we do and to growing a workforce that is representative of the users we serve.”

Fiona Cicconi, Alphabet’s chief people officer, told employees in a memo that the company has to make changes due to new requirements.

“Because we are a federal contractor, our teams are also evaluating changes to our programs required to comply with recent court decisions and U.S. Executive Orders on this topic,” Cicconi wrote in the memo, which was viewed by CNBC. “We’ll continue to invest in states across the U.S. — and in many countries globally — but in the future we will no longer have aspirational goals.”

The Wall Street Journal first reported on the memo.

Cicconi noted that in 2020, the company set aspirational hiring goals and focused on growing offices outside California and New York to improve representation.

One of Trump’s first acts as president after taking office in January was to sign an executive order ending the government’s DEI programs and putting federal officials overseeing those initiatives on leave. And following a midair collision between an American Airlines regional jet and an Army Black Hawk helicopter above Washington, D.C., last week, Trump blasted former President Joe Biden and DEI policies claiming they “could have been” to blame for the deadliest plane crash in the U.S. since 2001.

Tech companies have shown an eagerness to appease the new administration following a rocky four years during Trump’s first tenure in the White House.

Amazon said earlier in January that it was halting some of its diversity and inclusion initiatives, and Meta announced plans to end a number of internal programs designed to increase the company’s hiring of diverse candidates. Beyond the tech industry, companies including Target, Walmart and McDonald’s have made similar changes.

Google’s commitments for 2025 had included increasing the number of people from underrepresented groups in leadership by 30% and more than doubling the number of Black workers at non-senior levels.

The company began making cuts to its DEI programs in 2023, CNBC reported at the time, getting rid of staffers who were in charge of recruiting underrepresented groups and letting go of DEI leaders who worked with Chief Diversity Officer Melonie Parker.

Parker, who took on her current role in 2019, will work closely on evaluating programs and trainings and update “those that raise risk, or that aren’t as impactful as we’d hoped,” Cicconi wrote in her memo.

She added that the Google’s employee resource groups will remain as will the company’s work with colleges and universities.

A Google spokesperson told CNBC in a statement that the company is “committed to creating a workplace where all our employees can succeed and have equal opportunities, and over the last year we’ve been reviewing our programs designed to help us get there.”

Buy Nvidia for a trade into earnings later this month, says Evercore ISI

Published Mon, Feb 10 202510:01 AM EST

Updated 3 Hours Ago

Nvidia is set to report earnings in just more than two weeks, and one firm is getting bullish despite the stock’s recent losses in the wake of developments from Chinese artificial intelligence startup DeepSeek.

On Monday, Evercore ISI added the chip giant to its tactical outperform list in the lead-up to the company’s results due out after the bell on Feb. 26. The firm has a $190 price target on the name, which implies more than 46% upside from Friday’s close.

The stock has taken a hit in the wake of DeepSeek’s low-cost open-source model stoking fears around spending and competition in the AI space, which led at one point to a loss in market cap of nearly $600 billion — the biggest one-day loss for any U.S. company in history. Over the past month, it has underperformed the S&P 500 with a decline of more than 1%.

While Evercore ISI said investors are concerned that DeepSeek’s developments would lower AI demand, the firm does not think that is the case.

“Consensus amongst the AI community is that DeepSeek cost improvements are evolutionary rather than revolutionary, and that lower cost/compute cycle or cost/token likely translates to increased demand for those tokens, which likely manifests in more accurate larger parameter models and/or an acceleration in the development of ‘multi-mode’ models that train on images and videos,” the firm’s analysts wrote in a note to clients on Sunday.

Investors have also raised concerns that the move from DeepSeek shifts AI compute cycles away from Nvidia’s graphics processing units, or GPUs, and instead toward custom chips known as ASICs, or application-specific integrated circuits. Although Evercore ISI said ASICs will be impactful for high-volume internal workloads, the firm expects that external workloads, such as Amazon Web Services’ cloud infrastructure, will “remain dominated” by Nvidia.

“NVDA remains the platform of choice for hyperscalers’ customers, the robustness of its software ecosystem and breadth of its development community put it 5-10 years ahead of anything else in the market,” the analysts added.

Moreover, Evercore ISI noted that there is worry among investors about possible shipment delays for Nvidia’s Blackwell chips. And although that could lead some hyperscalers to “likely push some purchases from NVDA,” the firm revealed that demand for the company’s GPUs is “still outstripping supply.”

Evercore ISI’s bullish stance on the stock joins the majority of analysts on Wall Street with a similar view. According to LSEG data, 57 out of 63 analysts have a strong buy or buy rating, while only six have a neutral stance. Nvidia also has a consensus target of around $172, reflecting more than 32% upside potential.

Nvidia shares rose more than 3% on the heels of the tactical call.

Wall Street is souring on ‘Magnificent 7’ stocks after group’s worst earnings season since 2022

Published Mon, Feb 10 20252:02 PM EST

The “Magnificent Seven,” once Wall Street’s indisputable stalwart, is losing its shine with investors.

The group — made up of Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla — led the market higher in the past few years amid growing investments around artificial intelligence. In the past 12 months, Nvidia and Tesla have rallied 87% each, while Meta has soared more than 52%. That’s well ahead of the S&P 500′s 20% advance in that time.

But the Magnificent Seven’s market stronghold has diminished slightly, as the cohort struggles to meet ever-loftier expectations, and investors rotate into other parts of the market such as small caps. Tech titans also took a hit in late January after the emergence of Chinese startup DeepSeek raised concern over how much spending will be needed to implement AI capabilities.

Now, investors seem to be turning their backs on the stocks following their worst earnings season in a few years — which included Apple missing its iPhones sales expectations and Amazon posting disappointing current-quarter guidance.

“Excluding NVDA, which is yet to report results, the group posted combined 4Q 2024 revenue that was in line with expectation. This marks the first quarter with no positive sales surprise for the Mag 7 since 2022,” wrote Goldman chief U.S. equity strategist David Kostin. “The Magnificent 7 has been a pillar of S&P 500 sales and earnings growth during the last few years, but the magnitude of surprises has declined.”

Morgan Stanley Wealth Management chief investment officer Lisa Shalett echoed Kostin’s sentiment in a Monday note.

“Anxiety has continued to build around Magnificent Seven generative artificial intelligence-related capex spending and the extent to which players appear engaged in a multiyear race for dominance. Amid this development, Mag 7 earnings growth rates have been decelerating and are poised to continue to do so, converging with those expected from ‘the 493’ non-Mag 7 stocks,” she remarked.

Investors appear to already be shifting assets to other parts of the market. Financials and real estate are the best-performing S&P 500 sectors of the past month, rising 8.5% and 7%, respectively. Tech, on the other hand, is lagging with just a 1.3% advance in that time.

Financials, real estate and tech in past month

Indeed, expectations have skyrocketed for the stocks alongside their valuations, making now a “prudent” time for investors to begin lowering their exposure, according to Trivariate Research. Microsoft, for example, trades at 31 times forward earnings, while the S&P 500 sports a multiple around 22.

Founder Adam Parker also noted: “The high beta and increasingly high capital intensity combined with the elevated valuation of the Magnificent 7 is, in our judgment, an increasing cause for concern.”

In the same note, Parker argued that with so much buy- and sell-side exposure to the group, it’s challenging for investors to uncover anything about the stocks that haven’t already been priced in.

“On a beta-adjusted basis the current exposure of the Mag-7 is 44.7%,” he wrote, noting that’s near a 25-year high. “This means that a portfolio manager who owns in market-weight all the Magnificent 7 stocks has nearly half their fund’s beta-adjusted exposure in these stocks.”

Parker also pointed to the cohort’s high capital spending as another point likely to “come under increasing scrutiny until investors can better understand the return on today’s massive investments.”

U.S. Navy bans use of DeepSeek due to ‘security and ethical concerns’

Published Tue, Jan 28 20255:16 PM EST

Key Points

- The U.S. Navy issued a warning to its members to avoid using DeepSeek “in any capacity,” due to “potential security and ethical concerns.”

- The warning was sent out on Friday as buzz about the Chinese artificial intelligence startup was picking up across the tech industry.

- The email instructed all team members not to use DeepSeek “for any work-related tasks or personal use.”

The U.S. Navy has instructed its members to avoid using artificial intelligence technology from China’s DeepSeek, CNBC has learned.

In a warning issued by email to “shipmates” on Friday, the Navy said DeepSeek’s AI was not to be used “in any capacity” due to “potential security and ethical concerns associated with the model’s origin and usage.”

A spokesperson for the U.S. Navy confirmed the authenticity of the email and said it was in reference to the Department of the Navy’s Chief Information Officer’s generative AI policy.

The announcement followed DeepSeek’s release of its powerful new reasoning AI model called R1, which rivals technology from OpenAI. The DeepSeek model is open source, meaning any AI developer can use it. The DeepSeek app has surged to the top of Apple’s App Store, dethroning OpenAI’s ChatGPT, and people in the industry have praised its performance and reasoning capabilities.

DeepSeek’s pronouncements rocked the capital markets on Monday due to concerns that future AI products will require less-expensive infrastructure than Wall Street has assumed. DeepSeek said in late December that its large language model took only two months and less than $6 million to build despite the U.S. curbing chip exports to China three times in three years. That’s a tiny fraction of the amount spent by OpenAI, Anthropic, Google and others.

Shares of AI chipmakers Nvidia and Broadcom each dropped 17% on Monday, a route that wiped out a combined $800 billion in market cap. Those stocks led a 3.1% drop in the Nasdaq.

The Navy’s warning landed days earlier.

“We would like to bring to your attention a critical update regarding a new AI model called DeepSeek,” the email said. The memo said it’s “imperative” that team members do not use DeepSeek’s AI “for any work-related tasks or personal use.”

The email was sent on Friday morning to the distribution list OpNav, which stands for Operational Navy, indicating it was an all-hands memo. The warning was based on an advisory from Naval Air Warcraft Center Division Cyber Workforce Manger.

It said recipients were to “refrain from downloading, installing, or using the DeepSeek model in any capacity.”

DeepSeek said on Monday it would temporarily limit user registrations “due to large-scale malicious attacks” on its services, before later resuming operations as usual.

President Donald Trump, who took office last Monday, said the sudden rise of DeepSeek “should be a wake-up call” for America’s tech companies. Trump is currently trying to keep Chinese social media app TikTok alive in the U.S., after lawmakers determined that the service must be banned or sold due to national security concerns. Trump was in favor of banning TikTok in his first administration before flip-flopping on the matter.

Venture capitalist David Sacks, Trump’s AI and crypto czar, posted on X on Monday that DeepSeek R1 “shows that the AI race will be very competitive,” adding that he is “confident in the U.S. but we can’t be complacent.” Meta, which has developed its own open-source models called Llama, started four DeepSeek-related “war rooms” within its generative AI department, The Information reported.

Alexandr Wang, CEO of Scale AI, told CNBC last week that DeepSeek’s last AI model was “earth-shattering” and that its R1 release is even more powerful. He said it’s “roughly on par with the best American models” and described the race between the U.S. and China as an “AI war.” Wang’s company provides training data to key OpenAI, Google and Meta.

Trump’s first big move in AI came last week, when his administration announced a joint venture dubbed Stargate between OpenAI, Oracle and SoftBank to invest billions of dollars in AI infrastructure in the U.S.

HI Financial Services Mid-Week 06-24-2014