HI Market View Commentary 11-04-2024

It’s all about the election until Thursday and then it’s all about a rate cut?????

Currently we are ready and protected for the outcome?

Are you better today than 4 years ago? Are you OK with the status quo? Have your read and do you believe the individual will fulfil the platform they ran on?

What are we going to get from the FOMC? -0.25% because they said so at the last meeting

Core PCE 0.3 or +0.10% higher

Earnings dates:

BABA 11/21 BMO

BIDU 11/21 est

DG 12/05 est

DIS 11/14 BMO

JCI 11/06 AMC

MU 12/28 est

NVDA 11/20 est

O 11/04 AMC

SQ 11/07 AMC

TGT 11/20 BMO

UAA 11/11 est

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 01-Nov-24 15:45 ET |

Mind these risks to the bull market

The election is going to dominate the media’s attention in the coming week and rightfully so. Following close behind — for the business media anyway — will be the FOMC meeting.

One outcome is all but assured. The other is not. The FOMC is widely expected to cut the target range for the fed funds rate on November 7 by another 25 basis points to 4.50-4.75%.

The stock market has been fortified by the thought that the Fed will be cutting rates, but it hasn’t been fortified by just that. It has also been fortified by the sight of rising earnings estimates, which have kept it levitated with a premium valuation.

There has been a subtle, and not-so-subtle, change of late, however, that could weaken the bull market edifice if things persist.

The Subtle Change

The forward 12-month earnings estimate has moved from $265.36 at the end of August to $267.83 today, according to FactSet. That is a good thing. Rising earnings estimates are good, especially the forward 12-month estimate that market participants tend to favor.

Over the same period, however, the calendar year 2025 (CY25) earnings estimate has dropped from $277.74 to $273.67. That is not so good. Granted the CY25 EPS estimate is higher than the forward 12-month estimate, yet it is the trend that is noteworthy considering we are two months away from the CY25 effectively being the forward 12-month estimate.

At the current CY25 estimate, the S&P 500 trades at 21.0x earnings, which leaves it trading “cheaper” relative to the 21.5x forward 12-month multiple. That discount gives this bull market a little more room to maneuver, because if it can hold up at 21.5x forward 12-month estimates, why not 21.5x CY25 estimates?

With the S&P 500 at 5,753, a 21.5x CY25 multiple takes it to 5,883. If we press things and take it to the 22x forward 12-month multiple the S&P 500 sported in mid-October, then we get to 6,020 — but that is if the CY25 earnings estimate remains static.

It won’t. The estimate will change, and how it changes will matter in terms of where this market will allow itself to go. A market can remain overvalued if the earnings estimate trend is on its side, but if that trend turns against it, then the willingness to pay a premium for every dollar of earnings will turn against the market too.

That could mean anything from a market that stays range-bound to a market that suffers a correction (generally defined as a 10% pullback from a high) or — gasp — a bear market (generally defined as a 20%+ pullback from a high).

Where things fall on that continuum would have a lot to do with how far earnings estimates fall. This why economic data is being watched so closely. If the economy deteriorates, earnings estimates will come down, but if the economy holds up like it has been holding up, the risk of a material downward revision is lessened.

That is where things stand today. The stock market is holding up with a premium valuation because the economy and earnings are holding up. Accordingly, the subtle change in the CY25 earnings estimate hasn’t registered as a scare factor.

Something else, though, that is beginning to spook the stock market a bit is the trend in market rates.

The Not-So-Subtle Change

It isn’t a mystery to anyone following the market that Treasury yields have risen after the Fed cut rates on September 18. The mystery to many in the market is why that has been the case. There isn’t a pinpoint explanation, yet there is a lot of chatter about the following influences:

- Pricing out a hard landing scenario (i.e., no recession) and possibly even pricing out a soft landing scenario (i.e., economy just keeps growing above potential)

- Worries about inflation heating up again because the economy is remaining strong, yet the Fed is cutting rates

- Increased angst about the surging budget deficit and national debt, both of which are projected to worsen no matter who wins the presidential vote

- Some unwinding of the safety trade revolving around geopolitics after Israel tempered its response and held off attacking Iran’s oil/nuclear facilities

- Asset reallocation out of bonds and into stocks (for many of the reasons cited here)

- Technical selling after the 10-yr note cleared resistance at its 200-day moving average at 4.18%

- Recalibrating the number of rate cuts the Fed might enact

The cumulative effect of the matter is that the 2-yr note yield has risen 60 basis points to 4.21% since September 17 (the day before the 50-basis points rate cut) while the 10-yr note yield has risen 73 basis points to 4.37%.

With this move in rates, it has also been said that the stock market can handle it given that it did fine when rates were even higher. This is true, although the valuation wasn’t quite as demanding as it is today when the 10-yr note yield traded north of 4.50%. In any case, the chart below shows that there was multiple compression the past few years when the 10-yr note yield got above 4.50%.

One of the other key points as to why the stock market held its own when rates were higher is that earnings estimates were still trending higher; hence, the pullbacks were seen as buying opportunities rooted in what was still a fundamentally sound backdrop.

What It All Means

The stock market has maintained a resilient disposition, beating back selling interest and sticking near record highs. It has struggled more recently, though, to take another leg higher.

That struggle has to do in part with the uncertainty regarding the outcome of the election, yet some fundamental factors are rounding into form as an impediment. There is the subtle factor of CY25 earnings estimates coming down and the not-so-subtle factor of market rates moving up appreciably — and quickly — since the Fed cut rates on September 18 and the presidential candidates got more vocal about their policy proposals.

Higher interest rates can be tolerated to a point, but if market rates continue to ratchet up, and earnings estimates don’t, the multiple expansion that has been a hallmark of this bull market is apt to give way to multiple compression that may or may not be subtle depending on the driver.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Lower

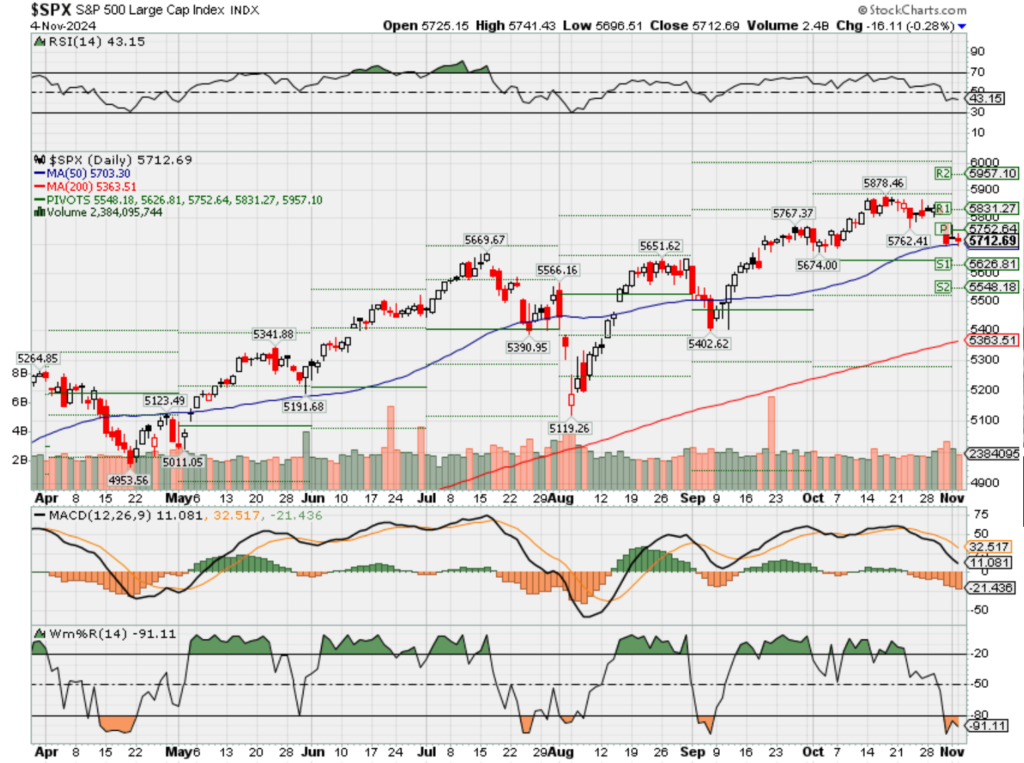

DJIA – Bearish

SPX – Bearish

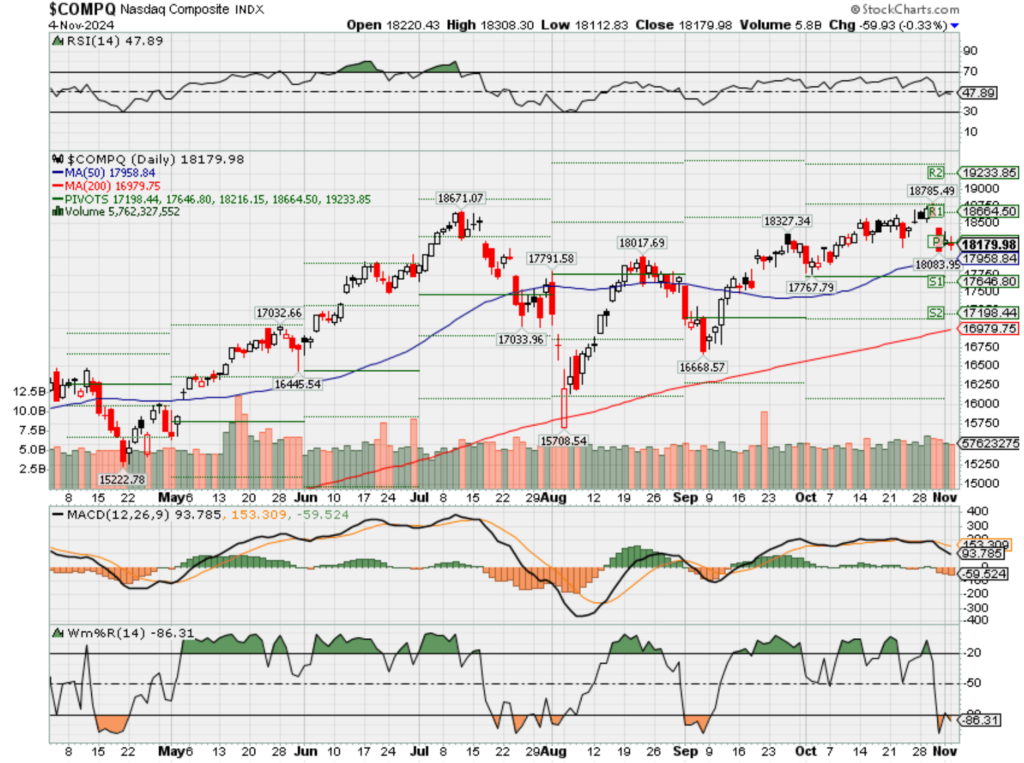

COMP – Bearish

Where Will the SPX end November 2024?

11-04-2024 ????

10-28-2024 ????

Earnings:

Mon: MAR, YUMC, CLF, WYNN

Tues: DD, YUM, DVN,

Wed: CVS, OC, QCOM, ZG, JCI, HUBS

Thur: GOLD, DUK, HAL, MUR, RL, TPR, ABNB, MNST, UAA, SQ

Fri:

Econ Reports:

Mon: Factory Orders,

Tue Trada Balance, ISM Services, ELECTION

Wed: MBA,

Thur: Initial Claims, Continuing Claims, FOMC Rate decision, Productivity, Unit Labor Costs, Consumer Credit, Wholesale Inventory

Fri: Michigan Sentiment

How am I looking to trade?

Protection thru earnings and leaving some on for the election next week

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

This sector that has been struggling in recent years is about to break out

Published Wed, Sep 25 20249:00 AM EDTUpdated Wed, Sep 25 202411:39 AM EDT

Fintech stocks have been in a rut since 2021. That may be about to change.

Wolfe Research technical strategist Rob Ginsberg pointed out the Global X FinTech ETF (FINX) is close to reaching the $30 level for the first time since 2022. The fund is also trading back above its 50- and 200-day moving averages.

While financials overall have done well recently, “fintech names have lagged, and appear to just be turning higher from a longer-term perspective. The FINX ETF illustrates this well. Not yet overbought, but clearly trying to breakout, $30+ should be in the cards.”

The fund has struggled since November 2021, losing more than 46% during that time. That decline came as the Federal Reserve hiked interest rates to dent inflationary pressures.

This year, the exchange-traded fund has made some progress, rising more than 9%, as the Fed begins its policy-easing campaign. It is also up nearly 40% over the past 12 months.

FINX since Nov. 2021

A breakout could have broader implications outside of fintech. For one, it may validate the stock market’s rally following the Fed’s rate cut last week. The S&P 500 hit a record Tuesday along with the Dow Jones Industrial Average. The two benchmarks are up 20% and 12%, respectively, year to date.

It could also signal that easing monetary policy may be doing what the Fed wants: boosting the economy. The overnight rate remains in a range of 4.75% to 5.00%, well above the near-zero levels seen in late 2021.

For investors looking for exposure to fintech, CNBC Pro scanned the FINX fund for stocks that met the following criteria:

- Buy rating from 60% of analysts or more

- Upside to average price target of 10% or more

- Listed at the New York Stock Exchange or Nasdaq

- Covered by at least eight analysts

Here are the stocks that made the cut.

FINX stocks liked by analysts

| Symbol | Name | (%) Buy Rating | Upside to Avg PT (%) |

| FLYW | Flywire Corp. | 84.2 | 39.8 |

| HQY | HealthEquity Inc | 71.4 | 32.4 |

| LC | LendingClub Corp | 80.0 | 26.7 |

| PAGS | PagSeguro Digital Ltd. Class A | 66.7 | 71.3 |

| RIOT | Riot Platforms, Inc. | 92.3 | 132.4 |

| SQ | Block, Inc. Class A | 61.4 | 27.2 |

| STNE | StoneCo Ltd. Class A | 61.1 | 56.6 |

Source: FactSet

Flywire, Riot Platforms and Block are among the names on the list.

Elsewhere on Wall Street this morning, Barclays upgraded Hewlett Packard Enterprise to overweight from equal weight.

“We believe that HPE will continue to grow its AI server revenues, improve in storage, and we like the accretion from the [Juniper Networks] deal,” analyst Tim Long wrote. HPE agreed to buy Juniper Networks for about $14 billion. The acquisition is expected to close before year-end.

Alphabet shares rise on earnings beats boosted by cloud revenue

Published Tue, Oct 29 202412:00 PM EDTUpdated Wed, Oct 30 202410:54 AM EDT

Key Points

- Alphabet reported stronger-than-expected earnings results.

- The company reported blowout cloud revenue at $11.35 billion, up nearly 35% from the $8.41 billion a year ago.

- Alphabet’s chief financial officer says the company plans to build on existing cost-cutting efforts around using AI to streamline workflow and manage headcount and the company’s physical footprint.

Google parent Alphabet reported third-quarter earnings that beat on top and bottom lines with strong revenue growth from the company’s cloud unit.

The company’s shares rose about 5% on Wednesday morning.

Here are the results:

- Earnings per share: $2.12 vs. $1.85 expected by LSEG

- Revenue: $88.27 billion vs. $86.30 billion expected by LSEG

Here are other numbers Wall Street was watching:

- YouTube advertising revenue: $8.92 billion vs. $8.89 billion, according to StreetAccount

- Google Cloud revenue: $11.35 billion vs. $10.88 billion, according to StreetAccount

- Traffic acquisition costs (TAC): $13.72 billion vs. $13.53 billion, according to StreetAccount

Alphabet’s revenue grew 15% year over year, which is stronger than the same quarter last year.

The company reported blowout cloud revenue at $11.35 billion, up nearly 35% from the $8.41 billion a year ago. The company attributed its strong cloud results to its artificial intelligence offerings, which include subscriptions for enterprise customers.

Alphabet CEO Sundar Pichai opened his call with investors saying the company’s “full stack” of AI products is now operating at scale and being used by Google’s billions of users and “creating a virtuous cycle.”

The search company’s strong quarter kicks off a big week of earnings for tech’s megacap companies. Meta and Microsoft report on Wednesday, followed by Apple and Amazon on Thursday.

Alphabet’s net income increased to $26.3 billion, or $2.12 per share, compared to $19.7 billion, or $1.55 per share, in the year-ago quarter.

Google’s search business generated $49.4 billion in revenue. That was up 12.3% from a year ago, and the search business remains the largest contributor to revenue growth for the company, said Alphabet Chief Financial Officer Anat Ashkenazi on the call.

Alphabet shares pop on earnings beat

Turning to AI for more cost cutting

Alphabet plans to build on existing cost-cutting efforts around using AI to streamline workflow and manage headcount and the company’s physical footprint, Ashkenazi said.

“I plan to build on these efforts but also evaluate where we might be able to accelerate work and where we might need to pivot to free up capital for more attractive opportunities,” said Ashkenazi, who joined the company in June after 23 years at drugmaker Eli Lilly.

Alphabet reported advertising revenue of $65.85 billion. That was up from $59.65 billion a year ago, showing that Google’s advertising business continues to grow, though at a slower pace than in the second quarter.

YouTube ad revenue just beat analysts’ expectations, showing better growth than last quarter. The Google-owned company faces increased pressure from other advertiser options such as Netflix, TikTok and Amazon.

AI is improving YouTube recommendations, Chief Business Officer Philipp Schindler said on the call with investors. The company’s AI language model Gemini has given YouTube the ability to “recommend more relevant, fresher and personalized content to the viewer.”

Google Workspace, the company’s collection of cloud computing and productivity suite, saw strong growth during the third quarter, Ashkenazi said. Google Cloud Platform, the company’s data management and AI suite, saw growth that outpaced the cloud unit’s growth during the quarter, Ashkenazi added.

Other Bets, which includes the company’s life sciences unit Verily and self-driving car unit Waymo, reported revenue of $388 million in the third quarter. That is up from $297 million a year ago.

Last week, Waymo closed a $5.6 billion funding round to expand its robotaxi service in Los Angeles, San Francisco and Phoenix and to more cities.

Google Lens, the company’s image recognition product that uses mobile cameras and photos, is now used for more than 20 billion visual searches per month, Pichai said. It is one of the fastest-growing search products and is used often for shopping, he added.

Alphabet’s third quarter was filled with shake-ups externally and internally, including at its most senior ranks and its most important business.

Earlier this month, the company replaced Prabhakar Raghavan, the company’s search and ads boss since 2018, with Nick Fox, a longtime executive known for his role in Google’s Assistant unit. Additionally, the team working on the Gemini app, which includes the company’s artificial intelligence direct-to-consumer products, will join Google DeepMind under head Demis Hassabis.

The company on Tuesday announced it is evaluating how this reorganization will affect its segment operating results.

Silver is breaking out and has potential to outperform gold ahead, says Katie Stockton

Published Mon, Oct 21 202412:36 PM EDT

The precious metals complex has seen strong performance this year, with gold returning 32% year-to-date and silver returning nearly 40%. Long-term bullish trends are intact for each commodity, but silver looks more actionable in the near term from a technical perspective.

While silver has produced strong returns this year, it does not appear overextended when looking at the monthly chart of the iShares Silver Trust (SLV), which shows a secular turnaround.

CQG, Fairlead Strategies

Long-term momentum is positive and expanding per the monthly MACD and histogram as silver pushes to its highest level since 2013. Next resistance for SLV is not until a long-term Fibonacci level near $34.00, which is a 61.8% retracement of the downtrend from 2011 to 2020.

Zooming in on the weekly chart, SLV has broken out from a six-month trading range on positive intermediate-term momentum, which supports a bullish bias over the next few months.

CQG, Fairlead Strategies

In the short term, there are some signs of exhaustion that support a retest of the breakout point near $29.60, which would provide a more favorable entry point. Additional support for SLV is at the 50-day (10-week) moving average near $27.60.

Silver’s breakout in absolute terms has the potential to result in relative outperformance versus gold in the weeks ahead.

CQG, Fairlead Strategies

The gold/silver ratio has seen intermediate-term momentum shift lower per the 10-week MA, and has room to support at the bottom of a long-term trading range.

—Katie Stockton with Will Tamplin

Access research from Fairlead Strategies for free here.

DISCLOSURES:

All opinions expressed by the CNBC Pro contributors are solely their opinions and do not reflect the opinions of CNBC, NBC UNIVERSAL, their parent company or affiliates, and may have been previously disseminated by them on television, radio, internet or another medium.

THE ABOVE CONTENT IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY. THIS CONTENT IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSITUTE FINANCIAL, INVESTMENT, TAX OR LEGAL ADVICE OR A RECOMMENDATION TO BUY ANY SECURITY OR OTHER FINANCIAL ASSET. THE CONTENT IS GENERAL IN NATURE AND DOES NOT REFLECT ANY INDIVIDUAL’S UNIQUE PERSONAL CIRCUMSTANCES. THE ABOVE CONTENT MIGHT NOT BE SUITABLE FOR YOUR PARTICULAR CIRCUMSTANCES. BEFORE MAKING ANY FINANCIAL DECISIONS, YOU SHOULD STRONGLY CONSIDER SEEKING ADVICE FROM YOUR OWN FINANCIAL OR INVESTMENT ADVISOR.

Click here for the full disclaimer.

Fairlead Strategies Disclaimer:

This communication has been prepared by Fairlead Strategies LLC (“Fairlead Strategies”) for informational purposes only. This material is for illustration and discussion purposes and not intended to be, nor construed as, financial, legal, tax or investment advice. You should consult appropriate advisors concerning such matters. This material presents information through the date indicated, reflecting the author’s current expectations, and is subject to revision by the author, though the author is under no obligation to do so. This material may contain commentary on broad-based indices, market conditions, different types of securities, and cryptocurrencies, using the discipline of technical analysis, which evaluates the demand and supply based on market pricing. The views expressed herein are solely those of the author. This material should not be construed as a recommendation, or advice or an offer or solicitation with respect to the purchase or sale of any investment. The information is not intended to provide a basis on which you could make an investment decision on any particular security or its issuer. This document is intended for CNBC Pro subscribers only and is not for distribution to the general public. Certain information has been provided by and/or is based on third party sources and, although such information is believed to be reliable, no representation is made with respect to the accuracy, completeness, or timeliness of such information. This information may be subject to change without notice. Fairlead Strategies undertakes no obligation to maintain or update this material based on subsequent information and events or to provide you with any additional or supplemental information or any update to or correction of the information contained herein. Fairlead Strategies, its officers, employees, affiliates and partners shall not be liable to any person in any way whatsoever for any losses, costs, or claims for your reliance on this material. Nothing herein is, or shall be relied on as, a promise or representation as to future performance. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Opinions expressed in this material may differ or be contrary to opinions expressed, or actions taken, by Fairlead Strategies or its affiliates, or their respective officers, directors, or employees. In addition, any opinions and assumptions expressed herein are made as of the date of this communication and are subject to change and/or withdrawal without notice. Fairlead Strategies or its affiliates may have positions in financial instruments mentioned, may have acquired such positions at prices no longer available, and may have interests different from or adverse to your interests or inconsistent with the advice herein. Any investments made are made under the same terms as nonaffiliated investors and do not constitute a controlling interest. No liability is accepted by Fairlead Strategies, its officers, employees, affiliates, or partners for any losses that may arise from any use of the information contained herein. Any financial instruments mentioned herein are speculative in nature and may involve risk to principal and interest. Any prices or levels shown are either historical or purely indicative. This material does not take into account the particular investment objectives or financial circumstances, objectives or needs of any specific investor, and are not intended as recommendations of particular securities, investment products, or other financial products or strategies to particular clients. Securities, investment products, other financial products or strategies discussed herein may not be suitable for all investors. The recipient of this information must make its own independent decisions regarding any securities, investment products or other financial products mentioned herein. The material should not be provided to any person in a jurisdiction where its provision or use would be contrary to local laws, rules, or regulations. This material is not to be reproduced or redistributed absent the written consent of Fairlead Strategies.

China’s property market is expected to stabilize in 2025 — but stay subdued for years

Published Tue, Oct 29 20247:43 PM EDTUpdated Wed, Oct 30 20241:59 AM EDT

Evelyn Cheng@in/evelyn-cheng-53b23624@chengevelyn

Anniek Bao@in/anniek-yunxin-bao-460a48107/@anniekbyx

Key Points

- China’s struggling real estate sector may not start turning around until the second half of next year, even with the latest stimulus measures, analysts predict.

- “We are finally at an inflection point of the ongoing downward spiral in the housing market on the back of a comprehensive and coordinated easing package,” Goldman Sachs analysts said.

- Analysts project any rebound in home sales and new construction would remain subdued in the coming years.

China’s struggling real estate sector may not start turning around until the second half of next year — even with the latest stimulus measures, three research firms predicted this month.

After months of incremental measures, Chinese President Xi Jinping in late September led a top-level meeting that vowed to “halt the real estate market decline.” Earlier this month, the Finance Ministry introduced more measures aimed at stabilizing the real estate sector.

“We are finally at an inflection point of the ongoing downward spiral in the housing market on the back of a comprehensive and coordinated easing package,” Goldman Sachs analysts said in an Oct. 22 note titled “China real estate 2025 outlook: Bottoming in sight.”

“This time is different from the previous piecemeal easing measures,” the report said.

The analysts expect property prices in China to stabilize in late 2025, and rise by an average of 2% two years later. Property sales and new home construction are unlikely to stabilize until 2027, Goldman forecast.

Elizabeth Economy discusses challenges to China’s economic transition

S&P Global Ratings and Morgan Stanley this month also published reports forecasting China’s real estate market will bottom in the second half of 2025.

“If the government continues to prioritize support for developer financing and destocking, we believe property sales and prices could stabilize toward the second half of 2025,” Edward Chan, director at S&P Global Ratings, and his team said in an Oct. 17 note. They cautioned it would take time for policies to take effect.

Beijing has made clear that efforts to support the struggling real estate sector come second to its aim of bolstering advanced manufacturing as a new driver of growth. But it’s no easy feat, as property once accounted for more than a quarter of gross domestic product, with ties to both household wealth and local government finances. China’s indebted developers have increasingly struggled to deliver pre-sold homes, dampening consumer sentiment.

Analysts are closely watching a parliamentary meeting next week for any details on fiscal spending on reducing housing inventory.

Goldman’s prediction assumes an additional 8 trillion yuan ($1.12 trillion) in fiscal spending from the government, which has yet to be announced.

“Without such stimulus, the property market downturn could be prolonged by another three years,” the Goldman analysts cautioned. They said such support would need to address developers’ liquidity issues, reduce unsold housing inventories and ensure delivery of the pre-sold but unfinished homes.

Houses in China have typically been sold ahead of completion. That business model proved unsustainable after Beijing cracked down on developers’ high reliance on debt for growth, and homebuyer demand fell with slower economic growth.

Nomura estimated late last year that about 20 million pre-sold homes remained unfinished. Last month, officials indicated around 4 million homes had been completed and delivered to buyers under this year’s whitelist program, and pledged to speed up financial support.

Back in June, even before the latest stimulus announcements, Morgan Stanley had expected the inventory destocking to lead to a “rebound in property loan demand in late 2025 or 2026.”

The analysts expect about 30% of unsold inventory will never be sold, requiring banks or other unspecified entities to bear the cost.

China’s latest efforts to bolster confidence have given the real estate market a lift. Property sales in 22 major cities have fallen by around 4% on-year in October, a much smaller contraction than a plunge of more than 25% in September, according to China Index Academy, a real estate research firm.

Not a return to boom days

Property market stabilization, however, does not mean a full-scale recovery. Analysts project any rebound in home sales and new construction would remain subdued in the coming years.

S&P expects property sales in China to decline to around 9 trillion yuan or less this year, before dropping further to as low as 8 trillion yuan in 2025 — less than half the 18 trillion yuan sales level in 2021.

The analysts attribute the sales declines to the increase in unsold housing inventories, which continue to pressure developers resorting to price-cutting to attract buyers and reduce stock.

After years of slump, China’s housing market is now showing signs of life

In September, property sales of China’s top 100 developers shrank 37.7% year on year, its steepest drop since April this year, S&P said, citing data from China Real Estate Information. It wasn’t a one-month plunge. Over the first nine months of the year, sales fell 36.6% from a year earlier, the data showed.

The deteriorating sales also take a further toll on developers’ liquidity, leading to a “lack of confidence” and developers seeking “a cautious approach” toward land acquisition and initiating new projects, according to S&P Global analysts.

The number of new construction projects had plummeted by 42% in 2023 from their peak in 2019, and declined a further 23% year on year in the first eight months of 2024, according to S&P Global’s analysis of official data from National Bureau of Statistics.

More to be done

Analysts remain cautious about the impact of China’s real estate stimulus.

“In our view, the scale of support has been insufficient and has faced execution challenges to stop the current downward spiral,” the Goldman analysts said, warning property prices could drop by another 20% to 25% if policy falls short.

In one of the few inventory-specific measures announced so far, the People’s Bank of China in May pledged 300 billion yuan for a relending loan facility for state-owned enterprises to buy up unsold completed homes, and convert them into affordable housing.

“Although helpful, it only accounted for a small percentage (4-6%) of the overall completed housing stock,” S&P said.

Morgan Stanley analysts said in their report Sunday that recent meetings with banks in Zhejiang, one of China’s better-off provinces, indicated they have not yet participated in the new government program to extend loans for buying housing inventory.

https://www.theepochtimes.com/opinion/no-central-bank-wants-to-stop-price-inflation-5747844

No Central Bank Wants to Stop Price Inflation

10/27/2024Updated:10/27/2024

Many citizens want more government control of the economy to curb rising prices. It is the worst strategy imaginable. Interventionist governments never reduce consumer prices because they benefit from inflation, dissolving their political spending commitments in a constantly depreciated currency. Inflation is the perfect hidden tax. The government makes the currency less valuable by issuing more units of fiat money, partially dissolves its debt in real terms, collects more taxes, and presents itself as the solution to rising prices with subsidies in an increasingly worthless currency. That is why socialism and hyperinflation go hand in hand.

Socialism rejects human action and economic calculation and sells a false image of a government that can create wealth at will by issuing more units of fiat currency. Obviously, when inflation arrives, the socialist government will use its two favorite tools: propaganda and repression. Propaganda, which accuses stores and businesses of driving up prices, and repression, which occurs when social unrest intensifies and citizens legitimately hold governments accountable for scarcity and high prices, are the two main strategies.

If you want lower prices, you need to give less economic power to the government, not more. Only free markets, competition, and open economies help decrease consumer prices. Many readers might think that we currently have a free market with competitive and open economies, but the reality is that we live in increasingly intervened and overregulated nations where central banks and governments work to perpetuate unsustainable public deficits and debt. Therefore, they continue to print more money, leading many to question why it is getting harder for families to make ends meet, buy a home, or for small businesses to prosper. The government is slowly eating away the currency it issues. They call it “social use of money.”

What is “social use of money”? In essence, it means abandoning one of the main characteristics of money, the reserve of value, to give the government preferential access to credit to finance its commitments. Therefore, the state can announce larger entitlement programs and increase the size of the public sector relative to the economy, creating a self-fulfilling prophecy. The state issues more currency, which makes people’s money less valuable. Citizens become more dependent on the state, and they will demand more subsidies paid in the currency the state issues. It is, in essence, a process of control through debt and currency depreciation.

When governments and central banks talk about price stability, it means a two percent annual depreciation of the currency. Aggregate prices rising an average of two percent is hardly price stability because it is measured by the consumer price index (CPI), which is a carefully crafted basket of goods and services weighted by the same people who print the money. That is why governments love CPI as a measure of inflation. It fails to fully reflect the erosion of the currency’s purchasing power. This is why the CPI’s basket calculation fluctuates so frequently. Even if it accurately measures, it will underestimate the rise in prices of non-replaceable goods and services by adding them to a basket of things we consume maybe once or twice a year at best. When you put together shelter, food, health, and energy with technology and entertainment, there will always be distortions.Thus, governments and central banks are never going to defend price stability. If aggregate prices fell, competition soared, and citizens saw their real wages rise and their deposit savings increase in real value, their jobs would disappear.

When a central bank like the Fed cuts rates and increases the money supply after an accumulated 20.4% inflation in four years, it is not defending price stability; it is defending price increases. This strategy serves to conceal the government’s financial insolvency. A currency with a declining value.

A government that tells you it will borrow $2 trillion per annum in a growth and record receipt economy and will continue to increase debt and borrow well into 2033 with the most optimistic assumptions of GDP and receipt is telling you it will make you poorer.

When a politician promises that he or she will cut prices, they are always lying. A weaker currency is a tool to increase government power in the economy. By the time you find out, it may be too late.

Money is credit, and government debt is fiat currency. Currency depreciation is inflation, and inflation is equivalent to an implicit default. No interventionist government or central bank wants lower prices because inflation allows the government to increase its power while slowly breaching its monetary commitments.

Updated Mon, Nov 4 20248:55 AM EST

Stock futures are mostly flat ahead of presidential election, Nvidia rises on Dow inclusion: Live updates

Stock futures were little changed on Monday as investors geared up for the highly-anticipated U.S. presidential election.

S&P 500 futures rose less than 0.1%, while Nasdaq-100 futures ticked down less than 0.1%. Futures connected to the Dow Jones Industrial Average were down 36 points, or about 0.1%

Nvidia shares were up 2% in the premarket after S&P Dow Jones Indices announced late Friday that the chipmaker would replace rival Intel in the 30-stock Dow. The change, which will take effect at the end of the week, comes as Nvidia continues to rip higher while Intel languishes in the artificial intelligence race.

Nvidia is up 173% year to date, while Intel has lost more than half of its value in that time.

NVDA vs INTC year to date

Tuesday’s election results could play a pivotal role in where stocks finish off the year. The latest poll from NBC News shows a “deadlocked race” between former President Donald Trump and Vice President Kamala Harris.

However, much of market aftershocks may hinge more heavily on which party takes control of Congress. If control of the U.S. House of Representatives and Senate is divided, it would likely mean a maintaining of the status quo. A Republican or Democratic sweep, however, would likely be coupled with a White House victory for the same party, and could mean fresh spending plans or a tax overhaul.

Some on Wall Street view the election as a key obstacle markets need to overcome to rally into year-end.

“The US election is incredibly important, but the process is likely to be incredibly noisy. Some patience, and a plan, can make the difference between navigating the noise and getting lost in it,” Morgan Stanley strategist Michael Zezas said in a note to clients.

Along with the election, Wall Street is bracing for the latest rate decision from the Federal Reserve. Traders are pricing in a 96% chance of a rate cut at the conclusion of the central bank’s policy meeting, according to CME Group’s FedWatch tool. It would follow a supersize 50 basis point move in September.

Greater focus will hinge on commentary from Fed Chair Jerome Powell following the meeting, as Wall Street hunts for more insight into the central bank’s rate moves from here.

Earnings seasons presses on with about a fifth of the S&P 500 slated to report in the coming week. About 70% of companies that have already reported results have surpassed estimates, according to FactSet data. Super Micro Computer, Moderna, CVS Health, Qualcomm and Wynn Resorts are among the companies reporting in the coming days.

Stocks are coming off a strong start to November, with Amazon and big technology stocks boosting the tech-heavy Nasdaq Composite and S&P 500 0.8% and 0.4%, respectively. The Dow Jones Industrial Average added nearly 289 points, or about 0.7%.

— CNBC’s Sarah Min contributed reporting

3 reasons why Warren Buffett is shunning stocks — including his own

Published Mon, Nov 4 20248:50 AM EST

Warren Buffett isn’t hot on stocks right now, and the 94-year-old CEO’s latest moves reflect that.

Berkshire Hathaway on Saturday said its cash pile swelled to a record $325.2 billion in the third quarter, up from $276.9 billion at the end of June. For context, that’s more than the market value of Nike, Goldman Sachs, Coca-Cola and Disney.

The cash hoard has grown as Berkshire pared down stakes in key holdings such as Apple and Bank of America. The conglomerate sold about 300 million Apple shares in the third quarter, or roughly 25% of its stake. It’s also raked in more than $10 billion from steadily selling Bank of America shares since the summer.

On top of that, Buffett isn’t buying back his own stock. Berkshire, which repurchased $345 million of shares in the second quarter, didn’t buy back any shares back during the latest selling spree.

Nicholas Colas, co-founder of DataTrek Research, highlighted three possible reasons for this “unusual activity” from the Oracle of Omaha:

- “Buffett sees stocks as overvalued, including his own, and therefore susceptible to a deep correction or outright bear market,” Colas said in a note to clients. Indeed, Buffett has prided himself in looking for solid investments that are undervalued. The S&P 500 trades at a forward price-to-earnings multiple of 21.5, near its highest level going back to April 2021. It’s also only about 2.5% below a record high. Berkshire Class A stock trades at 22.6 time earnings. Earlier this year, it traded at its highest multiple since May 2022.

- “Buffett may soon step back from active portfolio management and wants to clear the decks for his successors to remake Berkshire’s portfolio and rethink the company’s stock repurchase program,” Colas wrote. Buffett has already named his successor, Greg Abel, though he hasn’t signaled when he will step down.

- Lastly, Colas noted that Buffett may have “have identified one or more large acquisitions and is raising capital for those purchases.” But that’s probably less likely given his age and the planned succession.

Elsewhere on Wall Street this morning, Morgan Stanley upgraded Roblox to overweight from equal weight.

“RBLX is proving that its [user-generated content]-platform can drive accelerating share gains, as it reaches larger/more diverse audiences across more platforms,” the investment bank said in a Monday note to clients. “Micro milestones leave us confident in its ability to execute from here and exceed expectations.”

What the stock market typically does after the U.S. election, according to history

Published Mon, Nov 4 20242:14 PM ESTUpdated 4 Hours Ago

Stocks typically rise after a presidential election, but investors need to be prepared for some short-term choppiness first, history shows.

The three major benchmarks on average have seen gains between Election Day and year-end in the presidential election year going back to 1980, according to CNBC data. However, investors should not be expecting a straight shot up in the market after polls close.

The S&P 500 after the election

| Election Date | Day After | Week After | Month Later | Year End |

| 11/3/2020 | 2.20% | 5.23% | 8.83% | 11.48% |

| 11/8/2016 | 1.11% | 1.91% | 4.98% | 4.64% |

| 11/6/2012 | -2.37% | -3.77% | -1.01% | -0.15% |

| 11/4/2008 | -5.27% | -10.62% | -15.96% | -10.19% |

| 11/2/2004 | 1.12% | 2.97% | 5.29% | 7.20% |

| 11/7/2000 | -1.58% | -3.42% | -6.17% | -7.79% |

| 11/5/1996 | 1.46% | 2.16% | 4.23% | 3.72% |

| 11/3/1992 | -0.67% | -0.31% | 2.38% | 3.76% |

| 11/8/1988 | -0.66% | -2.48% | 0.52% | 0.93% |

| 11/6/1984 | -0.73% | -2.61% | -4.49% | -1.86% |

| 11/4/1980 | 2.12% | 1.72% | 5.77% | 5.21% |

| Average | -0.30% | -0.84% | 0.40% | 1.54% |

| Median | -0.66% | -0.31% | 2.38% | 3.72% |

Source: CNBC

In fact, the three indexes have all averaged declines in the session and week following those voting days. Stocks have tended to erase most or all of those losses within a month, CNBC data shows.

This means investors should not be anticipating an immediate pop on Wednesday or the next few days after.

The Dow after the election

| Election Date | Day After | Week After | Month Later | Year End |

| 11/3/2020 | 1.34% | 7.06% | 9.06% | 11.38% |

| 11/8/2016 | 1.40% | 3.22% | 6.99% | 7.80% |

| 11/6/2012 | -2.36% | -3.70% | -1.30% | -1.07% |

| 11/4/2008 | -5.05% | -9.68% | -12.98% | -8.82% |

| 11/2/2004 | 1.01% | 3.49% | 5.47% | 7.45% |

| 11/7/2000 | -0.41% | -2.48% | -3.06% | -1.51% |

| 11/5/1996 | 1.59% | 3.04% | 5.85% | 6.04% |

| 11/3/1992 | -0.91% | -0.83% | 0.74% | 1.50% |

| 11/8/1988 | -0.43% | -2.37% | 0.67% | 1.93% |

| 11/6/1984 | -0.88% | -3.02% | -5.92% | -2.62% |

| 11/4/1980 | 1.70% | 0.73% | 3.55% | 2.86% |

| Average | -0.27% | -0.41% | 0.83% | 2.27% |

| Median | -0.41% | -0.83% | 0.74% | 1.93% |

Source: CNBC

That is especially true given the chance that the presidential race, which is considered neck-and-neck, may not be called by Wednesday morning. America may also need to wait for close Congressional races to have final counts for determining which party has control of either house.

The Nasdaq Composite after the election

| Election Day | Day After | Week After | Month Later | Year End |

| 11/3/2020 | 3.85% | 3.52% | 10.90% | 15.48% |

| 11/8/2016 | 1.11% | 1.58% | 4.31% | 3.65% |

| 11/6/2012 | -2.48% | -4.25% | -0.75% | 0.25% |

| 11/4/2008 | -5.53% | -11.19% | -18.79% | -11.41% |

| 11/2/2004 | 0.98% | 2.95% | 8.00% | 9.61% |

| 11/7/2000 | -5.39% | -8.12% | -19.41% | -27.67% |

| 11/5/1996 | 1.34% | 2.23% | 5.78% | 5.04% |

| 11/3/1992 | 0.16% | 3.83% | 8.56% | 11.97% |

| 11/8/1988 | -0.29% | -1.77% | -0.96% | 0.67% |

| 11/6/1984 | -0.32% | -1.08% | -4.58% | -1.27% |

| 11/4/1980 | 1.49% | 0.97% | 6.75% | 4.76% |

| Average | -0.46% | -1.03% | -0.02% | 1.01% |

| Median | 0.16% | 0.97% | 4.31% | 3.65% |

Source: CNBC

The “election is now center stage as the next catalyst for financial markets,” said Amy Ho, executive director of strategic research at JPMorgan. “We caution that uncertainty could linger on the outcome as the timeline for certifying election results could take days for the presidential race and weeks for the House races.”

This election comes amid a strong year for stocks that has pushed the broader market to all-time highs. With a gain of about 20%, 2024 has seen the best first 10 months of a presidential election year since 1936, according to Bespoke Investment Group.