HI Market View Commentary 10-21-2024

Busy week for the S&P 500 – 14% of S&P 500 reporting, Very week economic reports, We have six weeks of S&P 500 gains.

What are your expectations for the S&P 500?= Bullish, Dependent on Earnings=Spectacular, Primed for a pullback 3-7.5%, Financials moved higher on Earnings and then gave a lot back,

Ecstatic that we don’t have any nuclear bombs or facilities going off yet.

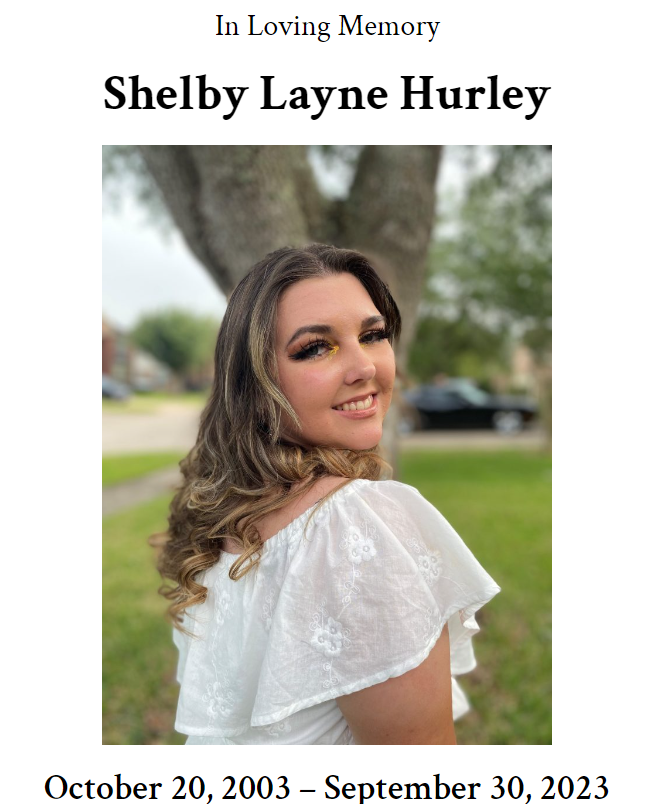

Very Emotional Weekend for the Hurley Family

What does financial freedom mean to you? The ability to do and pay for the things/needs of my family, Not worry about Money, $$ to buy another gun,

For me – It means making money in the stock market whether it’s moving up or down, Protecting to give myself the opportunity to be able to take time for others, the ability to help others when they can’t help themselves, It allows me to help my family both immediate and other family members,

Earnings dates:

AAPL 10/31 AMC

BA 10/23 BMO

BABA 11/21 BMO

BIDU 11/26 est

DG 12/05 est

DIS 11/14 BMO

F 10/28 AMC

GM 10/22 BMO

GOOGL 10/22 AMC

JCI 11/06 AMC

KO 10/23 BMO

LMT 10/22 BMO

META 10/30 AMC

MU 12/28 est

O 11/04 AMC

SQ 11/07 AMC

TGT 11/20 BMO

UAA 11/11 est

V 10/29 AMC

VZ 10/22 BMO

ZION 10/21 AMC

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 11-Oct-24 15:24 ET | Archive

Why the Treasury market’s direction of travel matters

The day is September 17. The 2-yr note yield is 3.60% and the 10-yr note yield is 3.64%. The market is eagerly anticipating a rate cut by the Federal Reserve on September 18. The Federal Reserve did not disappoint.

On September 18, the Federal Open Market Committee (FOMC) voted to cut the target range for the fed funds rate by 50 basis points to 4.75-5.00%. That was not a unanimous vote. Fed Governor Bowman dissented in favor of a smaller 25-basis points cut.

What followed the rate cut news was interesting in more ways than one. Something that stood out is that rates at the front of the yield curve and the back of the curve both went up after the FOMC cut rates.

Eyes Wide Open

The 2-yr note is more sensitive to changes in the fed funds rate. It went down initially on the rate cut, but at 3.95% today, it sits 35 basis points higher than where it was on September 17.

This adjustment stems from an acceptance that the market got too far ahead of itself in pricing in rate cuts, so the market has given back some of what it took in its hopeful policy easing view.

Interestingly, the fed funds futures market is in alignment now with the Fed’s own median estimate that there will be another 50 basis points of easing before the end of 2024 and another 100 basis points in 2025. Shortly before the September 18 rate cut decision, the fed funds futures market had priced in 100 basis points of easing before the end of 2024 and another 150 basis points by September 2025.

The difference is that the market now sees 50 basis points less of easing by September 2025, so it stands to reason why the 2-yr note yield has risen since that September 18 decision.

The changed outlook has been a byproduct of two things: (1) the arrival of economic data that remains suggestive of a soft landing/no landing outlook and (2) Fed officials, including Fed Chair Powell, tamping down the market’s more aggressive rate cut outlook.

Fed Chair Powell set the tone in this respect, saying overtly that there is likely to be two more 25-basis points cuts before the end of 2024 if the economy evolves as expected. It’s worth noting that Atlanta Fed President Bostic (FOMC voter) said recently that he would be open to skipping a rate cut in November. He said that following a Consumer Price Index for September that featured a 3.3% year-over-year increase in core-CPI, which excludes food and energy, up from 3.2% in August.

That is a long way still from the Fed’s 2% inflation goal, which admittedly is targeted for the PCE inflation rate, but it goes to show that the Fed can’t declare mission accomplished on its inflation mandate as it tends to shoring up the labor market with easier monetary policy.

The long end of the yield curve, which is more sensitive to inflation and which the Fed does not control, is eyes wide open in this respect.

Inflation Relapse?

The 10-yr note yield, which hit 4.11% this past week, sits currently at 4.07%, up 43 basis points from where it was on September 17.

Long rates were expected by many to come down further when the Fed started cutting rates. That’s because the Fed wouldn’t cut rates unless it was confident inflation would hit its 2% target on a sustained basis, right?

With PCE inflation up 2.2% year-over-year in August, the Fed has room to feel confident.

That doesn’t mean, however, the market isn’t worried about an inflation relapse. After all, the labor market is still in solid shape, evidenced by a 254,000 increase in September nonfarm payrolls, a 4.1% unemployment rate, and a 4.0% increase in average hourly earnings. Furthermore:

- The S&P 500 is at a record high.

- The personal savings rate, at 4.8%, is much higher than previously thought before recent revisions.

- There is a record $6.47 trillion in money market funds.

- The services sector saw an acceleration in activity in September and an increase in prices.

- China has announced a new wave of policy stimulus that has pushed up commodity prices.

- Gold, considered a hedge against inflation, recently hit a record high.

- Major central banks around the world are cutting rates.

- Oil futures have pressed higher on the escalating military tension between Israel and Iran.

An Uncomfortable Thought

Is this inflation worry why the 10-yr note yield has risen after the Fed cut rates? It’s possible, but it is also possible that the back of the curve, like the front of the curve, has adjusted simply to account for a better-than-feared economic outlook, which would mean fewer rate cuts.

Other considerations include an asset reallocation trade out of bonds and into a stock market that keeps climbing a wall of worry, aided by its belief in the soft landing outcome, the AI revolution, the continuation of rate cuts, and the restoration of the so-called “Fed put,” which is to say the market believes the Fed will be quick to step in with policy accommodation to prevent a stock market meltdown that would threaten the smooth functioning of the financial system.

Another explanation revolves around the persistent budget deficit and incessant increase in the national debt, which is $35.7 trillion or 124.3% of GDP.

The added concern is that there isn’t any concerted effort in Washington to reverse this untenable situation. The CBO estimates the budget deficit will be $1.8 trillion in FY24, up 11% from FY23. Additionally, the economic plans put forward by both presidential candidates are projected to add $3.5-7.5 trillion more in new debt over 10 years, according to the Committee for a Responsible Federal Budget.

The worry is that the exploding debt will either drive interest rates up or that bond vigilantes will drive interest rates up to force the U.S. government’s hand into getting the debt situation under control. Neither is a comfortable thought.

What It All Means

The stock market for its part has looked plenty comfortable following the September 18 rate cut. The market cap-weighted S&P 500, the equal-weighted S&P 500, Dow Jones Industrial Average, and S&P Midcap 400 have all hit new record highs.

They have done so with market rates rising, which suggests the stock market has welcomed the rise in rates so far as an expression of a stronger growth outlook that will be good for corporate earnings as opposed to the scarier thoughts of inflation reigniting or the debt problem coming home to roost.

That doesn’t mean the stock market can’t, or won’t, change its mind if circumstances change.

Neither the Treasury market nor the stock market needs an inflation scare or a debt scare, but it is the Treasury market that is likely to suss things out first, so keep an eye on the back end of the curve, which the Fed does not control.

The stock market can tolerate higher rates against a better growth backdrop, but it will struggle with a rapid increase in rates driven by an inflation scare or a debt scare, particularly since the stock market trades with a full, if not rich, valuation.

Where the 10-yr note yield goes, then, and how fast it goes in the direction of travel, will have a lot to do with the stock market’s next step and its view of the Fed’s credibility.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: the next installment of The Big Picture will be published the week of October 21)

Where will our markets end this week?

Lower

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end October 2024?

10-21-2024 -2.00%

10-14-2024 -2.00%

10-07-2024 -2.50%

09-30-2024 -2.50%

Earnings:

Mon: NUE, ZION,

Tues: CMCSA, DENN, FCX, KMB, PM, PHM, TXN, WMI, GM, LMT, VZ,

Wed: T, CME, GD, HLT, LAD, IBM, LVS, MAT, TMUS, KO, BA, TSLA,

Thur: AAL, HAS, HON, LUV, UPS, VLO, SAM, WDC

Fri: CL

Econ Reports:

Mon: Leading Indicators,

Tue

Wed: MBA, Existing Home Sales

Thur: Initial Claims, Continuing Claims, New Home Sales,

Fri: Durable Goods, Durable ex-trans, Michigan Sentiment

How am I looking to trade?

We added protection to: AAPL, DIS, BAC, GOOGL, VZ, CB, LMT, SQ, MU,

Doubled up on bidu protection

We are Protecting NVDA with covered calls because protection is no expensive =$7.60 of credit or 6.55% downside protection

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Will you roll protection higher?YES but still trying to keep protection slightly OTM

Rolled DIS 92 up to 95, APPL 225 to 230, SQ 65 to 72

https://finance.yahoo.com/news/why-nvidia-amd-arm-holdings-173327920.html

Why Nvidia, AMD, Arm Holdings, and Other Artificial Intelligence (AI) Stocks Sank on Tuesday

Danny Vena, The Motley Fool

Tue, October 15, 2024

Since early last year, investors have been bullish about the potential of artificial intelligence (AI), scooping up shares of companies best positioned to profit from this next-generation technology. However, as the bull market crosses the two-year mark, many are taking a step back to survey the landscape, and some are looking for any excuse to take profits.

With that as a backdrop, chip designer Arm Holdings (NASDAQ: ARM) slumped 6.7%, AI chipmaker Nvidia (NASDAQ: NVDA) tumbled 4.9%, chipmaker Advanced Micro Devices (NASDAQ: AMD) sank 4.8%, semiconductor device supplier Broadcom (NASDAQ: AVGO) fell 3.7%, and chip foundry Taiwan Semiconductor Manufacturing (NYSE: TSM) dipped 2.6%, as of 12:50 p.m. ET on Tuesday.

The catalyst that sent these AI stocks lower were reports the U.S. government is considering new curbs on chip exports.

Image source: Getty Images.

A curb on exports?

The Biden administration is considering limiting sales of advanced AI processors from Nvidia, AMD, and other companies, according to a report that first appeared in Bloomberg, citing “people familiar with the matter.” This would mark the most recent step by regulators to address concerns that advanced technology like AI could be used against the U.S. and its interests.

The government is discussing a cap on the number of export licenses for certain countries, citing national security as the reason for the potential move. It’s worth noting that the U.S. already has strict limits on the level of AI chip technology it allows to be sold to some countries, including China and 40 other countries in Asia, the Middle East, and Africa.

Currently, U.S. chipmakers are required to obtain government licenses to sell advanced semiconductors to customers in certain countries. The current deliberations would extend the existing curbs, which might be set on a country-by-country basis, with an emphasis on countries within the Persian Gulf region.

The considerations are still in the early stages, and no final decision has been reached, but the plans have been “gaining traction in recent weeks,” according to the report.

The potential implications

Limiting the sales of advanced AI chips to certain countries has potential implications for all of these AI-centric stocks:

- Nvidia is the leading provider of the graphics processing units (GPUs) used to facilitate AI systems. The company controls as much as 98% of the data center GPU market, according to semiconductor analyst firm TechInsights. As such, it has the most to lose.

- AMD has long battled with Nvidia for GPU supremacy and has recently decided to prioritize AI processors, with its legacy gaming chips taking a back seat. Curbs on advanced processors could dent those ambitions.

- Arm Holdings provides the intellectual property and chip designs used for some of the world’s most advanced chips, including those used by Nvidia and AMD. If sales of these processors are severely curbed, Arm Holdings’ revenue could take a hit.

- Broadcom provides a number of products that work side by side with GPUs in the data center, including Ethernet switching and application-specific integrated circuits (ASICs), to accelerate the movement of data. If sales of GPUs falter, sales of complementary products like Broadcom’s could suffer as well.

- Taiwan Semiconductor Manufacturing, also called TSMC, is the world’s leading foundry, responsible for 62% of the world’s semiconductors and an estimated 90% of the advanced processors used for AI. Any curbs on the sale of processors would trickle down to TSMC, crimping its revenue.

While investors fear a hit to Nvidia’s (and others’) sales, history suggests they may be overreacting. There were similar concerns on multiple other occasions when the U.S. government considered or announced curbs on chips to countries like China. Despite those fears, Nvidia went on to generate triple-digit growth for five consecutive quarters. Furthermore, recent reports suggest the company’s Blackwell chips are sold out for the next 12 months. This suggests that, potential curbs aside, demand for AI chips remains robust.

Then, there are valuations to consider. Arm Holdings, AMD, Nvidia, Broadcom, and TSMC are selling for 96 times, 46 times, 46 times, 36 times, and 28 times forward earnings, respectively. For those looking for a good value, TSMC is likely the only one worth buying, but this doesn’t account for the accelerating growth trajectory resulting from AI. Using the more appropriate forward price/earnings-to-growth (PEG) ratio — which factors in that growth — reveals that each of the remaining stocks boasts a multiple of less than 1, the standard for undervalued stocks.

It’s still early days for the adoption of generative AI, and while some experts peg the market value at $1.3 trillion, others believe the total could be much higher. For investors looking to profit from AI, the best strategy is to buy the best AI stocks you can find and hold tight for the long term.

https://finance.yahoo.com/news/netflix-beats-earnings-targets-5-200253212.html

Netflix beats earnings targets with 5 million new customers

Lisa Richwine and Dawn Chmielewski

Thu, Oct 17, 2024,

By Lisa Richwine and Dawn Chmielewski

LOS ANGELES (Reuters) – Streaming video pioneer Netflix picked up 5.1 million subscribers in the third quarter, topping Wall Street estimates by more than 1 million users, the company said in its earnings report on Thursday.

Investors had expected Netflix to bring in 4 million subscribers from July through September, according to analysts’ estimates compiled by LSEG. New programming during the period included murder mystery “The Perfect Couple” and romantic comedy “Nobody Wants This.”

Diluted earnings per share landed at $5.40, above the consensus forecast of $5.12. Revenue hit $9.825 billion, just ahead of the $9.769 billion consensus forecast.

Netflix has been trying to shift investor attention away from subscriber sign-ups to other metrics, including revenue growth and profit margins. The company said its operating margin hit 30% in the quarter, compared with 22% a year earlier.

“We’ve delivered on our plan to reaccelerate our business, and we’re excited to finish the year strong with a great Q4 slate,” the company said in a letter to shareholders.

Netflix is working to increase revenue from its new ad-supported plans but has said it does not expect advertising to become a primary growth driver until 2026. In the third quarter, researcher Antenna reported that Netflix added more than 1.9 million subscribers to its ad-supported service.

Part of the plan centers around live events including sports, a big draw for advertisers. In November, Netflix will stream a fight between YouTube star Jake Paul and Mike Tyson, followed by its first NFL games in December.

“Advertisers want to be part of big cultural moments. Compelling live programming will always amass and unite people for a snapshot in time,” said Forrester’s research director, Mike Proulx. “For brands, that’s a captive audience who’s ripe for advertising messages.”

(Reporting by Lisa Richwine and Dawn Chmielewski in Los Angeles; Editing by Matthew Lewis)

View comments

Nvidia and Apple supplier TSMC shares pop after quarterly profit soars on AI demand

Published Thu, Oct 17 20242:08 AM EDTUpdated Fri, Oct 18 20243:16 AM EDT

Key Points

- TSMC’s net income was 325.3 billion New Taiwan dollars ($10.1 billion) over the July-September quarter, surpassing an LSEG estimate of NT$300.2 billion.

- Net revenue came in at $23.5 billion in the third quarter, up 36% year on year.

- TSMC is the world’s largest producer of advanced chips, serving clients such as Apple and Nvidia.

Shares of Taiwan Semiconductor Manufacturing Co., the world’s largest producer of advanced chips, serving clients such as Apple and Nvidia, jumped nearly 10% during trading on Thursday after the company reported a 54% hike in net profit in the third quarter.

The company expects annual revenue growth in the last three months of the year, as global chipmakers continue to benefit from demand boosted by artificial intelligence applications.

Shares of chip companies rose on the results. Shares of Nvidia, Micron and AMD were all up almost 1% at market close on Thursday.

The company’s net income was 325.3 billion New Taiwan dollars ($10.1 billion) over the July-September quarter, surpassing an LSEG estimate of NT$300.2 billion cited by Reuters.

Net revenue came in at $23.5 billion in the third quarter, up 36% year on year, with TSMC’s gross margin rising to 57.8% over July-September, compared with 54.3% in the same period of last year.

“Based on the current business outlook, we expect for our fourth-quarter revenue to be between $26.1 billion and $26.9 billion, which represents a 13% sequential increase or a 35% year-over-year increase at the midpoint,” TSMC Chief Financial Officer Wendell Huang said during an earnings call following the results release, according to a call transcript produced by FactSet.

In the third quarter, “our business was supported by strong smartphone and AI-related demand for our industry leading 3nm and 5nm technologies,” TSMC said in a statement, referencing its semiconductor nodes.

U.S. politics unlikely to strongly affect TSMC business in the next 3-5 years

In the Thursday earnings call, TSMC Chairman and CEO C.C. Wei stressed that AI demand is “real” and that the company has experienced the “deepest and widest growth of anyone in this industry,” as a result.

“We have talked to our customers all the time, including our hyperscaler customers who are building their own chips. And almost every AI innovator is working with TSMC,” he said.

The company’s Taipei-listed shares have soared nearly 80% year to date, outpacing the 28.57% gains of the broader market over the same period.

TSMC now anticipates its capital expenditure for this year will pick up to slightly higher than $30 billion, it said during its earnings call. The firm’s capex costs edged higher to $6.4 billion in the third quarter, versus $6.36 billion across the three preceding months.

The Taiwanese chipmaker, whose advanced chips are vital to a swathe of products ranging from smartphones to AI applications, has been increasing its manufacturing presence worldwide, carrying out a vast overseas investment of $65 billion for three chip plants in Arizona to meet U.S. demand, as well as opening its first factory in Japan earlier this year.

TSMC’s earnings beat comes the same week as Netherlands-based ASML, which supplies machines to the Taiwanese company, issued a lower-than-expected forecast for net sales, sending shares tumbling.

Some market participants have questioned the long-term resilience of the artificial intelligence boom and the return on increasing investments in the technology sector — while Young Liu, CEO and chairman of key Apple supplier Foxconn, told CNBC last week that the AI frenzy “still has some time to go,” as advanced language models evolve with each new iteration.

Correction: This article has been updated to accurately reflect that TSMC’s third-quarter net income hit 325.3 billion New Taiwan dollars.

Biden forgives more student loans: 60,000 borrowers will get notices canceling $4.5 billion in debt

Published Thu, Oct 17 2024 5:00 AM EDTUpdated Thu, Oct 17 202411:08 AM EDT

Key Points

- The Biden administration announced on Thursday that it has forgiven another $4.5 billion in student debt for over 60,000 borrowers.

- The latest round of relief is a result of the U.S. Department of Education’s fixes to the popular, but once troubled, Public Service Loan Forgiveness program.

- Borrowers eligible for this round of relief should learn of their cancelled debt in the coming weeks.

The Biden administration announced Thursday that it was forgiving another $4.5 billion in student debt for more than 60,000 borrowers.

The latest round of relief is a result of the U.S. Department of Education’s fixes to the popular, but once troubled, Public Service Loan Forgiveness program.

President Joe Biden, who has forgiven more education debt than any other president in U.S history, said that the number of borrowers to benefit from the program under his administration now exceeded 1 million.

“Public service workers – teachers, nurses, firefighters, and more – are the bedrocks of our communities and our country,” Biden said in a statement. “But for too long, the government failed to live up to its commitments.”

The PSLF program, signed into law by President George W. Bush in 2007, allows certain not-for-profit and government employees to have their federal student loans canceled after 10 years. In 2013, the Consumer Financial Protection Bureau estimated that one-quarter of American workers may be eligible.

However, the program was plagued by problems. Often, borrowers believed they were on track to loan cancellation only to discover at some point that they didn’t qualify on a technicality, such as their loan type or repayment plan.

Before Biden took office, only 7,000 people had ever received the debt relief under PSLF, the Department of Education said. The program’s rejection rate was as high as 98% in some years, it added.

Under Biden, the Education Department has relaxed the program’s requirements and overhauled how it’s managed.

Borrowers eligible for this round of relief should learn of their canceled debt in the coming weeks. The average student loan balance forgiven under PSLF is around $70,000, according to a rough estimate by higher education expert Mark Kantowitz.

Thursday’s announcement comes in the final weeks of an extremely close race between Vice President Kamala Harris and former President Donald Trump.

Harris, in addition to working in the Biden administration on its student loan relief efforts, has also promised to strengthen the PSLF program if she wins in November, with a focus on helping more Black men become public school teachers.

By contrast, Trump has called for the elimination of the Public Service Loan Forgiveness initiative and expressed opposition to the Biden administration’s other efforts to cancel education debt.

European Central Bank cuts rates, Lagarde flags downside risks to inflation outlook

This was CNBC’s live blog covering the European Central Bank’s October meeting.

The European Central Bank on Thursday cut its key interest rate to 3.25%, in its third quarter-percentage-point reduction of the year.

The move at the October meeting had been fully priced by markets after policymakers flagged reduced inflation risks and a weakening growth outlook.

In a statement following the decision, the ECB’s Governing Council called the process of disinflation “well on track” in its most optimistic statement in the current cycle.

“The inflation outlook is also affected by recent downside surprises in indicators of economic activity,” it said.

Headline price rises in the euro area eased to 1.8% in September, coming in below the central bank’s 2% target for the first time in three years.

The ECB once again forecast that inflation would “rise in the coming months, before declining to target in the course of next year.”

It is the first time the ECB has reduced rates at consecutive meetings since December 2011.

The ECB only debated a 25 basis point rate cut, rather than a larger 50 basis point cut, as opted for by the U.S. Federal Reserve in September, ECB President Christine Lagarde said during a Thursday press conference.

“It is a fact that the economic activity has come in — on the basis of the … indicators that are available — a bit lower than we anticipated,” Lagarde said, when asked by CNBC’s Annette Weisbach why it did not cut by a half-percentage point.

Expectations for a faster pace of monetary easing had built since the ECB’s Sept. 12 meeting, when market pricing suggested just one more rate cut this year, rather than the two priced in as of Thursday morning.

Along with the latest inflation print on Oct. 1, that shift in sentiment came amid dovish comments from various ECB members. ECB’s Lagarde also swayed markets when she said the latest data readings “strengthen our confidence that inflation will return to target in a timely manner.”

Another key factor has been the euro zone growth outlook. The ECB trimmed its euro zone growth forecast for 2024 last month on the back of weaker domestic demand, now projecting an 0.8% GDP rise, compared with 0.9% previously. Some of its biggest economies continue to face major challenges, including manufacturing weakness in Germany and a huge fiscal consolidation project looming in France; while sentiment indicators remain weak.

HI Financial Services Mid-Week 06-24-2014