HI Market View Commentary 06-03-2024

A couple of you asked when you would be fully invested – because the sale of META shares

What would be a great purchase right now? Undervalued stocks, S&P 500 DIS, BA, UAA, BIDU, SQ, F,

IS it worthwhile to be in a position and plan on waiting for 2 years or more for it to move?

Do you want “US” to just put money into something so you are fulled invested?

Please give us some patience so that we can find a great opportunity instead of just making the account fully vested

|

Thu, May 23, 10:27 AM (11 days ago) | |||

|

|

||||

Enjoy your three day weekend and remember those who have given so much for our freedoms!!!

I wanted to go over the thoughts on our markets now and the plan for moving forward. Right now we are in what has been called the “summer doldrums.” The market usually trades in a range between now and September. Summer is just boring, LOL. October then comes which is usually one of the worst months in the year to then finish with a rebound November and December. Don’t forget this is an election year with volatility pre-election and then some fallout after the results. We have had a pretty good run in the market this year with the S&P 500 up roughly 10%. Our big winners have been AAPL, META, MU, GM, BAC, GOOGL, MRO. Everyone has at least one of these stocks in their portfolio. IF you don’t recognize these ticker symbols do a quick google search or open up your portfolio to see the names of these companies. It has been nice to see winners in Technology (AI – Artificial Intelligence), Banks, Autos, and Energy (gas). Normally we don’t see this many sectors winning at the same time. Welcome to another election year and the chaos that follows.

The concern about the market right now is the fear of a “hard landing”. What is a hard landing? Slowing GDP growth, continued loss of jobs, higher inflation which in turn leads to more rate hikes. Jerome Powell let us know he hasn’t seen inflation come down like he’s expected and is “data dependent” on when he will give us the rate cut. The honest truth is that the economy doesn’t warrant any rate cuts this year and we’ve let our clients know this since November of last year. I am telling you this because all the market gains are based on the expectation of these rate cuts that probably won’t materialize this year. We are expected and ready to add protection when the market gives these gains up sometime this year. Yesterday Jamie Dimon with JP Morgan let us know he is fearful for this hard landing coming to pass soon.

Our second concern is that the market, stocks, bond funds, commodities are all fully valued. This means that the yearly growth is already built into the end of year pricing of the stock. We are only in May! This means we will have a “pullback” or drop in the values of the stocks to then get back to these prices at the end of the year. The market doesn’t just go straight up even though it has for the last 6 to 7 months. The market moved too fast, too soon and needs to be corrected. This is the second reason we are fearful of a big drop in the market sometime this year.

Lastly, the election could rock our world here in the U.S.A. Either side could riot, shut down the logistical important infrastructure of the country, cause transportation delays of goods and services, etc… Things could get really ugly no matter who wins. I feel like we are in a no win situation this election year. I would suggest whatever you felt like you didn’t have enough of through covid go buy it now and stock up. Be ready for stores to not have items you may want and for people to need time to calm down if their guy didn’t win the election.

We are planning on protecting portfolios through summer and the election. Our main goal is to hold the current values of portfolios where they are right now through the volatile future. We would obviously love to be wrong about our worries and continue to follow the market higher but we will definitely be ready for a downturn. Weekly we hold the Monday night Market View Commentary to discuss our portfolio management and for you to answer questions. If you miss the live sessions, recordings are on the www.myhurleyinvestment.com website. If you don’t think you are registered for the commentary send me an email and I will make sure you are receiving the invites.

Please enjoy the three day weekend and we look forward to another great year,

Let’s talk Oil and MRO

OIL got hit big <10% roughly in the last week (4 days)

Too much supply from he US depleting our reserves

MRO is being purchased by COP

Closing price of MRO $26.50 and the expectation was that 0.2550 shares meant a 14.7% upside

26.50 x 1.1147 = $ 30.3955 basically $30.40

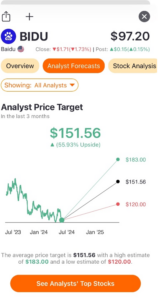

BIDU

Trump/ NY court case? The US looks like a dishonest, kangaroo courts right now. It’s just the Trump case it’s the current administration lack of backing of the US Supreme Court

Has anyone looked at the past two weeks of the Sale of US Treasuries? Under fulfillment

We will have to raise rates to fund our own debt which means prices are still going to go higher

Earnings Season:

MU 06/26

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 31-May-24 15:31 ET | Archive

A real important economic matter

There is a lot of hope — some might say faith — in the idea that the U.S. economy will achieve a soft landing. That’s a landing that would include a moderation in growth and inflation without a big jump in unemployment. Importantly, it does not include a recession.

So far, almost so good.

GDP growth moderated to 1.3% in the first quarter (from 3.4% in the fourth quarter), core-PCE inflation moderated to 2.8% in April, and the unemployment rate of 3.9% remains near a 50-year low.

It all seems to be lining up well, but the market cannot escape the nagging feeling that this just might be the calm before an economic storm brought on by the Fed maintaining a restrictive policy stance for too long.

That nagging feeling has a lot to do with the Fed’s acknowledgment that it waited too long to raise rates to fight inflation; hence, market participants worry that the Fed will refrain from cutting rates (when it should) out of concern that it might re-ignite inflation.

That worry is borne out of Fed officials constantly reiterating that they want to be confident inflation is moving sustainably to the 2% target. Well, confidence can’t be assured given that core-PCE inflation remained stuck at 2.8% for third straight month in April.

That’s not moving sustainably to the 2% target. That’s not moving at all, yet there was something else in the Personal Income and Spending Report for April that might give the Fed some hope inflation will be lower in coming months while at the same time creating some angst for the market that the Fed is going to overstay its inflation-fighting welcome by keeping rates higher for longer.

That something was the decline in real disposable personal income and real personal spending.

Chiming In

We’re not ringing any alarm bells here. We’re just chiming in with an observation that declines in real disposable personal income portend consumer spending pressure if they persist.

Disposable personal income is what one has left after paying taxes. The “real” part is the adjustment for inflation. For example, if disposable personal income is up 0.2% month-over-month (like it was in April), but PCE inflation is up 0.3% (like it was in April), real disposable personal income is -0.1% (like it was in April).

Basically, one’s income after taxes is not keeping up with inflation. That’s typically when one has to make a choice to spend out of savings to make up the difference or to cut back on spending.

For an economy driven by consumer spending (68% of GDP), this trade-off can make a big difference between a soft landing and a hard landing. Employment, however, will be the biggest difference.

If consumers are employed and making money, they are consumers who will be spending money. How they choose to spend money will be dictated by needs and wants, and the means to satisfy both.

When real disposable personal income is positive, a consumer has more discretionary spending potential. When it is flat, negative, or just marginally positive, a consumer will spend more on what they need and less — if at all — on what they want.

That slowdown in discretionary spending has a weighing effect on the economy, and if it gets too heavy unemployment levels will rise, as companies adjust to the weaker demand, and weigh further on the economy. Fortunately, the U.S. economy is not in that debilitating cycle — even after 11 rate hikes by the Federal Reserve since March 2022.

A Low Growth Track

In last week’s column, we discussed how the long and variable lags of monetary policy still appear to be missing in economic action, but that doesn’t mean they don’t exist.

The pressure of rising rates (and limited inventory) is evident in the housing market, the percentage of credit card payments 90+ days delinquent is the highest it has been in 12 years, multiple retailers have observed that low-income and middle-income consumers are being more discerning with their spending activity, and Bank of America CEO Brian Moynihan recently said at a financial conference, according to CNBC, that his bank is seeing slower growth in the rate of purchases whether it’s households or small- to medium-sized businesses.

The slowdown, he added, is consistent with the “very low growth environment” that prevailed from 2016 through 2018.

Ah, but he didn’t say the slower growth is consistent with a recession. It is just low growth, which can still be construed as a soft landing outcome. To be fair, there are other retailers and other businesses that continue to speak of solid demand and continue to forecast solid demand.

The good news is that real disposable personal income has increased 20% since the start of 2016. The tempered news is that real disposable personal income growth was up just 1.0% year-over-year in April, which is below the pace it was running at the start of 2016 and well below the 3.2% average pace seen in the five-year period from 2014 to 2019.

What It All Means

The slowdown in real disposable personal income growth matters for the economy because it matters for spending. When taxes and inflation are eating into personal income, the majority of consumers will rein in their spending activity in the absence of a savings safety net.

Fortunately, there is over $6.0 trillion sitting in money market mutual fund assets, and there is a silent reserve in home equity for homeowners and the paper wealth in investment accounts for investors. Of course, not everyone is a homeowner and/or an investor in the market.

Those who aren’t count even more on their real disposable personal income. If that comes under increased pressure, it can be a real problem for the soft landing outlook as discretionary spending and jobs start falling by the wayside.

That hasn’t happened yet to any alarming degree, but it’s worth chiming in on the importance of what could happen if it does.

—Patrick J. O’Hare, Briefing.com

Earnings dates:

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end June 2024?

06-03-2024 0.00%

Earnings:

Mon:

Tues: CRWD, HPE, SPWH

Wed: FIVE, LULU, DLTR

Thur: BIG, DOCU, MN

Fri:

Econ Reports:

Mon:

Tue

Wed: MBA, ADP Employment, ISM Services

Thur: Initial Claims, Continuing Claims, Productivity, Unit Labor Costs, Trade Balance

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Wholesale Inventory, Consumer Credit

How am I looking to trade?

Mostly letting stocks run = very little protection in place – BIDU $110

Took profitds on UUA, DIS puts,

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Biden to release 1 million barrels of gasoline to reduce prices at the pump ahead of July 4

PUBLISHED TUE, MAY 21 20241:16 PM EDTUPDATED TUE, MAY 21 20249:42 PM EDT

KEY POINTS

- The Department of Energy said the release is timed to maximize the impact on prices at the pump this summer.

- The gasoline will be sold through a competitive bidding process to retailers and terminals, according to the DOE.

- Gasoline futures have rallied 19% this year as crude oil prices have risen due to OPEC cutting production and fear of wider war in the Middle East.

US President Joe Biden delivers remarks on efforts to lower high gas prices in the South Court Auditorium at Eisenhower Executive Office Building June 22, 2022 in Washington, DC.

Jim Watson | AFP | Getty Images

The Biden administration will release 1 million barrels of gasoline from reserves held in the Northeast to reduce prices at the pump ahead of the Fourth of July holiday and summer driving season.

“By strategically releasing this reserve in between Memorial Day and July 4th, we are ensuring sufficient supply flows to the tri-state [region] and northeast at a time hardworking Americans need it the most,” Energy Secretary Jennifer Granholm said in a statement Tuesday.

Gasoline futures have rallied 19% this year as oil prices have risen due to OPEC cutting production and fears the Israel-Hamas war could spark a broader Middle East conflict that disrupts supplies. Rising energy prices stirred speculation in April that the Biden administration might tap the Strategic Petroleum Reserve in Texas and Louisiana ahead of the November presidential election.

White House National Economic Advisor Lael Brainard said last month that the administration would “make sure gas prices remain affordable.”

But gas prices have eased in recent weeks as oil has pulled back from April highs hit when traders bid up crude futures on fears that Israel and OPEC member Iran were on the brink of war.

Prices at the pump averaged $3.59 per gallon nationwide on Tuesday, about 4 cents higher than the year-ago average but lower than last month, according to the motorist association AAA. Though gasoline prices have come down over the past month, broader inflation has remained stubborn, irking consumers.

Retailers and terminals will receive the gasoline no later than June 30, according to the Department of Energy. The supply will be released in quantities of 100,000 barrels to ensure a competitive bidding process that maximizes the impact on prices at the pump, according to the DOE.

The barrels will be sold from storage sites in New Jersey and Maine that are part of the Northeast Gasoline Supply Reserve, which was established after Superstorm Sandy knocked out refineries in 2012.

The gasoline sale comes as the separate Strategic Petroleum Reserve has fallen to the lowest level in decades. The Biden administration released 180 million barrels from the SPR in 2022 as energy prices spiked in the wake of Russia’s invasion of Ukraine.

https://finance.yahoo.com/news/conocophillips-cop-buy-marathon-oil-112000847.html

ConocoPhillips (COP) to Buy Marathon Oil in a $22.5B Transaction

ConocoPhillips (COP), the U.S. oil giant, has announced a definitive agreement to acquire Marathon Oil Corporation MRO in an all-stock transaction valued at $22.5 billion, including $5.4 billion of net debt. This strategic move is set to be immediately accretive to ConocoPhillips’ earnings, cash flows and return of capital per share.

Key Details of the Acquisition

Per the terms of the deal, Marathon Oil shareholders will receive 0.2550 shares of ConocoPhillips common stock for each share of Marathon Oil common stock. This represents a 14.7% premium to Marathon Oil’s closing share price on May 28, 2024.

ConocoPhillips chairman and CEO Ryan Lance emphasized the strategic alignment of the acquisition. He highlighted that the addition of Marathon Oil would enrich the company’s portfolio. The buyout would also be in sync with COP’s financial strategy, bolstering its low-cost supply inventory alongside its prominent U.S. unconventional assets. Lance emphasized shared values of safety and responsibility, aimed at generating consistent shareholders’ value.

Marathon Oil chairman, president, and CEO Lee Tillman echoed these sentiments, expressing confidence in ConocoPhillips as the ideal platform to advance their legacy. He emphasized the unique benefits of combining both companies, enhancing scale, resilience, and long-term viability. Tillman anticipates significant shareholder value creation through the integration of assets and expertise within ConocoPhillips’ global portfolio.

Synergy and Financial Impact

The acquisition is anticipated to deliver substantial cost and capital synergies. ConocoPhillips expects to achieve at least $500 million in run-rate cost and capital savings within the first year post-transaction. These savings should primarily come from reduced general and administrative costs, lower operating costs and improved capital efficiencies.

The acquisition is also expected to enhance ConocoPhillips’ premier Lower 48 portfolio by adding more than 2 billion barrels of resources with an estimated average point forward cost of supply of less than $30 per barrel WTI.

Enhancing Shareholder Value

Apart from the acquisition, ConocoPhillips plans to increase its ordinary base dividend by 34% to 78 cents per share, beginning fourth-quarter 2024. Post-transaction, ConocoPhillips expects to conduct share buybacks exceeding $20 billion over the first three years, with more than $7 billion in the first year alone, based on recent commodity prices.

Lance affirmed the company’s dedication to its unique cash distribution strategy, aiming to return more than 30% of cash from operations to shareholders. Since 2016, the company has been consistently exceeding 40% returns. Its plans to include a 34% increase in ordinary dividends in the fourth quarter and achieve top-quartile dividend growth compared to the S&P 500. Furthermore, COP prioritizes share buybacks post-transaction, intending to retire newly issued equity within two to three years at existing commodity prices.

Conclusion

The acquisition of Marathon Oil by ConocoPhillips marks a milestone in the energy sector, reflecting a strategic consolidation aimed at enhancing operational efficiency, cost savings and shareholder returns. The transaction is set to deliver a strengthened position in the U.S. onshore market, positioning ConocoPhillips for long-term value creation and resilience.

Zacks Rank & Key Picks

Currently, ConocoPhillips carries a Zack Rank #3 (Hold).

A couple of better-ranked players in the energy sector are Marathon Petroleum Corporation MPC and SM Energy Company SM. While Marathon Petroleum currently sports a Zacks Rank #1 (Strong Buy), SM Energy carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Boeing Enters ‘New Territory’ With Federal Probe, Possible Criminal Charges

Aviation experts and lawyers say Boeing could see massive fines or another settlement agreement, and individuals such as CEO Dave Calhoun could face charges.

|

May 31, 2024

Updated:

May 31, 2024

When a door panel ripped off an Alaskan Airlines flight after takeoff on Jan. 5, Boeing’s fortunes changed overnight.

Had the company gone just two more days without an incident, it would have satisfied a settlement to avoid criminal prosecution by the Department of Justice (DOJ).

Instead, the accident triggered investigations by federal agencies and congressional hearings. The incident also renewed public scrutiny of Boeing and the 737 MAX 8 crashes in 2018 and 2019 that killed everyone on board and led to criminal charges for the company.

Boeing has since seen a significant financial fallout, reporting a $355 million loss and a near-50 percent drop in deliveries in the first quarter alone. The company also faces plummeting stock values and canceled orders from multiple airlines since the Jan. 5 incident.

The DOJ ended months of speculation on May 14 with a court filing alleging that Boeing violated its 2021 deferred prosecution agreement. The company failed to “design, implement, and enforce a compliance and ethics program to prevent and detect violations of the U.S. fraud laws.”

The DOJ will meet with the crash victims’ families on May 31 before announcing its intentions with Boeing’s case by July 7.

According to career pilots, aviation safety experts, and attorneys who spoke with The Epoch Times, how Boeing violated the agreement and the possible consequences are complicated.

What Triggered the DOJ Investigation?

To stay competitive, Boeing needed to design a new plane that could fly to destinations such as Hawaii with less fuel. The company’s competitor, Airbus, was edging out the market with new, more fuel-efficient jets.

Instead of designing a brand new plane, which would have required extensive pilot training from the airlines that buy them, raising the jet’s price, Boeing opted to release an upgraded version of its 737 jet, the 737 MAX. It has larger, more powerful engines that are installed farther forward on the plane’s wings, which causes the nose to push up higher during takeoff.

Boeing compensated with a new flight control software called Maneuvering Characteristics Augmentation System (MCAS), which automatically lowers the nose to avoid midair stalling. Federal regulators said Boeing didn’t tell the airlines or the Federal Aviation Administration (FAA) the extent of the software, how it controls the plane in the background, and how to disable it.

Planes also use angle of attack vanes, or indicators, to tell the computer whether the jet is ascending or descending at the right pitch angle. Before the 737 MAX, these indicators were wired to two sensors in case one malfunctioned during flight—because of damage from a bird strike, for instance. On the original 737 MAXs, the angle of attack indicators were wired to a single sensor, causing the flight control software to assume that the plane was in critical danger if either indicator malfunctioned.

American Airlines pilot captain Pete Gamble (L) and first officer John Konstanzer conduct a pre-flight check in the cockpit of a Boeing 737 Max jet in Grapevine, Texas, on Dec. 2, 2020. (LM Otero/AP Photo)

During the 2018 and 2019 fatal flights, the MCAS system kept pitching the nose downward with faulty angle-of-attack data, likely from a damaged angle of attack vane. Because Boeing didn’t properly disclose the software nuances and how to disable it to the airlines, the pilots took more than 10 seconds to respond. Federal guidelines expect pilots to respond to such as situation in four seconds to avoid a catastrophe.

Boeing also didn’t overhaul the flight control software until after the 2019 Ethiopian Airlines crash, which was five months after the 2018 Lion Air crash. The FAA responded by grounding all 737 MAX jets for nearly two years to ensure compliance with regulations.

“The MCAS accidents were pure, 100 percent money accidents,” said Shawn Pruchnicki, aviation safety expert and assistant professor at Ohio State University’s Center for Aviation Studies.

“They killed 346 people over money and nothing else.”

Disclosing the flight control software would have forced airlines to order new training for their pilots before using the 737 MAX, thus raising the sales price.

The DOJ, the FAA, and the House Transportation Committee initiated separate investigations into the crashes. All implicated the MAX’s flight control software and Boeing’s decision to withhold this information from regulators, airlines, and pilots, which meant that pilots didn’t respond in time in both fatal 737 MAX 8 crashes.

Boeing didn’t respond to a request for comment.

How Was Boeing Charged?

The DOJ charged Boeing on Jan. 7, 2021, with conspiracy to defraud the United States, particularly the FAA’s Aircraft Evaluation Group.

The U.S. government stated that Boeing deliberately withheld details of its flight control software from the FAA and airlines. Boeing maintained that two of its 737 MAX Flight technical pilots were responsible for deceiving federal regulators about the MCAS flight control software.

The government then brokered a deferred prosecution agreement with Boeing, a form of criminal settlement in which charges can be dismissed if the defendant fulfills certain obligations within a stated timeframe.

Boeing had to accept responsibility for the acts that led to criminal charges and pay a total of $2.5 billion, which included a $243.6 million penalty and a $500 million fund to compensate the families of the 2018 and 2019 737 MAX crash victims.

However, Boeing also had to stay in compliance for three years from the day the agreement was signed, Jan. 7, 2021.

During this period, the company had to avoid committing any federal felonies, could not deny responsibility for the charges, and was required to implement a “compliance and ethics program designed, implemented, and enforced to prevent and detect violations of the U.S. fraud laws throughout its operations.”

Boeing was two days from the end of its probationary period when the Alaskan Airlines panel blew out.

Alleged Violation

The DOJ’s May 14 letter states that Boeing failed to “design, implement, and enforce” the compliance and ethics program required under the terms of the settlement. However, the agency did not explicitly say whether the Alaskan Airlines incident or any others from 2024 were linked to Boeing’s lack of a compliance and ethics program.

Robert Clifford, lead attorney for the families of the 2018 and 2019 crash victims, told The Epoch Times that the DOJ hasn’t informed him or the families of the acts or incidents that led to Boeing’s breach of the agreement.

“We hope to learn details of the investigation and government plans going forward,” he said.

“Obviously, the events of 2024, such as Alaska Air, have caused greater focus on Boeing’s compliance and the scrutiny of the government, but we await word on the exact details that led to the finding of [the] breach.”

The DOJ also wrote in the letter that it reserves the right to find Boeing in violation of other terms of the agreement until July 7, when it will announce how the agency intends to proceed with the case.

Possible Criminal Charges

The DOJ could pursue multiple pathways if it criminally prosecutes Boeing.

Neama Rahmani is a former federal prosecutor who once worked for the aerospace company. He told The Epoch Times that the DOJ could issue a “massive fine,” require an independent monitor to “ensure that Boeing is complying with its obligations under the agreement,” or prosecute individuals in the company, such as CEO Dave Calhoun.

Mr. Rahmani explained that going after individuals at the company requires a higher bar of proof. He said prosecutors could use a text message between high-level executives admitting to fraud, for example.

Mr. Clifford said there are “statute of limitations issues that may prevent” prosecutions of individuals.

There are other avenues that the agency could take. Mr. Clifford said fines, criminal charges against Boeing, an appointment of an independent monitor, a new deferred prosecution agreement, and “more negotiations … are likely all on the table.”

Richard Levy, a 40-year commercial pilot and aviation consultant, told The Epoch Times that Boeing will likely argue that it has instituted changes to address any concerns from the government or agencies such as the FAA. He said he expects another probationary settlement agreement.

He said that although he doesn’t anticipate that individuals at Boeing will face criminal charges, that could change if anyone at the company was “intentionally fraudulent” during the three years of Boeing’s settlement agreement.

The DOJ did not respond to a request for comment.

What’s Next for Boeing?

Mr. Clifford said that he is “quite hesitant to speculate” about what the DOJ will ultimately do but expects it to “continue the prosecution of Boeing” and set a public trial date with the court.

Boeing has until June 13 to respond to its breach of the deferred prosecution agreement, the agency stated. The company has the chance to explain the “nature and circumstances of such breach” and any actions the company has taken to “address and remediate the situation.”

Paul Cassell, a law professor from the University of Utah and another attorney for the crash victims’ families, told The Epoch Times in late April that he’s not confident that the government will find Boeing in violation of the settlement. Nor does he expect any criminal prosecution to come from it, he said.

Mr. Rahmani said the government’s announcement should be “welcome news for the Boeing victims and lawyers.”

Some aviation experts emphasize that the case is “new territory” for the United States.

“We’ve never been in this situation ever before,” said Michael Boyd, president of the aviation consulting firm Boyd Group International.

He told The Epoch Times that the government could fine Boeing but that because it’s a “major aerospace and defense contractor” that employs tens of thousands in communities throughout the country, charging a few individuals could still be on the table.

“If they do go after individuals, even Calhoun, Boeing as a company will cut them loose on their own within a New York second,” Mr. Boyd predicted.

Millennials are ‘quiet vacationing’ rather than asking their boss for PTO: ‘There’s a giant workaround culture’

Published Tue, May 21 20249:50 AM EDTUpdated Tue, May 21 202410:30 AM EDT

Jennifer Liu@IN/JLJENNIFERLIU@JLJENNIFERLIU

Paid days off from work aren’t a guarantee for many Americans, but even when they do get them, they’re leaving them on the table.

A majority, 78%, of U.S. workers say they don’t take all their PTO days, and it’s highest among Gen Z workers and millennials, according to a new Harris Poll survey of 1,170 American workers.

Younger professionals say they don’t ask for time off because they feel pressure to meet deadlines and be productive, and they get nervous requesting PTO because they don’t want to look like a slacker, says Libby Rodney, chief strategy officer at The Harris Poll.

That’s not to say they’re not taking breaks — they’re just not telling their boss.

Millennials are most likely to be ‘quiet vacationing’

Millennials in particular have found workarounds to play hooky. Nearly 4 in 10 say they’ve taken time off without communicating it to their manager.

Similar shares say they “move their mouse” to show they’re still active on their company’s messaging platforms (like Slack or Microsoft Teams) when they’re not really working, and they’ve scheduled a message to send outside of regular hours to give the impression they’re working overtime.

“There’s a giant workaround culture at play,” Rodney says. While Gen Zers tend to be more vocal about workplaces that shame people for wanting to ask off work, millennials would rather take matters into their own hands but under the radar.

“They will figure out how to get appropriate work-life balance, but it’s happening behind the scenes,” Rodney adds. “It’s not exactly quiet quitting, but more like quiet vacationing.”

The pitfalls of unlimited PTO

When people feel the need to sneak out for breaks, it’s a sign that their workplace doesn’t have a supportive PTO system or culture in place, Rodney says.

Bosses can alleviate that tension in a number of ways, she adds: They can be more transparent about what requesting time off looks like, normalize taking PTO by taking time as a boss, support when their employees take off, and mandate a certain amount of time off.

Unlimited PTO isn’t necessarily the solution. Workers who receive 11 to 15 days of PTO each year are more likely to use up their days, Rodney says, but there’s a significant drop-off once people get 16 or more days.

Instead, employers can get creative in their PTO benefits, like offering company-wide week-long shutdowns around major holidays, paying new hires to take a vacation before they start, or requiring employees take a certain number of PTO days each quarter to pace their time off throughout the year.

More broadly, many Americans from the Harris Poll survey say the U.S. should adopt laws common in Europe that enforce boundaries on working hours vs. personal time, like extended vacation policies (think: a month off in August), longer lunch breaks, workweeks shorter than 40 hours, and regulations that protect slower response time outside of work hours.

Want to land your dream job? Take CNBC’s new online course How to Ace Your Job Interview to learn what hiring managers really look for, body language techniques, what to say and not to say, and the best way to talk about pay. Use discount code NEWGRAD to get 50% off from 5/1/24 to 6/30/24.