HI Market View Commentary 05-20-2024

Let’s start tonight talking about inflation and let me show you an article down below:

We are getting dupped into thinking that 3.4% yr/yr inflation MEANS inflation is coming down?!?!?!?!!!!!

This means NO rate cuts this year in fact a rate hike is now on the table

Are we in the clear for another big up year in the market = > 7.75%

We very well could be negative at the end of the year.

Let’s talk banks?= Good value or expensive? It is a stock pickers market !!!

For the market it is the same but now its not just the maga caps (Mag7)

Earnings Season:

DG 05/30

MU 06/26

TGT 05/22 BMO

WATCH JPM – Down $9o or 4.5% on a future event with no time table. Sept 195/2120 buull call would be my trade

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 17-May-24 15:39 ET | Archive

High valuations require more discerning view of the market

In early April we provided a preview of the first quarter earnings reporting period. We said then that it would be a breathing exercise, where the market would be holding its breath at the start of the reporting period but most likely exhaling in relief by the end of the reporting period.

That is exactly what happened.

The reporting period got off to a breathless start, which contributed to a 5% pullback in the S&P 500 in April, but it started breathing again when the mega-cap companies stepped up with results that contributed to the S&P 500 rebounding from its April swoon and running to a new record high this week.

At the time of our preview in early April, the blended growth rate for first quarter earnings for the S&P 500 was 2.9% (a blended growth rate accounts for actuals and estimates for the companies that have yet to report). What we know today is that the blended growth rate sits at 5.7%, according to FactSet — and that’s before NVIDIA’s (NVDA) report after the close on May 22.

Everybody exhale.

A High Five for the Market

The first quarter earnings reporting period was a good one. That is a debatable point given that five companies — NVIDIA, Alphabet (GOOG), Amazon.com (AMZN), Meta Platforms (META), and Microsoft (MSFT) — accounted for all of the earnings growth, according to FactSet.

The salient point for index investors is that earnings (and earnings expectations) drive the market. It all counts no matter how you break it down. Earnings growth is earnings growth, and it makes a big difference for a market-cap weighted index when the biggest companies are delivering the growth.

That’s not to say other companies didn’t report earnings growth. They did, but if you take the five companies above out of the equation, the bottom line is that the bottom line for the S&P 495 would look anemic, raising legitimate questions as to whether the market belonged at a record high.

But that’s not how it is done for an index. It all adds up to one final result that tells you if the numerator (“P”) is reasonable relative to the denominator (“E”).

Looking to the Outyears

So, what is a reasonable P/E? The answer is both absolute and relative.

We know from FactSet that the 10-year average forward 12-month P/E ratio for the S&P 500 is 17.8. Today, that P/E ratio is 20.8. On an absolute basis, the S&P 500 is expensive, trading at a 17% premium to its 10-year average.

On a relative basis, one can make the case that it is not as expensive as it seems. That case would be predicated largely on three views:

- Interest rates should be coming down as inflation pressures — and the Fed — ease, allowing for multiple expansion

- There will be a further upward revision to earnings estimates

- The P/E is less demanding when basing it off calendar year 2025 earnings estimates (19.1x vs 20.8x)

The stock market has seemingly embraced each of these thoughts, comforted by the fact that the forward 12-month earnings estimate has been revised higher over the course of the first quarter reporting period, Fed Chair Powell saying he thinks it is unlikely the next policy move will be a rate hike, the 10-yr note yield sliding 26 basis points in May, and a Consumer Price Index (CPI) for April that showed disinflation in total CPI and core CPI on a year-over-year basis.

The market knows, too, that over $6 trillion sits on the sidelines in money market funds but won’t sit there idly if rates come down and better return opportunities can be found elsewhere. It also knows that there is a groundswell of enthusiasm for the growth related to the advances of generative AI, which NVIDIA CEO Jensen Huang has said is going to be bigger than the internet, by far.

We draw this to your attention because considerations such as these can be the drivers of multiple expansion — or price appreciation that exceeds the pace of change in earnings estimates. It is why high valuations in a bull market can be rationalized as being less egregious when outyear estimates are used as the denominator.

What It All Means

Any of that sound familiar?

It should. We don’t even have to go back to the dot-com years for historical reference. How about 2021 when SPACs were all the rage?

We digress. The point here is that a market can stay overvalued longer than one thinks — or be seen as relatively attractive in the face of a high absolute valuation — if there isn’t any kind of shock to the system. The caveat is that a drawdown in an overvalued market will be swift and material if there is a shock to the system.

What might such a shock be?

- The U.S. falling into a recession and forward earnings estimates following suit

- China invading Taiwan

- A fiscal crisis that drives up market rates

- Inflation accelerating and prompting further policy tightening by the Fed

- A collective growth disappointment by the mega-cap companies

This isn’t an all-inclusive list of potential shocks, but it speaks to the idea that investors can’t be completely blind to risk — certainly not when a market sports a high valuation and reports are beginning to emerge that suggest the consumer, collectively, is becoming more discerning with spending behavior.

In the same vein, investors should be more discerning with regard to risk exposure if earnings estimates don’t keep pace and price momentum drives further multiple expansion.

—Patrick J. O’Hare, Briefing.com

Earnings dates:

Where will our markets end this week?

Lower

DJIA – Bullish

SPX – Bullish

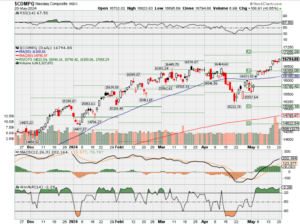

COMP – Bullish

Where Will the SPX end May 2024?

05-20-2024 0.00%

05-13-2024 -2.0%

05-06-2024 -2.0%

04-29-2024 -2.0%

Earnings:

Mon: ZM,

Tues: AZO, LOW, M, TOL, URBN

Wed: TJX, SNOW, TGT, NVDA

Thur: BJ, NTES, RL, INTU, ROST

Fri:

Econ Reports:

Mon:

Tue

Wed: MBA, Existing Home Sales,

Thur: Initial Claims, Continuing Claims, New Home Sales

Fri: Durable Goods, Durable ex-trans, Michigan Sentiment

How am I looking to trade?

Mostly letting stocks run = very little protection in place – UAA $9, DIS $114, BIDU $110

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Under Armour was a real threat to Nike. Now it’s fighting to stay relevant

By Parija Kavilanz, CNN | Posted – May 18, 2024 at 4:41 p.m.

NEW YORK — It was once hyped as a worthy rival to Nike. But at present, Under Armour, founded by a 23-year-old former college athlete, is struggling to “just do it.”

Instead, the brand that’s championed on the basketball court by Stephen Curry and on the golf course by Jordan Spieth, is now struggling — badly — to find its footing in an increasingly competitive and crowded sportwear marketplace for regular folks, where younger shoppers are more googly-eyed over newer entrants like Hoka and On running shoes.

Under Armour’s annual sales have been sluggish at best for the past several years, while its stock has plunged 88% from its all-time high in 2015. Industry experts said the company is mired in an unpleasant mix of problems, which include an identity crisis, several management controversies, ignoring evolving market trends to its detriment, and a rotating carousel of CEOs in quick succession.

One of them is Kevin Plank, its founder, who is back at the helm for a second time as CEO after being replaced in 2019. Similar to Starbucks founder Howard Schultz’s past returns to Starbucks and Disney chief Bob Iger’s recent return as CEO, Plank aims to right the ship at Under Armour.

“When Under Armour was growing at 20% plus numbers, people saw it as a legitimate competitor to Nike,” said David Swartz, senior equity analyst with research firm Morningstar, in an interview with CNN.

“It was like On or Hoka but 10 years ago. It was the upstart athletic brand that was making real inroads against Nike, the dominant name in the industry. People saw it as a company that actually could break through and take market share from Nike among the hardcore athletes,” Swartz said. “That actually did happen for a while, but then that didn’t last.”

Plank launched Under Armour in 1996 to be what the name suggests — a protective layer of clothing worn by competitive athletes sweating it out in the heat of the game.

The first product was a fitted T-shirt called “The Shorty,” made from moisture-wicking fabric for elite athletes to wear under their uniforms to keep them dry. Its iconic Under Armour intertwined “U” and “A” logo was strategically placed on the neckline, to keep it conspicuous.

The T-shirt eventually launched the brand to the masses after it quickly gained fandom among the ranks of professional athletes. The startup’s fast track to success led to Under Armour going public in 2005. It’s early slogan: “Protect This House.”

By 2010, the business had crossed $1 billion in sales. Five years later, sales surpassed $4 billion. But then the momentum started to wane.

Protracted period of pain

The past eight years for Under Armour have been a struggle that doesn’t appear to be abating.

The company on Thursday announced a restructuring of its business as its North America sales in its most recent quarter tumbled 10%. Looking ahead, the company cast a dour forecast for its current fiscal year, expecting sales to drop 15% to 17%. Layoffs will be part of the effort to right the ship but executives did not specify how many employees will lose their jobs.

Under Armour also announced a $500 million share buyback, a move to reward shareholders.

Plank told analysts during the earnings call on Thursday that he will shepherd a reset of the business that centers on selling fewer but more innovative products to meet the needs of athletes, significantly accelerating product development, refocusing on its men’s apparel category and reducing discounts of its products.

“We are simply doing too much stuff. There are too many products, too many initiatives. To reconstitute this brand, we must be highly focused and prioritize what needs to get done so that our teams know exactly what to do with a clear definition of success for them,” Plank said.

It can’t be ignored that management issues, too, have plagued the business for years, Swartz said.

“The company has essentially had five CEOs in the past five years, if you count Kevin Plank twice,” said Swartz. Plank was announced as CEO — again — in March, ending the very brief year-long tenure of Stephanie Linnartz.

Plank conceded during the analysts call Thursday that frequent C-suite turnover had become a serious impediment to success.

“With several CEOs and heads of product, marketing in North America over the past half-decade, ongoing turnover of critical leadership has been central to our inability to stay agile and decisive,” he said.

String of controversies

The period from 2016 onward is when “things really started to fall apart” at Under Armour, Swartz said. A huge issue arose when an important channel of distribution for the brand went bankrupt and closed stores.

A bulk of Under Armour products are sold through sporting goods retailers and department stores, including Macy’s and Kohl’s, and online.

“When Sports Authority went bankrupt in 2016 it really hurt Under Armour. It was a major customer of the brand, as is Dick’s Sporting Goods,” Schwartz said.

In 2020, UCLA sued Under Armour for ending a $280 million sponsorship deal. The suit alleged that Under Armour was struggling before Covid-19 and that it used the pandemic as a reason to get out of the deal.

The 15-year sponsorship deal, signed in 2016, was the largest in the history of college sports at the time. In exchange for the $280 million, UCLA’s student athletes and personnel would wear and use Under Armour (UA)-supplied products exclusively. The company reached a settlement with UCLA.

The following year, Under Armour paid $9 million to settle a multi-year investigation with the US Securities and Exchange Commission into its past accounting practices, according to Footwear News.

Outside of other bad press for Plank, competitors were gaining ground on Under Armour, whose high-performance sportwear offerings weren’t best suited for the Lululemon-driven athleisure trend that had emerged and then dominated the way consumers dressed through the pandemic.

“Under Armour has failed to latch upon streetwear, or sports style that catapulted On or Hoka or Merrell,” said Zak Stambor, senior analyst, retail and ecommerce, with market research firm eMarketer, in an interview with CNN. “It needs to figure out what is next. If it can’t do that, then it needs to quickly latch upon what another brand has identified as the next big thing.”

Stambor questioned Plank’s decision to pull back from discounts at a time when consumers are hyper focused on value.

“It carries the risk of decreasing demand particularly when you don’t have a must-have product,” he said. Stambor said this decision also stands in stark contrast to a recent move that rival Adidas has made to roll out cheaper versions of their must-have shoes.

Despite it’s significant challenges, Stambor said Under Armour can remain relevant in the market. “It is a very large company with huge revenue. It’s not as though the brand has fully diminished in standing. It’s a bit stuck,” he said.

“Under Armour needs to identify what it is that consumers want and lean heavily in that direction. It hasn’t fully shown an ability to do so over the past few years,” he said.

One area that’s going strong is the brand’s long-term celebrity-brand partnerships, said Eric Smallwood, president of Apex Marketing Group, a sports and entertainment firm that evaluates sponsorships and advertising campaigns.

“Under Armour’s relationship with the ‘The Rock’, Dwayne Johnson, has been pretty effective. They’ve expanded to the United Football League, which is the football league that Johnson co-owns,” Smallwood said. “Their uniforms are Under Armour.”

Golf is another area where the brand is making inroads while the Stephen Curry partnership has kept the brand visible in the basketball world, Smallwood said.

The basketball superstar Curry, arguably the best shooter in history, famously signed with Under Armour instead of Nike in 2013. Meanwhile, the brand’s other major NBA star, Joel Embiid, quit Under Armour in 2023 a few months after he was named the league’s most valuable player.

Embiid signed a shoe deal with Skechers last month. Under Armour reportedly bid hard for a shoe deal with WNBA phenom Caitlin Clark, who many expect will sign with Nike.

“The bottomline for Under Armour is for the brand to be clear about its identity,” he said. “Are they a shoe company? Are they an apparel company? At one point everyone else copied their mositure-wicking undershirt. Then maybe they had an identity crisis. It’s going to come down to deciding if they want to evolve into a lifestyle brand or stay in performance-based products.”

Google rolls out its most powerful AI models as competition from OpenAI heats up

PUBLISHED TUE, MAY 14 20241:46 PM EDTUPDATED TUE, MAY 14 20243:28 PM EDT

KEY POINTS

- Google on Tuesday announced new additions to its AI model series Gemini at its annual developer conference, Google I/O.

- Google launched Gemini 1.5 Pro, which CEO Sundar Pichai said “offers the longest context window of any foundational model yet.”

- The unveiling comes a day after OpenAI announced its newest AI model, GPT-4o.

Google used its annual developer conference to showcase what the company is calling its lightest and most efficient artificial intelligence models.

At Google I/O on Tuesday, the company announced Gemini 1.5 Flash, the newest addition to the Gemini series. Google said in a blog post that the new model can quickly summarize conversations, caption images and videos and extract data from large documents and tables.

“We heard from developers that they wanted something faster and even more cost-effective,” said Demis Hassabis, CEO of Google DeepMind, in a press briefing.

The unveiling comes as tech companies increasingly refocus their product development and rollouts around generative AI, which is of particular importance to Google because the new tools give consumers more advanced and creative ways to access online information compared with traditional web search.

OpenAI on Monday launched a new AI model and desktop version of ChatGPT, along with a new user interface. The new model, called GPT-4o, is twice as fast as GPT-4 Turbo and half the cost, the company said.

Google recently announced an improved Gemini 1.5 Pro model, which can make sense of multiple large documents — 1,500 pages total — or summarize 100 emails, according to a vice president working on Gemini.

Gemini 1.5 Pro will soon be able to handle an hour of video content, or codebases with more than 30,000 lines, said Sissie Hsiao, a vice president at Google and the general manager for Gemini experiences.

“You can quickly get answers and insights about dense documents, like figuring out the details of the pet policy in your rental agreement or comparing key arguments of multiple long research papers,” Hsiao said.

OpenAI’s latest upgrade brings with it improved quality and speed and allows ChatGPT to handle 50 different languages. It will also be available via OpenAI’s application programming interface, or API, allowing developers to begin building applications using the new model immediately, executives said.

With 35 languages, Google says Gemini 1.5 Pro has a 2 million token window, which measures context and indicates how much information the model can process at once. The new model has improved local reasoning, planning and image understanding, company executives said.

“It offers the longest context window of any foundational model yet,” Alphabet CEO Sundar Pichai said in the press briefing. At the event, he gave an example of a parent asking Gemini to summarize all recent emails from their child’s school.

Gemini 1.5 Pro will initially be available for testing in Workspace Labs. Gemini 1.5 Flash will be available for testing and in Vertex AI, which is Google’s machine learning platform that lets developers train and deploy AI applications.

Fed Chair Powell says inflation has been higher than thought, expects rates to hold steady

PUBLISHED TUE, MAY 14 202410:55 AM EDTUPDATED TUE, MAY 14 20242:04 PM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Fed Chair Jerome Powell reiterated Tuesday that inflation is falling more slowly than expected, likely keeping interest rates elevated for an extended period.

- “We did not expect this to be a smooth road. But these [inflation readings] were higher than I think anybody expected,” Powell said in Amsterdam. “What that has told us is that we’ll need to be patient and let restrictive policy do its work.”

- Tuesday brought a fresh round of discouraging inflation data, when the producer price index rose a higher-than-expected 0.5% in April.

Federal Reserve Chair Jerome Powell reiterated Tuesday that inflation is falling more slowly than expected and will keep the central bank on hold for an extended period.

Speaking to the annual general meeting of the Foreign Bankers’ Association in Amsterdam, the central bank leader noted that the rapid disinflation that happened in 2023 has slowed considerably this year and caused a rethink of where policy is headed.

“We did not expect this to be a smooth road. But these [inflation readings] were higher than I think anybody expected,” Powell said. “What that has told us is that we’ll need to be patient and let restrictive policy do its work.”

While he expects inflation to come down through the year, he noted that hasn’t happened so far.

“I do think it’s really a question of keeping policy at the current rate for longer than had been thought,” he said.

However, Powell also repeated that he does not expect the Fed to be raising rates.

The Fed has been holding its key overnight borrowing rate in a targeted range of 5.25%-5.5%. Though the rate has been there since July, it is the highest level in some 23 years.

“I don’t think that it’s likely, based on the data that we have, that the next move that we make would be a rate hike,” he said. “I think it’s more likely that we’ll be at a place where we hold the policy rate where it is.”

Markets vacillated as Powell spoke around 10 a.m. ET and major averages were near breakeven approaching noon ET. Treasury yields edged lower, and futures traders slightly raised the market-implied probability of the Fed’s first rate cut coming in September.

Powell’s comments mirrored sentiments he expressed during his May 1 news conference after the most recent Federal Open Market Committee meeting.

The committee unanimously voted to hold the line on rates while also expressing that it had seen a “lack of further progress” on getting inflation back to the Fed’s 2% target, despite a series of 11 interest rate increases.

Tuesday brought a fresh round of discouraging inflation data, when the Labor Department’s producer price index, a proxy for wholesale costs, rose a higher-than-expected 0.5% in April on the back of a surge in services prices.

Though the index on its surface indicated further price pressures, Powell called the report “mixed” as some of the components showed easing movement.

“Is inflation going to be more persistent going forward? … I don’t think we know that yet. I think we need more than a quarter’s worth of data to really make a judgement on that,” he said.

CPI report shows inflation easing in April, with consumer prices still rising 3.4% from a year ago

PUBLISHED WED, MAY 15 20248:31 AM EDTUPDATED WED, MAY 15 202412:50 PM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- The CPI report showed an increase of 0.3% from March, the Labor Department’s Bureau of Labor Statistics reported Wednesday.

- Inflation eased slightly in April, providing some relief for consumers.

- On a 12-month basis, however, the CPI increased 3.4%, in line with expectations.

- Core inflation was at 3.6%, the lowest reading ex-food and energy since April 2021.

Inflation eased slightly in April, providing at least a bit of relief for consumers while still holding above levels that would suggest a cut in interest rates is imminent.

The consumer price index, a broad measure of how much goods and services cost at the cash register, increased 0.3% from March, the Labor Department’s Bureau of Labor Statistics reported Wednesday. That was slightly below the Dow Jones estimate for 0.4%.

On a 12-month basis, however, the CPI increased 3.4%, in line with expectations.

Excluding food and energy, the key core inflation reading came in at 0.3% monthly and 3.6% on an annual basis, both as forecast. The core 12-month inflation reading was the lowest since April 2021 while the monthly increase was the smallest since December.

Markets reacted positively after the CPI release, with futures tied to major stock indexes rallying and Treasury yields tumbling. Futures traders raised the implied probability that the Federal Reserve would start cutting interest rates in September.

“This is the first print in a month that wasn’t hotter than expected, so there’s a relief rally,” said Dan North, senior economist at Allianz Trade North America. “The excitement is a little overdone. This is not Caitlin Clark. She’s exciting, this is not exciting.”

In other economic news Wednesday, the Commerce Department reported that retail sales were flat on the month, compared with the estimate for a 0.4% increase. That figure is adjusted for seasonality but not inflation, suggesting consumers did not keep up with the pace of price increases.

For the inflation report, price gains on the month were driven heavily by rises in both shelter and energy.

Shelter costs, which have been a particular trouble spot for Federal Reserve officials expecting inflation to come down this year, increased 0.4% for the month and were up 5.5% from a year ago. Both are levels uncomfortably high for a Fed trying to drive overall inflation back down to 2%.

The energy index rose 1.1% for a month and was up 2.6% on an annual basis. Food was flat and up 2.2%, respectively. Used and new vehicle prices, which had contributed to the early rise in inflation during the worst of the Covid pandemic, both declined, falling 1.4% and 0.4%, respectively.

Areas showing notable gains on the month included apparel (1.2%), transportation services (0.9%) and medical care services (0.4%). For transportation services, that took the annual increase up to 11.2%. Services excluding energy, a key point for policymakers, increased 0.4% on the month and were up 5.3% on the year.

The inflation increase was bad news for workers, who saw earnings fall 0.2% on the month when adjusted for inflation. On a 12-month basis, real earnings rose just 0.5%.

In the shelter components, both rent of primary residence and the important owners equivalent rent, or what homeowners think they can get to rent their properties, rose 0.4% on the month. They respectively increased 5.4% and 5.8% on a 12-month basis.

Retail sales disappoint

Consumers apparently still felt the pinch of higher prices for the month.

The advance estimate for retail sales in April showed no change on the month after increasing a downwardly revised 0.6% in March. Sales, however, were up 3% from a year ago. Excluding autos, sales rose 0.2%, in line with the Dow Jones estimate.

A 1.2% decline in online receipts held the sales figure back, as did a 0.9% slide in sporting goods and related stores, while motor vehicles and parts dealers posted a 0.8% decrease.

Gasoline stations, boosted by rising prices at the pump, reported a jump of 3.1%, while electronics and appliances saw a 1.5% increase.

The so-called control group, which excludes a number of items and feeds into the Commerce Department’s gross domestic product calculations, fell by 0.3%.

“The weaker than expected retail sales number needs to be watched – cooling consumer spending is good, but if that transitions into a deeper slowdown it could herald some economic problems that markets would not welcome,” said Seema Shah, chief global strategist at Principal Asset Management.

Dilemma for the Fed

The reports come with the Fed on hold since July 2023 as inflation has proved more resilient than expected. Policymakers have said in recent weeks that they need more evidence inflation is on a sustainable path back to their 2% goal before agreeing to lower rates.

The Fed’s benchmark overnight lending rate is targeted in a range between 5.25%-5.5%, the highest level in 23 years.

In remarks Tuesday, Fed Chair Jerome Powell acknowledged that readings earlier in 2024 had been higher than expected and said it’s likely the central bank will need to keep monetary policy “at the current rate for longer than had been thought.”

To financial markets, that means the Fed likely will wait out the summer for better inflation data, with an initial rate cut coming in September. That would be the first reduction since the early days of the Covid pandemic in 2020.

“We think it’s September at the earliest that they’re going to cut,” said North, the Allianz economist. “Their mind seems to be that, ‘we’re not in any hurry to cut rates. Inflation is not near 2%, the economy is OK, we’re not going anything for months.’”

Fed officials hiked the key overnight funds rate 11 times from March 2022 through July 2023 in hopes that it would help tamp down demand that drove inflation to its highest level in more than 40 years. Policymakers had thought inflation would pass once supply chain issues brought on by the pandemic eased, but powerful demand fueled by fiscal and monetary policy stimulus has kept price pressures elevated.

Warren Buffett’s Berkshire Hathaway made a number of changes in its equity portfolio last quarter

PUBLISHED WED, MAY 15 20245:19 PM EDT

Warren Buffett unveiled Chubb as his secret buy and Berkshire Hathaway’s equity portfolio had some other changes in the first quarter, according to a new regulatory filing.

Firstly, the Omaha-based conglomerate tweaked his energy exposure last quarter, adding to its Occidental Petroleum holding slightly and trimming the Chevron stake. Berkshire has been steadily increasing its Occidental bet since it first took a position in the first quarter of 2022.

It was previously disclosed that Buffett trimmed Berkshire’s Apple holding by 13% in the first quarter. He said he sold a portion of the large stake for tax reasons after reaping enormous gains. He implied the sale could be a means of avoiding an even higher tax bill down the road if tax rates rise to help plug a ballooning U.S. fiscal deficit.

Other than these changes, Berkshire’s top 10 holdings remained unchanged last quarter.

In terms of smaller stakes, the conglomerate slashed its stake in building materials manufacturer Louisiana-Pacific by about 6%. Berkshire also exited its HP stake last quarter.

Buffett told shareholders at Berkshire’s annual meeting earlier this month that he dumped the Paramount stake entirely at a loss.

Value investor Bill Nygren thinks financials are cheap. These are his top holdings

PUBLISHED MON, MAY 20 20245:59 AM EDTUPDATED 3 HOURS AGO

Don’t overlook the the financial sector as the stock market trends higher, according to Oakmark Funds portfolio manager and noted value investor BIll Nygren.

The Dow Jones Industrial Average closed above 40,000 for the first time on Friday, while both the Nasdaq Composite and S&P 500 entered Monday after four-week-long rallies. After a dreary April, all three indexes are now higher in the second quarter.

Despite the financial sector outperforming the broader market, banking and consumer finance stocks are cheaper compared to all S&P 500 companies, according to Nygren. The Financial Select Sector SPDR Fund (XLF), which tracks the S&P 500 financials index, has returned 12.6% in 2024, including reinvested dividends, while the S&P 500 has returned less than 11.8%.

″[W]e have just under 20% of our portfolio in banks and consumer finance companies, and they average about eight and a half times estimated earnings next year, relative to 20 something for the S&P,” Nygren told CNBC’s “Squawk on the Street” Friday. “I still think that’s really really cheap.”

His portfolio’s top holdings include some of the country’s largest banks, such as Citigroup and Wells Fargo, as well as regional banks like First Citizens. Here’s a list of Nygren’s top holdings by portfolio weight.

OAKMARK SELECT FUND’S FINANCIAL STOCK HOLDINGS

| TICKER | COMPANY | CHANGE | PRICE | NAME | %CHANGE | PREVIOUS CLOSE |

| C | Citigroup Inc | -0.07 | 64.07 | C | -0.11 | 64.07 |

| WFC | Wells Fargo & Co | 0.02 | 61.08 | WFC | 0.03 | 61.08 |

| COF | Capital One Financial Corp | 0.76 | 141.81 | COF | 0.54 | 141.81 |

| ALLY | Ally Financial Inc | -0.26 | 40.12 | ALLY | -0.64 | 40.12 |

| BAC | Bank of America Corp | 0.07 | 39.29 | BAC | 0.18 | 39.29 |

| FCNCO | First Citizens BancShares Inc (Delaware) | -0.08 | 22.82 | FCNCO | -0.35 | 22.9 |

Source: CNBC

″[I]n the regulatory environment they’re in now, [banks] are holding significantly more capital that brings down [returns on equity] a little bit and investors have severely punished them for that,” Nygren said. “But we think what they haven’t done is offset that by saying these banks aren’t as risky as they used to be, because they have so much capital.”

The Dow’s road to 40,000 in one chart

PUBLISHED THU, MAY 16 202410:49 AM EDTUPDATED THU, MAY 16 20243:34 PM EDT

KEY POINTS

- The 30-stock benchmark broke above 40,000 for the first time.

- Investors anticipate artificial intelligence boosting corporate profits and the Federal Reserve possibly cutting rates later this year.

- The Dow first closed above 20,000 in early 2017, on the heels of lower corporate taxes in the U.S. under former President Donald Trump.

The Dow Jones Industrial Average reached a milestone Thursday that seemed unfathomable a year ago.

The 30-stock benchmark broke above 40,000 for the first time. The move comes as investors cheer the prospects of artificial intelligence boosting corporate profits and the Federal Reserve possibly cutting rates later this year as inflation eases further from its pandemic highs.

It’s been a long and winding road for the Dow to climb to these levels. Here’s a look at the Dow’s trajectory over the past 20,000 points.

The Dow first closed above 20,000 in early 2017, as investors began pricing in lower corporate taxes in the U.S. under former President Donald Trump. Those expectations were met toward the end of that year and also drove the Dow above 25,000 by January 2018.

However, the Dow struggled in 2018 after the excitement around lower taxes faded, with trade tensions between China and the U.S. rising and the Federal Reserve raising interest rates. The Dow finished the year down more than 5%.

In 2019, the stock market recovered as the Fed pivoted away from raising rates. By early 2020, the Dow was nearing 30,000 — reaching a high of 29,551.42 on Feb. 12, 2020.

Then came the Covid-19 pandemic. The Dow tumbled 38% from its February 2020 intraday peak to a low of 18,213.65 in March 2020.

Over the following months, the benchmark would recover as progress on Covid vaccine development ramped up and the Fed and lawmakers took unprecedented measures to support the economy. By November 2020, the Dow had closed above 30,000 for the first time.

The momentum from the Covid lows carried through to 2021, with the Dow breaking above 35,000. However, the good times wouldn’t last for much longer, as a bear market knocked the Dow all the way down to 28,660.51 before it recovered. Since reaching that low, the Dow has surged 40%.

— CNBC’s Gabriel Cortés contributed reporting.

Red Lobster files for Chapter 11 bankruptcy protection

PUBLISHED MON, MAY 20 20247:47 AM EDTUPDATED 12 MIN AGO

KEY POINTS

- Red Lobster has filed for Chapter 11 bankruptcy protection, continuing the process to shrink its footprint and find a buyer, the company said in a statement.

- The seafood chain’s CEO blamed “difficult macroeconomic environment, a bloated and underperforming restaurant footprint, failed or ill-advised strategic initiatives, and increased competition.”

Red Lobster has filed for Chapter 11 bankruptcy protection, continuing the process to shrink its footprint and find a buyer, the company said in a statement.

The seafood chain also said it has a so-called stalking horse bid from its existing lenders to buy the company, unless a higher bid comes along.

CNBC reported last month Red Lobster was seeking a buyer, weighed down by significant debt and long-term leases. The company recently appointed a restructuring expert — Jonathan Tibus, a managing partner with advisory firm Alvarez & Marsal — as its CEO.

In a court filing, Tibus blamed “difficult macroeconomic environment, a bloated and underperforming restaurant footprint, failed or ill-advised strategic initiatives, and increased competition within the restaurant industry” for the chain’s need to file for Chapter 11 protection.

Red Lobster currently operates 551 locations in the U.S. and 27 restaurants in Canada. The chain closed 93 underperforming locations on May 13 and is asking the bankruptcy court to reject 108 of its leases to further slim down its footprint.

The company has 36,000 employees, most of whom work in part-time roles.

Orlando-based Red Lobster has assets between $1 billion and $10 billion and estimated liabilities of $1 billion to $10 billion, according to the bankruptcy filing. Its largest creditor is distributor Performance Food Group, which is claiming the company owes it $24.4 billion.

“This restructuring is the best path forward for Red Lobster,” Tibus said in a statement late Sunday. “It allows us to address several financial and operational challenges and emerge stronger and re-focused on our growth. The support we’ve received from our lenders and vendors will help ensure that we can complete the sale process quickly and efficiently while remaining focused on our employees and guests.”

Red Lobster was founded in 1968 and purchased by General Mills two years later. In 1995, General Mills spun off its restaurant division into Darden Restaurants, which also housed sister chain Olive Garden.

Nearly two decades later, Darden sold Red Lobster to private equity firm Golden Gate Capital. Thai Union Group, a seafood supplier and one of the chain’s longtime vendors, bought a stake in Red Lobster in 2016. By 2020, Thai Union, members of Red Lobster management and investors using the alias Seafood Alliance bought out Golden Gate’s remaining stake in the chain.

Although Red Lobster survived the pandemic, its business has struggled since then. The chain’s traffic has tumbled about 30% since 2019, according to the bankruptcy filing.

The company’s longtime CEO Kim Lopdrup also retired in 2021, beginning a revolving door of CEOs that left the chain with little stability to turn around the flailing business. Tibus is Red Lobster’s third chief executive in as many years.

In fiscal 2023, the company reported a net loss of $76 million. Some of that loss was driven by its disastrous “endless shrimp” promotion. Last year, it changed the offer from once a week to daily in an effort to boost slower sales in the second half of the year. But the offer juiced business too much as diners sought cheap deals, pressuring Red Lobster’s bottom line.

According to a court filing, the ill-conceived promotion’s actual aim may have been more about boosting Thai Union’s own sales. Red Lobster got rid of two of its shrimp suppliers under interim CEO Paul Kenny’s leadership, leaving Thai Union as its sole supplier of the crustacean. That decision led to higher costs for Red Lobster, according to the filing. The debtors are also investigating if Thai Union and Kenny pushed excessively for in-store promotions, which often led to major shortages of shrimp.

https://www.cnbc.com/2024/05/20/jpmorgan-ceo-jamie-dimon-retirement-approaching.html

JPMorgan CEO Jamie Dimon signals retirement is closer than ever

PUBLISHED MON, MAY 20 20242:15 PM EDTUPDATED 4 MIN AGO

KEY POINTS

- JPMorgan Chase CEO Jamie Dimon signaled retirement is closer than ever, striking a key change in messaging during the bank’s investor day.

- The ambiguity of Dimon’s plans has made succession timing at JPMorgan one of the persistent questions for the bank’s investors and analysts.

- Dimon is 68 years old.

- “We’re on the way, we’re moving people around,” Dimon said.

Jamie Dimon’s days as CEO of JPMorgan Chase are numbered — though it is unclear by how much.

In a response to a question Monday about the bank’s succession planning, Dimon indicated that his expected tenure is less than five more years. That is a key change from Dimon’s previous responses to succession questions, in which his standard answer had been that retirement was perpetually five years away.

“The timetable isn’t five years anymore,” Dimon said at the New York-based bank’s annual investor meeting.

The ambiguity of Dimon’s plans has made succession timing at JPMorgan one of the persistent questions for the bank’s investors and analysts. Over nearly two decades, Dimon, 68, has made his lender the largest in America by assets, market capitalization and several other measures.

Still, Dimon added Monday that he still has “the energy that I’ve always had” in managing the sprawling company.

The decision of when he moves on will ultimately be up to JPMorgan’s board, Dimon said, and he exhorted investors and analysts to examine the executives who could take his place.

Atop the short list of candidates is Marianne Lake, CEO of JPMorgan’s consumer bank, and Jennifer Piepszak, who co-leads its commercial and investment bank. The executives were given their latest assignments in January.

“We’re on the way, we’re moving people around,” Dimon said.

Even when he steps down as CEO, however, it is likely he will stay on as the bank’s chairman, JPMorgan has said.

HI Financial Services Mid-Week 06-24-2014