Trade Findings and Adjustments 10-12-2023

For a review we currently have open:

Meta Jan 17 2024 240/300 Bull Call

Meta Jan 17 2024 300/350 Bull Call

Closed Trades:

Oct 20, 2023 444 long put closed for $54 or 12.5% ROI

Oct 20, 2023 444 Long put = 102.02% ROI $1025

Nov 2, 2023 438 Long put = 45% ROI $468

Nov Monthly 334 Long puts lost -$165

What do we do now? Long Calls in the near future

Education is for you to learn how to invest in today’s market NOT to copy what someone else does.

What Is a Call Option and How to Use It With Example (investopedia.com)

What Is a Call Option and How to Use It With Example

Everything you need to know about this financial contract

What Is a Call Option?

Call options are financial contracts that give the buyer the right—but not the obligation—to buy a stock, bond, commodity, or other asset or instrument at a specified price within a specific period. A call seller must sell the asset if the buyer exercises the call.

A call buyer profits when the underlying asset increases in price. The seller profits from the premium if the price drops below the strike price at expiration because the buyer will typically not execute the option.

A call option may be contrasted with a put option, which gives the holder the right to sell (force the buyer to purchase) the asset at a specified price on or before expiration.

KEY TAKEAWAYS

- A call is an option contract giving the owner the right, but not the obligation, to buy an underlying security at a specific price within a specified time.

- The specified price is called the strike price, and the specified time during which the sale can be made is its expiration (expiry) or time to maturity.

- You pay a fee to purchase a call option, called the premium; this per-share charge is the maximum you can lose on a call option.

- Call options may be purchased for speculation or sold for income purposes or tax management.

- Call options may also be combined for use in spread or combination strategies.

Call Option Basics

Understanding Call Options

Options are essentially a bet between two investors. One believes the price of an asset will go down, and one thinks it will rise. The asset can be a stock, bond, commodity, or other investing instrument.

Options Terms

The contract is an option (a choice) to buy the asset at a specific price by a certain date. The date is called the expiration date (known as expiry), and the asset is called the underlying asset (it’s also called “the underlying”).

The price is called the strike price. The strike price and the exercise date are set by the contract seller and chosen by the buyer. There are usually many contracts, expiration dates, and strike prices traders can choose from.

You pay a fee to purchase a call option—this is called the premium. It is the price paid for the option to exercise. If, at expiration, the underlying asset is below the strike price, the call buyer loses the premium paid. This is the maximum loss the buyer can incur.

Buyer Choices

The call option buyer may hold the contract until the expiration date, at which point they can execute the contract and take delivery of the underlying.

They can also choose not to buy the underlying at expiry, or they can sell the options contract at any point before the expiration date at the market price of the contract at that time.

If an option reaches its expiry with a strike price higher than the asset’s market price, it “expires worthless” or “out of the money.”

Long vs. Short Call Options

There are two basic ways to trade call options, a long call option and a short call option.

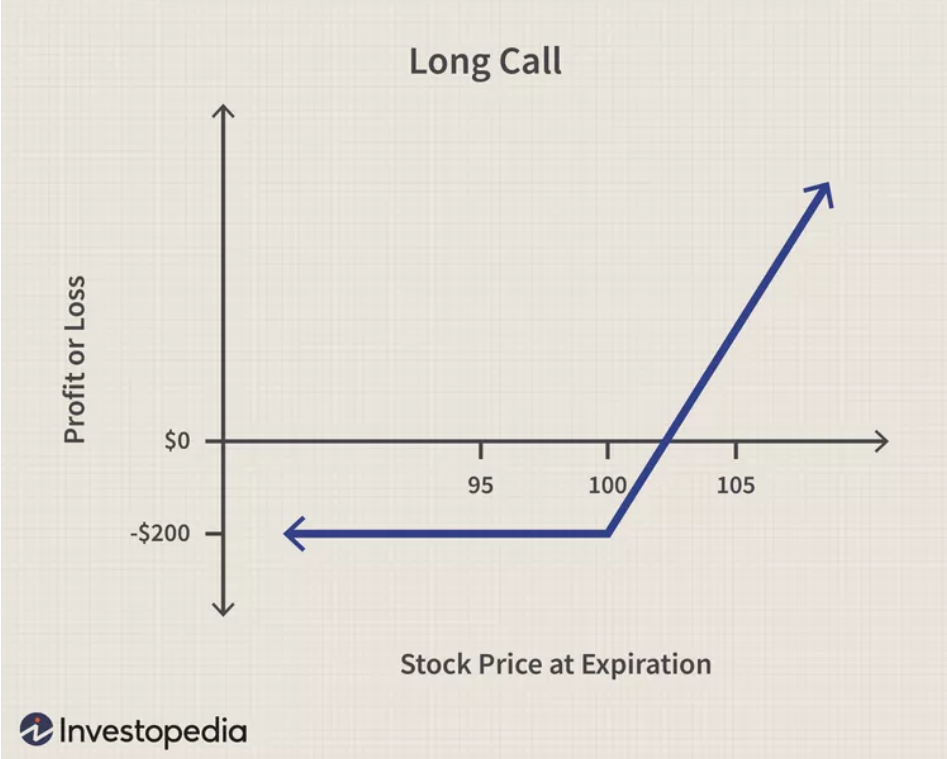

Long Call Option

A long call option is the standard call option in which the buyer has the right, but not the obligation, to buy a stock at a strike price in the future. The advantage of a long call is that it allows the buyer to plan ahead to purchase a stock at a cheaper price.

Image by Sabrina Jiang © Investopedia 2022

For example, you might purchase a long call option in anticipation of a newsworthy event, like a company’s earnings call. While the profits on a long call option may be unlimited, the losses are limited to premiums. Thus, even if the company does not report a positive earnings beat (or one that does not meet market expectations) and the price of its shares declines, the maximum losses the buyer of a call option will bear are limited to the premiums paid for the option.