HI Market View Commentary 03-27-2023

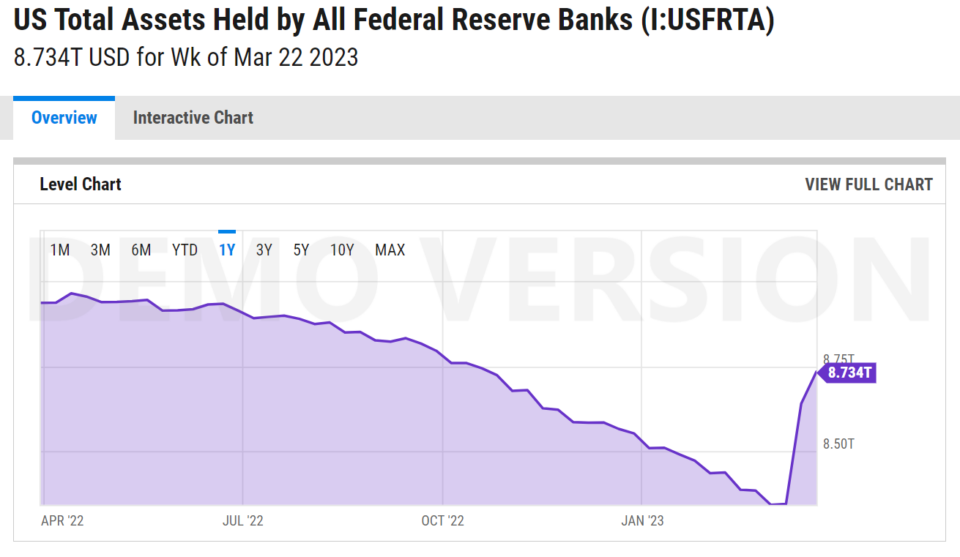

| Date | Value |

| March 22, 2023 | 8.734T |

| March 15, 2023 | 8.639T |

| March 08, 2023 | 8.342T |

| March 01, 2023 | 8.340T |

SO we are not going to have a tax increase and he 30B came from the FIDC banking insurance fund ?

I CALL BS !!!!!

What is it going to us? Higher taxes, weaker dollar, more inflation=higher interest rates = two or three more ¼ point or 25 basis point hikes

With that said, where will the market go?

Earnings dates:

MU 03/28

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 17-Mar-23 15:37 ET | Archive

Banking crisis a soon-to-be shock to earnings estimates

Market participants have been clamoring for relief on the interest rate front, and, boy, have they gotten it. The question, though, is at what cost?

Something Shocking This Way Comes

The 2-yr note yield plunged 79 basis points this week to 3.80% and the 10-yr note yield dropped 31 basis points to 3.39%. A little over two weeks ago, the 2-yr note yield stood at 5.06% and 10-yr note yield hit 4.10%.

The rapid reversal wasn’t precipitated by some unequivocally friendly inflation data. It was precipitated by the shocking failures of Silicon Valley Bank and Signature Bank.

We say shocking because those failures happened almost overnight and because Fed Chair Powell didn’t give any hint in his semiannual monetary policy testimony the week before that he was concerned about systemic risk to the banking system.

It was not a good look for the Fed Chair and the Federal Reserve’s supervisory capacity. They missed it, but to be fair, so did just about everyone else. Prior to last week, there were no public calls or research notes screaming that a banking crisis was at hand.

Nope. The focus on March 8 was whether the Fed would raise the target range for the fed funds rate by 50 basis points at the March 21-22 FOMC meeting.

On March 10, before the close of trading, Silicon Valley Bank was taken over by regulators. On March 12 Signature Bank was closed by its state chartering authority, and later that evening Treasury Secretary Yellen, Fed Chair Powell, and FDIC Chairman Gruenberg issued a joint statement noting that all depositors at these banks would be made whole under a systemic risk exception.

The Fed also introduced a Bank Term Funding Program designed to stem deposit runs on other banks by accepting high-quality assets as collateral at par value.

And just like that, it was evident to the world that the U.S. banking sector had a crisis on its hands. The characterization that this is a crisis might be debatable. It certainly doesn’t have the same characteristics as the financial crisis of 2008-2009 (thankfully), but the Treasury Department, Federal Reserve, and FDIC have themselves deemed it a crisis by invoking the systemic risk exception.

Some of the more unnerving elements of this latest bank “crisis” are that the decline in Treasury yields accelerated, and that bank stocks continued to decline, after the depositor rescue plan was announced. Also, Credit Suisse (CS) was compelled to engage the Swiss National Bank to shore up its liquidity position.

Remarkably, what hasn’t gone down (yet) are earnings estimates.

A Loaded Question

On March 8 the forward twelve-month earnings estimate for the S&P 500 was $226.19. Today, it sits at $226.66.

We can’t help but ask the question: do you think the 12-month outlook for earnings got better or worse since this latest banking crisis came to light?

We’ll load that question with the added insight that just about everyone now is labeling this banking crisis a disinflationary/deflationary force beyond the short term and is suggesting that banks of all stripes will be tightening their lending standards, managing their balance sheets more conservatively, and facing net interest margin pressures as they are forced to raise interest rates on deposit accounts.

When banks go into protection mode so to speak, it is not a good thing for growth prospects. Credit is the lifeblood of economic expansion, and when there are blood clots in the flow of credit, the economy suffers.

Accordingly, calls for the economy to experience a recession have picked up since the dawn of this latest banking crisis and many pundits are again pointing to the Treasury yield curve as their guide, only not because the 2s10s spread is widening further but because it is steepening.

That is, short-term rates are falling more rapidly than long-term rates on the assumption that weak economic conditions are going to force the Fed to cut rates. The widening in the 2s10s spread might be looked at as the canary in the coal mine, but the steepening in the wake of an adverse development is seen as the canary dying in the mine.

There may still be a chance for the canary to escape, but its survival will have a lot to do with how this banking crisis resolves itself both in terms of form (an abatement of deposit concerns) and function (the extent of bank lending activity).

Nevertheless, there is little doubt that the economy has been harmed by this crisis, which has compounded an already high sense of uncertainty and has created excess volatility in the capital markets that should weigh further on consumer and business confidence.

Growth Concerns in the Mix

The concerns about a slowdown in growth on account of the banking crisis were not limited to the Treasury market. Since March 8, WTI crude futures prices have fallen 13% to $66.39 per barrel, copper futures have dropped 3.2% to $3.90/lb, the ICE BofA U.S. High-Yield Index Option-Adjusted Spread has widened 84 basis points to 4.93%, and the S&P 500 Materials Sector has declined 7.6%.

Conversely, the Vanguard Mega-Cap Growth ETF (MGK) has risen 2.2%, versus a decline of 1.8% for the S&P 500, in the equivalent of a flight-to-safety trade within the stock market, as mega-cap issues like Apple (AAPL) and Microsoft (MSFT) are seen as having fortress balance sheets, sufficient distance from the banking issues, and the ability to hold up better than most if economic times do get quite tough. Over the same period, the Invesco S&P 500 Equal Weight ETF (RSP) has declined 5.8%.

The uncertainty about how difficult things might get will impede spending decisions and lead to more conservative management overall by companies outside the banking industry.

That would be considered a textbook response, but relative to earnings expectations, it is a new revelation to account for that wasn’t accounted for as much a little more than a week ago. What market participants also have to account for is the potential for collateral damage beyond the banks.

To that end, a favored trade before the banking crisis was to be long oil and short Treasuries. Any money manager levered up on those positions would naturally have some exposure issues on their hands. That’s not to say they didn’t cut their risk, but it is not unusual after a crisis that leads to outsized movement in prices to hear that a fund is in trouble and/or that some forced liquidations are taking place.

Thus far, it has been quiet on that exposure front, but one shouldn’t be surprised if such a story arises knowing that talk of liquidity crunches has been injected into the market narrative.

We digress.

What It All Means

The collateral damage in a collective sense should be showing up soon enough in declining earnings estimates. That will be particularly true for the banks, but if the economy stumbles like many think it will because of the banking crisis, it will be true of most companies.

That thinking has yet to make its presence felt in the forward twelve-month earnings estimate, but the banking crisis should soon be forcing a recalibration of earnings models.

We suggested in mid-February that earnings estimates for the second half of 2023 would be at risk along with the economy. Admittedly, that view didn’t envision a banking crisis being part of the equation, but it is now.

Sure, it might strike some as hopeful that market rates have come way down in the last few weeks and that the Fed’s terminal rate might not stretch as high as previously feared only a week ago. Some might see that as a basis for multiple expansion.

The impetus for those shifts, however, hasn’t been anything good. On the contrary, the impetus has been a negative shock to the economy that is going to be worse for earnings prospects. That is a basis that should keep the stock market in check because it is difficult to find a bottom in stock prices when confidence is low that there has been a bottom in earnings estimates.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: The next installment of The Big Picture will be published the week of April 3)

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF MAR. 20 THROUGH MAR. 24, 2023 |

| The S&P 500 index rose 1.4% last week, led by the communication services and energy sectors, as comments from the Federal Reserve’s Federal Open Market Committee sparked hopes for a slower pace of rate increases.

The market benchmark ended Friday’s session at 3,970.99, up from the previous Friday’s closing level of 3,916.64. The index is now up 3.4% for the year to date and nearly flat for the month of March. The weekly climb came as the US central bank’s Federal Open Market Committee on Wednesday raised its benchmark lending rate by 25 basis points, as expected, and reaffirmed its 2023 median rate outlook at 5.1%. In a statement, the committee said “some additional policy firming may be appropriate,” removing reference to “ongoing increases in the target range will be appropriate.” The change in language was seen as a sign the FOMC sees its rate increases becoming less frequent. This was a welcome indication for investors especially at a time when tensions have been running high following several recent bank failures. By sector, communication services had the largest percent increase of the week, up 3.4%, followed by a 2.3% climb in energy, a 2.1% rise in materials and a 2.0% increase in technology. Other gainers included health care, consumer staples, industrials, financials and consumer discretionary. There were just two sectors in the red: real estate fell 1.4% and utilities slipped 1.2%. The gainers in the communication services sector included Facebook parent Meta Platforms (META). Shares rose 5.3% last week amid positive reactions to the social network operator lowering its 2023 expense forecast last Friday due to layoff plans. Among the positive reactions, analysts at Morgan Stanley as well as KeyBanc Capital Markets upgraded their investment ratings on Meta’s stock. In the energy sector, shares of Pioneer Natural Resources (PXD) rose 5.6% as Citigroup upgraded its investment rating on the stock to buy from neutral. The firm also raised its price target on Pioneer Natural’s shares to $210 each from $193. In the materials sector, shares of WestRock (WRK) rose 5.7% as Citigroup upgraded its investment rating on the paper and packaging company’s stock to buy from neutral. On the downside, the decliners in real estate included Extra Space Storage (EXR), whose shares fell 4.0% amid a Bloomberg report that Life Storage (LSI) may receive a takeover proposal from Extra Space Storage. Extra Space is working with an adviser on a potential proposal, but plans aren’t final and may change, the Bloomberg report said, citing people with knowledge of the details. Economic data set to be released next week will include March US consumer confidence on Tuesday, February pending US home sales on Wednesday, and the latest reading of Q4 gross domestic product on Thursday. However, investors are likely to place the most attention on the release of February personal consumption expenditures, a key inflation reading, on Friday. A final reading on March consumer sentiment is also expected on Friday. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX –Bearish

COMP – Bearish

Where Will the SPX end April 2023?

03-27-2023 -2.5%

Earnings:

Mon: PVH

Tues: WBA, JEF, MU

Wed:

Thur:

Fri: BB

Econ Reports:

Mon:

Tue Consumer Confidence

Wed: MBA, Pending Home Sales

Thur: Initial Claims, Continuing Claims, GDP, GDP Deflator

Fri: Personal Income, Personal Spending, PCE Prices, Chicago PMI, Michigan Sentiment

How am I looking to trade?

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

You probably need to be defensive for the next quarter

Time to buy the tech rally? Hedge fund manager Dan Niles and others reveal their top picks

PUBLISHED SUN, MAR 19 20239:06 PM EDTUPDATED SUN, MAR 19 20239:15 PM EDT

The tech sector was a bright spot last week as the banking crisis rocked markets.

The Nasdaq Composite was up 4.4% over the week, while the Nasdaq 100 — which includes the index’s largest non-financial companies — was 5.8% higher.

Big tech and semiconductor stocks such as Nvidia and Microsoft were up around 12% over the week, while AMD soared over 18%.

Some investors started to view tech as something of a safe haven, as bond yields dropped and amid uncertainty over whether the U.S. Federal Reserve will continue with its rate hikes following the banking crisis.

So should you buy into the tech rally? Market pros urge caution — but think some stocks are set to outperform.

‘Creeping back’ into the sector

Tech investor Paul Meeks, portfolio manager at Independent Solutions Wealth Management, said he’s “creeping back into the sector” after advocating an underweight position in it for a long time.

“I do think within technology, there are some pretty interesting, very specific stories,” he said.

He likes semiconductor stocks in Europe, including ASML, and is also focusing on artificial intelligence names, such as Nvidia, Microsoft, and Chinese tech firm Baidu.

Hedge fund manager Dan Niles, meanwhile, said he likes Meta as it has a “strong” core business, with good user growth and engagement. Its Reels product is also holding up against Tik Tok, he told CNBC Pro Talks last week.

However, he cautioned that a lot of tech companies are going to be struggling with cost efficiency going forward.

Like Meeks, Niles is also bullish — but selective — on semiconductor stocks.

He highlighted that the sector dropped last year on collapsing demand as countries reopened following the pandemic. But in terms of the smartphone and PC corners of the market, “it’s gotten bad enough and it can start to turn with generative AI as a nice kicker on top of that,” Niles added.

He said he owns Intel and Nvidia, with the former “starting to close the gap” in manufacturing with Advanced Micro Devices and Taiwan Semiconductor Manufacturing, which should improve its outlook.

Nvidia is also the “biggest beneficiary of generative AI” as a lot of graphic chips will be needed, Niles added.

Is tech a safe haven?

But tech is not out of the woods yet, according to Meeks.

“The way that U.S. tech companies distinguished themselves to the upside with their first-quarter reports and … forward guidance is by how many people they could fire — and that is not a recipe for growth,” he told CNBC’s “Street Signs Asia” on Friday.

He added that the banking crisis has led to market talk about halting or declining interest rates, and “of course, that is a recipe for greatness for tech stocks.”

“It’s all about the interest rates, potentially going down after a full year of them rising swiftly and aggressively. But I don’t think that the fundamentals and technology have changed for the better, or not materially,” Meeks said.

Tech firms in particular are vulnerable to rising rates as future profits become less valuable.

Financial services firm BTIG said it believes that tech stocks have become something of a “rotation beneficiary given the recent events and rising odds for a hard landing.”

“If you are managing money, and you are selling high-beta cyclicals but have a mandate to be fully invested, that money is going to find its way into more perceived safe havens. While we don’t think FANG+ names are immune to weakness, they are perceived as safer in an economic downturn than Energy, Industrials, Financials, etc,” the bank’s analysts wrote in a March 16 note.

However, they warned that once these “rotations” have run their course, there could be renewed weakness in tech.

— CNBC’s Michael Bloom, Sarah Min contributed to this report.

Short Sellers Are Betting Serious Money 11 Stocks Will Crash Soon

- 08:00 AM ET 03/27/2023

Short sellers are getting bold again. And they’ve picked their favorite stock market targets to crash.

Eleven stocks in the S&P 1500, including retailer Big Lots (BIG), Cutera (CUTR) and Voya Financial (VOYA), are facing the highest levels of short interest, says an Investor’s Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith. Short sellers, investors who profit when a stock falls, control 18.5% or more of all these stocks’ shares outstanding.

Short sellers’ role is drawing attention again following a more than 15% drop in shares of mobile payments processing company Block (SQ) on a short-seller’s critical report. The question is which stocks are next?

S&P 1500 Short Interest Ticks Up

Short interest is up slightly in March from the start of the year as bears spot opportunities. But where do they see crashes coming?

The average short interest on stocks in the S&P 1500 is 3.9%. That’s up a bit from the 3.8% level coming into the year. But not surprisingly, many of the largest jumps in short interest are seen on individual stocks.

Take Big Lots, the Columbus, Ohio-based discount retailer. More than 31% of the company’s shares outstanding are controlled by shorts. That’s the highest short position in the S&P 1500. And the short interest is up from 28.7% coming into the year.

Remarkably, short interest remains high despite the stock already falling 30.1% this year. The company’s bottom line is in serious trouble. Analysts think the company will lose another $4.02 a share this fiscal year, after losing nearly $6 a share last fiscal year. Meanwhile, revenue is expected to drop nearly 6%.

Other Big Short Bets In The Stock Market

You have to wonder if short sellers are just piling on too late in some cases.

Shares of Cutera, a maker of laser systems for aesthetic procedures, are already down nearly 40% this year to 26.63 each. Nonetheless, short sellers control more than 24% of the company’s shares outstanding. Analysts think the company will lose another 52 cents a share in 2023, following a $3.05 a share loss in 2022. It’s interesting, though, that the company is expected to return to profitability in 2024.

But short sellers aren’t just kicking lagging stocks when they’re down. They’re also making big bets against asset manager Voya Financial and movie theater chain Cinemark Holdings (CNK), both of which are up strongly this year.

More than 23% of Voya’s shares outstanding are controlled by shorts. Even so, shares are up 9% this year. The company’s profit is expected to rise nearly 9% this year, too. And Cinemark shares are up even more, gaining 53% this year. That’s a bit of a surprise for the short sellers sitting on more than 21% of the company’s shares outstanding.

Shorts Picking Their Stock Market Spots Carefully

Of course, short interest is nowhere near where it was in 2021 during the GameStop rally.

In fact, now only 18.7% of GameStop’s shares outstanding are being shorted. That’s a fraction of where it was in 2021. In fact, many short sellers got shaken out of the market in February while the stock market gained.

“Average short interest in the S&P 500 was 2.25% in mid-February, down 11 basis points from mid-October 2022 when the S&P 500 hit a recent low,” according to the latest S&P Global Market Intelligence data. “Short interest, which measures the percentage of outstanding shares held by short sellers, fell across all sectors from mid-October 2022 to mid-February, as the S&P 500 rallied about 16% over the same stretch.”

But thanks to a slipping stock market and bank crisis, it looks like shorts are regaining some of their swagger.

Most Shorted Major Stocks

Highest short-interest to shares outstanding in S&P 1500

| Company Name | Ticker | Index | Short interest / shares outstanding | YTD % ch. | Sector |

| Big Lots | (BIG) | S&P 600 | 31.3 | -30.1% | Consumer Discretionary |

| Cutera | (CUTR) | S&P 600 | 24.4 | -39.8% | Health Care |

| Voya Financial | (VOYA) | S&P 400 | 24.0 | 9.0% | Financials |

| Cinemark Holdings | (CNK) | S&P 600 | 21.5 | 53.2% | Communication Services |

| PetMed Express | (PETS) | S&P 600 | 20.7 | -7.4% | Consumer Discretionary |

| GEO Group | (GEO) | S&P 600 | 20.4 | -29.6% | Industrials |

| Children’s Place | (PLCE) | S&P 600 | 20.3 | 2.7% | Consumer Discretionary |

| Trupanion | (TRUP) | S&P 600 | 19.5 | -20.0% | Financials |

| Ebix | (EBIX) | S&P 600 | 18.7 | -32.2% | Information Technology |

| GameStop | (GME) | S&P 400 | 18.7 | 24.9% | Consumer Discretionary |

| Medical Properties | (MPW) | S&P 400 | 18.5 | -34.0% | Real Estate |

Sources: IBD, S&P Global Market Intelligence

Follow Matt Krantz on Twitter @mattkrantz

Warren Buffett Finally Throws In The Towel On 4 Lousy Stocks

- 08:00 AM ET 08/17/2022

Warren Buffett likes to say his favorite holding period for an S&P 500 stock is forever. But that’s definitely not the case as he unloads some of his worst dogs.

Buffett’s Berkshire Hathaway (BRKB) sold off a least a portion of its four worst performers this year: Verizon (VZ), Store Capital (STOR), General Motors (GM) and U.S. Bancorp (USB). That’s according to an Investor’s Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith. Berkshire Hathaway retains a portion of the stocks (except Verizon), but now all the positions are below 10% of the companies’ shares outstanding.

When you see Buffett dump a stock, that’s about the closest thing to him ringing a sell bell. “There is very low portfolio turnover. Buffett didn’t buy a single new stock in the second quarter,” said Whitney Tilson of Empire Financial Research. “Almost all of his trading is generally among his existing positions.”

Remember: Buffett is an avowed value investor. When stocks he believes in fall in price, he often buys more. So if you see him dumping them instead, that should tell you something.

Plenty Of S&P 500 Dogs To Choose From

Berkshire Hathaway itself is having a decent year. Shares of Buffett’s conglomerate are up 2.4% this year. That’s a solid showing in a year that the S&P 500 is down nearly 10%.

But make no mistake, the Oracle of Omaha is struggling too with his investments. Just look at the massive $40 billion loss the company took in the second quarter. And 36 out of Berkshire Hathaway’s 49 U.S.-listed positions, or nearly three-quarters, are down for the year.

And some of the losses are enormous. Apple (AAPL), Berkshire Hathaway’s largest position, is down 2.7% this year, erasing more than $4 billion in value for Berkshire Hathaway’s portfolio. Berkshire Hathaway owns nearly 6% of the smartphone maker.

Buffett, though, isn’t giving up on Apple. Berkshire Hathaway actually boosted its position in the smartphone maker’s shares by nearly 1% to 894 million shares in the second quarter. And yet, as with other losers, he’s willing to part ways.

Hanging Up On Verizon

Given how T-Mobile US (TMUS) is running circles around Verizon, it’s not surprising Buffett’s had enough.

With shares of Verizon down nearly 12% this year, Berkshire Hathaway completely unloaded its remaining 1.4 million shares of the company in the second quarter. The great Verizon sell-off started in the first quarter, when Berkshire Hathaway dumped roughly 99% of its 158 million shares. So much for forever.

Another dog Berkshire Hathaway is selling off is Store Capital. With shares of the consumer discretionary stock still down nearly 15% this year, Berkshire Hathaway didn’t buy more. Just the opposite: It dumped more than half its position. Now it only owns 2.5% of the company.

No Love For GM

Fans of General Motors hold out hope that the U.S. automaker will take on Tesla (TSLA) in electric vehicles. But GM stock isn’t behaving that way, and Buffett isn’t buying it.

Shares of GM lost more than a third of their value this year. But rather than buying more, as is Buffett’s typical style, he sold off nearly 15% of it. Now Berkshire Hathaway owns just 3.6% of the company. Meanwhile, Buffett also took 5% off the table in his U.S. Bancorp position. Shares of the bank are down more than 12% this year. It’s important to note, though, that Buffett still owns 8% of the bank.

Is it possible Buffett will change his mind on some of these stocks later? Absolutely. Berkshire Hathaway has been adding to its Occidental Petroleum (OXY) position and now owns 20% of the company. But keep in mind, it dumped the position to zero as of the end of 2021.

So when you see Buffett running from a falling S&P 500 stock, that’s not a signal you should ignore.

Losing Stocks Buffett Is Dumping This Year

Berkshire Hathaway reduced its position in these stocks that are down this year

| Company | Symbol | YTD price change | Cut in Berkshire position in Q2 | Sector |

| Verizon Communications | (VZ) | -11.9% | -100% | Communication Services |

| Store Capital | (STOR) | -14.9 | -53.0 | Real Estate |

| General Motors | (GM) | -33.4 | -14.8 | Consumer Discretionary |

| U.S. Bancorp | (USB) | -12.3 | -5.2 | Financials |

Sources: IBD, S&P Global Market Intelligence

Follow Matt Krantz on Twitter @mattkrantz

Beware these debt-heavy stocks in your portfolio as borrowing costs rise

PUBLISHED MON, MAR 27 202312:31 PM EDT

A Ford Mustang Mach-E GT at the 2022 New York International Auto Show in New York in April that year.

Jeenah Moon | Bloomberg | Getty Images

As the cost of borrowing rises, investors should avoid companies that have a lot of debt on their balance sheets, Evercore ISI warned in a note Sunday.

Borrowing costs have been moving higher since the Federal Reserve began hiking interest rates last year in an effort to tame inflation. Then, the bank crisis hit earlier this month, prompting concerns about a further tightening in lending by the industry. In order to build up capital, banks could provide fewer loans.

“Events in the banking system over the past two weeks are likely to result in tighter credit conditions for households and businesses, which would in turn affect economic outcomes,” Fed Chair Jerome Powell said in a news conference after the central bank’s meeting last week.

Those tighter conditions also make lending more expensive. Powell said the bank crisis had the equivalent of an additional quarter-point rate hike. That leaves companies with high debt, accustomed to low financing costs, facing refinancing risks, Evercore ISI analyst Julian Emanuel said.

“Banks remain stressed; credit has become stressed, ‘Debt Exposed’ companies are likely to feel further stress,” he wrote.

Here are some of the names Evercore ISI said could be hurt by a material change in borrowing and business conditions. The firm screened for companies that have a market cap over $2 billion, and short-term debt that accounts for more than 10% of their total debt. Short-term debt will have to be refinanced if the company still needs the capital.

The names are also highly leveraged, with net debt to equity in the top decile (80% and higher), according to Evercore ISI. Lastly, their 2023 estimated earnings before interest, taxes, depreciation and amortization is not expected to cover interest expenses or their short-term debt is more than 10% of their 2023 estimated EBITDA.

EVERCORE’S ‘DEBT EXPOSED’ STOCKS

| TICKER | NAME | SHORT TERM DEBT, % TOTAL | NET DEBT/EQUITY | 23 EBITDA/INTEREST EXPENSES | SHORT TERM DEBT/2023E EBITDA |

| CVNA | Carvana | 20.40% | 503.60% | -0.7x | -410.50% |

| DUK | Duke Energy | 10.90% | 107.30% | 4.9x | 64.90% |

| F | Ford Motor | 36% | 211.80% | 11.0x | 364.50% |

| OPEN | Opendoor Technology | 25.60% | 317.20% | -2.1x | -210.50% |

| WOOF | Petco Health & Wellness | 10.70% | 135% | 3.7x | 61.10% |

| WBA | Walgreens Boots Alliance | 17.10% | 115.20% | 11.2x | 101.00% |

Source: Evercore ISI

Online used-car dealer Carvana was once a Covid-pandemic darling as consumers shopped for cars online, while the lack of new cars pushed the used car market higher. The stock has since sank, losing nearly 98% in 2022, as the company struggled. Carvana’s short-term debt is 20.4% of its total debt and its net debt to equity is 503.6%.

Last week, the company announced plans to restructure some of its $9 billion debt load. Carvana is offering noteholders the option to exchange their unsecured notes at a premium to current trading prices in exchange for new secured notes. That will provide exchanging noteholders with “collateral while reducing Carvana’s cash interest expense and maintaining significant flexibility,” the company said in a filing Wednesday with the Securities and Exchange Commission.

Meanwhile, Duke Energy’s short-term debt is 10.9% of its total debt and its net debt to equity is 107.3%, according to Evercore ISI.

Duke Energy Corp

ANALYST CONSENSUS

17

Ratings

Buy

3 Strong Buy

3 Buy

11 Hold

0 Underperform

0 Sell

Highest Price Target

119.00

Average Price Target

107.62

Upside (13.66%)

Lowest Price Target

99.00

In February, Duke Energy CEO Lynn Good told CNBC the company has been paying close attention to rising interest rates.

“Rising interest rates are a key issue because we are very leveraged,” she said in an interview with “Squawk Box.”

Duke plans to spend $65 billion over the next five years for its transition to clean energy, she said.

“It just means we need to look for ways to drive costs out of our business,” Good added, pointing out that the company found $300 million in savings for 2023 by becoming more efficient in its corporate operations.

Lastly, Walgreens Boots Alliance’s short-term debt is 17.1% of its total debt and its net debt to equity is 115.2%.

Walgreens Boots Alliance Inc

ANALYST CONSENSUS

20

Ratings

Hold

0 Strong Buy

3 Buy

15 Hold

2 Underperform

0 Sell

Highest Price Target

54.00

Average Price Target

41.29

Upside (25.35%)

Lowest Price Target

35.00

The drugstore chain has been ramping up its health-care strategy, recently acquiring Summit Health. It is also in the process of acquiring full ownership of at-home-care company CareCentrix, as well as specialty pharmacy Shields Health Solutions.

—CNBC’s Michael Bloom and Michael Wayland contributed reporting.

I talked to 70 parents who raised highly accomplished adults—here are 5 signs your kid will be successful

Published Sat, Mar 25 202310:01 AM EDTUpdated Sat, Mar 25 202310:29 AM EDT

“What will my kid be like when they grow up?” It’s a question that every parent asks.

But rather than just wondering, there are plenty of things you can do now to help your kid develop the skills they need to reach their full potential.

For my book, “Raising an Entrepreneur,” I talked to 70 parents who raised highly successful kids. Looking back, they identified five key characteristics that contributed to their children’s future accomplishments.

If your kid has these five traits, they’re destined for success:

1. They are persistent.

Kids who are persistent don’t give up on things until they find a solution or learn something from it. They have grit and aren’t discouraged by other people’s reactions.

Jonathan Neman started a number of businesses when he was in high school and college, but none of them worked. After graduating, he and two friends founded Sweetgreen, an eco-conscious salad chain that has over 900 locations.

“We keep going. We fail, we try and try again, we fail, we try and try and try,” he told me. “I’m not smarter than anyone else. I’m just more persistent.”

2. They are curious.

Being curious means asking lots of questions: Why is it like this? Does it have to be this way? Can it be better?

Tania Yuki founded Shareablee, a social media analytics company. She recalls being at a high-end gift store when she was young. There was a sign that said “NO TOUCHING,” but she still touched everything.

When a salesclerk snatched something from her hand, she was sure she’d get in trouble. But her dad said, “She’s just curious. If she breaks anything, I’ll pay for it.”

This kind of inquisitive nature is a common trait of people who go on to create their own path in life.

3. They have a passion.

We want kids to explore things in ways that are most meaningful to them, rather than having them trying to please us.

Robert Stephens is a perfect example of someone who turned a childhood passion into entrepreneurial success: The boy who loved to fix things started a company that fixes things.

At 24, he started Geek Squad, a repair company that he later sold for $3 million.

Stephens’ parents consistently supported his passion and trusted him to make his own choices, and he learned to believe in his own abilities.

4. They’re self-starters.

Self-starters don’t need external motivation.

When Paige Mycoskie was in her mid-20′s, each of her grandparents gave her $100 for her birthday.

She decided to use that money to fulfill her lifelong dream of starting a clothing company. She bought a sewing machine, quit her job, moved back home, and started designing.

Then she founded cult favorite fashion brand Aviator Nation. In 2021, Mycoskie’s company made $110 million in sales.

5. They’re risk-takers.

Dhani Jones is a former NFL linebacker who went on to host the TV show “Dhani Tackles the Globe” and start Qey Capital, a private equity firm.

Growing up, although he wasn’t always a superstar, he was never afraid to put himself out there.

Entrepreneurs will risk putting everything on the line to achieve what they think is important, his mom told me.

“A lot of people are frightened to let go of what they’ve attained,” she said. “But if their parents instill enough self-confidence in them, they can approach life fearlessly.”

Margot Machol Bisnow is a writer, mom and parenting expert. She spent 20 years in government, including as an FTC Commissioner and Chief of Staff of the President’s Council of Economic Advisers, and is the author of “Raising an Entrepreneur: How to Help Your Children Achieve Their Dreams.” Follow her on Instagram.

HI Financial Services Mid-Week 06-24-2014