HI Market View Commentary 12-12-2022

So Some of you have asked about 2023 best picks?

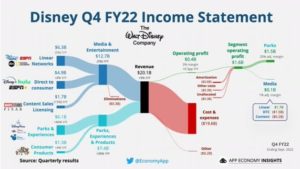

One of you referenced Yahoo Nov top 15 picks for 2023: DIS, MU, AAPL, Then top 5 AAPL, GOOGL, META, AMZN, MSFT

Aren’t those the Fang stocks? YES & YES they are recession proof Stocks = Hold Pricing Power, They have cash on hand, They cam weather the storm

Top picks or those stocks that can double in 2023: DIS, F, MU, UAA, BAC, V, SQ

So, let’s talk about a conversation with William and accounts.

Why have the accounts lost money? = When you book a loss on the position

That doesn’t mean the account will lose value on paper

Some stock/market trading action takes a crap ton longer than other times

Some of our positions from highs have lost 50%, 60%, 65%, 70%, 80%, 86%

What is some don’t come back

History shows the market always come back

Some stocks DON’T come back = Frauds or very poorly managed

FTX CEO Sam Bankman – HE is going to jail

Therous Founder/CEO Elizabeth Holmes = 11 in jail

Let’s look at this year

Earnings dates:

MU 12/20 AMC

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 09-Dec-22 15:11 ET | Archive

Markets see a problem on the horizon

The stock market looks forward with its pricing action and so does the Treasury market. What both markets are seeing right now is a problem on the horizon.

The problem they see is a period of much weaker growth, if not an actual recession, and the root of the problem is the Federal Reserve’s seeming inclination to use lagging data to drive its policy decisions.

Not Good Enough

The Fed is watching inflation data as it comes in and it is keeping close tabs on the employment numbers, paying particularly close attention to the unemployment rate and average hourly earnings growth.

That’s all well and good, only the employment data points are lagging indicators.

Furthermore, from the market’s standpoint, it is not good enough for the Fed to be watching incoming inflation reports. It wants the Fed to be forward-thinking and to extrapolate the likelihood of improving inflation trends due to the lag effect of its past rate hikes, real-time information like falling gas prices, reports of declines in rent prices, and CEO commentary pointing to improvements in supply chains and emerging softness in consumer spending.

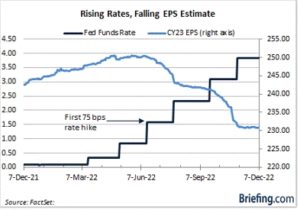

Some critics would argue that there is enough empirical data out there already that should convince the Fed to hold off on additional rate hikes. Those critics are going to be disappointed when the FOMC votes on December 14 to raise the target range for the fed funds rate by at least another 50 basis points and releases an updated Summary of Economic Projections that shows a higher median estimate for the terminal rate than the 4.6% estimate provided in September.

Ongoing rate increases are appropriate, according to the Fed; however, what the Fed thinks is appropriate, the Treasury market thinks is dangerous for the economy.

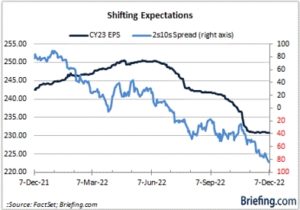

That view is plain to see in the deepening inversions across the Treasury yield curve. The lowest-yielding security isn’t the 3-month T-bill (4.30%), it is the 30-yr bond (3.53%). The 2s10s spread is the widest it has been since the early 1980s.

The inversion is a manifestation of the market’s concerns that the Fed is going to drive the U.S. economy into the ground with its incessant, and rapid, rate hikes. An inversion of the Treasury yield curve has often been a leading indicator of a recession — and the market knows that.

This Way to Registration

The recession view has come to the fore in recent weeks. It was already apparent in the Treasury market with the curve inversion, but it has started to register more noticeably in the stock market with the more recent underperformance of the bank stocks and the outperformance of the counter-cyclical health care, utilities, and consumer staples sectors.

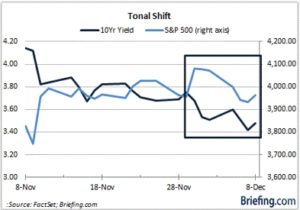

The main registration point, though, is that the stock market has been struggling to advance this month as long-term rates have been coming down.

Weaker growth and better inflation readings are supportive for Treasuries, yet, despite the sharp drop in market rates, stocks have traded in a guarded fashion, recognizing it seems that the driver of weaker inflation will be weaker growth that does not bode well for earnings prospects.

Sure enough, earnings estimates have been coming down in conjunction with the inversion of the yield curve.

Not surprisingly, the cut to earnings estimates has also happened in conjunction with the Fed’s rate hikes. It is the embodiment of a forward-looking stock market anticipating a slowdown because of the tighter monetary policy.

What It All Means

The Fed might not be looking at things the way market participants wish the Fed would look at things. Still, the Fed is forward-looking in one respect: it believes ongoing rate increases will be appropriate.

That view has the Treasury market concerned that the Fed will overtighten and trigger a deeper economic setback. Hence, there are inversions across the curve that, in some cases, are the deepest they have been in roughly 40 years.

The stock market is tuning in more to the Treasury market’s concerns, having heard more companies acknowledge a slowdown in business activity, having seen the ISM Manufacturing Index drop below 50.0%, which is the dividing line between expansion and contraction, having heard more businesses announce layoffs and hiring freezes, having noticed a personal savings rate of 2.3% that is the lowest since 2005, and having an awareness that higher interest rates and weakening demand are a global issue.

The stock market appears to be girding itself for more cuts to earnings estimates in coming weeks, which is why lower market rates have not translated into higher stock prices.

In brief, the forward-looking stock market is looking at the forward-looking Treasury market and doesn’t like what it sees.

—Patrick J. O’Hare, Briefing.com

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF DEC. 5 THROUGH DEC. 9, 2022 |

| The S&P 500 index fell 3.4% last week as investors worried that a recent round of better-than-expected economic data might prompt the Federal Reserve to keep its key rate higher for longer.

The market benchmark ended Friday’s session at 3,934.38, down from last week’s closing level of 4,071.70. This marks the S&P 500’s first weekly decline since the week ended Nov. 18, although it has spent much of 2022 in the red; it is down 17% for the year to date, with only three weeks remaining. The weekly decline came as a number of economic reports over the last week came in stronger than expected. A November reading on the services sector from the Institute for Supply Management as well as a December reading on consumer sentiment from the University of Michigan both came in above expectations last week. They followed a stronger-than-expected November employment data released last Friday. Investors are fearful that if economic data continue to come in above expectations, the Fed’s Federal Open Market Committee – which has a two-day meeting next week – may keep its benchmark lending rate higher for longer as it continues trying to tamp down inflation. Still, not all data have come in stronger than expected. Weekly jobless claims released Thursday showed US jobless claims increased by 4,000 to 230,000 in the week ended Dec. 3, and continuing claims advanced to 1.67 million from 1.61 million, marking the highest level of continuing claims since February. On Friday, a larger-than-expected rise in US producer prices in November only added to investors’ worries about rates and inflation. The core Producer Price Index for November rose by 0.4%, double the 0.2% rise that was expected and quadruple the previous month’s 0.1% increase. All of the S&P 500’s sectors fell last week. Energy had the largest percentage drop, down 8.4%, followed by communication services, which slid 5.4%, and consumer discretionary, which fell 4.5%. Other decliners included financials, down 3.9%; and technology and materials, which slipped 3.3% each. The smallest decline came from utilities, which edged down 0.3%. The energy sector’s slide came as futures in crude oil and natural gas fell. The sector’s decliners included EQT (EQT), down 11%, and EOG Resources (EOG), down 12%, amid investment rating downgrades. Citigroup downgraded its investment rating on EQT’s stock to neutral from buy while slashing its price target on the stock to $40 per share from $60. EOG was downgraded to hold from buy by Johnson Rice, which lowered its price target on the stock to $163 from $177. In communication services, shares of Paramount Global (PARA) fell 6.7% as the media and entertainment company’s CEO, Bob Bakish, said at a conference that the company now sees Q4 performance coming in “a bit below” Q3. The consumer discretionary sector’s decliners included shares of VF Corp. (VFC), which shed 15% as the company lowered its full-year financial outlook. The reduced guidance reflects softer-than-anticipated demand, primarily in North America, which is causing increased promotional activity and order cancellations in the wholesale channel, VF said. The utilities sector’s slim decline came amid gainers in the sector that included DTE Energy (DTE), whose stock received an investment rating upgrade to outperform from peer perform from Wolfe Research. DTE’s shares rose 1.9%. Next week, all eyes will be on the FOMC’s two-day meeting, which concludes on Wednesday. Other focal points on the economic calendar include the release of the November consumer price index on Tuesday, November retail sales on Thursday, and December readings on the manufacturing and services sectors from Standard & Poor’s on Friday. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bullish

SPX –technically bullish

COMP – Bullish looking to cross bearish again

Where Will the SPX end December 2022?

12-12-2022 -4.0%

12-05-2022 -4.0%

Earnings:

Mon: ORCL,

Tues:

Wed: LEN, TCOM

Thur: JBL,

Fri: ACN, DRI, WGO

Econ Reports:

Mon: Treasury Budget,

Tue CPI, Core CPI

Wed: MBA, Import, Export, FOMC Rate Hike

Thur: Initial Claims, Continuing Claims, Retail Sales, Retail ex-auto, Phil Fed, Empire Manufacturing, Industrial Production, Capacity Utilization, Business Inventory

Fri: Monthly Option Expiration

How am I looking to trade?

Currently have protection on for downward market movements, SPY puts in accounts for possible earnings disappointment

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

SO how is it that stocks can go down and we still have a tax bill= 2021

When stocks go down (collar process) what goes up? Put profits !!!! Which we close for a profit (booked profit) even when stocks are down

Here’s what America’s top CEOs are saying about a possible recession in 2023

PUBLISHED TUE, DEC 6 20221:57 PM ESTUPDATED TUE, DEC 6 20227:20 PM EST

KEY POINTS

- CEOs from JPMorgan, General Motors, Walmart, United and Union Pacific are preparing for an economic slowdown.

- Among the issues cited are rising interest rates, inflation and geopolitical concerns.

- The companies are taking a conservative approach to 2023.

As 2023 approaches and the prospect of a recession looms, corporate America is preparing for a slowdown in consumer spending.

CEOs of major companies including Walmart and General Motors joined CNBC’s “Squawk Box” on Tuesday morning to talk inflation, interest rates, geopolitics and what it all means for their outlooks in the new year.

Here’s what they said:

Jamie Dimon, JPMorgan

Rising interest rates, record inflation, geopolitical pressure and other factors could coalesce into a recession, JPMorgan Chase CEO Jamie Dimon told CNBC.

Savings and government aid during the pandemic are helping keep consumer wallets stable, but inflation and rate hikes are “eroding everything,” he said.

The CEO projected that the elevated consumer spending of 2022 will not last much longer, and underscored the risk posed by rising interest rates as the Fed works to curb inflation.

This year’s geopolitical upheaval, including the war in Ukraine and strained trade with China, are also among the “storm clouds” Dimon is watching. As the dollar strengthens, he noted that international trade for something like oil will continue to get more expensive since weaker currencies are forced to match the difference.

“When you look out forward, those things may well derail the economy and cause this mild to hard recession that people are worried about,” Dimon said. “It could be a hurricane. We simply don’t know.”

Mary Barra, GM

General Motors CEO Mary Barra anticipates economic headwinds next year but is not sounding the alarms for a recession just yet.

“I’m not going to call a recession, that’s for economists to do,” Barra told CNBC. “But right now, we’re still seeing a pretty strong consumer.”

Even so, the car manufacturer is proceeding with caution to be prepared for a potential collapse in demand, similar to what other industries have seen. During the pandemic, when consumers were spending less on travel and services, some industries saw elevated demand and were caught off guard when that demand later disappeared.

Barra said GM is preparing “a fairly conservative 2023” cost-wise to avoid being blindsided, but that she is still seeing “pent-up demand” lingering from the pandemic.

Barra also expects issues problems from the pandemic, such as semiconductor shortages and strained supply chains, to persist into 2023 despite improvements each quarter.

Doug McMillon, Walmart

Walmart CEO Doug McMillon doesn’t want a recession, but he thinks it might be a necessary evil to ease inflation for his customers.

“We’ve got some customers who are more budget conscious that have been under inflation pressure now for months,” McMillon said. “Should the Fed do what it needs to do, even if it is a much harder landing than we’d like? I think inflation needs to be dealt with.”

Though Walmart is still seeing strong spending, McMillon has spotted more conservative spending in certain categories like electronics and toys.

Walmart has seen its pandemic-era staffing issues begin to subside as it has raised wages, but McMillon noted there’s still hiring pressure at the cashier level. If a hard recession hits, McMillon ensured that Walmart would not turn to staffing cuts.

“Customers and members need to be served so that’ll drive our headcount. Growth will probably continue to go up,” said McMillon.

Scott Kirby, United Airlines

United Airlines CEO Scott Kirby told CNBC that his company is entering the year with optimism but that 2023 might see a “mild recession induced by the Fed.”

Business travel is enjoying a steady rebound from its pandemic-era collapse, but Kirby said that traveler demand is plateauing, which might indicate “pre-recessionary behavior.”

And even though the industry is in the “eighth inning” of Covid recovery, Kirby said it is still battling problems left over from the pandemic, such as a pilot shortage and expensive fuel.

For now, Airlines have reaped the benefits of hybrid work, with the increase in remote work giving people more flexibility to travel, said Kirby.

United still maintains a positive outlook as its revenue numbers continue to rise. Kirby said the company is “coming back to near all-time profit margins.”

“If I didn’t watch CNBC in the morning – which I do – the word recession wouldn’t be in my vocabulary,” Kirby said. “You just can’t see it in our data.”

Lance Fritz, Union Pacific

Shipping is slowing down, Union Pacific Railroads CEO Lance Fritz told CNBC, a sign that consumer spending is tapering off and the economy is tightening.

“The housing market has clearly slowed and parcel packaging has clearly slowed and we are seeing that in paper and parcel shipments,” he said.

Fritz left it up to the Fed to decide whether putting pressure on the consumer’s wallet – and potentially triggering a 2023 recession – is worth slowing down inflation. As rates continue rise, he said spending and demand will surely come down.

“The Fed is trying to hit all of us in the line of fire with a slower economy and hurting demand. It’s not good,” said Fritz.

https://biz.crast.net/bnp-paribas-studies-100-years-of-market-crashes-it-predicts-whats-next/

BNP Paribas studies 100 years of market crashes — it predicts what’s next

by Brian Neeley

Oops. The stock fell through a key support on Tuesday and it looks like some of the recent momentum is now gone. The new line in the sand for the S&P 500 SPX looks to be -1.44% at 3,900. Whether or not Santa eventually arrives is still to be determined, with Mr. Claus perhaps postponing the decision until next Tuesday’s CPI release.

But it is clear that the US stock market is still in a bear market. And with that in mind, equity strategists at BNP Paribas mined 100 years of crashes to try to determine what’s next.

Strategists led by Greg Boutel, head of US equities and derivatives strategy, are expecting a capitulation event next year. “This would be a departure from the current bear market regime, which has been characterized by a grinding in equity as P/E multiples have contracted,” he says.

The most recent crash – the COVID-19 recession of March 2020 – is a poor template in their view, as it was driven by both the extreme nature of economic shutdowns and rapid monetary and fiscal responses. Nor do they expect the 2008 model to be, as they see US GDP contracting about 1% next year, and earnings per share declining 1.5%.

However, 2002 is fairly representative of the crashes of the recession. That bear market was more than two years long, with a 50% drop, and a 29 percentage point peak-to-trough move in the VIX, +1.58%. A typical bear market is 1.5 years long, with an average decline of 38% and an average peak in VIX of 40.5.

“If we apply those averages to the market today, it implies a trough in the middle of next year, with the S&P down near 3,000, and the VIX in the low 40s,” he says.

The bull market that ended last year was similar to that of the 1990s, with high retail participation, massive P/E multiple price expansion and many top performers turning unprofitable. The S&P 500 collapsed in 2002 with a price-to-equity ratio of 14. BNP’s 2024 EPS forecast of $231 implies 3,250 for the S&P 500 if the P-to-E multiple falls to 14.

In a neat analysis, the BNP recreated the VIX VIX, +1.58%, which the CBOE introduced in 1993 to cover the last 100 years. Typically, volatility peaks at or just before the trough of the market.

“We consider a capitulation to be a move associated with panic sentiment that includes a reevaluation of expectations, analysts aggressively cutting forecasts, an increase in volatility and a recapitulation of tails. Over the past 100 years, capitulation in volatility has averaged about the same There are times when markets trough,” he says.

What are they like in such a market? One idea is to find companies that have maintained stock buybacks during downturns. Another is to look at companies with earnings momentum, although the only sector identified with positive momentum in the respective charts is Utilities XLU XLU, +0.62%. Tech is still weak, although what it calls prime tech may outperform the more speculative and cyclical parts of the sector.

https://seekingalpha.com/article/4562499-winner-streaming-war-disney-vs-netflix

Disney Vs. Netflix: Who Is Going To Be The New King Of Streaming?

Dec. 05, 2022 8:41 PM ETNetflix, Inc. (NFLX), DIS33 Comments5 Likes

Summary

- The streaming war is becoming a revenue growth war. The question is: who has better capabilities to generate more revenue from its subscribers over the long term?

- Both of the streaming giants are shifting the focus to ad-supported tiers which will generate a substantial amount of revenue in the upcoming years.

- Strong subscriber growth figures are slowly fading away as both Disney and Netflix are reaching the limits of the maximum subscribers they can have in the U.S.

- Who is better positioned for the new trend and which company should investors buy in?

Investment thesis

The streaming industry is facing major changes in the upcoming years. Until now, (partly due to the pandemic) the growth was unstoppable and investors valued subscriber growth more than earnings power. This trend has started to change in recent months because of Netflix’s subscriber losses, Disney’s content expense growth, and due to the decline in consumer confidence figures across the economy. This has shifted the focus on earnings power on streaming companies instead of subscriber growth.

This is the new trend in the streaming segment and we will see this trend unfolding even more in the upcoming years. Who is better positioned for the new trend and which company should investors buy in? Is The Walt Disney Company (NYSE:DIS) going to win big? Can Netflix, Inc. (NASDAQ:NFLX) maintain its leading position in the streaming segment?

Streaming trends

85% of U.S. households have streaming services subscriptions. In addition, each household has an average of 3 paid streaming services. Before 2022 the streaming industry was mainly focusing on subscriber growth and did not pay much attention to content expenses and overall profitability. The market and investors behaved the same way, one of the most important facts in every quarter was the subscription base growth and the number of new subscribers. This trend has started to change in the second half of 2022 and this new trend will stay with us for a long time. Just look at what happened to Disney after the company reported its Q4 subscriber growth numbers with rising expenses. The stock got hammered and later on the CEO was replaced. Since the second half of 2022, streaming platforms focus on growing the revenue and maximizing it from each subscriber rather than the excessive growth of subscriber figures. Most of the big players want to see the return on their streaming investments like Disney and those who are already profitable like Netflix want to produce as much cash as possible.

Both of them are focusing heavily on monetization and the ad-supported tiers. Originally, Netflix’s CEO said they will never show ads, then after disappointing quarterly results, this position was reconsidered, and then from the original plan to roll out an ad-supported tier in the first quarter of 2023 the new date was rushed to November 3, 2022. Disney’s ad-supported comes in December with a huge price increase in their current plans. This is due to the overall growth slowdown of the new subscribers and to increase the revenue.

Almost all of the streaming platforms spend a lot of resources on reboots, sequels, and big franchises from the 80s, 90s, and 2000s because people who grew up in the 1980s, 1990s, and early 2000s are spending the most time and money on streaming right now. This trend is likely to continue in the next 5-10 years until Generation Alpha (and late Generation Z kids) grows up, starts earning money, and starts to generate revenue for streaming platforms.

Live sports and events are also getting more and more popular and during the next 5 years, this market will experience significant growth. The global online live video sports streaming market is projected to grow at a CAGR value of 21.5% from 2022 to 2027. There are two major factors behind this extremely fast projected growth. One reason is the interest to watch live sports events are growing among people (as a consequence of the pandemic). The other reason is that the digital infrastructure is already in place, high-speed broadband is widely available and there is an upsurge in multi-platform and device-connected services.

The biggest risk factor is almost identical to all streaming services: consumer spending slowdown. If there is a major recession, streaming is among the first services that will be canceled by customers. They are not necessities and due to the easily accessible (and almost 3-click) canceling and then subscribing again later is much easier compared to cable. So in case of a deep recession customers might cancel for a couple of months and resubscribe later when things improve. However, this means not only subscription loss but revenue loss as well for the streaming service providers.

Highlights of Disney and Netflix

Disney has 235 million total streaming subscribers while Netflix has 223 million total subscribers. Streaming services account for 45% of ad views, overtaking TV everywhere. By 2027 the ad-supported video-on-demand (AVOD) revenue will likely surpass $69 billion. This is almost double the current 2022 spending of approximately $37 billion. To capitalize on this trend both of the streaming giants are moving in this direction.

Disney

Disney has started to focus on ads on its platforms and in August the company announced the ad-supported tier of Disney+. Investors were not given a lot of information about the specific details of it, only the launch date, 8th December. The same day when Disney will increase the prices for its streaming services by 38%. In terms of subscriber growth, if we take out the external macroeconomic factors, Disney is in a better position than Netflix purely based on the attractiveness of the content it produces. Due to its widely known brands such as Star Wars, Marvel, Toy Story, etc., they are in an excellent position to make content for every generation.

In the third quarter, the expenses rose for the Direct-to-Consumer segment due to higher marketing and content creation costs. From the next quarter, the management expects these losses to decline and by 2024 the streaming services should break even and then start to make consistent profits for Disney. This was the motivation behind the leadership change as well. So the next stage in the Direct-to-Consumer is to increase its earnings (with ads and subscription fee increases), rationalize expenses such as marketing and content creation costs, and deliver blockbuster shows that increase customer engagement on the platform. The biggest challenge Disney faces is that its content is under-earning and under-monetized. Bob Chapek (former CEO) emphasized in the earnings call that Disney is in a great position to “win the streaming war”:

“Building a streaming powerhouse has required significant investment. And now with its scale, incredible content pipeline, and global reach, Disney+ is well situated to leverage our position for long-term profitability and success.”

ESPN+ is a strong player in the live sports streaming space. They were able to extend the agreement until 2025 with one of the fastest-growing live sports events worldwide: Formula 1. In addition, Disney is thinking about somehow integrating sports betting on some of the live events into its platforms. I believe this is not going to come within the next few months and the management did not provide any updates since the third quarter but in the background, they are working on it:

…add some utility to sports betting and take away some friction for that for our guests. We have found that our sports fans that are under 30 absolutely require this type of utility in the overall portfolio of what ESPN offers. So we think it’s important. We’re working hard on it, and we hope to have something to announce in the future…

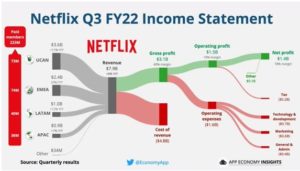

App Economy Insights

Netflix

Netflix is about to test out several new live broadcast shows in the upcoming months. The reason behind that is the further growth of the broadcast and streaming market share. One of the first live broadcasts is going to be the Chris Rock comedy special in early 2023. The management said they will focus on this segment in the future to capitalize on live broadcasts. I believe this is the consequence of Netflix dropping out of the bidding process for numerous live sports rights. Netflix might be able to win some live sports streaming rights but they are far behind Disney. Disney already has a very competitive advantage in the live sport streaming segment that Netflix either needs many years to be able to effectively compete with or drop the management’s intention to put major live sports events on Netflix.

Netflix is trying to take advantage of the merchandise sales of its most popular shows such as Stranger Things. In this segment, it is realistic to expect some extra revenue in the upcoming quarters and potentially $75 -100 million per quarter on average after 2-3 years, $300 – 400 million in a fiscal year. Disney recognizes approximately 6.5% of its revenue from product sales and merchandise. Calculating $300 – 400 million in additional merchandise sales revenue per year Netflix could increase its total revenue by approximately 3.5-4%. The reason why I calculated with only a fraction of Disney’s numbers is because of the brands Netflix owns and the fan base it has. Disney’s all-time favorite Star Wars will still be leading merchandise sales in the next few years despite Stranger Things’ or The Witcher’s success.

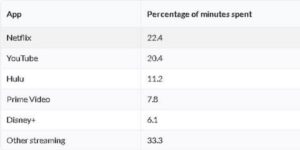

Netflix is in a good position to recognize substantial revenue growth from its ad-supported tier due to the platform having the longest watch hours among its competitors. Netflix remains the most popular streaming service in the US for total minutes watched so the platform will be able to generate great ad revenue if enough of its subscribers will use the ad-supported tier.

businessofapps.com

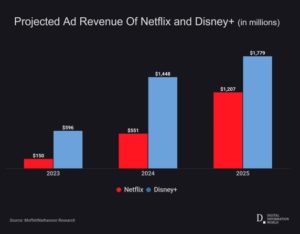

Disney is likely to win the ad spending competition in the next 2 years because it already has all the advertisers and infrastructure in place and the ad-supported tier has already been tested on HULU before applying it on Disney+.

digitalinformationworld.com

I like how Netflix’s management reacted quickly to subscriber losses and revenue decline earlier this year. They are committed to tackling password sharing, starting in early 2023. However, I have some serious doubts that it will work and the subscriber base will grow due to this management action. I am pleased with the ad-supported tier introduction because the first time the management talked about it, the goal was to implement it in the first half of 2023, then about two months later the deadline was moved to the end of the first quarter of 2023. Then after another disappointing quarterly result, the management proactively decided to start the ad-supported tier before its rival Disney introduces it so the date was moved to early November 2022. On the other hand, if we look back to January 2020, to the company’s full-year 2019 earnings call, the CEO was very clear and determined that they will never show ads on the platform and they have no intention to change this in the future.

“We want to be the safe respite where you can explore, you can get stimulated, have fun and enjoy – and have none of the controversies around exploiting users with advertising” Reed Hastings – CEO.

Obviously, in the past 2 years, a lot of things have changed but it looks really bad when the CEO has a crystal clear statement about a topic, then suddenly the whole company changes position due to external shareholder pressure and in addition, giving up its values (if no ads policy was truly the company’s core value in the first place).

In my opinion, Netflix is in a good place to boost its revenue via ads and possibly attract new customers with its lower-priced ad-tier subscription. It can also minimize subscriber loss in case of a deeper recession where people decide not to pay $9.99/month or $15.49/month but the $6.99/month ad-supported package is acceptable for them. The wider spread of merchandise will add 3-4% revenue growth in the next years to its total revenue according to my calculations. The biggest risk Netflix faces is its already toped-up customer base, it cannot grow the subscriber base further in North America, and the platform’s satisfaction ratings are dropping among its subscribers. “HBO Max leads the industry in terms of customer satisfaction, with 94% of respondents saying they were “satisfied” or “very satisfied” with the service; Netflix, which ranked second overall in 2021, dropped to fourth place in 2022 (with 80%) behind Disney+ (88%) and Hulu (87%)”.

App Economy Insights

Valuation

If we are looking at the DCF model, Disney is fairly valued and Netflix is overvalued at its current price. However, this fair overvaluation is only true if we are taking into consideration the events and earnings power of 2023 but if we look further both stocks become undervalued. Let’s see why. Calculating with an EPS of 4.9 and a growth rate of 6% Disney is fairly valued at around $96-97 per share. However, in 2023 the streaming segment will not add any net income but by the end of 2024, the steaming segment (when it is going to be profitable) will grow the company’s net income and therefore its EPS. We do not know the exact numbers but what we know is that once the streaming segment becomes profitable it will continue to produce a significant net income for Disney. Analysts’ average price target for Disney is $121 which means a 20% upside from its current price.

Netflix is less undervalued than Disney if we are looking at the long-term growth, revenue, and net income estimates. Calculating with an EPS of 11.2 and a growth rate of 6% NFLX is overvalued and its fair price would be around $220-225 per share. If the EPS grows to $15-16 per share by the end of 2024 the fair value would be around $330. This indicates a 4% upside potential from its current stock price. Analysts’ average target price for Netflix is $293.

If investors look at the future earnings power of the two streaming giants Disney looks more attractive for long-term investors. Investors cannot forget that Disney has several different revenue sources, so the comparison is not exactly apple to apple because if we buy Disney, we are not only buying into its streaming segment but into the whole entertainment industry.

Investor takeaway

I believe Disney is in a better place to win the streaming war due to its ability to generate more cash when advertising starts on its platforms. The merchandise sales will likely stay ahead of Netflix for many years and Disney+ still has room to grow its subscriber base. I do not believe that there will be a deep recession in 2023 so I think both of the streaming giants will be able to generate subscriber growth. I also believe that the streaming war is becoming a revenue growth war and Disney has better capabilities to generate more revenue from its subscribers over the long term but I am curious about your thoughts. What do you think, who will win the streaming war?

From Disney to Target to Boeing, retirement is a thing of the past for CEOs

PUBLISHED SUN, DEC 11 202210:00 AM ESTUPDATED SUN, DEC 11 202210:03 AM EST

KEY POINTS

- Lots of eyebrows were raised about Bob Iger’s return as CEO at Disney, but not related to his age.

- Traditional corporate succession planning has included mandatory retirement age of 65 for CEOs, but companies from Target to Boeing have recently changed those requirements to allow CEOs to serve longer.

- There are multiple reasons for a rising average CEO tenure, from longer, healthier lives to a pandemic that pushed back succession planning at many companies — during the past three global recessions, successions declined by 30%.

- There are ESG issues to consider from diversity to governance, but it’s also fair to argue a successful leader should not be forced out due to age.

Lots of eyebrows, and questions, were raised in November when Disney surprisingly rehired Bob Iger as its CEO, just 11 months after he turned the reins over to Bob Chapek, who in June had signed a three-year contract extension. Yet shoulders mostly shrugged regarding Iger’s age, 71, an indication that at the Magic Kingdom and beyond, there is no magic number when it comes to retirement — or unretirement — and that succession planning for key executives is increasingly crucial.

Target made headlines in September when the big-box behemoth announced that 63-year-old CEO, Brian Cornell, agreed to stay on the job for another three years and the company’s mandatory retirement age of 65 was being, well, retired. A month later, Caterpillar’s board waived its policy requiring chairman and CEO Jim Umpleby, 64, to retire when his next birthday rolled around. That followed previous expirations of preset CEO expiration dates by MetLife (in 2016), 3M (2017) and Merck (2018).

Last year, Boeing actually raised its compulsory aging-out age, to 70 from 65, as a way to keep CEO David Calhoun, then 64, in the pilot’s seat.

Although the average age of Fortune 500 CEOs is 57, a number of bosses on the well-known leaderboard range from 71 — Henry Schein’s Stanley Bergman — to 92 — Warren Buffett of Berkshire Hathaway, whose board’s vice chairman, Charlie Munger, is 98.

Retiring at 65 is out, average chief executive age is up

Among S&P 500 companies (all publicly held vs. the Fortune 500′s public and private businesses), the average age of a CEO at the end of his or her tenure was 64.2 in 2021 and 62.8 year to date in 2022, whereas in 2019 it was 59.7, said Cathy Anterasian, who leads CEO succession services in North America for leadership consulting firm Spencer Stuart, citing updated research from its 2021 CEO Transitions report.

The average tenure for departing CEOs during that same time period was about 11 years, up from nine years in 2020. “So they’re staying longer and therefore leaving at an older age. That’s not surprising, because of the impact of the pandemic and [other] crises, where boards put CEO succession on hold,” Anterasian said.

Once upon a time in America, chief executives and most other workers retired by 65, the age designated in 1935 for receiving benefits from the newly formed Social Security Administration — along with perhaps a gold watch and brochures for condo communities in Florida. Back then, however, life expectancy at birth was 58 for men and 62 for women.

Of course, in the 1930s, people generally performed more exhausting physical labor than today’s workers, who are also benefitting from exponential advances in health care and medical technology that have occurred over the ensuing decades.

By 2021, according to the latest data from the Centers for Disease Control and Prevention, at birth men were expected to live 73.2 years, women to 79.1 years. Yet those numbers were lower due to the pandemic, too, by a full year for men and 0.8 years for women.

Congress, the C-Suite, and age discrimination

In 1978, when Congress extended the protection under the Age Discrimination in Employment Act to private-sector employees up to the age of 70, it made an exception for CEOs and other senior executives, who could be asked to retire as soon as they turned 65. That allowed companies to legally sunset CEOs at 65, giving boards and shareholders a governance tool for getting rid of leaders who were underperforming, behaving badly or showing signs of mental and/or physical incompetence.

CEO turnover has always been a fact of corporate life, but during the last few topsy-turvy years, succession planning has been disrupted. “In our research, boards put CEO succession on hold during crises,” Anterasian said. Indeed, over the past three global recessions, successions declined by as much as 30%, she said. “The reason is that in turbulent times boards seek stability. Why change the captain of the ship when the waves are getting rougher and rougher?”

At Disney, Iger has said he will only stay on for two years before a successor takes over.

If what’s past is prologue, today’s rough seas will subside and the pace of CEO transitions should pick up over the next year or so, though the severity of any recession will be a factor. In the meantime, though, the debate over the merits of having a mandatory retirement policy (MRP) or not has gained traction.

Brandon Cline, a professor of finance at Mississippi State University, and Adam Yore, an assistant professor of finance at the University of Missouri, co-authored a paper in the Journal of Empirical Finance, investigating MRPs for CEOs. When it was published, in 2016, about 19% of S&P 1500 companies had such policies, though they have not updated their database since then.

Regardless, the pros and cons of MRPs persist. Most of them aren’t done specifically because boards and shareholders think there’s a certain age at which their CEO is too old to be productive, Cline said. “They do this because it gives them an easy way to get rid of someone who is underperforming or there are governance issues.” Conversely, as seen at Target, Caterpillar and Boeing, “boards will be quick to repeal [MRPs] if the opposite is true,” Cline said. “So when you have those types of concerns, that’s when they’re particularly useful.”

“The heart of the matter is, shareholders should know their executives best,” Yore said. “If they start seeing their executive slip because of aging issues, that’s one viable reason to use a MRP. On the other hand, we have countless examples of people who have managed firms well into their later ages, where so much profitability would presumably have been lost had they not done that. From that perspective, [MRPs] are good.”

ESG considerations in leadership

Matteo Tonello, managing director of ESG research at The Conference Board, has also studied CEO succession, but is less sanguine about MRPs. His findings were documented in a paper published in September by the Harvard Law School Forum on Corporate Governance.

“MRPs are a thing of the past,” Tonello said in an email. “They were a valuable tool at a time when CEOs and senior management used to exert extensive influence on the nomination and election of board members, and boards were often composed of executive directors — by definition more prone to merely ratify CEO decisions,” he said. “At that time, MRPs functioned as a substitute for CEO succession planning.”

Over the last two decades, though, the corporate governance environment has changed dramatically, Tonello said, prompted by statutory and regulatory reforms, the rise of shareholder activism and case law developments refining fiduciary responsibilities. “In this very different context, and if the company has a well-functioning board that does its job, MRPs have generally become unnecessary,” he said.

Martin Whittaker, founding CEO at ESG research nonprofit Just Capital, said in an email that this is not an issue which the firm has studied formally as part of its ESG methodology and rankings, and while ESG is a lens for assessing risk and good company management and leadership, it’s not about setting rules, or dictating how a company should act. Diversity goals and governance are factors to weigh in CEOs staying on the job longer, he said, but so is losing genuine experience from corporate leadership, “which is much needed today,” Whittaker said.

After FTX CEO Sam Bankman-Fried, 30, went down in flames, 63-year-old turnaround specialist John Ray was appointed to replace him and oversee the cryptocurrency company’s Chapter 11 bankruptcy proceedings, which could take years, with Ray commenting he has never seen “such a complete failure” of corporate controls.

MRPs aside, the matter of CEO succession planning remains paramount, exemplified by the tumult at Disney, which resulted in Iger having to succeed his successor. That incident also confirmed that CEO performance remains the key driver for boards to consider. Assessing performance is becoming more complex, though. CEOs are being measured by a wider network of stakeholders for hitting not only financial targets, but an array of environmental, social and governance (ESG) goals. If a board concludes that the CEO is underperforming on those various criteria, Tonello said, new leadership may be required.

But there also is no reason to conclude current successful CEOs are not the right leaders to hit a broader array of performance metrics. “Age doesn’t necessarily equate to conservatism and lack of innovation. Older white male directors can be avid proponents of advanced ESG strategy and performance. Indeed, you could say that ESG needs more rigor, stronger connections to financial and investor performance, better integration into governance and oversight practices. So, I guess I come down on the side of resilient older CEOs could be good or could be bad … it depends on the CEO,” Whittaker said.

And then there’s the traditional succession adage, that it may simply be time for the old guard to step aside for the younger generation. “That’s a super valid reason for somebody to call it a day,” said Jim Schleckser, founder and head of The CEO Project, which nurtures middle-market CEOs.

“It is profoundly selfish to stick around past your sell-by date,” he said, particularly if there are succession candidates in place and you’re of an age to think about a next act. “At that point, you’ve got lots of money, lots of time and lots of network,” Schleckser said. “You can go do something else and really make a contribution to the world.”

https://www.searchenginejournal.com/baidu-facts/336803/

25 Facts You Didn’t Know About Baidu

Baidu (not Google) controls China’s search engine market with billions of searches per month. See 25 things you may not know about Baidu.

Julia McCoy

- November 10, 2021

Google always dominates the SEO headlines. Content creators, website managers, and SEO experts go into a frenzy whenever Google publishes new updates about its algorithms and ranking factors.

But that isn’t the case in China.

Baidu, not Google, controls the majority of the search engine market in China, amounting to billions of searches each month. It even brings in some (though not many) users from the United States and Japan.

Screenshot from Statista, November 2021

Are you starting to get intrigued about Baidu?

Check out these fun facts and statistics about China’s dominant search engine.

What Is Baidu?

Baidu is more than just a search engine – it’s a massive Chinese tech company that specializes in artificial intelligence and internet-related services and products.

In fact, Baidu is one of the largest AI and internet companies in the world.

Since Google is banned in China, unless you have a VPN workaround, most Chinese internet users rely on Baidu as their search engine of choice.

Top 25 Fascinating Facts About Baidu You Need to Know

Baidu has a long history of ups and downs, acquisitions, growth, and intrigue. Here is a list of some of the facts that make Baidu what it is today.

1. How Did Baidu Get Its Name?

The name Baidu was taken from a beautiful poem called “The Green Jade Table in the Lantern Festival.” Written by Xin Qiji (1140-1207), this haunting poem portrays the search for one’s dreams amidst chaotic distractions.

Here are the lines (which vary in English depending on the translation) that inspired the name Baidu:

“…Hundreds and thousands of times, for her I searched in chaos / Suddenly, I turned by chance, to where the lights were waning, and there she stood.” – Xin Qiji (translated)

See the connection?

Baidu allows you to achieve a constant search for the ideal, and the word literally translates to “hundreds of times.”

2. How To Pronounce Baidu

The word Baidu is made up of two Chinese characters:

The first character is pronounced “bai.” The second one can be pronounced “do” or “to.” If you want to be technically accurate, it’s actually a blend of “d” and “t.”

3. Who Founded Baidu?

Baidu’s founder, Robin Li, came from humble beginnings. As the only son of two factory workers in Yang Quan, Li had no capital to start a big business.

He studied computer science at Beijing University, but after the campus was shut down due to pro-democracy protests, Li moved to Buffalo where he earned his master’s degree at the State University of New York.

Li’s first job was at a company called IDD (a Dow Jones subsidiary). During this time, he created a site-scoring algorithm called RankDex.

In 1999, Li was invited back to China to celebrate the 50th anniversary of the communist regime. He met his biochemist friend Eric Wu, and together, they decided to capitalize on China’s growing internet industry by starting Baidu. The rest is history.

4. Baidu Got Its Start With Silicon Valley Funding

When Baidu came to life in 2000, it caught the attention of major venture capital firms.

With $1.2 million in funding from Integrity Partners and Peninsula Capital, Li and Wu returned to Beijing to launch their project.

It didn’t take long for other venture capital firms to notice them. A few months later, Draper Fisher Jurvetson and IDG Technology Venture invested $10 million in Baidu.

5. Baidu.com Wasn’t Always A Search Engine

Li and Wu originally intended Baidu to be a search service to other Chinese portals. However, they were facing an uphill climb.

“The portals didn’t want to pay for (the service),” Lee told Forbes in 2009.

Luckily, they got the idea to launch Baidu as an independent site.

6. Baidu Beat Google To Ad Revenue

Just like Google, Baidu sported a simple, no-nonsense homepage. However, there was a key difference between the search engines.

Unlike Google back then, Baidu allowed companies to bid on space for ads. By 2004, Li and Wu started making a profit.

7. Robin Li Is The 46th Richest Person In China

As of August 2021, Robin Li’s net worth was $8.6 billion. Baidu’s founder has secured a position on several Forbes lists over the last few years, including:

- #138 Billionaires (2021)

- #46 China Rich List (2020)

- #58 Powerful People (2018)

- #17 Richest in Tech (2017)

8. The All-Time High For Baidu Stock Is $339.91

When Baidu went public in 2005, it opened at $27 a share and closed at $112. Since then, things have gone up and down for Baidu shares.

In February 2021, Baidu’s share price reached a staggering closing price of $339.91, although that peak quickly dropped immediately afterward. Today, the average stock price is around $157 HKD.

Here’s a look at Baidu stock share prices from 2005 to 2021:

Screenshot from Macrotrends by author, September 2021

9. Baidu Launched AI-Powered Cameras That Can Spot Ocular Fundus

Baidu isn’t restricted to focusing solely on giving internet users the best way to find information online. It also brings in revenue from other business ventures as well. In fact, the company is concerned about the general health and welfare of the Chinese people.

In 2018, Baidu revealed high-tech AI-powered cameras that spotted eye conditions that lead to blindness. These include glaucoma, macular degeneration, and diabetic retinopathy.

In 2019, hospitals began using Baidu’s cameras to run eye screenings on patients. The technology can generate a screening report in a matter of seconds.

10. Before The AI-Powered Cameras, Baidu Launched A Chatbot For Doctors And Patients

Baidu is a huge player in China’s health market. Two years before it launched the AI cameras for spotting ocular fundus, it introduced Melody to hospitals.

Melody is a chatbot that allows patients to give their health information to doctors. With it, doctors and patients can communicate in a faster, simpler way.

11. Baidu’s Total Revenue Reached $16.4 Billion In 2020

Robin Li released a company statement in February 2021:

“Baidu ended 2020 on a solid note with our business benefiting from improving macroeconomic environment and the digitalization of industrial Internet. Our focus on innovation through technology is paying off with Baidu Core non-marketing revenue growing 52% year over year in the fourth quarter.”

He went on to add,

“As we enter 2021, Baidu is well-positioned as a leading AI company with strong Internet foundation to seize the huge market opportunities in cloud services, autonomous driving, smart transportation, and other AI opportunities. We also hope to capitalize on our huge Internet reach with more non-marketing services.”

12. Baidu’s App Has 580 Million Monthly Active Users

In Q2 2021, Baidu reported that the number of monthly users logged in to its app had surpassed 580 million.

13. You Must Have A Mandarin Website To Rank On Baidu

Baidu prefers websites that are hosted on Chinese servers, and it can index only simplified Chinese characters.

Baidu isn’t great at distinguishing multiple languages, which is one of the reasons why it gives priority to 100% Chinese-written websites.

14. Baidu’s Ranking System Is Based On A Website’s Homepage

If you want better rankings on Baidu, put all of your energy into your site’s homepage.

You can give your landing pages a boost by making sure they have direct links on your homepage, as well as the header and footer.

15. Baidu Is The 5th Most Popular Website In The World

Baidu currently ranks at #5 on Alexa. This puts Baidu above both Facebook and Wikipedia!

16. Baidu Gives Ads Priority Space

While Google prioritizes organic results, Baidu’s first search pages are packed with ads.

This resonates with the fact that Chinese users typically believe that if a company can afford to pay for ads, it must be reliable.

17. 76.9% Of Internet Users In China Use Baidu

While that’s certainly an impressive portion of the market, Baidu is contending with increased competition from the #2 search engine, Sogou, which holds 14.02% and is predicted to continue closing the gap in the near future.

Bing, Google Hong Kong, and Haosou hold small margins in China’s online search market.

Market share of search engines in China as of August 2021

18. Baidu Analytics Is Used By More Than 7.6 Million Websites

Here are some of the top websites using Baidu Analytics, according to BuiltWith:

19. Baidu Was The First Chinese Company To Join The Partnership On AI (PAI)

Baidu joined forces with major companies like Amazon, Apple, and Google, all on a united mission to explore the benefits of AI for society.

However, it broke off the partnership in 2020. Baidu’s public reasons for the withdrawal were the cost of membership and recent financial pressures.

20. The Most Popular Keywords On Baidu

Considering the chaos that rocked the globe in 2020, it’s no surprise that the COVID-19 pandemic and face masks were at the top of the list of online searches on Baidu.

Mars exploration, Kobe Bryant’s death, and tensions with the United States were buzzworthy topics that also made the top 10 Baidu searches:

- The Pandemic.

- Moderately prosperous.

- Face Mask.

- China’s Mars Exploration.

- Return to China.

- 70thAnniversary of Resisting US Aggression and Aiding Korea.

- The Relationship Between China and US.

- Nothing But Thirty.

- Sisters Riding the Winds and Breaking the Waves.

- Kobe’s Death.

21. Baidu Gives Priority To Websites Hosted In China

Chinese websites end with .cn. If you’re thinking of getting a 100% Chinese website, you first need to register your company in the country.

22. Robin Li Warned Google There Would Be Stiff Competition If It Ever Returned To China

In 2018, Google was seriously considering making a return to China with modifications that fit the country’s strict censorship laws.

Baidu’s response? Google should expect stiff, all-out competition.

Google raised the white flag and ended up canceling its plans for a censored Chinese search engine, instead choosing to step back and let Baidu continue mostly uncontested in China.

23. Baidu Is More Than A Search Engine

Baidu’s users can access news, maps, government searches, an encyclopedia, internet TV, anti-virus products, and more!

Not to mention Baidu’s contributions in the AI and medical fields we discussed earlier.

24. Baidu Is Part Of The Biggest Autonomous Driving Program In The World

It partners with huge companies like Ford, Intel, Grab, and Honda to provide AI technology for driverless cars.

Baidu has even been testing robotaxis in major Chinese cities, including Shanghai, and the company is pushing to get more driverless taxis on the roads as a mass-market rollout after the testing phase is complete.

25. Baidu’s Reach Is Expanding Beyond China

Baidu USA was founded in 2014 and currently operates in Sunnyvale, California. It’s comprised of four separate groups:

- Baidu Research U.S.

- Baidu U.S.D.C.

- Intelligent Driving Group U.S.

- Smart Living Group U.S.

Baidu, Alibaba, and Tencent (collectively known as B.A.T.) are three of China’s biggest companies, and they’re extending their influence far beyond China.

All three are hiring U.S. talent and investing in AI startups in the United States.

Is Baidu The Search Engine Of The Future?

There’s no denying Baidu’s current hold over the Chinese market and its impressive growth over the years.

While it’s probably too early to be translating your website to simplified Chinese, Baidu and its influence should still be on your radar since it does help to shape the marketing landscape and push back against Google.

If you’re hoping to reach a sizable audience in China, Google isn’t going to get you very far.

Now that you know more about Baidu, you’re better informed to make the right global marketing decisions for your business.