I am NOT a fan of REITS =

Profitability on REITS is usually achieved at 90% plus occupancy

Payment of commercial loan is usually a break even at around 76% based on cap fees

Building management, electricity, maintenance are all expenses

Delinquency payments or bankruptcy are the investment risks with your money

Why would you be getting into a REIT at generational property high prices

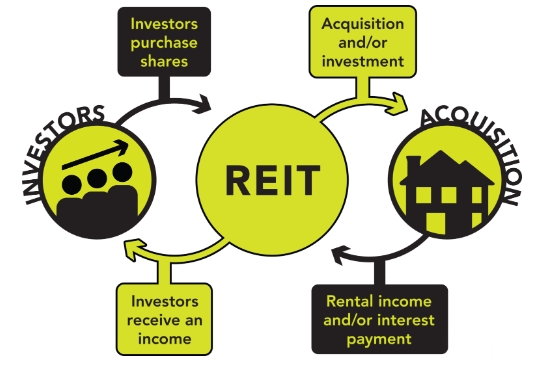

How Does a Real Estate Investment Trust Work?

REITs invest in a variety of real estate properties such as hotels, office buildings, shopping malls, warehouses, apartments, resorts, and more. Some focus on a particular type of real estate only, while others include several types of properties.

Like mutual funds, REITs create a large pool of capital from smaller investors. Generally, revenue is derived from leasing out the properties that it owns and collecting rent. For most real estate investment trusts, rent is the principal source of revenue.

Other REITs do not own properties at all but generate revenue by financing real estate transactions.

REITs are required to pay at least 90 percent of their taxable income to shareholders each year and must invest at least 75 percent of their total assets in real estate. Additionally, by law, they should earn at least 75 percent of their gross income from rents, real estate sales, or interest on mortgages targeted to financing real estate property.

https://www.investopedia.com/articles/04/030304.asp

How to Analyze REITs (Real Estate Investment Trusts)

Learn how to evaluate an REIT

Updated June 02, 2022

Reviewed by

A real estate investment trust (REIT) is a company that owns, operates, or finances income-producing properties. By law, 90% of an REIT’s profits must be distributed as dividends to shareholders.

Here, we take a look at REITs, their characteristics, and how to evaluate an REIT.1

KEY TAKEAWAYS

- Real estate investment trusts (REITs) are required to pay out at least 90% of income as shareholder dividends.1

- Book value ratios are useless for REITs. Instead, calculations such as net asset value are better metrics.2

- Top-down and bottom-up analyses should be used for REITs. Top-down factors include population and job growth. Bottom-up aspects include rental income and funds from operations.

What Qualifies as an REIT?

Most REITs lease space and collect rents, then distribute that income as dividends to shareholders. Mortgage REITs (also called mREITs) don’t own real estate; instead, they finance real estate. These REITs earn income from the interest on their investments, which include mortgages, mortgage-backed securities (MBSs), and other related assets.1

To qualify as an REIT, a company must comply with certain Internal Revenue Code (IRC) provisions. Specifically, a company must meet the following requirements to qualify as an REIT:3

- Invest at least 75% of total assets in real estate, cash, or U.S. Treasuries

- Earn at least 75% of gross income from rents, interest on mortgages that finance real property, or real estate sales

- Pay a minimum of 90% of taxable income in the form of shareholder dividends each year

- Be an entity that’s taxable as a corporation

- Be managed by a board of directors or trustees

- Have at least 100 shareholders after its first year of existence

- Have no more than 50% of its shares held by five or fewer individuals

By having REIT status, a company avoids corporate income tax. A regular corporation makes a profit and pays taxes on its entire profit, then decides how to allocate its after-tax profits between dividends and reinvestment. An REIT simply distributes all or almost all of its profits and gets to skip the taxation.3

https://f59e86fab8b40674a42248cd1a6d0a5e.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html Types of REITs

There are a number of different types of REITs. Equity REITs tend to specialize in owning certain building types such as apartments, regional malls, office buildings, or lodging/resort facilities. Some are diversified and some defy classification—for example, an REIT that invests only in golf courses.1

The other main type of REIT is a mortgage REIT. These REITs make loans secured by real estate, but they do not generally own or operate real estate. Mortgage REITs require special analysis. They are finance companies that use several hedging instruments to manage their interest rate exposure.1

While a handful of hybrid REITs run real estate operations and transact in mortgage loans, most REITs are the equity type—the REITs that focus on the “hard asset” business of real estate operations. When you read about REITs, you are usually reading about equity REITs. As such, we’ll focus our analysis on equity REITs.1

How to Analyze REITs

REITs are dividend-paying stocks that focus on real estate. If you seek income, you would consider them along with high-yield bond funds and dividend-paying stocks. As dividend-paying stocks, REITs are analyzed much like other stocks. But there are some big differences due to the accounting treatment of property.2

Traditional metrics like earnings per share (EPS) and price-to-earnings (P/E) ratio aren’t reliable ways to evaluate REITs. Funds from operations (FFO) and adjusted funds from operations (AFFO) are better metrics.2

Let’s illustrate with a simplified example. Suppose that an REIT buys a building for $1 million. Accounting rules require our REIT to charge depreciation against the asset. Let’s assume that we spread the depreciation over 20 years in a straight line. Each year, we deduct $50,000 in depreciation expense ($50,000 per year × 20 years = $1 million).Let’s look at the simplified balance sheet and income statement above. In year 10, our balance sheet carries the value of the building at $500,000 (i.e., the book value), which is the original cost of $1 million minus $500,000 accumulated depreciation (10 years × $50,000 per year). Our income statement deducts $190,000 of expenses from $200,000 in revenues, but $50,000 of the expense is a depreciation charge.

FFO

However, our REIT doesn’t actually spend this money in year 10—depreciation is a non-cash charge. Therefore, we add back the depreciation charge to the net income to produce funds from operations (FFO). The idea is that depreciation unfairly reduces our net income because our building probably didn’t lose half its value over the last 10 years. FFO fixes this presumed distortion by excluding the depreciation charge. FFO includes a few other adjustments, too.

AFFO

We should note that FFO gets closer to cash flow than net income, but it does not capture cash flow. Mainly, notice in the example above that we never counted the $1 million spent to acquire the building (the capital expenditure). A more accurate analysis would incorporate capital expenditures. Counting capital expenditures gives a figure known as adjusted funds from operations (AFFO).

Net Asset Value

Our hypothetical balance sheet can help us understand the other common REIT metric: net asset value (NAV). In year 10, the book value of our building was only $500,000 because half of the original cost was depreciated. So, book value and related ratios like price-to-book—often dubious in regard to general equities analysis—are pretty much useless for REITs. NAV attempts to replace the book value of a property with a better estimate of market value.2

Calculating NAV requires a somewhat subjective appraisal of the REIT’s holdings. In the above example, we see the building generates $100,000 in operating income ($200,000 in revenues minus $100,000 in operating expenses). One method would be to capitalize on the operating income based on a market rate. If we think that the market’s present capitalization rate (cap rate) for this type of building is 8%, then our estimate of the building’s value becomes $1.25 million ($100,000 in operating income ÷ 8% cap rate = $1,250,000).

This market value estimate replaces the book value of the building. We then would deduct the mortgage debt (not shown) to get NAV. Assets minus debt equal equity, where the “net” in NAV means net of debt. The final step is to divide NAV into common shares to get NAV per share, which is an estimate of intrinsic value. In theory, the quoted share price should not stray too far from the NAV per share.2

Top-Down vs. Bottom-Up Analysis

When picking stocks, you sometimes hear of top-down vs. bottom-up analysis. Top-down starts with an economic perspective and bets on themes or sectors (for example, an aging demographic may favor drug companies). Bottom-up focuses on the fundamentals of specific companies. REIT stocks clearly require both top-down and bottom-up analysis.

From a top-down perspective, REITs can be affected by anything that impacts the supply of, and demand for, property. Population and job growth tend to be favorable for all REIT types. Interest rates are, in brief, a mixed bag.

A rise in interest rates usually signifies an improving economy, which is good for REITs as people are spending and businesses are renting more space. Rising interest rates tend to be good for apartment REITs, as people prefer to remain renters rather than purchase new homes. On the other hand, REITs can often take advantage of lower interest rates by reducing their interest expenses and thereby increasing their profitability.4

Since REITs buy real estate, you may see higher levels of debt than for other types of companies. Be sure to compare an REIT’s debt level to industry averages or debt ratios for competitors.2

Capital market conditions are also important, namely the institutional demand for REIT equities. In the short run, this demand can overwhelm fundamentals. For example, REIT stocks did quite well in 2001 and the first half of 2002 despite lackluster fundamentals, because money was flowing into the entire asset class.

At the individual REIT level, you want to see strong prospects for growth in revenue, such as rental income, related service income, and FFO. You want to see if the REIT has a unique strategy for improving occupancy and raising its rents.

Economies of Scale

REITs typically seek growth through acquisitions and further aim to realize economies of scale by assimilating inefficiently run properties. Economies of scale would be realized by a reduction in operating expenses as a percentage of revenue. But acquisitions are a double-edged sword. If an REIT cannot improve occupancy rates and/or raise rents, it may be forced into ill-considered acquisitions to fuel growth.

As mortgage debt plays a big role in equity value, it is worth looking at the balance sheet. Some recommend looking at leverage, such as the debt-to-equity ratio. But in practice, it is difficult to tell when leverage has become excessive. It is more important to weigh the proportion of fixed-rate vs. floating-rate debt. In the current low-interest-rate environment, an REIT that uses only floating-rate debt will be hurt if interest rates rise.

REIT Taxes

Most REIT dividends aren’t what the Internal Revenue Service (IRS) considers qualified dividends, so they are generally taxed at a higher rate. Depending on your tax bracket, qualified dividends are taxed at 0%, 15%, or 20%. However, with REITs, most dividends are taxed as ordinary income—up to 37% for 2021.56

In general, REIT dividends are taxed as ordinary income.5 As such, it’s recommended that you hold REITs in a tax-advantaged account such as an individual retirement account (IRA) or a 401(k).

However, there may be some good news here. Since REITs are pass-through businesses, any dividends that don’t count as qualified dividends may be eligible for the 20% qualified business income (QBI) deduction.7 For example, if you have $1,000 in ordinary REIT dividends, you might owe taxes on only $800 of that.

Why are funds from operations (FFO) or adjusted funds from operations (AFFO) preferred when analyzing real estate investment trusts (REITs)?

Traditional per-share measures of stocks, like earnings per share (EPS) and price-to-earnings (P/E) ratio, are not often a reliable way to estimate the value of a real estate investment trust (REIT). Instead, REIT investors use funds from operations (FFO) or adjusted funds from operations (AFFO), both of which make adjustments for depreciation and required dividend distributions.2

Why are REITs subject to depreciation?

REITs hold real estate investments, which are depreciated over time for tax purposes. Depreciation serves to reduce taxable income in a given year, but is also an accounting figure only. That’s because an old property can be purchased several times over its existence, each time with a new depreciation schedule.8

Why don’t REITs tend to appreciate as fast as traditional stocks?

REITs must consistently pay out at least 90% of their taxable income as dividends to shareholders, so they have fewer resources to reinvest into new growth opportunities compared with traditional companies. When dividends are paid, stock prices additionally tend to fall by the amount of the dividend, so constant and relatively high dividends can constantly take a bite out of the market price as they are paid.19

The Bottom Line

REITs are real estate companies that must pay out high dividends to enjoy the tax benefits of REIT status. Stable income that can exceed Treasury yields combines with price volatility to offer a total return potential that rivals small-capitalization stocks. Analyzing an REIT requires investors to understand the accounting distortions caused by depreciation and pay careful attention to macroeconomic influences.

SPONSORED

Hire a Pro: Develop Your Financial Strategy

Finding a financial advisor can be challenging, but the right professional can help you create a financial strategy that meets your retirement goals. SmartAsset’s free tool takes the guesswork out of the process and matches you with fiduciary financial advisors in just 5 minutes. If you’re ready to be matched with advisors who can help you achieve your financial goals, get started now.

https://www.investopedia.com/articles/investing/031915/what-are-risks-reits.asp

What Are the Risks of Real Estate Investment Trusts (REITs)?

Updated April 11, 2022

Real estate investment trusts (REITs) are popular investment vehicles that generate income for their investors. A REIT is a company that owns and operates various real estate properties in which 90% of the income it generates is paid to shareholders in the form of dividends.1

As a result, REITs can offer investors a steady stream of income that is particularly attractive in a low interest-rate environment. Still, there are REIT risks you should understand before making an investment.

KEY TAKEAWAYS

- Real estate investment trusts (REITs) are popular investment vehicles that pay dividends to investors.

- Traded like shares of stock on exchanges, they can give exposure to diversified real estate holdings.

- One risk of non-traded REITs (those that aren’t publicly traded on an exchange) is that it can be difficult for investors to research them.1

- Non-traded REITs have little liquidity, meaning it’s difficult for investors to sell them.1

- Publicly traded REITs have the risk of losing value as interest rates rise, which typically sends investment capital into bonds.2

How Real Estate Investment Trusts Work

Since REITs return at least 90% of their taxable income to shareholders, they usually offer a higher yield relative to the rest of the market. REITs pay their shareholders through dividends, which are cash payments from corporations to their investors. Although many corporations also pay dividends to their shareholders, the dividend return from REITs exceeds that of most dividend-paying companies.1

REITs have to pay out 90% of taxable income as shareholder dividends, so they typically pay more than most dividend-paying companies.1

Some REITs specialize in a particular real estate sector while others are more diverse in their holdings. REITs can hold many different types of properties, including:3

- Apartment complexes

- Healthcare facilities

- Hotels

- Office buildings

- Self-storage facilities

- Retail centers, such as malls

https://ab51d733bfe64e5a35247cc9f75bd8fa.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html REITs are attractive to investors because they offer the opportunity to earn dividend-based income from these properties while not owning any of the properties. In other words, investors don’t have to invest the money and time in buying a property directly, which can lead to surprise expenses and endless headaches.3

If a REIT has a good management team, a proven track record, and exposure to good properties, it’s tempting to think that investors can sit back and watch their investment grow. Unfortunately, there are some pitfalls and risks to REITs that investors need to know before making any investment decisions.

Risks of Non-Traded REITs

Non-traded REITs or non-exchange traded REITs do not trade on a stock exchange, which opens up investors to special risks.

Share value

Non-traded REITs are not publicly traded, which means investors are unable to perform research on their investment. As a result, it’s difficult to determine the REIT’s value. Some non-traded REITs will reveal all assets and value after 18 months of their offering, but that’s still not comforting.1

Lack of liquidity

Non-traded REITs are also illiquid, which means there may not be buyers or sellers in the market available when an investor wants to transact. In many cases, non-traded REITs can’t be sold for a minimum of seven years. However, some allow investors to retrieve a portion of the investment after one year, but there’s typically a fee.1

Distributions

Non-traded REITs need to pool money to buy and manage properties, which locks in investor money. But there can also be a darker side to this pooled money. That darker side pertains to sometimes paying out dividends from other investors’ money—as opposed to income that has been generated by a property. This process limits cash flow for the REIT and diminishes the value of shares.1

Fees

Another con for non-traded REITs is upfront fees. Most charge an upfront fee between 9% and 10%—and sometimes as high as 15%.13 There are cases where non-traded REITs have good management and excellent properties, leading to stellar returns, but this is also the case with publicly traded REITs.

Non-traded REITs can also have external manager fees. If a non-traded REIT is paying an external manager, that expense reduces investor returns. If you choose to invest in a non-traded REIT, it’s imperative to ask management all necessary questions related to the above risks. The more transparency, the better.

Risks of Publicly Traded REITs

Publicly traded REITs offer investors a way to add real estate to an investment portfolio and earn an attractive dividend. Publicly traded REITs are a safer play than their non-exchange counterparts, but there are still risks.

Interest rate risk

The biggest risk to REITs is when interest rates rise, which reduces demand for REITs. In a rising-rate environment, investors typically opt for safer income plays, such as U.S. Treasuries. Treasuries are government-guaranteed, and most pay a fixed rate of interest. As a result, when rates rise, REITs sell off and the bond market rallies as investment capital flows into bonds.2

However, an argument can be made that rising interests rates indicate a strong economy, which will then mean higher rents and occupancy rates. But historically, REITs don’t perform well when interest rates rise.2

Choosing the wrong REIT

The other primary risk is choosing the wrong REIT, which might sound simplistic, but it’s about logic. For example, suburban malls have been in decline. As a result, investors might not want to invest in a REIT with exposure to a suburban mall. With Millennials preferring urban living for convenience and cost-saving purposes, urban shopping centers could be a better play.

Trends change, so it’s important to research the properties or holdings within the REIT to be sure that they’re still relevant and can generate rental income.

Tax treatment

Although not a risk per se, it can be a significant factor for some investors that REIT dividends are taxed as ordinary income. In other words, the ordinary income tax rate is the same as an investor’s income tax rate, which is likely higher than dividend tax rates or capital gains taxes for stocks.3

500,000+

In 2022, REITs collectively held in excess of 503,000 individual properties.4

Are REITs Risky Investments?

In general, REITs are not considered especially risky, especially when they have diversified holdings and are held as part of a diversified portfolio. REITs are, however, sensitive to interest rates and may not be as tax-friendly as other investments. If a REIT is concentrated in a particular sector (e.g. hotels) and that sector is negatively impacted (e.g. by a pandemic), you can see amplified losses.12

What Are Fraudulent REITs?

Some investors may be defrauded by bad actors trying to sell “REIT” investments that turn out to be scams. To avoid this, invest only in registered REITs, which can be identified using the SEC’s EDGAR tool.5

Do All REITs Pay Dividends?

In order to be classified as a REIT by the IRS and SEC, they must pay out at least 90% of taxable profits as dividends. This provision allows REIT companies to have exemptions from most corporate income tax. REITs dividends are taxed as ordinary income to shareholders regardless of the holding period.1

The Bottom Line

Investing in REITs can be a passive, income-producing alternative to buying property directly. However, investors shouldn’t be swayed by large dividend payments since REITs can underperform the market in a rising interest-rate environment.

Instead, it’s important for investors to choose REITs that have solid management teams, quality properties based on current trends, and are publicly traded. It’s also a good idea to work with a trusted tax accountant to determine ways to achieve the most favorable tax treatment. For example, it’s possible to hold REITs in a tax-advantaged account, such as a Roth IRA.