HI Market View Commentary 08-01-2022

Please tell me what happened with the GDP last week?= Two neg quarters so we are in a recession

So people ask me why I do what I do = Mathematics = make something on the way down, add shares to make more on the way up

Why not mutual funds or just let it ride?= Averages are not your friends

What have you done for me lately?= Kobe Bryant attitude

How can I be wasting my time knowing more than you do?= Running numbers, making up a portion of downward movement, adding shares without asking for more money to be put into the account?

Well you can’t always be right? = Yes we can but it might take longer for the market to realize it and the gains are not average yearly gains

This article is from J.D. Rucker of America First via one of my brothers.

BlackRock, World’s Largest Asset Manager, Lost $1.7 Trillion in Clients’ Money This Year

BlackRock, the world’s largest investment management firm with about $8.49 trillion in assets, recorded a $1.7 trillion loss in the first half of 2022, according to the company.

This was the largest sum of money ever lost by a single company in a six-month span, according to Marc Rubenstein, a Bloomberg analyst.

In the company’s second-quarter earnings report, BlackRock CEO Larry Fink attributed the immense loss to the collapse in the financial markets, blaming an environment of rampant price inflation, rising interest rates, and market carnage.

“The first half of 2022 brought an investment environment that we have not seen in decades,” Fink said in a statement. “Investors are simultaneously navigating high inflation, rising rates, and the worst start to the year for both stocks and bonds in half a century, with global equity and fixed-income indexes down 20% and 10%, respectively.”

Rubenstein said the investment titan had also focused too much on passive investing, writing that only one-quarter of BlackRock’s assets were actively managed “to beat a benchmark” by the end of the April-to-June period. In total, the company’s passive equity holdings are 10 times larger than its active strategy, “although it does operate some active multi-asset and alternatives strategies that narrow the gap,” he noted.

The earnings report also highlighted slower inflows into the New York-based firm’s core investment funds, totaling $69 billion in the three months ending on June 30. That’s $40 billion less than what analysts had forecast and a decline from the $114 billion in the previous quarter.

Today, BlackRock’s largest holdings are concentrated in technology, with positions in Apple, Amazon, Microsoft, and Tesla.

BlackRock’s adjusted profit was $1.12 billion, or $7.36 per share, compared to the year-earlier $1.61 billion, or $10.45 per share. It also fell short of the average analyst estimate of $7.90 per share.

Morningstar analysts are still long on BlackRock.

“There was little in wide-moat-rated BlackRock’s second-quarter earnings that would alter our long-term view of the firm,” Greggory Warren, a sector strategist at Morningstar, wrote in a recent note. “We are leaving our $850 per share fair value estimate in place and consider the shares to be undervalued. BlackRock continues to be our top pick among the more traditional U.S.-based asset managers we cover. The company’s shares are currently trading at a 30% discount to our fair value estimate—compared with 20% on average for the nine firms in our coverage—and it represents a solid entry point for long-term investors.”

BlackRock Making Adjustments

Additionally, BlackRock confirmed that it’s tightening its belt and delaying its hiring efforts.

General and administrative costs climbed by 12 percent year-over-year, driven mainly by higher expenses related to workers returning to the office, from computer equipment to health and safety investments.

“We are mindful of the current environment, and you are proactively managing the pace of what I would call certain of our discretionary investments,” Chief Financial Officer Gary Schedlin told analysts in a call.

The company also revealed that it will be exploring digital assets, despite Fink calling Bitcoin an “index of money laundering” in 2017. He revealed that institutional investors are still interested in that corner of the market, even though digital currency prices have cratered this year.

“The crypto asset market has witnessed a steep downturn in valuations over recent months. But we’re still seeing more interest from institutional clients about how to efficiently access these assets,” he said.

Fink told analysts that BlackRock clients are turning heavily to cash as a safe-haven asset in the current highly volatile market.

“Now an inverted yield curve has made cash not just a safe place but now also a more profitable place for investors,” he said.

The 2- and 10-year yields have inverted, and the spread is about minus 25 basis points, the deepest inversion in more than two decades, according to Nancy Tengler, the CEO and Chief Investment Officer at Laffer Tengler Investments.

Indeed, the Bank of America’s July survey of fund managers found that investors are parked in cash at the highest rate since 2001, while their stock allocation is the lowest since the financial crisis of 2008–09.

Despite the sharp sell-off in the equities arena, Fink is confident that investors can relax a little bit.

“A really famous person called me up, panicking, ‘What should I do, I’ve got to get out, I can’t stand it, I can’t stand it.’ And I said, ‘Go on vacation,’” Fink said in an interview with CNBC’s Jim Cramer. “If you really can’t stand it, then sell it. But the reality is, we’ve seen this. Inflation is going to be fixed over time.”

About the prospect of a recession, Fink thinks that if the United States is in the middle of an economic downturn, “it’s going to be quite mild.”

“The financial foundation of America is as strong today as ever,” he said.

BlackRock shares have tumbled by about 30 percent year to date.

Our market movement is right now based on Inflation, Earnings, China , Ukraine, and the European Recession already on their way

There is so much negatives news I’m not sure I understand how our markets can continue to go up?!?!?!?!!!!

Earnings dates:

BIDU 8/11 BMO – Pricing power

COST 9/22 AMC – ????

CVS 8/03 BMO – NO

DG 8/25 AMC – NO

DIS 8/10 AMC – Pricing power

MU 9/28 – NO

SQ 8/04 AMC – NO

UAA 8/03 BMO – NO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 29-Jul-22 15:00 ET | Archive

Shelter costs create difficult proving ground for policy pivot

From time to time, the market sees what it wants to see and hears what it wants to hear. This is one of those times.

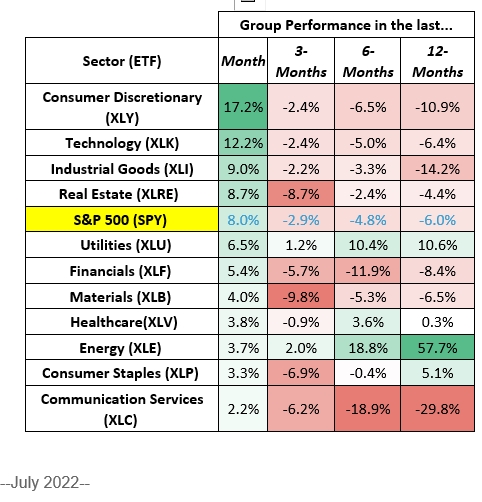

The month of July has been a splendid month– and we’re not talking about the weather. It has been splendid for investors who, frankly, needed a splendid month given that the first six months of the year were anything but splendid.

Alas, we write this with the Nasdaq Composite up 12.2% in July and the S&P 500 up 9.0%. As we alluded to last week, the stock market has gotten better as the economic and earnings news has gotten relatively worse and sometimes just bad.

The stock market has rallied like it has partly because bearish sentiment hit extreme levels and partly because the market has allowed itself to believe that the Federal Reserve will become a friend again by cutting rates as soon as the first half of 2023.

Ironically, that thinking rests on a belief that the unfriendly rate hikes in 2022 will kill the economy or at least put the economy on its back. The connection, it seems, is that the market loves the idea of the Fed turning soft on rate hikes more than it fears the economy turning soft and/or falling into a recession.

It is not surprising considering a new generation of market participants has grown up on rock-bottom interest rates that were the foundation for a prolonged bull market. Who wouldn’t want that back? Hence, this market loves to hear bad news at the moment, because what it sees in the bad news is a path back to a friendlier Fed.

Rate Hikes on the Chopping Block

The fed funds futures market is pricing in another 100 basis points of rate hikes for the remainder of 2022, with the target range for the fed funds rate topping out at 3.25-3.50% in December, according to the CME’s FedWatch Tool. Then, the fed funds futures market thinks the Fed will cut rates two times in the first half of 2023, leaving the target range at 2.75-3.00% in June 2023.

Falling commodity prices, fading inflation expectations, improving supply chains, and the Fed’s stated effort to drive growth below potential with frontloaded rate hikes that weaken demand (and the labor market as a result) are primary selling points for the rate-cut view.

The Fed and other central banks might stamp out growth with their rate hikes but stamping out inflation might not be such a cooperative endeavor.

Current indications point to Europe remaining stuck with an energy crisis this winter, a lot of companies have announced plans to raise prices further in coming months or at least see inflation pressures persisting, any weakening in the dollar would be a boon for dollar-denominated commodity prices, and shelter costs are expected to remain inflated.

In short, getting from here (tightening policy) to there (easing policy) involves a lot of proving ground to cross, including the Fed’s own median projection that the target range for the fed funds rate will hit 3.80% in 2023.

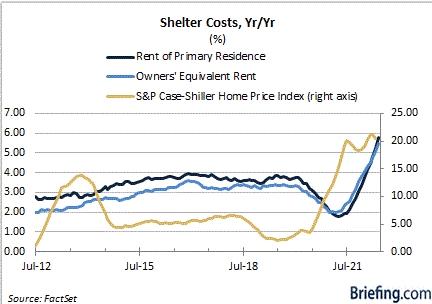

One of the potentially sticky points on that proving ground — for the Fed anyway — will be shelter costs.

Landlords Land a Raise

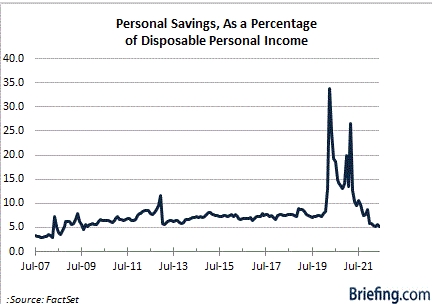

The Personal Income and Spending Report for June was not good. It featured high inflation, weak real spending, a decline in real disposable personal income, and a drop in the personal savings rate as a percentage of disposable income to 5.1%, which is the lowest since August 2009.

Another thing that jumped off the pages of that report to us was the month-over-month increase in rental income of persons with capital consumption adjustment. That’s a fanciful economic description for the income of landlords. That income increased 2.5% month-over-month on the heels of a 2.6% monthly increase in both April and May. The monthly gains from January to March ranged from 0.1-0.2%.

The more robust income gains of late for landlords stem from rising rental rates and/or occupancy rates. To be sure, the high prices for new and existing homes, combined with the spike in mortgage rates this year, has created a good deal of affordability pressure for prospective buyers.

Many have been “priced out of the market” from the economics alone while others have been driven out by the psychological view that they might be buying at the top of a housing cycle. In either case, it is necessary to fall back on a rental unit until the forces and economics align to allow for the purchase of a home.

That, however, creates more demand for rental units, which inevitably leads to higher rental costs.

The June CPI report showed shelter costs increasing 0.6% month-over-month and 5.6% year-over-year. That increase was driven by a 0.8% gain in the rent of primary residences (+5.8% year-over-year) and a 0.7% increase in owners’ equivalent rent of residences (OER), which was up 5.5% year-over-year.

Those two components — the rent of primary residence and OER — make up nearly the entirety of the shelter cost, which accounts for 41.4% of core CPI. Accordingly, shelter costs have a disproportionate influence on the measurement of core CPI.

That matters greatly because Fed Chair Powell has conceded that the Fed’s policy tools don’t work on commodity price shocks (namely food and energy) that factor into total CPI. Hence, when making policy decisions, the Fed keeps a closer watch on core inflation, which wouldn’t include commodity price shocks.

What It All Means

The Fed has stated that its preferred inflation gauge is the core-PCE Price Index, but that doesn’t mean it won’t take the core-CPI reading into account, especially when the general public’s inflation expectations are influenced by the CPI data.

The problem the Fed is going to face, and which the market will need to get its mind around, is that shelter costs aren’t expected to fall off sharply in the near term, regardless of further rate increases. That’s because the manner in which the Consumer Price Index measures rent and OER lags home prices.

According to research done by Fannie Mae, house price gains on a year-over-year basis historically lead changes in the CPI shelter costs measures by about five quarters1. Home price gains have started to weaken, but the latest Case-Shiller Home 20-city Composite Price Index still showed prices up a hefty 20.5% year-over-year.

A moderation in house prices will work in favor of core CPI readings eventually, but there is still more catching up to do in terms of shelter costs that capture the home price appreciation. That is why core CPI levels could remain stuck at elevated levels that keep the Fed from turning friendly with its monetary policy as soon as the fed funds futures market thinks it might.

That understanding isn’t a problem now because the market is only projecting preferred outcomes at the moment for the path of monetary policy. That path, however, still needs to cut through a difficult proving ground.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse Market Recap WEEK OF JUL. 25 THROUGH JUL. 29, 2022 The S&P 500 index rose 4.3% last week and recorded a 9.1% July climb, its strongest monthly gain in nearly two years, as better-than-expected quarterly earnings fueled a relief rally. The S&P 500 ended Friday’s session at 4,130.29, up from last Friday’s closing level of 3,961.63. Last week’s advance helped lock in the S&P 500’s strongest month of gains since November 2020. Still, July’s 9.1% jump failed to erase all of June’s tumble; the index is still below May’s closing level of 4,132.15. For 2022, the S&P 500 is also still solidly in the red with a 13% drop for the year to date. The weekly climb came even as the Federal Reserve’s policy-setting committee raised its key rate by another 0.75 point and data indicated the US economy may have entered a recession. The rate increase, made Wednesday by the Fed’s Federal Open Market Committee, brought the central bank’s benchmark lending rate to a range of 2.25% to 2.5%, in line with Wall Street projections but marking the highest level since December 2018. The move, which marked the second month in a row that the rate was increased by 0.75 point, came two weeks after inflation data showed US consumer prices soared 9.1% in June. Gross domestic product data released Thursday showed the US economy shrank in the second quarter as consumer spending slowed, triggering questions over whether a recession has begun. The Q2 GDP contraction amounted to a 0.9% annualized drop and follows a 1.6% contraction in the first quarter. Recessions are often defined by two successive quarters of GDP contractions, but the National Bureau of Economic Research makes the official determination considering many factors. At a Wednesday press conference ahead of the GDP data, Fed Chairman Jerome Powell said there are “too many areas of the economy that are performing too well” for him to think the US is in a recession. Still, he acknowledged that demand was “moderating.” The week’s advance was broad, with every sector of the S&P 500 gaining. Energy had the largest percentage increase, up 10%, followed by a 6.5% climb in utilities and a 5.7% rise in industrials. Other sectors up by more than 5% each included consumer discretionary and technology. In the energy sector, shares of Hess (HES) climbed 11% as the oil and gas company reported Q2 adjusted EPS and revenue above year-earlier results and analysts’ mean estimates. The gainers in the utilities sector included shares of Edison International (EIX), which rose 11% from a week earlier as the company reported Q2 adjusted earnings per share and revenue above analysts’ mean estimates. The electric utility holding company reiterated its full-year EPS guidance. In industrials, shares of United Rentals (URI) jumped 18% as the equipment rental company reported Q2 adjusted EPS and revenue above year-earlier results and analysts’ mean estimates. The company also raised its guidance for 2022 revenue. Companies expected to release quarterly results next week include Activision Blizzard (ATVI), Advanced Micro Devices (AMD), Starbucks (SBUX), Caterpillar (CAT), CVS Health (CVS), Eli Lilly (LLY), ConocoPhillips (COP) and Berkshire Hathaway (BRK.A, BRK.B). On the economic front, the market will get July readings on the manufacturing and services sectors from Standard & Poor’s as well as the Institute for Supply Management in the earlier part of next week, but July jobs numbers due Friday are likely to receive the most attention. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end August 2022?

08-01-2022 +2.0%

Earnings:

Mon: JELD, ATVI, DVN, MOS, RMBS, RIG

Tues: CAT, CMI, DD, MAR, TAP, UBER, ABNB, CHK, MEA, PYPL, SBUX,

Wed: CLX, EBAY, MRO, CVS, UAA

Thur: COP, CROX, LLY, JCI, K, MUR, AMC, AMGN, BYND, GPRO, MNST, WYNN, SQ

Fri: FLR, CNK, DKNG

Econ Reports:

Mon: Construction Spending, ISM Manufacturing

Tues:

Wed: MBA, ADP Employment, Factory Orders, ISM Services

Thur: Initial Claims, Continuing Claims, Trade Balance

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Consumer Credit

How am I looking to trade?

Currently protection on some core holding and making decisions on earnings, after earning sI am letting some stocks run

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

MAGAZINE – WASHINGTON BRIEFING

Trucker strike in the Port of Oakland threatens supply chain disruptions

| July 21, 2022 11:00 PM

The Port of Oakland’s website boasts that it’s “one of the ten busiest container ports in the U.S.” and vital to keeping Northern California provisioned. Last year, Oakland handled “the equivalent of 1.05 million 20-foot import containers,” the port reported.

That works out to about 2,875 containers a day. A significant portion of that daily container haul was stopped on July 20 when the port shut operations down over a trucker protest of a California law called Assembly Bill 5.

“The cargo won’t flow / until AB5 goes!” chanted some protesters, according to the trade publication FreightWaves.

Many truckers and industry observers say that people who rely on such shipments will experience more delays and stoppages if the law goes into effect. AB5 regulates contractors by vastly curtailing their numbers via criteria called the “ABC Test.” California enacted the law in 2019, and it has proven so hard to make work that the legislature has carved out exceptions for about 100 industries — but not trucking.

“Courts using this test look at whether a worker meets three separate criteria to be considered an independent contractor,” the Legal Information Institute explains. Those criteria are that the worker is “free from the employer’s control or direction in performing the work,” that the work “takes place outside the usual course of the business of the company and off the site of the business,” and that the worker “is engaged in an independent trade, occupation, profession, or business.”

The California Trucking Association had used the Federal Aviation Administration Authorization Act of 1994, with its preemption of some state regulations of the transportation of goods under federal law, to win an initial judgment against applying such a test to trucking. Then, the 9th U.S. Circuit Court of Appeals weighed in against that interpretation. That decision was then stayed, pending Supreme Court review.

When the Supreme Court declined to take up the case on June 30, the stay was lifted. That put an estimated 70,000 owner-operators of trucks who currently do business in California into a precarious legal position.

Absent action by the California Legislature, Gov. Gavin Newsom’s government has promised to enforce the law rigorously. Yet in light of what that could do to California’s and broader American supply chain problems, Newsom’s administration hasn’t done anything yet and hasn’t said when it will.

“We understand the frustration expressed by the protestors at California ports,” said Danny Wan, executive director of the Port of Oakland, after the stoppage in a statement. “But, prolonged stoppage of port operations in California for any reason will damage all the businesses operating at the ports and cause California ports to further suffer market share losses to competing ports.”

He added a caution to the state government. “We trust that implementation of AB5 can be accomplished in a way that accommodates the needs of this vital part of the supply chain,” Wan said.

R Street Institute’s western region director, Steven Greenhut, who lives in California, is not convinced that his state’s current government will be up to fixing the problem. “California lawmakers exempted more than 100 professions from their misguided ban on independent contracting, Assembly Bill 5,” he told the Washington Examiner. “But they never bothered to address the impact of their law on trucking, which is one of the most important functions in our economy.”

Greenhut said it was “astounding” that lawmakers didn’t act on this “given the ongoing supply chain disruptions and the backlog at the LA area ports.” He also had some sympathy for the protesters. “I don’t blame the truckers for protesting,” Greenhut said, though he qualified that by saying, “I don’t support halting traffic.”

He added, “The state also has imposed tough diesel emission rules that have already reduced the number of truckers. Instead of running political ads in Florida, perhaps Gov. Gavin Newsom should address these severe problems here in California.”

The Biden administration is considering forgiving the student debt for millions of Americans. Here’s why

KEY POINTS

- The Biden administration is considering forgiving the student debt of millions of Americans.

- Here are some of the key reasons why that may happen.

The Biden administration is considering wiping out hundreds of billions of dollars in student debt. Its announcement could come as soon as next month.

Why would the federal government relieve a large portion of the loans it gave out?

These are some of the main reasons, according to experts.

1. A growing sense the system is broken

With the cost of attending higher education ballooning and household wages sputtering over the last few decades, more families have had to turn to loans to cover their children’s college bills. Average student loan balances at graduation have almost tripled since 1980, from around $12,000 to more than $30,000 today.

The country’s outstanding education debt balance now exceeds $1.7 trillion and poses a larger burden to households than credit card or auto debt.

Borrowers complain that the lending system is riddled with problems.

About 20% of federal student loan borrowers attended for-profit colleges, many of which have come under fire for misleading students and failing to provide them with a quality education. Half of students who leave these schools end up defaulting on their loans.

The U.S. Department of Education has also not made good on many of its promises, said Persis Yu, policy director for the Student Borrower Protection Center.

Millions of people enrolled in programs that supposedly lead to debt forgiveness after a certain period of time haven’t received promised help. That includes borrowers in income-driven repayment plans and the popular public service loan forgiveness program, who have been stuck continuing to pay after being rejected for the relief, often for technical and confusing reasons.

The companies that service federal student loans also have been accused of giving borrowers wrong and incomplete information.

“There have been decades of mismanagement, abusive practices and general incompetence, which has resulted in millions of borrowers missing out on many of the vital programs and benefits afforded under the law,” Yu said.

2. Concern that much debt won’t be repaid anyway

One of the arguments for forgiving student loans is that millions of borrowers will never pay off their debt anyway.

According to a rough estimate by higher education expert Mark Kantrowitz, just about half of federal student loan borrowers, or 20 million people, were in repayment prior to the pandemic. A quarter — or more than 10 million people — were in delinquency or default. Many others had applied for temporary relief for struggling borrowers, including deferments or forbearances.

These grim figures led to comparisons to the 2008 mortgage crisis.

In the meantime, student loan borrowers face a host of consequences from having tens of thousands of dollars on their personal balance sheets, including difficulty buying a house and starting a business.

3. Midterms are looming

The Biden administration has said that its announcement on student loan forgiveness is coming soon, which means the news could break shortly before Americans vote in the midterm elections in November.

Advocates have said that forgiving student debt will galvanize younger voters at the polls, which is likely appealing to the president. He’s been losing popularity with the demographic.

“It could make or break the Democrats in battleground states,” said Astra Taylor, co-founder of the Debt Collective, a union for debtors.

Yet sweeping student loan forgiveness will also likely anger many Americans, including those who never borrowed for their education or went to college. Some Republicans have said they will try to block an effort by the president to cancel the debt. Rep. Kevin Brady, R-Texas, ranking member of the House Ways and Means Committee, recently called student loan forgiveness “a giveaway to highly educated college grads.”

Overall, though, the majority of voters (62%) support student loan forgiveness, according to a poll by Morning Consult.

The Fed just raised interest rates by another 0.75%—here are 5 things that will be more expensive

To combat untamed inflation, the Federal Reserve raised its key interest rate by another 0.75% on Wednesday — further increasing how much consumers will pay on debt like credit cards, mortgages and other loans.

The federal funds rate, which indirectly determines the cost of loans, has increased from near-zero to a range of 2.25% to 2.5%. This is the fourth rate hike in five months.

Rate hikes increase the costs of borrowing money, which can help slow inflation. But they also result in added costs for consumers already dealing with elevated prices for goods and services.

Here’s a look five things that will become more expensive:

1. Credit cards

With the Federal Reserve raising interest rates, your credit card’s annual percentage rate will likely increase within a couple of billing cycles. That means you’ll be paying more on any outstanding credit card debt that isn’t paid off by the end of the month.

A 2.25% year-to-date rate increase means that for a cardholder making the minimum payment on a $5,000 credit card balance, it will take an additional five months and $868 in interest to pay the card off completely, according to calculations provided by Bankrate.com.

2. Car loans

Auto loan lenders use the Fed’s benchmark rate to determine the interest rate you’ll pay on financing. This won’t affect borrowers already locked into fixed-rate financing, but new car loans or those with variable-rate financing will likely go up in cost.

A 2.25% year-to-date rate increase means that for a $35,000, 5-year new car loan, the monthly payment would be $36 higher now compared to a loan taken out at the beginning of the year, per calculations provided by Bankrate.com.

3. Adjustable-rate mortgages

The Fed’s benchmark indirectly affects rates on variable-rate mortgages, also known as adjustable-rate mortgages, or ARMs. Most homeowners are locked into fixed-rate mortgages, so they are unaffected by rate hikes unless they are refinancing or signing up for a new loan.

Borrowers with ARMs can expect a bump in the interest rate on their home loans, although it will vary based on the lender, the mortgage size and their credit score. That said, the average interest rate for five-year ARMs have nearly doubled since the beginning of the year, which coincides with four Fed rate hikes in that time.

4. Private student loans

Borrowers with federal student loans will be unaffected by the rate hike as interest rates for these loans are set by Congress, based on 10-year Treasury note yields. Plus, there is a payment and interest freeze on federal student loans still in effect through Aug. 31, which might be extended even further.

However, borrowers with private, variable-rate student loans could see an increase in how much they pay in interest charges, usually within a month of the rate hike. This would also apply to new borrowers signing up for private, fixed-term student loans after the rate hike kicks in. The rates for these types of loans tend to rise with the federal funds rate — though technically, they aren’t directly linked.

Interest rates and terms on private student loans can vary depending on your financial situation, credit history and the lender you choose.

5. Other variable-rate loans

Expect increased costs for variable-rate loans like personal loans and home equity lines of credit (HELOC).

Lenders for these types of loans set their prime rate — the lowest rate offered for the most qualified buyers — based on the Fed’s benchmark rate. That means that the interest you pay will increase, although what you will pay will vary based on your lender, the size of the loan and your credit score.

House passes bill to boost U.S. chip production and China competition, sending it to Biden

Kevin Breuninger@KEVINWILLIAMB

KEY POINTS

- The House passed bipartisan legislation to boost U.S. competitiveness with China by allocating billions of dollars toward domestic semiconductor manufacturing and science research.

- The bill now heads to the White House for President Joe Biden to sign it into law.

- Republican leaders urged Congress to vote against the Chips and Science Act after Senate Democrats Chuck Schumer and Joe Manchin revealed that they have struck a deal on a sweeping reconciliation bill.

The House on Thursday passed bipartisan legislation to boost U.S. competitiveness with China by allocating billions of dollars toward domestic semiconductor manufacturing and science research.

The bill passed 243-187, with no Democrats voting against the bill. Twenty-four Republicans voted for the legislation, even after a last-minute push by GOP leaders to oppose it.

The bill, which passed the Senate on Wednesday, now heads to the White House for President Joe Biden to sign into law.

It is “exactly what we need to be doing to grow our economy right now,” Biden said in a statement after the vote. “I look forward to signing this bill into law.”

Lawmakers pushed to quickly approve the package before they depart Washington, D.C., for the August recess. But the final vote came after years of wrangling on Capitol Hill, with the legislation taking numerous forms, and names, in both chambers of Congress.

The ultimate version, known as the Chips and Science Act, includes more than $52 billion for U.S. companies producing computer chips, as well as billions more in tax credits to encourage investment in chip manufacturing. It also provides tens of billions of dollars to fund scientific research, and to spur the innovation and development of other U.S. technologies.

House Speaker Nancy Pelosi, D-Calif., called the bill “a major victory for American families and the American economy.”

But House Republican Leader Kevin McCarthy, R-Calif., urged his colleagues to “reject this deeply flawed bill” and “start from scratch” in floor remarks before the vote.

The Senate passed the bill Wednesday in a 64-33 vote, drawing support from 17 Republicans. Among those yea votes was Senate Minority Leader Mitch McConnell, R-Ky., who previously warned that Republicans would not back the China competition bill if Democrats continued to pursue an unrelated reconciliation package.

Hours after Wednesday’s bipartisan Senate vote, Senate Majority Leader Chuck Schumer, D-N.Y., and Sen. Joe Manchin, D-W.Va., revealed that they have struck a deal on a sweeping reconciliation bill.

“It’s been a momentous 24 hours here in Congress, a legislative one-two punch that the American people rarely see,” Schumer said in a post-vote victory lap Thursday afternoon.

Schumer and Manchin hope to pass their reconciliation package next week with just a simple majority in the Senate, which is evenly split between Republicans and Democrats with Vice President Kamala Harris casting any tiebreaking votes.

Shortly after that deal was announced, House Republican leaders urged their members to vote down the Chips and Science Act. They argued against giving multibillion-dollar subsidies to chipmakers at a time of historically high inflation, while also noting the timing of the Democrats’ reconciliation deal.

“The partisan Democrat agenda has given us record inflation, and now they are poised to send our country into a crushing recession,” the office of House Minority Whip Steve Scalise, R-La., said in a memo Wednesday night.

Republicans echoed that new stance during floor debates before the vote. Rep. Frank Lucas, the top Republican on the House Science Committee where many of the bill’s provisions had first been hashed out, said he would regretfully vote against it because it has been “irrevocably” linked to the reconciliation plan.

That committee’s chairman, Rep. Eddie Bernice Johnson, D-Texas, responded with a plea for all lawmakers to “put aside politics” and vote for the bipartisan bill.

Some Republicans who opposed the bill on its own merits said it lacked “guardrails” to prevent any of the funding from winding up in China’s hands. Other critics have argued that the U.S. would have to spend many billions more to have a real chance at competing with the world’s leading chipmakers.

But the bill’s advocates say it is vital to America’s economy and national security to build more chips, which are increasingly critical components in a vast array of products including consumer electronics, automobiles, health-care equipment and weapons systems.

The chips have been in short supply during the Covid-19 pandemic. Factory shutdowns at the beginning of the outbreak sidelined chip production in Asia while consumer demand for autos and upgraded home electronics that need the chips surged during the lockdowns. The U.S. share of global chip production also has fallen sharply in recent decades, while China and other nations have invested heavily in the industry.

The U.S. also makes few of the most advanced types of semiconductors, which are largely produced in Taiwan, the epicenter of rising political tensions with China.

Much modern warfare requires sophisticated semiconductors — each Javelin missile launching system contains hundreds, for instance — leading U.S. defense officials to worry about the nation’s reliance on foreign producers for its chip supply.

Biden has also blamed the chip shortage for the sky-high inflation that has dogged his presidency. A lack of chips available for new-car manufacturing has been linked to soaring prices for used cars, which are pushing inflation higher.

“America invented the semiconductor. It’s time to bring it home,” Biden said this week.

HI Financial Services Mid-Week 06-24-2014