HI Market View Commentary 05-30-2022

So each week I look for something to teach as well as what we are currently doing.

I spend countless hours reading to give you the most up to date information from reliable sources.

These guys are new and I am looking forward to using them for the time being as they seem to have interesting information.

Reasons To Be Bullish. Are There Any?

By Lance Roberts | May 28, 2022

In this 05-26-22 issue of “Reasons To Be Bullish. Are There Any?”

- Market Review & Update

- Are There Any Reasons To Be Bullish?

- Portfolio Positioning

- Sector & Market Analysis

·

Market Finally Rallies

Over the last few weeks, we have been a bit of a broken record suggesting a counter-trend rally was likely. However, that rally remained very elusive. Finally, a rally took hold this week, as investors found reasons to be bullish pushing the market above the 20-dma and triggering a fairly strong “buy” signal.

As John Murphy noted on Friday:

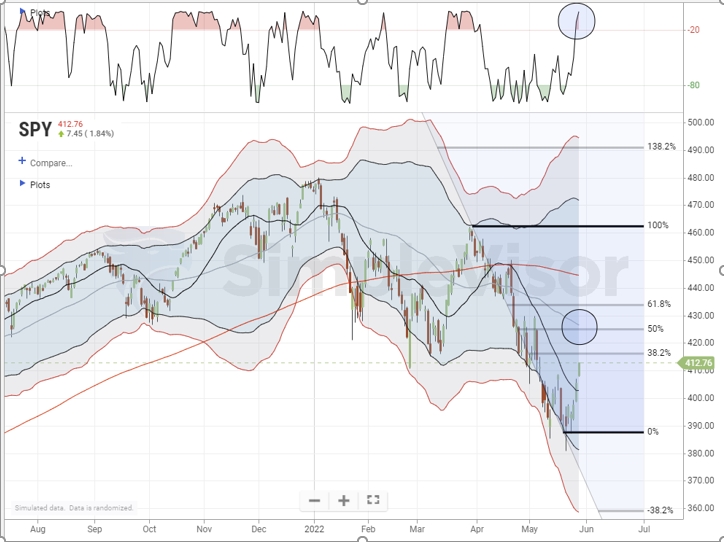

“Stocks are having their best week in two months which suggests that a short-term bottom may be in place. The weekly bars show the S&P 500 bouncing off its 38% Fibonacci retracement line measured from its 2020 bottom to this year’s top. That’s not usual because those retracement lines often provide some support. That’s especially true if the market has reached an oversold condition — which it has.”

Notably, as shown, the market was also 3-standard deviations below its 1-year moving average which further added support for a bounce.

As John continues:

“The daily bars show the S&P 500 exceeding its mid-May peak to turn its short-term trend higher. Stocks, however, have a lot of overhead resistance barriers to deal with.

The grey horizontal lines measure Fibonacci retracement lines measured from their late March peak to their May bottom. Those three lines should now act as overhead resistance barriers. The SPX has already reached the lower line at 38%. More substantial resistance is likely at the two higher lines at 50% and 62%. Moving average lines should also act as overhead resistance. That’s especially true of the blue 50-day average which may be tested (blue circle).

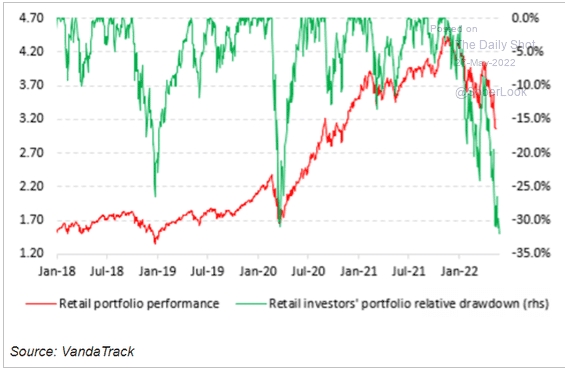

We agree with John’s analysis, which, at least for now suggests that rallies should be sold into, portfolios rebalanced, and cash levels raised. As we will discuss below, with the average investor down 30% this year, there are many “trapped longs” looking for an exit.

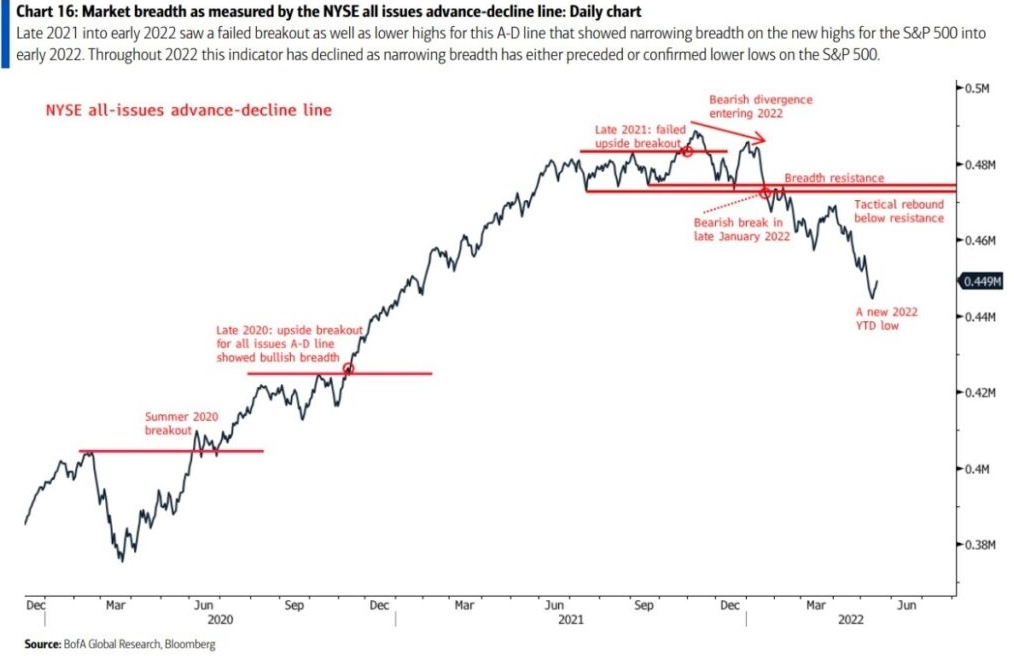

Markets Are Weakest When Narrow

“In this market environment, it seems everything moves up or down, with these swings changing on a day-to-day, or sometimes minute-to-minute, basis. This is not market leadership.

Bob Farrell, one of the O.G. gods of technical analysis, explains why this dynamic is such a problem for any bulls still out there. Spelling it out in rule seven of his famous 10 rules of investing,Farrell said, ‘Markets are strongest when they are broad and weakest when they narrow to a handful of blue chip names.’” – Yahoo Finance

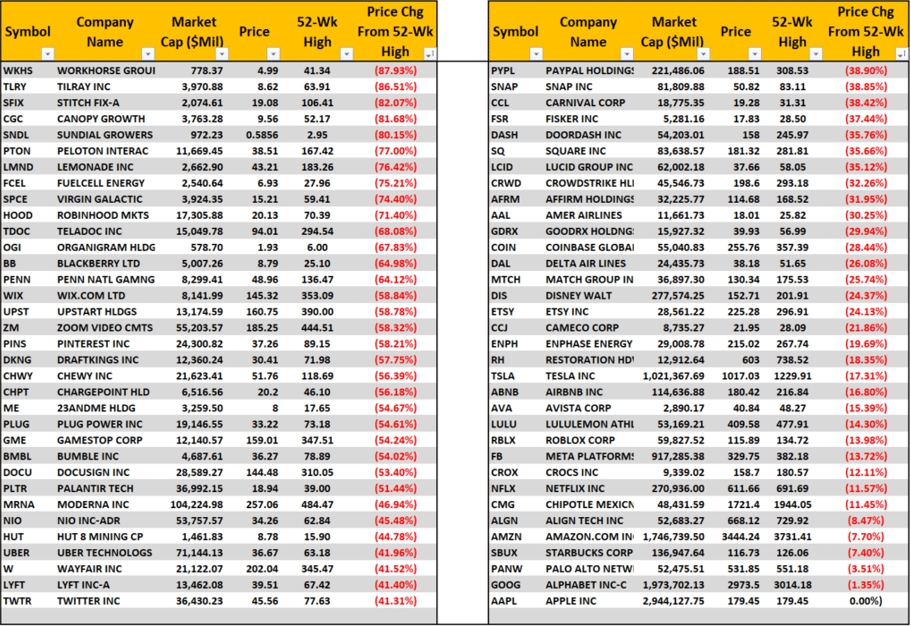

That “weakness” in the market leadership has been highly evident over the last 6-months. As discussed in December last year, despite the S&P 500 minting a 28% total return last year, there was a lot of devastation happening below the surface. To wit:

“Without the support of the top-10 holdings, the year-to-date returns and overall volatility would be very different.

Looking at a sampling of the more ‘popular’ trading stocks, you can understand current retail traders’ frustration. A vast majority of 2020 and early 2021’s high-flying stocks are down significantly from their respective 52-week highs.”

Since publishing that table in mid-December 2021, many of those stocks tumbled even further this year. The issue of narrow breadth is now readily apparent. As noted by Yahoo Finance:

“The following chart from Bank of America technical research strategist Stephen Suttmeier, CFA, CMT shows the New York Stock Exchange advance-decline line.”

Such is a textbook example of a market lacking solid leadership. The damage suffered by the biggest stocks in the market no longer gets concealed.

But are there reasons to be bullish?

Are There Any Reasons To Be Bullish

For the last few weeks, we discussed the highly bearish sentiment, oversold conditions, and seemingly endless selling of equities. With the Fed set to hike rates over the next few months in 50 bps increments, inflation running hot, and the economy slowing, investors’ negative bias is not surprising. Of course, from a contrarian viewpoint, such begs the question, “are there any reasons to be bullish?”

The answer, at least short-term, is “yes.”

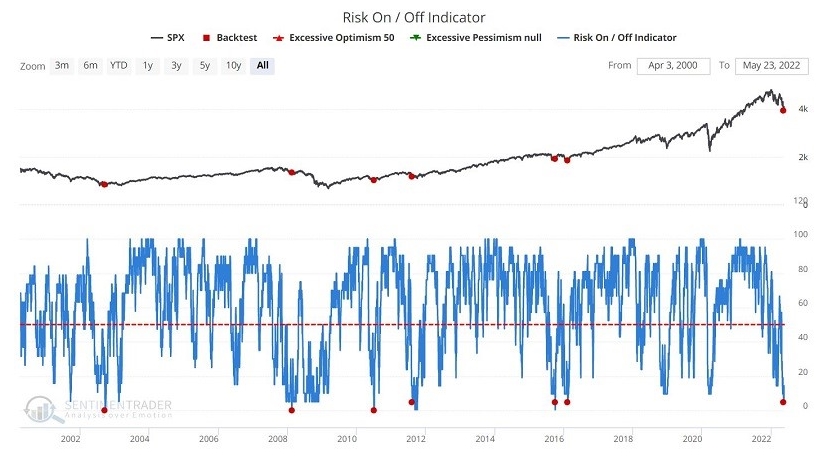

The chart from Sentiment Trader below shows the performance of the S&P 500 Index when the Risk On/Risk Off indicator crosses below 4.9 for the first time in three months. While it does denote short-term bottoms, it doesn’t necessarily suggest the “bear market” is over, as seen in 2008.

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 27-May-22 15:26 ET | Archive

Investors see benefit of stock market’s shift work

There has been a shift in the marketplace. It is unclear still if it is a temporary or more permanent shift, but various points of interest have new bearings that have the stock market in a better place at the end of this week than it has been in some time.

A Monumental Reversal

As of this writing, the S&P 500 is up 6.0% for the week and back above 4,100. That has been a welcome move by investors going into the Memorial Day weekend.

There is a lot of moving left to do, though, to reclaim the high the S&P 500 reached in January, which is 14.1% above its current level. We won’t dwell on that. Instead, we will dwell on the fact that there was an ample amount of bad news this week, yet the stock market chose either to focus on the good news this week or to find some good news in the bad news.

A few cases in point include the responses to disappointing guidance from retailer Dick’s Sporting Goods (DKS) and semiconductor company NVIDIA (NVDA).

Dick’s Sporting Goods cut its FY23 EPS outlook well below the consensus estimate. The stock traded down as much as 17% in pre-market action following the report. DKS, however, made up all of that lost ground and then some, closing 9.7% higher the day of its report (May 25).

Following the close of trading on May 25, NVIDIA reported better-than-expected fiscal Q1 earnings, but issued fiscal Q2 revenue guidance that was below the consensus estimate. NVDA traded down as much as 10% in the after-hours session, but during regular trading on May 26, it made up the entirety of that loss and closed the day 5.2% higher.

The important context is that, going into their reports, DKS was down 52% from the all-time high it hit last September and NVDA was down 51% from the all-time high it hit in November. The knee-jerk selling on the disappointments was understandable, but the subsequent rebounds from a sentiment standpoint were monumental.

They conveyed seller exhaustion, which in turn incited buying interest in the broader market that was predicated on the thinking that many stocks have gotten deeply oversold on their own bad news and/or the fear of bad news to come.

Shifting Trends

The reversals in DKS and NVDA were important, but they weren’t the only shifts in trading patterns that have infused some better sentiment into the marketplace.

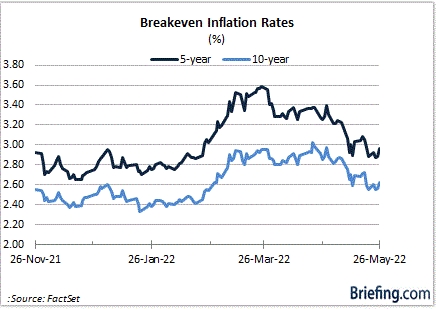

There has been a shift in breakeven inflation rates unfolding in recent weeks. That is true for both 5-year breakeven inflation rates and 10-year breakeven inflation rates, which are signaling what market participants expect the inflation rate, on average, to be over the next five years and ten years.

The chart below shows breakeven rates have been coming down. In late March, the 5-year breakeven rate hit 3.59%. Today it is 2.96%. In April, the 10-year breakeven rate hit 3.02%. Today it is 2.62%.

This is exactly what the Fed wants to see. Its aim in driving up policy rates isn’t just to quell inflation, it is also intended to quell inflation expectations. One can say, then, that the Fed, with its tough-sounding rate-hike rhetoric, has had some success in curtailing inflation expectations.

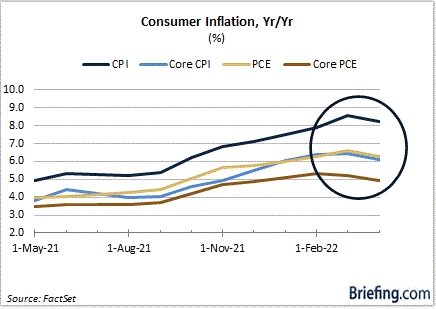

Actual inflation remains another matter, but even there the marketplace has found some basis to think the inflation rate might have peaked. There has been some incremental improvement in the trends for consumer inflation rates.

The idea that inflation might have peaked and could/should come down further has also been working its way into market pricing. Market participants are anticipating some disinflation in coming months for a variety of reasons:

- China’s economy gets going again after its Covid-related lockdowns and supply chain bottlenecks ease.

- The high inflation rates themselves, particularly for food and gas, create demand destruction.

- Declines in real earnings and the personal savings rate (currently the lowest since 2008 at 4.4%) prompt consumers to trade down to less expensive items and/or cut back on discretionary spending.

- Inventory bloat, which was apparent on the balance sheet for a growing number of retailers, triggers aggressive promotional activity.

- The Fed has acknowledged that it likes the idea of getting to the neutral rate expeditiously and has conceded that it may have to move to a restrictive policy stance.

- Companies talking about slowing hiring, freezing hiring, or cutting staff, starts to temper some wage-based inflation pressures.

What is anticipated and what comes to fruition remains to be seen. There is a strong case to be made today that supports the disinflation view, but with the war in Ukraine still going, energy investment still constrained, and China still clinging to a zero-Covid policy, there are hurdles in our midst that could slow the rate of improvement.

In any case, the market is starting to discount the likelihood that the Fed could slow its aggressive rate-hike approach in the latter half of the year. The FOMC Minutes for the May 3-4 FOMC meeting, and some Fed officials themselves, have hinted at the possibility.

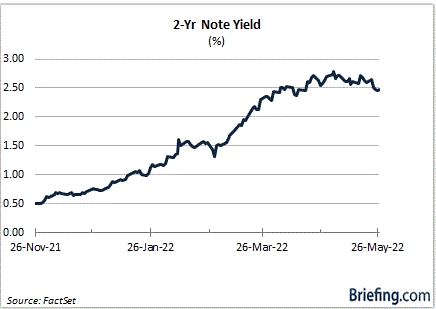

This potential policy shift has been manifesting itself in the 2-yr note yield, and it has been making some headway this week in the fed funds futures market.

The yield on the 2-yr note, which is most sensitive to changes in the fed funds rate, dropped 11 basis points this week to 2.46%, but it is down 29 basis points from its high on May 3. Meanwhile, the fed funds futures market now sees only a 37.8% probability of a 50 basis point rate hike at the September meeting, versus 52.7% a week ago, according to the CME’s FedWatch Tool.

The softening in rate-hike expectations, combined with the downshift in the 10-yr note yield from 3.17% earlier this month to 2.74% today, has certainly contributed to the rebound-minded activity in the stock market this week.

What It All Means

Shift work is not typically easy, yet the stock market made it look somewhat easy this week.

Everything rebounded for the most part, and it was many of the market’s most beaten-down areas, like mega-cap stocks, semiconductors, and consumer discretionary issues, that were among the best performers.

It was an overdue rally effort. Coming into the week, the S&P 500 and Nasdaq Composite had suffered losing weeks for seven consecutive weeks. The Dow Jones Industrial Average had an eight-week losing streak, something it has not accomplished in nearly 100 years.

The stock market was like a coiled spring waiting to be sprung, and it made the most of some tonal shifts to bounce like it did.

In the end, it was largely a sentiment-driven rally that presumably got the added benefit of month-end rebalancing activity. The stock market has a lot of work left to do, however, to make it clear in hindsight that this week was more than just temporary shift work.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse |

| Nothing posted for this week |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end June 2022?

05-30-2022 +3.0%

Earnings:

Mon: Memorial Day

Tues: HPQ, CRM, SPWH

Wed: WB, GME, HPE, NTAP, PVH

Thur: HRL,

Fri:

Econ Reports:

Mon: Memorial Day

Tues: FHFA Housing Price Index, Case-Shiller, Chicago PMI, Consumer Confidence

Wed: MBA, ISM Manufacturing, Jolts, Construction Spending,

Thur: Initial Claims, Continuing Claims, ADP employment, Productivity, Unit Labor Costs, Factory Orders,

Fri: Average Workweek, Non-Farm Payroll, Pruivate Payroll, Hourly Earnings, Unemployment Rate, ISM Services Index

How am I looking to trade?

Currently we have started to let positions run without protection

Ready to start to add some share back into he portfolios as we have been holding onto cash since last November

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Fed is losing credibility over its inflation narrative, Mohamed El-Erian says

KEY POINTS

- “I’ve argued that it is really important to reestablish a credible voice on inflation and this has massive institutional, political and social implications,” El-Erian said Monday.

- He was speaking to CNBC’s Dan Murphy at the ADIPEC energy industry forum in Abu Dhabi, the United Arab Emirates.

- Fed Chair Jerome Powell has previously said he expects inflation conditions to persist “well into next year” and conceded it is “frustrating” that supply chain issues are showing no sign of improvement.

The Federal Reserve is losing credibility over its long-standing view that inflation is transitory, according to Mohamed El-Erian, chief economic advisor at Allianz.

“I think the Fed is losing credibility,” El-Erian said Monday. “I’ve argued that it is really important to reestablish a credible voice on inflation and this has massive institutional, political and social implications.”

He was speaking to CNBC’s Dan Murphy at the ADIPEC energy industry forum in Abu Dhabi, the United Arab Emirates.

El-Erian contended that the Fed’s inflation stance weakened the central bank’s forward guidance and undermined President Joe Biden’s economic agenda. He said that people shouldn’t forget that those on low incomes are hardest hit by rising consumer prices.

“So, it is a big issue and I hope that the Fed will catch up with developments on the ground,” he added.

A spokesperson for the Federal Reserve was not immediately available to comment when contacted by CNBC.

Fed Chair Jerome Powell has previously said he expects inflation conditions to persist “well into next year” and conceded it is “frustrating” that supply chain issues are showing no signs of improvement. The Fed has largely stuck to its messaging, however, that rising inflation is largely tied to the coronavirus pandemic and these supply chain problems will pass.

The consumer price index, which covers products ranging from gasoline and health care to groceries and rents, rose 0.9% on a monthly basis in October, the Labor Department reported on Nov. 10, significantly higher than expectations. The reading climbed to 6.2% year over year, hitting its highest point since December 1990.

‘It is not transitory’

“We are in this transition of central banks mischaracterizing inflation. The repeated narrative: ‘It is transitory, it is transitory, it is transitory.’ It is not transitory,” El-Erian said, warning the Fed risked making a major policy mistake.

“We have ample evidence that there are behavioral changes going on,” El-Erian said. “Companies are charging higher prices [and] there’s more to come. Supply disruptions are lasting for a lot longer than anybody anticipated. Consumers are advancing purchases in order to avoid problems down the road — that of course puts pressure on inflation. And then wage behaviors are changing.”

“So, if you look at the underlying behavioral element that leads to inflation, you come up with the conclusion that this will last for a while. And that’s even before you talk about the renewed Covid disruptions,” he added.

El-Erian cited the reintroduction of public health restrictions and the closure of ports in big manufacturing nations, such as China and Vietnam, as examples of renewed supply chain disruptions.

When asked what the most appropriate response from the Fed would be, El-Erian said, “To accelerate, in December, the pace of tapering.”

The Fed said on Nov. 3 that it would start tapering the pace of its monthly bond purchases “later this month.” The process will see reductions of $15 billion each month — $10 billion in Treasurys and $5 billion in mortgage-backed securities — from the current $120 billion a month that the Fed is buying.

“And secondly, start doing what the Bank of England is doing … which is start preparing people for higher interest rates,” El-Erian said, citing similar steps taken by central banks from Australia, New Zealand and Norway, among many others.

— CNBC’s Jeff Cox contributed to this report.

Correction: Mohamed El-Erian spoke Monday. An earlier version misstated the day.

Schwab, TD Ameritrade, Fidelity Accused of Collusion, Price Fixing

Stephen Greco sued the firms and has also made allegations against Creative Planning and its chief executive officer.

May 24, 2022

A new lawsuit accuses Schwab, TD Ameritrade and Fidelity — acting in their capacity as the largest custodians for registered investment advisor firms — of anti-competitive behavior, according to news reports.

The firms allegedly engaged in collusion and price-fixing and included Creative Planning in their scheme, FA-IQ sister publication Ignites writes, citing the suit filed by Stephen Greco last week in Illinois federal court.

From 2013 to 2017, Greco served as Creative Planning’s national director of wealth management, prior to which he spent around seven years at TD Ameritrade, the bulk of them as branch manager of the firm’s Chicago office, according to the publication.

The suit also accuses Creative Planning — which has acquired close to 30 RIA firms since 2019 — as well as chief executive officer Peter Mallouk of inflating the company’s assets under management, segregating unmanaged assets to inflate advisory fees and misleading Securities and Exchange Commission auditors, Ignites writes.

“This case is about massive-scale collusion in the investment advisor industry, an industry subject to the rare federal fiduciary standard, and long-recognized to be of paramount importance to our national economy,” the complaint says, according to the publication.

In 2016, Greco, citing malfeasance at Creative Planning, formed Spotlight Asset Group, Ignites writes. In 2017, Greco filed antitrust claims with the SEC involving Creative Planning and TD Ameritrade, according to the publication.

Mallouk and Greco reached a confidential settlement in 2017, Ignites writes, citing a 2020 lawsuit filed in Kansas federal court by Mallouk accusing Greco of soliciting Creative Planning employees and making disparaging comments about Mallouk to reporters. Greco claimed that Mallouk was using the suit to retaliate against him for going to the SEC, according to the publication.

In 2019, TD Ameritrade and Schwab filed separate arbitration claims against Spotlight, accusing the firm of hiring away advisors from them and then soliciting client assets, Ignites writes.

In February 2020, Greco filed a complaint with the U.S. Department of Justice alleging collusion and anti-competitive practices involving Creative Planning, TD Ameritrade and Schwab, three months after Schwab announced its plans to buy TD Ameritrade, Ignites writes.

A lawyer for Creative Planning says that last week’s lawsuit is based on “malicious claims [that] are completely meritless and wholly denied,” according to the publication.

An SEC spokesperson declined comment to Ignites, while the DOJ and Fidelity didn’t respond to the publication’s request for comment.

A Schwab spokesperson said that the firm plans “to defend ourselves against these meritless allegations,” according to Ignites.

Greco’s suit filed last week also names General Atlantic, which in 2020 bought a minority stake in Creative Planning, according to the publication.

A General Atlantic spokesperson said the lawsuit is without merit.

Do you have a news tip you’d like to share with FA-IQ? Email us at editorial@financialadvisoriq.com.

Treasury Secretary Janet Yellen says Americans will likely see another year of ‘very uncomfortably high’ inflation

KEY POINTS

- Treasury Secretary Janet Yellen said Thursday that Americans will likely see another year of “very uncomfortably high” inflation.

- “We have seen a very meaningful increase in gas prices, and my guess is that next month we’ll see further evidence of an impact on U.S. inflation of Putin’s war on Ukraine,” Yellen said.

- The Treasury secretary’s comments came just hours after the Labor Department said consumer prices rose 7.9% in February, the fastest pace since 1982.

Treasury Secretary Janet Yellen said Thursday that Americans will likely see another year of “very uncomfortably high” inflation as Russia’s invasion of Ukraine muddles her prior forecast that price acceleration would moderate in the months ahead.

“I think there’s a lot of uncertainty that is related to what’s going on with Russia in Ukraine,” Yellen told CNBC’s “Closing Bell.”

“And I do think that it’s exacerbating inflation. I don’t want to make a prediction exactly as to what’s going to happen in the second half of the year,” she continued. “We’re likely to see another year in which 12-month inflation numbers remain very uncomfortably high.”

The Treasury secretary’s comments came just hours after the Labor Department published its latest gauge on how fast prices are climbing for American consumers. The report showed that consumer prices rose 7.9% in the 12 months ending in February, the hottest pace of inflation since 1982.

Those remarks also come just months after Yellen told CNBC that she expected inflation to moderate toward the end of 2022 as supply-chain hiccups resolved and met fiery consumer demand for goods.

She was reluctant to make a similar forecast on Thursday. Yellen said that Russia’s attack on Ukraine has introduced more uncertainty and driven up the price of several commodities including crude oil and wheat.

Crude oil futures leaped to multiyear highs earlier this week as the Kremlin intensified its assault on Kyiv, sending the price of West Texas oil for April delivery to nearly $130 a barrel on Tuesday. It has retreated somewhat since then and was last trading around $105 a barrel on Thursday.

But the price is still up about $30 a barrel from three months ago.

“We have seen a very meaningful increase in gas prices, and my guess is that next month we’ll see further evidence of an impact on U.S. inflation of Putin’s war on Ukraine,” Yellen said.

“Russia, in addition to exporting oil … Ukraine and Russia are major producers of wheat,” she added. “We’re seeing impacts on food prices, and I think that can have a very severe effect on some very vulnerable emerging market countries.”

The Treasury Department has led the Biden administration’s economic sanctions against Moscow, depriving the country of its access to U.S. dollars and blocking access to a significant portion of the global banking system.

Yellen said the litany of penalties against Russia have been overwhelming and that she continues to consult with her counterparts around the world on how to intensify sanctions if warranted.

“I think the sanctions have been devastating in their economic impact,” Yellen said. “We have all but cut Russia off from the international financial system.”

“The export controls that we have put in place will have a devastating longer, medium-run effect in depriving Russia of the technology that they need to run a modern economy and advance in defense and other areas,” she said. “Russia is experiencing very severe economic consequences. I expect there to be a severe downturn in the Russian economy.”

JPMorgan Chase reports $524 million hit from market dislocations caused by Russia sanctions

KEY POINTS

- Here are the numbers: adjusted earnings of $2.76 a share vs $2.69 estimate.

- Revenue: $31.59 billion vs. $30.86 billion estimate

- In remarks, CEO Jamie Dimon said he saw “significant geopolitical and economic challenges ahead due to high inflation, supply chain issues and the war in Ukraine.”

JPMorgan Chase said Wednesday that first-quarter profit fell sharply from a year earlier, driven by increased costs for bad loans and market upheaval caused by the Ukraine war.

Here are the numbers:

- Adjusted earnings: $2.76 a share vs $2.69 estimate.

- Revenue: $31.59 billion vs. $30.86 billion estimate, according to Refinitiv.

Profit fell 42% from a year earlier to $8.28 billion, or $2.63 a share, the New York-based bank said. Adjusted earnings of $2.76, which excludes the 13-cent impact tied to Russia, exceeded the $2.69 estimate of analysts surveyed by Refinitiv.

Revenue dropped a more modest 5% to $31.59 billion, exceeding analysts’ estimate for the quarter, helped by better-than-expected trading results.

Shares of the bank dipped 3.2%, reaching a new 52-week low.

The quarter illustrated how quickly events have changed the industry’s outlook. A year ago, JPMorgan CEO Jamie Dimon predicted a long-running economic expansion and banks were reaping benefits as billions of dollars in loan loss reserves were released. Now, amid rampant inflation and the worst European conflict since World War II, Dimon called attention to the possibility of a recession ahead.

JPMorgan said it took a $902 million charge for building credit reserves for anticipated loan losses, compared with a $5.2 billion release a year earlier. The bank also booked $524 million in losses driven by markdowns and widening spreads after Russian’s invasion of its neighbor.

Combined, the two factors sapped 36 cents from the quarter’s earnings, the bank said.

Dimon said he built up credit reserves because of “higher probabilities of downside risk” in the U.S. economy, specifically from the impact of high inflation and the Ukraine conflict.

“We remain optimistic on the economy, at least for the short term – consumer and business balance sheets as well as consumer spending remain at healthy levels – but see significant geopolitical and economic challenges ahead due to high inflation, supply chain issues and the war in Ukraine,” Dimon said.

The bank’s provision for credit losses, which includes the $902 million reserve build, was $1.46 billion, more than double the $617.5 million expected by analysts.

JPMorgan, the biggest U.S. bank by assets, is closely watched for clues to how Wall Street fared during a tumultuous first quarter. On the one hand, investment banking fees were expected to plunge because of a slowdown in mergers, IPOs and debt issuance in the period. On the other hand, spikes in volatility and market dislocations caused by the Ukraine war may have benefited some fixed income desks.

That means there may be more winners and losers on Wall Street than usual this quarter: Firms that navigated the choppy markets well could exceed expectations after analysts slashed estimates in recent weeks, while others could disclose trading blowups.

Indeed, fixed income trading revenue of $5.7 billion in the quarter exceeded analysts’ estimates by roughly $800 million, and equities trading revenue of $3.1 billion topped estimates by nearly $500 million. At the same time, investment banking revenue of $2.1 billion came in below the $2.37 billion estimate.

JPMorgan said last month that its trading revenue dropped 10% through early March, but that turbulence tied to the Ukraine war and sanctions on Russia made further forecasts impossible.

“The markets are extremely treacherous at the moment; there’s a lot of uncertainty,” Troy Rohrbaugh, JPMorgan’s global markets chief, said during the March 8 conference.

Another area of focus for investors is how the industry is taking advantage of rising interest rates, which tend to fatten banks’ lending margins. Analysts also anticipate improving loan growth as Federal Reserve data show banks’ loans increased 8% in the first quarter, driven by commercial borrowers.

Net interest income at JPMorgan climbed 7% to $13.97 billion, topping the $13.7 billion estimate.

Still, while longer-term rates rose during the quarter, short-term rates rose more, and that flat, or in some cases inverted, yield curve spurred concerns about a recession ahead. Banks sell off when investors worry about a recession as that could create a surge in loan losses as borrowers fall behind.

JPMorgan said last month that it was unwinding its Russia operations. Dimon said in his annual shareholder letter that while management isn’t worried about its Russia exposure, it could “still lose about $1 billion over time.”

During a call Wednesday with reporters, CFO Jeremy Barnum said there was roughly $600 million in Russia exposure remaining after taking the quarter’s hit.

Shares of JPMorgan have dropped 16.9% this year before Wednesday, worse than the 10.6% decline of the KBW Bank Index.

Rival banks Goldman Sachs, Citigroup, Morgan Stanley and Wells Fargo are scheduled to report results Thursday.

Utah collected nearly $14B in tax revenue in 2021, a fiscal year record. Here’s why

By Emily Ashcraft, KSL.com | Posted – Dec. 29, 2021 at 9:16 p.m.

SALT LAKE CITY — Utah’s tax revenue is up, despite and partially because of various COVID-19 policies and reactions. The Utah State Tax Commission’s annual report, released Wednesday, showed a total revenue of $13.97 billion in the 2021 fiscal year — an increase of $3.26 billion, or 30.5% over 2020 revenue.

John Valentine, Utah State Tax Commission chairman, said it is the highest amount the state has collected for taxes in a fiscal year.

This significant boost in tax revenue, he said, could lead to changes during the upcoming Utah legislative session. Gov. Spencer Cox has suggested a food tax credit, and reducing income tax rates was suggested by another Utah lawmaker, Valentine said.

One major component of the increase is the extended tax deadline to July 2020, which pushed some income tax revenue into the 2021 fiscal year; the 2021 extension was shorter and kept the taxes within the same fiscal year. However, there were other factors, including growth in Utah’s population and economy.

“We had a very robust increase in 2021 where we rebounded faster than the rest of the national economy. Our income tax rebounded significantly, and candidly, our sales tax really didn’t have the big fall off that many places did,” Valentine said.

He said that shortly before COVID-19 hit, the Utah tax code changed to include taxes on remote sales, which helped the state not lose sales tax revenue. Valentine said Utah saw a 300% increase in online sales during the fiscal year.

Federal stimulus money allowed people to spend more, which also benefited sales tax revenue. Currently, Valentine said, the state is up 8% in just sales tax, which is one of the largest state revenue sources along with income tax.

Another factor causing the increased tax revenue was $720 million collected in delinquent taxes, which Valentine said is higher than normal. He said the commission found that a lot of this amount was back taxes that people paid in order to refinance their home. The stimulus money gave people more cash, and interest rates were extremely low which led more people to refinance their homes during the last fiscal year. When refinancing a home, people are required to release and pay any tax liens that were put on them from previous years.

The food tax credit suggested by Cox or reduced income tax rates suggested by others are among the options for use of the revenue that may be considered by the Utah Legislature in its upcoming session, which begins Jan. 18.

“The policymakers will be making choices as to how to restructure our tax code and to release burdens, and then how to spend significant increases in public education, higher education, public safety, health and human services. The governor’s recommendations in all those areas have had significant increases to reflect the fact that we’ve got a change in the economy,” Valentine said.

Of the 2021 fiscal year revenue, the report said that 49.2% was placed in the education fund, 21.2% in the general fund, 10.9% in the transportation fund, 16% in fiduciary funds and 2.6% in other funds.

Throughout this fiscal year there have been a lot of “surprises,” Valentine said, because of changes in federal and state law, including some that are still in the process of being implemented.

One of the year’s challenges for the tax commission has been addressing long lines at the Department of Motor Vehicles. Currently the goal is to get people in and out of the DMV in 20 minutes. They developed technology to transfer car titles online, but quickly had to develop an auditing system to make sure that the correct car price was reported.

Start-up investors are warning of dark days ahead as boom times are ‘unambiguously over’

KEY POINTS

- Prominent venture capital firms are telling their portfolio companies to start cutting costs and looking for ways to cushion their cash position.

- It’s a stark contrast to last year, when IPOs were raising record amounts of cash, valuations were sky high and venture firms’ wallets were wide open.

- Y Combinator said companies have to “understand that the poor public market performance of tech companies significantly impacts VC investing.”

Slow your hiring! Cut back on marketing! Extend your runway!

The venture capital missives are back, and they’re coming in hot.

With tech stocks cratering through the first five months of 2022 and the Nasdaq on pace for its second-worst quarter since the 2008 financial crisis, start-up investors are telling their portfolio companies they won’t be spared in the fallout, and that conditions could be worsening.

“It will be a longer recovery and while we can’t predict how long, we can advise you on ways to prepare and get through to the other side,” Sequoia Capital, the legendary venture firm known for early bets on Google, Apple and WhatsApp, wrote in a 52-page presentation titled “Adapting to Endure,” a copy of which CNBC obtained.

Y Combinator, the start-up incubator that helped spawn Airbnb, Dropbox and Stripe, told founders in an email last week that they need to “understand that the poor public market performance of tech companies significantly impacts VC investing.”

It’s a stark contrast to 2021, when investors were rushing into pre-IPO companies at sky-high valuations, deal-making was happening at a frenzied pace and buzzy software start-ups were commanding multiples of 100 times revenue. That era reflected an extended bull market in tech, with the Nasdaq Composite notching gains in 11 of the past 13 years, and venture funding in the U.S. reaching $332.8 billion last year, up sevenfold from a decade earlier. according to the National Venture Capital Association.

The sudden change in sentiment is reminiscent of 2008, when the collapse in the subprime mortgage market infected the entire U.S. banking system and dragged the country into recession. At the time, Sequoia published the infamous memo titled, “R.I.P. Good Times,” proclaiming to start-ups that “cuts are a must” along with the “need to become cash flow positive.”

However, Sequoia hasn’t always nailed the timing of its warnings. In March 2020, the firm called the Covid-19 pandemic the “Black Swan of 2020” and implored founders to pull back on marketing, prepare for customers to cut spending and evaluate whether “you can do more with less.”

As it turns out, technology demand only increased and the Nasdaq had its best year since 2009, spurred on by low interest rates and a surge in spending on products for remote work.

This time around, Sequoia’s words look more like the emerging conventional wisdom in Silicon Valley. The market started to turn in November, with companies going public trickling to a halt to start 2022. The crossover funds that fueled so much of the private market boom have pulled way back as they grapple with historic losses in their public portfolios, said Deena Shakir, a partner at Lux Capital, which has offices in New York City and Silicon Valley.

‘Prepared for winter’

“Companies that recently raised at very high prices at the height of valuation inflation may be grappling with high burn rates and near-term challenges growing into those valuations,” Shakir told CNBC in an email. “Others that were more dilution-sensitive and chose to raise less may now need to consider avenues for extending runway that would have seemed unpalatable to them just months ago.”

In its first-quarter letter to limited partners, Lux reminded investors that it had been predicting such trouble for months. The firm cited its fourth-quarter letter, which told companies to preserve cash and avoid putting money behind unprofitable growth.

“Our companies heeded that advice and most companies are now prepared for winter,” Lux wrote.

Sustained increases in fuel and food prices, the ongoing pandemic and raging geopolitical conflicts have collided in such a way that investors now fear out-of-control inflation, rising interest rates and a recession all at once.

What’s different this time, according to Sequoia’s presentation, is there’s no “quick-fix policy solution.” The firm said that what it missed in early 2020 was the government’s aggressive response, which was to pour money into the economy and to keep borrowing rates artificially low by buying bonds.

“This time, many of those tools have been exhausted,” Sequoia wrote. “We do not believe that this is going to be another steep correction followed by an equally swift V-shaped recovery like we saw at the outset of the pandemic.”

Sequoia told its companies to look at projects, research and development, marketing and elsewhere for opportunities to cut costs. Companies don’t have to immediately pull the trigger, the firm added, but they should be ready to do it in the next 30 days if needed.

Job cuts and hiring freezes have already become a big story inside major public tech companies. Snap, Facebook, Uber and Lyft have all said they would slow hiring in the coming months, while Robinhood and Peloton announced jobs cuts.

And among companies that are still private, staff reductions are underway at Klarna and Cameo, while Instacart is reportedly slowing hiring ahead of an expected initial public offering. Cloud software vendor Lacework announced staffing cuts on Friday, six months after the company was valued at $8.3 billion by venture investors.

“We have adjusted our plan to increase our cash runway through to profitability and significantly strengthened our balance sheet so we can be more opportunistic around investment opportunities and weather uncertainty in the macro environment,” Lacework said in a blog post.

Tomasz Tunguz, managing director at Redpoint Ventures, told CNBC that many start-up investors have been advising their companies to keep enough cash on hand for at least two years of potential pain. That’s a new conversation and it goes along with tough discussions around valuations and burn rates.

Shakir agreed with that assessment. “Like many, we at Lux have been advising our companies to think long term, extend runway to 2+ years if possible, take a very close look at reducing burn and improving gross margins, and start to set expectations that near-term future financings are unlikely to look like what they may have expected six or 12 months ago,” she wrote.

In a post on May 16, with the headline, “The Upside of a Downturn,” Lightspeed Venture Partners began by saying, “The boom times of the last decade are unambiguously over.” Among the sub-headlines, one reads, “Cut Non-Essential Activities.”

“Many CEOs will make painful decisions in order to keep their companies afloat in choppy waters,” Lightspeed wrote. “Some will face trade-offs that only a few months ago would have seemed outlandish or unnecessary.”

Lux highlighted one of the painful decisions it expects to see. For several companies, the firm said, “sacrificing people will come before sacrificing valuation.”

But venture firms are keen to remind founders that great companies emerge from the darkest of times. Those that prove they can survive and even thrive when capital is in short supply, the thinking goes, are positioned to flourish when the economy bounces back.

For companies that can add talent today, there’s more available because of hiring freezes at some of the biggest companies, Sequoia said. And Lightspeed noted that technology will continue to progress regardless of what’s happening in the market.

“Despite all the talk of doom and gloom, we continue to be optimistic about the opportunities to build and invest in generational technology companies,” Shakir said. “We’ve been heartened to see our CEOs exchanging notes and tips with one another, at once energized and humbled by these changing conditions.”