HI Market View Commentary 05-09-2022

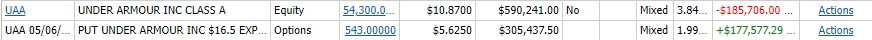

So last Friday after earning UAA lost 185K and we made up 177K

We chose since UAA will probably go down to $7

Why are we out of UAA?= China is shutting down and Asia is also shutting down with another round of Covid

BUT, We plan on adding some long puts for the next three months as UAA looks to head to $7ish a share

Our hey get back in price is around $7.50 or $10.88

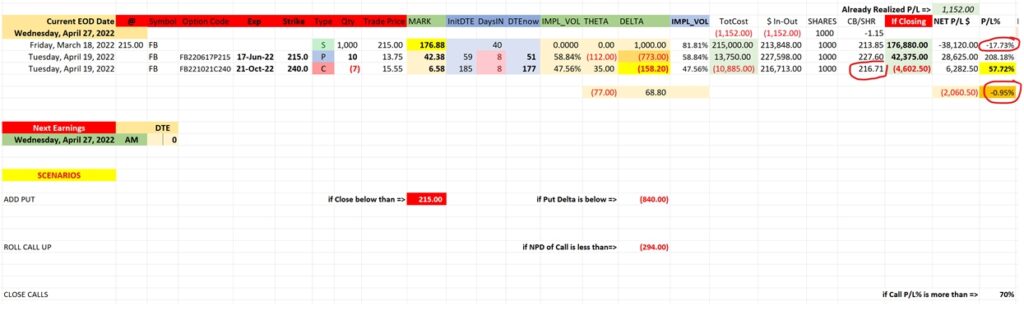

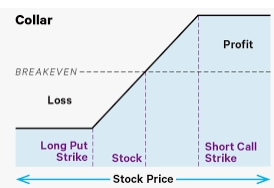

I am trying an experiment, on paper for now, to develop a way to collar in a systematic way, with the objective to define myself rules so I can execute more or less “robotically”.

YOU don’t want to “robotically” trade the market ever!!! The market is always and ever changing. Each time you look at a stock, a new situation, a trend change you need to treat it on it own merits

The picture below comes from a spreadsheet that allows me to follow the trade in real time with data from TOS. I also added the chart I was looking for timing evaluation.

On the 27th, just before the earnings announcement I was considering selling the 215P (~ $ 46.55) and use the money received, to buy a 175P (~ $ 17.65) same expiration, or alternatively, if I suspected it was near a bottom, leave it unprotected and buy more shares (~ +250 shares) to lower the cost basis. The pictures were taken near the end of the session that day.

My questions to you, which if you can kindly reply directly or in the webinar (maybe better?) would be really appreciated are:

– Of those alternatives, how would you decide?

– In each of the alternatives, how would you handle the remaining short call?

There is so much you can do with the collar trade = You can easily beat the market over a period of time because stocks move more quickly than the market, making up anything to the downside becomes a profit sometime in the future, dollar cost averaging WITHOUT having to add more capital to the portfolio is pretty darn amazing

I went through our stocks to make sure the volatile horribly down Blue chips we’ve chosen aren’t in danger of going out of business and can still make last years profit

Earnings coming up:

BIDU 5/18 est

DIS 5/11 AMC

MU 6/30 est

TGT 5/18 BMO

CORE HODLING = AAPL, BAC, BIDU, COST, DIS, F, FB, GOOGL, GM, IBB, JPM, KO, MU, SBUX, SQ, V, TGT, UAA, VZ

I just figured something out – Hedge funds had redemptions, looked like the dollar is too strong and hurting international business, inflation is continuing to rise, three more 0.50 basis point (half percent) rate hikes= more expensive borrowing, Still have the Ukraine Russia war going on, Hungry said that “IF we stop importing Russian oil it would be like we set off an atomic bomb to our economy”,

What really happened last week was outflows from the markets back to government holding

It looks like we are going to have a global recession because other countries have started the cash hording that usually is the precursor to a recession.

SO what are you going to do – Little slower at putting new money to work, adding a couple additional put protection to make up more than the stocks are losing, doing a full collar trade with a short call to receive some credit to make up more than the stocks are losing.

IF it turns into another 2008 scenario we will double up the protective insurance options to make much more on the way down than the stocks are losing. That is how you quadruple a portfolio in a couple years period of time after the drop

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 06-May-22 14:33 ET | Archive

The stock market needs the Treasury market to settle down

Are Treasuries oversold? That’s a matter of opinion and perspective.

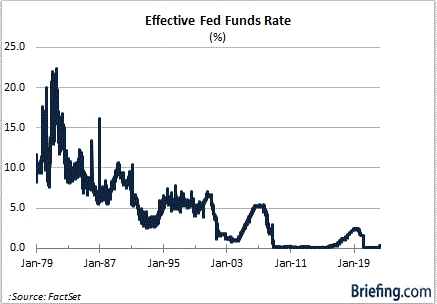

Ironically, we are hearing talk that Fed Chair Jerome Powell is set on having his Paul Volcker moment. Mr. Volcker, of course, was the Fed Chair when the economy was dealing with double-digit inflation more than 40 years ago.

To put things succinctly, Mr. Volcker’s approach was to jack up interest rates and limit the supply of money to kill demand, which would take care of inflation and squash inflation expectations. He knew full well that an aggressively tight monetary policy would likely throw the U.S. economy into a recession.

He was right. He was loathed… and then he was loved.

Mr. Volcker did kill inflation and, in the process, launched a secular bull market in bonds that ultimately paved the way for a secular bull market in stocks that ended with the implosion of the dotcom bubble in March 2000.

Some Tough Medicine

Paul Volcker delivered some very tough medicine, but it worked.

With the consumer inflation rate at 8.5%, Fed Chair Powell needs to deliver some medicine, too, if inflation is to be cured. The ultimate dosage is unknown, but it will be a high dose. That could potentially tip the U.S. economy into recession.

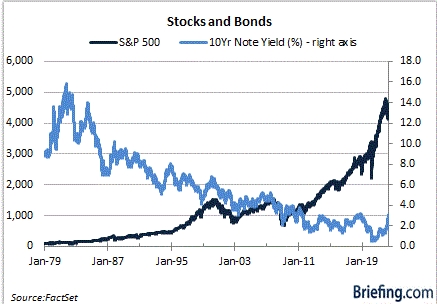

The Treasury market has been bracing for a period of slower growth. The yield curve has flattened. The 2s10s and 5s30s spreads even inverted for a short time not that long ago.

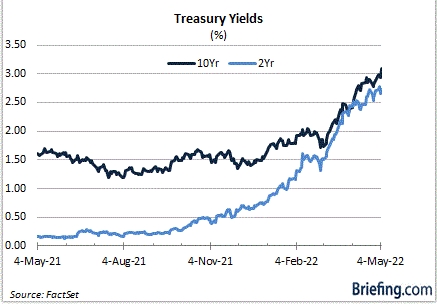

The Treasury market has been for sale this year, and the selling has been aggressive. For example, the yield on the 10-yr note has more than doubled since the end of last year to 3.12%; meanwhile, the yield on the 2-yr note, which is most sensitive to changes in the fed funds rate, has surged nearly 200 basis points to 2.67%.

Those moves have been precipitated by a pivot in the Fed’s approach to setting monetary policy, which has included an end to quantitative easing, raising the target range for the fed funds rate from the zero bound, and a plan to start reducing the size of the Fed’s balance sheet.

In other words, the Treasury market’s biggest support is backing away, raising questions about who will step in to pick up the slack. It is a daunting question without a clear-cut answer, which is partly why Treasuries have gotten hammered this year and why the bricks have been piling up on the Treasury market’s wall of worry.

What It All Means

The Treasury market not only has to contend with the Fed’s pandemic denouement, but it also must contend with the reality that other sources of buying support are falling away at the same time, too.

- Weakness in the euro and yen has increased hedging costs for foreign buyers.

- Rising sovereign bond yields elsewhere are winning back domestic investors who had been seeking higher yields in the U.S. when domestic yields were either negative or near rock-bottom levels.

- The era of low and steady inflation near 2.0% has come to an abrupt end.

- The steps the U.S. and its allies took to freeze Russia’s foreign reserves following its invasion of Ukraine may very well prompt China, the second largest holder of Treasuries, to reduce its exposure to dollar-denominated assets.

It is a problematic mix for the Treasury market, which is arguably oversold on a short-term basis. If it is going to get back on a bull market track, though, it is going to have to climb a rising wall of worry and it won’t be easy.

If it isn’t easy for the Treasury market, it won’t be easy for the stock market, which is stacking bricks on its own wall of worry that includes the difficulties for the Treasury market.

The Treasury market needs to settle down for the stock market to settle down. Right now, both are a volatile mess.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse |

| Market Recap |

| WEEK OF MAY. 2 THROUGH MAY. 6, 2022 |

| The S&P 500 index slipped by 0.2% last week as sharp daily gains and losses almost canceled each other out in a week that included the largest federal funds rate increase since 2000. The market benchmark ended Friday’s session at 4,123.34, down from last Friday’s closing level of 4,131.93. Last week’s move came as the market began May searching for direction following a tough April in which the S&P 500 fell by 8.8%. April’s loss marked the S&P 500’s third monthly decline out of the first four months of 2022; only March has had a gain so far last year. The S&P 500 is now down 13% for the year to date. Over the first three days of the week, the S&P 500 climbed 4.1%. Much of that climb came Wednesday as the index jumped 3% amid signals from Federal Reserve Chairman Jerome Powell that while the central bank’s policy-setting committee was raising its benchmark federal-funds rate by half a percentage point — the largest such increase since 2000 — it isn’t “actively considering” a larger increase for an upcoming meeting. Still, the positive Wednesday reaction was wiped out Thursday as the S&P 500 slid 3.6% amid questions and concerns over the potential impacts of the higher rate environment. While upcoming rate increases may be smaller than previously feared, investors are still uneasy about rates rising as much as they are. The S&P 500 continued to decline Friday, even as the Labor Department reported nonfarm payrolls rose by 428,000, more than the 380,000 jobs increase expected in a survey compiled by Bloomberg. The unemployment rate held steady at 3.6%, compared with a 3.5% rate expected, while the labor force participation rate fell to 62.2% from 62.4% in the previous month as the size of the labor force contracted. By sector, real estate had the largest percentage drop of the week, down 3.8%, followed by a 3.4% drop in consumer discretionary and a 1.3% slip in consumer staples. Other decliners included technology, materials and health care, down by less than 1% each. The energy sector had the largest percentage increase of the week as it jumped 10%, but the other sectors in the black were up by a much smaller amount: Utilities climbed 1.2%, communication services rose 1.1%, financials gained 0.6% and industrials edged up 0.3%. The real estate sector’s decliners included Public Storage (PSA), which reported Q1 core funds from operations above analysts’ mean estimate but missed analysts’ expectations for the quarter’s revenue. Shares of the real estate investment trust that focuses on self-storage facilities fell 9.3% on the week. In consumer discretionary, shares of Expedia (EXPE) fell 24%. The online travel company reported a slightly narrower Q1 adjusted loss than analysts expected but revenue slightly missed the Street view while analysts noted the company is grappling with rising inflation and geopolitical concerns. The energy sector’s advance came as futures in crude oil and natural gas climbed amid a proposal by the European Union to phase out imports of Russian crude over the next six months. Among the energy gainers, shares of Devon Energy (DVN) climbed 20% last week as the oil and gas producer reported Q1 core earnings and revenue above year-earlier results and analysts’ mean estimates. The company also boosted its fixed-plus-variable quarterly dividend by 27% and expanded its stock buyback plan by 25%. Next week’s earnings calendar features companies such as Tyson Foods (TSN), Simon Property Group (SPG), Hyatt Hotels (H), Wendy’s (WEN) and Walt Disney (DIS). On the economic calendar, inflation data will be in focus, with the April consumer price index due Wednesday and the April producer price index due Thursday. Other data expected next week include March wholesale inventories on Monday and University of Michigan consumer sentiment for May on Friday. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end May 2022?

05-09-2022 -2.0%

05-02-2022 -2.0%

Earnings:

Mon: DUK, DDD, ZNGA

Tues: H, PTON, EA, HRB, WYNN, PRPL

Wed: WEN, BYND, DIS

Thur: CYBR, DDS, TPR, BABA

Fri:

Econ Reports:

Mon: Wholesale Inventory

Tues: NFIB Small Business Optimism

Wed: MBA, CPI, Core CPI, Treasury Budget

Thur: Initial Claims, Continuing Claims, PPI, Core PPI

Fri: Michigan Sentiment

How am I looking to trade?

Currently protection on all core holding and making decisions on earnings,

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Bulls finding it’s tough to buy the dip until there are signs inflation is getting under control

PUBLISHED MON, MAY 9 20229:36 AM EDT

When you look at what the market is grappling with, it’s remarkable the S&P 500 is only down 14% for the year.

Consider that: 1) the Federal Reserve and inflation are threatening the U.S. economy and stock market, 2) the Russia-Ukraine war is threatening the European economy and global commodities like oil, wheat, and corn, and 3) the Covid lockdowns in China are threatening the Chinese economy.

In other words, there are three separate threats to the three largest economic areas in the world.

The Russia-Ukraine war is not improving, and China appears to be tightening its Covid lockdown.

As for the Fed and inflation, the bulls are going to have a tough time arguing it’s safe to buy the dip until there are clear signs that inflation is getting under control.

It’s early, but bulls were heartened on Friday when Cox Automotive said its Manheim Used Vehicle Value Index — which tracks prices of used vehicles sold at its U.S. wholesale auctions — declined 1% in April from March, marking the third straight month of declines from the first month of the year. It’s still up 14% from a year ago, but at least it’s declining and it’s one data point for the bulls.

A much bigger one will come Wednesday at 8:30 a.m. ET with April CPI. Headline inflation is still expected in the 8% range (it was 8.5% year over year in March), but at least it’s not expected to go higher.

Regardless, a couple of data points will not change the Fed’s mind. Chairman Jerome Powell made it clear that they will push ahead with their rate increases until there is a clear and persistent trend in their favor.

Until that trend emerges, any argument that “stocks are cheap” sounds hollow. I’ve noted the dramatic multiple compression some high quality tech names have already seen (AMD, Nvidia, for example), not to mention the drubbing that companies with little or no profits have taken, even though revenues continue to improve.

Indeed, Ark Invest’s Cathie Wood loudly proclaimed at the recent Exchange ETF conference in Miami Beach that most of her companies would see revenues increase 50% this year.

That may be true, but it’s not about revenues this year. It’s about multiple compression, and what happens to companies with little or no profits in a rising interest rate environment that may also be seeing an economic slowdown.

On Roe v. Wade, big companies already have a precedent for effective action

PUBLISHED SUN, MAY 8 20229:01 AM EDT

Cheryl Winokur Munk, special to CNBC.com

KEY POINTS

- The Roe v. Wade Supreme Court draft opinion leak will pressure corporations to take a stronger stand on women’s reproductive rights.

- Some major brands including Apple, Citigroup, Salesforce, and Yelp had already made health benefits changes in the wake of recent strict state-level abortion laws.

- One activist investor said to expect a SCOTUS “tsunami” from corporations and a focus on health benefits can be the best way to respond directly in a sensitive political situation.

With the Supreme Court draft decision leak increasing the likelihood of Roe v. Wade’s demise, companies are under pressure to adopt more favorable employee policies with respect to women’s reproductive rights.

In recent months, several companies including Apple, Citigroup, Salesforce, and Yelp have spoken out or announced shifts in their benefits policies amid several state-led efforts aimed at restricting or banning abortion. Last week, Amazon announced new benefits, while a few companies, including JPMorgan Chase & Co., Goldman Sachs and Bank of America, have said they are reviewing existing policies in the wake of news that the nation’s highest court is potentially on the verge of overturning the landmark case over abortion rights.

As the abortion debate intensifies, some corporate activists are urging companies to take prompt action to adopt more favorable reproductive rights policies ahead of any action by the Supreme Court. “Right now, it’s a ripple, but it will become a wave, and once Roe is overturned, it will become a tsunami,” said Andrew Behar, CEO of As You Sow, a non-profit shareholder organization.

The corporate world is being monitored for what it is saying — or not saying publicly. Among corporate giants who have been mum on the issue, some may be concerned about stepping into a political landmine, or angering certain constituents. But experts in corporate social responsibility say that despite these concerns, it’s important for companies to address the issue of reproductive rights head on.

“Public companies, whether they like it or not, are in the spotlight for this debate,” said Carla Bevins, assistant teaching professor of business communication at Carnegie Mellon University’s Tepper School of Business. “They will continue to set the example for other businesses,” she said.

Some companies have publicly urged other businesses to take a stand. “Given what is at stake, business leaders need to make their voices heard and act to protect the health and well-being of our employees. That means protecting reproductive rights,” Levi Strauss & Co. said in a May 4 statement.

To be sure, taking a stand on a polarized issue such as abortion presents challenges for companies who are dealing with multiple constituents with differing opinions. That said, the message companies send doesn’t have to be “overtly political,” said Martin Whittaker, CEO of Just Capital, a research nonprofit which measures and seeks to improve corporate performance on environmental, social and governance factors. “If you’re focusing on it as a health benefit issue, that’s probably the safest ground,” he said.

That’s what Citigroup did, for example, and its CEO explained the company’s stance in response to a question posed at its annual shareholders’ meeting on April 26 about its policy of paying for employee travel related to seeking an abortion. “We know this is a subject that people feel passionate about. I want to be clear that this benefit isn’t intended to be a statement about a very sensitive issue,” CEO Jane Fraser said at the time.

Companies for years have been insuring abortion, and changing their policies now is consistent with that, said Shelley Alpern, director of corporate engagement at Rhia Ventures, which invests in reproductive health-care solutions that empower women. “They should take action now to mitigate what’s coming,” she said.

Yelp, in a statement provided to CNBC, called on Congress to codify the rights of women to make decisions over their own bodies. Yelp also said companies should “step up to safeguard their employees, and provide equal access to the health services they need no matter where they live.”

Furthermore, company policies that pay for travel when it is required to receive health care are not limited to abortion, with Amazon among those noting coverage for travel related to many conditions, from cancer care to mental health and substance abuse, in cases where there is no medical option within a 100-mile radius of an employee’s home.

For many years, Citi has offered a travel benefit that typically enables employees to access specific health-care services, such as transplant, bariatric or orthopedic procedures, outside their local area.

“What we did here was follow our past practices,” Fraser told shareholders. “We’ve covered reproductive healthcare benefits for over 20 years. And our practice has also been to make sure our employees have the same health coverage, no matter where in the U.S. they live. So, to that end, we’ve had a practice of reimbursing travel for many years. We respect everyone’s views on this subject,” she said.

This approach to employee health benefits has been used by Walmart for years, which has partnered with “centers of excellence” around the country to provide health-care services, and travel and lodging expenses, to employees for conditions including bariatric surgery, spine and heart health, cancer care, and other conditions.

It would be naive to think any response to the Supreme Court decision, even one focused on a company’s own employees, will be able to entirely avoid the political fray. Republican Senator Marco Rubio of Florida introduced legislation last week to use the tax code to penalize companies that offer additional health and travel coverage.

In the meantime, companies that withhold their plans from stakeholders, including employees, investors and customers, risk making a mistake, according to corporate responsibility experts. A company’s prolonged silence could easily backfire and cause a loss of credibility with employees, consumers and shareholders.

Whittaker pointed to the recent cautionary tale of Disney. The media giant faced intense scrutiny from employees and the public for its initial reluctance to speak out against Florida legislation nicknamed “Don’t Say Gay.”

The company’s leadership said it had thought it was better to work behind the scenes, but later promised to support efforts to strike down the controversial law.

“What we saw with Disney is that if you’re too behind the scenes, it actually looks like betrayal,” said Cait Lamberton, the Alberto I. Duran Presidential Distinguished Professor of Marketing at The Wharton School.

Companies that don’t act promptly could ultimately have trouble attracting and retaining top talent. If you’re at the top of your class at Harvard, and you get two offers from prominent companies, and one has a favorable policy and the other doesn’t, employees are likely to choose the one with the favorable policy, Behar said.

Moreover, as expanded benefits become the norm, companies that are slow to act could face ripple effects. “If an employee who works for a company that doesn’t offer the benefits ends up with a $2.3 million bill after having these experiences, that will make for a very powerful story and will keep drawing attention to the company’s decisions,” Lamberton said.

Taking a stance could be especially important for companies who routinely promote ideals specific to health, like wellness, and broader aims of equality and independence as part of their public persona.

“You can’t hold yourself up as a brand that supports certain outcomes in society and stay silent on an issue like this. It just doesn’t make sense,” Lamberton said.

—By Cheryl Winokur Munk, special to CNBC.com

Here’s the average 401(k) balance of Americans in their 40s — how do you compare?

Here’s what participants in the Vanguard 2021 How America Saves survey shared.

Updated Thu, May 5 2022

If you have a 401(k) account, you’re already taking a very important step when it comes to saving for retirement. This type of account is provided through your employer and uses pre-tax money to help you save up for those years when you won’t be working. Most employees are automatically enrolled in an account by their employer and they can choose how much of each paycheck they want contributed to the account. The automatic nature of these savings helps you build your balance without having to lift a finger.

The older you get, the higher your balance should be (unless at one point you made a hardship withdrawal from your 401(k) account).

Select used information from Vanguard’s 2021 How America Saves Survey to take a peek at how much money the average American in their 40s has saved up in their 401(k) account. Here are the numbers that were reported:

- Average 401(k) balance of ages 35–44: $86,582 (average); $32,664 (median)

- Average 401(k) balance of ages 45–54: $161,079 (average); $56,722 (median)

- Average 401(k) balance of ages 55–64: $232,379 (average); $84,714 (median)

Keep in mind that personal retirement savings goals can differ based on the type of lifestyle you want to enjoy during retirement. So if your ideal retirement lifestyle is less costly compared to someone else’s it’s okay to not save up as much as they do.

How to figure out how much money you need to save for retirement

Knowing how much money you’ll need to have saved up before you enter retirement can help give you an idea of how much you should be putting away right now in order to reach that goal.

Figuring out how much money you need to save before you can retire starts with estimating how much money you’re likely to spend each year in retirement. You should account for expenses like housing, health insurance, food, medication, travel and pet care, to name a few.

Next, you should consider approximately how much of that money you’ll be receiving through federal benefits like Social Security. The Social Security Administration has an online benefits calculator that lets you estimate how much you might receive in social security based on your current income and when you hope to retire. Keep in mind that this is only an approximation and not an exact number; still, though, it can be helpful to look at such an estimation. Once you figure out how much you might receive each year in federal benefits, you can subtract that from the total amount you expect to spend each year in retirement. You’ll be left with the amount of money you’ll need out-of-pocket each year to sustain yourself.

Now that you know how much out-of-pocket money you will need to come out of your retirement savings each year, you can use the 4% rule to figure out the total amount you’ll need to have saved up before you enter retirement.

The 4% rule states that you should be able to comfortably live off of 4% of your money in investments in your first year of retirement, then slightly increase or decrease that amount to account for inflation each subsequent year. Based on historical data, living off of just 4% will allow you to use your retirement portfolio to cover expenses for 30 years.

Just take the amount you need to spend yourself each year in retirement and divide it by 0.04 (or multiply it by 25). The result represents how much you’ll need to have saved up before you enter retirement to sustain yourself for about 30 years. It’s important to note that you don’t have to withdraw 4% of your money — you can withdraw more or less depending on your personal needs. Keep in mind, though, that if you withdraw more each year you’ll likely need to have more money saved up to pull from. But if you withdraw less than 4%, you can get away with saving a little less and your money may even last you longer.

How to start saving for retirement

One of the best ways to start saving for retirement is to make sure you’re enrolled in your employer’s 401(k) plan and are receiving the full match amount. For example, if your employer matches contributions of at least 4%, you’ll need to contribute at least 4% of each paycheck to your 401(k) in order to receive the match.

You can contribute up to $20,500 to your 401(k) account for 2022 (the contribution limit adjusts each year). But that doesn’t mean you can only save $20,500 a year for retirement. You can actually stash away an additional $6,000 a year by opening up a traditional IRA or Roth IRA.

A Roth IRA is a powerful tool you can use when it comes to saving for retirement since you can contribute after-tax money that gets invested, grows tax-free over time and can be withdrawn without paying taxes. The longer your time horizon, the more your money can grow.

If you were to open a Roth IRA today by investing $100 and contributing just $3,000 each year — assuming an 8% annual return — in 30 years, you’d have accumulated $340,856. However, if you were to follow the same steps and only give your money 20 years to grow, you’d end up with just $137,752. That 10-year difference can wind up costing you more than $200,000 so it’s better to do it sooner than later.

There are lots of Roth IRA providers out there. If you want a hands-off approach, look into one such as Betterment or Wealthfront, since they’re robo-advisors can pick the portfolio that’s right for you and automatically adjust your allocation based on your needs and risk tolerance.

https://www.newsmax.com/tomdelbeccaro/joe-biden-first-year-worst-presidency/2021/12/29/id/1050351/

Joe Biden’s First Year: The Worst in Modern History

By Tom Del BeccaroWednesday, 29 December 2021 12:39 PM

American presidents, from time to time, face difficult first years. None more so than President Abraham Lincoln when he was greeted by the secession of southern states. In the modern television era, in his first year, President John Kennedy endured the Bay of Pigs debacle and then, Nikita Khrushchev’s browbeating of JFK at their Vienna summit, which Kennedy termed “worst thing in my life. He savaged me.”

So how does Biden’s first year compare and what criteria should be used to determine the success of the first year of the president?

Should it be based on popularity ratings? The state of the economy? Foreign policy achievements? Legislative accomplishments? Law and order? Handling a crisis? Domestic unity?

It is likely all of those things should be considered as well as other considerations. Regardless of the criteria, however, by any fair measure, the first year of the Biden presidency is likely the worst first year in modern presidential history.

1. The Economy. The economy Joe Biden inherited was not the best in history. After all, it was still suffering the dislocations of our government’s response to COVID. Nevertheless, it was inflation free by historical standards and the economic growth rate was improving from its COVID low.

The inflation rate was approximately 2% for the four years prior to Biden. Now it is at a 40 year high of nearly 7%. According to some analyses, however, it would be nearly as high as inflation during the Jimmy Carter years if government didn’t change how it measured inflation. Further, the recent drop in growth has many saying we have hit stagflation.

While the Biden administration is not at fault for all of the inflationary rise, his policies of enormous spending, higher regulations and renewed war on energy play a major role in not only the rise in inflation but our drop in economic growth. Further, there is no expectation that Biden will moderate his policies to combat inflation.

Keep in mind that inflation is likely the worst of economic ills. If it gets out of control, it can take years of pain to get back under control. That is what happened during the Carter years and the early Ronald Reagan years.

Carter’s inflation problems were caused by his spending policies and the Federal Reserve monetary policy — but inflation hit in his second and third years, not so much in his first. As for Biden, no president in modern times has ended his first year with the combination Biden did this year with much of it his own doing.

2. Foreign Policy. Most presidents are tested in the first year of their presidency by foreign leaders determined to assess the mettle of the new president. Harry Truman faced Russian provocation. In 1961, John Kennedy’s Bay of Pigs his first year and Soviet leader Khrushchev’s bullying at the Vienna summit certainly marked a bad first year for Kennedy.

While some will say the world lost confidence in Donald Trump his first year, nothing Trump did or didn’t do compares with the fallout Biden and the U.S. has endured because of the horrific pullout of U.S. troops from Afghanistan. It has shaken world confidence in U.S. leadership.

Further, as the year closes, Russia is acting in a way never seen during the Trump administration. Russia appears to be preparing for war with Ukraine, which is a replay of sorts of Russia’s taking of Crimea when Biden was a vice president. Meanwhile, China looms large and Biden is without a significant accomplishment. Overall, Biden had a bad first foreign policy year and serious geopolitical danger lies ahead in 2022.

3. Legislative Accomplishments. Biden’s first year, during his first 100 Days, was focused on reversing Trump policies through a flurry of executive actions that did, in fact, reverse Trump policies. His largest legislative victory came with the signing of a $1 trillion infrastructure bill.

But that didn’t happen until November and it was immediately followed by a high profile legislative defeat that left questions about his ability to control his party. Still, overall, Biden got a fair amount from a policy point of view — part of which is why we are having the economic trouble we are having.

As for other presidents, certainly, President Gerald Ford had a less effective legislative first year. Of course, Ford became president under the most difficult of circumstances, i.e., being appointed to becoming vice president and then the Nixon resignation that left the country scarred.

Thus, Biden did not have the worst legislative year of any modern president but he did not have the best either.

4. Law and Order. There can be little doubt that among the biggest issues of the day is the lack of law and order across America today and along our border. Polling gives Republicans a huge advantage on the border issue and sends a warning to Biden on law and order overall.

Biden has only 38% approval rating for his handling of immigration, according to a recent Reuters/Ipsos poll, and, according to a Wall Street Journal poll, Republicans have a 52% to 16% advantage over Democrats on which party is better to handle the border issue.

Further, “the percentage of Americans who say crime in the United States is ‘extremely serious’ has reached its highest point in two decades,” according to a 2021 Washington Post/ABC poll and “only a little more than 1 in 3 Americans (36%) approve of Biden’s handling of crime, down from 43% in an ABC News/Ipsos poll in late October.”

As 2021 comes to an end, our national media is filled with images of smash and grab crimes. Altogether, it is hard to conclude that Biden has had a good year on the law and order issue.

5. Handling of a Crisis. Certainly, the Biden administration has stated to all Americans that the United States remains in a COVID crisis. So how has Biden done?

Well, when he ran for president, Biden tweeted the following: “We’re eight months into this pandemic, and Donald Trump still doesn’t have a plan to get this virus under control. I do.”

As 2021 ended, Biden admitted a form of defeat.

A December poll by ABC/Ipsos showed Biden’s approval rating on COVID had tumbled 19% to just 41%.

Along with the Afghan pullout, which became a crisis, Biden’s responses to them also contributed to Biden’s historically bad first year.

6. Domestic Unity. As the New York Post accurately reported: “Unifying the country was a major campaign pledge for Biden during the 2020 presidential election and was the dominant theme of his Inaugural Address.”

The problem for Biden, however, is that, as the New York Post also reported, “Fifty-four percent of the respondents think the country is less united, while only 37 percent say it is more united, a Fox News poll found.”

Obviously, as the author of “The Divided Era,” I am keenly aware of this issue. Our country has been becoming more divided since the mid-1990s — the start of The Divided Era.

One of the key reasons our divisions are rising is in reaction to ever more intrusive government mandates. Indeed, the more government decides, the more it divides Americans between those who see government as an effective tool for change and those whose object to government overreach and who want to preserve their liberties.

Barack Obama’s first year was divisive as well as his administration and House Speaker Nancy Pelosi, D-Calif., derided those who opposed their agenda of Obamacare and other spending.

It is also true that the first year of the Trump presidency was, by all accounts, divisive. Trump, however, can point to his miserable treatment by the media and an investigation built on lies.

Biden, by contrast, has benefited from a supportive media and has had no such investigation. To the contrary, Trump is still under investigation.

All of which brings us to …

7. Popularity polls.

Despite his supporters in the media, Biden polling is among the worst of any first year president in history. According to Rasmussen, Biden’s approval rating was 40% on Dec. 27. That is 5% lower than Trump had on the same date.

Rasmussen wasn’t alone. Trafalgar also had him at 40% in December, Politico/Morning Consult had him at 43%, the Economist/YouGov had him at 42% and The Wall Street Journal had him at 41%.

Perhaps worst of all, for months the country has doubted Biden on honesty and leadership. Below is data from an October Quinnipiac poll:

When it comes to Biden’s personal traits, Americans were asked whether or not Biden …

- cares about average Americans: 49 percent say yes, while 48 percent say no, compared to 58-37 percent yes in April;

- is honest: 44 percent say yes, while 50 percent say no, compared to 51-42 percent yes in April;

- has good leadership skills: 41 percent say yes, while 56 percent say no, compared to 52-44 percent yes in April.

The majority in a December Wall Street Journal poll answered consistent with that October Quinnipiac Poll. Biden has all of those bad polls despite a favorable press.

Overall, it is hard but to conclude that Biden is in trouble on all the major issues of the day at the end of his first year in office. No president in the modern era has found himself troubled to this degree and most of it is his own doing.

The question for 2022 is whether Biden can reverse his fate. The public, obviously, doesn’t think he can.

Tom Del Beccaro is an acclaimed author, speaker and national columnist as well as a radio and television commentator. Tom is the Chairman of carevival.com. Read Tom Del Beccaro’s Reports — More Here.

Charlie Munger says the Robinhood trading app is justly ‘unraveling’ for ‘disgusting’ practices

PUBLISHED SAT, APR 30 20221:11 PM EDTUPDATED MON, MAY 2 20221:07 PM EDT

Berkshire Hathaway Vice Chairman Charlie Munger blasted stock trading app Robinhood on Saturday, saying the company is now “unraveling.”

“It’s so easy to overdo a good idea. … Look what happened to Robinhood from its peak to its trough. Wasn’t that pretty obvious that something like that was going to happen?” Munger said at Berkshire Hathaway’s annual shareholder meeting Saturday.

Munger lambasted what he characterized as Robinhood’s “short-term gambling and big commissions and hidden kickbacks and so on.”

Robinhood does not charge users commission and generates a majority of its revenue from “payment for order flow,” the back-end payment brokerages receive for directing clients’ trades to market makers.

“It was disgusting,” Munger said. “Now it’s unraveling. God is getting just.”

Robinhood went public last July and shares are down 88% from their August 2021 high.

The company rose to prominence during the pandemic and played a key role in some massive short squeezes last year, as retail investors flocked to the app to push meme stock prices higher and inflict pain on short sellers betting against the stocks.

Munger in February 2021 amid a wild trading rush first criticized Robinhood for its practices, calling the app’s business model a “dirty way of making money.”

The company on Thursday reported a decrease in users and a wider-than-expected loss for the first quarter. Earlier in the week, Robinhood announced it would cut about 9% of full-time employees.

Robinhood responded to Munger’s comments, saying the vice chairman does not understand the trading platform.

“It is tiresome witnessing Mr. Munger mischaracterize a platform and customer base he knows nothing about. … He should just say what he really means: unless you look, think, and act like him, you cannot and should not be an investor. We’re happy to share our educational tools, as it also seems he is lost on digital currencies,” Jacqueline Ortiz Ramsay, Robinhood head of public policy communications, said in an email to CNBC.

Munger’s remarks echoed comments from Berkshire Chairman and CEO Warren Buffett earlier in the meeting ripping on Wall Street for turning the stock market into a “gambling parlor.”

“Is it wise to criticize people at all?” Buffett asked.

“Probably not, but I can’t help it,” Munger said.

Check out all of the CNBC Berkshire Hathaway annual meeting coverage here.

Citi says a trader error caused Europe’s ‘flash crash.’ Here’s how it unfolded

PUBLISHED TUE, MAY 3 20227:12 AM EDTUPDATED WED, MAY 4 20224:27 AM EDT

KEY POINTS

- U.S. banking giant Citigroup on Monday took responsibility for the flash crash which saw some European stocks turn sharply lower.

- Nordic stocks were hit the hardest, with Sweden’s Stockholm OMX 30 share index falling by as much as 8% at one point, before paring most of those losses to close the session down 1.9%.

- “On Monday, one of our traders made an error when inputting a transaction. Within minutes, we identified the error and corrected it,” a spokesperson for Citi told CNBC.

A so-called flash crash in European markets on Monday prompted several indexes to tumble sharply, sparking alarm among investors on a day when trading was thin due to public holidays around the world.

Trading was temporarily halted in several markets just before 9 a.m. London time on Monday after some European stocks abruptly turned lower.

Nordic stocks were hit the hardest, with Sweden’s Stockholm OMX 30 share index falling by as much as 8% at one point, before paring much of those losses to close the session down 1.9%.

Other European markets also plummeted for a brief period.

U.S. banking giant Citigroup on Monday took responsibility for the flash crash.

“On Monday, one of our traders made an error when inputting a transaction. Within minutes, we identified the error and corrected it,” a spokesperson for Citi told CNBC.

European markets closed Monday’s session sharply lower as investors reacted to the flash crash and digested weak economic data out of China and Germany.

The pan-European Stoxx 600 traded marginally lower Tuesday afternoon as market participants monitored key interest rate decisions worldwide.

What is a flash crash?

A flash crash refers to an extremely sharp fall in the price of an asset followed by a swift recovery within the same day.

They typically take place over a few minutes and are often caused by a trading mistake or a so-called fat finger error — when someone presses the wrong computer key to input data.

High-frequency trading firms have been blamed for a number of flash crashes over recent years.

In January 2020, high-frequency futures trader Navinder Singh Sarao was sentenced to one year of home detention for helping to trigger a brief $1 trillion stock market crash a decade earlier.

Sarao was charged by the U.S. Justice Department, accused of wire fraud, commodities fraud and manipulation, as well as a count of “spoofing” — when a trader places thousands of buy offers with the intent of immediately canceling or changing them before execution.

The fabrication of sudden market activity created a momentum in price that Sarao was able to profit from.

The U.S. made the practice of “spoofing” a crime in 2010 in an effort to tighten regulations following the 2008 financial crisis.

Correction: This story has been updated to reflect that several markets were halted at 9 a.m. London time on Monday.

These are the top 15 cities where college students want to live post-graduation, a new survey says

Published Wed, Mar 16 202212:01 PM EDT

Figuring out what to do after college is only half the battle. You also need to figure out where you want to live.

Typically, hotspots like New York and Los Angeles are strong contenders: They tend to have plenty of job demand, and highly valued social scenes for people in their 20s. But a recent survey discovered a new frontrunner: Seattle.

On Monday, Axios and The Generation Lab published their newest Next Cities Index, which broke down the most desired locations in the country for people ages 18 to 24, filtered by metrics like gender and political party affiliation. Altogether, Seattle ranked highest on the overall list for most desired location.

“It feels like a young-person city,” one college senior told Axios, about why he wanted to move to Seattle after graduating.

The Emerald City was slightly more desired by men than women: Female students choose New York as their top choice, followed by Seattle and Boston, respectively. Seattle was also the most popular choice for politically independent students. Republicans picked Austin, Texas, as their top choice, and Democrats picked New York.

Overall, these 15 cities are college students’ most desired destinations, according to the report:

- Seattle

- New York

- Los Angeles

- Denver

- Boston

- Chicago

- Washington

- Phoenix

- Colorado Springs, Colorado

- Austin, Texas

- Portland, Oregon

- San Francisco

- Minneapolis

- Dallas

- Atlanta

The survey also found that health care was the respondents’ most desired industry, with 29% expressing interest in the field — followed by education and research at 15% and tech jobs at 12%.

To conduct the study, Axios polled 2,109 college students nationwide, from both 2- and 4-year schools, between Nov. 18, 2021 and Feb. 14, 2022. Half of the survey’s respondents said they actively planned to live outside their home states after graduating. Only 20% said they planned to move back to their hometowns.

Seattle isn’t the only city gaining traction, the report noted: Colorado Springs, Austin and Denver also moved up the list this year. The trend is a couple of years in the making, as people ages 25 to 29 have been migrating to cities like Denver, Seattle, Phoenix and Austin since 2019, according to 2021 report using Census Bureau data.

HI Financial Services Mid-Week 06-24-2014