Trade Findings and Adjustments 03-31-2022

Since it is the last day of the month what do we know?- Window Dressing and rebalancing

You see a sell side biased with a little purchasing and more purchasing within the next three days

1st day of the month is new money coming in

2nd to 3rd day of the month are cleared closed positions that happen the end of the month

We are in a news driven market –

Russia still attacking some cities but seems to be slowing down because they aren’t able to resupply

Russia will only sell natural gas and crude using the ruble= they still are allowing the use of their banks

- It funds their banks with currency exchange rate fees

- Strengthens the ruble and it helps them cash hoard other currencies

GDP slowed to 6.9 vs est 7.1

Consumer confidence 107.2 vs 107.5

Personal spending 0.2 vs est 0.5

Personal Income 0.5 vs est 0.5

FOR THE LAST THREE WEEKS OR SO ….

Hurley Investments on up days has been 3x the increase of the market

Hurley Investments on down days has been 1.5 to 2x as bad as the drop

Portfolios are based around technology, banks (financials) and consumer discretionary (retail) AND we use the long put option as insurance

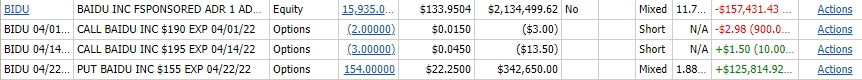

Technology – AAPL, BIDU, FB, MU,

Banks – BAC, JPM, ZION, V, SQ

Consumer Discretionary = AAPL, DIS, UAA, F, VZ,

Others – BA, KO, LMT, CVS, DG, USB, PRPL, MU, NEM

We are NOT holding Energy, Healthcare or Bio Pharma

On BIDU’s pop the market was up 0.23 and you were up 7.1%

BIDU on the China Delisting targets

Baidu (BIDU) – Baidu lost 2.2% in premarket trading after the SEC added the search engine company to its list of U.S.-traded China stocks that could be delisted if they don’t allow American regulators to review three years’ worth of financial audits. Online entertainment company iQYI (IQ) was also added to that list, with its shares sliding 6.6%.

https://www.barrons.com/articles/baidu-futu-sec-hfcaa-stock-delisting-list-51648714207?siteid=yhoof2

How are we going to make more than penny for penny on the way down?

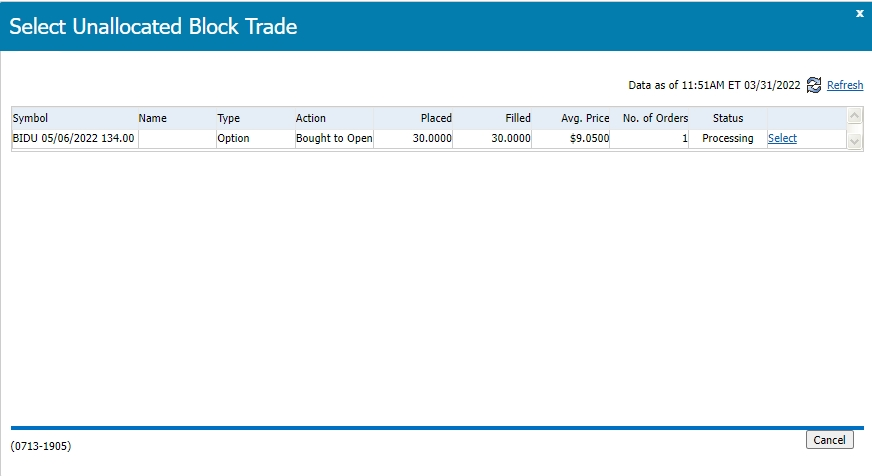

So IF you had 300 to 900 shares we added another long put contract

IF you had 1000 to 1700 shares we added two contracts

IF you had 1800 – 2600 shares we added four contracts

Closing COST out again

We closed 450, 500, 550 and some 600 leaps out for profits over the life of our COST trades

Right around $593-600 we are going to close the current COST leap position down again

And we will probably start another single contract leap call position for the next earnings around 5/26 estimated date

We would probably leap out to 2024