Trade Findings and Adjustments 02-24-2022

SO I had a pump you up type of webinar today and then Russia happened so let’s make this real for the next 30 mintues

Worldwide indexes are getting hit hard

DAX -3.96%, FTSE -3.88%, CACX -3.83, NIKKIE -1.81%, SHANGHAI -1.70%, HSI -3.21%

This Morning at the open SPX -2.54 $COMP -3.50

What’s my morning trading rule? DON’T Touch the account for the first hour

Why? Because futures have to clear out in that first half hour and economic report finish usually within the first hour

Which means I want a confirmation on the trend

S&P 500 YTD 12.17 Drop IT WOULDN’T SUPRISE me to see a 20% Bear Market Correction

Nasdaq Ytd -16.57

Currently Market Drags = Russia. March 15-16 FOMC rate decision, End of March Tax selling, April 15th taxes are due and they will be higher than expected because of stimulus

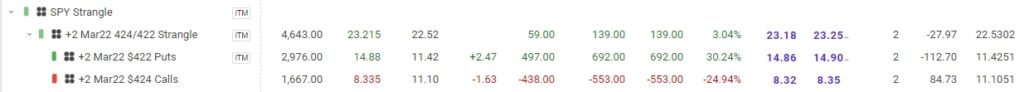

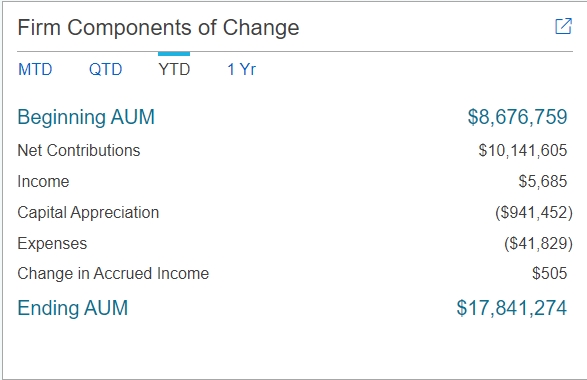

Accounts YTD

17,841,274 + 941,452 = start of year at 18,782,726

941,452/18,782,726 = – 5.01

Against the S&P 500 = 12.17 – 5.01 = +7.16

What we are doing and plan to do shortly?

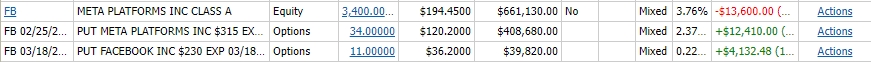

Add additional long put contracts to make up more that the stock loses on the way down

Look for short calls to be added

“I don’t want to cap AAPL, BA, BIDU, DIS, F, UUA, V, JPM with a short call”

In time & Up to higher Strike Price UP strike, Same Price Out in time & At a Higher Strike Price

In time & At the same Strike Price Short CALL Out in time & At the same Strike Price

In time & Up to Lower Strike Price Down Strike, Same Price Out in time & At a Lower Strike Price

You can take them off and possibly for a profit

Mistake = OR we made the best possible decision with the information we had at that time and then changed our mind two hours later

OUR mistake yesterday morning We too off the AAPL $170 long Puts for a profit/closing cost of $7.10

THEN two hours later we add farther out in time and $165 Long Puts for $6.50ish