Trade Findings and Adjustments 01-13-22

The 4 Option Instruments

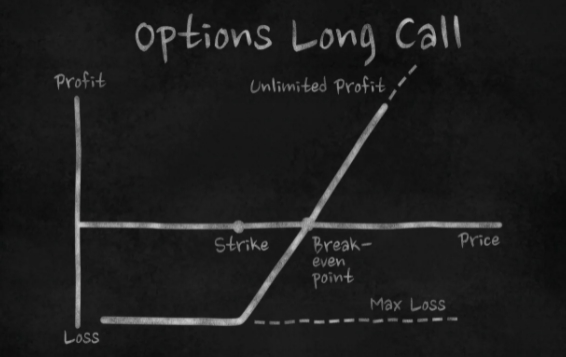

- Long Call Option

- Contract

- Buy To Open

- Right to BUY the underlying stock at a certain stock price for a certain period of time

- Goes up in value or down in value WITH the movement of the stock

- Debit: premium for the contract

- Ex: AAPL trading at 175 per share will have call options that might cost $5 of premium

- Many different option choices: Strike prices and expiration time.

- AAPL 175 strike Feb 18th 2022 which costs $5.22

- 1 Option contract controls 100 shares of underlying stock

- So this option would be $522 in real cost, even though it’s listed as $5.22

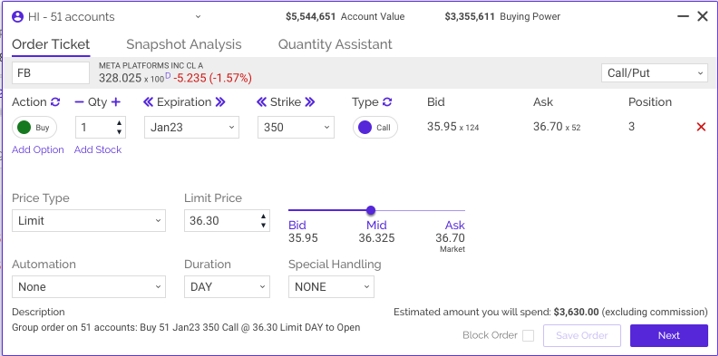

Leap Long Call “stock replacement” strategy

- Go out 1 year or more in expiration date

- Look at nearest highs and all time highs

- Higher strikes are cheaper premium cost

- FB 350 strike out to Jan23 (1year)

- Leave room in cash holdings to “dollar cost average” and lower the breakeven cost

- Wait until our call option contract is half off of the original price before considering doubling down with more Call option(s).

- Want to avoid “doubling down” more than 3 times