HI Market View Commentary 09-13-2021

Big Announcement and the Brady lesson for investing

Big Announcement IS …….. We are going to be moving accounts over to TD Ameritrade

So over the weekend I was out in Denver with Brady

Loved the guy, he likes to Golf and basically we golfed Fri-Sun ate at expensive restaurant’s and got to know each other as friends

BUT as I was trying to pay for all the food and fun

His comment back was ….. “ Oh, I thought it was because we were friends?”

We are approaching Sept 17th which usually / historically is the start of a 6 week downturn

Expect adding more long puts for this time period to protect stock ownership

Bank of America’s reliable model indicates negative long-term returns for the first time since 1999

Bank of America’s reliable model indicates negative long-term returns for the first time since 1999 PUBLISHED WED, SEP 8 20216:04 PM EDT Tanaya Macheel @TANAYAMAC

Traders work on the floor at the New York Stock Exchange.

Brendan McDermid | Reuters

Bank of America’s decades-old valuation model that predicts long-term returns has turned negative for the first time in more than 20 years as valuations have continued to climb.

The valuation model currently suggests the S&P 500 will lose 0.8% over the next decade on an annualized basis. That represents the first negative return predicted by the model of long-term returns since the tech bubble in 1999, Savita Subramanian, head of U.S. equity and quantitative strategy at the firm, wrote Wednesday in a note.

“Investor sentiment and valuations are extended – a lot of optimism is already priced in – and our long-term valuation model indicates negative returns for the S&P 500 over the next decade,” she wrote.

After more than doubling since the pandemic low in March 2020, the S&P 500 is trading for 29 times normalized earnings calculated by Bank of America. That’s 51% above the average forward normalized P/E since 1987.

Based on the bank’s calculations, at these valuation levels, the model suggests that the S&P 500 will lose money the next 10 years. The bank shows that while the valuation model is not very predictive over shorter time periods, over periods of 10 years and beyond the predictive power of this valuation metric is quite good.

“Valuation is almost all that matters for long-term stock returns,” the note says.

The bank shows that the valuation model correctly predicted the negative returns 10 years out from the 1999 bubble period and we’re back at that similar valuation point.

The valuation model is one of five inputs that Bank of America uses to forecast its S&P 500 targets and one of the reasons why Subramanian unveiled a measly 2022 target of just 4600, or about a 2% gain from here.

“Valuations leave no margin for error,” she wrote. “This may not end now. But when it ends, it could end badly.”

THIS means stock picking, valuations and growth potential are the only way to beat the S&P 500 moving forward for the next decade

Expect your taxes and corporate taxes to go up

Corp from 21% to 26.5%

Personal up 3-4% it is 7 % will now pay 11%

IT WON’T come with the stimulus bill that is ahead of the tax reform bill

| https://go.ycharts.com/weekly-pulse |

| Market Recap WEEK OF SEP. 6 THROUGH SEP. 10, 2021 The S&P 500 index ended the week in the red, snapping a two-week winning streak. The benchmark average closed the week at 4,459, down 1.67% from last Friday’s close of 4,535. Despite a strong start on Friday, the S&P tumbled into negative territory in the last hour of trading, fueled by gloomy Wall Street projections for the economy and stock market as COVID-19 continues to spread. With five consecutive losses, this was the worst week for the S&P 500 since February. Investors’ pivot into more defensive assets such as Treasuries was driven by worries about the longevity of the economic recovery and the spread of the Delta variant while global central bankers make preparations to exit pandemic-era stimulus programs. All sectors of the S&P ended the week in the red with the real estate sector taking the brunt of last week’s selling pressure, down nearly 4% from last Friday’s close. Digital Realty Trust (DLR) was the worst-performing stock in the sector with the majority of its 7.3% loss attributed to a 6.25 million stock offering last week. Healthcare stocks were also under heavy selling pressure with the sector down 2.7% from last week. A sizable gain in component stock Moderna (MRNA) was overshadowed by a big loss for Biogen (BIIB) and Eli Lilly (LLY) as Biogen announced a “slower than anticipated” launch for its Alzheimer’s drug Aduhelm. The stock suffered its longest losing streak in more than two years, taking Eli Lilly down in sympathy. Supply chain disruptions continued to weigh on the industrial sector, down for a second straight week with a loss of 2.5%. Construction machinery manufacturer Deere (DE) was the sector’s worst-performing stock, losing 6.7% in value alongside chemical-maker PPG (PPG) which withdrew its 2021 outlook on increased supply-chain challenges that were undermining profits. The tech sector started the week near record highs, dodging a broad market sell-off but ultimately ended the week 1.8% lower as losses in Hewlett Packard Enterprises (HPE) and Enphase Energy (ENPH) offset strength in Analog Devices (ADI) and Global Payments (GPN). The consumer discretionary sector nearly ended the week in the green, but ultimately lost ground in sympathy with a broad market sell-off. CarMax (KMX) was higher by almost 6% as the dearth of automobile inventory coupled with the preference for touch-less car buying made CarMax investors’ top pick in the sector. At the other end of the spectrum was Pulte Homes (PHM) with a problematic supply chain undermining the company’s Q3 closing projections. The homebuilders’ stock lost more than 10% in value last week, leaving it at its lowest level since March. A dearth of key economic data last week was offset by a strong Treasury refunding and a deluge of Fedspeak. Investors eagerly scooped up $120 billion in 3-Year notes, 10-Year notes, and 30-Year bonds, driving Treasury yields lower, and dampening demand for financial stocks amid declining lending rates. The sector was down 1.3% on the week. The Fed released their Beige Book last week with the Delta variant making a prominent appearance, mentioned more than 30 times in the report. Dining and travel were noticeably impacted while sectors like manufacturing and transportation remained strong. Next week’s calendar includes the consumer price index on Tuesday, the Empire State manufacturing index, production data on Wednesday, and retail sales Thursday. Provided by MT Newswires |

Earnings Dates

COST – 09/23 AMC

Where will our markets end this week?

Lower

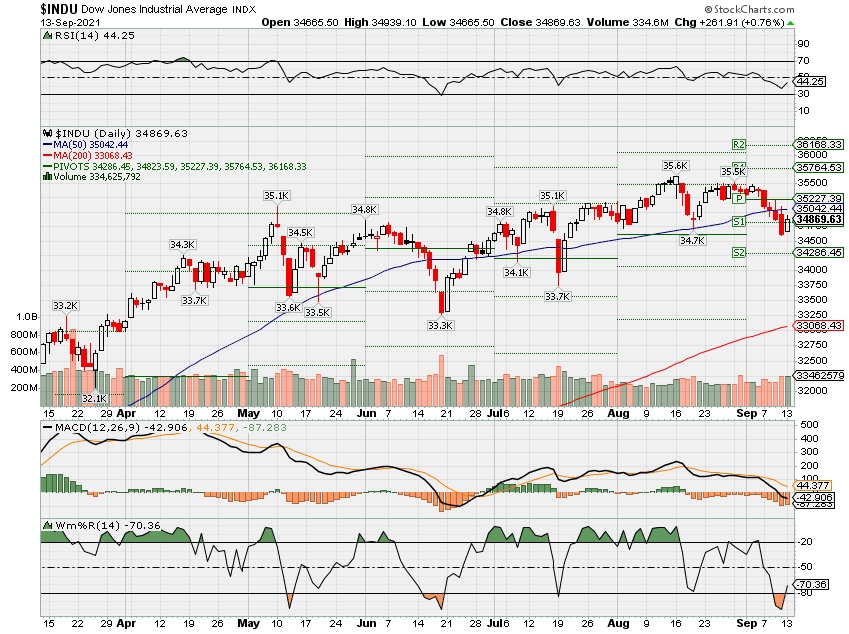

DJIA – Bearish

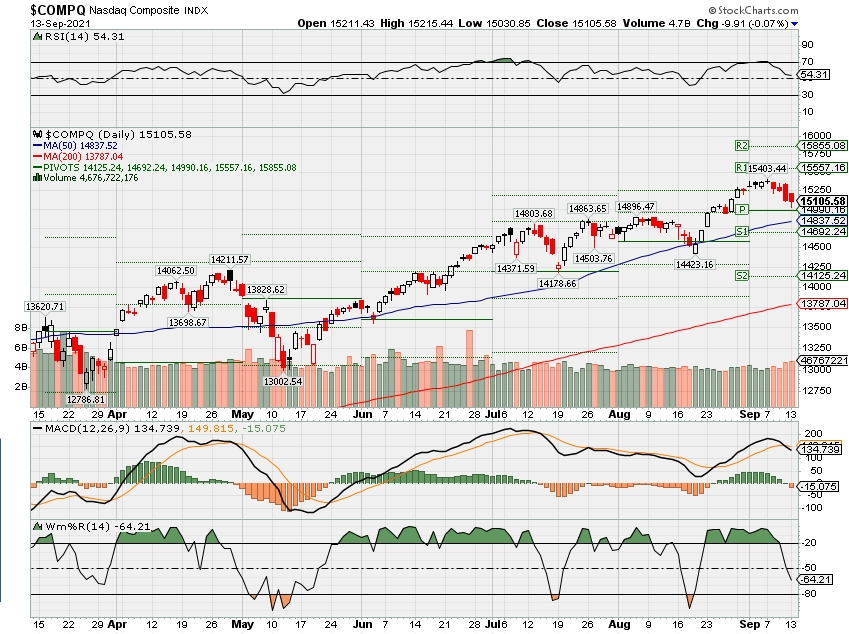

SPX – Bullish

COMP – Bullish

Where Will the SPX end September 2021?

09-13-2021 -1.0%

09-07-2021 -1.0%

08-30-2021 -1.0%

08-23-2021 -1.0%

Earnings:

Mon: ORCL

Tues:

Wed: JKS

Thur:

Fri:

Econ Reports:

Mon: Treasury Budget

Tues: CPI, Core CPI

Wed: MBA, Empire Manufacturing, Import, Export, Capacity Utilization, Industrial Production

Thur: Initial Claims, Continuing Claims, Retail Sales, Retail ex-auto, Phil Fed, Business Inventories, TIC Flows

Fri: Michigan Sentiment, Monthly OPTIONS EXPIRATION

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Long put protection is going to be added in the very near future

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://finance.yahoo.com/news/morgan-stanley-warns-15-plunge-182700213.html

Morgan Stanley warns of a 15% plunge before year-end — protect yourself this way

Sigrid Forberg

Thu, September 9, 2021, 12:27 PM

In this article:

COVID cases are surging while consumer confidence is plummeting. And the Fed is doing its best to cool the effects of inflation.

All of that makes Lisa Shalett, Morgan Stanley’s chief investment officer of the firm’s wealth management division, nervous.

In a recent call with investors, Shalett reiterated her confidence that the market is due for a major correction — between 10% and 15% — before the end of the year.

– ADVERTISEMENT –

https://s.yimg.com/rq/darla/4-6-0/html/r-sf-flx.html Within that context, Shalett advised investors to rebalance their portfolios to favor financials, consumer staples, consumer services and health care — particularly companies that can provide a steady stream of income.

Let’s take a quick look at a few possible plays from those sectors.

From banks to Band-Aid and snacks to shopping, one of them could be your next big wealth-building investment.

1. Financials: Bank of America (BAC)

Over the last decade, Bank of America has streamlined and refined its business practices and operations to rise from one of the lowest rated banks in the country to the second-largest bank by assets.

As the economy continues to recover from the pandemic and inflation continues to surge, interest rates are likely to rise, putting the bank is in a good position to continue its success. Banks benefit from higher rates through a wider “spread” — the difference in interest that they pay to customers and what they earn by investing.

And despite not quite hitting its earning mark last quarter, Bank of America delivered shareholders a dividend hike — upping its yield 17% from 18 cents to 21 cents per share. Currently, the shares offer a dividend yield of 1.8%.

Blue-chip investors might want to grab that yield using a free investing app.

2. Consumer Staples: PepsiCo (PEP)

Pepsico is so much more than a major cola and soda brand. Most consumers will be aware that Mountain Dew and Gatorade fall under the Pepsico umbrella.

But this food and beverage juggernaut also owns Frito-Lay, Quaker Foods, Tropicana, SodaStream and dozens of other brands across the world.

With everyone spending so much time at home, snack food consumption went way up during the pandemic — which was great news for Pepsi. In July, the company reported that net sales rose more than 20% year over year to $19.22 billion — nicely above expectations of $18 billion.

And the company is passing on some of those sweet (or salty, depending on your taste) dollars to shareholders through healthy dividends, which have been steadily increasing over the years. Over the past ten years, Pepsico’s dividend has grown at a compounded rate of 7.7%.

Pepsico shares offer a dividend yield of 2.7%.

3. Consumer Services: Target (TGT)

While many brick and mortar retailers suffered through long lockdowns, Target’s profits have soared over the last year and a half. So much so that it’s even been beating sales of pre-pandemic years.

Part of that can be attributed to the company’s investment in its contactless delivery and pick-up in-store capabilities — with many orders now available for same-day fulfillment.

Another factor in Target’s success is its convenience: with everything from cleaning supplies to clothing and from food to furniture, Target’s one-stop shop is appealing — especially for consumers still thinking about limiting their exposure as the country grapples with the delta variant.

Even after a record year of 24.3% growth in comparable sales last year, in Q2, Target reported 8.9% growth. Its dividend of 90 cents per share reflects that growth — as it’s a significant jump from 68 cents the previous quarter.

At the moment, Target shares sport a dividend yield of 1.5%.

4. Health care: Johnson & Johnson (JNJ)

Between its business in medical devices, pharmaceuticals and consumer packaged goods, Johnson & Johnson has become a household name.

And more than that, its numerous subsidiaries including Band-Aid, Tylenol, Neutrogena, Listerine and Clean & Clear could stand on their own as successful brands.

JNJ’s diverse holdings in the health care segment ensures it’s able to ride out any economic slumps. And with a handful of industry-leading drugs for immunology and cancer treatment under its Janssen Pharamceutica arm, there’s a good deal of growth opportunity for JNJ.

The company’s Q2 results were buoyed by $12.59 billion in revenue from its COVID-19 shot over the year — with global sales of $164 million in the second quarter alone.

JNJ shared its success with shareholders through a dividend of $1.06 in the third quarter, up from $1.01 six months before.

The stock currently has a dividend yield of 2.5%.

Where to go from there

You don’t have to buy into these specific companies to build a correction-proof portfolio heading into the last few months of 2021.

Follow the principle of Shalett’s advice and look for assets that offer both stability and high returns at a reasonable price.

All that can be found in one of Bill Gates’ top portfolio picks — investing in U.S. farmland.

There’s a reason a billionaire like Gates is now the country’s biggest owner of farmland: Agriculture has been shown to offer higher risk-adjusted returns compared to both stocks and real estate.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

https://www.ksl.com/article/50234502/your-money-its-better-to-be-reasonable-than-rational

Your money: It’s better to be reasonable than rational

By Joe Griffin Ceo, TrueNorth Wealth | Posted – Sept. 12, 2021 at 8:00 a.m.

This story is sponsored by Joe Griffin, CEO TrueNorth Wealth.

In the world of personal finance and investing, many believe that it’s all about math. Yet, while math plays a powerful role, in Morgan Housel’s recent book, “The Psychology of Money,” Housel argues that finding financial success is more of a lesson in psychology than in mathematics.

Housel believes investors are better off being fairly reasonable than coldly rational because in the end, behavior and emotions end up driving much of an investor’s success or downfall.

To demonstrate his point, Housel tells the story of Julius Wagner-Jauregg, a 19th century psychiatrist who won the Nobel Prize in medicine for his work to treat neurosyphilis.

Wagner-Jauregg specialized in patients with severe neurosyphilis, which had roughly a 3 in 10 survival rate at the time. Through his work, he began to recognize a surprising outcome: patients with a high fever due to a separate ailment seemed to have a greater chance of survival. So, he started to test his theory. Wagner-Jauregg began injecting patients with mild strains of typhoid, malaria, and smallpox to induce a fever, and fight off the syphilis.

As you can imagine, this was an incredibly dangerous trial, and many of the treated patients died. However, after much trial and error, his hunch was confirmed.

Wagner-Jauregg had settled on a mild version of malaria that he could easily treat after a few days of high fever. He later reported, “6 in 10 syphilis patients treated with ‘malariotherapy’ recovered, compared to 3 in 10 patients left alone.”

Housel writes of the impact this breakthrough had at a time when fevers were feared and largely misunderstood. He says, “…Wagner-Jauregg was onto something. Fevers are not accidental nuisances. They do play a role in the body’s road to recovery. We now have better, more scientific evidence of fever’s usefulness in fighting infection. A one-degree increase in body’s temperature has been shown to slow the replication rate of some viruses by a factor of 200.”

But, Housel laments, that is where the science ends, and reality takes over. Still to this day, fevers are primarily viewed as a bad thing and are typically treated as quickly as possible to eliminate them.

If we know that fevers are an essential piece in fighting illness, why are we so quick to treat them?

Housel says it’s simple, “Fevers hurt. And people don’t want to be hurt.”

“A doctor’s goal is not just to cure disease. It’s to cure disease within the confines of what’s reasonable and tolerable to the patient. …It may be rational to want a fever if you have an infection. But it’s not reasonable,” he continues.

This same logic applies to your money: it doesn’t matter if you’ve found the mathematically optimal investment strategy, if it doesn’t allow you to sleep at night, you won’t stick to it.

Housel writes, “What’s often overlooked in finance is that something can be technically true but contextually nonsense.”

Despite being a wholly rational and mathematically optimal strategy, no investor will be able to withstand the volatility.

He goes on to say, “The researchers argued that when using their strategy “the expected retirement wealth is 90% higher compared to life-cycle funds.”

“It is also 100% less-reasonable.” Housel quips.

For those looking to craft a reasonable financial plan that solves for sleeping well at night, here are some keys to consider.

Humans are wired to avoid losses, and some are wired stronger than others.

Part of a successful financial plan boils down to understanding your risk tolerance. Risk tolerance is your ability to weather the ups and downs of a market while still sleeping well at night. Markets rise and fall, and as an investor, you need to be mentally prepared for managing that volatility.

The benefits of a financial buffer often outweigh the drag of inefficiency.

From a mathematical standpoint, cash and bonds are typically not the most efficient use of capital, at this time. That said, they are less volatile than stocks and allow investors to create some stability in their financial plan. During lean years or a down-market, they can be as valuable as oxygen. Investing in 100% stocks may be the most rational strategy, but it’s not always the most reasonable.

Invest in things you love.

There is a common sentiment among investment professionals that you should be coldly unattached to your investments—willing to cut ties and jump ship if something underperforms. On the flip side, consider this: if you invest in things you love, you will be more likely to stick it out during the tough years rather than selling out at the first sign of trouble. This allows you to stay fully invested and capture the returns that may follow.

Warren Buffett’s winning equity portfolio is concentrated in just 4 stocks. Here’s what they are

PUBLISHED SAT, AUG 7 20219:18 AM EDT

Yun Li

@YUNLI626

Warren Buffett at Berkshire Hathaway’s annual meeting in Los Angeles California. May 1, 2021.

Gerard Miller | CNBC

Warren Buffett’s Berkshire Hathaway reported a strong rebound in earnings on Saturday and the conglomerate continued to rake in profits from its equity bets. Berkshire’s stock itself is up 23% this year.

Berkshire revealed that about 70% of its equity portfolio was concentrated in just four names. Take a look at these high-conviction bets from the “Oracle of Omaha.”

Apple remained Berkshire’s biggest common stock investment as of the end of June with a market value of $124.3 billion.

The gigantic Apple stake played a crucial role in helping the conglomerate weather the pandemic as other pillars of its business, including insurance and energy, took a huge hit. Shares of the tech giant gained 10% this year after an 80% rally in 2020 as investors flocked to megacap growth stocks that benefited from the stay-at-home trend last year.

Berkshire also owns big stakes in American Express and Bank of America as of the end of June. Outside of the two stocks, the conglomerate has been paring back its exposure to the financial sector. Berkshire exited its JPMorgan Chase and PNC Financial positions at the end of last year, while cutting the Wells Fargo stake drastically.

Buffett’s longtime bet Coca-Cola had a market value of $21.6 billion at the end of the second quarter. The consumer giant continued to underperform the broader market, however, as the stock rose a mere 3% this year so far following a flat year in 2020.

The conglomerate reported operating earnings of $6.69 billion in the second quarter, up 21% from $5.51 billion in the same period a year ago. Overall earnings, which reflect Berkshire’s equity investments, increased 6.8% year over year to $28 billion in the second quarter.