HI Market View Commentary 07-26-2021

Thoughts in general and things that are making me worried right now

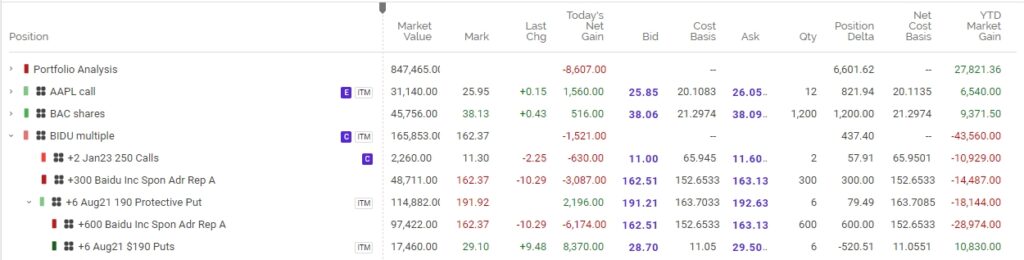

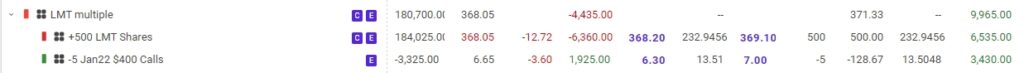

Today I did not beat the market = you might be a little over protected, there is a big loss in a particular core holding, Time to re-evaluate the over portfolios

I can live to trade another day

The indexes are trading sideway which is the one direction that the collar or protective put strategy loses money

LMT Earnings today and they beat top and bottom line

As I was doing my research I figured as much

| https://go.ycharts.com/weekly-pulse Market Recap WEEK OF JUL. 19 THROUGH JUL. 23, 2021 The S&P 500 index rose 2% last week, wiping out last week’s decline and sending the market benchmark to fresh record highs, as many sectors including communication services and consumer discretionary were boosted by better-than-expected Q2 financial results. The market benchmark ended Friday’s session at 4,411.79, up from last Friday’s closing level of 4,327.16 and representing a new closing high. The index also set a fresh intraday high Friday at 4,415.18. In the week prior, the S&P 500 fell 1% amid worries about inflation. The index continued to drop Monday on increasing concerns about the rise in COVID-19 cases amid the spread of the highly contagious Delta variant of the virus. But the index recouped those losses over the remainder of the week as more Q2 earnings reports beat expectations. With just five sessions remaining in July, the S&P 500 is now up 2.7% so far this month. It is up 17% in 2021. The communication services sector posted the largest gain last week, up 3.2%, followed by a 2.9% increase in consumer discretionary and a 2.8% rise in technology. Just two sectors were in the red for the week: utilities, down 0.9%, and energy, down 0.4%. Among the gainers in communication services, shares of Interpublic Group (IPG) rose 12% for the week as the advertising and marketing services company reported Q2 adjusted earnings per share and revenue above year-earlier results and analysts’ expectations. Also boosting communication services, shares of Twitter (TWTR) climbed 8%. The microblogging platform provider swung to a higher-than-expected Q2 adjusted profit per share on revenue that climbed more than expected from the year-earlier period. Twitter also forecast Q3 revenue above the Street consensus view. Chipotle Mexican Grill (CMG) was among the stocks lifting the consumer discretionary sector. Its shares jumped 17% on the week as the restaurant chain reported Q2 results above those from a year earlier as well as analysts’ expectations, prompting many analysts to raise their share price targets. Domino’s Pizza (DPZ) was another strong gainer in consumer discretionary. The pizza chain reported fiscal Q2 results that topped consensus estimates amid continued comparable sales momentum. Shares climbed 8.9%. In the technology sector, shares of Salesforce (CRM) rose 4.1% last week as the customer relationship management technology company said it completed its acquisition of Slack Technologies, the operator of a digital platform for business communication, following the closure of a Justice Department probe into the deal. On the downside, the utilities sector’s decliners included Atmos Energy (ATO), whose shares fell 1.8% on the week. Morgan Stanley cut its price target on the stock to $119 from $121 but maintained its overweight rating. Next week’s earnings calendar will feature quarterly earnings reports from companies including Hasbro (HAS) and Otis Worldwide (OTIS) on Monday; 3M (MMM), General Electric (GE), Alphabet (GOOGL) and Apple (AAPL) on Tuesday; Pfizer (PFE), Boeing (BA), McDonald’s (MCD) and Facebook (FB) on Wednesday; Altria Group (MO) and Amazon.com (AMZN) on Thursday; and Colgate-Palmolive (CL), Procter & Gamble (PG) and Caterpillar (CAT) on Friday. On the economic data front, next week will offer several updates on housing, with June new home sales due Monday, the May S&P Case-Shiller home price index as well as Q2 housing vacancies on Tuesday, and the June pending home sales index on Thursday. Other data due next week include July consumer confidence on Tuesday and June consumer spending and core inflation on Friday. Also in focus next week will be the two-day Federal Open Market Committee meeting concluding Wednesday. Provided by MT Newswires |

Earnings Dates

AAPL – 07/27 AMC

BA – 07/28 BMO

BABA – 08/19 est

BIDU – 08/12 est

COST – 09/23 AMC

DIS – 08/12 AMC

F – 07/28 AMC

FB – 07/28 AMC

FSLR – 07/29 AMC

GE – 07/27 BMO

GM – 08/04 AMC

TGT – 08/19 BMO

UAA – 08/03 BMO

V- 07/27 AMC

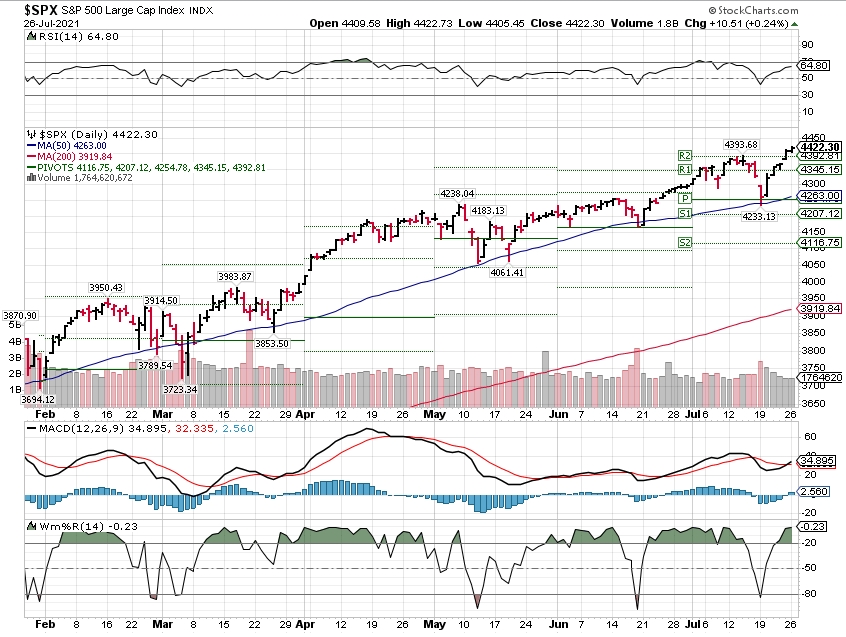

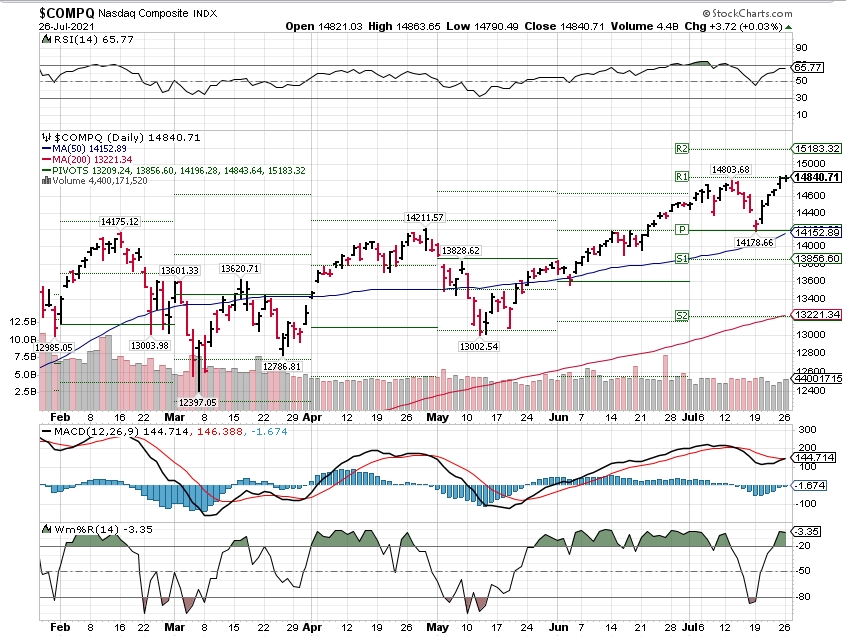

Where will our markets end this week?

Lower

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end August 2021?

07-26-2021 0.0%

Earnings:

Mon: HAS, FFIV, TSLA, LMT

Tues: MMM, BSX, CIT, GLW, JBLU, PHM, RTX, SIRI, UPS, WM, GOOG, JNPR, MSFT, GE, AAPL, SBUX, V

Wed: CME, GRMN, GD, MCD, PFE, SHOP, SPOT, LC, VAC, PYPL, BA, FB, F

Thur: TREE, MA, MDC, TAP, VLO, BZH, GRUB, SKYW, SWKS, TMUS, TWLO, X, AUY

Fri: CAT, CVX, CL, GWW, VFC

Econ Reports:

Mon: New Home sales

Tues: Durable goods, Durable ex-trans, FHFA Housing Price Index, S&P Case Shiller, Consumer Confidence

Wed: MBA, FOMC Rate Decision

Thur: Initial Claims, Continuing Claims, Pending Home Sales, GDP, GDP Deflator,

Fri: Employment Cost Index, PCE Prices Core, Personal Income, Personal Spending, Chicago PMI, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Added protection for earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

In 1999, Warren Buffett was asked what you should do to get as rich as him—his advice still applies today

Published Fri, Jul 23 20219:00 AM EDTUpdated Sun, Jul 25 20217:59 PM EDT

If you want to be as rich as Warren Buffett, don’t wait to get started. That’s the advice that the investing titan shared in 1999 at Berkshire Hathaway’s annual shareholders meeting when asked how to make $30 billion, which was roughly his net worth at the time.

The then-68-year-old Buffett — whose fortune has since grown to more than $100 billion — said that compound interest is an investor’s best friend and compared building wealth through interest to rolling a snowball down a hill.

“Start early,” Buffett said. “I started building this little snowball at the top of a very long hill. The trick to have a very long hill is either starting very young or living to be very old.”

The Oracle of Omaha said that if he were graduating from college in 1999 and had $10,000 to invest, he would be strategic about choosing where to put his money. “I probably would focus on smaller companies because I would be working with smaller sums and there’s more chance that something is overlooked in that arena,” Buffett explained, saying he would start examining companies alphabetically and work his way from there.

Investors, Buffett explained, need to fend for themselves and rely on their own knowledge and intuition when searching for promising businesses to invest in. He added that savvy investors would do best to “learn what you know and what you don’t” and act “very vigorously” when they see something they consider to be a good opportunity.

“You can’t look around for people to agree with you,” Buffett said of putting money into an investment. “You can’t look around for people to even know what you’re talking about.”

That said, Buffett is also a staunch supporter of index funds, which hold every stock in an index, making them automatically diversified. To build wealth, investors should “consistently buy an S&P 500 low-cost index fund,” Buffett said in 2017. “Keep buying it through thick and thin, and especially through thin.”

Still, Buffett said that aspiring to make $30 billion is unnecessary, and recently said that the size of his fortune is “incomprehensible.”

“The money makes very little difference after a moderate level,” he said.

He continued: “If you asked me to trade away a very significant percentage of my net worth either for some extra years on my life or being able to do during those years what I want to do, I’d do it in a second.”

China orders Tencent to give up exclusive music licensing rights as crackdown continues

PUBLISHED SAT, JUL 24 202112:22 AM EDTUPDATED SAT, JUL 24 20218:10 AM EDT

KEY POINTS

- The State Administration for Market Regulation on Saturday ordered Tencent to give up its exclusive music licensing rights and slapped a fine on the company for anti-competitive behavior.

- The competition watchdog ordered Tencent and its affiliates to relinquish its exclusive music rights within 30 days, and to end requirements for copyright holders to grant the company better treatment than to its competitors.

- In response, Tencent said it will “comply with all the regulatory requirements, fulfill our social responsibilities and contribute to healthy competition in the market.”

China’s antitrust regulator has ordered Tencent to give up its exclusive music licensing rights and slapped a fine on the company for anti-competitive behavior, as Beijing continues to crack down on its internet giants at home.

The State Administration for Market Regulation (SAMR) on Saturday imposed a fine of 500,000 yuan ($77,141) on the company citing violations in its acquisition of China Music in 2016.

Following that acquisition, Tencent owns more than 80% of exclusive music library resources, giving the company an advantage over its competitors as it is able to reach more exclusive deals with copyright holders, SAMR said in a statement.

The competition watchdog ordered Tencent and its affiliates to relinquish exclusive music rights within 30 days, and to end requirements for copyright holders to grant the company better treatment than to its competitors.

Tencent will have to report to the SAMR on its progress every year for three years, according to the statement, and the antitrust regulator will strictly supervise its implementation according to law.

In response, Tencent said in a statement it will “comply with all the regulatory requirements, fulfill our social responsibilities and contribute to healthy competition in the market.”

Tencent will work with affiliates, including Tencent Music Entertainment, to make those changes and ensure full compliance, it said.

China’s grip on internet giants

The latest regulatory crackdown comes as Beijing continues to curb the power of its domestic technology firms that have grown to become some of the most valuable companies in the world.

Tencent’s business includes WeChat — China’s most popular messaging service, games, music and fintech services. Tencent, which is listed in Hong Kong, has a market value of nearly $656 billion.

China’s widening clampdown has ranged from anti-competitive practices, to data security as well as increased scrutiny on Chinese companies with overseas listings in the U.S.

Just this month, Chinese regulators launched a cybersecurity probe on Chinese ride-hailing service Didi days after its massive U.S. IPO. In the past year, Beijing also slapped a $2.8 billion antitrust fine on Alibaba and suspended Ant Group’s $34.5 billion IPO.

In April, the SAMR summoned 34 companies including Tencent and ByteDance, and ordered them to conduct self-inspections so as to comply with anti-monopoly rules.

China tech stocks are on sale — one key level to watch if you’re considering buying

PUBLISHED FRI, JUL 16 202110:27 AM EDTUPDATED SUN, JUL 18 202110:55 PM EDT

Regulatory crackdowns have torpedoed the China tech trade.

Alibaba, Baidu, JD.com and Pinduoduo, some of the country’s largest tech companies, have collectively lost more than $500 billion in market cap since their February peaks as new anti-monopoly and data security rules in China threaten to weigh on profits.

With Alibaba, Baidu and JD.com trading at significant discounts to their historical price-earnings multiples, valuations may look compelling to those willing to shoulder the regulatory risks.

It’s worth being selective in the group, however, MKM Partners’ chief market technician, JC O’Hara, told CNBC’s “Trading Nation” on Thursday.

“When you look at a lot of these charts, they’re in downtrends, and downtrends to me say stay away,” he said.

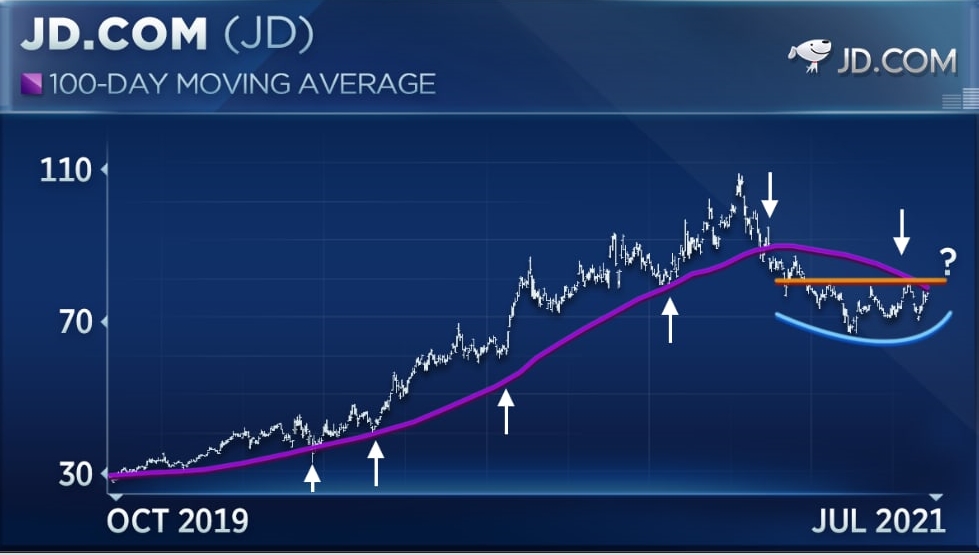

One name that showed some technical promise was JD.com, O’Hara said.

The stock has begun to stabilize after breaking below longtime support at its 100-day moving average, which initially caused a roughly 40% decline, O’Hara said.

“I’m really focused on the $80 level. That is key chart resistance as well as that longer-term 100-day moving average,” he said. “If JD can put in a sustained close above that level, now we would have a stock that’s in an uptrend with attractive valuations. That’s when it becomes a buy for us.”

JD.com fell by nearly 2% to around $75.50 a share in early Friday trading.

Another trader saw this as a chance to buy some of China’s most important companies on sale.

“I believe this is a big opportunity to own some of the biggest and best Chinese tech names, names like Tencent, Alibaba and Baidu,” Michael Binger, president of Gradient Investments, said in the same “Trading Nation” interview.

“These are secular growth stocks that still have a long runway of growth,” he said.

Though government intervention is not to be ignored, neither are the deep discounts at which these stocks are trading, Binger said.

“China’s economy is big and it’s recovering rapidly,” he said. “If I have a chance at these stock levels to own the biggest search engine, the biggest social networking company and the biggest e-commerce company in that rapidly growing economy in China there, I’m in and I want to invest right here.”

Another 2.2 million stimulus checks have gone out. Here’s who received the payments

PUBLISHED WED, JUL 21 20214:04 PM EDT

KEY POINTS

- The aggregate value of all stimulus checks sent out since early March is about $400 billion.

- The American Rescue Plan Act authorized payments of up to $1,400 per person, plus $1,400 per eligible dependent, for individuals and families who qualified.

About 2.2 million more stimulus checks have gone out over the last six weeks, the government said Wednesday.

The latest batch brings the total number of payments disbursed to more than 171 million, with an aggregate value of $400 billion, according to the announcement from the IRS, Treasury Department and Bureau of the Fiscal Service. These payments started going out in March when the American Rescue Plan Act was signed into law by President Joe Biden.

That legislation authorized payments of up to $1,400 per person, plus $1,400 per eligible dependent, for individuals and families who fall under certain income thresholds and also meet other requirements.

For the latest tranche, about 1.3 million of the payments — with a value of about $2.6 billion — were sent to eligible individuals for whom the IRS previously did not have information to issue a stimulus check but who recently filed a tax return.

This batch also includes supplemental payments for individuals who earlier this year received payments based on their 2019 tax returns yet were eligible for a new or larger amount based on their 2020 tax returns, which would have been processed more recently.

The IRS said it will continue to disburse these stimulus checks on a weekly basis.

HI Financial Services Mid-Week 06-24-2014