HI Market View Commentary 06-21-2021

What is the most important “thing” in relation to successful investing or trading

My most important “thing” for successful investing = TIME

My Quote of the Day: Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas. Paul Samuelson

https://go.ycharts.com/weekly-pulse

| WEEK OF JUN. 14 THROUGH JUN. 18, 2021 |

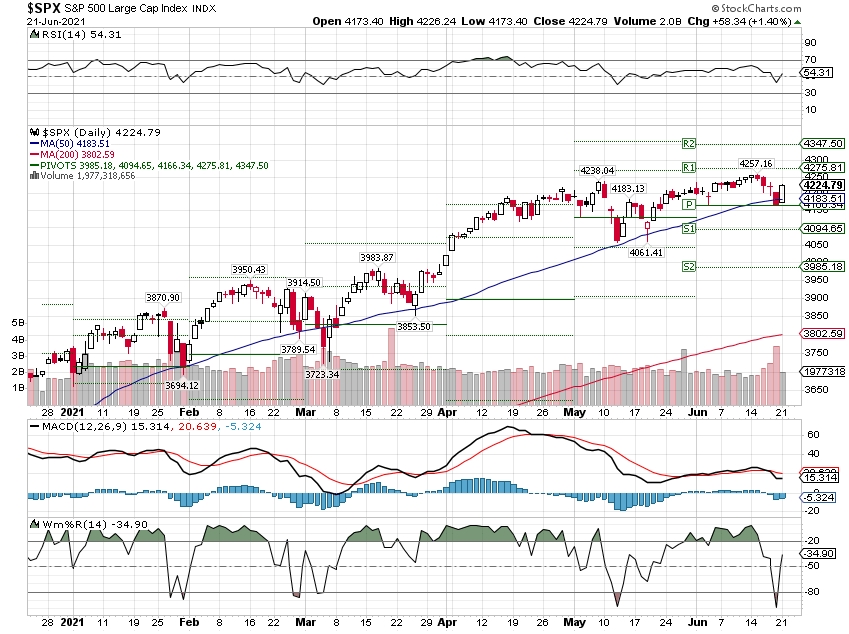

| The S&P 500 index fell 1.9% last week with the materials and financial sectors leading most others into the red as the Federal Reserve’s policy-setting committee signaled it may raise interest rates sooner than previously anticipated. The market benchmark ended the week at 4,166.45, down from last Friday’s closing level of 4,247.44. This marks the S&P 500’s first weekly decline since the week ended May 21. It also pushed the index into the red for the month of June, wiping out gains recorded in the first two weeks of the month; the S&P 500 is now down 0.9% for the month to date. It is still up 11% for the year to date. The week’s tumble came as the Fed’s Federal Open Market Committee concluded a two-day meeting with a median projection that it will raise its benchmark rate to 0.6% from near zero by late 2023, a shift from its March prediction that it would hold the rate steady near zero through that year. The central bank’s officials also discussed eventually tapering its bond-buying program, Chairman Jerome Powell said. Amid the change in tone from the FOMC, the materials sector had the largest percentage drop of the week, down 6.3%, followed by a 6.2% decline in financials and a 5.2% slip in energy. Technology, which eked out a 0.1% increase, was the only sector that managed to rise versus last Friday’s close. The materials sector’s decliners included the shares of copper and gold miner Freeport-McMoRan (FCX), which shed 14% on the week as copper and gold futures fell amid the rate worries. Prices of metals tend to fall when rates are expected to rise, making yield-bearing investments more attractive. In the financial sector, shares of Citigroup (C) dropped 12% last week as Chief Financial Officer Mark Mason said at a conference that revenue in the bank’s markets business, investment banking unit and North America consumer business is likely to be down in Q2. On the upside, the technology sector’s gainers included NVIDIA (NVDA), whose shares rose 4.5% last week amid positive analyst actions. Jefferies raised its price target on the graphics chip maker’s stock to $854 per share, up from $740. BofA Securities raised its price objective on the stock to $900 from $800, citing accelerating growth opportunities in cloud-based artificial intelligence and the company’s move into the central processing units and data processing units markets. Next week’s economic data will include updated readings on the housing market and the manufacturing and services sectors. May existing home sales are to be reported Tuesday and May new home sales will be released Wednesday. Markit’s manufacturing and services purchasing managers’ indexes are also due Wednesday. Thursday’s data releases will include revised Q1 gross domestic product while Friday’s data will feature May consumer spending and June consumer sentiment. Provided by MT Newswires The market has been ridiculously hard to understand The FED just said that they are thinking about thinking about a tapering, the opening was a process related to the extra unemployment that was being given out by the government |

https://www.wealthmanagement.com/webinars/investing-gambling-and-gamification-new-market-dynamics-demand-new-portfolio-risk-metrics?code=UM_WM_NewAgeAlpha_09&utm_rid=CPG09000005715818&utm_campaign=32937&utm_medium=email&elq2=18bb9e61e8af4a35be85ee73dbe86047&oly_enc_id=6677F7147745C9Z

Investing, Gambling and Gamification – New Market Dynamics Demand New Portfolio Risk Metrics

Wednesday, June 23, 2021 | 2:00 PM Eastern Daylight Time

The gamification of markets spurred by the wave of retail investors has replaced disciplined investment analysis with speculation and conjecture. For a lucky few, the irrational behavior provided short-term success. However, such behavior goes hand-in-hand with steep losses, which—you guessed it—is actually gambling rather than investing.

In today’s market, many advisors don’t realize they are dealing with gambling outcomes, thereby exposing their clients to a gambling risk that continues to grow in severity. This new dynamic makes the mitigation of gambling risk in a portfolio critical and begs the question: Are you rolling the dice with your client’s portfolio?

that presentation is already recorded

Where will our markets end this week?

Lower

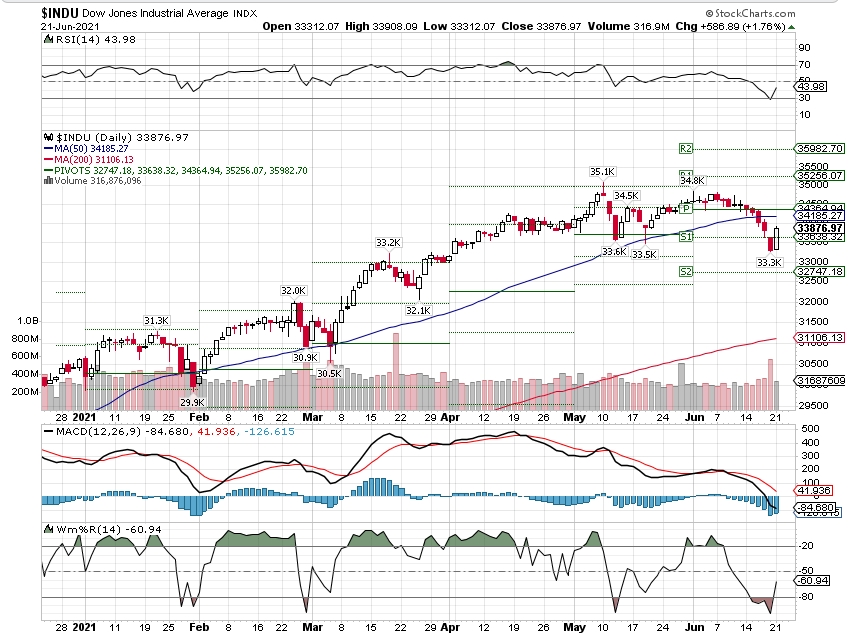

DJIA – Bullish

SPX – Bullish

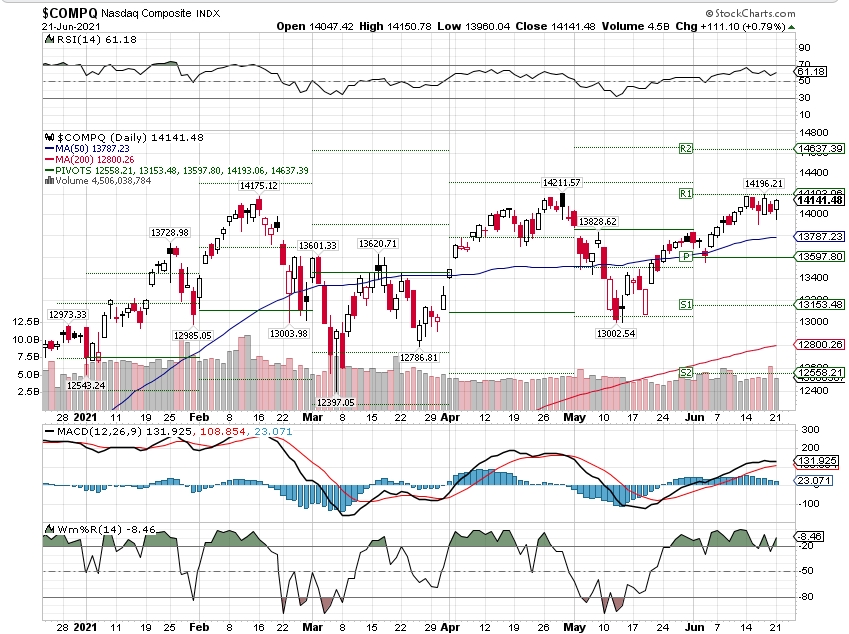

COMP – Bullish

Where Will the SPX end June 2021?

06-21-2021 1.0%

06-14-2021 1.0%

06-07-2021 1.0%

06-01-2021 1.0%

05-24-2021 4.0%

Earnings:

Mon:

Tues:

Wed: WGO, FUL, KBH, SCS

Thur: DRI, RAD, BB, FDX, NKE

Fri: KMX

Econ Reports:

Mon:

Tues: Existing Home Sales,

Wed: MBA, New Home Sales,

Thur: Initial Claims, Continuing Claims, Durable Goods, Durable ex-trans

Fri: PCE Prices, Personal Income, Personal Spending, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Looking to add monthly short calls where appropriate

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Am I reading my confirmations correctly? did I just lose AAPL for

$52.50 in my account # ####? Was that accidental? Or planned?

American Airlines cancels hundreds of flights due to staffing crunch, maintenance issues

PUBLISHED SUN, JUN 20 20218:56 PM EDTUPDATED AN HOUR AGO

KEY POINTS

- The carrier canceled hundreds of flights due to staffing shortages, maintenance and other issues.

- American Airlines says it will trim its schedule by 1% through mid-July though it canceled more than that this weekend.

- The disruptions come as airlines are trying to capture a surge in vacation demand after record losses in the Covid pandemic.

American Airlines said it canceled hundreds of flights over the weekend due to staffing shortages, maintenance and other issues, challenges facing the carrier as travel demand surges toward pre-pandemic levels.

About 6% of the airline’s mainline schedule, or 190 flights, were canceled Sunday, according to flight tracking site FlightAware. The airline said that equaled about 3% of its total flights, including those operated by regional carriers. An internal company list, which was viewed by CNBC, showed about half of those were because of unavailable flight crews. On Saturday, about 4% of its mainline schedule, or 123 flights, were canceled and 106 on Monday, FlightAware showed.

American said it is trimming its overall schedule by about 1% through mid-July to help ease some of the disruptions, some of which it said resulted from bad weather at its Charlotte, North Carolina, and Dallas/Fort Worth international airport hubs during the first half of June. The planned cuts amount to about 950 flights in the first half of next month.

Airlines are scrambling to keep up with a spike in air travel demand as governments lift pandemic-related restrictions and allow more attractions from concerts to restaurants to theme parks to reopen, after spending much of the past year trying to reduce staff. Some returning travelers have complained about hourslong customer service hold times.

American said it’s in the process of hiring hundreds of customer service agents after about a quarter of its customer service agents took voluntary leaves of absence or buyouts. Delta Air Lines is in the process of hiring about 1,300 people for these positions, spokesman Morgan Durrant said. Both carriers said they are reaching out to people who took leaves or buyouts to help cover demand.

The Transportation Security Administration said it screened more than 2.1 million people on Sunday, the most since March 7, 2020, but 23% below the 2.7 million people screened two years ago, months before the Covid pandemic began.

“The bad weather, combined with the labor shortages some of our vendors are contending with and the incredibly quick ramp up of customer demand, has led us to build in additional resilience and certainty to our operation by adjusting a fraction of our scheduled flying through mid-July,” said American Airlines spokeswoman Sarah Jantz in a statement. “We made targeted changes with the goal of impacting the fewest number of customers by adjusting flights in markets where we have multiple options for re-accommodation.”

Bad weather has impacted flight crews’ ability to get to assigned flights and storms and other weather can mean that crews can fall outside of the hours they are federally allowed to work, the spokeswoman said.

Dennis Tajer, spokesman for the Allied Pilots Association, which represents American’s roughly 15,000 pilots, said the company should offer more overtime in advance to encourage staff to fill in as well as more flexibility in pilots’ schedules to cover staffing shortages.

“They’re trying to put a Band-Aid on something that needs stitches,” said Tajer, who is also a Boeing 737 captain.

American is also racing to train all of the pilots it furloughed in between two federal aid packages that prohibited layoffs as well as its aviators who are due for periodic recurrent training. Jantz said American is on track to finish training furloughed pilots by the end of this month and added the company is offering overtime because of its operational issues.

The airline isn’t the only carrier whose operations have been disrupted by staffing shortfalls. Delta canceled more than 300 flights last Thanksgiving weekend and scores of others during Christmas due to a pilot shortage.

The weekend’s disruptions, reported earlier by the View from the Wing airline blog, come just as carriers are trying to capture a sharp increase in travel demand and stem record losses. American said in a filing earlier this month that it expects its second-quarter capacity to be down 20% to 25% from 2019, while United Airlines estimated it will fly about 46% less and Delta forecasts a 32% decline versus 2019. Meanwhile, Southwest Airlines forecast its July capacity to be off just 3% from 2019, down from a 7% decline this month.

Beware of inflation ‘headwinds’: It could take a year to break even after a 10% to 20% market correction, economist Mark Zandi warns

PUBLISHED SUN, JUN 20 20215:00 PM EDTUPDATED 6 HOURS AGO

Stephanie Landsman@STEPHLANDSMAN

Moody’s Analytics’ Mark Zandi has a message for investors: Brace for a significant market correction.

The firm’s chief economist expects a more hawkish Federal Reserve will spark a 10% to 20% pullback.

And, unlike the sharp drops over the past several years, Zandi anticipates a quick recovery won’t be in the cards particularly because the market is richly valued. He estimates it could take a year to return to break even.

“The headwinds are building for the equity market,” Zandi told CNBC’s “Trading Nation” on Friday. “The Federal Reserve has got to switch gears here because the economy is so strong.”

He suggests the correction may already be underway because investors are starting to get spooked.

The Dow just saw its biggest weekly loss since October 2020, tumbling 3.45%.The broader S&P 500 saw its worst week since late February. The tech-heavy Nasdaq also had a losing week, but it’s just 1.28% off its all-time high.

Despite his market warning, Zandi believes the economy will avert a recession because the downturn is more about risk asset prices getting overextended than a serious fundamental issue.

“The economy is going to be rip-roaring,” he said. “Unemployment is going to be low. Wage growth is going to be strong.”

Zandi has been ringing the alarm on inflation for months.

On “Trading Nation” in early March, Zandi asserted inflation was “dead ahead” and investors weren’t fully grasping the risks. According to Zandi, it’s still a problem affecting stock market and bond investors. Zandi sees little chance the benchmark 10-year Treasury Note yield will keep falling.

“I wouldn’t count on rates staying at 1.5% for very long given what’s going on,” he added.

Stocks and bonds aren’t the only risk assets catching his attention. Zandi also sees more trouble brewing in the commodities and cryptocurrency sell-offs. Plus, he’s worried about the sustainability of a strong housing market amid higher mortgage rates.

“Inflation is going to be higher than it was pre-pandemic,” Zandi said. “The Fed has been struggling for at least a quarter of a century to get inflation up, and I think they’ll be able to get that.”

HI Financial Services Mid-Week 06-24-2014