HI Market View Commentary 04-19-2021

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF APR. 12 THROUGH APR. 16, 2021 |

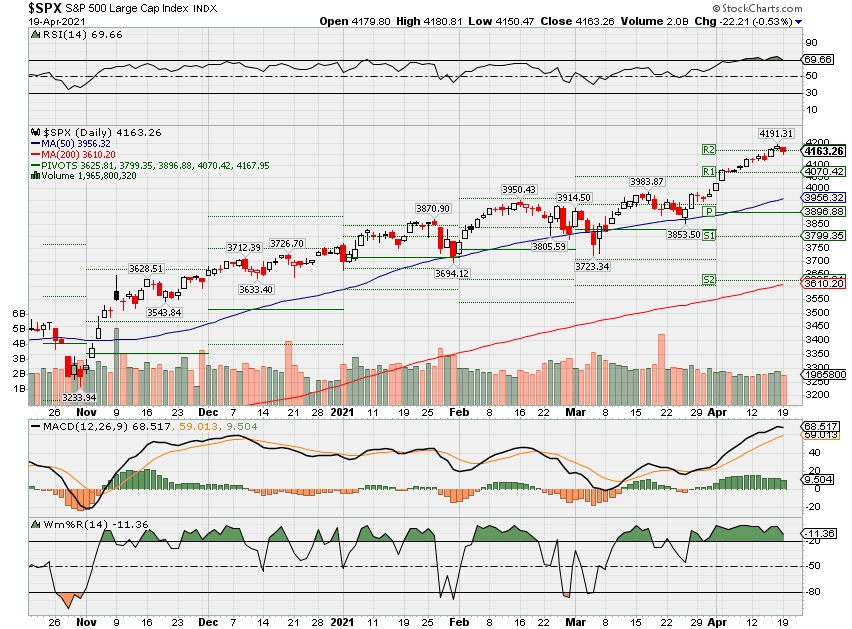

| The S&P 500 index rose 1.4% last week and set new record highs yet again as the first round of financial results from Q1 came in ahead of expectations while weekly jobless claims fell to their lowest level since March 2020. The market benchmark ended the week at 4,185.47, up from last Friday’s close of 4,128.80 and marking a record closing high. The index also reached a new intraday high Friday at 4,191.31. The S&P 500 is now up 11% for the year to date. The weekly climb was broad, with one sector barely in the red and all other sectors in the black for the week. Utilities had the largest percentage increase, up 3.7%, followed by a 2.9% rise in health care and a 2.6% gain in real estate. The lone declining sector was communication services, down by less than a hundredth of a percentage point. Investor sentiment was boosted by stronger-than-expected Q1 reports as well as economic data. The companies that reported Q1 results above analysts’ expectations included Goldman Sachs (GS), Alcoa (AA) and PepsiCo (PEP). The week’s economic data, meanwhile, featured the drop in weekly jobless claims to their lowest level since March 2020 as well as a 9.8% jump in US retail sales. The investor optimism came even as the seven-day average of newly reported US COVID-19 cases edged up and the US vaccination effort hit a major setback. The Food & Drug Administration and the Centers for Disease Control & Prevention recommended a pause in the use of Johnson & Johnson’s (JNJ) COVID-19 vaccine following six cases of a rare blood clot in six women who had received the vaccine. Still, with two other authorized vaccines in the US, the news of the pause didn’t prevent the stock market from climbing. The utilities sector’s gainers included Entergy (ETR), whose shares rose 5.4% on the week as the electric power producer said its board declared a quarterly dividend payment of $0.95 per share on its common stock, maintaining the company’s previous quarterly rate. In health care, UnitedHealth Group (UNH) shares jumped 3.9% as the provider of health care benefits as well as technology-enabled health services reported stronger-than-expected Q1 earnings and revenue and boosted its guidance for 2021 adjusted earnings per share. In real estate, shares of Public Storage (PSA) rose 3.5% as the acquirer, developer and operator of self-storage properties announced a deal to acquire ezStorage, another self-storage company, for $1.8 billion. Public Storage expects the deal to immediately boost its funds from operations following an anticipated closing in May. The decliners in communication services included shares of Discovery (DISCA), down 11% amid reports that Credit Suisse (CS) is unloading holdings in the media company after Archegos Capital Management defaulted on its credit with the Swiss lender and other banks. Next week’s earnings calendar features Coca-Cola (KO) and United Airlines (UAL) on Monday, Procter & Gamble (PG) and Netflix (NFLX) on Tuesday, Verizon Communications (VZ) and Halliburton (HAL) on Wednesday, AT&T (T) and Intel (INTC) on Thursday, and American Express (AXP) and Kimberly-Clark (KMB) on Friday. The economic calendar will be light, with no major reports due the first three days of the week. Weekly jobless claims, March existing home sales and leading economic indicators are expected Thursday, followed by March new home sales and Markit’s April purchasing managers indexes. Provided by MT Newswires |

Core Holdings,

AAPL – 4/28 AMC

BA – 4/28 BMO

BIDU – 5/17 est

DIS – 5/13 AMC

F – 4/28 AMC

KO – 4/19 BMO

UAA – 5/10 est

GE – 4/27 BMO

GM – 5/5 BMO

COST – 5/27 AMC

FB – 4/28 AMC

VZ – 4/21 bmo

V – 4/27 AMC

Where will our markets end this week?

Higher

DJIA – Bullish, Overbought

SPX – Bullish, Overbought

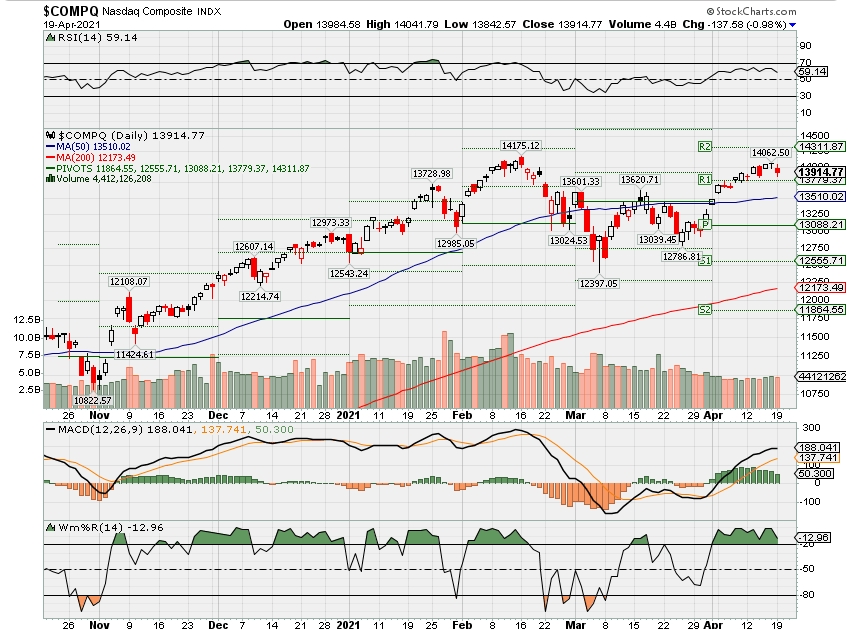

COMP – Bullish

Where Will the SPX end May 2021?

04-23-2021 2.0%

Earnings:

Mon: KO, IBM, UAL, ZION

Tues: ABT, KEY, LMT, PM, PG, NFLX, ISRG

Wed: FHN, HAL, LAD, VZ, KMT, LVS, VMI

Thur: ALK, AAL, ARCH, T, DHI, FCX, LUV, UNP, INTC, MAT

Fri: AXP, HON, KMB, SLB

Econ Reports:

Mon:

Tues:

Wed: MBA,

Thur: Initial Claims, Continuing Claims, Leading Indicators, Existing home Sales,

Fri: New Home Sales

Int’l:

Mon –

Tues –

Wed –

Thursday – ECB Interest Rate Decision

Friday-

Sunday –

How am I looking to trade?

Earnings and adding protection where needed

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Netflix and Disney are trading places: Disney is the upstart, Netflix the old guard

PUBLISHED TUE, JAN 19 20216:30 PM ESTUPDATED TUE, JAN 19 20217:05 PM EST

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- Netflix said Tuesday it may start buying back shares for the first time since 2011.

- Activist investor Dan Loeb has pushed Disney to halt its dividend in order to use the capital for content.

- Netflix has become streaming’s incumbent while Disney is the upstart.

Disney and Netflix pride themselves on storytelling. Now they’ve switched places when it comes to the tales they’re telling Wall Street.

Netflix said on Tuesday that it would consider buying back shares for the first time since 2011. After nearly a decade of borrowing $15 billion to fund original content, Netflix said Tuesday it planned to be cash-flow positive after 2021 and would no longer need outside financing for its operations.

Disney, meanwhile, temporarily halted its dividend last year and has heard calls from activist investor Dan Loeb to permanently end its annual $3 billion payment to shareholders. Loeb wanted Disney to funnel that money into original content, using Netflix’s startling runup from an $11 billion company to a $220 billion media giant as a model.

While Disney hasn’t ended its dividend yet, the company is focusing its operations around streaming. Disney plans to roll out dozens of Star Wars, Marvel and Pixar movies and series in the coming years for its flagship streaming service, Disney+. The service has gained more than 86 million subscribers in a year, way ahead of Disney’s original expectations, and the company now expects between 230 million and 260 million subscribers by 2024.

“It’s super impressive what Disney has done,” Netflix co-CEO and co-founder Reed Hastings said during Netflix’s earnings conference call. “It’s incredible execution for an incumbent to pivot to take on the insurgent. It shows members are willing and interested to pay for more content because they’re hungry for great stories. And Disney does have great stories.”

But while Hastings still refers to Disney as the incumbent, investors see a different picture. There’s a reason Disney shares gained more than 2% after hours on Netflix’s news, which sent Netflix shares up more than 12%. Investors don’t see the battle as Disney versus Netflix. They see that Disney wants to be like Netflix, and there’s room for both.

Netflix was founded in 1997. Disney has been around for nearly 100 years.

But in the streaming video world, Netflix is the incumbent and Disney the upstart.

The student has become the teacher.

Fundstrat’s Tom Lee explains why he expects a ‘face-ripper rally’ in April

PUBLISHED MON, APR 5 20216:37 PM EDT

KEY POINTS

- “I think there’s a level of surprise coming in April because we already had a strong finish beginning Wednesday of last week,” Fundstrat’s Tom Lee told CNBC on Monday.

- Lee said he believes the S&P 500 could rally roughly 3% by the end of the month.

Tom Lee said Monday he expects the stock market’s strong start to April to continue throughout the month as part of what he’s previously dubbed a “face-ripper rally.”

The co-founder of Fundstrat Global Advisors made his case in an interview on CNBC’s “Fast Money,” following the S&P 500′s 1.4% gain Monday to notch a record close of 4,077.91.

“Institutions raised almost $200 billion of cash since the start of the year, so they’ve turned quite cautious, and they’ve been fading or selling their tech and growth holdings but they’ve only just begun to nibble on the … epicenter [stocks],” said Lee, whose firm considers those to be companies that were among the hardest-hit in the pandemic but stand to gain from the economic recovery.

“So, I think there’s a level of surprise coming in April because we already had a strong finish beginning Wednesday of last week. It’s really three days of strong rallies and history shows this is really building up to be what could be a, potentially, S&P 4,200 before the end of the month,” Lee said.

The broad equity index reaching that level would represent roughly 3% upside from Monday’s close.

Additionally, Lee said it would make the April rally “something that is both really strong but, more importantly, quite a big surprise for institutions.”

As for what happens after a so-called face-ripper rally, Lee said there could be a period of choppy trading.

“I think if the S&P does in fact rally strongly this month at a time when institutions are sitting on so much cash and there’s so much skepticism on this market, we could see a big chase and that could mark the high for the year,” he said. “I wouldn’t say that’s our base case, but yes, we would have to consolidate these gains.”

Alibaba, Tencent are still China’s ‘benchmark’ techs — even as Beijing ramps up pressure, says investor

PUBLISHED SUN, APR 4 202110:20 PM EDTUPDATED SUN, APR 4 202111:41 PM EDT

KEY POINTS

- Alibaba and Tencent remain stalwarts among China’s technology stocks despite fears of increasing regulation, says Jackson Wong of Amber Hill Capital.

- Chinese tech stocks in Hong Kong have lagged relative to other sectors so far this year. In the first quarter, no tech stocks were in the 10 top constituents of the city’s benchmark Hang Seng index.

- Tencent shares rose about 8% in the first quarter of the year. Alibaba, on the other hand, saw its Hong Kong-listed shares drop more than 5% in the same period.

Alibaba and Tencent remain China’s top technology stocks — even as Beijing continues to ramp up regulatory pressure on its big internet firms, says Jackson Wong of Amber Hill Capital.

“At this point, I can’t see any other stocks that can challenge their positions in China,” Wong, director of asset management at Amber Hill, told CNBC’s “Street Signs Asia” on Thursday.

Alibaba and Tencent “are still the benchmark” among China’s tech stocks, he said. Wong’s family and Amber Hill both own shares in the two companies.

His comments come as Chinese tech stocks in Hong Kong lagged the other sectors so far this year.

The top 10 constituents of the Hang Seng index did not include a single tech stock at the end of the first quarter, according to a CNBC analysis using data from Refinitiv Eikon.

What’s dragging down tech shares?

A range of factors have contributed to the comparatively poorer performance of the tech sector, which makes up more than 42% of Hong Kong’s benchmark index.

One reason is that bond yields are rising — and that hurts growth stocks like techs because they reduce the relative value of future earnings.

Another concern is delisting threats from the U.S. Chinese tech shares that are also listed in the U.S. have taken a beating this year, amid fears that a new U.S. law could stop the trading of securities that fall foul of Securities and Exchange Commission rules.

Finally, China’s regulatory crackdown on the sector has also spooked investors.

The business empire of Alibaba’s founder, Jack Ma, suffered a huge blow last year when China pulled the plug on Ant Group’s initial public offering, and suspended what would have been the largest IPO in history. Ma is the co-founder and controller of Ant Group.

Alibaba does not appear to be the only internet titan that’s being targeted. Reuters reported in March that Tencent’s founder Pony Ma met with Chinese antitrust officials earlier last month.

Still, Tencent shares rose about 8% in the first quarter of the year. Alibaba, on the other hand, saw its Hong Kong-listed shares drop more than 5% in the same period.

Both firms got off to a positive start in the second quarter. Tencent’s stock soared 7.21% while Alibaba shares in Hong Kong jumped 2.55% on Thursday — the last trading day before the long holiday. Trading starts again on April 7.

Challenges ahead

Looking ahead, Wong acknowledged that political headwinds and potential regulatory rules ahead could “really damage” the profit outlook for the two internet giants that dominate China’s tech space.

However, he expects “some kind of compromise” to be eventually reached on the regulatory front.

“Going forward, their valuations might not be, you know, 50 or 60 times of earnings. Still … they’re trading at around 30 times of earnings and they are at a very good position in China,” Wong said.

He was referring to price-to-earnings (P/E) ratio — a measure of a company’s stock price relative to its earnings. A high P/E ratio could indicate an expensive stock price compared to its earnings.

Alibaba’s Hong Kong-listed stock had a P/E ratio of 26.34 while Tencent’s P/E ratio was 33.36, according to data from Refinitiv Eikon.

In comparison, some U.S. tech stocks have much loftier valuations. Amazon and Netflix have P/E ratios of 75.71 and 91.6, respectively, while Tesla’s stands at more than 1,000.

Meanwhile, Apple and Facebook share similar valuations with the Chinese tech giants. The two firms’ P/E ratios were at 33.25 and 29.61 respectively.

Wall Street banks brace for digital dollars as the next big disruptive force

PUBLISHED MON, APR 19 20213:41 PM EDTUPDATED AN HOUR AGO

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Wall Street banks view central bank digital currencies as the next big financial disruptor.

- Countries as large as China and as small as the Bahamas have instituted these digital currencies.

- In the U.S., the Federal Reserve is taking a cautious approach though it has launched a project with MIT.

Wall Street is warming up to the idea that the next big disruptive force on the horizon is central bank digital currencies, even though the Federal Reserve likely remains a few years away from developing its own.

Led by countries as large as China and as small as the Bahamas, digital money is drawing stronger interest as the future of an increasingly cashless society.

A digital dollar would resemble cryptocurrencies such as bitcoin or ethereum in some limited respects, but differ in important ways.

Rather than be a tradable asset with wildly fluctuating prices and limited use, the central bank digital currency would function more like dollars and have widespread acceptance. It also would be fully regulated and under a central authority.

Myriad questions remain before an institution as large as the Fed will wade in. But the momentum is building around the world.

The race towards Digital Money 2.0 is on.

Citigroup

“A major move to introduce central bank digital currencies (CBDCs) could actually disrupt the financial system,” Chetan Ahya, chief economist at Morgan Stanley, said in a report for clients. “Efforts to introduce CBDCs are gaining momentum, with as many as 86% of the world’s central banks exploring digital currencies.”

Indeed, a 2020 survey from the Bank for International Settlements indicated that nearly every central bank in the world at least did some work on these digital currencies. Some 60% are working on “proof of concept” testing, though just 14% have actually launched a pilot program or are in development.

Several areas of worry

Along with the enthusiasm about a possible new horizon for the financial system has come concern over getting the implementation right.

Central bank digital currency advocates, conversely, cite multiple advantages. Paramount among those reasons is giving unbanked people access to the financial system.

There’s also a speed consideration. Transfer payments, such as those provided by governments to people during the Covid-19 crisis, would be made faster and easier if that money could be deposited directly into digital wallets.

“New forms of digital money could provide a parallel boost to the vital lifelines that remittances provide to the poor and to developing economies,” Kristalina Georgieva, managing director at the International Monetary Fund, said in recent remarks at a joint meeting with the World Bank. “The biggest beneficiaries would be vulnerable people sending small value remittances: those most at risk from being left behind by the pandemic.”

Potential losers from the digital currencies include some financial institutions, both in traditional banking and fintech, that could lose deposits due to people putting their money into central bank accounts.

There also are privacy concerns and worries over integration.

‘Digital Money 2.0’

As the Fed and other central banks work through those logistical issues, Wall Street is growing in anticipation over what the future will hold.

“The race towards Digital Money 2.0 is on,” Citigroup said in a report. “Some have framed it as a new Space Race or Digital Currency Cold War. In our view, it doesn’t have to be a zero sum game — there’s a lot of room for the overall digital pie to grow.”

There, however, has been at least the semblance of a race, and China is perceived as taking the early lead.

With the launch of a digital yuan last year, some fear that the edge China has ultimately could undermine the dollar’s status as the world’s reserve currency. Though China said that is not its objective, a Bank of America report notes that issuing digital dollars would let the U.S. currency “remain highly competitive … relative to other currencies.”

“CBDCs offer the benefits of improving monetary transactions, without the adverse side effects of crypto currencies,” Bank of America economist Anna Zhou wrote.

Multiple other nations have moved ahead on projects, after the Bahamas was first with its Sand Dollar.

The Fed is currently working on a joint project with the Massachusetts Institute of Technology to evaluate the efficacy of a digital dollar, though there isn’t a specific timetable on when or if the U.S. central bank will move forward.

“There are many subtle and difficult policy choices and design choices that you have to make,” Fed Chairman Jerome Powell said in a recent interview with the CBS program “60 Minutes.”

“We’re doing all that work,” he said. “We have not made a decision to do this because, again, the question is will this benefit the people that we serve? And we need to answer that question well.”

In a working paper on the subject, Greg Baer, CEO of the Bank Policy Institute, an industry lobbying group, cautioned about a potential “diminishment” of the traditional banking system. He added that “the impact on economic growth could be significant – unless the central bank also assumed responsibility for lending or became a regular source of funding for banks.”

“The path forward is currently uncertain, and design choices could drive very different outcomes,” Baer wrote. He noted the Fed’s caution and how that contrasts with the “more precipitate” action from the European Central Bank.

‘Cash is going the way of the dodo’

The ECB is moving ahead with its “britcoin” project though it has said it will be simply a conduit for banks, which would act as the intermediaries for digital currency accounts.

“This ‘britcoin’ would be tied to the value of the pound to eliminate holding it as an asset from to derive profit. There could be an economic impact in the form of wider investment into the UK tech sector and lower transaction costs for international businesses,” said Jeremy Thomson-Cook, chief economist at international business payments specialist Equals Money.

“I think this legitimizes the belief that cash is going the way of the dodo and that the wider payments landscape will be entirely online within the next decade apart from incidentals or quixotic spending,” Thomson-Cook said.

Even with the seemingly intractable move toward digital currencies backed by central banks, U.S. authorities seem determined to take their time.

Powell also has said the Fed will not act without specific congressional authority and has said there are multiple concerns that need to be addressed.

“While central banks’ CBDC initiatives are not intended to disrupt the banking system, they will likely have unintended disruptive consequences,” Morgan Stanley’s Ahya said. “The more widely digital currencies are accepted, the more opportunity for innovation and the greater the scope for disruption to the financial system.”

HI Financial Services Mid-Week 06-24-2014