Trade Findings and Adjustments 02-23-2021

RISK TOLERANCE

So let’s go over RISK Tolerance today

https://seekingalpha.com/article/4399779-baidu-stock-forecast-2021-should-you-invest

Baidu Stock Forecast 2021: Should You Invest?

Jan. 20, 2021 9:30 AM ETBaidu, Inc. (BIDU)BABA, BABAF, GELYF…

Summary

- Baidu’s entry into EV-making is the main driver in getting market players truly excited and sending the stock parabolic in the past weeks.

- This article endeavors to determine if the current valuation is justified and what is the upside remaining.

- I argue that the share price of Baidu still has much room to go if we are to expect the stock recovers to the price-to-sales ratio it achieved in 2018.

- This would mean a share price of $359.57, an upside of 51 percent from the last closing price of $238.87.

- While bullish, there are some risks that investors should consider.

Investment Thesis

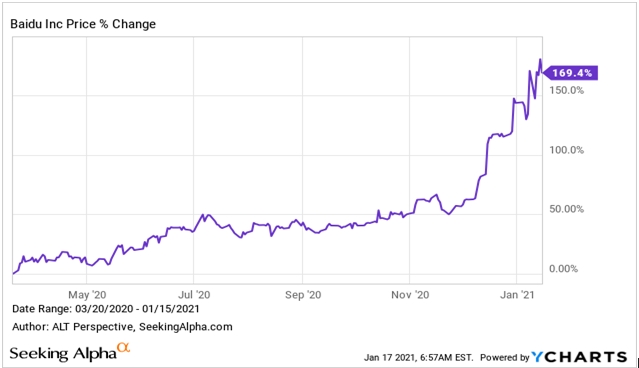

Baidu (BIDU) has seen its share price skyrocketing since early December. While there are many bullish drivers, suffice to say, it is the firm’s entry into electric vehicle manufacturing that is getting market truly excited and which has been sending Baidu’s stock parabolic. Since the trough in March, Baidu has seen its share price appreciate 170 percent.

Data by YCharts

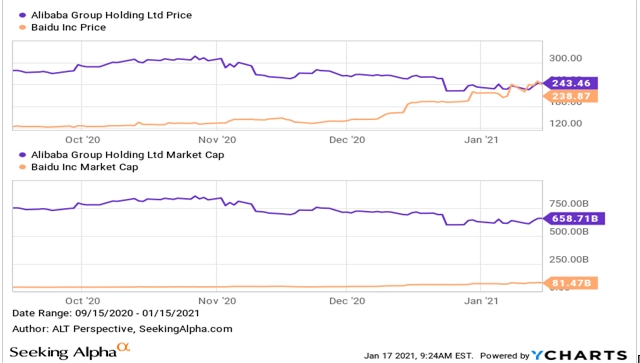

Coincidentally, the other Chinese internet giant, Alibaba Group (BABA) is having a rough time with the regulators clamping down on its monopolistic practices on its e-commerce platforms. The heightened scrutiny came in quick succession to the IPO suspension of Ant Group, its fintech unit.

As a result of the contrasting fortunes, Alibaba shares were sold off while investors clamored for Baidu’s shares. A reader rightly pointed out that the share price of Baidu has now reached roughly parity with that of Alibaba. If someone said as recently as late October that this could happen, he would find few believers.

However, the use of share prices to decide whether to buy or sell a stock might be rather crude. As the following chart comparing the market capitalization of Alibaba and Baidu shows, the latter still has a wide chasm to narrow. The latter is valued at a mere 12.4 percent of the former even after the recent closing of the gap.

Data by YCharts

A reader’s question on whether the “huge pullback is a buying opportunity for BIDU” motivated me to dig deeper into the fundamentals. The aim is to determine if the current valuation is justified and what is the upside remaining.

There’s a saying, buying a stock is easy, selling it is the hard part. That’s oversimplifying things, especially in today’s market where it’s arguably very tough to find growth or “story” stocks that have yet to reach astronomical valuations to add to our portfolios.

In this article, I argue that the share price of Baidu still has much room to go if we are to expect the stock recovers to the price-to-sales ratio it achieved in 2018. This is a conservative projection as Baidu has progressed from being a search engine giant to an internet titan leading in artificial intelligence research that has been deployed in consumer electronics products as well as a well-developed autonomous driving technology on the cusp of commercialization.

In other words, if the market could value Baidu at just the same P/S ratio as two and a half years ago when it was less technologically advanced, based on the consensus 2020 revenue estimate, we would be looking at a market cap of $122.6 billion. This would mean a share price of $359.57, an upside of 51 percent from the last closing price of $238.87.

Further upside from market players valuing Baidu as an EV play would be a bonus. I elaborate in the subsequent sections on my rationale.

What caused Baidu’s recent price increase?

As a keen observer of Chinese internet stocks, I have covered both Alibaba and Baidu extensively in the past year. However, the recent spike enjoyed by Baidu was still beyond my imagination in terms of magnitude and timeframe. In my mid-December article titled More Upside To Come For Baidu And JD.Com (JD), I postulated the stock could see a mere 10 percent upside.

“With the stock hitting the resistance level of the multi-month price uptrend channel, there is the possibility of profit-taking to send it back to the support line. I estimated that to be around 9 percent hit over the next two months. On a longer-term view, the stock could still reach higher to around $180 over the next four months, a 10 percent upside, if shareholders remained bullish within the price channel.”

Instead, the stock has risen 46.6 percent higher to $238.87, even after a pullback last week. Sure, Baidu has rebounded steadily from the March trough in line with the successful containment of the COVID-19 outbreak in China. However, it was only early December that the stock started to turn parabolic.

There were several triggers for that. On December 4, the company announced that its Apollo division was granted permission by Beijing transportation authorities for five of its vehicles to conduct fully driverless road tests. That makes Baidu the first and only company permitted to conduct driverless tests-—where there is no safety driver in the autonomous driving vehicle —on public streets in Beijing.

Since driverless operations are necessary for cost reduction and scalability of autonomous driving, the permission to conduct driverless tests marks a significant step towards commercialization. Given that the Chinese capital has the most stringent safety requirements for obtaining driverless testing permission in China, the permit affirms Baidu’s leading position in autonomous driving technology.

A few days later, Baidu revealed an increase in the aggregate value of shares repurchases from $3 billion to $4.5 billion under the 2020 Share Repurchase Program effective through December 31, 2022. Hot on the heels of this announcement, Reuters reported Baidu held talks with automakers regarding its plans to make its own electric vehicles, citing “three people with knowledge of the matter.”

Three weeks later, Reuters updated on the developments with further color on the partnership where Baidu would tie-up with Volvo’s parent Geely Automobile Holdings (OTCPK:GELYF). The latter planned to revamp some of its existing car manufacturing facilities to make the vehicles while Baidu will provide the software for the vehicles.

On the same day, as if on cue, it was Bloomberg’s turn to leak Baidu’s plan to raise at least $3.5B in a Hong Kong listing, having picked CLSA and Goldman Sachs (GS) as two of the banks handling the offering. When materialized, the move would be the antidote for a touted investment ban that has been momentarily shelved.

Is it too late to buy Baidu stock?

Naturally, given such a spike in the share price, those who have just stumbled upon Baidu are wondering if they have missed the boat to invest in Baidu. Existing shareholders would also be weighing between adding more shares, do nothing, or take profit. These are tough questions and I seek to share my opinion in this article.

With the stock trading at a two and a half year high, shareholders who bought in this period would be enjoying a paper profit. There could be temptations to sell and never look back for some, while others might sell and wait for a pullback to return to the stock.

At the same time, many of those who had invested in Baidu in the period from October 2017 to September 2018 are eagerly waiting for the opportunity to square their positions, having endured more than two years to breakeven. This creates a tremendous resistance for the stock to head higher.

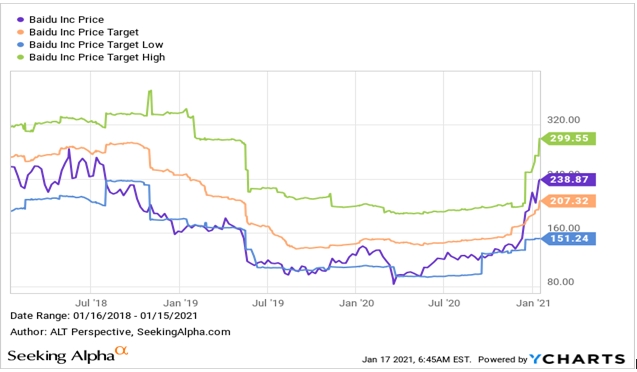

That said, it doesn’t mean Baidu cannot break out higher from here. Analysts are waking up to the big jump and fervently upgrading their price targets. Yet the highest price target on Baidu at $299.55 is still around $60 lower than what it received in Q4 2018 when its autonomous driving development was in a nascent stage.

The consensus price target at $207.32 is even lower than the closing price of $238.87. The wave of upward price revisions by the analysts to catch up with the prevailing traded price alone would be sufficient to keep the momentum going. Furthermore, I expect the entry of Baidu into EV-making would provide analysts with the narrative they need to raise their price targets more aggressively.

Data by YCharts

Baidu could also organize spin-offs to extract value from its AI portfolio. According to renowned research firms including Canalys, Baidu’s conversational AI system Xiaodu (also known as DuerOS conversational AI) leads in the global shipment of smart displays as well as in the national shipment of smart speakers.

In September, Baidu announced that its Smart Living Group (“SLG”) entered into definitive agreements with CPE, Baidu Capital, and IDG Capital for Series A financing at a post-money valuation of approximately RMB 20 billion, or $3.09 billion. SLG operates DuerOS voice assistant and DuerOS-powered smart devices.

How should investors think about the valuation of Baidu?

In mid-2018, Baidu did not have much to show on the AI front or autonomous driving technology. Fast forward to today and the company is leading in the hot fields but the stock is still trading at a P/S ratio several steps lower than its 2018 peak. This seems to suggest much of its developments have yet to be “priced-in”.

Nevertheless, simply assuming Baidu could be valued at its mid-2018 PS ratio of 7.4 times, based on the consensus 2020 revenue estimate, we would be looking at a market cap of $122.6 billion. This would mean a share price of $359.57, an upside of 51 percent from the last closing price of $238.87.

Data by YCharts

Can we expect further revenue growth/acceleration from Baidu?

Following the pandemic-ravaged year of 2020, analysts are forecasting Baidu to grow its 2021 revenue by 14.3 percent on a year-on-year basis. If it grew at the consensus 10.9 percent year-on-year basis in 2022, its P/S ratio would fall to below 4 times.

Source: Seeking Alpha Premium

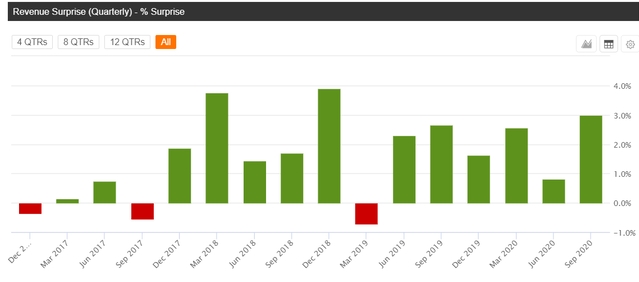

Given the tendency of Baidu to surprise positively on its revenue (13 times in the last 16 quarters), there is the potential for the P/S ratio on a forward basis to trend down even lower.

Source: Seeking Alpha Premium

Valuing Baidu on a forward price-to-earnings ratio, the stock would be trading at a mere 19.0 times, based on the fiscal year 2022 numbers. Again, this is based on the analyst consensus.

Source: Seeking Alpha Premium

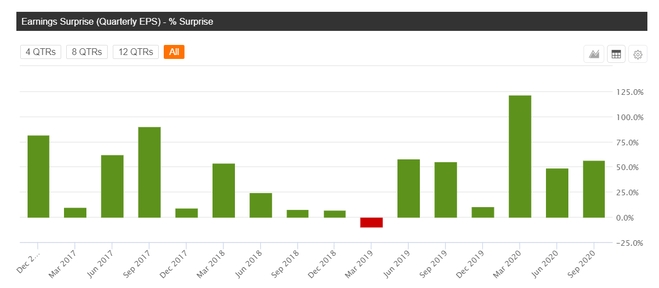

As it did so for the revenue, Baidu has also tended to surprise positively on the upside for its earnings. There was only one negative surprise in the past 16 quarters. There is certainly room for multiple expansions, especially if Baidu keeps on churning out results surpassing analyst estimates. I don’t even have to resort to its EV peers with bloated valuations to suggest Baidu is cheaply valued.

Source: Seeking Alpha Premium

Besides getting involved in EV-making directly, Baidu Apollo still embraces its role as an open platform and continues its strategy of “providing intelligent automotive products and technologies for OEM clients.” Baidu also invested heavily in WM Motors, an EV-maker specializing in SUVs.

Source: WM Motor

Risks and Threats To Baidu Stock

In case readers get too carried away, I would like to state some risk factors.

Firstly, the speculated investment ban by the Trump administration involving Baidu is only temporarily suspended. The potential inclusion could hang over the stock like the Sword of Damocles.

Second, the company is new to EV-making. There is no precedent to determine whether Baidu can be successful in this new business segment. This risk is mitigated by the strong experience its partner has in automobile making and recently in EV-making.

Third, Baidu remains beholden to advertising revenues. If the pandemic affects China’s economy again, Baidu could suffer from reduced earnings and hamper its support for the newly set-up EV unit.

What is your take? Share your thoughts with the Seeking Alpha community in the comments field. If you like this article, click on the orange “Follow” button and make sure the “Get email alerts” is checked.

Disclosure: I am/we are long BABA, BIDU, JD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I need to have a plan to NOT make knee jerk reactions to our positions

When BIDU gets to $340-$350ish we are selling half our stock and converting to a stock replacement strategy

Leap long calls for growth and leap short calls for protection

Let’s go spend $22-$26 dollars to make $100 with downside protection in place