HI Market View Commentary 01-25-2021

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF JAN. 18 THROUGH JAN. 22, 2021 |

| The S&P 500 index rose 1.9% last week as the market had a positive reaction to the inauguration of US President Joe Biden and his plan to battle the COVID-19 pandemic, while stronger-than-expected quarterly earnings from companies including Intel (INTC) also boosted sentiment. The market benchmark ended Friday’s session at 3,841.47, up from last Friday’s closing level of 3,768.25. The index posted a new intraday high Thursday at 3,861.45 and a fresh closing high Thursday at 3,853.07 but failed to top those levels Friday. The weekly advance came as Biden released a national COVID-19 strategy on his second day in office. The plan, which calls for the authorization of the Defense Production Act to boost supplies of personal protective equipment, rapid test kits, and material for vaccines, as well as new mask mandates for travelers and a requirement that international travelers show proof of a negative COVID-19 test before departing to the US, encouraged investors in a week that has seen cumulative US COVID-19 fatalities surpass 400,000. Some bellwether companies including Intel reported fourth-quarter results above expectations this week, also giving the index a boost. By sector, communication services had the largest percentage increase of the week, up 5.4%, followed by a 4.3% climb in technology and a 2.6% increase in consumer discretionary. However, the financial sector fell 1.9% and energy slipped 1.6%. Other sectors in the red included materials, consumer staples, industrials and utilities. The gainers in communication services included Netflix (NFLX), whose shares jumped 13.5% as the provider of streaming services reported Q4 sales and subscriber growth ahead of expectations. The company also forecast Q1 earnings per share and revenue above Street views. In the technology sector, shares of semiconductor companies climbed as Intel reported Q4 adjusted EPS and revenue above analysts’ expectations and forecast Q1 results above Street views. The chipmaker also raised its quarterly dividend. Shares of Intel ended the week 1.6% lower but shares of other chipmakers rose. Nvidia (NVDA) added 6.6%. In consumer discretionary, automotive industry shares got a boost as Bank of America said it expects the automotive industry to produce “solid” Q4 earnings, with many reporting improved year-over-year earnings. Shares of automakers General Motors (GM) and Ford Motor (F) climbed 10.9% and 6.6%, respectively. On the downside, in the financial sector, shares of Bank of America (BAC) fell 4.4% this week as the big bank reported weaker-than-expected Q4 revenue, hurt by a drop in consumer banking revenue. The company’s earnings fell year on year but topped analysts’ expectations. The energy sector’s decliners included NOV (NOV), which had a 9.1% decline in its shares this week as the oilfield equipment company warned investors it expects Q4 consolidated revenue of $1.33 billion, below prior guidance. The company’s chairman and CEO, Clay Williams, also said NOV expects continued softness in Q1, although it is hopeful for improved profitability over the course of 2021. Next week’s earnings calendar includes reports from Kimberly-Clark (KMB) on Monday; 3M (MMM), Microsoft (MSFT) and Johnson & Johnson (JNJ) on Tuesday; Apple (AAPL) and Facebook (FB) on Wednesday; McDonald’s (MCD) on Thursday; and Caterpillar (CAT) on Friday, among others. The data calendar next week features the January consumer-confidence index on Tuesday; durable goods and capital goods orders for December on Wednesday; weekly jobless claims and December trade data and new home sales Thursday; and December consumer spending and core inflation on Friday. There will also be a two-day Federal Open Market Committee meeting concluding next Wednesday. Provided by MT Newswires. |

New equity positions for 2021 that I am looking at – WMT, ALK, PYPL, SQ, CCL, RCL, MGM, SBUX

I still like my favorites – AAPL, BIDU, BAC, BA, DIS, F, V, & UAA is “still” my wildcard

For smaller accounts following the SPY, QQQ, DIA, F, UAA, Leaps

Earnings Watch List

AAPL 1/27 AMC

BA 1/27 BMO

BIDU 2/25

CVS 2/16 BMO

DIS 2/11 AMC

F 2/04 AMC

FB 1/27 AMC

FCX 1/26 BMO

KEY 1/21 BMO

KO 2/10 BMO

LMT 1/26 BMO

MU 3/24

NEM 2/18 BMO

SBUX 1/26 AMC

TGT 3/02 BMO

UAA 2/09

UBS 1/26 BMO

V 1/27 AMC

VZ 1/26 BMO

WMT 2/18 BMO

ALK 1/26 BMO

PYPL 1/28 AMC

SQ 2/23 AMC

RCL 2/02

MGM 2/11

Where will our markets end this week?

DOWN

DJIA – Bullish

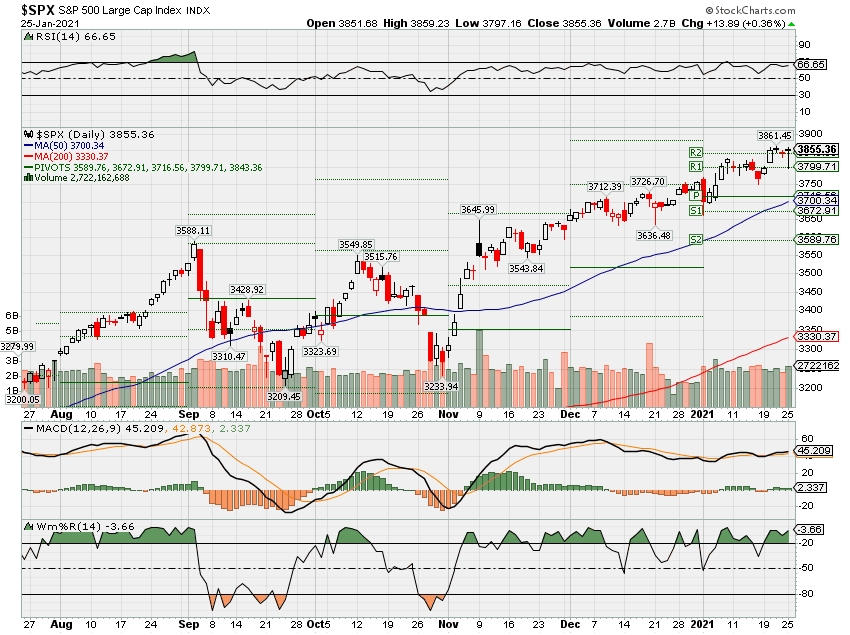

SPX – Bullish

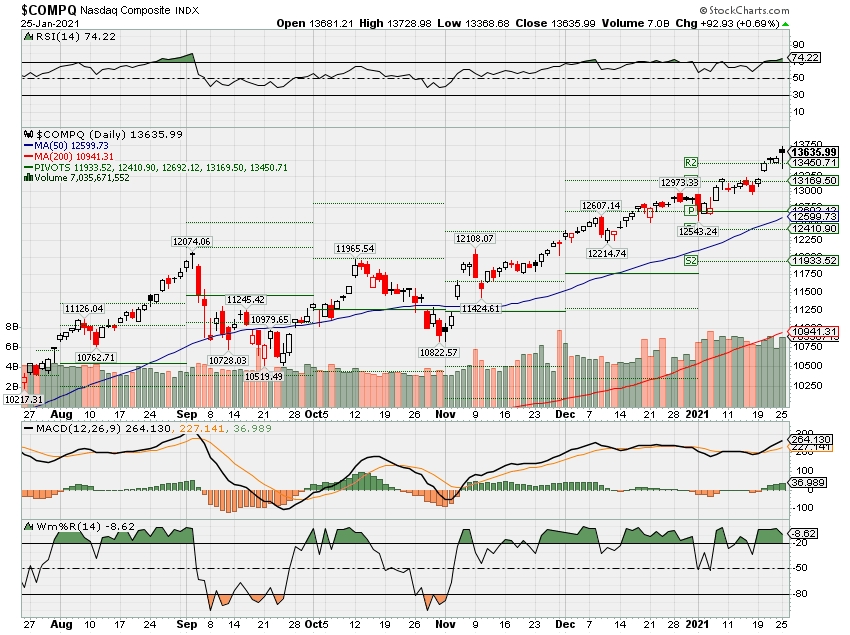

COMP – Bullish

Where Will the SPX end January 2021?

01-25-2021 +0.0%

01-19-2021 +0.0%

01-11-2021 +0.0%

01-04-2021 +0.0%

Earnings:

Mon: KMB , FUL

Tues: MMM, AXP, CIT, DHI, JNJ, RTX, VZ, UBS, AMD, COF, FFIV, MSFT, TXN, ALK, FCX, GE, LMT, SBUX

Wed: ABT, T, GLW, GD, VFC, CREE, LVS, LEVI, WHR, BA, AAPL, FB, TSLA

Thur: MO, AAL, JBLU, MA, MCD, NUE, LUV, VLO, X, WDC, V,

Fri: CAT, CUV, CL, LLY, HON, JCI, PSX

Econ Reports:

Mon:

Tues: S&P Case Shiller, Consumer Confidence, FHFA Housing Market Price Index

Wed: MBA, Durable Goods, Durable ex-trans, FOMC Rate Decision,

Thur: Initial Claims, Continuing Claims, New Home Sales, Leading Indicators, GDP, GDP Deflator

Fri: Personal Income, Personal Spending, PCE Prices, PCE Core, Chicago PMI, Employment Cost Index, Pending Home Sales, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Waiting for earnings and will protective put into this earnings season and add short calls after the announcement and after I listen to the guidance

EARNINGS

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Tech should do really well with sales last quarter, Some retail, Some energy

Legendary investor Jeremy Grantham says Biden’s $1.9 trillion stimulus plan would make the stock market bubble even worse

Jan. 24, 2021, 03:45 PM

The legendary investor Jeremy Grantham warned investors during a Bloomberg interview that the $1.9 trillion in federal aid President Joe Biden is seeking from Congress would further inflate a bubble in the stock market.

The GMO cofounder told Erik Schatzker that he had “no doubt” some of the federal money would end up in the market. He said the “sad truth” about the last federal coronavirus relief package enacted in 2020 was that it didn’t increase capital spending and didn’t increase real production but certainly flowed into stocks.

The plan that Biden is proposing contains a new round of $1,400 direct payments, robust state and local aid, and funds for vaccine distribution. Grantham said that if a $1.9 trillion package were passed, it could lead to the dangerous end of the bubble.

“If it’s as big as they talk about, this would be a very good making of a top for the market, just of the kind that the history books would enjoy,” Grantham said.

“We will have a few weeks of extra money and a few weeks of putting your last, desperate chips into the game, and then an even more spectacular bust,” he added.

Grantham has long warned of what he sees as a ballooning bubble in the US stock market. In his investor outlook letter in the beginning of January, he detailed how extreme overvaluations, explosive price increases, frenzied issuance, and what he called “hysterically speculative investor behavior” all demonstrated that the stock market was in a bubble that not even the Federal Reserve could stop from bursting.

“When you have reached this level of obvious super-enthusiasm, the bubble has always, without exception, broken in the next few months, not a few years,” Grantham told Bloomberg.

Grantham also said the combination of fiscal stimulus and emergency Fed programs that helped inflate the bubble could increase inflation.

“If you think you live in a world where output doesn’t matter and you can just create paper, sooner or later you’re going to do the impossible, and that is bring back inflation,” Grantham said. “Interest rates are paper. Credit is paper. Real life is factories and workers and output, and we are not looking at increased output.”

He told investors to seek out stocks outside US markets, as many other countries haven’t seen the huge bull market the US has. He called emerging markets stocks “handsomely priced.”

“You will not make a handsome 10- or 20-year return from US growth stocks,” Grantham said. “If you could do emerging, low-growth and green, you might get the jackpot.”

https://www.gmo.com/americas/research-library/waiting-for-the-last-dance/

Viewpoints | January 05, 2021

WAITING FOR THE LAST DANCE

The Hazards of Asset Allocation in a Late-stage Major Bubble

By Jeremy Grantham

By

Executive Summary

The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.

These great bubbles are where fortunes are made and lost – and where investors truly prove their mettle. For positioning a portfolio to avoid the worst pain of a major bubble breaking is likely the most difficult part. Every career incentive in the industry and every fault of individual human psychology will work toward sucking investors in.

But this bubble will burst in due time, no matter how hard the Fed tries to support it, with consequent damaging effects on the economy and on portfolios. Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives. Speaking as an old student and historian of markets, it is intellectually exciting and terrifying at the same time. It is a privilege to ride through a market like this one more time.

“The one reality that you can never change is that a higher-priced asset will produce a lower return than a lower-priced asset. You can’t have your cake and eat it. You can enjoy it now, or you can enjoy it steadily in the distant future, but not both – and the price we pay for having this market go higher and higher is a lower 10-year return from the peak.”1

Most of the time, perhaps three-quarters of the time, major asset classes are reasonably priced relative to one another. The correct response is to make modest bets on those assets that measure as being cheaper and hope that the measurements are correct. With reasonable skill at evaluating assets the valuation-based allocator can expect to survive these phases intact with some small outperformance. “Small” because the opportunities themselves are small. If you wanted to be unfriendly you could say that asset allocation in this phase is unlikely to be very important. It would certainly help in these periods if the manager could also add value in the implementation, from the effective selection of countries, sectors, industries, and individual securities as well as major asset classes.

The real trouble with asset allocation, though, is in the remaining times when asset prices move far away from fair value. This is not so bad in bear markets because important bear markets tend to be short and brutal. The initial response of clients is usually to be shocked into inaction during which phase the manager has time to reposition both portfolio and arguments to retain the business. The real problem is in major bull markets that last for years. Long, slow-burning bull markets can spend many years above fair value and even two, three, or four years far above. These events can easily outlast the patience of most clients. And when price rises are very rapid, typically toward the end of a bull market, impatience is followed by anxiety and envy. As I like to say, there is nothing more supremely irritating than watching your neighbors get rich.

How are clients to tell the difference between extreme market behavior and a manager who has lost his way? The usual evidence of talent is past success, but the long cycles of the market are few and far between. Winning two out of two events or three out of three is not as convincing as a larger sample size would be. Even worse the earlier major market breaks are already long gone: 2008, 2000, or 1989 in Japan are practically in the history books. Most of the players will have changed. Certainly, the satisfaction felt by others who eventually won long ago is no solace for current pain experienced by you personally. A simpler way of saying this may be that if Keynes really had said, “The market can stay irrational longer than the investor can stay solvent,” he would have been right.

I am long retired from the job of portfolio management but I am happy to give my opinion here: it is highly probable that we are in a major bubble event in the U.S. market, of the type we typically have every several decades and last had in the late 1990s. It will very probably end badly, although nothing is certain. I will also tell you my definition of success for a bear market call. It is simply that sooner or later there will come a time when an investor is pleased to have been out of the market. That is to say, he will have saved money by being out, and also have reduced risk or volatility on the round trip. This definition of success absolutely does not include precise timing. (Predicting when a bubble breaks is not about valuation. All prior bubble markets have been extremely overvalued, as is this one. Overvaluation is a necessary but not sufficient condition for their bursting.) Calling the week, month, or quarter of the top is all but impossible.

I came fairly close to calling one bull market peak in 2008 and nailed a bear market low in early 2009 when I wrote “Reinvesting When Terrified.” That’s far more luck than I could hope for even over a 50-year career. Far more typically, I was three years too early in the Japan bubble. We at GMO got entirely out of Japan in 1987, when it was over 40% of the EAFE benchmark and selling at over 40x earnings, against a previous all-time high of 25x. It seemed prudent to exit at the time, but for three years we underperformed painfully as the Japanese market went to 65x earnings on its way to becoming over 60% of the benchmark! But we also stayed completely out for three years after the top and ultimately made good money on the round trip.

Similarly, in late 1997, as the S&P 500 passed its previous 1929 peak of 21x earnings, we rapidly sold down our discretionary U.S. equity positions then watched in horror as the market went to 35x on rising earnings. We lost half our Asset Allocation book of business but in the ensuing decline we much more than made up our losses.

Believe me, I know these are old stories. But they are directly relevant. For this current market event is indeed the same old story. This summer, I said it was likely that we were in the later stages of a bubble, with some doubt created by the unique features of the COVID crash. The single most dependable feature of the late stages of the great bubbles of history has been really crazy investor behavior, especially on the part of individuals. For the first 10 years of this bull market, which is the longest in history, we lacked such wild speculation. But now we have it. In record amounts. My colleagues Ben Inker and John Pease have written about some of these examples of mania in the most recent GMO Quarterly Letter, including Hertz, Kodak, Nikola, and, especially, Tesla. As a Model 3 owner, my personal favorite Tesla tidbit is that its market cap, now over $600 billion, amounts to over $1.25 million per car sold each year versus $9,000 per car for GM. What has 1929 got to equal that? Any of these tidbits could perhaps be dismissed as isolated cases (trust me: they are not), but big-picture metrics look even worse.

The “Buffett indicator,” total stock market capitalization to GDP, broke through its all-time-high 2000 record. In 2020, there were 480 IPOs (including an incredible 248 SPACs2) – more new listings than the 406 IPOs in 2000. There are 150 non-micro-cap companies (that is, with market capitalization of over $250 million) that have more than tripled in the year, which is over 3 times as many as any year in the previous decade. The volume of small retail purchases, of less than 10 contracts, of call options on U.S. equities has increased 8-fold compared to 2019, and 2019 was already well above long-run average. Perhaps most troubling of all: Nobel laureate and long-time bear Robert Shiller – who correctly and bravely called the 2000 and 2007 bubbles and who is one of the very few economists I respect – is hedging his bets this time, recently making the point that his legendary CAPE asset-pricing indicator (which suggests stocks are nearly as overpriced as at the 2000 bubble peak) shows less impressive overvaluation when compared to bonds. Bonds, however, are even more spectacularly expensive by historical comparison than stocks. Oh my!

So, I am not at all surprised that since the summer the market has advanced at an accelerating rate and with increasing speculative excesses. It is precisely what you should expect from a late-stage bubble: an accelerating, nearly vertical stage of unknowable length – but typically short. Even if it is short, this stage at the end of a bubble is shockingly painful and full of career risk for bears.

I am doubling down, because as prices move further away from trend, at accelerating speed and with growing speculative fervor, of course my confidence as a market historian increases that this is indeed the late stage of a bubble. A bubble that is beginning to look like a real humdinger.

The strangest feature of this bull market is how unlike every previous great bubble it is in one respect. Previous bubbles have combined accommodative monetary conditions with economic conditions that are perceived at the time, rightly or wrongly, as near perfect, which perfection is extrapolated into the indefinite future. The state of economic excellence of any previous bubble of course did not last long, but if it could have lasted, then the market would justifiably have sold at a huge multiple of book. But today’s wounded economy is totally different: only partly recovered, possibly facing a double-dip, probably facing a slowdown, and certainly facing a very high degree of uncertainty. Yet the market is much higher today than it was last fall when the economy looked fine and unemployment was at a historic low. Today the P/E ratio of the market is in the top few percent of the historical range and the economy is in the worst few percent. This is completely without precedent and may even be a better measure of speculative intensity than any SPAC.

This time, more than in any previous bubble, investors are relying on accommodative monetary conditions and zero real rates extrapolated indefinitely. This has in theory a similar effect to assuming peak economic performance forever: it can be used to justify much lower yields on all assets and therefore correspondingly higher asset prices. But neither perfect economic conditions nor perfect financial conditions can last forever, and there’s the rub.

All bubbles end with near universal acceptance that the current one will not end yet…because. Because in 1929 the economy had clicked into “a permanently high plateau”; because Greenspan’s Fed in 2000 was predicting an enduring improvement in productivity and was pledging its loyalty (or moral hazard) to the stock market; because Bernanke believed in 2006 that “U.S. house prices merely reflect a strong U.S. economy” as he perpetuated the moral hazard: if you win you’re on your own, but if you lose you can count on our support. Yellen, and now Powell, maintained this approach. All three of Powell’s predecessors claimed that the asset prices they helped inflate in turn aided the economy through the wealth effect. Which effect we all admit is real. But all three avoided claiming credit for the ensuing market breaks that inevitably followed: the equity bust of 2000 and the housing bust of 2008, each replete with the accompanying anti-wealth effect that came when we least needed it, exaggerating the already guaranteed weakness in the economy. This game surely is the ultimate deal with the devil.

Now once again the high prices this time will hold because…interest rates will be kept around nil forever, in the ultimate statement of moral hazard – the asymmetrical market risk we have come to know and depend on. The mantra of late 2020 was that engineered low rates can prevent a decline in asset prices. Forever! But of course, it was a fallacy in 2000 and it is a fallacy now. In the end, moral hazard did not stop the Tech bubble decline, with the NASDAQ falling 82%. Yes, 82%! Nor, in 2008, did it stop U.S. housing prices declining all the way back to trend and below – which in turn guaranteed first, a shocking loss of over eight trillion dollars of perceived value in housing; second, an ensuing weakness in the economy; and third, a broad rise in risk premia and a broad decline in global asset prices (see Exhibit 1). All the promises were in the end worth nothing, except for one; the Fed did what it could to pick up the pieces and help the markets get into stride for the next round of enhanced prices and ensuing decline. And here we are again, waiting for the last dance and, eventually, for the music to stop.

EXHIBIT 1: BUBBLES – GREAT WHILE THEY LAST

Housing bubble as of 11/30/2011, Tech bubble as of 2/28/2003

Source: S&P 500 (Tech bubble); National Association of Realtors, U.S. Census Bureau (Housing bubble)

Nothing in investing perfectly repeats. Certainly not investment bubbles. Each form of irrational exuberance is different; we are just looking for what you might call spiritual similarities. Even now, I know that this market can soar upwards for a few more weeks or even months – it feels like we could be anywhere between July 1999 and February 2000. Which is to say it is entitled to break any day, having checked all the boxes, but could keep roaring upwards for a few months longer. My best guess as to the longest this bubble might survive is the late spring or early summer, coinciding with the broad rollout of the COVID vaccine. At that moment, the most pressing issue facing the world economy will have been solved. Market participants will breathe a sigh of relief, look around, and immediately realize that the economy is still in poor shape, stimulus will shortly be cut back with the end of the COVID crisis, and valuations are absurd. “Buy the rumor, sell the news.” But remember that timing the bursting of bubbles has a long history of disappointment.

Even with hindsight, it is seldom easy to point to the pin that burst the bubble. The main reason for this lack of clarity is that the great bull markets did not break when they were presented with a major unexpected negative. Those events, like the portfolio insurance fiasco of 1987, tend to give sharp down legs and quick recoveries. They are in the larger scheme of things unique and technical and are not part of the ebb and flow of the great bubbles. The great bull markets typically turn down when the market conditions are very favorable, just subtly less favorable than they were yesterday. And that is why they are always missed.

Either way, the market is now checking off all the touchy-feely characteristics of a major bubble. The most impressive features are the intensity and enthusiasm of bulls, the breadth of coverage of stocks and the market, and, above all, the rising hostility toward bears. In 1929, to be a bear was to risk physical attack and guarantee character assassination. For us, 1999 was the only experience we have had of clients reacting as if we were deliberately and maliciously depriving them of gains. In comparison, 2008 was nothing. But in the last few months the hostile tone has been rapidly ratcheting up. The irony for bears though is that it’s exactly what we want to hear. It’s a classic precursor of the ultimate break; together with stocks rising, not for their fundamentals, but simply because they are rising.

Another more measurable feature of a late-stage bull, from the South Sea bubble to the Tech bubble of 1999, has been an acceleration3 of the final leg, which in recent cases has been over 60% in the last 21 months to the peak, a rate well over twice the normal rate of bull market ascents. This time, the U.S. indices have advanced from +69% for the S&P 500 to +100% for the Russell 2000 in just 9 months. Not bad! And there may still be more climbing to come. But it has already met this necessary test of a late-stage bubble.

It is a privilege as a market historian to experience a major stock bubble once again. Japan in 1989, the 2000 Tech bubble, the 2008 housing and mortgage crisis, and now the current bubble – these are the four most significant and gripping investment events of my life. Most of the time in more normal markets you show up for work and do your job. Ho hum. And then, once in a long while, the market spirals away from fair value and reality. Fortunes are made and lost in a hurry and investment advisors have a rare chance to really justify their existence. But, as usual, there is no free lunch. These opportunities to be useful come loaded with career risk.

So, here we are again. I expect once again for my bubble call to meet my modest definition of success: at some future date, whenever that may be, it will have paid for you to have ducked from midsummer of 2020. But few professional or individual investors will have been able to have ducked. The combination of timing uncertainty and rapidly accelerating regret on the part of clients means that the career and business risk of fighting the bubble is too great for large commercial enterprises. They can never put their full weight behind bearish advice even if the P/E goes to 65x as it did in Japan. The nearest any of these giant institutions have ever come to offering fully bearish advice in a bubble was UBS in 1999, whose position was nearly identical to ours at GMO. That is to say, somewhere between brave and foolhardy. Luckily for us though, they changed their tack and converted to a fully invested growth stock recommendation at UBS Brinson and its subsidiary, Phillips & Drew, in February 2000, just before the market peak. This took out the 800-pound gorilla that would otherwise have taken most of the rewards for stubborn contrariness. So, don’t wait for the Goldmans and Morgan Stanleys to become bearish: it can never happen. For them it is a horribly non-commercial bet. Perhaps it is for anyone. Profitable and risk-reducing for the clients, yes, but commercially impractical for advisors. Their best policy is clear and simple: always be extremely bullish. It is good for business and intellectually undemanding. It is appealing to most investors who much prefer optimism to realistic appraisal, as witnessed so vividly with COVID. And when it all ends, you will as a persistent bull have overwhelming company. This is why you have always had bullish advice in a bubble and always will.

However, for any manager willing to take on that career risk – or more likely for the individual investor – requiring that you get the timing right is overreach. If the hurdle for calling a bubble is set too high, so that you must call the top precisely, you will never try. And that condemns you to ride over the cliff every cycle, along with the great majority of investors and managers.

What to Do?

As often happens at bubbly peaks like 1929, 2000, and the Nifty Fifty of 1972 (a second-tier bubble in the company of champions), today’s market features extreme disparities in value by asset class, sector, and company. Those at the very cheap end include traditional value stocks all over the world, relative to growth stocks. Value stocks have had their worst-ever relative decade ending December 2019, followed by the worst-ever year in 2020, with spreads between Growth and Value performance averaging between 20 and 30 percentage points for the single year! Similarly, Emerging Market equities are at 1 of their 3, more or less co-equal, relative lows against the U.S. of the last 50 years. Not surprisingly, we believe it is in the overlap of these two ideas, Value and Emerging, that your relative bets should go, along with the greatest avoidance of U.S. Growth stocks that your career and business risk will allow. Good luck!

Download article here.

1 Jeremy Grantham, CNBC, November 12, 2020.

2 A SPAC is a Special Purpose Acquisition Company, a shell that is created for the specific purpose of merging with some private company to take that company public more quickly than could have been the case with a normal initial public offering (IPO) process.

3 My paper of January 2018, “Bracing Yourself for a Possible Near-term Melt-up,” has substantially more data and exhibits on this topic.

Disclaimer: The views expressed are the views of Jeremy Grantham through the period ending January 5, 2021, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Biden has promised to reform Social Security — some changes could come as soon as this year

KEY POINTS

- As President Joe Biden takes office, helping the nation through Covid-19 is a top priority.

- Social Security will take a back burner for now, yet some experts say that may not be for long.

- If successful, big changes to fix the program could secure his presidential legacy, one expert says.

Newly elected President Joe Biden has a tall list of priorities in his first days in office, with stemming the pandemic chief among them.

But experts expect one issue he promised to deal with during his campaign, Social Security reform, could also become a focal point as soon as this year.

Millions of Americans count on Social Security benefits to provide income when they are retired or disabled, or when loved ones pass away.

The program’s funds have been running low. The latest official estimate from the Social Security Administration shows that just 79% of promised benefits will be payable in 2035 due to depletion of its trust funds. That estimate does not factor in the effects of the pandemic, which experts say could move that date up even sooner.

Biden touted big changes to the program on the campaign trail.

Under his plan, eligible workers would get a guaranteed minimum benefit equal to at least 125% of the federal poverty level. People who have received benefits for at least 20 years would get a 5% bump. Widows and widowers would receive about 20% more per month.

Biden also proposes changing the measurement for annual cost-of-living increases to the Consumer Price Index for the Elderly, or CPI-E, which could more closely track the expenses retirees face.

To pay for those higher benefits, Biden would apply Social Security payroll taxes to those making $400,000 and up. In 2021, workers generally pay the 6.2% Social Security tax on up to $142,800 of wages. (Earnings between $142,800 and $400,000 would not be subject to those levies under the plan, though that gap would eventually close over time.)

Other Democratic candidates in the run-up to the 2020 presidential election also issued their own ideas for Social Security reform. The last time sweeping changes were put in place was in 1983, when then President Ronald Reagan, a Republican, struck a deal with Democratic House Speaker Tip O’Neill, D-Mass.

“I’ve always believed it takes a Democratic president to do Social Security reform,” said Jason Fichtner, a fellow at the Bipartisan Policy Center and former Social Security Administration official.

Because Biden, 78, has hinted from the outset that he plans to be a one-term president, he would have to address the issue in the next few years.

“I am hoping that President Biden might look at least after the midterms in 2022, going into 2023, of trying to secure a legacy for himself and that would be Social Security reform,” Fichtner said.

What changes could come in 2021

Experts expect one Social Security issue to be on lawmakers’ agendas this year.

The Covid-19 pandemic has created a so-called notch that would reduce benefits for those turning 62 and claim retirement benefits in 2022, as well as those who file for disability or survivor benefits that year.

Congress is expected to act to prevent those reductions before they take effect.

Because those benefit reductions were directly caused by Covid-19, it could be addressed in the next relief package, said Dan Adcock, director of government relations and policy the National Committee to Preserve Social Security and Medicare.

“I think that’s the most likely early action on Social Security,” Adcock said.

If reduced benefits for that cohort is not included in that upcoming legislation, lawmakers could consider it later in the year, which could prompt bigger conversations about Social Security reform, said Nancy Altman, president of Social Security Works, which advocates for Social Security expansion.

“If it’s not done in the Covid package, then it would make sense to do it in a comprehensive Social Security package, which gives some impetus to acting on it in this coming year,” Altman said.

Room for compromise?

Despite a Democratic majority in the House and Senate, there could be obstacles to getting major Social Security reform approved.

Democrats have proposed their own legislation aimed at shoring up the program. The Social Security 2100 Act, proposed by Rep. John Larson, D-Conn., aims to boost benefits and restore the program’s solvency for the next 75 years by raising payroll taxes.

Another proposal, the Social Security Expansion Act, from Sen. Bernie Sanders, I-Vt., also aims to increase benefits for low earners while raising taxes for those with higher wages.

In a statement, Larson said the Biden administration, and members of the Senate and House, are looking to come to a consensus by holding roundtables and evaluating different proposals.

“There are a lot of similarities between the Social Security 2100 Act and President Biden’s campaign proposal,” Larson said. “We will be reintroducing a modified Social Security 2100 Act based on what comes out these discussions.”

Meanwhile, on the Republican side, Sen. Mitt Romney, R-Utah, has touted the TRUST Act, which would let lawmakers form bipartisan committees to address programs like Social Security that face a shortfall in funding and fast track changes to improve them.

Traditional Senate negotiations would need bipartisan support, however.

It’s America’s favorite entitlement program, and part of the reason it’s so popular is it’s not solvent.

“It will require 60 votes in the Senate, which means that we have to persuade probably at least 10 Republican Senators to go along with a comprehensive Social Security reform bill,” Adcock said.

Conservative politicians would likely object to raising benefits across the board, said Rachel Greszler, research fellow at the Heritage Foundation.

“There could be room for a compromise to be made here in terms of boosting the minimum benefit that’s provided, so it’s at least at the poverty level,” Greszler said. “But that would have to come … with a reduction in benefits at the top.”

One challenge that could emerge in the negotiations is for leaders to face the decision of whether Social Security should be an anti-poverty or entitlement program, Greszler said. Heritage is advocating for a universal benefit to protect those who are low income, while reducing how much middle- to high-wage earners rely on benefits.

“It’s America’s favorite entitlement program, and part of the reason it’s so popular is it’s not solvent,” Greszler said.

However, groups like Social Security Works and the National Committee to Preserve Social Security and Medicare are focused on preventing benefit cuts.

Some Republicans could be swayed, Altman said.

“Even though the Republicans can try to block it, this is something that’s going to be quite popular with their constituents,” she said. “It’s just a question of whether they’ll do it.”

Lloyd Blankfein on how the SPAC rush could go wrong for investors

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- The SPAC process circumvents the rigorous due diligence of the normal IPO process, and that will lead to problems, according to Blankfein.

- “You’re getting companies public, but you’re getting them public in a two-step process where one of the elements of an IPO is dropping out,” Blankfein said.

- Another issue: Blankfein suggested that SPAC participants weren’t incentivized to prevent overpaying for their target businesses.

Former Goldman Sachs CEO Lloyd Blankfein sees trouble ahead for SPACs, the special purpose acquisition companies being used to take companies public.

While the SPAC trend shows no sign of cooling down amid high demand for shares of new companies, investors need to be careful, Blankfein said Monday on Squawk Box. That’s because the SPAC process circumvents the rigorous due diligence of the normal IPO process, according to Blankfein.

“You’re getting companies public, but you’re getting them public in a two-step process where one of the elements of an IPO is dropping out,” Blankfein said.

“When the initial SPAC goes public, you are scrutinizing a shell company, possibly the reputation of the sponsor,” he continued. “When that company then de-SPACs and mergers, it’s a merger, it’s not an IPO that carries with it a lot of diligence obligations.”

SPACs have been around for years, but they exploded in popularity last year. SPACs raised $64 billion in 2020, nearly as much as traditional IPOs, according to Renaissance Capital.

Blankfein, who as former CEO of Goldman led one of Wall Street’s top IPO advisers for more than a decade, suggested that SPAC participants weren’t incentivized to prevent overpaying for their target businesses. That could lead to situations where “some people make a lot of money and investors lose money,” he said.

“In the absence of diligence, that’s going to be what will happen,” Blankfein said. “There are going to be things that go wrong.”

The larger backdrop is that behavior seen in SPACs and other areas like bitcoin are signs of “bubble elements” because of central banks’ reaction to the coronavirus pandemic, a point Blankfein has made in the past.

https://www.investopedia.com/terms/s/spac.asp

Special Purpose Acquisition Company (SPAC)

By JULIE YOUNG

Reviewed By SOMER ANDERSON

Updated Nov 24, 2020

What Is a Special Purpose Acquisition Company (SPAC)?

A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company. Also known as “blank check companies,” SPACs have been around for decades. In recent years, they’ve become more popular, attracting big-name underwriters and investors and raising a record amount of IPO money in 2019. In 2020, as of the beginning of August, more than 50 SPACs have been formed in the U.S. which have raised some $21.5 billion.

KEY TAKEAWAYS

- A special purpose acquisition company is formed to raise money through an initial public offering to buy another company.

- At the time of their IPOs, SPACs have no existing business operations or even stated targets for acquisition.

- Investors in SPACs can range from well-known private equity funds to the general public.

- SPACs have two years to complete an acquisition or they must return their funds to investors.

How a SPAC Works

SPACs are generally formed by investors, or sponsors, with expertise in a particular industry or business sector, with the intention of pursuing deals in that area. In creating a SPAC, the founders sometimes have at least one acquisition target in mind, but they don’t identify that target to avoid extensive disclosures during the IPO process. (This is why they are called “blank check companies.” IPO investors have no idea what company they ultimately will be investing in.) SPACs seek underwriters and institutional investors before offering shares to the public.

The money SPACs raise in an IPO is placed in an interest-bearing trust account. These funds cannot be disbursed except to complete an acquisition or to return the money to investors if the SPAC is liquidated. A SPAC generally has two years to complete a deal or face liquidation. In some cases, some of the interest earned from the trust can be used as the SPAC’s working capital. After an acquisition, a SPAC is usually listed on one of the major stock exchanges.

Advantages of a SPAC

Selling to a SPAC can be an attractive option for the owners of a smaller company, which are often private equity funds. First, selling to a SPAC can add up to 20% to the sale price compared to a typical private equity deal. Being acquired by a SPAC can also offer business owners what is essentially a faster IPO process under the guidance of an experienced partner, with less worry about the swings in broader market sentiment.

SPACs Make a Comeback

SPACs have become more common in recent years, with their IPO fundraising hitting a record $13.6 billion in 2019—more than four times the $3.2 billion they raised in 2016. They have also attracted big-name underwriters such as Goldman Sachs, Credit Suisse, and Deutsche Bank, as well as retired or semi-retired senior executives looking for a shorter-term opportunity.

Examples of High-Profile SPAC Deals

One of the most high-profile recent deals involving special purpose acquisition companies involved Richard Branson’s Virgin Galactic. Venture capitalist Chamath Palihapitiya’s SPAC Social Capital Hedosophia Holdings bought a 49% stake in Virgin Galactic for $800 million before listing the company in 2019.1

In 2020, Bill Ackman, founder of Pershing Square Capital Management, sponsored his own SPAC, Pershing Square Tontine Holdings, the largest-ever SPAC, raising $4 billion in its offering on July 22.