Trade Findings and Adjustments 08-04-2020

6:00 AM today and my first check on DIS

DANG the stock is down about $1.00 on premarket on earnings day

SO for the next hour I thought about DIS and their earnings

The sentiment was negative on DIS

Their theme parks have been closed

Their cruise ship parked

NO movies with a less than expected excitement than last year

I knew they had a huge payment for FOX

7:00 AM down a delicious Rock Star POG energy drink

7:07 AM First text to Keve

Ford new CEO and look at DIS

What are we going to do with DIS

Do NOTHING until after the first hour

9:08 AM = What are going to do with DIS

There has been NO Earnings Forgiveness

We did think that because of Covid-19 maybe there would be more Disney + Subscribers

We KEEP the ITM Aug $120 Puts where they were at !!!!

What does this mean ?

ITM moneys a higher delta to make more up as DIS falls lower in price

Better protection against a bad earnings report

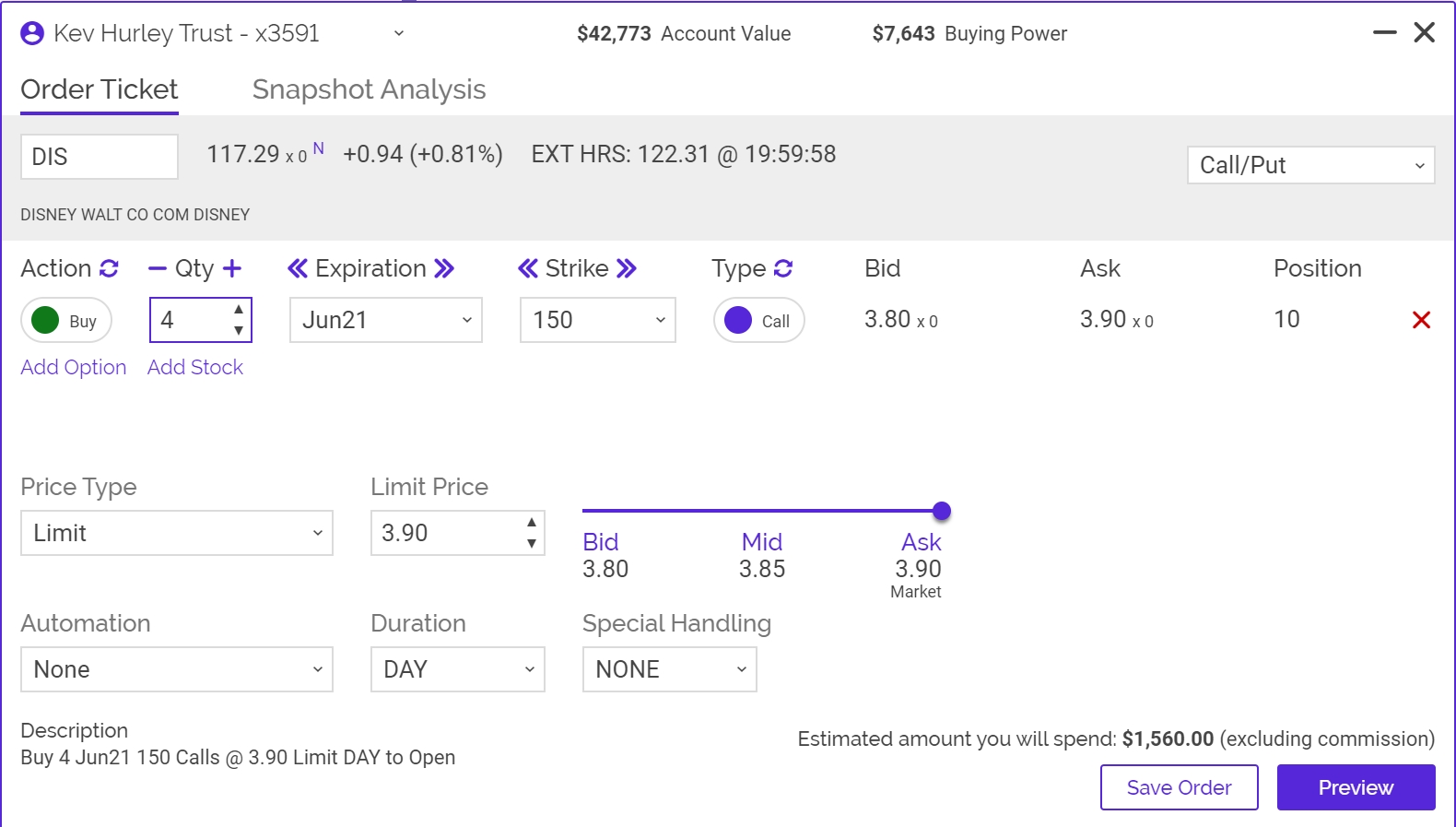

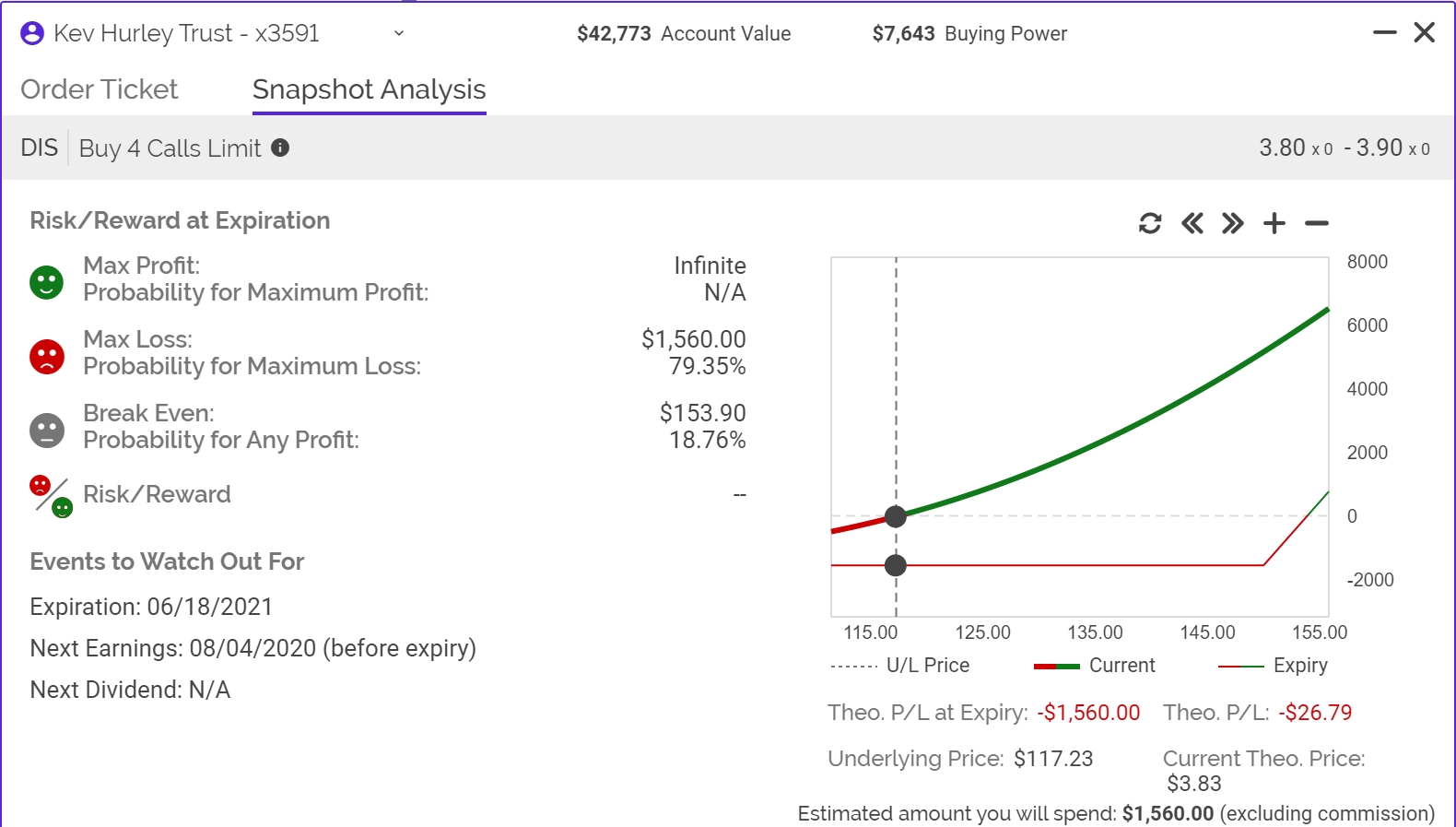

BUT what about the leaps calls?

Some strikes had already lost half of their value

SO, do we dollar cost average? Do half ? do 1/3 ? do ¼ ? Do we wait until after their earnings

We added a little ¼ to 1/3 we dollar cost averaged in the Jan $150, $135 and maybe one other strike that was down more than half

AND we can still dollar cost average more tomorrow = Won’t be at the same price

We Nibbled in case we were wrong about DIS

WILL there be follow through tomorrow? = YES

Glad we “nibbled”

We NEED to adjust Long Puts or close them out, we need to continue to dollar cost average

Disney shares rise after the company says it has 100 million streaming subscribers, plans to launch a new streaming service

PUBLISHED TUE, AUG 4 20203:32 PM EDTUPDATED 2 HOURS AGO

KEY POINTS

- Disney reported mixed earnings for its third quarter of 2020 after the bell on Tuesday as it continues to feel the impact of the coronavirus pandemic on sectors like its parks business.

- The company took a $3.5 billion hit to its operating income from parks being closed during the quarter.

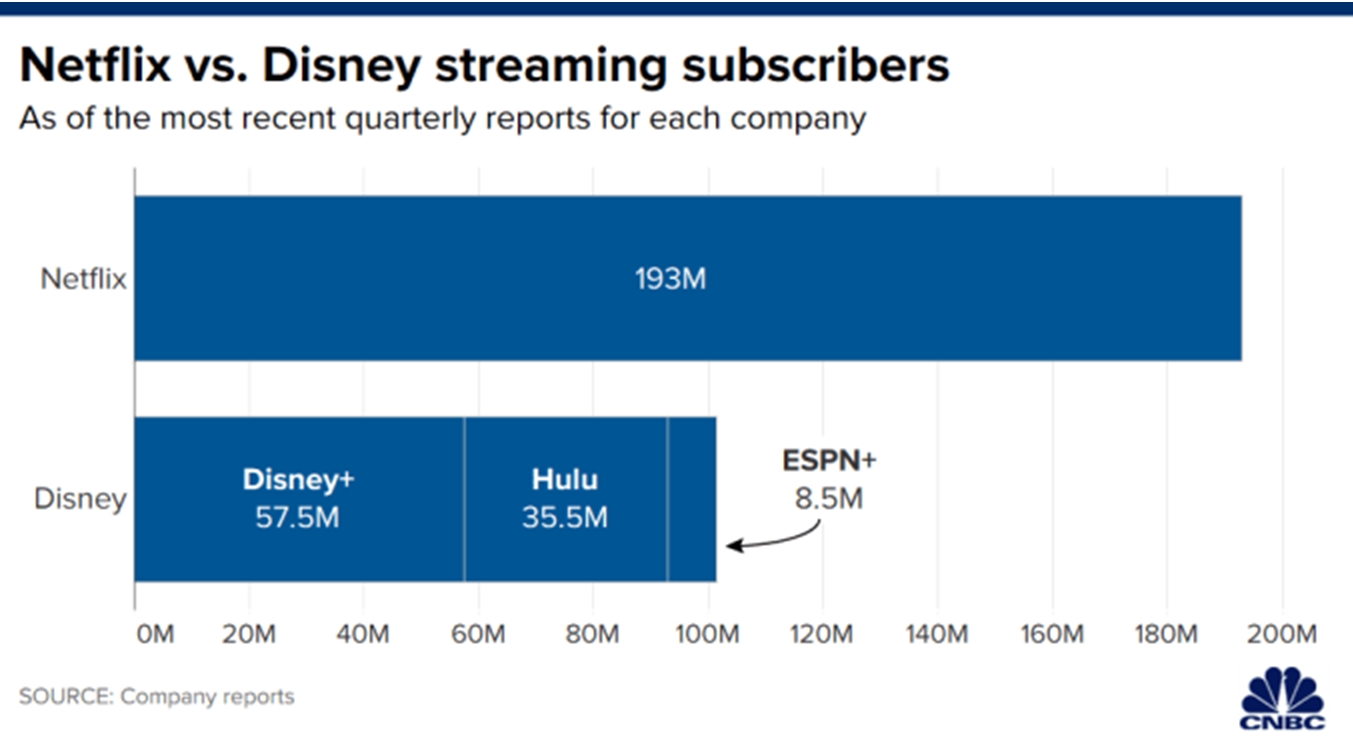

- Disney now has 100 million paid subscribers across its streaming offerings, more than half of which are subscribers to Disney+.

Disney reported mixed earnings for its fiscal third quarter on Tuesday, but the stock rose 5% in extended trading after CEO Bob Chapek announced a new streaming service and said Disney+ subscribers will get exclusive access to the release of “Mulan,” which has been repeatedly delayed due to theater closures.

Disney continues to feel the impact of the coronavirus pandemic on sectors like its parks business, where revenue plunged 85% from a year earlier.

Here are the key numbers:

- Earnings per share, adjusted: 8 cents vs. loss of 64 cents expected, according to Refinitiv

- Revenue:$11.78 billion, vs $12.37 billion expected, according to Refinitiv

Disney reported a net loss for the quarter of $4.72 billion due in large part to charges related to its earlier acquisition of Twenty-First Century Fox, including severance and contract termination costs and integration expenses.

Chapek announced that Disney+ subscribers would be able to watch its much-anticipated live action film “Mulan” on the platform for $29.99 in the U.S., beginning Sept. 4. Subscribers in Canada, Australia, New Zealand and parts of Western Europe will also be able to stream the movie at slightly varied prices, Chapek said.

The movie’s original release had been pushed back as theaters were forced to close during the pandemic. It will be Disney’s first effort to sell content on Disney+, on top of the monthly $6.99 subscription.

Chapek also said that Disney would launch a new general entertainment streaming service in fiscal 2021 under the Star brand it acquired from Fox. The service will feature content Disney already owns from ABC Studios, Fox Television, FX, Freeform, 20th Century Studios and Searchlight, Chapek said. The service will be fully integrated into Disney+ in many markets, Chapek said, and distributed under the Star brand.

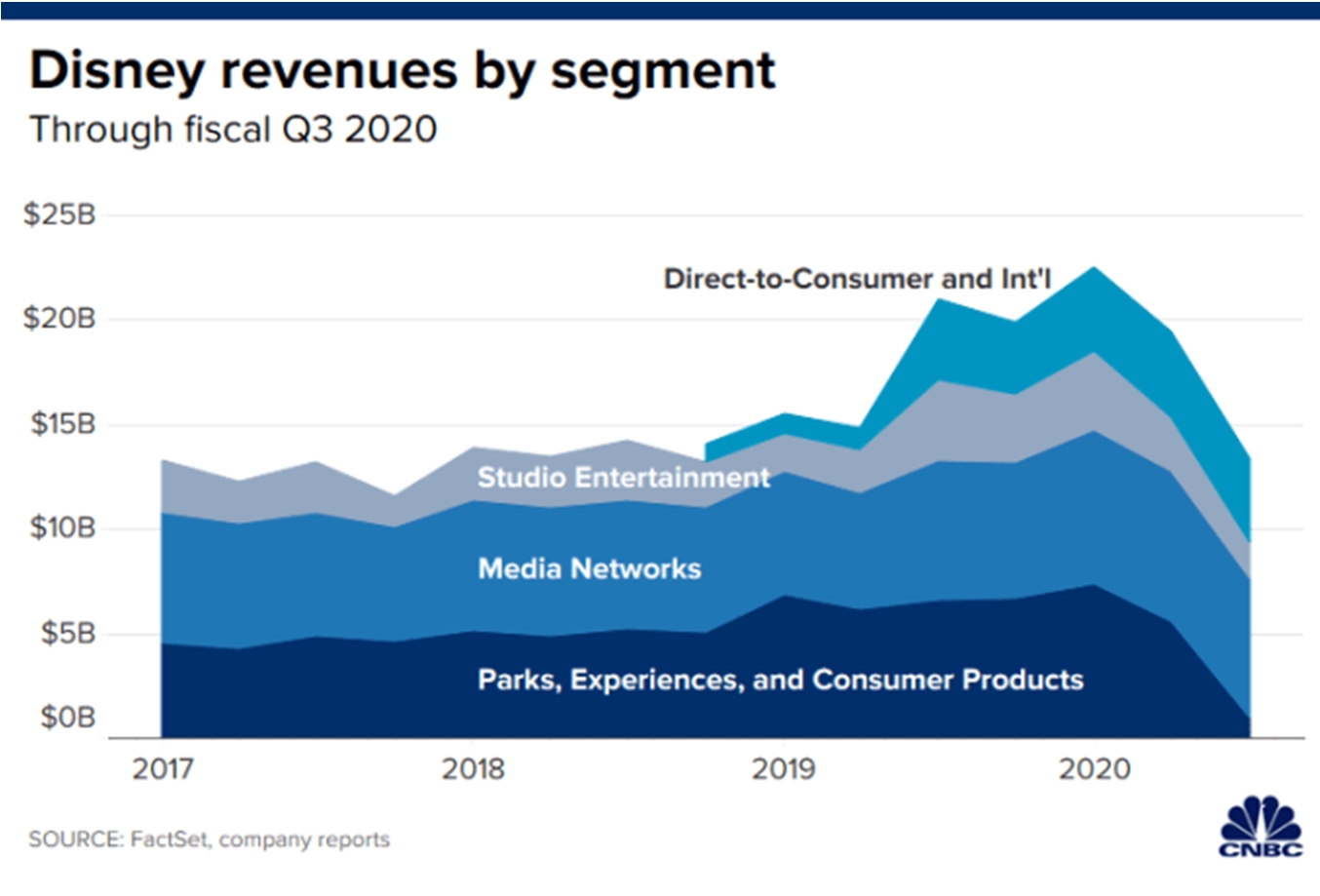

Disney’s direct-to-consumer and international segment was the only one to report an increase in year-over-year revenue. Disney said it now has 100 million paid subscribers across its streaming services, which include Disney+, Hulu and ESPN+. More than half of those subscriptions are for Disney+, which boasted 57.5 million subscribers as of the end of the quarter, less than a year after launch.

As of Monday, Disney+ reached 60.5 million paid subscribers, Chapek said on the company’s earnings call, hitting its goal of 60 million to 90 million subscriptions by 2024, four years early.

Here’s how Disney’s segments did in the third quarter in terms of revenue compared to the same quarter last year:

- Media Networks: $6.56 billion, down 2%

- Parks, Experiences and Products:$983 million, down 85%

- Studio Entertainment:$1.74 billion, down 55%

- Direct-to-Consumer and International: $3.97 billion, up 2%

Disney’s parks and studio entertainment segments suffered the most during the quarter as pandemic lockdowns restricted travel and production.

Disney had been able to reopen some of its parks with limited capacity and new restrictions to keep visitors safe, but its Disneyland theme park and resort in California was forced to delay its expected July reopening as the state pushed back its guidelines amid rising case numbers.

The company took a $3.5 billion hit to its operating income from parks being closed during the quarter. CFO Christine McCarthy said on Disney’s earnings call that it did not see as much upside as originally anticipated from its reopening of Walt Disney World in Orlando, Florida, due to the surge of cases in the region.

Revenue for the Parks, Experiences and Products segment, which includes cruises, resorts and merchandise, fell 85% to below $1 billion during the quarter.

Disney has been unable to release a new film in theaters since mid-March, which has taken a toll on its studio business. During the quarter, studio entertainment revenues slumped 55% to $1.7 billion.

The lack of theatrical releases was partially offset by video on demand, lower marketing costs and lower film costs.

Disney faced particularly tough comparisons this quarter, as the company released box office blockbusters “Avengers: Endgame” and “Aladdin” during the same period last year. “Avengers: Endgame” was the highest grossing film of all time, earning $2.79 billion at the global box office.

Disney announced last quarter it was suspending its dividend payout for the first half of the year. McCarthy told analysts on the call a decision on whether to pay out a dividend for the last half of the year would come around late November or early December. She added that the dividend suspension gave Disney more flexibility to deal with changes required by the pandemic.

Correction: This story has been updated to reflect Disney’s net loss after income taxes.

With gold & silver at such high rates, doesn’t that traditionally signal high anxiety in the market and economy? If so, why is the VIX at only 24.31 or so? The VIX is showing less worry at the 24 levels. Could it have to do with the low interest rates possibly giving confidence? Are earnings good enough to give a feeling of a recovering economy?

False sense of security with Stimulus, a Vaccine, plain old stupid people !!!!!